Professional Documents

Culture Documents

Range Estimating Process PDF

Uploaded by

markigldmm918Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Range Estimating Process PDF

Uploaded by

markigldmm918Copyright:

Available Formats

AACE International Recommended Practice No.

41R-08

RISK ANALYSIS AND CONTINGENCY DETERMINATION

USING RANGE ESTIMATING

TCM Framework: 7.6 Risk Management

Acknowledgments:

Dr. Kenneth K. Humphreys, PE CCE (Author) William E. Maddex, CEP

Kevin M. Curran Stephen E. Mueller, CCE EVP

Michael W. Curran Dr. Shekhar S. Patil

Christopher O. Gruber, CCC Robert F. Wells, CEP

John K. Hollmann, PE CCE CEP John G. Zhao

Copyright 2008 AACE, Inc. AACE International Recommended Practices

AACE International Recommended Practice No. 41R-08

RISK ANALYSIS AND CONTINGENCY DETERMINATION

USING RANGE ESTIMATING

TCM Framework: 7.6 Risk Management

June 25, 2008

INTRODUCTION

Scope

This Recommended Practice (RP) of AACE International describes the process known as range

estimating, a methodology to determine the probability of a cost overrun (or profit underrun) for any level

of estimate and determine the required contingency needed in the estimate to achieve any desired level

of confidence. The process uses range estimating and Monte Carlo analysis techniques (as defined in RP

10S-90). The RP provides the necessary guidelines for properly applying range estimating and Monte

Carlo analysis to determine probabilities and contingency in a reliable manner using any of a number of

commercially available risk analysis software packages.

The RP does not recommend any particular software. Rather it describes the factors that the analyst must

consider when using risk analysis software for probability and contingency determination.

Purpose

This RP is intended to provide guidelines (i.e., not a standard) for risk analysis using range estimating

that most practitioners would consider to be a good practice that can be relied on and that they would

recommend be considered for use where applicable.

This RP is also intended to improve communication as to what the practice called range estimating is.

Many of the methods found in industry that are being called this are not in accordance with this RP.

Practitioners should always make sure that when someone uses the term range estimating, that they

are talking about the same practice recommended here.

Background

This RP is new. It is based upon the successful efforts of many companies to evaluate project risk and

[1,2,3]

contingency using the range estimating techniques originally developed by Michael W. Curran . Users

should be aware that the principles outlined in this RP must be rigorously followed in order to achieve the

desired results. Failure to follow the RPs recommendations will likely lead to significant misstatements of

risk and opportunities and of the amount of required contingency. In the great majority of cases,

contingency and bottom line uncertainty are understated when the RPs recommendations are not

followed.

It is AACEs recommended practice that whenever the term risk is used, that the terms meaning be

clearly defined for the purposes at hand. In range estimating practice as described in this RP, risk means

"an undesirable potential outcome and/or its probability of occurrence", i.e. "downside uncertainty (a.k.a.

threats)." Opportunity, on the other hand is "a desirable potential outcome and/or its probability of

occurrence", i.e, "upside uncertainty." The range estimating process for risk analysis quantifies the impact

of uncertainty, i.e. "risks + opportunities".

RECOMMENDED PRACTICE

Range Estimating

Range estimating is a risk analysis technology that combines Monte Carlo sampling, a focus on the few

critical items, and heuristics (rules of thumb) to rank critical risks and opportunities. This approach is used

to establish the range of the total project estimate and to define how contingency should be allocated

Copyright 2008 AACE International, Inc. AACE International Recommended Practices

Risk Analysis and Contingency Determination Using Range Estimating 2 of 9

June 25, 2008

among the critical items (RP 10S-90). It must be understood that total project estimate does not

necessarily mean a cost estimate. The range estimating technique is equally applicable to profitability

analyses (e.g., return on investment, projected earnings, earnings per share). It is also applicable to

schedule-risk applications provided that the ranges determined for the critical schedule tasks do not result

in a change in the critical path.

It must also be noted that the process applies to estimates that are based on a defined scope. Should

scope changes be needed, or scope creep develops and results in significant changes in scope, the

estimate upon which the range estimate is applied must be revised to reflect such scope changes.

An exception to this rule occurs when scope changes or modifications are anticipated and when the

estimate includes a line item to cover such scope changes. In no event should contingency ever be

treated as a source of funds to cover scope changes.

Identifying the Critical Items

The key to performing a project risk analysis using range estimating is to properly identify those items that

can have a critical effect on the project outcome and in applying ranges to those items and only to those

items. It is human nature to assume, for example, that a very large item in a cost estimate is critical simply

because of its magnitude. That is not the case. An item is critical only if it can change enough to have a

significant effect on the bottom line. The effect need not be negative (unfavorable). What matters is its

degree, either in the negative or the positive direction.

