Professional Documents

Culture Documents

VAT System

Uploaded by

alejandrorojas013Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT System

Uploaded by

alejandrorojas013Copyright:

Available Formats

1.

Definition

2. Nature

2.1. Tax on Consumption – The VAT is ultimately a tax on consumption, even though it is assessed on many levels of

transactions. It is the end user of consumer goods or services which ultimately shoulders the tax, as the liability

therefrom is passed on to the end users by the providers of these goods or services who in turn may credit their own

VAT liability (input VAT) from the VAT payments (output VAT) they received from the final consumer [CIR v. Magsaysay

Lines, 2006].

2.2. Uniform Tax – The VAT is a uniform tax ranging, at present, from 0% to 12% levied on every importation of goods,

whether or not in the course of trade or business, or on each sale, barter, exchange or lease of goods or properties or

on each rendition of services in the course of trade or business.

2.3. Indirect Tax – The VAT is an indirect tax because the amount of tax may be shifted or passed on to the buyer,

transferee or lessee of the goods, properties or services [Sec. 105, par. 2 NIRC]. What is transferred in such instance is

not the liability for the tax (impact of taxation), but the tax burden (incidence of taxation) [Contex v. CIR, 2004].

3. Who are Liable?

3.1. In General – Any person who, in the course of trade or business, sells barters, exchanges, leases goods or properties,

renders services, and any person who imports goods shall be subject to the value-added tax (VAT) imposed in Sections

106 to 108 of this Code [Sec. 105, NIRC].

3.1.1. The phrase 'in the course of trade or business' means

(a) the regular conduct or pursuit of a commercial or an economic activity, including transactions incidental

thereto,

(b) by any person regardless of whether or not the person engaged therein is a nonstock, nonprofit private

organization (irrespective of the disposition of its net income and whether or not it sells exclusively to

members or their guests), or government entity.

3.1.1.1. Revenue Memorandum Circular 4-98

Any business where the aggregate gross sales or receipts do not exceed P100,000 during any 12-

month period shall be considered principally for subsistence or livelihood and not in the course of

business, and a taxpayer who qualified under the such definition shall be exempt from

(a) payment of registration fee presecribed under Sec. 236 (B) of the NIRC;

(b) payment of VAT under Title IV, Chapter 1, NIRC; and

(c) payment of percentage taxes under Title V, NIRC.

3.1.1.2. See also Revenue Audit Memorandum Order 1-86 (pp. 32-33, AN).

3.1.1.3. Non-resident persons who performed services in the Philippines are deemed to be making sales in the

course of trade or business, even if the performance of services is not regular [RR No. 16-2005]

3.1.2. Rule on Importation – However, in the case of importation of taxable goods, the importer, whether an

individual or corporation and whether or not made in the course of his trade or business, shall be liable to VAT

imposed in Art. 107 of the NIRC.

3.2. Summary: Taxable Person

(a) That he undertakes taxable transaction in goods, properties or services consumed or destined for consumption

within the Philippines;

(b) That such transactions are entered into in the course of his trade or business;

(c) That the amount of his gross sales or receipts is over the threshold fixed by law or regulations; and

(d) That in case of importation, an importer of taxable goods, whether or not made in the course of trade or business,

is a taxable person.

4. VAT System

4.1. Taxability of Transactions (See Table)

(a) Sale of Goods

(b) Sale of Real Properties

(c) Sale of Services

(d) Lease or Use of Properties

(e) Importation

4.2. Important Technical Terms

4.3. Taxable & Exempt Transactions (See Table)

4.4. Tax Base (See Table)

4.5. Tax Credit

You might also like

- Tax ReviewerDocument8 pagesTax ReviewerCharina NipesNo ratings yet

- VAT DiscussionDocument39 pagesVAT DiscussionCheenee Nuestro SantiagoNo ratings yet

- Value Added TaxDocument20 pagesValue Added TaxJerlene Sydney Centeno100% (1)

- Value-Added Tax Nature of VatDocument22 pagesValue-Added Tax Nature of VatDiossaNo ratings yet

- Vat - 1Document20 pagesVat - 1biburaNo ratings yet

- Value Added Tax Ust PDFDocument23 pagesValue Added Tax Ust PDFcalliemozartNo ratings yet

- Taxrev VatDocument33 pagesTaxrev VatnikkiNo ratings yet

- Introduction To Business TaxesDocument10 pagesIntroduction To Business TaxesChristine AceronNo ratings yet

- Tax 2 - VATDocument37 pagesTax 2 - VATShirley Marie Cada - CaraanNo ratings yet

- Value Added Tax: Output Tax Less Input Tax VAT PayableDocument26 pagesValue Added Tax: Output Tax Less Input Tax VAT PayableRon RamosNo ratings yet

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justineNo ratings yet

- Reviewer BTTDocument14 pagesReviewer BTTAlthea Frances VasalloNo ratings yet

- Case: Cir V PLDTDocument29 pagesCase: Cir V PLDTJaymee Andomang Os-agNo ratings yet

