Professional Documents

Culture Documents

Big Bazaar Challenges Ahead

Uploaded by

Gopi KrishnaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Big Bazaar Challenges Ahead

Uploaded by

Gopi KrishnaCopyright:

Available Formats

Big Bazaar Challenges Ahead

Big Bazaar: Challenges Ahead

Members

Ambica Prasad Patnaik PGP/14/192

Gopi Krishna PGP/14/196

Naveen Kiran PGP/14/220

Pawan Jagnik PGP/14/224

Rajkumar Deegwal PGP/14/233

Satya Sekhar Babu.K PGP/14/240

Marketing Project, Section –D, Group-1 Page 1

Big Bazaar Challenges Ahead

Contents

Contents................................................................................................................ 2

Executive Summary...............................................................................................3

India as an attractive proposition for retail............................................................4

Pantaloon Retail (India) Limited (PRIL)...................................................................6

Future Value Retail Limited (FVRL)........................................................................6

Situational Analysis................................................................................................7

4 C’s Analysis......................................................................................................7

Market Opportunities...........................................................................................14

SWOT Analysis..................................................................................................14

Market Objective..................................................................................................19

Retail Market Growth in the World....................................................................19

Indian Retail Bazaar..........................................................................................20

Window Opportunity for India in Retail Market.................................................21

Sales Projections...............................................................................................22

Place................................................................................................................. 23

Promotion......................................................................................................... 27

Price.................................................................................................................. 28

Product............................................................................................................. 29

References........................................................................................................... 30

Marketing Project, Section –D, Group-1 Page 2

Big Bazaar Challenges Ahead

Executive Summary

The term “Retailing” refers to any activity that involves a sale to an

individual customer. Retailing is the interface between the producer and

the individual consumer buying for personal consumption.

The origins of retailing in India can be traced back to the emergence

of Kirana stores and mom-and-pop stores. These stores used to cater to

the local people. Eventually the government supported the rural retail and

many indigenous franchise stores came up with the help of Khadi &

Village Industries Commission. The economy began to open up in the

1980s resulting in the change of retailing. The first few companies to

come up with retail chains were in textile sector, for example, Bombay

Dyeing, S Kumar's, Raymonds, etc.With the passage of time new entrants

moved on from manufacturing to pure retailing. Retail outlets such as

Foodworld and Big Bazaar in FMCG,Planet M and Musicworld in Music,

Crossword in books entered the market before 1995.

The retail industry is one of the biggest money spinners in the world,

notching up US$ 6.60 trillion in turnover (Source: Euromonitor Study).

Marketing Project, Section –D, Group-1 Page 3

Big Bazaar Challenges Ahead

India as an attractive proposition for retail

In India the sector is set to become a US $450 billion market by 2015 and

is set to expand to 14-18% by 2015.Despite its massive size, the business

is almost entirely controlled by the unorganised sector. While organised

retail makes up 70% to 80% of all retail business in developed countries,

in India it is pegged at a lowly 2% (Source: Crisis Report on India’s Retail

Industry).India has been rated as the most attractive retail destination in

the world by AT Kearney for the third year in a row; the company’s annual

Global Retail Development Index (GRDI) ranks 30 emerging countries,

selected from a universe of 185 countries, on a 100 point scale (based on

country risk, population size, and wealth) to find out the relative

attractiveness of these markets.

Marketing Project, Section –D, Group-1 Page 4

Big Bazaar Challenges Ahead

India is poised to become one of the hottest destinations in the world

because of following favorable economic growth

Big Bazaar

Big Bazaar is a chain of department stores in India, currently with 149

outlets, has presence in metros as well as small cities. It is owned by the

Pantaloon Retail India Ltd, Future Group. It works on the same economy

model as Wal-Mart and has considerable success in many Indian cities and

small towns. The idea was pioneered by entrepreneur Kishore Biyani, the

CEO of Future Group. The first Big Bazaar store, with an area of about

24,000 square feet, opened on VIP Road, Kolkata in August 2001.Currently

Big Bazaar stores are located only in India. This large format store

comprise of almost everything required by people from different income

groups. It varies from clothing and accessories for all genders like men,

women and children, playthings, stationary and toys, footwear, plastics,

Marketing Project, Section –D, Group-1 Page 5

Big Bazaar Challenges Ahead

home utility products, cosmetics, crockery, home textiles, luggage gift

items, other novelties, and also food products and grocery. The added

advantage for the customers shopping in Big Bazaar is that there are all

time discounts and promotional offers going on in the Big Bazaar on its

saleable products. Shopping in the Big Bazaar is a great experience as

one can find almost everything under the same roof. It has different

features which caters all the needs of the shoppers. Some of the

significant features of Big Bazaar are:

• Food Bazaar which is a grocery store

• There is a games zone specially meant for the amusement of the

kids

• Furniture Bazaar which deals with furniture

• Electronics Bazaar which holds electronic goods such as TVs,

computers, wash machines, etc.

• FutureBazaar.com which is an online shopping portal wherein one

can shop any product of the Big Bazaar stable

Pantaloon Retail (India) Limited (PRIL)

Pantaloon Retail (India) Limited is a leading retailer with a turnover of Rs.

9786.94 crore for the financial year 2009-10. Headquartered in Mumbai,

the company operates through primarily the Lifestyle and Value formats

through multiple delivery mechanisms and lines of business — some of

them being, fashion, food, general merchandise, home, leisure and

entertainment, financial services, communications and wellness.

The company has about 591 stores in over 90 cities across the country,

constituting 13.9 million square feet of retail space. The company caters

to the Lifestyle ‘segment through its 48 Pantaloons Stores and 4 Central

Malls, as well as its other concepts. In Value‘ retailing it is present through

51 Big Bazaar hypermarkets, 53 Food Bazaars and 5 Fashion Stations, and

other delivery formats.

Future Value Retail Limited (FVRL)

Future Value Retail Limited founded in 2007 is a wholly owned

subsidiary of Pantaloon Retail (India) Limited. This entity has been

created keeping in mind the growth and the current size of the company’s

value retail business, led by its format divisions, Big Bazaar and Food

Marketing Project, Section –D, Group-1 Page 6

Big Bazaar Challenges Ahead

Bazaar.Big Bazaar and Food Bazaar constitutes about 62% of PRIL sales

and about 90% of FVRL sales The company operates 120 Big Bazaar

stores, 170 Food Bazaar stores, among other formats, in over 70 cities

across the country, covering an operational retail space of over 6 million

square feet.

Situational Analysis

4 C’s Analysis

Customers

The customer base of Big Bazaar consists of mainly the upper class and

the middle class. India’s National Council for Applied Economic Research

estimated that the nation’s middle class population consists of around 17

million households – 90 million people – with annual earnings ranging

between $4,500 and $22,000. An additional 287 million could be termed

as ‘aspirers’ or those who might come into the middle class segment in

the near future. Rising incomes are impacting retail growth in India as

these groups tend to spend more on upgrading and diversifying their

lifestyles.

