Professional Documents

Culture Documents

Cir vs. AGFHA

Cir vs. AGFHA

Uploaded by

dll1230 ratings0% found this document useful (0 votes)

2 views4 pages.

Original Title

1. cir vs. AGFHA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views4 pagesCir vs. AGFHA

Cir vs. AGFHA

Uploaded by

dll123.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

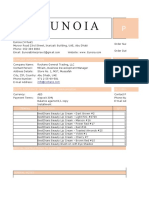

G.R. No.

187425 March 28, 2011

COMMISSIONER OF CUSTOMS, Petitioner,

vs.

AGFHA INCORPORATED, Respondent.

DECISION

MENDOZA, J.:

This is a petition for review on certiorari under Rule 45 of the Rules of Court assailing the February 25, 2009 Decision1 of

the Court of Tax Appeals En Banc (CTA-En Banc), in CTA EB Case No. 136, which affirmed the October 18, 2005

Resolution2 of its Second Division (CTA-Second Division), in CTA Case No. 5290, finding petitioner, the Commissioner of

Customs (Commissioner), liable to pay respondent AGFHA Incorporated (AGFHA) the amount of US$160,348.08 for the

value of the seized shipment which was lost while in petitioners custody.

On December 12, 1993, a shipment containing bales of textile grey cloth arrived at the Manila International Container Port

(MICP). The Commissioner, however, held the subject shipment because its owner/consignee was allegedly fictitious.

AGFHA intervened and alleged that it was the owner and actual consignee of the subject shipment.

On September 5, 1994, after seizure and forfeiture proceedings took place, the District Collector of Customs, MICP,

rendered a decision3 ordering the forfeiture of the subject shipment in favor of the government.

AGFHA filed an appeal. On August 25, 1995, the Commissioner rendered a decision4 dismissing it.

On November 4, 1996, the CTA-Second Division reversed the Commissioners August 25, 1995 Decision and ordered the

immediate release of the subject shipment to AGFHA. The dispositive portion of the CTA-Second Division Decision5

reads:

WHEREFORE, in view of the foregoing premises, the instant Petition for Review is hereby GRANTED. Accordingly, the

decision of the respondent in Customs Case No. 94-017, dated August 25, 1995, affirming the decision of the MICP

Collector, dated September 5, 1994, which decreed the forfeiture of the subject shipments in favor of the government, is

hereby REVERSED and SET ASIDE. Respondent is hereby ORDERED to effect the immediate RELEASE of the subject

shipment of goods in favor of the petitioner. No costs.

SO ORDERED.

On November 27, 1996, the CTA-Second Division issued an entry of judgment declaring the above-mentioned decision

final and executory.6

Thereafter, on May 20, 1997, AGFHA filed a motion for execution.

In its June 4, 1997 Resolution, the CTA-Second Division held in abeyance its action on AGFHAs motion for execution in

view of the Commissioners appeal with the Court of Appeals (CA), docketed as CA-G.R. SP No. 42590 and entitled

"Commissioner of Custom v. The Court of Tax Appeals and AGFHA, Incorporated."

On May 31, 1999, the CA denied due course to the Commissioners appeal for lack of merit in a decision, 7 the dispositive

portion of which reads:

WHEREFORE, the instant petition is hereby DENIED DUE COURSE and DISMISSED for lack of merit. Accordingly, the

Commissioner of Customs is hereby ordered to effect the immediate release of the shipment of AGFHA, Incorporated

described as "2 x 40" Cont. No. NYKU-6772906 and NYKU-6632117 STA 197 Bales of Textile Grey Cloth" placed under

Hold Order No. H/CI/01/2293/01 dated 22 January 1993.

No costs.

SO ORDERED.

Thereafter, the Commissioner elevated the aforesaid CA Decision to this Court via a petition for review on certiorari,

docketed as G.R. No. 139050 and entitled "Republic of the Philippines represented by the Commissioner of Customs v.

The Court of Tax Appeals and AGFHA, Inc."

On October 2, 2001, the Court dismissed the petition.8

On January 14, 2002, the Court denied with finality the Commissioners motion for reconsideration of its October 2, 2001

Decision.

