Professional Documents

Culture Documents

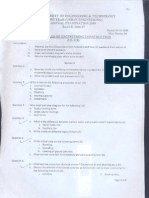

Engineering Economics Course Outline

Uploaded by

Arif SamoonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Engineering Economics Course Outline

Uploaded by

Arif SamoonCopyright:

Available Formats

:|:|:::: COURSE | ENGINEERING ECONOMICS

1. Analysis before launching an product

a. Technical

b. Social

c. Financial

2. Economic environment (6)

3. Financial analysis (10)

a. Time value of money

b. Interest rate

c. Various factor

d. Present worth analysis

e. Annual worth analysis

f. Internal rate of return

g. Benefit cost ratio

h. Selection between alternative

i. Capitalized cost

j. Gradient analysis

4. Depreciation and valuation

5. Break even analysis

6. Linear programming

Optimal allocation of scarce resources.

a. Graphical

b. Simplex

c. Duality Not part of course

d. Transportation

7. Business organization & market

a. Types of organization

i. Single ownership

ii. Partnership

iii. Corporation company

b. Operation of organization in market

i. Perfectly competitive

ii. Monopolic

iii. Oligopolic

8. Financial accounting

a. Income statement

b. Balance sheet

c. Financial statement

9. Books

a. Engineering economics by Tarquin

b. Engineering economics by Paul degammo

c. Mathematical economics by A. Chang

d. General economics by Samaulso (dictionary)

||||||||+ Powered by Arificial Intelligence

:|:|:::: INTRODUCTION

1. Microeconomics

a. Cost

b. Profit

2. Macroeconomics

a. Inflation

b. Unemployment

3. Economic activity

a. Two sector model

i. Consumer sector

ii. Business sector

b. 3 sector model

i. Government

ii. Consumer

iii. Business

c. 4 sector model

i. Government (allows import/export)

ii. Business

iii. Consumer

iv. International market

4. Flow chart

a. Input market -> finished goods

5. Basic inputs

a. Land

b. Labour

c. Capital

d. Organization

6. Five M’s of management

a. Money

b. Material

c. Machinery

d. Manpower

e. Management

7. Table: Input – agent

8. Demand & supply

a. Shortage (D>S; loss of consumer)

b. Surplus (D<S; loss of business)

9. Interest & profit

10. Principal amount & interest

11. Goods & services (flow chart)

a. Consumer goods & services (directly consumed)

b. Producer goods and services (used in further processing)

Engineering Economics | Course Outline

2|P a g e

12. Goods and services

a. Normal (aka superior goods)

b. Inferior

c. Substitute

d. Compliment

13. Demand

a. Demand curve

b. Law of demand

c. Quantity demand (Qd) : function of Qd=a-bP

i. Price

ii. Price of related good

iii. Consumer income

iv. Consumer taste (fashion)

v. Expectation (view of price in future)

d. Quantity supply (Qs) : function of Qs=-c+dP

i. Price

ii. Price of related good

iii. Price of input

iv. Technology

v. Number of firms

vi. Expectation

↑ Qs w hen ↓Future price (clearance sale)

↓ Qs w hen ↑Future price (hoarding)

e. Equilibrium

i. Qs = Qd

ୟୢିୠୡ

ii. Qs =

ୠାୢ

14. Elasticity

a. Elasticity of demad (Ed)

i. Strongly elastic Ed>1

ii. Weakly elastic Ed<1

iii. Unitary elastic Ed=1

iv. Special cases

Perfectly elastic

Perfectly inelastic

v. Numerical: Elasticity of demand

Engineering Economics | Course Outline

3|P a g e

:|:|:::: LINEAR PROGRAMMING

“Optimal allocation of resources in a competing environment.”

