Professional Documents

Culture Documents

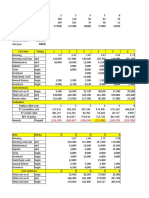

Table 1: Operational Budget Operational Budget Estimated Total Cost Year 1 Year 2 Year 3 Year 4 Year 5

Table 1: Operational Budget Operational Budget Estimated Total Cost Year 1 Year 2 Year 3 Year 4 Year 5

Uploaded by

Denzel0 ratings0% found this document useful (0 votes)

2 views5 pagesathily

Original Title

Appendix

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentathily

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views5 pagesTable 1: Operational Budget Operational Budget Estimated Total Cost Year 1 Year 2 Year 3 Year 4 Year 5

Table 1: Operational Budget Operational Budget Estimated Total Cost Year 1 Year 2 Year 3 Year 4 Year 5

Uploaded by

Denzelathily

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

APPENDIX

TABLE 1: OPERATIONAL BUDGET

Operational Budget

Estimated total cost Year 1 Year 2 Year 3 year 4 year 5

activity/imput/yr cost(GH)

Community Entry 2500 0 0 0 0

Land preparation 500 0 0 0 0

Planting material 2000 0 0 0 0

Fertilizer 1800 0 0 0 0

Fungicides 300 300 300 305 305

Labour 2400 3000 3500 20561.54 4550

production cost 9500 3300 3800 20866.54 4855

export cost 9692.307692 11076.92 12461.538 12461.54 12461.54

total cost/Ha 28692.30769 17676.92 20061.538 54194.62 22171.54

total cost/80Ha 2295384.615 1414154 1604923.1 4335569 1773723

Estimated Revenue

average yield per bunch/KG 7 8 9 9 9

average bunches per Ha 2000 2000 2000 2000 2000

total Kg/Ha 14000 16000 18000 18000 18000

no. of 13kg/Ha 1076.923077 1230.769 1384.6154 1384.615 1384.615

estimated rejects(20%) 215.3846154 246.1538 276.92308 276.9231 276.9231

number of bunchs 30.76923077 30.76923 30.769231 30.76923 30.76923

farm gate price/bunch 8.5 9 10 10 10

Export price/13kg($) 10 10 10 10 10

export price/13kg() 45 45 45 45 45

income/ha(Export)(GH) 48461.53846 55384.62 62307.692 62307.69 62307.69

income(local)() 261.5384615 276.9231 307.69231 307.6923 307.6923

total income/ha 48723.07692 55661.54 62615.385 62615.38 62615.38

total income/80Ha 3897846.154 4452923 5009230.8 5009231 5009231

% losses @ 5%/Ha 2436.153846 2783.077 3130.7692 3130.769 3130.769

%losses @ 5%/80Ha 194892.3077 222646.2 250461.54 250461.5 250461.5

gross margin/Ha 3866717.692 4432463 4986038.5 4951905 4983928

gross margin/80Ha 1407569.231 2816123 3153846.2 423200 2985046

other income/ha(suckers) 0 4000 8000 10000 11000

other income/80ha 0 320000 640000 800000 880000

fixed cost

tractor set 234783 0 0 0 0

processor 73372.5 0 0 0 0

vehecles 900000 0 0 0 0

installation 11005.875 0 0 0 0

building 99999.99 0 0 0 0

land 480000 0 0 0 0

total fixed cost 1799161.365 0 0 0

-

net income/80ha 391592.1342 2816123 3153846.2 423200 2985046

other cost

administrative cost 50000 50000 50000 50000 50000

fuel 50000 30000 30000 30000 30000

lubricant 15000 9000 9000 9000 9000

power 208800 219240 229680 240120 250560

salaries 900000 900000 900000 900000 900000