On March 18, 2002, the Entry of Judgment was issued by the Court declaring its aforesaid decision final and executory as

of February 5, 2002.

In view thereof, the CTA-Second Division issued the Writ of Execution, dated October 16, 2002, directing the

Commissioner and his authorized subordinate or representative to effect the immediate release of the subject shipment. It

further ordered the sheriff to see to it that the writ would be carried out by the Commissioner and to make a report thereon

within thirty (30) days after receipt of the writ. The writ, however, was returned unsatisfied.

On July 23, 2003, the CTA-Second Division received a copy of AGFHAs Motion to Show Cause dated July 21, 2003.

Acting on the motion, the CTA-Second Division issued a notice setting it for hearing on August 1, 2003 at 9:00 oclock in

the morning.

In its August 13, 2003 Resolution, the CTA-Second Division granted AGFHAs motion and ordered the Commissioner to

show cause within fifteen (15) days from receipt of said resolution why he should not be disciplinary dealt with for his

failure to comply with the writ of execution.

On September 1, 2003, Commissioners counsel filed a Manifestation and Motion, dated August 28, 2003, attaching

therewith a copy of an Explanation (With Motion for Clarification) dated August 11, 2003 stating, inter alia, that despite

diligent efforts to obtain the necessary information and considering the length of time that had elapsed since the subject

shipment arrived at the Bureau of Customs, the Chief of the Auction and Cargo Disposal Division of the MICP could not

determine the status, whereabouts and disposition of said shipment.

Consequently, AGFHA filed its Motion to Cite Petitioner in Contempt of Court dated September 13, 2003. After a series of

pleadings, on November 17, 2003, the CTA-Second Division denied, among others, AGFHAs motion to cite petitioner in

contempt for lack of merit. It, however, stressed that the denial was without prejudice to other legal remedies available to

AGFHA.

On August 13, 2004, the Commissioner received AGFHAs Motion to Set Case for Hearing, dated April 12, 2004,

allegedly to determine: (1) whether its shipment was actually lost; (2) the cause and/or circumstances surrounding the

loss; and (3) the amount the Commissioner should pay or indemnify AGFHA should the latters shipment be found to have

been actually lost.

On May 17, 2005, after the parties had submitted their respective memoranda, the CTA-Second Division adjudged the

Commissioner liable to AGFHA. Specifically, the dispositive portion of the resolution reads:

WHEREFORE, premises considered, the Bureau of Customs is adjudged liable to petitioner AGFHA, INC. for the value of

the subject shipment in the amount of ONE HUNDERED SIXTY THOUSAND THREE HUNDRED FORTY EIGHT AND

08/100 US DOLLARS (US$160,348.08). The Bureau of Customs liability may be paid in Philippine Currency, computed at

the exchange rate prevailing at the time of actual payment, with legal interests thereon at the rate of 6% per annum

computed from February 1993 up to the finality of this Resolution. In lieu of the 6% interest, the rate of legal interest shall

be 12% per annum upon finality of this Resolution until the value of the subject shipment is fully paid.

The payment shall be taken from the sale or sales of the goods or properties which were seized or forfeited by the Bureau

of Customs in other cases.

SO ORDERED.9

On June 10, 2005, the Commissioner filed his Motion for Partial Reconsideration arguing that (a) the enforcement and

satisfaction of respondents money claim must be pursued and filed with the Commission on Audit pursuant to

Presidential Decree (P.D.) No. 1445; (b) respondent is entitled to recover only the value of the lost shipment based on its

acquisition cost at the time of importation; and (c) taxes and duties on the subject shipment must be deducted from the

amount recoverable by respondent.

On the same day, the Commissioner received AGFHAs Motion for Partial Reconsideration claiming that the 12% interest

rate should be computed from the time its shipment was lost on June 15, 1999 considering that from such date,

petitioners obligation to release their shipment was converted into a payment for a sum of money.

