Professional Documents

Culture Documents

Requirement (A) : Post Tax Operating Cash Flows (A) 165.75

Uploaded by

MohitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Requirement (A) : Post Tax Operating Cash Flows (A) 165.75

Uploaded by

MohitCopyright:

Available Formats

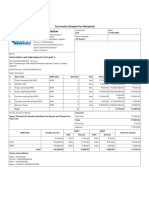

Requirement (a)

Year 0 1

Sales 700.00

Less:

Raw material costs 280.00

Variable manufacturing cost 140.00

Fixed annual operating and maintenance costs 2.50

Variable selling expenses 105.00

Depreciation expense (Note 1) 150.00

Income before taxes 22.50

Tax expense 6.75

Net income after taxes 15.75

Add: Depreciation expense 150.00

Post tax operating cash flows (A) 165.75

Cost of equipment - 600.00

Working capital investment - 70.00 - 15.00

Liquidation of working capital investment (net of Rs.5 million loss)

Tax advantage for loss of working capital (Rs.5 million*30%)

Net receipt on sale of equipment (note 2)

Post tax non-operating cash flows (B) - 670.00 - 15.00

Post tax Incremental cash flows (A + B) - 670.00 150.75

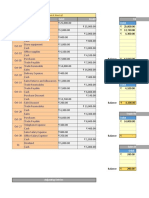

Requirement (b)

Year Cash flows

0 - 670.00

1 150.75

2 155.75

3 226.06

4 212.23

5 341.70

Net present value

NPV of the project is -$33.97

Note 1: Calculation of Depreciation expe

(Rs. in millions)

2 3 4 5 Year

850.00 1,100.00 1,000.00 800.00 0

1

340.00 440.00 400.00 320.00 2

170.00 220.00 200.00 160.00 3

2.50 2.50 2.50 2.50 4

127.50 165.00 150.00 120.00 5

112.50 84.38 63.28 47.46

97.50 188.13 184.22 150.04 Note 2: Post tax salvage value of equipm

29.25 56.44 55.27 45.01

68.25 131.69 128.95 105.03 Book value of the equipment at the end

112.50 84.38 63.28 47.46 Salvage value of equipment at the end o

180.75 216.06 192.23 152.49 Loss on sale of equipment

Tax advantage for loss on sale of equipm

- 25.00 10.00 20.00 Post tax salvage value of equipment

75.00

1.50

112.71

- 25.00 10.00 20.00 189.21

155.75 226.06 212.23 341.70

Present value Present value

of Re.1 at 18% of cash flows

1 - 670.00

0.84746 127.75

0.71818 111.86

0.60863 137.59

0.51579 109.47

0.43711 149.36

present value - 33.97

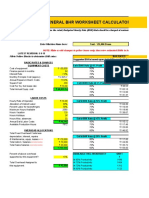

Note 1: Calculation of Depreciation expense and Book value

(Rs. in millions)

Beginning book value of Depreciation Ending book value of

equipment expense equipment

600.00

600.00 150.00 450.00

450.00 112.50 337.50

337.50 84.38 253.13

253.13 63.28 189.84

189.84 47.46 142.38

Note 2: Post tax salvage value of equipment

Book value of the equipment at the end of 5 years 142.38 million

Salvage value of equipment at the end of 5 years 100.00 million

Loss on sale of equipment 42.38 million

Tax advantage for loss on sale of equipment 12.71 million

Post tax salvage value of equipment 112.71 million

You might also like

- Comparison of assembly line profitabilityDocument2 pagesComparison of assembly line profitabilityJeet VaishnavNo ratings yet

- Adani Total GasDocument13 pagesAdani Total GasShiv LalwaniNo ratings yet

- Rs in Million 1 Particulars Present 2020: Fixed Assets Net Working CapitalDocument19 pagesRs in Million 1 Particulars Present 2020: Fixed Assets Net Working CapitalKamakshi GuptaNo ratings yet

- Particulars Year Ended 31 March, 2020: Income Statement For Birla Corporation LTDDocument24 pagesParticulars Year Ended 31 March, 2020: Income Statement For Birla Corporation LTDSomil GuptaNo ratings yet

- Balance Sheet (Modern)Document5 pagesBalance Sheet (Modern)kearaerNo ratings yet

- Cav 2022 Q1-1Document5 pagesCav 2022 Q1-1arjun guptaNo ratings yet

- CashflowsDocument5 pagesCashflowshar maNo ratings yet

- Equity Analysis of A Project in GVT JV: Capital Budgeting WorksheetDocument8 pagesEquity Analysis of A Project in GVT JV: Capital Budgeting WorksheetSandesh SinghNo ratings yet