-

contingency 39159.21342 281612.3 315384.62 42320 298504.6

total other cost 1134640.787 39000 39000 39000 39000

-

net income(final)/80ha 1526232.921 2777123 3114846.2 384200 2946046

TABLE 2: SUMMAERIZED CASH FLOW

Summarized Cash Flow

items Year 1 Year 2 Year 3 Year 4 Year 5

production cost 9,500.00 3,300.00 3,800.00 20,866.54 4,855.00

spoilage(5%) 194,892.31 222,646.15 250,461.54 250,461.54 250,461.54

export cost 775,384.62 886,153.85 996,923.08 996,923.08 996,923.08

fruit purchase cost 150,000.00 164,000.00 189,500.00 215,000.00 240,500.00

fixed cost 1,799,161.37 - - - -

other cost

(production) 1,134,640.79 39,000.00 39,000.00 39,000.00 39,000.00

other cost (processing) 75,000.00 86,000.00 86,000.00 86,000.00 96,000.00

total cost 4,138,579.07 1,401,100.00 1,565,684.62 1,608,251.15 1,627,739.62

revenue

revenue (production) 3,897,846.15 4,452,923.08 5,009,230.77 5,009,230.77 5,009,230.77

revenue (processing) 270,000.00 296,000.00 339,250.00 382,500.00 425,750.00

total revenue 4,167,846.15 4,748,923.08 5,348,480.77 5,391,730.77 5,434,980.77

net revenue 29,267.08 3,347,823.08 3,782,796.15 3,783,479.62 3,807,241.15

TABLE 3: PAYBACK PERIOD

Payback Period

year investment operating cost cost benefit cashflow cum cf

1 1,799,161.37 0 1,799,161.37 0 (1,799,161.37)

2 - 1,209,640.79 1,129,776.92 29,267.08 (1,100,509.84) (1,100,509.84)

3 - 125,000.00 1,276,100.00 3,347,823.08 2,071,723.08 971,213.24

4 - 125,000.00 1,440,684.62 3,782,796.15 2,342,111.54 3,313,324.78

5 - 125,000.00 1,483,251.15 3,783,479.62 2,300,228.46 5,613,553.24

TABLE 3: BENEFIT COST RATIO

benefit cost ratio

present

operating present value of

year investment cost benefit DF@25% value of

cost benefit(25%)

cost (25%)

1 1,799,161.37 1,209,640.79 1,129,776.92 29,267.08 0.80 903,821.54 23,413.66

2 - 125,000.00 1,276,100.00 3,347,823.08 0.64 816,704.00 2,142,606.77

3 - 125,000.00 1,440,684.62 3,782,796.15 0.51 737,630.52 1,936,791.63

4 - 125,000.00 1,483,251.15 3,783,479.62 0.41 608,132.97 1,551,226.64

5 - 135,000.00 1,492,739.62 3,807,241.15 0.33 492,604.07 1,256,389.58

TOTAL 3,558,893.11 6,910,428.29

NET PRESENT VALUE= PRESENT VALUE OF BENEFIT PRESENT VALUE OF COST

= 3558893.11 - 6910428.29

= 3,351,535.18

BENEFIT COST RATIO = PRESENT VALUE OF BENEFIT

PRESENT VALUE OF COST

= 6,910,428.29

3,558,893.11

= 1.94

You might also like

- The Valuation and Financing of Lady M Case StudyDocument4 pagesThe Valuation and Financing of Lady M Case StudyUry Suryanti Rahayu100% (3)

- 7e Ch5 Mini Case AnalyticsDocument6 pages7e Ch5 Mini Case AnalyticsDaniela667100% (9)

- The Valuation and Financing of Lady M Case StudyDocument4 pagesThe Valuation and Financing of Lady M Case StudyUry Suryanti RahayuNo ratings yet

- Template SAP B1 Pre-Sales Questionnaire V2Document6 pagesTemplate SAP B1 Pre-Sales Questionnaire V2Ndru Dru50% (2)

- Mechanical Drying Equipment FinalDocument8 pagesMechanical Drying Equipment Finalvijaypal2000100% (1)