[2]

Curran has demonstrated that in virtually all project estimates the uncertainty is concentrated in a select

number of critical items -- typically 20 or less. Very few things are really important. This is called variously

the Law of the Significant Few and the Insignificant Many or the 80/20 Rule. Others refer to it as Pareto's

Law after the noted Italian sociologist and economist, Vilfredo Pareto. On rare occasions there may be

more than 20 critical items or less than 10. If this occurs, the risk analyst should carefully reexamine the

items to be certain that the critical ones have been properly identified.

A critical item is one whose actual value can vary from its target, either favorably or unfavorably, by such

a magnitude that the bottom line cost (or profit) of the project would change by an amount greater than its

critical variance. The bottom lines critical variance is determined from the following table:

Bottom Line Critical Variances

Bottom Line Conceptual Estimates Detailed Estimates

(Cost or Profit) (AACE Classes 3, 4, 5) (AACE Classes 1, 2)

Cost 0.5% 0.2%

Profit 5.0% 2.0%

Table 1 Bottom Line Critical Variances

Critical items are those which can cause changes greater than the above s (critical variances), either in

the negative or positive direction.

It is important to link or combine items that are strongly related (i.e., when one item increases or

decreases, the linked item also changes either directly or inversely). Such dependencies are generally

obvious or become quite apparent during the process of evaluating the critical items and establishing their

ranges. As an example, if the cost of concrete is the major cost driver in more than one estimate item and

concrete costs may vary over a critical range, those items for which concrete cost is the major cost driver

are dependent and must be combined in the analysis.

While the above s may seem to be rather small to some observers, they have been proven valid on

many thousands of projects and it generally is not recommended that larger values be assumed. The only

exception would be if significantly more than 20 items are shown to be critical. It such a case, in keeping

Copyright 2008 AACE International, Inc. AACE International Recommended Practices

Risk Analysis and Contingency Determination Using Range Estimating 3 of 9

June 25, 2008

with Paretos Law, it is useful to apply larger s to reduce the number of items to those which are most

critical. In any event, limit any such changes to s with values no larger than twice the values shown in

the table.

It is very important to understand that the magnitude of an item is not important. What is important is the

effect of a change in the item on the bottom line. Relatively small items are often critical while very large

ones may not be critical at all. Typically, there will be only 10 to 20 critical items, even in the largest

projects with hundreds or thousands of components to consider. In identifying the critical items, it is

necessary to link strongly related items together, not to treat them separately.

It is also necessary in the range estimate to apply ranges only to the items which are identified as being

critical. The project team must know when an item is important and when it is not. If non-critical items are

ranged, the inevitable result will be a far narrower predicted range of possible project costs than actually

exists, misstatements of risk and opportunity, and understatement of required contingency.

Identifying the Risks

Prior to estimating contingency or otherwise quantifying risk impacts, the risks must first be identified. This

RP does not cover the methods of identifying and screening risks as described in the Total Cost

Management Framework risk management process[7]. However, in today's project management practice

a "risk register" is normally established to highlight potential project risks of any type which might

significantly affect the project. When determining ranges (as covered in the following section), the project

team must assure that these risks are all considered in the ranges.

Determining the Ranges

To establish the ranges, the project team, including owner(s) and the contractor(s) if appropriate,

determines the ranges for the critical items, and only the critical items, based upon their experience and

knowledge of the project and its risks using any available databases and/or benchmarking information.

Generally speaking, everyone with significant knowledge and experience about the projects items and its

risks should be involved in the process. Each estimate item is a single point number that is highly likely to

vary in actual practice. The project team must examine each critical item and predict its possible extreme

values considering all risks, including compounding effects. It is important to understand that the range,

as considered in this method, is not the expected accuracy of each item. This is a key issue. Risk

analysis is not an analysis of estimate accuracy. Accuracy is dependent upon estimate deliverables and

estimate maturity. Contingency, as determined via the use of risk analysis, is not a measure of estimate

accuracy. Rather it is a reflection of risk at any specified or desired probability of not completing the

project within the estimate. You might reasonably expect a given estimate number to be accurate say,

within -10% to +20%. That is not the range needed. The range is what you don't normally expect - the

extremes which could happen, not what you expect to happen. If it can happen, it must be considered.

Effectively, the extremes must be predicted at a probability range of 98+% (i.e., P1/P99) without making

them so high or so low as to be absurd. The extremes should not include events that would be

considered as far out of scope, such as Acts of God or funding cuts. Using ranges which are ridiculously

wide (i.e., considering very rare adverse occurrences) will lead to overstatement of risk, opportunity, or

both, as will linking items which are not actually strongly correlated with each other.