1. Limitations

a. Financial constraints

b. Raw material constrains

c. Machine constraints

2. Maximize

a. Revenue

b. Production

c. Profit

3. Minimize

a. Cost

b. Usage of inputs

4. Steps

a. Initial program (Qualitative -> Quantitative)

i. Objective function

ii. Structural constraints

iii. Non-negative constraints

b. Method (mechanism)

c. Optimal program (quantitative)

d. Result (Qualitative result: textual)

5. Optimal program (either or)

a. Maximize profit

b. Minimize cost

6. Constrains

a. Technicalities ( X+2Y )

b. Capacities ( ≤80 )

c. Non-negative constraints

7. Methods of linear programming

a. Graphical (two variables only)

b. Simplex (two or more variables)

c. Duality Master’s course

d. Transportation

8. Simplex method

a. Unit matrix

b. Square matrix

c. Row column operations

Engineering Economics | Course Outline

4|P a g e

9. Graphical method

a. Initial program

i. Objective function (maximization/ minimization)

ii. Structural constraints

iii. Non-negative constraints

b. Extreme points for each constraint

c. Graph plot

d. Feasible area for each constraint

e. Feasible area feasible points

f. Optimal point result

g. Special cases

i. Degenerate case (corner point solution)

ii. Multiple optimal solution case

iii. Non feasible area case

10. Simplex approach

“An iterative optimizing technique of linear programming for more complicated problems with many

variables.”

a. Steps

i. Develop initial program

ii. Rearrange initial program for matrix development

Minimization: introduce dummy variables

iii. Tableau construction

Select pivot column (highest negative value column)

ୡ୭୬ୱ୲ୟ୬୲

Mark pivot elements (minimum )

୰ୣୱ୮ୣୡ୲୧୴ୣୣ୪ୣ୫ ୣ୬୲୭୮୧୴୭୲ୡ୭୪୳୫ ୬

Mark pivot row (contains pivot element)

୮୧୴୭୲୰୭୵

Develop next tableau ( )

୮୧୴୭୲ୣ୪ୣ୫ ୣ୬୲

Make objective function row zero

iv. Conduct feasibility test

Minimisation (minimum one negative value in objective function row)

Maximisation (minimum one positive value in objective function row)

v. Optimality condition

Maximisation: All positive value or zero in objective function row

Minimisation: All negative value or zero in objective function row

a. Convert tableau into feasible tableau

(R1 1 =∑ଶ R x ϐ of dummy variable x Rଵ)

vi. Extract identity matrix from tableau

b. Special cases

i. Degenerate case

more than one pivot element

zero is constant column (except first row)

ii. Non-feasible area

Constant column repeats Non-improving case

Negativity shifts in any other column

Engineering Economics | Course Outline

5|P a g e

:|:|:::: FINANCIAL ANALYSIS

“It considers the time value of money.”

1. Money value

a. Nominal

b. Real (used in financial analysis)

2. Cash flow diagram

a. Inflow ↑

b. Outflow ↓

3. Factors affecting value of money

a. Time

b. Interest rate

4. Interest (excess rate principle)

a. Simple interest

b. Compound interest

c. Nominal interest

d. Composite interest

5. Factors to convert money from one period to another

{

ଵ

a. Discount factor future to present ܲ=Fx

(ଵା୧)ొ

b. Reciprocal of discount factor present to future = ܨP x ( 1 + i)

(ଵା୧)ొ ିଵ

{

c. Annuality factor annual to present ܲ=Ax

୧(ଵା୧)ొ

୧(ଵା୧)ొ

d. Capital recovery factor present to annual =ܣPx

(ଵା୧)ొ ିଵ

{

୧

e. Sinking fund factor future to annual =ܣFx

(ଵା୧)ొ

(ଵା୧)ొ ିଵ

f. Reciprocal of sinking fund annual to lump sum =ܨAx

୧

(ଵା୧)ొ ିଵ

{

ୋ

g. Gradient factor gradient to present ܲ= x +

୧ ୧(ଵା୧)ొ (ଵା୧)ొ

ୋ (ଵା୧)ొ ିଵି୧

h. Gradient to annual gradient to annual =ܣ x

୧ ୧(ଵା୧)ొ ିଵ

6. Steps: Financial analysis

a. Enumerate (cost and benefit)

b. Evaluate (cost and benefit)

c. Discount net benefit (outcome)

Engineering Economics | Course Outline

6|P a g e

7. Money evaluation

a. Present worth analysis

i. Net present value ܸܰܲ = ܹܲ ܤ− ܹܲ ≥ ܥ0

ii. Present worth cost analysis least cost ܹܲ ܥ ܹܲ = ܥ− ܹܲ ܤ

Different lives (take LCM of lives)

b. Annual worth analysis

“Simplifies annual instalment calculation. Useful for different or perpetual lives.”