- FIN501 - Financial Management Mid Term Assignment - Zin Thet Nyo LwinDocument16 pagesFIN501 - Financial Management Mid Term Assignment - Zin Thet Nyo LwinZin Thet InwonderlandNo ratings yet

- Treasure Trophy CompanyDocument12 pagesTreasure Trophy CompanyArslan ShaikhNo ratings yet

- Boston Beer ExcelDocument6 pagesBoston Beer ExcelNarinderNo ratings yet

- Phuket Beach Case SolutionDocument8 pagesPhuket Beach Case SolutionGmitNo ratings yet

- Group 2 EconomicDocument14 pagesGroup 2 EconomicCourage ChigerweNo ratings yet

- Case StudyDocument11 pagesCase StudyPriti SawantNo ratings yet

- Traditional Costing Method Ice-Mint Paan ElaichiDocument11 pagesTraditional Costing Method Ice-Mint Paan ElaichiI.E. Business SchoolNo ratings yet

- Account Excel Class 1Document14 pagesAccount Excel Class 1Flora bhandariNo ratings yet

- Revenue ProjectionDocument17 pagesRevenue ProjectionKriti AhujaNo ratings yet

- Fructose Financial PlanDocument10 pagesFructose Financial PlandoieNo ratings yet

- Dewi Kartika Ramadhani Marpaung - Mantekpro ADocument3 pagesDewi Kartika Ramadhani Marpaung - Mantekpro ANurmaiNo ratings yet

- San Fabian Rev1Document4 pagesSan Fabian Rev1sneha patelNo ratings yet

- Monthly Revenue Projections For Year 1Document2 pagesMonthly Revenue Projections For Year 1Vijay GaikwadNo ratings yet

- Balance-Sheet 015138Document6 pagesBalance-Sheet 015138mesadaeterjohn.studentNo ratings yet

- Coffee CubeDocument5 pagesCoffee Cubes3976142No ratings yet

- APP Sefrina 2Document5 pagesAPP Sefrina 2Rafli FauqoniNo ratings yet

- Multiplex ProjectionsDocument2 pagesMultiplex ProjectionsTheHackersdenNo ratings yet

- BC RatioDocument7 pagesBC Ratiosubdivision1 MydukurNo ratings yet

- Traditional Costing Method Vs ABC Costing Ice-Mint Paan ElaichiDocument11 pagesTraditional Costing Method Vs ABC Costing Ice-Mint Paan ElaichiI.E. Business SchoolNo ratings yet

- A) Financial Analysis of Divisional Performance of GMPHS: ParticularsDocument6 pagesA) Financial Analysis of Divisional Performance of GMPHS: ParticularsAtmiya BiscuitwalaNo ratings yet

- Thermax Limited: Standalone Audited Financial Results For The Quarter Ended September 30, 2014Document1 pageThermax Limited: Standalone Audited Financial Results For The Quarter Ended September 30, 2014kartiknamburiNo ratings yet

- Income StatementDocument11 pagesIncome StatementBianca Camille CabaliNo ratings yet

- Taller N°1 AulaDocument10 pagesTaller N°1 AulaArmand VcsNo ratings yet

- SITXFIN003 TablesDocument4 pagesSITXFIN003 Tables李MayNo ratings yet

- Pricing Strategy: I I O M, BDocument5 pagesPricing Strategy: I I O M, BPraveen RevankarNo ratings yet

- MR - Chandrashekar KDocument9 pagesMR - Chandrashekar KAnirudha SarkarNo ratings yet

- Prestige TelephoneDocument10 pagesPrestige TelephoneDeep GandhiNo ratings yet

- Cookies: Item Name Unit Used Price Total PriceDocument11 pagesCookies: Item Name Unit Used Price Total Priceshakhawat HossainNo ratings yet

- Calculations Tata NanoDocument5 pagesCalculations Tata NanovighneshmehtaNo ratings yet