- Direct Materials Consumed Direct Wages: Particulars Per Unit AmountDocument6 pagesDirect Materials Consumed Direct Wages: Particulars Per Unit AmountYaduNo ratings yet

- Income and expense breakdown by categoryDocument7 pagesIncome and expense breakdown by categoryHarryNo ratings yet

- Project 11Document10 pagesProject 11Deep AnjarlekarNo ratings yet

- Tata Motor AnalysisDocument14 pagesTata Motor Analysisnamahashivay2No ratings yet

- Financial ModelingDocument12 pagesFinancial ModelingHetviNo ratings yet

- Wheat Lagat 7783Document1 pageWheat Lagat 7783Rajan RaiNo ratings yet

- Raw Material Cost Breakup and Erection Expenses for Steel StructureDocument1 pageRaw Material Cost Breakup and Erection Expenses for Steel Structuresri projectssNo ratings yet

- Dabur IndiaDocument336 pagesDabur IndiakjNo ratings yet

- Peb Quote WF 29.08.2022Document1 pagePeb Quote WF 29.08.2022sri projectssNo ratings yet

- 3.TAMO - FS AnalysisDocument12 pages3.TAMO - FS AnalysisNobodyNo ratings yet

- ITC Analysis Using TATA by Screener ExcelDocument12 pagesITC Analysis Using TATA by Screener Excelnamahashivay2No ratings yet

- Financial Model - DLFDocument18 pagesFinancial Model - DLFkukrejanikhil70No ratings yet

- Joint CostingDocument7 pagesJoint CostingMovie MasterNo ratings yet

- FM Cia3bDocument15 pagesFM Cia3bThinakaran S BNo ratings yet

- MicroDrive CFO Sales & Ratio AnalysisDocument4 pagesMicroDrive CFO Sales & Ratio AnalysisRehan KhanNo ratings yet

- EVM Report - Sample ProjectDocument6 pagesEVM Report - Sample ProjectDheerajMadisettyNo ratings yet

- Tata MotorsDocument13 pagesTata MotorsPrathameshNo ratings yet

- Case Study-Octane-Service-StationDocument10 pagesCase Study-Octane-Service-Stationprakashscribd123No ratings yet

- Analyze Company's Performance Using Ratios - Guided Project WorkbookDocument19 pagesAnalyze Company's Performance Using Ratios - Guided Project WorkbookAditya SeethaNo ratings yet

- Mergers Mid TermDocument4 pagesMergers Mid Termsuraj nairNo ratings yet

- Airport ModelDocument11 pagesAirport ModelMayank JAinNo ratings yet

- MARICO Ltd. - Financial ModelDocument12 pagesMARICO Ltd. - Financial Modelmundadaharsh1No ratings yet

- BLUE DART EXPRESS DCF VALUATIONDocument6 pagesBLUE DART EXPRESS DCF VALUATIONRahulTiwariNo ratings yet

- Grocery Store Project Cost AnalysisDocument2 pagesGrocery Store Project Cost AnalysisSurendra SharmaNo ratings yet

- Airtel Financial StatmentsDocument7 pagesAirtel Financial StatmentsAbhishek PatilNo ratings yet

- Income Statement Horizontal Analysis TemplateDocument2 pagesIncome Statement Horizontal Analysis TemplateSope DalleyNo ratings yet

- Income Statement Horizontal Analysis TemplateDocument2 pagesIncome Statement Horizontal Analysis TemplateSope DalleyNo ratings yet

- FM TaMoDocument14 pagesFM TaMoJatin MittalNo ratings yet

- Heavy Metal and Tube India PVT LTD Unit 1 - 272 - 17-06-2022Document1 pageHeavy Metal and Tube India PVT LTD Unit 1 - 272 - 17-06-2022pragnesh prajapatiNo ratings yet

- WorkbookDocument7 pagesWorkbookHarshit GoyalNo ratings yet

- Financial Modeling and Valuating 2023Document22 pagesFinancial Modeling and Valuating 2023Eduardo LazoNo ratings yet

- Hind AeronauticsDocument16 pagesHind AeronauticsRahul YadavNo ratings yet

- NPV Analysis of $3M Investment over 3 YearsDocument3 pagesNPV Analysis of $3M Investment over 3 Yearszeeshanahmad111No ratings yet

- Amul Ratio AnalysisDocument5 pagesAmul Ratio AnalysisAnshul yadav100% (1)

- Earnings Per Equity Share of Face Value of F 10 Each Continuing OperationsDocument1 pageEarnings Per Equity Share of Face Value of F 10 Each Continuing Operationsobroymanas0No ratings yet

- Avenue SupermartDocument21 pagesAvenue SupermartAndy NainggolanNo ratings yet

- General BHR Worksheet CalculatorDocument2 pagesGeneral BHR Worksheet CalculatorEmba MadrasNo ratings yet