On October 18, 2005, after the filing of several pleadings, the CTA-Second Division promulgated a resolution which reads:

WHEREFORE, premises considered, respondent Commissioner of Customs "Motion for Partial Reconsideration" is

hereby PARTIALLY GRANTED. The Resolution dated May 17, 2005 is hereby MODIFIED but only insofar as the Court

did not impose the payment of the proper duties and taxes on the subject shipment. Accordingly, the dispositive portion of

Our Resolution, dated May 17, 2005, is hereby MODIFIED to read as follows:

WHEREFORE, premises considered, the Bureau of Customs is adjudged liable to petitioner AGFHA, INC. for the value of

the subject shipment in the amount of ONE HUNDRED SIXTY THOUSAND THREE HUNDRED FORTY EIGHT AND

08/100 US DOLLARS (US$160,348.08), subject however, to the payment of the prescribed taxes and duties, at the time

of the importation. The Bureau of Customs liability may be paid in Philippine Currency, computed at the exchange rate

prevailing at the time of actual payment, with legal interests thereon at the rate of 6% per annum computed from February

1993 up to the finality of this Resolution. In lieu of the 6% interest, the rate of legal interest shall be 12% per annum upon

finality of this Resolution until the value of the subject shipment is fully paid.

The payment shall be taken from the sale or sales of the goods or properties which were seized or forfeited by the Bureau

of Customs in other cases.

SO ORDERED.

Petitioner AGFHA, Inc.s "Motion for Partial Reconsideration" is hereby DENIED for lack of merit.

SO ORDERED.10

Consequently, the Commissioner elevated the above-quoted resolution to the CTA-En Banc.

On February 25, 2009, the CTA-En Banc promulgated the subject decision dismissing the petition for lack of merit and

affirming in toto the decision of the CTA-Second Division.

On March 18, 2009, the Commissioner filed his Motion for Reconsideration, but it was denied by the CTA-En Banc in its

April 13, 2009 Resolution.

Hence, this petition.

ISSUE

Whether or not the Court of Tax Appeals was correct in awarding the respondent the amount of US$160,348.08, as

payment for the value of the subject lost shipment that was in the custody of the petitioner.

In his petition, the Commissioner basically argues two (2) points: 1] the respondent is entitled to recover the value of the

lost shipment based only on its acquisition cost at the time of importation; and 2] the present action has been theoretically

transformed into a suit against the State, hence, the enforcement/satisfaction of petitioners claim must be pursued in

another proceeding consistent with the rule laid down in P.D. No. 1445.

He further argues that the basis for the exchange rate of its liability lacks basis. Based on the Memorandum, dated August

27, 2002, of the Customs Operations Officers, the true value of the subject shipment is US$160,340.00 based on its

commercial invoices which have been found to be spurious. The subject shipment arrived at the MICP on December 12,

1992 and the peso-dollar exchange rate was 20.00 per US$1.00. Thus, this conversion rate must be applied in the

computation of the total land cost of the subject shipment being claimed by AGFHA or 3,206,961.60 plus interest.

The Commissioner further contends that based on Executive Order No. 688 (The 1999 Tariff and Customs Code of the

Philippines), the proceeds from any legitimate transaction, conveyance or sale of seized and/or forfeited items for

importations or exportations by the customs bureau cannot be lawfully disposed of by the petitioner to satisfy respondents

money judgment. EO 688 mandates that the unclaimed proceeds from the sale of forfeited goods by the Bureau of

Customs (BOC) will be considered as customs receipts to be deposited with the Bureau of Treasury and shall form part of

the general funds of the government. Any disposition of the said unclaimed proceeds from the sale of forfeited goods will

be violative of the Constitution, which provides that "No money shall be paid out of the Treasury except in pursuance of an

appropriation made by law."11

Thus, the Commissioner posits that this case has been transformed into a suit against the State because the satisfaction

of AGFHAs claim will have to be taken from the national coffers. The State may not be sued without its consent. The

BOC enjoys immunity from suit since it is invested with an inherent power of sovereignty which is taxation.

To recover the alleged loss of the subject shipment, AGFHAs remedy here is to file a money claim with the Commission

on Audit (COA) pursuant to Act No. 3083 (An Act Defining the Condition under which the Government of the Philippine

Island may be Sued) and Commonwealth Act No. 327 (An Act Fixing the Time within which the Auditor General shall

render his Decisions and Prescribing the Manner of Appeal therefrom, as amended by P.D. No. 1445). Upon the

determination of State liability, the prosecution, enforcement or satisfaction thereof must still be pursued in accordance

with the rules and procedures laid down in P.D. No. 1445, otherwise known as the Government Auditing Code of the

Philippines.