- Submitted By:: Qaisar Shahzad Submitted To: Dr. Haroon Hussain Sb. Roll NoDocument8 pagesSubmitted By:: Qaisar Shahzad Submitted To: Dr. Haroon Hussain Sb. Roll NoFaaiz YousafNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- Perhitungan NPV Dan Hubungan Dengan Discount RateDocument5 pagesPerhitungan NPV Dan Hubungan Dengan Discount RateChristopher D NaraNo ratings yet

- What IF 234565weqwdsxvDocument12 pagesWhat IF 234565weqwdsxvOmer CrestianiNo ratings yet

- Flood Management Programme During XII Plan (2012-2017) : 30st SEP/ 2019 Progress in The Present Quarter 30st SEP/ 2019Document16 pagesFlood Management Programme During XII Plan (2012-2017) : 30st SEP/ 2019 Progress in The Present Quarter 30st SEP/ 2019NILRATAN SARKARNo ratings yet

- 10 Year Forecast Estepona Townhouse Purchased V2Document62 pages10 Year Forecast Estepona Townhouse Purchased V2gabiNo ratings yet

- F5 CRQ PracticeDocument11 pagesF5 CRQ Practiceprabhakaran arumugamNo ratings yet

- Analysis: Calculation of Total Sales of The ProjectDocument7 pagesAnalysis: Calculation of Total Sales of The ProjectShailesh Kumar BaldodiaNo ratings yet

- Om - Monthly ReportDocument81 pagesOm - Monthly ReportRajeshbabhu Rajeshbabhu100% (1)

- AnalysisDocument34 pagesAnalysisIndraneel MahantiNo ratings yet

- Safari 3Document4 pagesSafari 3Bharti SutharNo ratings yet

- The Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Document4 pagesThe Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Rahul VenugopalanNo ratings yet

- Lady M SolutionDocument4 pagesLady M SolutionRahul VenugopalanNo ratings yet

- Ramesh Kumar SoniDocument13 pagesRamesh Kumar SoniShreeRang ConsultancyNo ratings yet

- 0497427936124Document18 pages0497427936124Saleh AlgdaryNo ratings yet

- SITXFIN009 Assessment C Bistro Reports V1Document3 pagesSITXFIN009 Assessment C Bistro Reports V1Sylovecy EXoNo ratings yet

- $R4UFVSNDocument3 pages$R4UFVSNGrace StylesNo ratings yet

- Telecom Industry ForecastDocument23 pagesTelecom Industry Forecastcharan ranaNo ratings yet

- Apo - 1 Aishwarya Mundada 210101139 Vamika Shah 210101121 Somnath Banerjee 210101109 Siddhant Goyal 210101166 Navneet Fatehpuria 210101182 Vissapragada Ananth 210101151 Victor D 21FRN-612Document3 pagesApo - 1 Aishwarya Mundada 210101139 Vamika Shah 210101121 Somnath Banerjee 210101109 Siddhant Goyal 210101166 Navneet Fatehpuria 210101182 Vissapragada Ananth 210101151 Victor D 21FRN-612Siddhant Goyal100% (1)

- MA Simulation Game 1st and 2nd PeriodDocument18 pagesMA Simulation Game 1st and 2nd PeriodIvan IvanNo ratings yet

- Dr. Sen's FFDocument16 pagesDr. Sen's FFnikhilluniaNo ratings yet

- Materials Pallet ListDocument4 pagesMaterials Pallet ListHumza MazharNo ratings yet

- Chap 14 Case Study Q2Document3 pagesChap 14 Case Study Q2vecasussince2023No ratings yet

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouNo ratings yet

- Business Plan For Biofuel Industry (Briquette)Document7 pagesBusiness Plan For Biofuel Industry (Briquette)Sudarshan GovindarajanNo ratings yet

- Unaudited Financial Results Quarter Ended 31 12 2011Document1 pageUnaudited Financial Results Quarter Ended 31 12 2011Rakshit MathurNo ratings yet