i. Equivalent uniform annual benefit >0

ii. Equivalent uniform annual cost ݈݁ܽݐݏܿݐݏ

Cash flow diagram

PWNR

EUAC one life cycle

ா

Capitalised cost =

Total capitalised cost = ݐݏܿ ݀݁ݏ݈݅ܽݐ݅ܽܥ− ܹܲ ேோ

c. Internal rate of return (IRR)

i . Rate of interest at PWB-PWC=0 = ∑ଵ − ∑

(ଵା) (ଵା)

ii . Alternatives

Independent (A or B) select project with highest IRR

Mutually exclusive (incremental analysis technique)

ܽ

- EUAC (products x,y,z) ܣ = ݎ% + (ܤ% − ܣ%)

ܽ−(−ܾ)

i<r i>r

d. Benefit cost ratio ܤ ܹܣ/ > ܥ ܹܣ1

i. Approaches

Conventional

ܤ ܤܣ

= >0

ܴܥ ܥ+ ܱ&ܯ

ݐݏܿ ݊݅ݐܽ݅ܿ݁ݎ݈݁݀ܽݐݐ = ܴܥ+ ݁݃ܽݒ݈ܽݏ ݊ݏݏܮ

ܲ =ݐݏܿ ݊݅ݐܽ݅ܿ݁ݎ݁ܦ− ܨ

Now

ܤ

=

ܥ

Engineering Economics | Course Outline

7|P a g e

Modified

A

ܤ

l = ܤܣ− ܤܦܣ− ܱ& > ܯ0

ܥ

t ܴܥ

e

Now

r

ܤܣ−ܤܦܣ−ܱ&ܯ

n= ܣ >0

(ܲ− )ܨቂܲ,݅%,ܰ ቃ+ )݅(ܨ

a

t

Alternatives

- Independent (simple analysis)

- Mutually exclusive (incremental analysis)

ܤ ∆ܤܣ

=

ܥܣܷܧ∆ ܥ

Now

(ଵା)ಿ

( × ܥ = ܥܣܷܧଵା)ಿ ିଵ

Tabulation

Ascending Annual AB/AC Compare ∆EUAC ∆B ∆EUAC/∆B

EUAC Benefit

Engineering Economics | Course Outline

8|P a g e

:|:|:::: DEPRECIATION

1. Assets worth goes down as

a. Tangible depreciation

b. Intangible amortisation

c. Natural depletion

2. Depreciation types

a. Normal depreciation

i. Physical (capacity)

ii. Functional (obsoletion)

b. Monetary depreciation

3. Terms

a. Booked value

b. Salvage value

c. Annual depreciation

d. Total depreciation

2. Depreciation calculation techniques Preferred for

a. Straight line method 1-10 years

ିௌ

i. Annual depreciation ܣ. ݀݁=

ே

ii. Total depreciation ܶ. ݀݁ܣ(݊ = . ݀݁)

iii. Booked value ܤ. ܸ = ܲ − ܶ. ݀݁

b. Sum of year digit method 10-20 years

i. Depreciation ܦ = (ܲ − ܵ)݀݁. ݂ܽܿݎݐ

ோ௩௦ ௬

ii. Depreciation factor ݀݁. ݂ܽܿ= ݎݐ

∑ ௬௦

iii. Booked value ܤ. ܸ = ܲ − ( ܲ − ܵ) ݀݁. ݒ݁ݎ

∑ ௩௦ ௬௦௧

iv. Depreciation reverse ݀݁. = ݒ݁ݎ

∑ ௬௦

v. Total depreciation ܶ. ݀݁ ܲ = − ܤ. ܸ

c. Declining balance approach >20 years

i. Depreciation ܦ = ݇(ܤ. ܸିଵ)

ଵ/ே

ௌ

ii. k ݇= 1− ቀ ቁ

iii. Booked value ܤ. ܸ = ܲ(1 − ݇)

d. Double declining balance >20 years

i. Depreciation ܦ = ݇(ܤ. ܸିଵ)