On the other hand, AGFHA counters that, in line with prevailing jurisprudence, the applicable peso-dollar exchange rate

should be the one prevailing at the time of actual payment in order to preserve the real value of the subject shipment to

the date of its payment. The CTA-En Banc Decision does not constitute a money claim against the State. The

Commissioners obligation to return the subject shipment did not arise from an import-export contract but from a quasi-

contract particularly solutio indebiti under Article 2154 of the Civil Code. The payment of the value of the subject lost

shipment was in accordance with Article 2159 of the Civil Code. The doctrine of governmental immunity from suit cannot

serve as an instrument for perpetrating an injustice on a citizen. When the State violates its own laws, it cannot invoke the

doctrine of state immunity to evade liability. The commission of an unlawful or illegal act on the part of the State is

equivalent to implied consent.

THE COURTS RULING

The petition lacks merit.

The Court agrees with the ruling of the CTA that AGFHA is entitled to recover the value of its lost shipment based on the

acquisition cost at the time of payment.

In the case of C.F. Sharp and Co., Inc. v. Northwest Airlines, Inc. the Court ruled that the rate of exchange for the

conversion in the peso equivalent should be the prevailing rate at the time of payment:

In ruling that the applicable conversion rate of petitioner's liability is the rate at the time of payment, the Court of Appeals

cited the case of Zagala v. Jimenez, interpreting the provisions of Republic Act No. 529, as amended by R.A. No. 4100.

Under this law, stipulations on the satisfaction of obligations in foreign currency are void. Payments of monetary

obligations, subject to certain exceptions, shall be discharged in the currency which is the legal tender in the Philippines.

But since R.A. No. 529 does not provide for the rate of exchange for the payment of foreign currency obligations incurred

after its enactment, the Court held in a number of cases that the rate of exchange for the conversion in the peso

equivalent should be the prevailing rate at the time of payment.12 [Emphases supplied]

Likewise, in the case of Republic of the Philippines represented by the Commissioner of Customs v. UNIMEX Micro-

Electronics GmBH,13 which involved the seizure and detention of a shipment of computer game items which disappeared

while in the custody of the Bureau of Customs, the Court upheld the decision of the CA holding that petitioners liability

may be paid in Philippine currency, computed at the exchange rate prevailing at the time of actual payment.

On the issue regarding the state immunity doctrine, the Commissioner cannot escape liability for the lost shipment of

goods. This was clearly discussed in the UNIMEX Micro-Electronics GmBH decision, where the Court wrote:

Finally, petitioner argues that a money judgment or any charge against the government requires a corresponding

appropriation and cannot be decreed by mere judicial order.

Although it may be gainsaid that the satisfaction of respondent's demand will ultimately fall on the government, and that,

under the political doctrine of "state immunity," it cannot be held liable for governmental acts (jus imperii), we still hold that

petitioner cannot escape its liability. The circumstances of this case warrant its exclusion from the purview of the state

immunity doctrine.

As previously discussed, the Court cannot turn a blind eye to BOC's ineptitude and gross negligence in the

safekeeping of respondent's goods. We are not likewise unaware of its lackadaisical attitude in failing to provide

a cogent explanation on the goods' disappearance, considering that they were in its custody and that they were

in fact the subject of litigation. The situation does not allow us to reject respondent's claim on the mere

invocation of the doctrine of state immunity. Succinctly, the doctrine must be fairly observed and the State

should not avail itself of this prerogative to take undue advantage of parties that may have legitimate claims

against it.

In Department of Health v. C.V. Canchela & Associates, we enunciated that this Court, as the staunch guardian of the

people's rights and welfare, cannot sanction an injustice so patent in its face, and allow itself to be an instrument in the

perpetration thereof. Over time, courts have recognized with almost pedantic adherence that what is inconvenient and

contrary to reason is not allowed in law. Justice and equity now demand that the State's cloak of invincibility against suit

and liability be shredded.1awphi1

Accordingly, we agree with the lower courts' directive that, upon payment of the necessary customs duties by respondent,

petitioner's "payment shall be taken from the sale or sales of goods or properties seized or forfeited by the Bureau of

Customs."