Similarly, choosing narrower probability ranges (e.g., P10/P90 or P5/P95) can lead to misstatement of the

level of risk. The ranges, as stated, must reflect all reasonable possibilities of occurrence short of major

disasters such as Acts of God.

It is not important how the estimate is structured, for example according to a work breakdown structure

(WBS), areas and units, a cost breakdown structure (CBS), disciplines or assemblies. Any consistent

estimate basis may be used in determining the critical items and their ranges. No matter how the estimate

is structured, the project team works down through it in order to determine which items are critical and to

establish their ranges and probabilities. In order to be successful, the project team must have a full

Copyright 2008 AACE International, Inc. AACE International Recommended Practices

Risk Analysis and Contingency Determination Using Range Estimating 4 of 9

June 25, 2008

knowledge of the project scope, the project objectives and the project plans as well as all project

documentation as they go through this process. They must know the full estimate basis and, if any

information is missing, they should ask for it before beginning the process.

Obviously, when the project team is examining the critical items and determining the ranges, if it is

discovered that the estimating, forecasting, control or other practices being used for the project are not

industry best practice, if possible corrections to the estimate and project plan should be made. If this is

not possible, the added risk of using poor practices must be considered in the ranges which are

established for the analysis.

Note also that extremely rare risk driven events (i.e., Acts of God) are not part of the analysis. They and

their effects are unpredictable. They are outside of the P1/P99 range. However, highly possible but

unlikely events such as severe weather must be considered.

As an example, in a hurricane prone area, a hurricane might normally be expected to occur once every

ten years. While not expected during a project of a few years duration, a hurricane is a reasonable

possibility and the ranges should reflect the possible effects of a hurricane. However, a 100-year storm of

extreme magnitude which causes massive destruction such as Hurricane Katrina in New Orleans is

extremely unlikely and the possibility is not a reasonable consideration. To include such an extreme event

in the analysis would lead to a probable significant overstatement of risk and of the amount of required

contingency to mitigate that risk.

When the ranges are being determined by the project team, they must also make an estimate of the

probability that each critical item can be completed within the estimate (e.g., do they feel that there is a

50% probability of the critical item not overrunning?... an 80% probability?). These probability estimates

need not be precise figures to the nearest percent. It is sufficient to judge the probabilities within

increments of 5%. Estimators generally present estimates which strive for an equal probability of overrun

or underrun for each item, i.e. the most likely or modal (and mean) values. In the process of establishing

the ranges, the project team will develop strong feelings as to how reasonable each estimate item really

is. This in turn leads rather readily to a quantitative judgment of the probability that the particular item can

be accomplished within the estimated value.

In establishing the ranges and determining the critical items, estimates should be examined top down,

not bottom up. The first level of the breakdown, whatever its structure may be, is examined for critical

extremes. Those shown to be critical are then examined at the next level down in order to determine

which components of the item are causing the criticality, and so forth as necessary down through the

estimate until the specific factors which lead to criticality are identified. If at one level an item is identified

as being critical and examining its components does not identify anything as critical, then the first item is

the critical factor for the analysis.

At this point, the project team will have the required information for conducting the risk analysis.

Specifically, for each critical item, they will have:

its estimated value

the probability that its actual value will not exceed its estimated value

its maximum possible value

its minimum possible value

The probability should be elicited from the project team before the maximum and minimum possible

values. This helps to preclude the teams usually incorrect assumption that the probability represents the

relative proportion of where the estimated value is located within the range.

The estimated value may be less than the minimum possible value or greater than the maximum possible

value. This can occur if the current state of knowledge is radically different than what it was at the time

the estimated value was chosen and, for whatever reason, the estimated value cannot be revised to

Copyright 2008 AACE International, Inc. AACE International Recommended Practices

Risk Analysis and Contingency Determination Using Range Estimating 5 of 9

June 25, 2008

reflect current knowledge. This scenario frequently occurs when a risk analysis is performed for the

remainder of the life cycle of a project in execution. The current assessment of a critical item can be so

pessimistic or optimistic that the entire range for that item is above or below its estimated value, in which

case the probability of not exceeding its estimated value is 0 or 1, respectively.

This information becomes the input to the range estimate. All non-critical items are backed out and

entered into the analysis as a fixed sum.

The effort to gather correct (i.e., reliable) information on critical items should not be underestimated.