Competitors

Reliance Retail

Marketing Project, Section –D, Group-1 Page 7

Big Bazaar Challenges Ahead

Reliance Retail Limited (RRL), a subsidiary of RIL, was set up to lead

Reliance Group’s foray into organized retail. Since its inception in 2006,

Reliance Retail Limited (RRL) has grown into an organization that caters to

millions of customers, thousands of farmers and vendors. Based on its

core growth strategy of backward integration, RRL has made rapid

progress towards building an entire value chain starting from the farmers

to the end consumers.

In the last year, Reliance Retail Limited (RRL) continued to fulfill its

commitment of enriching Indian consumer’s shopping experience and

providing quality merchandise at an attractive value proposition. More

than 3 years into operation, RRL has now expanded its presence in more

than 85 cities across 14 states in India. RRL forged ahead with its

expansion plans and rolled out stores across the country. RRL’s footprint

now spans a network of more than 1,000 stores.

RRL operates several ‘value’ & ‘specialty’ formats. The ‘value’ formats

that RRL operates are: ‘Reliance Fresh’, a neighborhood concept,

‘Reliance Mart’, an all under one roof supermarket concept & ‘Reliance

Super’, a mini-mart concept. The ‘value’ formats offer a wide range and

assortment of products required for daily household needs. The ‘specialty’

formats are: ‘Reliance Digital’, a consumer durables & information

technology concept, ‘Reliance Trends’, an apparel & accessories concept,

‘Reliance Wellness’, a health, wellness & beauty concept, ‘iStore by

Reliance Digital’, an exclusive Apple products concept, ‘Reliance

Footprint’, a footwear concept, ‘Reliance Jewels’, a jewellery concept,

‘Reliance TimeOut’, a books, music & entertainment concept, ‘Reliance

AutoZone’, an automotive products & services concept and ‘Reliance

Living’, a home ware, furniture, modular kitchens, furnishings concept.

Aditya Birla Retail Ltd. (ABRL)

A US$ 29 billion corporation, the Aditya Birla Group is in the League of

Fortune 500. It is anchored by an extraordinary force of 130,000

employees, belonging to 40 different nationalities. In the year 2009, the

Group was ranked among the top six great places for leaders in the Asia-

Pacific region, in a study conducted by Hewitt Associates, RBL Group and

Fortune magazine. In India, the Group has been adjudged the best

employer in India and among the top 20 in Asia by the Hewitt-Economic

Times and Wall Street Journal Study 2007.

Over 60 per cent of the Group's revenues flow from its overseas

operations. The Group operates in 26 countries – India, UK, Germany,

Hungary, Brazil, Italy, France, Luxembourg, Switzerland, Australia, USA,

Marketing Project, Section –D, Group-1 Page 8

Big Bazaar Challenges Ahead

Canada, Egypt, China, Thailand, Laos, Indonesia, Philippines, UAE,

Singapore, Myanmar, Bangladesh, Vietnam, Malaysia, Bahrain and Korea.

ABRL is among the top three supermarket chains in the retail business of

India. Till end-September 2009, ABRL had set up 640 supermarkets and

five hypermarkets. All the supermarkets are branded ‘More’ and the

hypermarkets are branded ‘More Megastore’. The company has around

11,000 employees and has a pan-India presence. ‘More’ supermarkets are

neighborhood stores with the core proposition of offering value,

convenience and trust to the customers and averaging 2,500 sq ft area.

The hypermarkets are self-service superstores offering value and range in

food and non-food products and services at a single location.

Spencer's Retail Limited

Spencer's Retail Limited is one of India's largest and fastest growing multi-

format retailers with 250 stores, including 36 large format stores across

66 cities in India. Spencer's focuses on verticals like food and grocery,

fruit and vegetables, electrical and electronics, home and office

essentials, garments and fashion accessories, toys, food and personal

care, music and books. Established in 1996, Spencer's has become a

popular destination for shoppers in India with hypermarkets and

convenient stores catering to various shopping needs of its large

consumer base.

The Spencer's Hyper-stores are destination stores, of more than 15,000

sq. ft in size. They offer everything under one roof. The merchandise

ranges from fruits & vegetables, processed foods (Ready to Eat, Ready to

Cook and FMCG products), specialty foods including international, sugar

free, organic foods, etc...groceries, meat, chicken, fish, bakery, chilled and

frozen foods, garments, consumer electronics & electrical products, home

care, home décor & home needs, office stationeries, soft toys. Besides,

the stores also comprise book & music retailing, electronic gadgets and IT

accessories. On an average, a Spencer's hyper stocks 70,000 SKUs across

35,000 items.

The Spencer's stores are neighbourhood stores ranging from 1500 less

than 15000 sqft. These stores stock the necessary range and assortment

in fruit and vegetables, FMCG food and non-food, staples and frozen foods

and cater to the daily and weekly top-up shopping needs of the consumer.

Marketing Project, Section –D, Group-1 Page 9

Big Bazaar Challenges Ahead

Some of these stores which have floor area of more than 10,000 sq ft

sometimes offer home care products; personal care products, bakery,

chilled and frozen food; baby care, basics in garments and limited range

of electronics and electrical.

Shoppers Stop

Shoppers Stop is one of the leading retail stores in India. Shoppers Stop

began by operating a chain of department stores under the name

“Shoppers’ Stop” in India. Currently Shoppers Stop has 33 stores across

the country and three stores under the name ‘HomeStop’. Shoppers Stop

has also begun operating a number of specialty stores, namely Crossword

Bookstores, Mothercare, Brio, Desi Café, Arcelia.

Shoppers Stop retails a range of branded apparel and private label under

the following categories of apparel, footwear, fashion jewellery, leather

products, accessories and home products. These are complemented by

cafe, food, entertainment, personal care and various beauty related

services. Shoppers Stop launched its e-store with delivery across major

cities in India in 2008. The website retails all the products available at

Shoppers Stop stores, including apparel, cosmetics and accessories.

E-tailing

E-retailing, most commonly known as e-tailing is nothing but shopping

through the Internet and other media forms. The Ecommerce market is

expected to touch 9210 Crore INR in 2007-08, E Tailing or E RE-tailing

market is only about 1150 Crore INR according to a survey conducted by

Internet and Mobile Association of India and Indian Market Research

Bureau (IMRB).

E Bay is heading the race of online retailers. In this race it has become

very difficult to determine the online retail store that makes the products

available at convenient and cheap rates. From this very difficulty has

cropped up comparison sites. Comparison is done on the basis of an index

which is constructed from the data available from different shopping sites.

The bechna.com and the ultop.com are such sites though many more

sites are entering this zone.

There are divergent views on the future of e-retailing in India. Some

experts are of the opinion that the giant, big brand retailers would

dominate the small ones due to their wider investment capacities. It would

be next to impossible for the small retailers and the kiranas to prove their

existence in the battlefield of online retailing. Another viewpoint is that

there would be an exponential growth in the online retailing business in

India.

