Professional Documents

Culture Documents

Budgeting Homework

Budgeting Homework

Uploaded by

api-334921583Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgeting Homework

Budgeting Homework

Uploaded by

api-334921583Copyright:

Available Formats

Introduction to Management Accounting Solutions Manual

Problems: Set A

P9-54A Comprehensive budgeting problem (Learning Objectives 2 & 3)

Solution:

Given

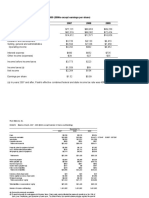

Sales Budget

December January February

Unit sales* 5,067 5,340 5,940

Unit selling price 15 $ 15 $ 15

Total sales Revenue $ 76,000 $ 80,100 $ 89,100

*Hint: Unit sales = Sales in dollars ÷ Selling price per unit

Req. 1

Cash Collections Budget

January February March

Cash Sales (30%) $24,030 $26,730 $24,840

Credit Sales (70%) $ 53,200 $ 56,070 $ 62,370

Total collections $77,230 $82,800 $87,210

Req. 2

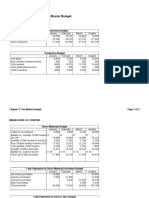

Production Budget

January February March

Unit sales 5,340 5,940 5,520

Plus: Desired ending inventory (10%) 594 552 570

Total needed 5,934 6,492 6,090

Lesss: Beginning inventory 534 594 552

Units to produce 5,400 5,898 5,538

Req. 3

Direct Materials Budget

January February March

Units to be produced 5,400 5,898 5,538

Multiply by: Quantity of DM needed per unit 2 2 2

Quantity of DM needed for production 10,800 11,796 11,076

Plus: Desired ending inventory of DM (20%) 2,359 2,215 2,568

Total quantity of DM needed 13,159 14,011 13,644

Less: Beginning inventory of DM 2,160 2,359 2,215

Quantity of DM to purchase 10,999 11,652 11,429

Multiply by: Cost per pound $ 1.50 $ 1.50 $ 1.50

Total cost of DM purchases $16,499 $17,478 $17,143

Chapter 9: The Master Budget and Responsibility Accounting 1

Introduction to Management Accounting Solutions Manual

April May

Unit Sales 5,700 5,160

Plus: Desired End Inventory (25%) 1,290

Total Needed 6,990

Less: Beginning Inventory 570

Units to produce 6,420

DM needed per unit 2

Quantity of DM needed for production 12,840

Req. 4

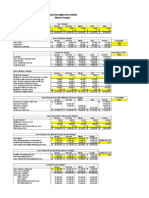

Cash Payments for Direct Material Purchases Budget

January February March

December purchases (From AP) $43,000

January purchases 3300 13199

February purchases 3496 13982

March purchases 3429

Total disbursements $46,300 $16,695 $17,411

a

33,630 x 20%

e

39,220 x 20%

Req. 5

Cash Payments for Direct Labor Costs

January February March

Direct Labor $2,106 $2,300 $2,160

Chapter 9: The Master Budget and Responsibility Accounting 2

Introduction to Management Accounting Solutions Manual

Req. 6

Cash Payments for Manufacturing Overhead Budget

January February March

Rent (fixed) $6,500 $6,500 $6,500

Other MOH (fixed) $2,900 $2,900 $2,900

Variable manufacturing overhead $ 7,560 $ 8,257 $ 7,753

Total disbursements $16,960 $17,657 $17,153

Req. 7

Cash Payments for Operating Expenses Budget

January February March

Variable operating expenses $ 6,408 $ 7,128 $ 6,624

Fixed operating expenses $ 1,400 $ 1,400 $ 1,400

Total disbursements $ 7,808 $ 8,528 $ 8,024

* Hint: Units sold x Variable operating expenses per unit sold ($1.25)

Req. 8

Combined Cash Budget

January February March

Cash balance, beginning $4,460 $4,716 $4,861

Plus: cash collections (req. 1) 77,230 82,800 87,210

Total cash available 81,690 87,516 92,071

Less cash payments:

DM purchases (req. 4) 46,300 16,695 17,411

Direct labor (req. 5) 2,106 2,300 2,160

MOH costs (req 6) 16,960 17,657 17,153

Operating expenses (req 7) 7,808 8,528 8,024

Tax payment 10,800

Equipment purchases 5800 11,600 15800

Total cash payments 78,974 67,580 60,548

Ending cash before financing 2,716 19,936 31,523

Financing:

Borrowings 2,000

Repayments -15000 -27000

Interest -75 -75

Total financing 2,000 -15,075 -27,075

Cash balance, ending $4,716 $4,861 $4,448

Req. 9

Budgeted Manufacturing Cost per Unit

Chapter 9: The Master Budget and Responsibility Accounting 3

Introduction to Management Accounting Solutions Manual

Direct materials cost per unit $3.00

Direct labor cost per unit $0.39

Variable MOH cost per unit $1.40

Fixed MOH per unit (given in problem) $0.80

Cost of manufacturing each unit $5.59

Req. 10

Damon Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales $ 252,000

Cost of goods sold -93,912

Gross profit 158,088

Operating expenses 24,360

Depreciation expense -4,400

Operating income 138,128

Less: interest expense -150

Less: provision for income tax @ 30% 41,288

Net income $96,690

Chapter 9: The Master Budget and Responsibility Accounting 4

Introduction to Management Accounting Solutions Manual

March April May

5,520 5,700 5,160

$ 15 $ 15 $ 15

$ 82,800 $ 85,500 $ 77,400

Quarter

$75,600

$171,640

$247,240

Quarter

$16,800

570

17,370

534

16,836

Quarter

16,836

2

33,672

2,568

36,240

2,160

34,080

$ 1.50

$51,120

Chapter 9: The Master Budget and Responsibility Accounting 5

Introduction to Management Accounting Solutions Manual

Quarter

$43,000

$16,499

$17,478

$3,429

$80,405

Quarter

$6,566

Chapter 9: The Master Budget and Responsibility Accounting 6

Introduction to Management Accounting Solutions Manual

Quarter

$19,500

$8,700

$23,570

$51,770

Quarter

$ 20,160

$ 4,200

$ 24,360

Quarter

$4,460

247,240

251,700

80,405

6,566

51,770

24,360

10,800

33,200

207,102

44,598

2,000

-42,000

-150

-40,150

$4,448

Chapter 9: The Master Budget and Responsibility Accounting 7

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Lec 09 Highway Engineering - Earthworks & Mass Haul DiagramDocument20 pagesLec 09 Highway Engineering - Earthworks & Mass Haul DiagramDr Firas Asad92% (26)

- SaaS Sales Force Economics: Excel ModelDocument86 pagesSaaS Sales Force Economics: Excel ModelCazoomi100% (3)

- Engineering and Commercial Functions in BusinessFrom EverandEngineering and Commercial Functions in BusinessRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Flash Memory Case SolutionDocument10 pagesFlash Memory Case SolutionsahilkuNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Instant Download Facial Volumization An Anatomic Approach 1st Edition PDF FREEDocument32 pagesInstant Download Facial Volumization An Anatomic Approach 1st Edition PDF FREEchristina.walton573100% (48)

- Final Reflection Paper of Laughter YogaDocument4 pagesFinal Reflection Paper of Laughter Yogaapi-248335637No ratings yet

- Cameron Fisher Excel Budget ProjectDocument2 pagesCameron Fisher Excel Budget Projectapi-340519862No ratings yet

- Excel Budget ProjectDocument6 pagesExcel Budget Projectapi-314303195No ratings yet

- Excel Budget ProblemDocument5 pagesExcel Budget Problemapi-313254091No ratings yet

- Ivan Madrigals Comprehensive Master Budget Project Version ADocument5 pagesIvan Madrigals Comprehensive Master Budget Project Version Aapi-315768301No ratings yet

- Masterbudget Acct2020Document4 pagesMasterbudget Acct2020api-249190933No ratings yet

- Comprehensive BudgetDocument5 pagesComprehensive Budgetapi-317125310No ratings yet

- Budget Assignment Norma GDocument5 pagesBudget Assignment Norma Gapi-242614310No ratings yet

- Master Budget ProjectDocument7 pagesMaster Budget Projectapi-404361400No ratings yet

- Acct 2020 Excel Budget Problem Student Template 1Document5 pagesAcct 2020 Excel Budget Problem Student Template 1api-316764247No ratings yet

- Excel Budget ProjectDocument7 pagesExcel Budget Projectapi-341205347No ratings yet

- Acct 2020 Excel Master BudgetDocument6 pagesAcct 2020 Excel Master Budgetapi-302665852No ratings yet