- February Bulacao Profit and Loss ReportDocument13 pagesFebruary Bulacao Profit and Loss ReportSage SuirrattNo ratings yet

- Investment DetectiveDocument25 pagesInvestment DetectiveTestNo ratings yet

- FAR Assignment - 2Document7 pagesFAR Assignment - 2Melvin ShajiNo ratings yet

- Adani Enterprises 3 statement F.MDocument9 pagesAdani Enterprises 3 statement F.MArnav DasNo ratings yet

- Nestle Model Group 5Document129 pagesNestle Model Group 5Aayushi ChandwaniNo ratings yet

- Colgate PalmolivDocument8 pagesColgate PalmolivAnshika SinghNo ratings yet

- Tam Sam Som - Bitm Div2Document9 pagesTam Sam Som - Bitm Div2Yash BafnaNo ratings yet

- 09dpxpk2191m1zx Gstr3br1 Reconciled Summary (2022-2023)Document19 pages09dpxpk2191m1zx Gstr3br1 Reconciled Summary (2022-2023)birpal singhNo ratings yet

- Mehul Construction. - 150 - 17-12-2022Document2 pagesMehul Construction. - 150 - 17-12-2022Pragati OnlineServiceNo ratings yet

- MA OppurtunityCostDocument3 pagesMA OppurtunityCostSakshi KshirsagarNo ratings yet

- Tata Motors FS AnalysisDocument27 pagesTata Motors FS AnalysisAnswers GlobeNo ratings yet

- Date Description Debit Credit Cash: General JournalDocument13 pagesDate Description Debit Credit Cash: General JournalMelvin ShajiNo ratings yet

- Case Study ShrutiDocument115 pagesCase Study ShrutiMukund MalpaniNo ratings yet

- Submitted To: Submitted By:: Group No 5Document11 pagesSubmitted To: Submitted By:: Group No 5NairaNo ratings yet

- CH 03072017 1Document1 pageCH 03072017 1MohitNo ratings yet

- Requirement A.: Year Cash Flows 0 - $ 8,210.00 1 $ 6,220.00 2 $ 20,400.00Document1 pageRequirement A.: Year Cash Flows 0 - $ 8,210.00 1 $ 6,220.00 2 $ 20,400.00MohitNo ratings yet

- Item Discount Factor Workings PVDocument2 pagesItem Discount Factor Workings PVMohitNo ratings yet

- CH 30092017 1Document1 pageCH 30092017 1MohitNo ratings yet

- Cash Flows From Operating ActivitiesDocument1 pageCash Flows From Operating ActivitiesMohitNo ratings yet

- CH 18072017 1Document1 pageCH 18072017 1MohitNo ratings yet

- CH 11082017 5Document2 pagesCH 11082017 5MohitNo ratings yet

- CH 09082017 1Document4 pagesCH 09082017 1MohitNo ratings yet

- CH 11072017 1Document2 pagesCH 11072017 1MohitNo ratings yet

- Alternative A Alternative B Alternative CDocument9 pagesAlternative A Alternative B Alternative CMohitNo ratings yet

- CH 18072017 1Document1 pageCH 18072017 1MohitNo ratings yet

- CH 11072017 1Document2 pagesCH 11072017 1MohitNo ratings yet

- CH 08072017 1Document1 pageCH 08072017 1MohitNo ratings yet

- Requirement (A) : Post Tax Operating Cash Flows (A) 165.75Document3 pagesRequirement (A) : Post Tax Operating Cash Flows (A) 165.75MohitNo ratings yet

- CH 19062017 5Document1 pageCH 19062017 5MohitNo ratings yet

- CH 22062017 1Document9 pagesCH 22062017 1MohitNo ratings yet

- Statement of Problem With The Trial Balance Still Balance? What Is The Amount of Difference? Which Trial Balance Column Have The Larger Total?Document1 pageStatement of Problem With The Trial Balance Still Balance? What Is The Amount of Difference? Which Trial Balance Column Have The Larger Total?MohitNo ratings yet

- CH 06032017 11Document1 pageCH 06032017 11MohitNo ratings yet

- CH 22042017 2Document10 pagesCH 22042017 2MohitNo ratings yet

- CH 26032017 7Document2 pagesCH 26032017 7MohitNo ratings yet

- CH 04042017 3Document1 pageCH 04042017 3MohitNo ratings yet

- Financial analysis and NPV calculation of a company over 5 yearsDocument3 pagesFinancial analysis and NPV calculation of a company over 5 yearsMohitNo ratings yet