Marketing Project, Section –D, Group-1 Page 10

Big Bazaar Challenges Ahead

Bharti Walmart Private Limited

Bharti Walmart Private Limited is a joint venture between Bharti

Enterprises, one of India's leading business groups with interests in

telecom, agri-business, insurance and retail, and Walmart, the world’s

leading retailer, renowned for its efficiency and expertise in logistics,

supply chain management and sourcing. The joint venture is establishing

wholesale cash-and-carry and back-end supply chain management

operations in line with Government of India guidelines. Under the

agreement, Bharti and Walmart hold a 50-50 stake in Bharti Walmart

Private Limited. The first wholesale cash-and-carry facility named “Best

Price Modern Wholesale” opened in Amritsar in May 2009.

Best Price Modern Wholesale store is a one-stop shop that meets the day-

to-day needs of restaurant owners, hoteliers, caterers, fruit and vegetable

resellers, kiranas, other retail store owners, offices and institutions. The

store offers an assortment of approximately 6,000 items, including food

and non-food items, which are available at competitive wholesale prices,

allowing retailers and business owners to lower their cost of operations.

More than 90 percent of these goods and services are being sourced

locally; thereby helping keep costs to a minimum, adding to the growth of

the local economy and creating job opportunities, with the cash and carry

store directly employing more than 200 local people. A typical wholesale

cash-and carry facility will stand between 50,000 and 100,000 square feet

and sell a wide range of fruits and vegetables, groceries and staples,

stationery, footwear, clothing, consumer durables, and other general

merchandise items.

Company

Big Bazaar is India’s first hypermarket chain launched in 2001. Big Bazaar

is not just another hypermarket. It caters to every need of your family.

Where Big Bazaar scores over other stores is its value for money

proposition for the Indian customers.

At Big Bazaar, the best products at the best prices are guaranteed. With

the ever increasing array of private labels, it has opened the doors into

the world of fashion and general merchandise including home furnishings,

utensils, crockery, cutlery, sports goods and much more at prices that will

surprise you.

Marketing Project, Section –D, Group-1 Page 11

Big Bazaar Challenges Ahead

Big Bazaar has tied up with ICICI bank to produce the ‘Retail Credit Card’

to provide a plethora of offers to the customers each time they visit the

supermarket.

Context

The retail scenario is one of the fastest growing industries in India over

the last couple of years. India retail sector comprises of organized retail

and unorganized retail sector. Traditionally the retail market in India was

largely unorganized; however with changing consumer preferences,

organized retail is gradually becoming popular. Unorganized retailing

consists of small and medium grocery store, medicine stores, subzi mandi,

kirana stores, paan shops etc. More than 90% of retailing in India fall into

the unorganized sector, the organized sector is largely concentrated in big

cities. Organized retail in India is expected to grow 25-30 per cent yearly

and is expected to increase from INR 35,000 crore in 2004-05 to INR

109,000 crore ($24 billion) by 2010.

According to the 8th Annual Global Retail Development Index (GRDI) of AT

Kearney, India retail industry is the most promising emerging market for

investment. In 2007, the retail trade in India had a share of 8-10% in the

GDP (Gross Domestic Product) of the country. In 2009, it rose to 12%. It is

also expected to reach 22% by 2010.

According to a report, the India retail industry is expected to grow to US$

700 billion by 2010. By the same time, the organized sector will be 20% of

the total market share. It can be mentioned here that, the share of

organized sector in 2007 was 7.5% of the total retail market.

PEST Analysis for Organized Retail

Political factors

Barring the long overdue decision on FDI in 'single-brand retail', the

official economic policies have favored the retail sector. In January 2006,

the Union Cabinet approved a major rationalization of the policy on FDI in

retail to further simplify procedures for investing in India and to avoid

multiple layers of approvals required in some activities.

Till now, Government approval was required for FDI in wholesale cash-

and-carry trading and FDI beyond 51% in export trading. To facilitate

easier FDI inflow, instead of having to seek FIPB approval, FDI up to 100%

Marketing Project, Section –D, Group-1 Page 12

Big Bazaar Challenges Ahead

will now be allowed under the automatic route for cash and carry

wholesale trading and export trading.

The Cabinet has also allowed FDI up to 51% with prior Government

approval for retail trade in 'single brand' products with the objective of

attracting investment, technology and global best practices and catering

to the demand for such branded goods in India. Still, are restrictions on

FDI in retail continue, but the common channels for entry of foreign

retailers are through strategic licensing and franchising arrangements,

besides cash-and-carry wholesale trading.

Economic factors

The year 2009 saw a significant slowdown of GDP’s growth rate to 6.8%.

The GDP is expected to grow at 8.5% during the fiscal 2010-2011 as

stated recently by the Finance Minister. The non-banking finance

companies provide much needed funds for the overall growth of retail

sector. Their focus on the growing retail market and their experience in

managing the retail portfolio has helped in their performance. The

financing for the non-corporate sectors like trade is mainly from private

money markets which offer higher interest rates.

India has one of the youngest populations in the world with 54% of the

population below the age of 25 and strong growth is expected to continue

in this age bracket. Discretionary spending has seen a 16% rise for the

urban upper and middle classes and the number of high-income

households has grown by 20% year on year since 1995-96.

Social factors

The urban customers are undergoing drastic changes in their lifestyles.

This generation is starting to make exceptional amount of money at a

relatively younger age due to the overall growth of the IT sector in India.

The organized sector is expected to grow at a good pace along with the

GDP due to the changing lifestyles and burgeoning incomes.

Technological factors

It is estimated that over $2.5 billion will be spent on IT in the Indian retail

sector by 2010. Over 40% of this will be spent on software and services.

The supply chain managements systems have been improving at a fast

pace. The RFID (Radio frequency identification) and the Bar code

technology are being extensively used to fasten up the sales process at

the outlets. This has improved the operational efficiency through better

management of supply chain, inventory and store.

Marketing Project, Section –D, Group-1 Page 13

Big Bazaar Challenges Ahead

Market Opportunities

SWOT Analysis

Strengths

Big Bazaar’s success and continuous growth in the Indian organized retail

market can be attributed to a number of factors, some of which mimic the

strategies of large retailers in the west and others that have been

completely tailored to the Indian market.

1) Versatile Retailing

Big Bazaar’s policy of comprehensive experimentation has given it an

important advantage. Intentionally or unintentionally, Big Bazaar has

developed a versatile retail presence. Indian consumers see Big Bazaar as

an exclusive brand retailer, discount retailer, specialty retailer and food

retailer all at once. The company has managed to avoid retail stereotypes

and the insular strategies that result from catering to them. So while Wal-

Mart is seen as a discount store, Safeway is considered a food retailer and

Ikea is known as a furniture seller, Big Bazaar is all of these at once. While

this has proven to be a successful bet for the company, it is not entirely a

blind one. In a country where unorganized retailers, who have no co-

ordination between themselves, control 98% of the market, versatile

retailing might be the best way to go. Big Bazaar is essentially an

organized retailer in the disguise of a large number and variety of

unorganized retailers. This again represents the company’s unique

understanding of the Indian scenario.

