Professional Documents

Culture Documents

Financial Literacy Exam

Uploaded by

api-247476114Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Literacy Exam

Uploaded by

api-247476114Copyright:

Available Formats

Planning 10 Name:________________________ Block:______

Financial Literacy Exam

I. Multiple Choice- please circle the letter which represents the best answer.

1. This occurs when prices of goods and services increase.

a. Deflation.

b. Inflation.

c. Ablation.

d. Multiplier Effect.

2. With regards to a savings account, paying yourself first means saving the first

_______% of your income after deductions.

a. Five.

b. Ten.

c. Fifteen.

d. Twenty.

3. Which of the following is not true in regards to taxes?

a. Taxes are a compulsory payment.

b. Taxes raise revenue for governments.

c. Taxes are collected at three government levels.

d. Taxes may only be collected directly.

4. Which of the following is true of the Goods and Services Tax (GST)?

a. It is a provincial tax.

b. It is a territorial tax.

c. It is a federal tax.

d. It is a provincial/federal tax.

e. It is an unfair tax

5. Property taxes are paid to this level of government.

a. Municipal.

b. Provincial.

c. Territorial.

d. Federal.

6. Customs duties must be paid on these types of goods.

a. Local goods.

b. Domestic goods.

c. Imported goods.

d. Excise goods.

e. Federal goods

7. With regards to insurance, this is the monthly________that is paid monthly or yearly.

a. Deductible.

b. Premium.

c. Compensation.

d. Replacement.

8. This is a type of loan, which is paid over a set period of time.

a. Term.

b. Demand.

c. Consumer.

d. None of the above answers are correct.

9. Which of the following best defines liquidity?

a. A type of loan made only for those customers who are financially secure.

b. The exchange of money for products or services.

c. The process of turning assets into cash quickly.

d. A type of investment which guarantees a minimum yield of two percent.

10. Which of the following has the highest liquidity?

a. House

b. Bonds.

c. Older car.

d. Chequing Account

11. This is another word for multiple stocks in grouped funds.

a. GICs.

b. Shares.

c. Term Deposits.

d. Mutual Funds.

12. This is when you spread your money over a variety of investments.

a. Risk.

b. Diversification.

c. Yield.

d. Containerization.

13. This is the uncertainty about the results of an expected return.

a. Risk.

b. Diversification.

c. Yield.

d. Containerizatioin.

14. Which of the following is not a form of credit?

a. Mortgage.

b. Stocks.

c. Charge Card.

d. Line of Credit.

15. In which example is the most interest charged on a credit card?

a. A phone transaction.

b. A gasoline purchase.

c. An ATM withdrawal, cashback.

d. A point of purchase sale.

16. If expenses were to exceed income on a spending plan, what would be a financially smart

solution?

a. decrease deductions

b. increase expenses

c. decrease spending

d. increase taxes

e. none of the above

17. Which of the following best describes the term minimum wage?

a. a fixed yearly payment paid monthly

b. a payment made to employees for working extra hours

c. the lowest amount legally a firm can pay its employees

d. a payment for reaching an employee target.

18. The rule of 72 states that in order to discover how long it takes an investment to double.

a. you must divide the interest rate per period by 72

b. you must divide 72 by the interest rate per period

c. compound interest is divided by 72

d. the number 72 is divided by simple interest

e. none of the above

19. Which is not a useful criterion for students shopping for a credit card?

a. APR

b. Grace period

c. Balance computation method

d. Equity balance

e. Any associated fees

20. What is a SIN?

a. It is a number used by provincial government for ID purposes

b. Used by your city for census information

c. Used by schools to identify you for tax purposes

d. Needed in order to claim a tuition refund

e. None of the above

21. An insurance premium is:

a. Used to pay an injured party

b. Deducted from house insurance

c. A payment the insured makes in exchange for compensation

d. A payment the insured makes for any losses sustained

e. None of the above

ii. True or False.

1. _____ The decrease in inflation is known as reflation.

2. _____ A Canada Savings Bond has a high risk and high expected return.

3. _____ Compound interest is the interest paid on the initial deposit.

4. _____ Only banks are regulated by the Canada Deposit Insurance Corporation

5. _____ Banks are run as non-profit organizations.

6. _____ In order for a business to operate it must have a business license.

7. _____ Travel insurance only covers travel within Canada.