Based on experience gained from thousands of range estimating sessions, the necessary level of

interrogation and discussion typically requires six to eight hours, even for small projects or budgets,

Probability Density Functions

Monte Carlo software for risk analysis requires identification of a probability density function (PDF) for

each critical item. Not all values in a range are likely to have an equal probability of occurrence and this is

reflected by an appropriate PDF. In rare instances the behavior of a critical item is known to conform to a

specific type of PDF such as a lognormal or beta distribution, which reflects items that may skew heavily

to one side of a distribution. If a distribution such as this is appropriate for the item in question, the item

should be represented by that PDF. However, it generally is unlikely that the actual type of PDF that truly

represents the item is known. Thus, a reasonable approximation is to use one of two distributions:

the triangular distribution

the double triangular distribution

In most cases, the double triangular distribution is a better approximation since it can be made to conform

to the implicit skew of the project teams probability assessment. The double triangle allows the risk

analyst to use the probabilities which the project team believes are reasonable rather than letting the

triangular distribution dictate a probability which, more often than not, is invalid.

While these distributions are approximations, within the anticipated level of accuracy of any estimate,

Class 1 through Class 5, they are sufficiently accurate for the purposes of the risk analysis.

The Triangular Distribution

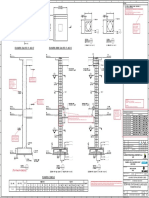

A triangular distribution looks like this:

The Triangular Distribution

Probability Density, P(x)

Area = underrun probability

Area = overrun probability

a c b

Random Variable, x

Figure 1 Triangular Distribution

Copyright 2008 AACE International, Inc. AACE International Recommended Practices

Risk Analysis and Contingency Determination Using Range Estimating 6 of 9

June 25, 2008

A common error is to assign the triangular distribution without verifying that it actually applies. As with any

PDF, the range implies a probability in a triangular distribution. In the triangle, the areas of the two sides

of the triangle to the left and to the right of the estimated value are proportional to the probability of a

value being greater than or less than the estimate. If, for example, the range is 2000 (a) to 5000 (b) with

an estimate of 4000 (c), the probability of being under the estimate is (4000-2000)/(5000-2000) or 66.7%.

If the project team believes that this implied probability is unrealistic (it is, more often than not), the

triangular distribution will not be satisfactory. Far more commonly, the double triangular distribution is the

more realistic choice.

The Double Triangular Distribution

The double triangular distribution looks like this:

The Double Triangular Distribution

Probability Density, P(x)

Area = underrun probability

Area = overrun probability

a c b

Random Variable, x

Figure 2 Double Triangular Distribution

The double triangular distribution should be applied for any critical item for which the single triangular

implied probability of not overrunning differs from the probability assessed by the project team. Assuming

that the ranges properly reflect the possible extremes of cost or profit, this will generally be the case.

In the commercially available software, the double triangular distribution is not defined. It must therefore

be entered into the software as a custom distribution (or as two right triangles using an if, then criterion

to select between the two triangles depending upon the value of the randomly selected values). These

options are generally available in commercial software so the specification of a custom distribution is not

an obstacle to the use of risk analysis software.

The nomenclature for the two distributions above is:

a = the minimum value of the range for the item in question

b = the maximum value of the range for the item in question

c = the estimated value of the item in question, i.e. what is believed to be the most likely value (the

mode)

x = a randomly selected value for the item in question

P(x) = the probability associated with the random value of x

It must be noted that the double-triangle is really two triangular distributions, one representing values

which underrun the estimate and the other, values which overrun the estimate. At the estimate value (c),

the distribution is discontinuous and some software may not be able to handle a discontinuous function

Copyright 2008 AACE International, Inc. AACE International Recommended Practices

Risk Analysis and Contingency Determination Using Range Estimating 7 of 9

June 25, 2008

such as this. In that case, an "if-then" scenario is used with the software to select the appropriate triangle

for each randomly selected probability value P(x), depending upon whether it is above or below the

probability for c.

Contingency Determination and Probability of Overrun

The various software packages, using the inputs as described, will generate a cumulative probability

distribution curve for the complete estimate. Typically, between 300 and 800 iterations are necessary in

order to obtain statistically significant results using these software packages. It is recommended that 1000

iterations be used as this will, with rare exceptions, be a large enough sample for reliable results. (The

rare exception is most often precipitated by abstruse discontinuous relationships amongst the critical

items or in cases where one or two critical items have large and highly skewed ranges.) The curve will

show the probability of the estimated cost or profit being achieved. If the probability is less than desired,

the required contingency to bring the estimate to the desired probability of not overrunning is the

difference in the curve's cost or profit value at the desired probability minus the value at the actual

probability. Most of the software packages provide this information in tabular form as well.

It is generally better to specify the desired probability when inputting data to the software. The results will

then state the contingency required to achieve the specified probability. The selection of desired

probability depends upon the risk attitude of management. A good estimate should have equal probability

of overrun and underrun (i.e., a 50% probability). This is a risk neutral approach, the assumption being

that some projects will overrun while others will underrun and, in the long run, they will balance out.

