Professional Documents

Culture Documents

Relevant Costs of In-House Management of Receivables

Uploaded by

Jaspal Singh0 ratings0% found this document useful (0 votes)

26 views1 pagesolution of factoring problems

Original Title

Factoring Solution

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsolution of factoring problems

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views1 pageRelevant Costs of In-House Management of Receivables

Uploaded by

Jaspal Singhsolution of factoring problems

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

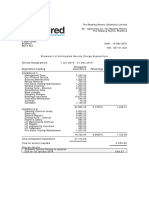

Relevant Costs of In-house Management of Receivables

A. Cash discount 240*.02*0.4 1.92

Average collection period (10*.4+90*0.6)

Cost of bank finance 240*2/3*58/360*0.18 4.64

Cost of long-term funds 240*1/3*58/360*0.24 3.09

B. Cost of funds invested in receivables 7.73

C. Bad debt loss 240*.015 3.60

D. Contribution lost on foregone sales 20*0.2 4.00

E. Avoidable costs of sales ledger 1.00

administration and credit monitoring

Relevant Costs of Recourse Factoring

F. Factoring commission 260*.015 3.90

G. Discount charge 0.8*260*0.19*60/360 6.59

H.Cost of long-term funds invested in 0.2*260*0.24*60/360 2.08

receivables

Relevant Costs of Non-Recourse Factoring

I. Factoring commission 260*.035 9.10

J. Discount charge 0.8*260*0.19*60/360 6.59

Cost of long-term funds invested in 0.2*260*0.24*60/360 2.08

receivable

Cost-Benefit Analysis of Recourse Factoring

L. Benefits associated with recourse A+B+D+E 14.65

factoring

M. Costs associated with recourse F+G+H 12.57

factoring

N. Net Benefit L–M 2.09

Cost-Benefit Analysis of Non-Recourse Factoring

O. Benefits associated with non-recourse A + B + C + D+E 18.25

factoring

P. Costs associated with non-recourse I+J+K 17.77

factoring

Q. Net Benefit O–P 0.49

Since the net benefit associated with recourse factoring is higher than that of nonrecourse

factoring, the firm is advised to opt for recourse factoring.

You might also like

- Air VesselDocument42 pagesAir VesselJaspal SinghNo ratings yet

- Air VesselDocument42 pagesAir VesselJaspal SinghNo ratings yet

- Front Valuation Page: Un-Levered Firm ValueDocument61 pagesFront Valuation Page: Un-Levered Firm Valueneelakanta srikar100% (1)

- Rising Main Design SheetDocument9 pagesRising Main Design SheetJaspal SinghNo ratings yet

- Water Pollution Management Training Manual PDFDocument176 pagesWater Pollution Management Training Manual PDFJaspal SinghNo ratings yet

- Advance Financial Management AssignmentDocument4 pagesAdvance Financial Management AssignmentRishabh JainNo ratings yet

- National Building Code 2005Document1,161 pagesNational Building Code 2005api-2617216889% (47)

- Corporate Governance Theory and ModelsDocument43 pagesCorporate Governance Theory and ModelsJaspal Singh88% (8)

- Lecture On SurgeDocument42 pagesLecture On SurgeJaspal SinghNo ratings yet

- Factoring SolutionDocument1 pageFactoring SolutionJaspal SinghNo ratings yet

- Factoring Problems-SolutionsDocument11 pagesFactoring Problems-SolutionsChinmayee ChoudhuryNo ratings yet

- FN281 Financial Management QuestionsDocument10 pagesFN281 Financial Management QuestionsRashid JalalNo ratings yet

- 4.EF232.FIM (IL-II) Solution CMA 2023 January ExamDocument6 pages4.EF232.FIM (IL-II) Solution CMA 2023 January ExamnobiNo ratings yet

- Problemas de Opciones Reales Con SoluciónDocument192 pagesProblemas de Opciones Reales Con SoluciónCarlos Jesús Ponce AranedaNo ratings yet

- Intacc2-Quiz ExamDocument10 pagesIntacc2-Quiz ExamCmNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Kubik PolymersDocument17 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Kubik Polymersamit22505No ratings yet

- Test 1 Answer SheetDocument12 pagesTest 1 Answer SheetNaveen R HegadeNo ratings yet

- Encouraging Sustainability Empowering Lives: Annual Report 2012 - 2013Document180 pagesEncouraging Sustainability Empowering Lives: Annual Report 2012 - 2013divya mNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Capital Gains - IndexationDocument22 pagesCapital Gains - IndexationTomy MathewNo ratings yet

- alemuPIA AssignmentDocument5 pagesalemuPIA AssignmentAlemu JemberieNo ratings yet

- 3.EF232. FIM IL II Solution CMA September 2022 Exam.Document5 pages3.EF232. FIM IL II Solution CMA September 2022 Exam.nobiNo ratings yet

- F 2 Nov 09 Specimen AnswersDocument9 pagesF 2 Nov 09 Specimen AnswersRobert MunyaradziNo ratings yet

- Anmols AssignmentDocument9 pagesAnmols AssignmenttusharNo ratings yet

- Cost of Capital (Problem)Document4 pagesCost of Capital (Problem)Rio RegalaNo ratings yet

- Unaudited Consolidated Financial Results 30 06 2022 5fbd98142dDocument5 pagesUnaudited Consolidated Financial Results 30 06 2022 5fbd98142dheerkummar2006No ratings yet

- One Way That Companies and Investors Can Estimate The Cost of Equity Is Through TheDocument6 pagesOne Way That Companies and Investors Can Estimate The Cost of Equity Is Through TheniyatiNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Trans 1 DetailsDocument14 pagesTrans 1 DetailsSURANA1973No ratings yet

