Professional Documents

Culture Documents

AS 22 Accounting Standard Seminar Materials

Uploaded by

Joerichards0 ratings0% found this document useful (0 votes)

14 views1 page1) The document provides background material on Accounting Standard 22 regarding accounting for taxes on income, including the key requirements of AS 22 with examples, frequently asked questions, and a comparison to international standards.

2) It details what is included in the publication such as the text of AS 22 and interpretations, and how it can be obtained from the Institute for Rs. 40.

3) Additional background materials on other new accounting standards are also available for purchase.

Original Description:

Original Title

11561p1190

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document provides background material on Accounting Standard 22 regarding accounting for taxes on income, including the key requirements of AS 22 with examples, frequently asked questions, and a comparison to international standards.

2) It details what is included in the publication such as the text of AS 22 and interpretations, and how it can be obtained from the Institute for Rs. 40.

3) Additional background materials on other new accounting standards are also available for purchase.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageAS 22 Accounting Standard Seminar Materials

Uploaded by

Joerichards1) The document provides background material on Accounting Standard 22 regarding accounting for taxes on income, including the key requirements of AS 22 with examples, frequently asked questions, and a comparison to international standards.

2) It details what is included in the publication such as the text of AS 22 and interpretations, and how it can be obtained from the Institute for Rs. 40.

3) Additional background materials on other new accounting standards are also available for purchase.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

ACCOUNTING

Understanding And Implementing

Accounting Standard (AS) 22

Accounting For Taxes On Income

Background Material for Seminars on Accounting Standard (AS) 22,

Accounting for Taxes on Income

Background Material for Seminars on Accounting of Financial Accounting Standard issued by the

Standard (AS) 22, Accounting for Taxes on Income, has Financial Accounting Standards Board in USA,

recently been released. The publication, inter alia, con-

● Text of AS 22, and

tains

● Accounting Standards Interpretations issued on AS 22.

● Key requirements of AS 22 explained with examples

and dealing with aspects such as: The background material is priced at Rs. 40 and can

be obtained from the Institute's sales counters at New

✔ Recognition of deferred tax assets in case the

Delhi and the Regional Offices at Mumbai, Kolkata,

same can be realised against deferred tax liabilities

Chennai and Kanpur.

✔ Manner of disclosure of major components of

Persons who desire to obtain above publication by

deferred tax assets and deferred tax liabilities

post may send Demand Draft in favour of the Secretary,

● Frequently asked questions (FAQs), such as, ICAI, for the cost of the background material plus the

postal charges (Rs. 19, if desired by unregistered parcel;

✔ Is it permissible not to recognise deferred tax lia-

Rs. 36 if required by registered parcel).

bility on the ground that a company expects that

there will be losses both for accounting and tax Background material on the following newly issued

purposes in near future? Accounting Standards are also available:

✔ Can a deferred tax credit be considered for ascer- 1. AS 17, Segment Reporting (price Rs. 50)

taining the quantum of dividend to be declared?

2. AS 18, Related Party Disclosures (price Rs. 30)

✔ How should the diminution in the value of a cur-

3. AS 19, Leases (price Rs. 40)

rent investment be dealt with keeping in view the

requirements of AS 22? 4. AS 20, Earnings Per Share (price Rs. 40)

✔ How should the accumulated deferred tax liabil- 5. AS 21, Consolidated Financial Statements (price Rs.

ity be absorbed if the revenue reserves are inade- 30)

quate at the first occasion AS 22 is applied?

6. AS 23, Accounting for Investments in Associates in

✔ What is the tax effect of sale of fixed assets, con- Consolidated Financial Statements (price Rs. 30)

sidering the block of assets approach followed in

The above publications also contain the features as

the Income-tax Act, 1961?

mentioned in case of background material on AS 22

✔ How should deferred tax assets and liabilities be above.

disclosed in the balance sheet of a company?