The more conservative, risk-averse attitude used by many profit-making companies, is to specify a

probability of 80% or higher that the project will not overrun. This is a safer route but by specifying a high

probability, the required contingency will increase and with it the project cost. This results in a

maldistribution of funds. Large contingencies on projects in the organizations project portfolio will

sequester monies that could otherwise be put to productive use (e.g., funding additional projects, beefing

up R&D, investing in product improvement, new equipment). Excess contingency should be released

from the project as remaining work becomes smaller and the risk decreases as indicated by periodic risk

analyses. This is especially important in organizations where project teams are permitted to increase

scope when excess contingency is available (i.e., when project funds are expended simply because they

are not required to meet the original scope).

It must be noted that the contingency which is determined is total required contingency. It does not reflect

what is sometimes called "management reserve," a discretionary amount which is added to the estimate

for possible scope changes or unknown future events which cannot be anticipated by the project team

unless an allowance for this purpose has specifically been included in the estimate as a line item.

Before accepting the final contingency amount, the team should review the analysis and its

documentation to ensure quality and effective communication of the work and its outcomes. This should

include comparing the result to empirical metrics, past results and expert expectations. If the result is out

of line with past experience, this does not mean it is invalid, but that it should be checked to ensure there

were no errors or omissions.

All of the commercially available software will generate what is commonly known as a tornado diagram,

a graphic and ranked representation of the risks and opportunities generated by the critical items. The

diagram ranks the items from that with the greatest potential effect to the one with the smallest potential

effect. Some software allocates the contingency to these items in proportion to their potential effects, thus

enabling contingency to be managed based upon a draw-down plan. In those cases where the software

does not allocate the contingency, the contingency per item can be inferred from the tornado diagram.

For risk management purposes, contingency can be assigned to the critical items based upon their

relative potential to contribute to cost variances. However, contingency should never be included in the

control budget for a critical item - contingency is its own budgeted control account except in the case of

Copyright 2008 AACE International, Inc. AACE International Recommended Practices

Risk Analysis and Contingency Determination Using Range Estimating 8 of 9

June 25, 2008

estimates which are prepared for line item bidding. Risks are dynamic and periodic range estimates

should be conducted to reassess project risks and to reassign and/or release contingency as appropriate

throughout the project's life.

Limitations of the Technique

Note that the method described in this RP has been used successfully for estimates of all types.

However, empirically-based modeling methods often require less effort to apply in the case of Class 5

estimates for which there are only a few critical items (e.g., less that five) and for those for which the

content is poorly structured, defined and understood by the project team. In such cases empirical

[5]

methods (see Hackney ) should be considered for such early estimates, optimally in conjunction with

range estimating.

In a perfect world, the items in a project estimate truly are the most likely values and thus represent modal

values. If such is the case, the statistics inherent in the range estimating process would be precise.

Unfortunately the world is not perfect, nor are estimates.

Ideally, the range estimating process should be used to examine the estimate before commitments are

made and, if the project team concludes that any critical project item has an unacceptable level of

probability, i.e. that the estimate is not really the most likely value, the estimate should be refined to

correct the problem. This is always the recommended approach to preparing estimates and conducting

risk analyses and it will assist greatly in facilitating the development of a quality estimate.

However, this is often not possible. The project may have been approved at a budget level other than the

estimated value, or the project may be well underway. If budget changes are not permitted, or if additional

funds are not available, as is often the case, the option to revise the budget does not exist. The estimate

is not as good as it should be but it is fixed and the risk analyst must work with it, no matter how bad

some of the numbers may be. The range estimate nevertheless will generally yield reasonable results

which are well within levels of error which most managers are willing to accept. Some items may deviate

widely from the estimate. The values then may not actually be the most likely values and hence would no

longer approximate the mode which statistics would decree as the proper input to the PDF which is used.

In this case the distributions may not yield a reasonably precise number for the item in question.

However, that is unlikely to be the case for all of the critical items and the resultant predicted PDF and

contingency for the total project will generally still be reliable within acceptable levels. Effectively, the idea

that the plusses will equal the minuses generally applies.

Another situation is when the budget is fixed and subsequent range estimates indicate that a critical item

is now totally out of the predicted range. That can be handled by increasing the value of the critical item to

the minimum value of the range, assigning a zero percent probability of being under the estimate, and to

correct for the addition to the item, to enter a non-critical contingency correction of negative the amount

added to the item. That retains the total equal to the budgeted amount which permitting the analysis to

proceed.

When to Apply Risk Analysis

Range estimates are dynamic, not static, and should be applied regularly through all phases of project

design and construction. As the estimates go from an order of magnitude Class 5 estimate to a detailed

Class 1 or 2 estimate, range estimates should be conducted to refine the contingency number. Then, as

the project progresses, range estimates should be done at least quarterly to track the use of contingency

and to reflect project progress. This enables contingency to be released when it is no longer needed.