- VAT NotesDocument21 pagesVAT NotesiBEAYNo ratings yet

- PM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)Document22 pagesPM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)dodong123100% (1)

- Value Added TaxDocument29 pagesValue Added TaxRai MarasiganNo ratings yet

- 07 Chap 15 16 Mamalateo 2019 Tax BookDocument19 pages07 Chap 15 16 Mamalateo 2019 Tax BookJeremias CusayNo ratings yet

- VALUE-ADDED TAX NOTES-WPS OfficeDocument14 pagesVALUE-ADDED TAX NOTES-WPS Officeyasser lucmanNo ratings yet

- Tax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsDocument12 pagesTax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsChaNo ratings yet

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyNo ratings yet

- OtesvatDocument18 pagesOtesvatRichelle Joy Reyes BenitoNo ratings yet

- VAT, Other Percentage Tax, Excise Tax and Documentary Stamp TaxDocument5 pagesVAT, Other Percentage Tax, Excise Tax and Documentary Stamp TaxJune Romeo ObiasNo ratings yet

- Characteristic of Vat-Business TaxationDocument8 pagesCharacteristic of Vat-Business TaxationAthena LouiseNo ratings yet

- Vat TaxDocument6 pagesVat TaxJunivenReyUmadhayNo ratings yet

- Tax 2Document14 pagesTax 2Nash Ortiz LuisNo ratings yet

- Value-Added Tax PDFDocument118 pagesValue-Added Tax PDFRazel MhinNo ratings yet

- Taxation VATDocument22 pagesTaxation VATB-an JavelosaNo ratings yet

- 2 Value Added TaxDocument216 pages2 Value Added TaxnichNo ratings yet

- PM Reyes Notes On Taxation 2 Valued Added Tax Working Draft Updated 22 Feb 2013Document22 pagesPM Reyes Notes On Taxation 2 Valued Added Tax Working Draft Updated 22 Feb 2013Riel Picardal-VillalonNo ratings yet

- Business TaxesDocument100 pagesBusiness Taxeslynne tahilNo ratings yet

- Module ObjectivesDocument9 pagesModule ObjectivesKyrzen NovillaNo ratings yet

- Tax Midterms Reviewer - VatDocument8 pagesTax Midterms Reviewer - VatAgot GaidNo ratings yet

- 43677RMO 3-2009 - Suspension GroundsDocument29 pages43677RMO 3-2009 - Suspension GroundsAnonymous OyhbxcjNo ratings yet

- Rmo 3-2009Document29 pagesRmo 3-2009sheena100% (2)

- VatDocument274 pagesVatzaneNo ratings yet

- Notes in Other Percentage TaxDocument2 pagesNotes in Other Percentage TaxNovie Marie Balbin AnitNo ratings yet

- VAT ReviewerDocument72 pagesVAT ReviewerJohn Kenneth AcostaNo ratings yet

- Value Added TaxDocument13 pagesValue Added TaxRyan AgcaoiliNo ratings yet

- VALUE ADDED TAX - Part 1Document30 pagesVALUE ADDED TAX - Part 1Derek C. EgallaNo ratings yet

- VAT - GuidenotesDocument14 pagesVAT - GuidenotesNardz AndananNo ratings yet

- Law On Taxation: ConceptDocument78 pagesLaw On Taxation: ConceptgoerginamarquezNo ratings yet

- Value Added TaxDocument38 pagesValue Added TaxAhmad AbduljalilNo ratings yet

- Vat With TrainDocument16 pagesVat With TrainElla QuiNo ratings yet

- Taxation Value-Added Tax: Lecture NotesDocument23 pagesTaxation Value-Added Tax: Lecture Notestherezzzz0% (1)

- Bar Review Lecture - VATDocument71 pagesBar Review Lecture - VATIsagani DionelaNo ratings yet

- Value-Added Tax: Secs. 105 To 115Document71 pagesValue-Added Tax: Secs. 105 To 115louise carinoNo ratings yet

- Cases in Tax ReviewDocument173 pagesCases in Tax ReviewErmawooNo ratings yet

- VAT Digests and NotesDocument20 pagesVAT Digests and NotesJoseph FullNo ratings yet

- VAT RefundDocument45 pagesVAT RefundPatrick Tan100% (1)

- CIR v. Seagate Technology PhilsDocument6 pagesCIR v. Seagate Technology PhilsL.A. ManlangitNo ratings yet

- Taxation IIDocument3 pagesTaxation IIAnonymous BNrz1arNo ratings yet

- Value Added TaxDocument15 pagesValue Added TaxJoshua PeraltaNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxJune Romeo ObiasNo ratings yet

- VAT Taxpayer Guide - VAT Return FilingDocument16 pagesVAT Taxpayer Guide - VAT Return FilingNeeyum Njaanum0021No ratings yet