8. _____ Credit card interest is low compared to line of credit interest.

9. _____ Wants should be included in any spending plan.

10. _____ A chequing account helps make paying bills and charting spending easier

iii. Matching

1. _____ A financial institution owned by its members.

2. _____ Allows you to withdraw money even if theres not enough in your account

3. _____ Paying for purchase with borrowed money

4. _____ Another name for hidden taxes

5. _____ An electronic bank teller

6. _____ Insurance coverage from injuries/illness that prevent you from working

7. _____ Insurance coverage in case of accidental death.

8. _____ Insurance which covers valuables in y our home (appliances, clothes, etc.)

9. _____ Insurance which covers extensive damage to your vehicle.

10. _____ This is another word for liabilities.

11. _____ A record of the financial positions of a business at specific date

12. _____ A record of ones personal financial statement within a given month

13. _____ Essentially these are loans to the government

14. _____ A short-term debt security issued by the government

15. _____Units in a pool of money managed by a money manager.

a. Credit Union f. Content k. Balance Sheet

b. Credit Card g. Collisions l. Overdraft

c. ATM h. Debts m. Indirect

d. Disability i. Budget n. Life

e. Bonds j. Mutual funds o. Treasury bill

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Money Matters FinalDocument3 pagesMoney Matters Finalapi-336224582No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Banking and Financial InstitutionsDocument6 pagesBanking and Financial InstitutionsAriel ManaloNo ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Wise Practice TestDocument9 pagesWise Practice TestJosh SimonNo ratings yet

- FL 5Document36 pagesFL 5Emma EshoNo ratings yet

- Financial Literacy Test Grade 11 Entrepreneurship Mr. Valley Student NameDocument8 pagesFinancial Literacy Test Grade 11 Entrepreneurship Mr. Valley Student Nameapi-350400617No ratings yet

- Question BankingDocument12 pagesQuestion BankingĐặng Ngọc Yến TrâmNo ratings yet

- Courtney Holmes - Module 2 Pre:Post Test PDFDocument5 pagesCourtney Holmes - Module 2 Pre:Post Test PDFAnonymous yGh2qVNo ratings yet

- Money Management Test - MoneyPowerDocument13 pagesMoney Management Test - MoneyPowerMalik MuhammadNo ratings yet

- Personal Finance 12th Edition Kapoor Test BankDocument56 pagesPersonal Finance 12th Edition Kapoor Test Bankkiaracrawfordxfingpmjbd100% (15)

- Name - ScoreDocument2 pagesName - ScoreJade LegaspiNo ratings yet

- Chapter 4 and 5.Document7 pagesChapter 4 and 5.cumar maxamuud samatarNo ratings yet

- Current LiabilitiesDocument4 pagesCurrent Liabilitiescumar maxamuud samatarNo ratings yet

- Business Finance 1st Quarter Examination 22-23Document3 pagesBusiness Finance 1st Quarter Examination 22-23Phegiel Honculada MagamayNo ratings yet

- FABM1Document6 pagesFABM1Nhel ZieNo ratings yet

- Banking Finance Tax Test SK2019 - 1Document4 pagesBanking Finance Tax Test SK2019 - 1Vishwas JNo ratings yet

- Chapter 01 Testbank - StaticDocument27 pagesChapter 01 Testbank - StaticAlan ZhangNo ratings yet

- Sample Multiple Choice Questions For UP Graduate ClassDocument2 pagesSample Multiple Choice Questions For UP Graduate ClassEliphaz KalaweNo ratings yet

- Macro Tut 4Document9 pagesMacro Tut 4trang snoopyNo ratings yet

- Answer: ADocument7 pagesAnswer: AGrace CheungNo ratings yet

- Latsol Abc Ujian 2 InterDocument9 pagesLatsol Abc Ujian 2 InterABIMANTRANANo ratings yet

- Prelim Exam - For PrintingDocument4 pagesPrelim Exam - For PrintingThat's FHEVulousNo ratings yet

- Fmi BazaDocument18 pagesFmi BazaАнель ПакNo ratings yet

- Đề trắc nghiệm TACNDocument4 pagesĐề trắc nghiệm TACN21063129No ratings yet

- For Students Prelim ExamDocument8 pagesFor Students Prelim ExamHardly Dare GonzalesNo ratings yet