WHEREFORE, the assailed decisions of the Court of Appeals in CA-G.R. SP Nos. 75359 and 75366 are hereby

AFFIRMED with MODIFICATION. Petitioner Republic of the Philippines, represented by the Commissioner of the Bureau

of Customs, upon payment of the necessary customs duties by respondent Unimex Micro-Electronics GmBH, is hereby

ordered to pay respondent the value of the subject shipment in the amount of Euro 669,982.565. Petitioner's liability may

be paid in Philippine currency, computed at the exchange rate prevailing at the time of actual payment.

SO ORDERED.14 [Emphases supplied]

In line with the ruling in UNIMEX Micro-Electronics GmBH, the Commissioner of Customs should pay AGFHA the value of

the subject lost shipment in the amount of US$160,348.08 which liability may be paid in Philippine currency computed at

the exchange rate prevailing at the time of the actual payment.

WHEREFORE, the February 25, 2009 Decision of the Court of Tax Appeals En Banc, in CTA EB Case No. 136, is

AFFIRMED. The Commissioner of Customs is hereby ordered to pay, in accordance with law, the value of the subject lost

shipment in the amount of US$160,348.08, computed at the exchange rate prevailing at the time of actual payment after

payment of the necessary customs duties.

SO ORDERED.

You might also like

- StudentDocument30 pagesStudentAnh Lý100% (1)

- Esso V CIRDocument4 pagesEsso V CIRWinnie Ann Daquil Lomosad-MisagalNo ratings yet

- GR No. 166993 Dec. 19, 2005Document6 pagesGR No. 166993 Dec. 19, 2005Allysa Lei Delos ReyesNo ratings yet

- Industrial - Disputes Act - 1947Document21 pagesIndustrial - Disputes Act - 1947settiNo ratings yet

- Notes On Comelec: CIR, Mendoza v. COMELEC)Document10 pagesNotes On Comelec: CIR, Mendoza v. COMELEC)Daisyree CastilloNo ratings yet

- Sample Invitation Letter For Visitor Visa To AustraliaDocument3 pagesSample Invitation Letter For Visitor Visa To AustraliaHà Hà60% (5)

- NDC V CIRDocument5 pagesNDC V CIRjonbelzaNo ratings yet

- Ampatuan vs. de LimaDocument18 pagesAmpatuan vs. de LimaisaaabelrfNo ratings yet

- Abakada v. ES Ermita - SiangDocument2 pagesAbakada v. ES Ermita - SiangCJ MillenaNo ratings yet

- Consti CasesDocument5 pagesConsti CasesJeje MedidasNo ratings yet

- CIR v. ESSO Standard 1989Document4 pagesCIR v. ESSO Standard 1989Mark Ebenezer BernardoNo ratings yet

- Facts:: Facts: Commonwealth Act No. 567, Otherwise Known As Sugar Adjustment Act WasDocument2 pagesFacts:: Facts: Commonwealth Act No. 567, Otherwise Known As Sugar Adjustment Act WasRuiz Arenas AgacitaNo ratings yet

- Safic Alcan & Cie Vs Imperial Vegetable Oil Co.Document10 pagesSafic Alcan & Cie Vs Imperial Vegetable Oil Co.Eller-jed M. MendozaNo ratings yet

- Edi v. GranDocument2 pagesEdi v. GranChariNo ratings yet

- KABATAAN PARTYLIST Vs ComelecDocument1 pageKABATAAN PARTYLIST Vs ComelecJenilyn EntongNo ratings yet

- Customs CasesDocument28 pagesCustoms CasesCheCheNo ratings yet

- Moreno vs. COMELEC (G.R. No. 168550 August 10, 2006) - Case DigestDocument1 pageMoreno vs. COMELEC (G.R. No. 168550 August 10, 2006) - Case DigestAmir Nazri Kaibing100% (1)