ଶ

ii. kmax ݇ ௫ = ݎ200%

ே

iii. Booked value ܤ. ܸ = ܲ(1 − ݇)

e. Sinking fund

i. Depreciation ܦ = ( ܲ − ܵ) ܵ݅݊݇݅݊݃ ݂ݎݐ݂ܿܽ ݀݊ݑ

ܣ

= ( ܲ − ܵ) ቂ , ݅%, ܰ ቃ

ܨ

ܣ

ቂܨ,݅%,ܰ ቃ

ii. Total depreciation ܶ. ݀݁ ܲ = − ܵ ܣ

ቂܨ,݅% ,݊ቃ

iii. Booked value ܤ. ܸ = ܲ − ܶ. ݀݁

Engineering Economics | Course Outline

9|P a g e

ିௌ

f. Production rate ݀݁/=ݐ݅݊ݑ

்.ை/

ିௌ

g. Hourly rate ݀݁/=ݐ݅݊ݑ

்.

Engineering Economics | Course Outline

10 | P a g e

You might also like

- Disouq Well Hand-Over Certificate: (Y/N) (Rigless "Gravel Pack")Document6 pagesDisouq Well Hand-Over Certificate: (Y/N) (Rigless "Gravel Pack")eng20072007No ratings yet

- 5 Ee12-Electrical System Design-Lec (Residential) - Lec-2021Document13 pages5 Ee12-Electrical System Design-Lec (Residential) - Lec-2021Silwy OneNo ratings yet

- Air Conditioning 1Document17 pagesAir Conditioning 1Esmail AnasNo ratings yet

- Chapter 4 Continuous Random Variables and Probability Distribution (Part 1)Document17 pagesChapter 4 Continuous Random Variables and Probability Distribution (Part 1)Ay SyNo ratings yet

- Perspective Projection TypesDocument2 pagesPerspective Projection TypesKade BenNo ratings yet

- Goodwill LetterDocument2 pagesGoodwill LetterArjun AK100% (1)

- White Paper Relaibility of UPSDocument7 pagesWhite Paper Relaibility of UPSMarino ValisiNo ratings yet

- Problems On Two Dimensional Random VariableDocument15 pagesProblems On Two Dimensional Random VariableBRAHMA REDDY AAKUMAIIANo ratings yet

- Building Systems Design - OBE Syllabus 2020Document5 pagesBuilding Systems Design - OBE Syllabus 2020Grace PerezNo ratings yet

- Liebert PCW Brochure EnglishDocument20 pagesLiebert PCW Brochure EnglishXinrong JoyceNo ratings yet

- Planned M Aintenance: Gearing Towards A Pro-Active Maintenance SystemDocument42 pagesPlanned M Aintenance: Gearing Towards A Pro-Active Maintenance SystemNadol SwasnateeNo ratings yet

- An Introduction To Engineering EconomyDocument65 pagesAn Introduction To Engineering EconomypaulNo ratings yet

- HR CompendiumDocument13 pagesHR CompendiumNeelu Aggrawal100% (1)

- Teqip2 Swotanalysis PDFDocument379 pagesTeqip2 Swotanalysis PDFAnonymous 5HYsyrddpNo ratings yet

- CA Inter Advance Accounts Question BankDocument566 pagesCA Inter Advance Accounts Question BankHarshit BahetyNo ratings yet

- Chapter 7: Statistical Intervals For A Single Sample: Course Name: Probability & StatisticsDocument59 pagesChapter 7: Statistical Intervals For A Single Sample: Course Name: Probability & StatisticsKỳ KhôiNo ratings yet

- Design DefinitionsDocument8 pagesDesign DefinitionsDWG8383No ratings yet

- Agency: Effect of Death - 1919, 1930 and 1931Document25 pagesAgency: Effect of Death - 1919, 1930 and 1931johnkyleNo ratings yet

- 2022 Global Skills ReportDocument35 pages2022 Global Skills ReportJostNo ratings yet

- Perspective ProjectionDocument17 pagesPerspective ProjectionCedrick DyNo ratings yet

- Fundamentals Probability 08072009Document51 pagesFundamentals Probability 08072009sriharshagadiraju100% (2)

- Activities and Assignment 2-Regina Gulo PachoDocument8 pagesActivities and Assignment 2-Regina Gulo PachoAlthea RoqueNo ratings yet

- Breakdown and Preventive MaintenanceDocument18 pagesBreakdown and Preventive Maintenancem_alodat6144No ratings yet