- Final ExamDocument13 pagesFinal ExamLAGUN ROVELYNNo ratings yet

- QuizDocument26 pagesQuizDung Le100% (1)

- Part I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)Document5 pagesPart I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)solomonaauNo ratings yet

- Net Working CapitalDocument8 pagesNet Working CapitalJoseph AbalosNo ratings yet

- Part I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)Document5 pagesPart I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)solomonaauNo ratings yet

- CISI Mock Exam Questionnaires (Consolidated)Document17 pagesCISI Mock Exam Questionnaires (Consolidated)Jerome GaliciaNo ratings yet

- New Microsoft Office Word DocumentDocument9 pagesNew Microsoft Office Word DocumentNausheen WaheedNo ratings yet

- Applied Economics Semi FinalDocument2 pagesApplied Economics Semi FinalAimelenne Jay AninionNo ratings yet

- Mid Term Mgt411 Vu NewDocument30 pagesMid Term Mgt411 Vu Newhk dhamanNo ratings yet

- Solution File: Choose The Correct Option Among The Choices Given BelowDocument7 pagesSolution File: Choose The Correct Option Among The Choices Given BelowPranav KolaganiNo ratings yet

- MGT of FM & Institution WorksheetDocument5 pagesMGT of FM & Institution WorksheetfitsumNo ratings yet

- Part I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)Document5 pagesPart I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)solomonaauNo ratings yet

- MCQ Fin 502Document50 pagesMCQ Fin 502Tareque Rubel90% (10)

- Tutorial Questions Bank MGTDocument4 pagesTutorial Questions Bank MGTObed AsamoahNo ratings yet

- Macro Tut 4Document6 pagesMacro Tut 4TACN-2M-19ACN Luu Khanh LinhNo ratings yet

- Chapter 7 Bond MarketsDocument15 pagesChapter 7 Bond MarketsDianne BallonNo ratings yet

- Sebenta Inglês AplicadoDocument30 pagesSebenta Inglês AplicadoJoana PimentelNo ratings yet

- Tailieuqtnh Đã Chuyển Đổi 1Document63 pagesTailieuqtnh Đã Chuyển Đổi 1hùng mạnhNo ratings yet

- FinanceDocument156 pagesFinancearavindan_net100% (2)

- Department of Education: Region VII, Central Visayas Division of Cebu ProvinceDocument3 pagesDepartment of Education: Region VII, Central Visayas Division of Cebu ProvinceHazel GumaponNo ratings yet

- Personal Finance IQ - Multiplechoice.qaDocument6 pagesPersonal Finance IQ - Multiplechoice.qaAbdalla Mustafa Mohamed AhmedNo ratings yet

- Corporate Finance Trial Questions 2Document11 pagesCorporate Finance Trial Questions 2Sylvia Nana Ama DurowaaNo ratings yet

- 12th Accountancy Study Material English MediumDocument41 pages12th Accountancy Study Material English Mediumsubashsb903No ratings yet

- Sample Midterm Questions 7570 #NewDocument6 pagesSample Midterm Questions 7570 #NewJay Su100% (1)

- 06 Short Term Financing ManagementDocument8 pages06 Short Term Financing ManagementLee TeukNo ratings yet

- Financial Market & Institution WorksheetDocument5 pagesFinancial Market & Institution Worksheetbikilahussen100% (1)

- Problem Session-1 02.03.2012Document12 pagesProblem Session-1 02.03.2012charlie simoNo ratings yet

- 10 28 QuestionsDocument5 pages10 28 QuestionstikaNo ratings yet

- LTTCTT PDFDocument19 pagesLTTCTT PDFjuliee7273No ratings yet

- Prelim Test Paper Abm Banking FinanceDocument4 pagesPrelim Test Paper Abm Banking FinanceyoreberlyNo ratings yet

- 201 EXM2 XComp Pract Exam MCDocument11 pages201 EXM2 XComp Pract Exam MCvonns80No ratings yet

- Receivables Theories QuizDocument6 pagesReceivables Theories QuizJoovs JoovhoNo ratings yet

- Final Term Examination. Intermediate AccountingDocument8 pagesFinal Term Examination. Intermediate AccountingOrtiz, Trisha Mae S.No ratings yet