- VIGILAR v. AQUINODocument1 pageVIGILAR v. AQUINOKingNo ratings yet

- Tomlin vs. MoyaDocument2 pagesTomlin vs. MoyadanettheninjaNo ratings yet

- Partnership (Case Digests)Document17 pagesPartnership (Case Digests)Lou Ann AncaoNo ratings yet

- Osmena Vs PendatunDocument3 pagesOsmena Vs PendatunJem A. ArisgaNo ratings yet

- Accenture Vs CirDocument1 pageAccenture Vs CirCess EspinoNo ratings yet

- Maria Carolina P. Araullo Et. AlDocument3 pagesMaria Carolina P. Araullo Et. AlClaire SilvestreNo ratings yet

- People of The Philippines Vs SyjucoDocument2 pagesPeople of The Philippines Vs SyjucoEmpty CupNo ratings yet

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemCrisanta MarieNo ratings yet

- Midterm Reviewer - Corporation LawDocument40 pagesMidterm Reviewer - Corporation LawLegalmindsNo ratings yet

- Absolute Management Corporation vs. Metropolitan Bank and Trust Company - Pre-Trial 2014Document9 pagesAbsolute Management Corporation vs. Metropolitan Bank and Trust Company - Pre-Trial 2014Ottats IceNo ratings yet

- Lesson 2.1 Definition and Importance of Legal FormsDocument3 pagesLesson 2.1 Definition and Importance of Legal FormsChanpol ArceNo ratings yet

- Quinto VS Comelec, 606 Scra 258Document12 pagesQuinto VS Comelec, 606 Scra 258Jha Niz100% (1)

- Association of Trade Unions vs. AbellaDocument15 pagesAssociation of Trade Unions vs. AbellaT Cel MrmgNo ratings yet

- Lacoste v. FernandezDocument1 pageLacoste v. FernandezFayie De LunaNo ratings yet

- Balibago Faith Baptist Church V Faith in Christ Jesus Baptist ChurchDocument13 pagesBalibago Faith Baptist Church V Faith in Christ Jesus Baptist ChurchRelmie TaasanNo ratings yet

- 6456347Document1 page6456347Kirstine Mae GilbuenaNo ratings yet

- Aurora City Code: Use of Turf and Ornamental Water FeaturesDocument5 pagesAurora City Code: Use of Turf and Ornamental Water FeaturesWilson BeeseNo ratings yet

- Decent Work Employment and Transcultural NursingDocument35 pagesDecent Work Employment and Transcultural NursingGlory Anne Joy Willy100% (3)

- Quiz - IAS 16 - Property, Plant and Equipment: (A) (B) (C) (D)Document2 pagesQuiz - IAS 16 - Property, Plant and Equipment: (A) (B) (C) (D)furqan100% (2)

- B5 Martinez For Shipside Vs CADocument2 pagesB5 Martinez For Shipside Vs CASandra Domingo100% (1)

- 04 Chrysler Philippines Corp. Vs CADocument6 pages04 Chrysler Philippines Corp. Vs CAIronFaith19No ratings yet

- Morales Vs Harbour Centre Port TerminalDocument2 pagesMorales Vs Harbour Centre Port TerminalTootsie Guzma100% (1)

- Ignacio Vs Director of LandsDocument2 pagesIgnacio Vs Director of LandsCristineVillablancaNo ratings yet

- Maceda Vs MacaraigDocument1 pageMaceda Vs MacaraigcqpascuaNo ratings yet

- ROHM Apollo Semiconductor v. CirDocument3 pagesROHM Apollo Semiconductor v. Cirdll123No ratings yet

- Constitutional Law 1 Digest CompilationDocument26 pagesConstitutional Law 1 Digest CompilationKrystoffer YapNo ratings yet

- CLU vs. Exec. Secretary, 194 SCRA 317 (1991)Document1 pageCLU vs. Exec. Secretary, 194 SCRA 317 (1991)Reginald Dwight FloridoNo ratings yet

- Tetangco Vs OmbudsmanDocument5 pagesTetangco Vs OmbudsmanRon AceNo ratings yet

- Hontiveros v. AltavasDocument2 pagesHontiveros v. AltavasmisterdodiNo ratings yet