Contingency should never be held until project completion. Periodic range estimates will indicate when

contingency can and should be released. Periodic range estimates will also highlight trouble areas which

have developed, or are developing, which may require corrective action and/or a revision of the project

budget.

Copyright 2008 AACE International, Inc. AACE International Recommended Practices

Risk Analysis and Contingency Determination Using Range Estimating 9 of 9

June 25, 2008

REFERENCES

1. Curran, Michael W., Range Estimating: Coping With Uncertainty, AACE Transactions, AACE

International, Morgantown, WV, USA, 1976

2. Curran, Michael W., Range Estimating: Measuring Uncertainty and Reasoning with Risk, Cost

Engineering, Vol. 31, No. 03, AACE International, Morgantown, WV, USA, 1989

3. Curran, Michael W., Range Estimating: Contingencies with Confidence, AACE Transactions, AACE

International, Morgantown, WV, USA, 1989

4. Brienzo, Kenneth D., Editor, AACE Internationals Professional Practice Guide to Risk, 2nd Edition,

AACE International, Morgantown, WV, USA, 2007

5. Hackney, John W., Control and Management of Capital Projects, 2nd Edition, Kenneth K. Humphreys,

Editor, AACE International, Morgantown, WV, USA, 1997

6. AACE International Recommended Practice 10S-90, Cost Engineering Terminology (latest revision),

AACE International, Morgantown, WV, USA

7. Hollmann, John K., Editor, Total Cost Management Framework: An Integrated Approach to Portfolio,

Program and Project Management, AACE International, Morgantown, WV, 2006.

CONTRIBUTORS

Dr. Kenneth K. Humphreys, PE CCE (Author)

Kevin M. Curran

Michael W. Curran

Christopher O. Gruber, CCC

John K. Hollmann, PE CCE CEP

William E. Maddex, CEP

Stephen E. Mueller, CCE EVP

Dr. Shekhar S. Patil

Robert F. Wells, CEP

John G. Zhao

Copyright 2008 AACE International, Inc. AACE International Recommended Practices

You might also like

- 44R-08 Risk Analysis and Contingency Determination Using Expected ValueDocument8 pages44R-08 Risk Analysis and Contingency Determination Using Expected ValueDody BdgNo ratings yet

- 57R-09 Aace PDFDocument24 pages57R-09 Aace PDFmirakulNo ratings yet

- 42R-08 Risk Analysis and Contingency Determination Using Parametric EstimatingDocument9 pages42R-08 Risk Analysis and Contingency Determination Using Parametric EstimatingDody BdgNo ratings yet

- 55r 09 Analysing S CurvesDocument15 pages55r 09 Analysing S CurvesSitaram SakamuriNo ratings yet

- EVP - Certification GuideDocument202 pagesEVP - Certification GuideFahad89% (9)

- 43R-08 Risk Analysis and Contingency Determination Using Parametric Estimating - Example Models As Applied For The Process IndustriesDocument14 pages43R-08 Risk Analysis and Contingency Determination Using Parametric Estimating - Example Models As Applied For The Process IndustriesDody Bdg100% (2)

- 30R-03 Implementing Project ConstructionDocument9 pages30R-03 Implementing Project Constructionmaifi100% (2)

- 39R 06 PDFDocument23 pages39R 06 PDFRonald Menacho AraujoNo ratings yet

- Aace 48r-06 Schedule Constructability ReviewDocument11 pagesAace 48r-06 Schedule Constructability Reviewaugusto5615100% (2)

- AACEI Recommended Practice No.13S-90Document3 pagesAACEI Recommended Practice No.13S-90Anonymous 19hUyemNo ratings yet

- Ce11 09Document40 pagesCe11 09planning5100% (1)

- AACE Recommended Practice Level of ScheduleDocument13 pagesAACE Recommended Practice Level of ScheduleAbiy Kebere0% (1)

- 10S-90 - 2014-Cost Engineering Terminology PDFDocument120 pages10S-90 - 2014-Cost Engineering Terminology PDFHohnWuNo ratings yet

- 65R-11 - Integrated Cost and Schedule Risk Analysis and ...Document13 pages65R-11 - Integrated Cost and Schedule Risk Analysis and ...Pratik ChouguleNo ratings yet

- 22r-01 Direct Labor Productivity MeasurementDocument19 pages22r-01 Direct Labor Productivity Measurementmax73100% (4)