- This Is Me - Personal Timeline: Part 1: What Has Shaped Me?Document1 pageThis Is Me - Personal Timeline: Part 1: What Has Shaped Me?api-247476114No ratings yet

- Chapter 4 TestDocument6 pagesChapter 4 Testapi-247476114No ratings yet

- AttitudeDocument1 pageAttitudeapi-247476114No ratings yet

- Introduction Survey For Students All CoursesDocument1 pageIntroduction Survey For Students All Coursesapi-247476114No ratings yet

- Test and Assignment Preparation Strategies QUIZ: TOTAL: - / 30Document12 pagesTest and Assignment Preparation Strategies QUIZ: TOTAL: - / 30api-247476114No ratings yet

- Chapter 4 Answer KeyDocument3 pagesChapter 4 Answer Keyapi-247476114No ratings yet

- Personal Timeline and This Is MeDocument1 pagePersonal Timeline and This Is Meapi-247476114No ratings yet

- Final Project - Professional Team or Theme ParkDocument7 pagesFinal Project - Professional Team or Theme Parkapi-247476114No ratings yet

- Introduction Survey For Students All CoursesDocument1 pageIntroduction Survey For Students All Coursesapi-247476114No ratings yet

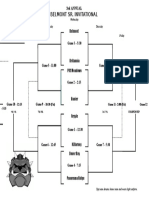

- 1st Annual Ra 22 Thunder Alumni TournmentDocument3 pages1st Annual Ra 22 Thunder Alumni Tournmentapi-247476114No ratings yet

- Flyer - 1st Annual Ra 22 Alumni Basketball TournamentDocument1 pageFlyer - 1st Annual Ra 22 Alumni Basketball Tournamentapi-247476114No ratings yet

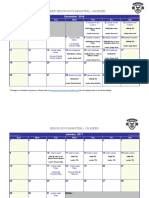

- Schedule 2017-2018 SR Boys BasketballDocument4 pagesSchedule 2017-2018 SR Boys Basketballapi-247476114No ratings yet

- 1st Annual Ra 22 Thunder Alumni TournmentDocument3 pages1st Annual Ra 22 Thunder Alumni Tournmentapi-247476114No ratings yet

- Survival ProjectDocument3 pagesSurvival Projectapi-247476114100% (1)

- Test and Assignment Preparation Strategies QUIZ: TOTAL: - / 30Document13 pagesTest and Assignment Preparation Strategies QUIZ: TOTAL: - / 30api-247476114No ratings yet

- Games ScheduleDocument4 pagesGames Scheduleapi-247476114No ratings yet

- Guide To Banking ServiceDocument3 pagesGuide To Banking Serviceapi-247476114No ratings yet

- 7 - Interview ExpectationsDocument1 page7 - Interview Expectationsapi-247476114No ratings yet

- Social Justice 12 - Article Analysis FentanyalDocument3 pagesSocial Justice 12 - Article Analysis Fentanyalapi-247476114No ratings yet

- 5 - Sample Questions Exit InterviewsDocument1 page5 - Sample Questions Exit Interviewsapi-247476114No ratings yet

- 6 - Exit Interview EvaluationDocument1 page6 - Exit Interview Evaluationapi-247476114No ratings yet

- Survival ProjectDocument3 pagesSurvival Projectapi-247476114No ratings yet

- SR Draw 2016 Bel Inv 2Document1 pageSR Draw 2016 Bel Inv 2api-247476114No ratings yet

- Games ScheduleDocument4 pagesGames Scheduleapi-247476114No ratings yet

- Surrey RCMP Basketball Classic 2017Document2 pagesSurrey RCMP Basketball Classic 2017api-247476114No ratings yet

- RCMP 2017 Senior DrawDocument4 pagesRCMP 2017 Senior Drawapi-247476114No ratings yet

- Games ScheduleDocument4 pagesGames Scheduleapi-247476114No ratings yet

- 2016 Tbi Boys DrawDocument1 page2016 Tbi Boys Drawapi-247476114No ratings yet

- Falls Ridge - Phase Wise Lot LayoutDocument1 pageFalls Ridge - Phase Wise Lot Layoutapi-247476114No ratings yet

- Test 5Document4 pagesTest 5Lam ThúyNo ratings yet

- Advanced Stock Trading Course + Strategies Course CatalogDocument5 pagesAdvanced Stock Trading Course + Strategies Course Catalogmytemp_01No ratings yet