- Cma FormatDocument14 pagesCma FormatBISHNU PADA DASNo ratings yet

- Discussion Answers On Leases 2DDocument6 pagesDiscussion Answers On Leases 2DJoeneil DamalerioNo ratings yet

- Tata Consultancy Servies Common SizeDocument2 pagesTata Consultancy Servies Common Sizeshannia dcostaNo ratings yet

- Directorate of Distance Education and Open Learning (Ddeol)Document9 pagesDirectorate of Distance Education and Open Learning (Ddeol)Mabvuto PhiriNo ratings yet

- Assessment 2Document2 pagesAssessment 2Trisha DiegoNo ratings yet

- Illustration On Projects AppraisalDocument6 pagesIllustration On Projects AppraisalAsmerom MosinehNo ratings yet

- 1 Jan 2019 - 31 Dec 2019: Statement of Anticipated Service Charge ExpenditureDocument1 page1 Jan 2019 - 31 Dec 2019: Statement of Anticipated Service Charge ExpenditureAlina RaduNo ratings yet

- Analysis Investment ProjectDocument13 pagesAnalysis Investment ProjectsolomonNo ratings yet

- Notes To FSDocument3 pagesNotes To FSDianara De GuzmanNo ratings yet

- Accenture Fin ModelDocument14 pagesAccenture Fin ModelShashi BhushanNo ratings yet

- FIN304 (End-Sem Model Answer 2021)Document9 pagesFIN304 (End-Sem Model Answer 2021)sha ve3No ratings yet

- Finance Student 11Document14 pagesFinance Student 11yany kamalNo ratings yet

- Answer The Following Questions and Provide The Necessary RequirementsDocument11 pagesAnswer The Following Questions and Provide The Necessary RequirementsKervin Rey JacksonNo ratings yet

- Final Examination: Group - Iii Paper-12: Financial Management & International FinanceDocument76 pagesFinal Examination: Group - Iii Paper-12: Financial Management & International FinanceNITHISH KUMARNo ratings yet

- Delivery Advice: For The DealerDocument3 pagesDelivery Advice: For The Dealersanjay bindNo ratings yet

- A222 Tutorial 2QDocument5 pagesA222 Tutorial 2Qchong huisinNo ratings yet

- Sfm-Mpe Mock Solution-1Document6 pagesSfm-Mpe Mock Solution-1Abdul BasitNo ratings yet

- Bodie10ce SM CH18Document20 pagesBodie10ce SM CH18beadand1No ratings yet

- Provisional Profit and Loss Accounts For The Period Un-Audited AuditedDocument4 pagesProvisional Profit and Loss Accounts For The Period Un-Audited AuditedAnonymous btsj64wRNo ratings yet

- Maruti Analysis (3) (2305843009214479326)Document20 pagesMaruti Analysis (3) (2305843009214479326)Ragu RamNo ratings yet

- SPM-Tutorial-01 (QnA) 1.18Document6 pagesSPM-Tutorial-01 (QnA) 1.18loojiawei97No ratings yet

- Finance Student 5Document13 pagesFinance Student 5yany kamalNo ratings yet

- Answer 1. The Correct Answers Are A and BDocument9 pagesAnswer 1. The Correct Answers Are A and BBadihah Mat SaudNo ratings yet

- Delivery Advice: For The DealerDocument3 pagesDelivery Advice: For The Dealersanjay bindNo ratings yet

- With The: One SunDocument14 pagesWith The: One SunPoojaDasguptaNo ratings yet

- Finance Student 4Document13 pagesFinance Student 4yany kamalNo ratings yet

- (Ust-Jpia) Quiz 1 Intermediate Accounting 2 Solution ManualDocument6 pages(Ust-Jpia) Quiz 1 Intermediate Accounting 2 Solution ManualRENZ ALFRED ASTRERONo ratings yet

- Examination: Subject SA3 - General Insurance Specialist ApplicationsDocument5 pagesExamination: Subject SA3 - General Insurance Specialist Applicationsdickson phiriNo ratings yet

- CMA Case StudyDocument15 pagesCMA Case Studyyajur_nagiNo ratings yet

- Bora Assignment FinalDocument12 pagesBora Assignment FinalBora AslanNo ratings yet

- Chapter 20 - AnswerDocument11 pagesChapter 20 - AnswerLove FreddyNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Audit of Liabilities SolManDocument3 pagesAudit of Liabilities SolManReyn Saplad PeralesNo ratings yet

- ASSIGNMENTDocument29 pagesASSIGNMENTAdish JainNo ratings yet

- CSS Accounting Papers-1Document2 pagesCSS Accounting Papers-1rabia khanNo ratings yet

- Adjusted Present Value & FCFF To Equity Value: XIM Bhubaneswar 2019-2021 BM Program by Rajiv BhutaniDocument7 pagesAdjusted Present Value & FCFF To Equity Value: XIM Bhubaneswar 2019-2021 BM Program by Rajiv BhutaniSejal KumarNo ratings yet

- Rising Main DesignDocument3 pagesRising Main DesignJaspal Singh0% (1)

- Selection and Sizing of Air Release Valves-R1Document22 pagesSelection and Sizing of Air Release Valves-R1Jaspal SinghNo ratings yet

- Information GuideDocument23 pagesInformation GuideJaspal SinghNo ratings yet

- Design of Pipelines and Pumping SystemsDocument21 pagesDesign of Pipelines and Pumping SystemsRaghuveer Rao PallepatiNo ratings yet

- Case Study 1Document11 pagesCase Study 1Jaspal Singh100% (1)

- Is 783Document79 pagesIs 783abhijit_xp8880No ratings yet