- Ce11 12Document40 pagesCe11 12planning5No ratings yet

- 20r 98Document14 pages20r 98Joseph GhazalehNo ratings yet

- 78R-13 - Original Baseline Schedule ReviewDocument21 pages78R-13 - Original Baseline Schedule ReviewVivekNo ratings yet

- 58R 10Document21 pages58R 10John WatsonNo ratings yet

- 71R-12 Aace PDFDocument43 pages71R-12 Aace PDFmirakulNo ratings yet

- List of AACE DocumentsDocument5 pagesList of AACE DocumentsenfrspitNo ratings yet

- Project Code of Accounts: AACE International Recommended Practice No. 20R-98Document14 pagesProject Code of Accounts: AACE International Recommended Practice No. 20R-98Mohamed HassanNo ratings yet

- Estimating Skills AACEIDocument27 pagesEstimating Skills AACEISL24980100% (5)

- 52r-06 Prospective TIADocument12 pages52r-06 Prospective TIAfa ichNo ratings yet

- Ce12 11Document56 pagesCe12 11planning5No ratings yet

- AACEI RP 27R-03 - Schedule Classification PDFDocument11 pagesAACEI RP 27R-03 - Schedule Classification PDFsylvanusfim100% (1)

- 31R-03 - AACE InternationalDocument16 pages31R-03 - AACE InternationalFirasAlnaimi100% (3)

- 13S 90Document8 pages13S 90Stanislav StoychevNo ratings yet

- 32R 04Document18 pages32R 04Reza SalimiNo ratings yet

- 54R-07 - AACE InternationalDocument17 pages54R-07 - AACE InternationalFirasAlnaimiNo ratings yet

- Cep Exam Study GuideDocument2 pagesCep Exam Study GuideI Kailash Rao100% (1)

- 54r-07 Recovery SchedulingDocument12 pages54r-07 Recovery Schedulingmax7367% (3)

- 19R-97 Estimate Preparation Costs For The Process IndustriesDocument18 pages19R-97 Estimate Preparation Costs For The Process IndustriesAnonymous znPzQTaYo50% (2)

- Analyzi NG S-CurvesDocument18 pagesAnalyzi NG S-Curveshumberto hurtado100% (1)

- 46R-11 - AACE InternationalDocument27 pages46R-11 - AACE InternationalFirasAlnaimi50% (2)

- 56r-08 Cost Estimate Classification System - As Applied For The Building and General Construction IndustriesDocument16 pages56r-08 Cost Estimate Classification System - As Applied For The Building and General Construction IndustriesWalter100% (4)

- Cepsiab Sample For Web 2021Document37 pagesCepsiab Sample For Web 2021CCENo ratings yet

- Schedule Levels of Details - As Applied in Engineering, Procurement & ConstructionDocument13 pagesSchedule Levels of Details - As Applied in Engineering, Procurement & Constructionakinlade100% (1)

- AACE Recommended Practice 11R 88 PDFDocument24 pagesAACE Recommended Practice 11R 88 PDFSanthosh KannanNo ratings yet

- 18R 97Document16 pages18R 97Loreto Urra0% (1)

- CFCC CertStudyGuideDocument23 pagesCFCC CertStudyGuideAnonymous mJHwO0r5No ratings yet

- AACE Recommended Practice 11R-88Document24 pagesAACE Recommended Practice 11R-88asokan80100% (3)

- AACEI Houston Jan 2008Document84 pagesAACEI Houston Jan 2008klibiNo ratings yet

- Claims & Dispute ResolutionDocument48 pagesClaims & Dispute ResolutionBTconcordNo ratings yet

- Skills and Knowledge of Cost EngineeringDocument66 pagesSkills and Knowledge of Cost EngineeringVipin Sreekumar100% (2)

- Skills and Knowledge of CostDocument33 pagesSkills and Knowledge of CostMohamed Omar SileemNo ratings yet

- 12R-89 - Master in Cost EngeneeringDocument8 pages12R-89 - Master in Cost Engeneeringstefan_iacob72No ratings yet

- AACE Cost Engineering JournalDocument48 pagesAACE Cost Engineering Journalgopinathan_karutheda100% (1)

- Total Cost ManagementDocument22 pagesTotal Cost ManagementYagnik GohelNo ratings yet

- Toc 105r-19Document9 pagesToc 105r-19samih soliman0% (1)

- 52R 06Document14 pages52R 06Showki Wani100% (1)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- Contract Strategies for Major Projects: Mastering the Most Difficult Element of Project ManagementFrom EverandContract Strategies for Major Projects: Mastering the Most Difficult Element of Project ManagementNo ratings yet

- Integrated Project Planning and Construction Based on ResultsFrom EverandIntegrated Project Planning and Construction Based on ResultsNo ratings yet