- Energy Use Analysis of The Variable Refrigerant Flow (VRF) System Versus The Multi - Split Unit Using TRNSYS PDFDocument20 pagesEnergy Use Analysis of The Variable Refrigerant Flow (VRF) System Versus The Multi - Split Unit Using TRNSYS PDFroger_shNo ratings yet

- AP - Oracle R12 Account Payables (AP) SetupsDocument39 pagesAP - Oracle R12 Account Payables (AP) Setupssatyam shashi100% (1)

- Kentucky Fried ChickenDocument42 pagesKentucky Fried Chickenosama asadNo ratings yet

- Feasibility of Parking Plaza in Sadar Town of KarachiDocument15 pagesFeasibility of Parking Plaza in Sadar Town of KarachiArif SamoonNo ratings yet

- Flow Chart For Doubly Reinforced Beam DesignDocument2 pagesFlow Chart For Doubly Reinforced Beam DesignArif Samoon100% (1)

- Money Time Relationships and EquivalenceDocument34 pagesMoney Time Relationships and EquivalenceRyan Jay EscoriaNo ratings yet

- MCQ 0543Document15 pagesMCQ 0543Carlos Benavides AlvarezNo ratings yet

- MCQDocument29 pagesMCQmuralitmps100% (1)

- Group 3 - Presentation PDFDocument20 pagesGroup 3 - Presentation PDFSofina HumagainNo ratings yet

- Minggu 2 - Interest and EquivalenceDocument32 pagesMinggu 2 - Interest and EquivalencekasmitaNo ratings yet

- Spray Humidifier Design PED II FinalDocument39 pagesSpray Humidifier Design PED II FinalPritam SharmaNo ratings yet

- S-Curve Exam QuestionsDocument3 pagesS-Curve Exam QuestionsSanjith SadanandanNo ratings yet

- Mitubishi AirCon TechManual DXK32ZL SDocument92 pagesMitubishi AirCon TechManual DXK32ZL Scraig027No ratings yet

- Chapter 7 ReviewDocument2 pagesChapter 7 ReviewRonaldNo ratings yet

- MCQDocument5 pagesMCQOne Degree100% (1)

- Math 22-1 SyllabusDocument6 pagesMath 22-1 SyllabusJeffrey PalconeNo ratings yet

- Superheat and Subcooling Made Easy PDFDocument4 pagesSuperheat and Subcooling Made Easy PDFFajar Rumanto100% (1)

- Ild - 03 - Interior Lighting Design TechniquesDocument8 pagesIld - 03 - Interior Lighting Design TechniquesTarunChauhanNo ratings yet

- Chapter 7Document5 pagesChapter 7Leonita Swandjaja100% (1)

- Math24-1 Syllabus - EEDocument8 pagesMath24-1 Syllabus - EEJoshua Roberto GrutaNo ratings yet

- Chapter 12 PDFDocument41 pagesChapter 12 PDFaaaNo ratings yet

- Ii-1 MCQDocument2 pagesIi-1 MCQMofazzal Hossain KhondekarNo ratings yet

- Basic Electrical TheoryDocument22 pagesBasic Electrical TheoryAnthony MinozaNo ratings yet

- Notes On Sensitivity AnalysisDocument12 pagesNotes On Sensitivity AnalysisNikhil KhobragadeNo ratings yet

- Eng'g Economics Part IIDocument10 pagesEng'g Economics Part IILiezel Dahotoy100% (1)

- Liebert-Alber Battery MonitoringDocument47 pagesLiebert-Alber Battery MonitoringPaul RasmussenNo ratings yet

- Overview Renewable Energy Systems 402Document59 pagesOverview Renewable Energy Systems 402jacopanyNo ratings yet

- Co GenerationDocument14 pagesCo GenerationDairo Ruiz-LogreiraNo ratings yet

- Topic 8-Mean Square Estimation-Wiener and Kalman FilteringDocument73 pagesTopic 8-Mean Square Estimation-Wiener and Kalman FilteringHamza MahmoodNo ratings yet

- CH 8 Rate of Return AnalysisDocument31 pagesCH 8 Rate of Return Analysisaqmarina sabilaNo ratings yet

- Series and Parallel Circuits WorksheetDocument7 pagesSeries and Parallel Circuits WorksheetDaryl Langamon Uy CruzNo ratings yet