The orders may be sent to Postal Sales Section,

● Comparison of AS 22 with the corresponding Institute of Chartered Accountants of India,

International Accounting Standard and the Statement Indraprastha Marg, New Delhi - 110 002. ■

THE CHARTERED ACCOUNTANT

1190 JUNE 2003

You might also like

- PGBP IcdsDocument38 pagesPGBP IcdsRakesh TripathiNo ratings yet

- Indian Accounting Standards (IndAS): Practical Aspects, Case Studies and Recent DevelopmentsDocument46 pagesIndian Accounting Standards (IndAS): Practical Aspects, Case Studies and Recent DevelopmentsKANADARPARNo ratings yet

- Indian Accounting StandardsDocument26 pagesIndian Accounting StandardsISHANJALI MADAAN 219005No ratings yet

- Accounting Standards Grp-1 Accounts by Accounts ManDocument52 pagesAccounting Standards Grp-1 Accounts by Accounts ManAlankritaNo ratings yet

- 1.3) Accounting StandardsDocument15 pages1.3) Accounting StandardsF93 SHIFA KHANNo ratings yet

- J. K. Industries Ltd. & Anr Vs Union of India & Ors On 19 November, 2007Document91 pagesJ. K. Industries Ltd. & Anr Vs Union of India & Ors On 19 November, 2007Anonymous 1LYRgooNo ratings yet

- J. K. Industries Ltd. & Anr Vs Union of India & Ors On 19 November, 2007 PDFDocument91 pagesJ. K. Industries Ltd. & Anr Vs Union of India & Ors On 19 November, 2007 PDFAnonymous 1LYRgooNo ratings yet

- Accounting Standards and their ImportanceDocument27 pagesAccounting Standards and their ImportanceVeerNo ratings yet

- Financial Statement Analysis and Ratio AnalysisDocument29 pagesFinancial Statement Analysis and Ratio AnalysisNayana GoswamiNo ratings yet

- Financial AccountingDocument20 pagesFinancial AccountingArveen NairNo ratings yet

- Impact Analysis - ICDSDocument50 pagesImpact Analysis - ICDSRaghavendra RahulNo ratings yet

- CH.12 Tax AuditDocument19 pagesCH.12 Tax AuditSita BhuraNo ratings yet

- Overview of Indian Accounting Standards For SMEsDocument44 pagesOverview of Indian Accounting Standards For SMEsSamrat JonejaNo ratings yet

- AS Theory CA IPCC I & IIDocument19 pagesAS Theory CA IPCC I & IICaramakr ManthaNo ratings yet

- Tax Audit U/s 44AB A Study On The Application of Relevant Accounting StandardsDocument32 pagesTax Audit U/s 44AB A Study On The Application of Relevant Accounting StandardschethansoNo ratings yet

- National Seminar on IFRSDocument9 pagesNational Seminar on IFRSpsawant77No ratings yet

- Accounting StandardsDocument6 pagesAccounting StandardsJohnsonNo ratings yet

- Differences Be SOCPA and IFRSDocument2 pagesDifferences Be SOCPA and IFRSKhaled SherifNo ratings yet

- OVERVIEW 2020 Printed Edition (iBOOK Version)Document21 pagesOVERVIEW 2020 Printed Edition (iBOOK Version)Quinciano MorilloNo ratings yet

- AC3103 Seminar 19: Biosensors International Group (BIG) Valuation and Impairment Testing of IntangiblesDocument39 pagesAC3103 Seminar 19: Biosensors International Group (BIG) Valuation and Impairment Testing of IntangiblesTanisha GuptaNo ratings yet

- HK Revenue Department Interpretation and Practice NotesDocument74 pagesHK Revenue Department Interpretation and Practice NotesDifanny KooNo ratings yet

- Accounting-Class 1: by - Sakshi SaxenaDocument26 pagesAccounting-Class 1: by - Sakshi SaxenaSakshiNo ratings yet

- Natura 2016 AR Engl PDFDocument140 pagesNatura 2016 AR Engl PDFManuel CámacNo ratings yet

- CA Ajay Rathi Accounts BookDocument449 pagesCA Ajay Rathi Accounts BookNkume Irene100% (1)

- Section 4 IDocument22 pagesSection 4 ISatish Ranjan PradhanNo ratings yet

- 66638bos53803 cp1Document170 pages66638bos53803 cp1417 Rachit SinglaNo ratings yet

- Overview of Income Tax 2017 by Masum PDFDocument44 pagesOverview of Income Tax 2017 by Masum PDFAl-Muzahid EmuNo ratings yet

- IND ASyear-end-consideration-tl - EYDocument56 pagesIND ASyear-end-consideration-tl - EYDilip ChoudharyNo ratings yet