2) Ground-up Development

Big Bazaar’s major advantage over current and new competitors in the

retail sector has been its unique understanding of the Indian organized

retail market with all its shortcomings and challenges. By creating a retail

business from the ground-up and expanding rapidly, Big Bazaar has

followed a Wal-Mart-sequel pattern of growth. It decided to experiment

with as many retail formats, 9 product-mixes and brands as was possible

in order to gain maximum knowledge about the uncertain Indian

organized retail sector and get a leg-up on any possible competition. In

fact, current entrants in the organized retail market not only have to learn

the opes of the unique Indian organized retail sector, but also have to find

a way to combat Big Bazaar’s dominant market share in almost all forms

of organized retail-an uphill task for any competitor, regardless of size.

3) Multiple Brands

Big Bazaar adopted itself to the Indian market rather than attempting to

copy a Macy’s or a Wal-Mart and follow a cookie-cutter model. It

Marketing Project, Section –D, Group-1 Page 14

Big Bazaar Challenges Ahead

experimented with a variety of products. From men’s wear the company

has moved on to experiment with retailing furniture, sportswear, kitchen

appliances, food, electronics and children’s apparel. Big Bazaar has also

gone a step further by experimenting with brands as well. It has

introduced a number of its own brands, a successful strategy that has

worked in stores like Target and Wal-Mart.

For example, it has experimented with launching clothing lines based on

famous Indian Bollywood movies. It has also introduced several clothing

lines of its own. Within the brand retailing space, Big Bazaar has also tied

up with some of India’s most popular brands like Gini, Puma, Adidas, etc

to sell them in their stores. Rather than attempt to compete with existing

popular brands the company has decided to partner with major Indian

brands and leverage the success of these brands in the ambiguous Indian

market. For whatever reason these brands have achieved success and a

loyal following; Big Bazaar’s move is sure to bring in more customers and

retain them. With the pace at which Big Bazaar is moving, it is likely by

the time new entrants figure out their strategy, Big Bazaar would have

made the several sectors of organized retail in India out of anybody’s

reach.

4) Winning Team

While Big Bazaar has achieved much of its success on the back of its

experimentation policy, it has also made some great recruiting decisions

that have put the right people in charge of the right departments (See

Exhibit 17 for Pantaloon’s Management Team and their diverse

experience). The company understood the absence of any real knowledge

or experience-base in the organized retail market. Instead of head-hunting

people with pure retail experience, the company has poached a number of

highly experienced managers and executives from a number of diverse

and successful Indian companies. Their knowledge about the Indian

business environment and supply-chain dynamics as well as experience of

launching products in the country and adapting strategies to the 10

unique tastes of the Indian consumer have been key to Big Bazaar’s

success. The company understood the core competencies required to

dominate in the untapped organized retail sector and made hiring

decisions accordingly.

Weaknesses

1) Inventory Management

One of the key weaknesses of Big Bazaar is Weak Inventory Management.

As inventories are the least liquid form of the asset, a high inventory

Marketing Project, Section –D, Group-1 Page 15

Big Bazaar Challenges Ahead

turnover ratio is generally positive. In contrast, Big Bazaar’s inventory

turnover ratio declined from 4.2 times in FY2004 to 3.5 times in FY 2008.

Further, the inventory turnover days of the company increased from 86

days in FY2004 to 102 days in FY2008. Declining inventory turnover ratio

and increasing inventory turnover days indicates a slackening demand

and slower movement of goods on sale. Weak inventory management

increases the cost of holding inventory and negatively affects its margins.

Seeing the middle class of India growing at such a large pace, Big Bazaar

is not able to meet the targets of the number of opening of the outlets.

Lack of infrastructure facilities has been one of the main reasons for this

shortfall.

2) Political Factor

Political factor is also hindering its growth. The local person has much

better contacts with local representatives of the region and these local

vendors are the main competitors of these organized retail outlets. There

is a poor general perception among the people about the low value of

products sold in Big Bazaar. Many people consider the quality of Big

Bazaar products to be inferior. Big Bazaars are not able to generate the

revenues at the same rate as the expansion in the number of outlets.

Thus, a fall in the revenues per square feet has been observed.

Opportunities

1) Middle Class

The country’s staggering economic growth of around 8% over the last 2

years has resulted in major shifts in the Indian class structure with higher

incomes leading to the growth of the Indian middleclass. Like other

countries, the middle class in India has also become aware of the

standards of living. Unlike their forefathers they have decided to adopt a

“Spending” approach to improve their standard of living rather than a

“Saving” approach. With an estimated 400 million shoppers and growing,

organized Indian retail’s target population is larger than that of the entire

United States. India is expected to witness 7-8% growth in its retail sector

over the next few years.

2) Retail space to increase from 66 mn sq ft to over 300 mn sq ft

by 2011E

We expect the 315 mn sq ft of retail space to come up by FY11E, taking

modern retail to USD 70 bn. In the next 4-5 years, the country will have

over 1,000 hypermarkets and 3,000 supermarkets. Real estate players

Marketing Project, Section –D, Group-1 Page 16

Big Bazaar Challenges Ahead

have already announced big plans for development of close to 300-600

malls and shopping complexes all over the country.

An estimated investment of USD 25-30 bn (industry estimates) is

expected to be made in development of retail space by the large real

estate players to bridge this shortfall of space. In addition to the real

estate players, some retailers have also entered the land development

space.

3) Supply-Chain and Behind-the-Scenes Operations

For major retailers like Big Bazaar especially, that have established a

name and market presence through multi-format experimentation, the

next step is the improvement of the supply-chain and behind-the-scene

operations. These factors serve as the backbone of a successful organized

retail chain in the long-run. Big Bazaar cleverly ignored these aspects due

to the unique inadequacies of Indian infrastructure and rightly favoured

experimentation over organization. But, to continue to grow at the pace it

has over the last five years it needs to pay attention to its sourcing

network, transportation system and other logistics. By developing these

now, Pantaloon will also be able to gain a leg-up on its competitors.

Marketing Project, Section –D, Group-1 Page 17

Big Bazaar Challenges Ahead

4) Relative share of GDP to turnover of Future group is very low

(0.1%)

Threats

Big Bazaar has the upper hand on the most potential foreign and domestic

competition in the organized retail sector. However the same

characteristics that have made it an exclusive and versatile retailer can

find it a disadvantage.

1) Money: The Ultimate Differentiator

Much of Big Bazaar’s competition consists is either retail ventures of large

Indian industrial houses (Reliance Retail, Birla’s retail venture) or foreign

retail giants (Wal-Mart). In other words, Big Bazaar’s competition is rich,

very rich. While competitors may not have Big Bazaar’s large and diverse

experience and knowledge bank, they still have enough money bank to

Marketing Project, Section –D, Group-1 Page 18

Big Bazaar Challenges Ahead

potentially compensate for that. While the money versus experience

competition is yet to play itself out in the Indian organized retail sector, in

most industries money is a pretty good tool to compete with. Big Bazaar,

which is almost exclusively a retail body despite scattered efforts to

diversify its portfolio, might find it difficult to raise sufficient resources to

compete with the likes of Wal-Mart and Reliance

2) Connections and Relationships

Big Bazaar made the right decision by making supply-chain development

secondary to experimentation to gain dominance in the unknown

organized retail market. Its recent initiative to begin paying attention to

back-end-operations would be successful if it weren’t faced with

formidable competition. Companies like Reliance that do business in a

variety of sectors and locations in India might be better suited to

developing a strong supply-chain and back-end operation system.