- CH 06032017 2Document1 pageCH 06032017 2MohitNo ratings yet

- CH 25032017 3Document1 pageCH 25032017 3MohitNo ratings yet

- CH 05032017 7Document1 pageCH 05032017 7MohitNo ratings yet

- CH 01022017 6Document3 pagesCH 01022017 6MohitNo ratings yet

- Calculating variable overhead, fixed overhead, estimated costs, work in process, and material costsDocument1 pageCalculating variable overhead, fixed overhead, estimated costs, work in process, and material costsMohitNo ratings yet

- CH 30012017 6 1Document2 pagesCH 30012017 6 1MohitNo ratings yet

- ElmwoodDocument3 pagesElmwoodMohitNo ratings yet

- Case Study AssignmentDocument3 pagesCase Study AssignmentfalinaNo ratings yet

- Multinational Capital BudgetingDocument24 pagesMultinational Capital BudgetingsajjadNo ratings yet

- 562 Spring2003Document5 pages562 Spring2003Emmy W. RosyidiNo ratings yet

- Important Student Exam InstructionsDocument13 pagesImportant Student Exam InstructionsCarl-Henry FrancoisNo ratings yet

- PMP AddendumDocument88 pagesPMP AddendummeneghelsNo ratings yet

- Department of Banking and Finance: Abdu Gusau Polytechnic Talata Mafara Zamfara StateDocument7 pagesDepartment of Banking and Finance: Abdu Gusau Polytechnic Talata Mafara Zamfara StateSOMOSCONo ratings yet

- Course Section Information Centre For Business: School of Accounting & FinanceDocument3 pagesCourse Section Information Centre For Business: School of Accounting & FinanceSyed TalhaNo ratings yet

- Question Bank FMDocument4 pagesQuestion Bank FMN Rakesh100% (3)

- Club Capital Budgeting Practices Over Four DecadesDocument8 pagesClub Capital Budgeting Practices Over Four DecadesAima Zulfiqar Aima ZulfiqarNo ratings yet

- FPAC Part 1 Chapter 01Document72 pagesFPAC Part 1 Chapter 01Agnes BofillNo ratings yet

- Weighted Average CostDocument5 pagesWeighted Average CostsureshdassNo ratings yet

- ACC 543 WK 2 - Apply Signature Assignment Net Present Value and Internal Rate of ReturnDocument17 pagesACC 543 WK 2 - Apply Signature Assignment Net Present Value and Internal Rate of ReturnDonny JobNo ratings yet

- Gul OzerolDocument74 pagesGul OzerolMimma afrinNo ratings yet

- Investment Decision: Unit IiiDocument50 pagesInvestment Decision: Unit IiiFara HameedNo ratings yet

- VVU School of Business Final Exam Questions on Financial ManagementDocument4 pagesVVU School of Business Final Exam Questions on Financial ManagementNubor RichardNo ratings yet

- Capital BudgetingDocument59 pagesCapital BudgetingSaharsh SaraogiNo ratings yet

- Capital Expenditures Linked to Future Earnings in Taiwan Manufacturing FirmsDocument9 pagesCapital Expenditures Linked to Future Earnings in Taiwan Manufacturing Firmstaoyuan521No ratings yet

- CH09 PDFDocument98 pagesCH09 PDFmohit verrmaNo ratings yet

- Stock Market Investing For DummiesDocument7 pagesStock Market Investing For DummiesayersktmrpylutvNo ratings yet

- Dec 2022 - Strategic Financial ManagementDocument8 pagesDec 2022 - Strategic Financial ManagementindrakumarNo ratings yet

- 151 - Fa M&a - 5Document5 pages151 - Fa M&a - 5Manjunath R IligerNo ratings yet

- The ABC Company: Balance SheetDocument10 pagesThe ABC Company: Balance SheetFahad AliNo ratings yet

- Request For Proposal - RFPDocument85 pagesRequest For Proposal - RFPpanikarickyNo ratings yet

- BNRR Lease vs PurchaseDocument5 pagesBNRR Lease vs PurchaseAlivia HasnandaNo ratings yet

- Entrepreneur DevelOpment MCQSDocument12 pagesEntrepreneur DevelOpment MCQSHardik Solanki100% (3)

- BA5203 Financial ManagementDocument20 pagesBA5203 Financial Managements.muthuNo ratings yet

- Capital Budgeting ConceptsDocument61 pagesCapital Budgeting Conceptsterrence jacob diamaNo ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- CPA Review: Excel Professional Services IncDocument7 pagesCPA Review: Excel Professional Services IncMm100% (1)

- A Teacher Must Choose Five Monitors From A Class of 12 Students. How Many Different Ways Can The Teacher Choose The Monitors?Document11 pagesA Teacher Must Choose Five Monitors From A Class of 12 Students. How Many Different Ways Can The Teacher Choose The Monitors?Syed Ali HaiderNo ratings yet