- Chapter 7 Revenue & InventoriesDocument34 pagesChapter 7 Revenue & Inventoriesswarna dasNo ratings yet

- Financial Reporting ChangesDocument7 pagesFinancial Reporting ChangesyogeshNo ratings yet

- Finalisation Account Under GSTDocument20 pagesFinalisation Account Under GSTkbharathNo ratings yet

- Accounting StandardDocument128 pagesAccounting StandardIndu GuptaNo ratings yet

- COVID-19's impact on financial reportingDocument7 pagesCOVID-19's impact on financial reportingMohit SainiNo ratings yet

- Indian Accounting Standands V/S. International Accounting StandardsDocument70 pagesIndian Accounting Standands V/S. International Accounting StandardsVishal ChandakNo ratings yet

- TataDocument56 pagesTataAndreea GeorgianaNo ratings yet

- Vinayak Pai - MAT Acturial ValDocument3 pagesVinayak Pai - MAT Acturial Valarihant dagaNo ratings yet

- PICPA NO - Corporate Income TaxDocument80 pagesPICPA NO - Corporate Income TaxMerlyn M. Casibang Jr.No ratings yet

- Revenue Recognition PrinciplesDocument74 pagesRevenue Recognition PrinciplesaNo ratings yet

- Tax Insights Will Bahrain Introduce Corporate Income TaxDocument2 pagesTax Insights Will Bahrain Introduce Corporate Income TaxIstvan GodányNo ratings yet

- Audit Report Form 88Document12 pagesAudit Report Form 88TarifNo ratings yet

- Accounting Standard 170417Document32 pagesAccounting Standard 170417selvam sNo ratings yet

- Accounting Standards for Non Going Concern Entities 1709923353Document36 pagesAccounting Standards for Non Going Concern Entities 1709923353Bilal Ahmed KhanNo ratings yet

- Corporate Advisor Summer 2019 2Document29 pagesCorporate Advisor Summer 2019 2Michael ChenNo ratings yet

- Accounting StandardsDocument45 pagesAccounting StandardsriteshnirmaNo ratings yet

- Dabur Notes To Standalone Financial Statements PDFDocument55 pagesDabur Notes To Standalone Financial Statements PDFRupasinghNo ratings yet

- Accounting Standard2Document24 pagesAccounting Standard2shajiNo ratings yet

- Income Computation and Disclosure Standard (Icds) : CA. Ritesh MittalDocument143 pagesIncome Computation and Disclosure Standard (Icds) : CA. Ritesh MittalSubrat MohapatraNo ratings yet

- International Accounting: - Topic: Financial Reporting of JapanDocument6 pagesInternational Accounting: - Topic: Financial Reporting of JapanPrathibha. M PrathiNo ratings yet

- International Accounting: - Topic: Financial Reporting of JapanDocument6 pagesInternational Accounting: - Topic: Financial Reporting of JapanPrathibha. M PrathiNo ratings yet

- Accounting Standards 32Document91 pagesAccounting Standards 32bathinisridhar100% (3)

- As 2Document170 pagesAs 2Udit RajNo ratings yet

- Short Report on Footnotes of Three Textile CompaniesDocument34 pagesShort Report on Footnotes of Three Textile CompaniesAhnaf RaselNo ratings yet

- Tax Audit Series 6 – S. Nos. 14-15Document4 pagesTax Audit Series 6 – S. Nos. 14-15Hanumantha Reddy BellaryNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndiaRobinxyNo ratings yet

- Introduction To Accounting & Financial Statements: MN 3042 - Business Economics and Financial Accounting Offered byDocument31 pagesIntroduction To Accounting & Financial Statements: MN 3042 - Business Economics and Financial Accounting Offered byAwishka ThuduwageNo ratings yet

- CARODocument3 pagesCARONiket SharmaNo ratings yet

- Accounting StandardsDocument45 pagesAccounting Standardsjitesh_kumar_275% (4)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- NJ India Invest ProjectDocument52 pagesNJ India Invest ProjectPrakash Rathor100% (1)

- Tanla Share Price - Google SearchDocument1 pageTanla Share Price - Google Searchaditya goswamiNo ratings yet