Leveraging their diverse relationships across the board of Indian industry,

Reliance might be able to quickly develop a sourcing-network that is both

efficient and cheap. This scenario has the potential of robbing Big Bazaar

of the advantages it has enjoyed from its early presence and better

understanding of the market.

Market Objective

Retail Market Growth in the World

The retail industry is one of the biggest money spinners in the world,

notching up US$ 6.60 trillion (Rs. 2.64 Crore) in turnover (Source:

Euromonitor Study). In India the sector is worth Rs. 720,000 Crore (US$

180 billion) growing at between 11% and 12% annually (Source: CII-

McKinsey Report). Despite its massive size, the business is almost entirely

controlled by the unorganised sector. While organised retail makes up

70% to 80% of all retail business in developed countries, in India it is

pegged at a lowly 2% (Source: Crisil Report on India’s Retail Industry).This

is by far the lowest in the world and even far below comparable countries

in Asia. In China, organised retailing accounts for 20% of all business,

while in Indonesia it is 25%, in Philippines 35%, in Thailand it is pegged at

40% and in Malaysia it is reputed to be 50% (Source: Euromonitor Study).

Marketing Project, Section –D, Group-1 Page 19

Big Bazaar Challenges Ahead

Indian Retail Bazaar

Organized Retail captures only 3% of the retail market. Unorganized retail

is mostly family owned business that leverage unique selling point of

being close to the people’s homes.

Share in Spending- Rural Vs Urban

Rur Urba

al n

Entertainment 33 67

Consumer Services 44 56

Durables 50 50

Miscellaneous Consumer

Goods 57 43

Clothing & Foot wear 61 39

Food 64 36

The above figures show the scope for largely untapped market in the

organized retail industry. Moreover it is backed by the strong economic

growth, where India has witnessed a more than double growth in GDP in

10 years.

P&L For Big Bazaar

2002 2003 2004 2006 2007 2008

285.3 444.8 658.3 1,933. 3,668. 5,840.

Sales 1 3 1 67 56 54

Purchase of Trading 1,382. 2,729. 4,432.

Goods 100.6 175.8 368.4 18 94 42

Sales 18.36 14.54 24.51 106.68 234.68 380.39

Rent, Rates and

Wages 10.32 16.33 28.72 118.9 238.19 425.96

Advertisement 8.77 11.83 18.74 53.02 119.95 214.84

123.2 186.9 158.8

Other Expenses 9 5 9 128.64 113.38 30.39

Profit 23.97 39.38 59.05 144.25 232.42 356.54

India has been rated as the most attractive retail destination in the world

by AT Kearney for the third year in a row; the company’s annual Global

Retail Development Index (GRDI) ranks 30 emerging countries, are shown

below

Marketing Project, Section –D, Group-1 Page 20

Big Bazaar Challenges Ahead

Window Opportunity for India in Retail Market

Marketing Project, Section –D, Group-1 Page 21

Big Bazaar Challenges Ahead

Sales Projections

Assumptions for the Sales Projections of the Big Bazaar Sales:

1. The Pantaloon Retail India Limited (PRIL) has the Compound

Average Growth Rate (CAGR) of 34%

2. Big Bazaar Constitutes to 60-65% of the PRIL Sales, i.e. 62.5% is

taken for the calculation purposes

3. Percentage Shares of Value Retail, Life Style and Home Retail are

the average of the percentages. i.e. assumed to be constant

percentage of the Sales.

o Value Retail is 63, 60, 61, 59 percent of the sales for the years

2007, 2008, 2009, 2010 respectively

The average percent sale=(63+60+61+59)/4=60.75%

o Life Style is 27, 24, 24, 25 percent of the sales for the years

2007, 2008, 2009, 2010 respectively

The average percent sale=25%

o Home is 10, 16,16,15 percent of the sales for the years 2007,

2008, 2009, 2010 respectively

The average percent sale=14.25%

2007 2008 2009 2010 2011 2012

3668. 11960 16027.

Sales 56 5840 6342 8926 .8 5

2292. 3963. 5578. 7475. 10017.

Big Bazaar Share 85 3650 8 75 53 2

2311. 3868. 5266. 7266. 9736.7

Value Retail 19 3504 6 34 21 2

990.5 1401. 1522. 2231. 1816. 2434.1

Life Style 11 6 1 5 55 8

366.8 1014. 1338. 258.8 346.87

Home 56 934.4 7 9 59 1

1. Value Retail is 63, 60, 61, 59 percent of the sales for the years

2007, 2008, 2009, 2010 respectively

2. Life Style is 27, 24, 24, 25 percent of the sales for the years 2007,

2008, 2009, 2010 respectively

3. Home is 10, 16,16,15 percent of the sales for the years 2007, 2008,

2009, 2010 respectively

Bar- Graph for Sales Growth

Marketing Project, Section –D, Group-1 Page 22

Big Bazaar Challenges Ahead

Marketing Plan

In order to withstand the future competitive challenges and maintain the

current market leadership, Big bazaar can use the efficient market mix

consisting of Product, Place, Price & Promotion.

Place

Since the first Big Bazaar was opened in VIP Road, Kolkata in October

2001, within a span of just seven years, Big Bazaar opened its 100th store

– marking one of the fastest ever organic expansions of a hypermarket

format store anywhere in the world. Currently, it has opened its 135th

store.

The location of Big Bazaar is of high importance as it is competing against

convenience stores which are easily accessible. Hence store location

should be in a prime business location. The size of the store can be

compromised for getting an effective location

Marketing Project, Section –D, Group-1 Page 23

Big Bazaar Challenges Ahead

Marketing Project, Section –D, Group-1 Page 24

Big Bazaar Challenges Ahead

Marketing Project, Section –D, Group-1 Page 25

Big Bazaar Challenges Ahead

E-commerce industry has touched 9210 crore, online classifieds: 820

crores, online travel: 7000 crores (30% jump from Rs 7,080 crore in ’07)

as per the survey conducted by the IAMAI and IMRB

• Online Travel Industry: growth rate of 30% to Rs 7,000 crore by end

FY08 (from 5500 crores in ‘07)

• Online Classifieds: reached Rs 820 crore by end FY08

• Online retailing/auction (eTailing): Rs 1,105 crore industries by end

FY08 (from Rs 850 crore in FY07.

• Digital downloads (i.e. downloading from Internet to mobiles using

wap phones or web) and paid content (research/exclusive

videos/articles etc) for the rest of 285 crores.