- Osmena Vs Orbos DigestDocument16 pagesOsmena Vs Orbos DigestMiko Caralde Dela CruzNo ratings yet

- ITAD BIR RULING NO. 026-18, March 5, 2018Document10 pagesITAD BIR RULING NO. 026-18, March 5, 2018Kriszan ManiponNo ratings yet

- 1ST AssignmentDocument17 pages1ST AssignmentZen TurrechaNo ratings yet

- Hacienda Luisita Vs PARCDocument12 pagesHacienda Luisita Vs PARCJumen TamayoNo ratings yet

- United States Vs Aniceto BarriasDocument4 pagesUnited States Vs Aniceto BarriasAdrian DaveNo ratings yet

- Property DigestDocument16 pagesProperty DigestCresteynTeyngNo ratings yet

- Torayno V ComelecDocument4 pagesTorayno V ComelecyanieggNo ratings yet

- Republic v. Rovency Realty and Development Corp PDFDocument11 pagesRepublic v. Rovency Realty and Development Corp PDFAnnieNo ratings yet

- Kmu Vs Neda and Ople Vs TorresDocument17 pagesKmu Vs Neda and Ople Vs TorresRon GamboaNo ratings yet

- Lagman V OchoaDocument17 pagesLagman V OchoaAmanda ButtkissNo ratings yet

- Dela Llana v. The Chairperson, COA, 665 SCRA 176Document1 pageDela Llana v. The Chairperson, COA, 665 SCRA 176Rafales, RJNo ratings yet

- Metropolitan Waterworks Vs Court of Appeals 143 SCRA 623Document11 pagesMetropolitan Waterworks Vs Court of Appeals 143 SCRA 623Janella Montemayor-RomeroNo ratings yet

- Declaratory Relief - Suit For DamagesDocument111 pagesDeclaratory Relief - Suit For DamagesLizzette Dela Pena100% (1)

- 6 Batch6 Guerrero Vs HernandoDocument2 pages6 Batch6 Guerrero Vs HernandoLex D. TabilogNo ratings yet

- MANILA PRINCE HOTEL V GSIS DigestDocument2 pagesMANILA PRINCE HOTEL V GSIS DigestcymonNo ratings yet

- Case DigestsDocument3 pagesCase DigestsAnna Dela VegaNo ratings yet

- Case 6 Demetria vs. Alba, 148 SCRA 208 (1987)Document6 pagesCase 6 Demetria vs. Alba, 148 SCRA 208 (1987)blude cosingNo ratings yet

- NegoDocument30 pagesNegodollyccruzNo ratings yet

- Tañada vs. Tuvera, G.R. No. L-63915, April 24, 1985Document11 pagesTañada vs. Tuvera, G.R. No. L-63915, April 24, 1985Edgar Joshua TimbangNo ratings yet

- CIR V Esso StandardDocument2 pagesCIR V Esso StandardJerico GodoyNo ratings yet

- 006-Soriano v. Offshore Shipping and Manning Corp., Et. Al., G.R. No. 78409, 14 Sept. 1989Document4 pages006-Soriano v. Offshore Shipping and Manning Corp., Et. Al., G.R. No. 78409, 14 Sept. 1989Jopan SJNo ratings yet

- Macalintal VS ComelecDocument5 pagesMacalintal VS ComelecMA. TERESA DADIVASNo ratings yet

- G.R. No. 180050 NAVARRO VS ERMITADocument20 pagesG.R. No. 180050 NAVARRO VS ERMITALou Ann AncaoNo ratings yet

- G.R. No. 207851 NAVAL VS COMELECDocument18 pagesG.R. No. 207851 NAVAL VS COMELECLou Ann AncaoNo ratings yet

- Goquiolay vs. Sycip, G.R. No. L-11840, December 10, 1963Document7 pagesGoquiolay vs. Sycip, G.R. No. L-11840, December 10, 1963Lou Ann AncaoNo ratings yet

- PP VS RestbeiDocument14 pagesPP VS RestbeiLou Ann AncaoNo ratings yet

- Teodora de Buencamino vs. Maria de Matias, G.R. No. L-19397, April 30, 1966Document3 pagesTeodora de Buencamino vs. Maria de Matias, G.R. No. L-19397, April 30, 1966Lou Ann AncaoNo ratings yet