- Understanding 1 View ReportingDocument370 pagesUnderstanding 1 View ReportingSindhu RamNo ratings yet

- FA1Document289 pagesFA1Abhishek BhatnagarNo ratings yet

- Set Depreciation Start Dates Period ControlDocument5 pagesSet Depreciation Start Dates Period ControlSpandana SatyaNo ratings yet

- Manual of Cost Accounting in The Ordnance and Ordnance Equipment Factories Section - I General ObjectsDocument73 pagesManual of Cost Accounting in The Ordnance and Ordnance Equipment Factories Section - I General ObjectsSachin PatelNo ratings yet

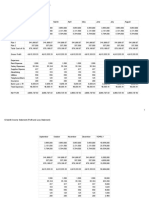

- Company financial statements and key metricsDocument6 pagesCompany financial statements and key metricsAther RamzanNo ratings yet

- Easton 6E Module 2 (7 Files Merged)Document445 pagesEaston 6E Module 2 (7 Files Merged)KhairulBasherSujonNo ratings yet

- Mom and Pop Stores SurvivalDocument2 pagesMom and Pop Stores Survivallonely_hrt123@yahoo.comNo ratings yet

- China Banking Corporation investment loss classificationDocument7 pagesChina Banking Corporation investment loss classificationBernadette RacadioNo ratings yet

- Taxation NotesDocument27 pagesTaxation NotesRound RoundNo ratings yet

- 7 Benchmarking Mercer 2010 MethodologyDocument17 pages7 Benchmarking Mercer 2010 MethodologyAdelina Ade100% (2)

- Days Operated/Rooms Occupied: Particulars Amount (RS.) Amount Per RoomDocument5 pagesDays Operated/Rooms Occupied: Particulars Amount (RS.) Amount Per RoomDr Linda Mary SimonNo ratings yet

- Change in Demand and Supply Due To Factors Other Than PriceDocument4 pagesChange in Demand and Supply Due To Factors Other Than PriceRakesh YadavNo ratings yet

- 3 Forward Prices-DeterminationDocument26 pages3 Forward Prices-DeterminationSaurabh AhujaNo ratings yet

- Accountancy - Class 11Document151 pagesAccountancy - Class 11Ketan ThakkarNo ratings yet

- The Economics of Upstream Petroleum ProjectDocument18 pagesThe Economics of Upstream Petroleum ProjectLulav BarwaryNo ratings yet

- Case Study Lyons DocumentDocument3 pagesCase Study Lyons DocumentSandip GumtyaNo ratings yet

- Claremont COURIER 10-17-14Document36 pagesClaremont COURIER 10-17-14Claremont CourierNo ratings yet

- 12-Month Income Statement Profit-And-Loss Statement - Sheet1Document2 pages12-Month Income Statement Profit-And-Loss Statement - Sheet1api-462952636100% (1)

- Ratio Analysis of The Annual Report On Standard BankDocument15 pagesRatio Analysis of The Annual Report On Standard BankShopno Konna Sarah80% (5)

- Primavera PERT Master Risk Analysis ToolDocument22 pagesPrimavera PERT Master Risk Analysis ToolPallav Paban BaruahNo ratings yet

- Indian Insurance SectorDocument18 pagesIndian Insurance SectorSaket KumarNo ratings yet

- Accounting For Managers - CH 3 - Recording Financial Transactions...Document14 pagesAccounting For Managers - CH 3 - Recording Financial Transactions...Fransisca Angelica Atika SisiliaNo ratings yet

- An Introduction to Financial Management Principles and ConceptsDocument30 pagesAn Introduction to Financial Management Principles and ConceptsGautami JhingaranNo ratings yet

- Prelim AFAR 1Document6 pagesPrelim AFAR 1Chris Phil Dee75% (4)

- Auditing-Review Questions Chapter 13Document5 pagesAuditing-Review Questions Chapter 13meiwin manihingNo ratings yet

- Unit 2 Tutorial SheetDocument5 pagesUnit 2 Tutorial Sheetemmanuel cooperNo ratings yet

- Solved Ashley Company Uses A Perpetual Inventory System From The Following PDFDocument1 pageSolved Ashley Company Uses A Perpetual Inventory System From The Following PDFAnbu jaromiaNo ratings yet

- The Entering EsDocument95 pagesThe Entering Esthomas100% (1)