Source: IAMAI and IMRB Analysis Report

The major triggers of e-commerce in India are:

• Saves time and efforts

• Convenience of shopping at home

• Wide variety / range of products are available

• Good discounts / lower prices

• Get detailed information of the product

• You can compare various models / brands

In order to gain a competitive advantage Big Bazaar has already launched

a website www.futurebazaar.com which has to be revamped further as

it helps customers to orders products online which will be delivered to

their doorstep. This helps in saving a lot of time of its customers.

Marketing Project, Section –D, Group-1 Page 26

Big Bazaar Challenges Ahead

Promotion

The promotion should be consistent with the “positioning” of the Big

Bazaar brand which is: “Isse sasta aur achcha kahi nehi”. Big Bazaar is

going out of its way to make small town consumers feel comfortable with

the beast called modern retail.

Big Bazaar positions itself as a value-for-money hypermarket. With the

launch of “Fashion Bazaar” as its brand extension it should be positioned

as fashionable, trendy and affordable apparel in the middle class fashion-

savvy consumer. The Marketing Communications Mix to be used as

follows:

Public Direct & Events &

Advertisin Sales relationship & Interactive Personal Experien

g promotion publicity marketing selling ce

Sales

contest charitable presenatio

print Ad and games donations catalogs ns Festivals

Motion Premiums community telemarketi

pictures & gifts relations ng

fair and

trade company

posters shows magazine emails

leaflets coupons blogs

display TV

signs rebates shopping

The various promotion schemes to be used:

• “Saal ke sabse saste 3 din”

• Hafte ka sabse sasta din “Wednesday bazaar”

• Exchange Offers “Junk swap offer”

• Future card(3% discount)

• Shakti card

Fashion@Big Bazaar campaign led by cricket icon, MS Dhoni was one of

the largest initiatives taken by the company in recent times. The core

message of 'Des Badla, Bhes Badlo' gained significant traction among its

target audience as is evident in the increasing share of fashion in total

sales. The campaign has helped Big Bazaar transform into the preferred

and accessible fashion destination for the masses.

Marketing Project, Section –D, Group-1 Page 27

Big Bazaar Challenges Ahead

If any bollywood film becomes huge box office hit then big bazaar should

follow the fashion statement signaled by the film. New star has to be

signed in for brand endorsement Big Bazaar has to continue with the

similar catchy lines written on hoardings taking on biggies like Westside,

Shoppers stop and Lifestyle. They are:

· “Keep West- aSide. Make a smart choice!”

· “Shoppers! Stop. Make a smart choice!”

· “Change your Lifestyle. Make a smart choice!”

All the promotional offers should be prominently displayed in the stores.

Advertisements through local channels like print media and FM channels

should be placed for promotion. The Pentagon driven growth will give Big

Bazaar high volumes which are required in its low margin strategy.

Once these strategies start giving favourable result the triangle

parameters can also be strengthened. With higher bargaining powers the

suppliers can be pressurised to lower their margins. Efficient systems can

be used for CRM and other POS data which can be used to formulate

strategies based on consumption patterns.

Price

‘Sabse Sasta, Sabse Acha’ this tag line defines Big Bazaar’ s USP. Big

Bazaar has created a brand image among its customer by providing a

wide range of household products at the lowest possible market price. Big

bazaar has created a high value for same money for the customer by

providing more purchasing power and freedom in their hand.

The prime objective of pricing at Big Bazaar is to get “Maximum Market

Share”. It is based on the following techniques:

Value Pricing (EDLP – Every Day Low Pricing): Big Bazaar promises

consumers the lowest available price without coupon clipping, waiting for

discount promotions or comparison shopping.

Promotional Pricing: Big Bazaar offers financing at low interest rate.

The concept of psychological discounting (Rs. 99, Rs. 49, etc.) is also used

to attract customers. Big Bazaar also caters on Special Event Pricing

(Close to Diwali, Id, New Year, Independence Day, Rakshabandhan and

Durga Pooja).

Marketing Project, Section –D, Group-1 Page 28

Big Bazaar Challenges Ahead

Differentiated Pricing: Differentiated pricing i.e. difference in rate

based on peak and non-peak hours or days of shopping is also a pricing

technique used in Indian retail, which is aggressively used by Big Bazaar.

E.g. Wednesday Bazaar

Bundling: It refers to selling combo-packs and offering discount to

customers. The combo-packs add value to customer and lead to increased

sales. Big Bazaar lays a lot of importance on bundling. E.g. 5 kg oil + 5kg

rice + 5kg sugar for Rs 599

Product

Big Bazaar offers a wide range of products which range from apparels,

food, farm products, furniture, child care, toys, etc of various brands like

Levis, Allen Solly, Pepsi, Coca- Cola, HUL, ITC, P&G, LG, Samsung, Nokia,

HP etc. The assortment of the merchandise should provide ample choice

to the customers. Also the intensity of high margin product should be

high.

Big Bazaar should expand their product line in the following areas – Home

Decor – as CAGR of this segment is as high as 71% more and more

branded products in this sector must be incorporated. There has to be

range in the items which should cater the needs of customers of all ages.

For example keeping study tables, computer tables, sofas,22 curtains, bed

sheets, etc. This will let other brands like Carmichael House, Bombay

Dying, KitchenAid, etc. to tie up with Big Bazaar to increase their sales

and will allow Big Bazaar to make good its reputation in the market as a

store of all the brands.

Food and Grocery – The CAGR in Hypermarket is 42%. Improvement has

to be done to amplify the sales. Various options that can be put into action

are: including local people to sell their food products (after necessary

tests to check its freshness, etc) under Big Bazaar. Also get the food

materials from the unorganized retailers (local shop owners) so as to sell

them in Food Bazaar.

Apparels and Fashion Accessories – There is a huge scope of doubling

the gains in this segment due to its high CAGR of 41%. Apparels sold in

the market must cater to each and every category of customer. For

example garments for expecting mothers, senior citizens who mostly wear

subtle colors, etc. must be included Eye level slots should be carefully

Marketing Project, Section –D, Group-1 Page 29

Big Bazaar Challenges Ahead

planned and stocked as they generate a significant amount of sale. The

way in which products are displayed should be aesthetic and pleasing.

The style and fashion of presentation of product is an important aspect of

overall ambience.

Big Bazaar should also continue to stock and promote a number of in

house brands like:

• DJ & C

• Tasty Treat

• Clean Mate

• Sensei

• Care Mate

• Koryo and 44 other brands

Recommendations

Big Bazaar should go about their expansion strategy more

aggressively as the current modern retail market share just

represents the tip of the iceberg, the total retail market, which is

expected to grow up to $ 5.6 billion by 2011.This will provide a

competitive advantage over the incoming international players.

In order to achieve more share of growing e-commerce market, Big

Bazaar should more pay more attention to attract more customers

for e-tailing. The look and feel factor of the website should be

improved so that there is high possibility that the visiting customer

is tempted to buy.

The shop format can be changed to suit the requirements of smaller

towns. In the line of Kishan Seva Kendra, an initiative retail chain by

Indian oil, a hypermarket with small size and more product variation

can be adopted.

They should invest more in the corporate social responsibility so as

to create more visibility in the eyes of the customer.