- Oracle Primavera Contract Management, Business Intelligence Publisher Edition v14From EverandOracle Primavera Contract Management, Business Intelligence Publisher Edition v14No ratings yet

- Zeal High Precision Wet Test Gas Flow Meters 2022Document5 pagesZeal High Precision Wet Test Gas Flow Meters 2022Hiran ChathurangaNo ratings yet

- K SedimentationDocument13 pagesK SedimentationKitty VNo ratings yet

- Nitrile RubberDocument1 pageNitrile RubberMohamedNo ratings yet

- IT Dashboard Dec2013Document870 pagesIT Dashboard Dec2013Dolly SinghNo ratings yet

- SmartBright LED Downlight G3Document11 pagesSmartBright LED Downlight G3Puji SnNo ratings yet

- ASSEMBLY AND PARTS ALBUM - Kipor Power Systems - KDE6700TA PDFDocument2 pagesASSEMBLY AND PARTS ALBUM - Kipor Power Systems - KDE6700TA PDFracsoNo ratings yet

- PreponlineDocument8 pagesPreponlineGeeth SagarNo ratings yet

- Manual de Parts ES16D6Document36 pagesManual de Parts ES16D6Eduardo CortezNo ratings yet

- Jovan Marjanovic Theory of Gravity MachinesDocument10 pagesJovan Marjanovic Theory of Gravity MachinesWilhelm HartmanNo ratings yet

- BITS Herald Summer Issue 2013Document23 pagesBITS Herald Summer Issue 2013Bits Herald100% (1)

- Welding Product Technology TheoryDocument4 pagesWelding Product Technology TheoryPecai MamatNo ratings yet

- 1 5 1Document5 pages1 5 1daemsalNo ratings yet

- MZP10000000-30010-MTS-TC - 000007 - T&C Ahu & Fahu - FinalDocument59 pagesMZP10000000-30010-MTS-TC - 000007 - T&C Ahu & Fahu - FinalFaiyazsulthanNo ratings yet

- Apple Value ChainDocument3 pagesApple Value ChainKeng Keat Lim100% (2)

- A2 Accu-Flo Clamped Metal Pump: Engineering Operation MaintenanceDocument28 pagesA2 Accu-Flo Clamped Metal Pump: Engineering Operation MaintenanceThanh Nghị BùiNo ratings yet

- 01+yn1m301719-Afb 1rtaDocument53 pages01+yn1m301719-Afb 1rtaNurul Islam FarukNo ratings yet

- Dokumen - Tips - Curriculum Vitae Adrian Danar Wibisono 1Document2 pagesDokumen - Tips - Curriculum Vitae Adrian Danar Wibisono 1Reo DeraNo ratings yet

- Telescoping Guide Rhs and Chs Aug13 sj0510-1Document2 pagesTelescoping Guide Rhs and Chs Aug13 sj0510-1Richard GrahamNo ratings yet

- Nachi Special SteelsDocument20 pagesNachi Special SteelsBambang MulyantoNo ratings yet

- Quadrature Amplitude ModulationDocument10 pagesQuadrature Amplitude ModulationSafirinaFebryantiNo ratings yet

- Business Plan: Syeda Zurriat & Aimen RabbaniDocument11 pagesBusiness Plan: Syeda Zurriat & Aimen RabbanizaraaNo ratings yet

- Index of Revisions Rev. Description And/Or Revised SheetsDocument17 pagesIndex of Revisions Rev. Description And/Or Revised Sheetsfabio.henriqueNo ratings yet

- 14 Fine Tuned Assembly LineDocument4 pages14 Fine Tuned Assembly LineSadhish KannanNo ratings yet

- CHAPTER 8 Hazop StudyDocument7 pagesCHAPTER 8 Hazop StudyNethiyaa50% (2)

- Alien Legacy-Manual PDFDocument93 pagesAlien Legacy-Manual PDFMark BallingerNo ratings yet

- Assessment 1 - Questioning - Written Assessment: Satisfactory or Not Yet SatisfactoryDocument35 pagesAssessment 1 - Questioning - Written Assessment: Satisfactory or Not Yet SatisfactorySonal Awasthi MishraNo ratings yet

- 327101-BJ81-C-RCC-0007 Rev.00 - Client MarkupDocument1 page327101-BJ81-C-RCC-0007 Rev.00 - Client MarkupGokulprabhuNo ratings yet

- Partner Colibri II O2010 Euenapen 545196762Document13 pagesPartner Colibri II O2010 Euenapen 545196762Popescu OvidiuNo ratings yet

- Lect-6 - Economics of Chemical PlantsDocument36 pagesLect-6 - Economics of Chemical Plantsmaged1998No ratings yet

- Screw Conveyor DesignDocument9 pagesScrew Conveyor DesignAJAY1381No ratings yet