- Annual Cash Flow AnalysisDocument32 pagesAnnual Cash Flow AnalysisSalih A. Razag Jr.No ratings yet

- Statistical IntervalsDocument27 pagesStatistical IntervalsRhenz Ashley AdemNo ratings yet

- Rate of Return MethodDocument3 pagesRate of Return Methodutcm77No ratings yet

- Lecture 1 - Overview of Construction IndustryDocument52 pagesLecture 1 - Overview of Construction IndustryWong Yi RenNo ratings yet

- TelecomDocument108 pagesTelecomDhuftan Worraa RorrooNo ratings yet

- Chapter No: 1: MCQ Question-UeeDocument5 pagesChapter No: 1: MCQ Question-UeeNitishkumar PatelNo ratings yet

- LP SensitivityAnalysisDocument47 pagesLP SensitivityAnalysisHarshit MishraNo ratings yet

- Hitachi-VRF CatalogueDocument36 pagesHitachi-VRF CatalogueSachin KharatNo ratings yet

- Types of TransformersDocument11 pagesTypes of TransformersAbdulGhaffarNo ratings yet

- Continuous Probability Distributions: True/FalseDocument5 pagesContinuous Probability Distributions: True/FalseMahmoud Ayoub GodaNo ratings yet

- MCQ On Unit-1Document13 pagesMCQ On Unit-1chirag shindeNo ratings yet

- Continuous Random Variables and Probability DistributionDocument37 pagesContinuous Random Variables and Probability DistributionJerome ValdezNo ratings yet

- Renewable Energy SourcesDocument13 pagesRenewable Energy SourcesRAJAN RAMANUJNo ratings yet

- MM 314 Engineering Economy - 2. Interest Rate and Economic EquivalenceDocument61 pagesMM 314 Engineering Economy - 2. Interest Rate and Economic EquivalenceOğulcan AytaçNo ratings yet

- Chap4 Exercise On Sensitivity Analysis SolutionDocument2 pagesChap4 Exercise On Sensitivity Analysis SolutionIves LeeNo ratings yet

- QP AgriDocument3 pagesQP AgriSharath.H sharuNo ratings yet

- Applied Linear Programming: For the Socioeconomic and Environmental SciencesFrom EverandApplied Linear Programming: For the Socioeconomic and Environmental SciencesNo ratings yet

- Urban Engineering Course Outline - Final Year (First Semester)Document6 pagesUrban Engineering Course Outline - Final Year (First Semester)Arif SamoonNo ratings yet

- Coordination Between Different Civic AgenciesDocument22 pagesCoordination Between Different Civic AgenciesArif SamoonNo ratings yet

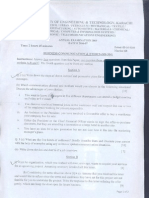

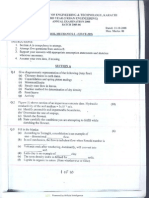

- Traffic Class Tests - Third Year EngineeringDocument5 pagesTraffic Class Tests - Third Year EngineeringArif SamoonNo ratings yet

- Flow Chart For Flexure Design of T-Section BeamDocument2 pagesFlow Chart For Flexure Design of T-Section BeamArif Samoon100% (1)

- Tender-Standard ExampleDocument2 pagesTender-Standard ExampleArif SamoonNo ratings yet

- Business Communications Course OutlineDocument3 pagesBusiness Communications Course OutlineArif SamoonNo ratings yet

- I Own Karachi 2010Document14 pagesI Own Karachi 2010Arif SamoonNo ratings yet

- Third Year Sessionals 2010Document2 pagesThird Year Sessionals 2010Arif SamoonNo ratings yet

- Structural Analysis Paper 2007Document3 pagesStructural Analysis Paper 2007Arif SamoonNo ratings yet

- Hepatitis C ManagementDocument86 pagesHepatitis C ManagementArif SamoonNo ratings yet

- Traffic Engineering FormulaeDocument3 pagesTraffic Engineering FormulaeArif SamoonNo ratings yet

- 30 Day PlannerDocument1 page30 Day PlannerArif SamoonNo ratings yet

- Reinforced Concrete Design Past PapersDocument10 pagesReinforced Concrete Design Past PapersArif SamoonNo ratings yet