References

www.bigbazaar.com

Marketing Project, Section –D, Group-1 Page 30

Big Bazaar Challenges Ahead

www.futuregroup.com

www.pantaloonretail.in

www.Euromonitor.com

www.Wikipedia.com

www.authorstream.com

www.Google.com

www.slideshare.com

Marketing Project, Section –D, Group-1 Page 31

You might also like

- BigbazaarDocument31 pagesBigbazaaralokmohapatraNo ratings yet

- B.P.Collage of Business Administration/ Ty Bba-Sem ViDocument63 pagesB.P.Collage of Business Administration/ Ty Bba-Sem Vimohan ksNo ratings yet

- Project On Big Bazaar The Indian Wall Mart: Submitted By:-Vijayababu.B Reg No: 77Document15 pagesProject On Big Bazaar The Indian Wall Mart: Submitted By:-Vijayababu.B Reg No: 77Karthik EzilNo ratings yet

- CP On Big Bazaar Vs D-MartDocument63 pagesCP On Big Bazaar Vs D-MartKeyur RajparaNo ratings yet

- Indian Retail Sector - AnalysisDocument15 pagesIndian Retail Sector - AnalysisPromodkumar kpNo ratings yet

- Marketing Stratergy: Big Bazaar - The Indian Organised GiantDocument33 pagesMarketing Stratergy: Big Bazaar - The Indian Organised GiantPravin Rajpurohit RiduaNo ratings yet

- Big Bazaar ReportDocument43 pagesBig Bazaar ReportShobhit PatelNo ratings yet

- Training Report - Big Bazaar LudhianaDocument41 pagesTraining Report - Big Bazaar LudhianaSarah GallowayNo ratings yet

- Marketing Strategy of Big BazaarDocument6 pagesMarketing Strategy of Big BazaarchotakidaNo ratings yet

- Project On Marketing Strategy of Big Bazaar: Submitted ByDocument6 pagesProject On Marketing Strategy of Big Bazaar: Submitted ByMohit TrivediNo ratings yet

- Project On Marketing Strategy of Big Bazaar: Submitted By:-Group - IV, MBA I (A)Document6 pagesProject On Marketing Strategy of Big Bazaar: Submitted By:-Group - IV, MBA I (A)smitakambleNo ratings yet

- Shivakumar Project Book Print 143Document48 pagesShivakumar Project Book Print 143Shivakumar PanshettyNo ratings yet

- A) Executive Summary: Bazaar Mysore Road Bangalore' Helps To Know The Effectiveness of Promotional StrategyDocument43 pagesA) Executive Summary: Bazaar Mysore Road Bangalore' Helps To Know The Effectiveness of Promotional StrategyPariNo ratings yet

- Big Bazaar Case Study 1Document35 pagesBig Bazaar Case Study 1Mậḓʟỵ RohitNo ratings yet

- Navneeth Customer Strategies - 1453039520206 - 1453183299003Document63 pagesNavneeth Customer Strategies - 1453039520206 - 1453183299003ramarajuNo ratings yet

- Analysis of Big BazaarDocument12 pagesAnalysis of Big BazaarKonda RakeshNo ratings yet

- Assignment-Rural Marketing: Submitted By-Ankit Tiwari (MBA II Year)Document2 pagesAssignment-Rural Marketing: Submitted By-Ankit Tiwari (MBA II Year)Ankit TiwariNo ratings yet

- Dmart and The Retail IndustryDocument29 pagesDmart and The Retail IndustryVansh JainNo ratings yet

- Big Bazaar Vs Reliance MartDocument5 pagesBig Bazaar Vs Reliance MartMalvika Mehra100% (1)

- Logistics of Big Bazaar and ProblemsDocument14 pagesLogistics of Big Bazaar and ProblemsAnonymous Vj8Rk8No ratings yet

- Strategic Mangement-Big BazaarDocument23 pagesStrategic Mangement-Big BazaarSanjay Kumar Jena67% (3)

- A Study On The Effective Promotional Strategy Influencing Customer of The Product of Big Bazaar and D MartDocument47 pagesA Study On The Effective Promotional Strategy Influencing Customer of The Product of Big Bazaar and D MartPratik vadodkarNo ratings yet

- Big BazarDocument3 pagesBig BazarAvolupati Suneel kumarNo ratings yet

- Synopsis: Retail Industry-BazaarDocument19 pagesSynopsis: Retail Industry-BazaarGaurav ChoudharyNo ratings yet

- Kavita ShindeDocument36 pagesKavita ShindeSanjay SutarNo ratings yet

- Department of MBA Lingaraj Appa Enggineering College BidarDocument34 pagesDepartment of MBA Lingaraj Appa Enggineering College BidarSuraj KottawarNo ratings yet

- Smart BazaarDocument7 pagesSmart Bazaarumangrathod8347No ratings yet

- Own Brand Promotion: TrainingDocument82 pagesOwn Brand Promotion: TrainingGoutham RajNo ratings yet

- DMart Case Emerald 2 Sept 2020Document13 pagesDMart Case Emerald 2 Sept 2020Himani ConnectNo ratings yet

- Aknowledgement: Tina Dubey Ms. Sarita Dubey Mr. Sameer ThakurDocument23 pagesAknowledgement: Tina Dubey Ms. Sarita Dubey Mr. Sameer ThakurPrachi TiwariNo ratings yet

- Abhishek Big BazaarDocument58 pagesAbhishek Big Bazaarabhiplatinum100% (1)

- Retail Project On Consumer Perception About Private Labels-Future GroupDocument35 pagesRetail Project On Consumer Perception About Private Labels-Future GroupSanket ShahNo ratings yet

- Dare To Disrupt - The Rise of Grocery Startups in Pakistan: Prepared by I2i's Insights Lab & Released November 18, 2020Document20 pagesDare To Disrupt - The Rise of Grocery Startups in Pakistan: Prepared by I2i's Insights Lab & Released November 18, 2020Bushra GoharNo ratings yet

- Big BazaarDocument92 pagesBig BazaarSUMANTO SHARAN67% (3)

- Big BazaarDocument8 pagesBig BazaarPrathip KumarNo ratings yet

- Company Introduction Big BazaarDocument16 pagesCompany Introduction Big Bazaarcity9848835243 cyber100% (1)

- Big Bazzar Final MitDocument112 pagesBig Bazzar Final MitMayankJainNo ratings yet

- Introduction To Retailing: Retailing - Customer Is KingDocument7 pagesIntroduction To Retailing: Retailing - Customer Is KingsajalNo ratings yet

- Big Bazaar Case StudyDocument2 pagesBig Bazaar Case StudyAayush BansalNo ratings yet

- Summer Excellence Final ReportDocument54 pagesSummer Excellence Final Reportsfimarpgdm2012No ratings yet

- PantaloonsDocument20 pagesPantaloonsKhiles EngineerNo ratings yet

- The Reckitt Vs Retailer Story: Unified Response A Good ThingDocument4 pagesThe Reckitt Vs Retailer Story: Unified Response A Good ThingVarun RamuNo ratings yet