- Managerial Accounting Final ProjectDocument5 pagesManagerial Accounting Final Projectapi-382641983No ratings yet

- Numbers Sheet Name Numbers Table NameDocument8 pagesNumbers Sheet Name Numbers Table NameAhmed MahmoudNo ratings yet

- Acct 2020 Excel Budget ProblemDocument6 pagesAcct 2020 Excel Budget Problemapi-307661249No ratings yet

- Problems: Set A: SolutionDocument8 pagesProblems: Set A: Solutionapi-395519937No ratings yet

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-356769323No ratings yet

- Excel Budget Problem TemplateDocument2 pagesExcel Budget Problem Templateapi-324651338No ratings yet

- Chapt.6 Budgeting For Profit Planning-DikonversiDocument9 pagesChapt.6 Budgeting For Profit Planning-DikonversiRahma NiaNo ratings yet

- Tanner McqueenDocument4 pagesTanner Mcqueenapi-242859321No ratings yet

- Ponderosa-IncDocument6 pagesPonderosa-IncpompomNo ratings yet

- Sales Budget in Units and in PesosDocument4 pagesSales Budget in Units and in PesosJeson MalinaoNo ratings yet

- Acct 2020 EportfolioDocument5 pagesAcct 2020 Eportfolioapi-311375616No ratings yet

- Presidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument28 pagesPresidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualMarc Jim Gregorio100% (1)

- CH 8 ExerciseshDocument14 pagesCH 8 Exercisesh김가온No ratings yet

- Jacobh Excel3Document8 pagesJacobh Excel3api-664413574No ratings yet

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- Final TemplateDocument14 pagesFinal TemplateAyesha BatoolNo ratings yet

- BigbudhunterkaarlsenDocument25 pagesBigbudhunterkaarlsenapi-356428418No ratings yet

- Chapter 9 HomeworkDocument2 pagesChapter 9 Homeworkapi-311464761No ratings yet

- Public Accountancy PracticeDocument69 pagesPublic Accountancy Practicelov3m3100% (2)

- RevisionDocument16 pagesRevisionKaycee C. San DiegoNo ratings yet

- PIA - Contabilidad AdministraivaDocument24 pagesPIA - Contabilidad AdministraivaleslieNo ratings yet

- PIA Contabilidad AdministraivaDocument20 pagesPIA Contabilidad AdministraivaleslieNo ratings yet

- Budget InformationDocument10 pagesBudget InformationIsabella BattiataNo ratings yet

- VIII. Financial Plan: 1. 12-Month Profit and Loss ProjectionDocument4 pagesVIII. Financial Plan: 1. 12-Month Profit and Loss ProjectionAJ CalunsagNo ratings yet

- Year 1Document17 pagesYear 1lov3m3No ratings yet

- (A) Jorge Company CVP Income Statement (Estimated) For The Year Ending December 31, 2014Document4 pages(A) Jorge Company CVP Income Statement (Estimated) For The Year Ending December 31, 2014Kim QuyênNo ratings yet

- Rubino Anna Bu20145 Budget Project s3-23Document10 pagesRubino Anna Bu20145 Budget Project s3-23api-701459983No ratings yet

- SCM 10 Activity1Document2 pagesSCM 10 Activity1Katelyn SungcangNo ratings yet

- IV. Financial Study A. Project CostDocument13 pagesIV. Financial Study A. Project CostKeil Joshua VerdaderoNo ratings yet

- Accounting 202 Chapter 9 NotesDocument15 pagesAccounting 202 Chapter 9 NotesnitinNo ratings yet

- BT Ke Toan Quan TriDocument39 pagesBT Ke Toan Quan TriTram NguyenNo ratings yet

- Apple Q3 FY19 Consolidated Financial StatementsDocument3 pagesApple Q3 FY19 Consolidated Financial StatementsJack PurcherNo ratings yet

- Projections TemplateDocument4 pagesProjections TemplateAlfonso Coke ResellerNo ratings yet

- Ch4 Spreadsheets Update 2 13Document19 pagesCh4 Spreadsheets Update 2 13Toàn ĐìnhNo ratings yet

- Master Budget Assignment Solution VADocument17 pagesMaster Budget Assignment Solution VANour SawaftaNo ratings yet

- Acct 1120 ReflectionDocument1 pageAcct 1120 Reflectionapi-248335637No ratings yet