- Business Communications Paper 2009Document2 pagesBusiness Communications Paper 2009Arif SamoonNo ratings yet

- Soil Mechanics-1 Past PapersDocument15 pagesSoil Mechanics-1 Past PapersArif Samoon100% (1)

- Environmental Engineering Course OutlineDocument9 pagesEnvironmental Engineering Course OutlineArif SamoonNo ratings yet

- Reinforced Concrete Design BasicsDocument5 pagesReinforced Concrete Design BasicsArif SamoonNo ratings yet

- Principles of Engineering ConstructionDocument2 pagesPrinciples of Engineering ConstructionArif SamoonNo ratings yet

- NED SE Urban Final Result 2009Document2 pagesNED SE Urban Final Result 2009Arif SamoonNo ratings yet

- Soil CompactionDocument17 pagesSoil CompactionArif SamoonNo ratings yet

- Geology Paper: +handout Topic ListDocument6 pagesGeology Paper: +handout Topic ListArif SamoonNo ratings yet

- Workbook IndexDocument1 pageWorkbook IndexArif SamoonNo ratings yet

- Water ResourcesDocument63 pagesWater ResourcesArif SamoonNo ratings yet

- Enotesofm Com2convertedpdfnotesinternationalbusiness 100330064505 Phpapp01Document291 pagesEnotesofm Com2convertedpdfnotesinternationalbusiness 100330064505 Phpapp01Hari GovindNo ratings yet

- 167 Sep2019 PDFDocument13 pages167 Sep2019 PDFShah KhanNo ratings yet

- Geoffrey Rash BrookeDocument4 pagesGeoffrey Rash BrookeChartcheckerNo ratings yet

- Review of Literature On Inventory Management For MbaDocument7 pagesReview of Literature On Inventory Management For Mbac5hc4kgxNo ratings yet

- ISO 9001 AwarenessDocument1 pageISO 9001 AwarenessAnand Chavan Projects-QualityNo ratings yet

- Identifying and Selecting Original Automotive Parts and ProductsDocument23 pagesIdentifying and Selecting Original Automotive Parts and ProductsRon Alvin AkiapatNo ratings yet

- Learning Activity 5.2 Concept ReviewDocument4 pagesLearning Activity 5.2 Concept ReviewJames CantorneNo ratings yet

- Class DiagramDocument2 pagesClass DiagramJongNo ratings yet

- Chapter 2 AnswersDocument3 pagesChapter 2 Answersapi-479802605No ratings yet

- Chapter 3 Business PlansDocument4 pagesChapter 3 Business PlansTalha Bin Saeed67% (3)

- Lesson 5 - New CU1.8 and CU2.12Document16 pagesLesson 5 - New CU1.8 and CU2.12nightlight123No ratings yet

- Tariff Petition MEPCO PDFDocument170 pagesTariff Petition MEPCO PDFahmed khanNo ratings yet

- The Marketing EnvironmentDocument66 pagesThe Marketing EnvironmentNoreen AlbrandoNo ratings yet

- Pantene Brand Audit ReportDocument3 pagesPantene Brand Audit ReportSaad RazaNo ratings yet

- BIR NO DirectoryDocument48 pagesBIR NO DirectoryRB BalanayNo ratings yet

- Adissalem Asefa FinalDocument55 pagesAdissalem Asefa FinalSteven Kisamo AmbroseNo ratings yet

- Advanced Accounting CH 14, 15Document16 pagesAdvanced Accounting CH 14, 15jessicaNo ratings yet

- AR SKLT 2017 Audit Report PDFDocument176 pagesAR SKLT 2017 Audit Report PDFAnDhi Lastfresh MuNo ratings yet

- Supply Chain Management 5th Edition Chopra Solutions ManualDocument3 pagesSupply Chain Management 5th Edition Chopra Solutions Manualdammar.jealousgvg6100% (18)

- Management Accounting Level 3/series 2 2008 (Code 3024)Document14 pagesManagement Accounting Level 3/series 2 2008 (Code 3024)Hein Linn Kyaw67% (3)

- GCA Software Sector Report Q2 2019 PDFDocument32 pagesGCA Software Sector Report Q2 2019 PDFdear14us1984No ratings yet