- Ais CH5Document30 pagesAis CH5MosabAbuKhater100% (1)

- 2023 10 3 19 47 48 231003 195751Document7 pages2023 10 3 19 47 48 231003 195751riyamoni54447No ratings yet

- Crisis Communications: Steps For Managing A Media CrisisDocument15 pagesCrisis Communications: Steps For Managing A Media Crisismargarita BelleNo ratings yet

- 2020 HGDG Pimme Checklist 16Document2 pages2020 HGDG Pimme Checklist 16Kate MoncadaNo ratings yet

- IntroductionDocument37 pagesIntroductionA ChowdhuryNo ratings yet

- Social Dimensions OF EducationDocument37 pagesSocial Dimensions OF Educationjorolan.annabelleNo ratings yet

- Matalam V Sandiganbayan - JasperDocument3 pagesMatalam V Sandiganbayan - JasperJames LouNo ratings yet

- Logistics Specialist NAVEDTRA 15004BDocument970 pagesLogistics Specialist NAVEDTRA 15004Blil_ebb100% (5)

- Acknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyDocument3 pagesAcknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyLanie BatoyNo ratings yet

- AI Intelligence (Sam Charrington and Abeba Birhane)Document2 pagesAI Intelligence (Sam Charrington and Abeba Birhane)Ethel Shammah Waoulda Acleta90% (10)

- AssignmentDocument25 pagesAssignmentPrashan Shaalin FernandoNo ratings yet

- Voodoo 101Document8 pagesVoodoo 101The Divine Prince Ty Emmecca67% (9)

- Ecology Block Wall CollapseDocument14 pagesEcology Block Wall CollapseMahbub KhanNo ratings yet

- Swepp 1Document11 pagesSwepp 1Augusta Altobar100% (2)

- Discipline, Number of Vacancies, Educational Qualification and ExperienceDocument8 pagesDiscipline, Number of Vacancies, Educational Qualification and ExperienceMohammedBujairNo ratings yet

- Aaron VanneyDocument48 pagesAaron VanneyIvan KelamNo ratings yet

- Construction Design Guidelines For Working Within and or Near Occupied BuildingsDocument7 pagesConstruction Design Guidelines For Working Within and or Near Occupied BuildingsAthirahNo ratings yet

- Sales ProcessDocument4 pagesSales ProcessIsaac MorokoNo ratings yet

- Hilti 2016 Company-Report ENDocument72 pagesHilti 2016 Company-Report ENAde KurniawanNo ratings yet

- Philippine Phoenix Surety vs. WoodworksDocument1 pagePhilippine Phoenix Surety vs. WoodworksSimon James SemillaNo ratings yet

- AR 700-84 (Issue and Sale of Personal Clothing)Document96 pagesAR 700-84 (Issue and Sale of Personal Clothing)ncfranklinNo ratings yet

- Estimating Guideline: A) Clearing & GrubbingDocument23 pagesEstimating Guideline: A) Clearing & GrubbingFreedom Love NabalNo ratings yet

- My Portfolio: Marie Antonette S. NicdaoDocument10 pagesMy Portfolio: Marie Antonette S. NicdaoLexelyn Pagara RivaNo ratings yet

- Pol Parties PDFDocument67 pagesPol Parties PDFlearnmorNo ratings yet

- 2.1 Song of The Open RoadDocument10 pages2.1 Song of The Open RoadHariom yadavNo ratings yet

- The Mental Health Act 2018 Tested by High Court of UgandaDocument7 pagesThe Mental Health Act 2018 Tested by High Court of UgandaLDC Online ResourcesNo ratings yet

- Easter in South KoreaDocument8 pagesEaster in South KoreaДіана ГавришNo ratings yet

- OD428150379753135100Document1 pageOD428150379753135100Sourav SantraNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (89)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- Altcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesFrom EverandAltcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesRating: 5 out of 5 stars5/5 (1)

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- Buy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeFrom EverandBuy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeNo ratings yet

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestFrom EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestRating: 5 out of 5 stars5/5 (1)

- Bitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyFrom EverandBitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyRating: 4 out of 5 stars4/5 (4)

- The Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)From EverandThe Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Rating: 4 out of 5 stars4/5 (34)

- Summary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamFrom EverandSummary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamRating: 5 out of 5 stars5/5 (1)