- ReferencesDocument1 pageReferencesapi-248335637No ratings yet

- Resume 2014 2Document1 pageResume 2014 2api-248335637No ratings yet

- Resume 2014 2Document2 pagesResume 2014 2api-248335637No ratings yet

- Meditation Reserch PaptersDocument4 pagesMeditation Reserch Paptersapi-248335637No ratings yet

- Unit-V Mobile TicketingDocument25 pagesUnit-V Mobile TicketingDevi Varra Prasad TirunagariNo ratings yet

- Steps Involved in Questionnaire DesignDocument2 pagesSteps Involved in Questionnaire DesignHami KhaNNo ratings yet

- Idahosa Trails - Sides For Thomas - FinalDocument18 pagesIdahosa Trails - Sides For Thomas - Finalapi-21119159No ratings yet

- Exploratory Data Analysis On Indian Economy Using PythonDocument12 pagesExploratory Data Analysis On Indian Economy Using PythonIJRASETPublicationsNo ratings yet

- Water 14 041091Document15 pagesWater 14 041091Abdelhak BelbaliNo ratings yet

- 8 Foundation: 8.1 Bearing CapacityDocument3 pages8 Foundation: 8.1 Bearing CapacityPiseth HengNo ratings yet

- SEC Presentation (Kelvin) - Singapore Green Labelling Scheme (SGLS)Document53 pagesSEC Presentation (Kelvin) - Singapore Green Labelling Scheme (SGLS)Zachary Yassir GonzalezNo ratings yet

- Praktica BC 1Document24 pagesPraktica BC 1Valentin TudorNo ratings yet

- Simulink StatechartDocument1,408 pagesSimulink StatechartKimberly TaylorNo ratings yet

- Report 1668349748488Document86 pagesReport 1668349748488Victor TabuncicNo ratings yet

- f1rc RCParts KyoshoDocument4 pagesf1rc RCParts KyoshoaascmdthlbaimpgtbiNo ratings yet

- Xylometazoline: A Tropical Nasal Decongestant and An Extensive Cause of Rhinitis Medicamentosa (RM)Document5 pagesXylometazoline: A Tropical Nasal Decongestant and An Extensive Cause of Rhinitis Medicamentosa (RM)Suci Triana PutriNo ratings yet

- NRC Beef RequqDocument3 pagesNRC Beef RequqAldinho SalesNo ratings yet

- Puffery or DeceptiveDocument6 pagesPuffery or DeceptiveMcristinaNo ratings yet

- Guide To Storage HandlingDocument26 pagesGuide To Storage Handlingvona pawaka ningrumNo ratings yet

- Document 243Document4 pagesDocument 243Abhishank BhardwajNo ratings yet

- Spe 98108 PaDocument12 pagesSpe 98108 PaKacha SmitNo ratings yet

- Procedures To Implement During Tsunami ImpactDocument6 pagesProcedures To Implement During Tsunami Impactsabellano.md100% (1)

- 8051 Microcontroller Part 1Document21 pages8051 Microcontroller Part 1Sardar IrfanullahNo ratings yet

- Resume - Rachel FosterDocument3 pagesResume - Rachel Fosterapi-331867409No ratings yet

- The Suitable Racking System For Any Demand: ProductsDocument18 pagesThe Suitable Racking System For Any Demand: ProductsSheel JhaNo ratings yet

- CPAR Q1 W2 VariousArtsFormsV2Document41 pagesCPAR Q1 W2 VariousArtsFormsV2bert jacob tropicalesNo ratings yet

- About Walmart Vriddhi ProgrammeDocument1 pageAbout Walmart Vriddhi ProgrammeAkash SelokarNo ratings yet

- Capillary TubeDocument8 pagesCapillary Tubeziko23100% (2)

- Research Article: Old Sagay, Sagay City, Negros Old Sagay, Sagay City, Negros Occidental, PhilippinesDocument31 pagesResearch Article: Old Sagay, Sagay City, Negros Old Sagay, Sagay City, Negros Occidental, PhilippinesLuhenNo ratings yet

- XXXXDocument2 pagesXXXXzl251625No ratings yet

- Entone Kamai 410 Specification SheetDocument2 pagesEntone Kamai 410 Specification SheetUglyNo ratings yet

- Guía de Inglés Grado Sexto-Periodo 2 - Indicador 1.Document2 pagesGuía de Inglés Grado Sexto-Periodo 2 - Indicador 1.Harold ÁlvarezNo ratings yet