- Muhmmed Ans 1&3Document10 pagesMuhmmed Ans 1&3Lucky LuckyNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Summary Book Public Finance Rosen and Gayer Lecture S Chapters 3 To 6-8-12!14!15 16 18 20 22Document35 pagesSummary Book Public Finance Rosen and Gayer Lecture S Chapters 3 To 6-8-12!14!15 16 18 20 22SitwatHashmi50% (2)

- Finance Case StudyDocument8 pagesFinance Case StudyEvans MettoNo ratings yet

- Statute of Limitations For Collecting A DebtDocument2 pagesStatute of Limitations For Collecting A DebtmikotanakaNo ratings yet

- Investment Principles and Checklists OrdwayDocument149 pagesInvestment Principles and Checklists Ordwayevolve_us100% (2)

- SCR Banking KMDDocument25 pagesSCR Banking KMDamitguptaujjNo ratings yet

- Risk and Return: Past and PrologueDocument39 pagesRisk and Return: Past and ProloguerrNo ratings yet

- Canada Life RCA BrochureDocument4 pagesCanada Life RCA Brochuremacsmith0007No ratings yet

- Terralima Agri Trading PlatformDocument17 pagesTerralima Agri Trading PlatformRoy NjokaNo ratings yet

- Securitization: Final Term ReportDocument35 pagesSecuritization: Final Term ReportMohsin HassanNo ratings yet

- Meaning of Convertibility of Rupee by YashuDocument4 pagesMeaning of Convertibility of Rupee by YashuVishal ModiNo ratings yet

- Latin American Debt CrisisDocument15 pagesLatin American Debt Crisisakash jainNo ratings yet

- Understanding The Time Value of MoneyDocument20 pagesUnderstanding The Time Value of MoneyanayNo ratings yet

- Chapter 11 - Percentage Taxes (Valencia)Document8 pagesChapter 11 - Percentage Taxes (Valencia)Rose CastilloNo ratings yet

- RDocument3 pagesRAminul Haque RusselNo ratings yet

- FIN 460-END OF Chap 2 - AmendedDocument5 pagesFIN 460-END OF Chap 2 - AmendedBombitaNo ratings yet

- Research Paper Corporate FinanceDocument7 pagesResearch Paper Corporate Financeaflbrpwan100% (1)

- Investme C7 - Harvard Management Co. and Inflation-Protected Bonds, Spreadsheet SupplementDocument8 pagesInvestme C7 - Harvard Management Co. and Inflation-Protected Bonds, Spreadsheet SupplementANKUR PUROHITNo ratings yet

- Systems, Processes and Challenges of Public Revenue Collection in ZimbabweDocument12 pagesSystems, Processes and Challenges of Public Revenue Collection in ZimbabwePrince Wayne SibandaNo ratings yet

- Financial Accounting For ManagersDocument127 pagesFinancial Accounting For ManagerssowmtinaNo ratings yet

- Credit and Debit CardDocument2 pagesCredit and Debit Cardnouha KABBAJNo ratings yet

- Ahmed Madad Proposal NormalDocument29 pagesAhmed Madad Proposal NormalDhaabar Salaax100% (1)

- ACCA - Chapter 5-6Document7 pagesACCA - Chapter 5-6Bianca Alexa SacabonNo ratings yet

- TOPIC 1 Pengantar Manajemen KeuanganDocument14 pagesTOPIC 1 Pengantar Manajemen Keuanganbams_febNo ratings yet

- ANNEX A ECB II Form PDFDocument5 pagesANNEX A ECB II Form PDFSudhir Kochhar Fema AuthorNo ratings yet

- Palkka Mepv2022k12a1t36702c0 09.12.2022Document3 pagesPalkka Mepv2022k12a1t36702c0 09.12.2022CesarNo ratings yet

- Midlands State University: Undergraduate and Postgraduate Degree Programmes For The August 2022 IntakeDocument21 pagesMidlands State University: Undergraduate and Postgraduate Degree Programmes For The August 2022 IntakeMcDavids MakoraNo ratings yet

- 12 Podar International School QPDocument2 pages12 Podar International School QPAkshat KhetanNo ratings yet