- Jo Chung vs. Pacific, G.R. No. 19892, September 6, 1923Document10 pagesJo Chung vs. Pacific, G.R. No. 19892, September 6, 1923Lou Ann AncaoNo ratings yet

- Dulay v. CA - Closed CorpDocument3 pagesDulay v. CA - Closed CorpChicklet ArponNo ratings yet

- 2018 Q4 Jakarta Hotel Market Report Colliers PDFDocument7 pages2018 Q4 Jakarta Hotel Market Report Colliers PDFGita Aulia AzahraNo ratings yet

- Chapter 9 - Liabilities and InterestDocument5 pagesChapter 9 - Liabilities and InterestArmanNo ratings yet

- Statement of Interest Form: Internship at WWF-PakistanDocument2 pagesStatement of Interest Form: Internship at WWF-Pakistansumeer khanNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument7 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Magellan 9300i - 9400i Regulatory AddendumDocument2 pagesMagellan 9300i - 9400i Regulatory AddendumiulianNo ratings yet

- Purchase OrderDocument4 pagesPurchase OrderJan Rafael ReyesNo ratings yet

- Banned PDFDocument106 pagesBanned PDFIgor AndjelkovicNo ratings yet

- Accord Tax Ruling Entre Heinz Et Le Luxembourg - 2010Document126 pagesAccord Tax Ruling Entre Heinz Et Le Luxembourg - 2010JulieMangematinNo ratings yet

- Branco - Lavoura - Silva - CP Violation - 2007 - OUPDocument536 pagesBranco - Lavoura - Silva - CP Violation - 2007 - OUPdastegirNo ratings yet

- Read Online Textbook 2 The Sun and Its Shade The Night Its Moon Piper CJ Ebook All Chapter PDFDocument22 pagesRead Online Textbook 2 The Sun and Its Shade The Night Its Moon Piper CJ Ebook All Chapter PDFgerald.stratter644100% (9)

- Expectation As A Malaysian Living in A Multicultural SocietyDocument7 pagesExpectation As A Malaysian Living in A Multicultural SocietyLau Hui BingNo ratings yet

- Kvpy 2021Document2 pagesKvpy 2021Study BuddyNo ratings yet

- Marks and Spencers Investment AnalysisDocument5 pagesMarks and Spencers Investment AnalysisHussam AliNo ratings yet

- USCOURTS TXSD 4 - 05 CV 03392 0Document49 pagesUSCOURTS TXSD 4 - 05 CV 03392 0omar behNo ratings yet

- Westmont Bank vs. Eugene OngDocument5 pagesWestmont Bank vs. Eugene OngKhiarraNo ratings yet

- Package & Pinout User Guide: Arora V Series of FPGA ProductsDocument18 pagesPackage & Pinout User Guide: Arora V Series of FPGA ProductsJOSE FRANÇANo ratings yet

- Phishing - Dfas!!!!!Document3 pagesPhishing - Dfas!!!!!vsnusaNo ratings yet

- Montgomery Transition PlanDocument22 pagesMontgomery Transition PlanSteve Arnold100% (1)

- Microsoft Word - MOSS - Complaint Ver 9Document8 pagesMicrosoft Word - MOSS - Complaint Ver 9Anne SchindlerNo ratings yet

- Juvenile Justice (Care and Protection of Children) Act 2015: Whether Driven by Populism or A Well Thought Out Move ?Document52 pagesJuvenile Justice (Care and Protection of Children) Act 2015: Whether Driven by Populism or A Well Thought Out Move ?Deeksha ChaudharyNo ratings yet

- Electromagnetic Theory Unit I GENERAL PRINCIPLES1.1The Field Concept: 1.1.1 Orthogonal Coordinate SystemsDocument13 pagesElectromagnetic Theory Unit I GENERAL PRINCIPLES1.1The Field Concept: 1.1.1 Orthogonal Coordinate Systemschandra2006No ratings yet

- Sip Crafting Training DesignDocument8 pagesSip Crafting Training DesignHERNOR DE ASISNo ratings yet