- VatDocument15 pagesVatEller-JedManalacMendozaNo ratings yet

- VAT - Module 1 - General Principles To Zero-RatedDocument57 pagesVAT - Module 1 - General Principles To Zero-RatedReyan RohNo ratings yet

- Compliance Requirements SEC. 113. Invoicing and Accounting Requirements For VAT-Registered Persons.Document4 pagesCompliance Requirements SEC. 113. Invoicing and Accounting Requirements For VAT-Registered Persons.shakiraNo ratings yet

- Cir vs. Seagate TechnologyDocument6 pagesCir vs. Seagate TechnologyMa Gabriellen Quijada-TabuñagNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Itr2 719710260121120$Document1 pageItr2 719710260121120$vvn HarishNo ratings yet

- Investment in Debt SecuritiesDocument21 pagesInvestment in Debt SecuritiesAlarich CatayocNo ratings yet

- Do Restaurant Owners Have To Pay GST On The Entire Amount of The Bill If Delivery Is Done by Zomato?Document2 pagesDo Restaurant Owners Have To Pay GST On The Entire Amount of The Bill If Delivery Is Done by Zomato?pratyusha_3No ratings yet

- ZOHO Corporation Pte LTD: Tax Invoice Tax InvoiceDocument1 pageZOHO Corporation Pte LTD: Tax Invoice Tax InvoiceNairo Julian Rodriguez BallesterosNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountBalajiNo ratings yet

- Revised TDS Rate Chart (FY 2009-10)Document1 pageRevised TDS Rate Chart (FY 2009-10)haldharkNo ratings yet

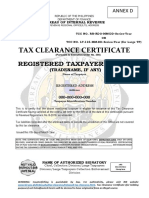

- Annex DDocument1 pageAnnex DIdan Aguirre50% (2)

- Time For The Income-Tax Act, 1961: Subiect: Extension of Lines Electronic Filing of Various Fomms UnderDocument3 pagesTime For The Income-Tax Act, 1961: Subiect: Extension of Lines Electronic Filing of Various Fomms UnderRambabu TatikondaNo ratings yet

- DG - 0015 PDFDocument1 pageDG - 0015 PDFGasBuddyNo ratings yet

- Apollo Medicine InvoiceJun 6 2023 18 52Document1 pageApollo Medicine InvoiceJun 6 2023 18 52RAGHU PILLINo ratings yet

- IRCTC Retiring RoomDocument1 pageIRCTC Retiring RoomGSAIBABANo ratings yet

- ACC 311 Sample Problem General Instructions:: ST ND RD THDocument1 pageACC 311 Sample Problem General Instructions:: ST ND RD THexquisiteNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- Yeamin Pi 73Document1 pageYeamin Pi 73Tofail IslamNo ratings yet

- InvoiceDocument2 pagesInvoiceqwrhhemNo ratings yet

- RR 1-79Document9 pagesRR 1-79matinikkiNo ratings yet

- Kibassa TaxDocument3 pagesKibassa TaxInnocent MollaNo ratings yet

- Computation - Computation (23-24)Document2 pagesComputation - Computation (23-24)BIKASH KUMARNo ratings yet

- Income Taxation: Gross Revenue PXXXXX Deductions XXXXXDocument8 pagesIncome Taxation: Gross Revenue PXXXXX Deductions XXXXXPSHNo ratings yet

- VAT-Computation 2Document28 pagesVAT-Computation 2Alvin Dagohoy100% (1)

- Central Avenue Price ListDocument2 pagesCentral Avenue Price Listsignature globalNo ratings yet

- Tax Invoice: Invoice Date: Terms: Due Date: Bill ToDocument2 pagesTax Invoice: Invoice Date: Terms: Due Date: Bill ToAlbert TaczNo ratings yet

- OD329422999281816100Document1 pageOD329422999281816100sanjeev kumarNo ratings yet

- P60 End of Year Certificate 2021 P60 End of Year CertificateDocument1 pageP60 End of Year Certificate 2021 P60 End of Year CertificateIsmael GomesNo ratings yet

- Income Tax 2022 Part 2Document6 pagesIncome Tax 2022 Part 2Chezkie EmiaNo ratings yet

- 011 CIR V General FoodsDocument2 pages011 CIR V General FoodsJacob Dalisay100% (3)

- Solved MG Is An Accrual Basis Corporation in 2015 It WroteDocument1 pageSolved MG Is An Accrual Basis Corporation in 2015 It WroteAnbu jaromiaNo ratings yet

- Payslip Name: Juan Dela Cruz Month: January 1-31, 2020 Contract SalaryDocument3 pagesPayslip Name: Juan Dela Cruz Month: January 1-31, 2020 Contract SalaryTESDAR12 SKTESDANo ratings yet

- Swastik Invoice 2Document1 pageSwastik Invoice 2Amit PrajapatiNo ratings yet

- Affidavit Gratuity and Leave EncashmentDocument2 pagesAffidavit Gratuity and Leave EncashmentAtharva GhogareNo ratings yet