- Big Bazaar GYANDocument65 pagesBig Bazaar GYANdxtrahulNo ratings yet

- Big BazarDocument38 pagesBig BazarJyothi RameshNo ratings yet

- Marketing Application and Practices: Topic: FMCGDocument11 pagesMarketing Application and Practices: Topic: FMCGVinit PaulNo ratings yet

- A Project Report On Perception of Customers About Big BazaarDocument75 pagesA Project Report On Perception of Customers About Big BazaarBabasab Patil (Karrisatte)100% (3)

- Project On Sales Promotion in Big BazaarDocument24 pagesProject On Sales Promotion in Big Bazaaryaganti sivakrishnaNo ratings yet

- DownfallofFutureRetail LimitedDocument24 pagesDownfallofFutureRetail LimitedAvdhoot GiriNo ratings yet

- Big BazaarDocument14 pagesBig BazaarAmrit KeyalNo ratings yet

- Big BazaarDocument9 pagesBig BazaarNitish GoreNo ratings yet

- "A Study On Strategy For Promoting Retails Brands '': Dissertation Project Report ONDocument56 pages"A Study On Strategy For Promoting Retails Brands '': Dissertation Project Report ONshahidaNo ratings yet

- Retail EnvironmentDocument75 pagesRetail Environmentbhawana bothraNo ratings yet

- Training Report ON Customer Behaviour Pantaloons Retail India LTD, Zirakpur (Chandigarh), PunjabDocument51 pagesTraining Report ON Customer Behaviour Pantaloons Retail India LTD, Zirakpur (Chandigarh), PunjabgurvindersingNo ratings yet

- Big Bazaar Q2-Q3-Q4Document3 pagesBig Bazaar Q2-Q3-Q4Nina MartinNo ratings yet

- Market Ting ProjectDocument24 pagesMarket Ting Projectneenakm22No ratings yet

- Pantaloons ProjectDocument49 pagesPantaloons ProjectSuman Dutta SharmaNo ratings yet

- ReportDocument141 pagesReportitsankurzNo ratings yet

- India's Store Wars: Retail Revolution and the Battle for the Next 500 Million ShoppersFrom EverandIndia's Store Wars: Retail Revolution and the Battle for the Next 500 Million ShoppersNo ratings yet

- The 86% Solution (Review and Analysis of Mahajan and Banga's Book)From EverandThe 86% Solution (Review and Analysis of Mahajan and Banga's Book)No ratings yet

- Nrn101 and Nrn102 Drug Card: Zithromax, Zmax, Z-PakDocument2 pagesNrn101 and Nrn102 Drug Card: Zithromax, Zmax, Z-PakJanet Sheldon50% (2)

- 2022 CA Security Assessment and Authorization StandardDocument25 pages2022 CA Security Assessment and Authorization StandardDonaldNo ratings yet

- Chapter 52 - Drugs Affecting The Urinary Tract and The BladderDocument12 pagesChapter 52 - Drugs Affecting The Urinary Tract and The BladderJonathonNo ratings yet

- Syllabus PSY112 Indus OrgPsych MagallanesDocument4 pagesSyllabus PSY112 Indus OrgPsych MagallanesMa. Nenita L. MagallanesNo ratings yet

- Nissan RPX80 Vs Crown PE4500Document13 pagesNissan RPX80 Vs Crown PE4500Forklift Systems IncorporatedNo ratings yet

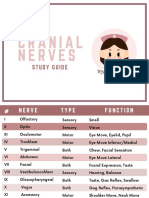

- Cranial NervesDocument6 pagesCranial Nervesvienny kayeNo ratings yet

- Borang IshipDocument9 pagesBorang IshipUlfa RahayuNo ratings yet

- Safety Health & Environment MethodologyDocument14 pagesSafety Health & Environment MethodologymusengemNo ratings yet

- Ka TurayDocument6 pagesKa TurayNizelCalmerinBaesNo ratings yet

- PPLS Seri A Februari 2020 PDFDocument33 pagesPPLS Seri A Februari 2020 PDFhedriansyah edNo ratings yet

- 2300 - Performing The EngagementDocument1 page2300 - Performing The EngagementAlexandra AvîrvareiNo ratings yet

- Assessing Health Impacts of Air Pollution From Electricity Generation The Case of ThailandDocument22 pagesAssessing Health Impacts of Air Pollution From Electricity Generation The Case of Thailandcamilo_ortiz_6100% (1)

- Lbe Diskusi 16 Tambahan FixDocument4 pagesLbe Diskusi 16 Tambahan FixRayhan Al FaiqNo ratings yet

- Mothership Zine Rulebook v5 PDFDocument44 pagesMothership Zine Rulebook v5 PDFAna Luiza FernandesNo ratings yet

- Mind Body Relationship in PsychotherapyDocument8 pagesMind Body Relationship in Psychotherapymoyosore100% (1)

- Q2-PPT-PE10-Module1.2 (Running As Exercise)Document30 pagesQ2-PPT-PE10-Module1.2 (Running As Exercise)Gericho MarianoNo ratings yet

- Sentinel Node Biopsy For CA BreastDocument7 pagesSentinel Node Biopsy For CA Breastwasima1956No ratings yet

- Guide in Filling Up The Competency Assessment FormDocument5 pagesGuide in Filling Up The Competency Assessment FormJOSEPH CAJOTENo ratings yet

- Sentence PatternDocument2 pagesSentence PatternBrito RajNo ratings yet

- Total Kjeldahl Nitrogen (TKN) Faqs: Why Is TKN Important?Document4 pagesTotal Kjeldahl Nitrogen (TKN) Faqs: Why Is TKN Important?dsbishtNo ratings yet

- Fuji FCR 5000Document435 pagesFuji FCR 5000Lion Micheal OtitolaiyeNo ratings yet

- Summary of Cutting Data For Plain Surface: DegrosareDocument4 pagesSummary of Cutting Data For Plain Surface: DegrosareAndrei MihaiNo ratings yet

- Assignment Schumpeter CaseDocument1 pageAssignment Schumpeter CaseValentin Is0% (1)

- The Fine Print Lisa Renee Dec 2010Document8 pagesThe Fine Print Lisa Renee Dec 2010Ali SaghafiNo ratings yet

- (V) Disaster Management by Vaishali MamDocument7 pages(V) Disaster Management by Vaishali Mamnvn.2130No ratings yet

- HSEQ-HQ-06-08-00 Transportation StandardDocument15 pagesHSEQ-HQ-06-08-00 Transportation StandardAHMED AMIRANo ratings yet

- Test 6Document3 pagesTest 6Андрій МедвідьNo ratings yet

- Class 8 Cbse Science Question Paper Fa 1Document2 pagesClass 8 Cbse Science Question Paper Fa 1Sunaina Rawat100% (1)

- Chemical Bonding Assignment 2 AnswersDocument5 pagesChemical Bonding Assignment 2 AnswersdarylchenNo ratings yet

- Staffing: Presentation TranscriptDocument4 pagesStaffing: Presentation TranscriptagelesswapNo ratings yet