Professional Documents

Culture Documents

Itr62form16 PDF

Itr62form16 PDF

Uploaded by

Shiva KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr62form16 PDF

Itr62form16 PDF

Uploaded by

Shiva KumarCopyright:

Available Formats

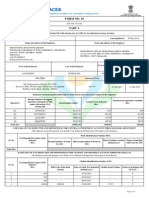

FORM NO.

16

[See rule 31(1)(a)]

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source

from income chargeable under the head “Salaries”

Name and address of the Employer Name and designation of the Employee

PAN No. of the Deductor TAN No. of the PAN No. of the Employee

Deductor

Acknowledgement Nos. of all quarterly Period Assessment year

statements of TDS under sub-section (3) of

section 200 as provided by TIN Facilitation

Centre or NSDL web-site

Quarter Acknowledgement No. From To

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1. Gross salary

(a) Salary as per provisions contained in

section 17(1) Rs.

(b) Value of perquisites under section 17(2)

(as per

Form No. 12BA, wherever applicable) Rs.

(c) Profits in lieu of salary under section

17(3) (as per Form No. 12BA,

wherever applicable) Rs.

(d) Total Rs.

2. Less : Allowance to the extent exempt

under section 10

Allowance Rs.

Rs.

3. Balance (1 – 2) Rs.

4. Deductions :

(a) Entertainment

allowance Rs.

(b) Tax on

Employment Rs.

5. Aggregate of 4(a) and (b) Rs.

6. Income chargeable under the head .

‘Salaries’ (3 - 5) Rs.

7. Add : Any other income reported by the

Printed from www.taxmann.com

employee

Rs.

Rs.

8. Gross total income (6 + 7) Rs.

9. Deductions under Chapter VI-A

(A) sections 80C, 80CCC and 80CCD

Gross amount Deductible amount

(a) section 80C

(i) Rs.

(ii) Rs.

(iii) Rs.

(iv) Rs.

(v) Rs.

(vi) Rs. Rs. Rs.

(b) section 80CCC Rs. Rs.

(c) section 80CCD Rs. Rs.

Note :1. aggregate amount deductible under section 80C shall not exceed one lakh rupees

2. aggregate amount deductible under the three sections , i.e., 80C, 80CCC and 80CCD, shall not exceed one lakh

rupees

(B) other sections (e.g., 80E, 80G etc.)

Under Chapter VIA

Gross Amount Qualifying Amount Deductible Amount

(a) section Rs. Rs. Rs.

(b) section Rs. Rs. Rs.

(c) section Rs. Rs. Rs.

(d) section Rs. Rs. Rs.

(e) section Rs. Rs. Rs.

10. Aggregate of deductible amounts Rs.

under Chapter VI-A

11. Total income (8—10) Rs. Rs.

12. Tax on total income Rs. Rs.

13. Surcharge (on tax computed at S. No. 12) Rs.

Rs.

14. Education Cess @ 2% on (tax at S. No. Rs.

12 plus surcharge at S. No. 13) Rs.

15. Tax payable (12+13+14) Rs. Rs.

16. Relief under section 89 (attach details) Rs. Rs.

17. Tax payable (15-16) Rs. Rs.

18 Less : (a) Tax deducted at source u/s Rs. Rs.

192(1)

(b) Tax paid by the employer on behalf of Rs. Rs.

the employee u/s 192(1A) on perquisites

u/s 17(2)

19. Tax payable/refundable (17-18) Rs.

Printed from www.taxmann.com

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT

(The Employer is to provide transaction-wise details of tax deducted and deposited)

S. No. TDS Surcharge Education Total tax Cheque/DD No. (if BSR Code of Date on which Transfer voucher/

Cess deposited any) Bank branch tax deposited Challan Identification

Rs. Rs. (dd/mm/yy) No.

Rs. Rs.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

I _________________, son/daughter of ____________________ working in the capacity of ___________________

(designation) do hereby certify that a sum of Rs. _______________ [Rupees _________________ (in words)] has been

deducted at source and paid to the credit of the Central Government. I further certify that the information given above is true

and correct based on the books of account, documents and other available records.

Place ______________ ____________________________.

Date ______________ Signature of the person responsible for deduction of tax

Full Name

Designation

Printed from www.taxmann.com

You might also like

- McPherson 1967 - Political ObligationDocument95 pagesMcPherson 1967 - Political ObligationCivis Vulgaris0% (1)

- Form No 16 in Excel With FormuleDocument3 pagesForm No 16 in Excel With FormuleSayal Ji33% (6)

- Basic Taxation - Aban ReviewerDocument50 pagesBasic Taxation - Aban ReviewerMariam Bautista100% (1)

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- Form 16 WORD FORMATEDocument2 pagesForm 16 WORD FORMATEJay83% (47)

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument5 pagesForm 16 Part A: WWW - Taxguru.inDarshan PatelNo ratings yet

- Form 16Document3 pagesForm 16Bijay TiwariNo ratings yet

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Mayur Hedge Fund Private Placement MemorandumDocument73 pagesMayur Hedge Fund Private Placement MemorandumBenjaminRavaruNo ratings yet

- Form No 16 (By Sagar Goyal)Document3 pagesForm No 16 (By Sagar Goyal)sagarNo ratings yet

- Form 16Document2 pagesForm 16Hari Krishnan ElangovanNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- Form16Rpt 169567-1Document3 pagesForm16Rpt 169567-1ishalshamnasNo ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Tds 16 NDocument3 pagesTds 16 Nssanju_bhatNo ratings yet

- Institutional Investment in Infrastructure in Emerging Markets and Developing EconomiesFrom EverandInstitutional Investment in Infrastructure in Emerging Markets and Developing EconomiesNo ratings yet

- Form 16Document3 pagesForm 16ganesh_korgaonkarNo ratings yet

- Form 16Document6 pagesForm 16balaramappana2No ratings yet

- Form 16Document3 pagesForm 16Vikas PandyaNo ratings yet

- Handbook - Final 2017 PDFDocument60 pagesHandbook - Final 2017 PDFRegina Matias100% (1)

- Form No 16Document4 pagesForm No 16Md ZhidNo ratings yet

- Form16 Applicable From 01.04Document3 pagesForm16 Applicable From 01.04Vishaal TalwarNo ratings yet

- SALARY CERTIFICATE - MINISTRY OF FINANCE's Notification On FormatsDocument7 pagesSALARY CERTIFICATE - MINISTRY OF FINANCE's Notification On FormatsShabeer UppotungalNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Pastor Search Committee WorkbookDocument45 pagesPastor Search Committee WorkbookTad TraylorNo ratings yet

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- Business Women 2010Document1 pageBusiness Women 2010JayNo ratings yet

- Name and Address of The Employer Name and Designation of The EmployeeDocument4 pagesName and Address of The Employer Name and Designation of The Employeeyogesh.b.lokhande9022No ratings yet

- Form No 16Document3 pagesForm No 16thapalNo ratings yet

- Form No.16 (See Rule 31 (1) (A) )Document2 pagesForm No.16 (See Rule 31 (1) (A) )Akash ShedgeNo ratings yet

- Form No 16Document3 pagesForm No 16Deepak Kumar YadavNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument2 pagesDetails of Salary Paid and Any Other Income and Tax DeductedPapar Rao GNo ratings yet

- Form No 16 - Ay0607Document4 pagesForm No 16 - Ay0607api-3705645100% (1)

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Form 16 Excel FormatDocument12 pagesForm 16 Excel Formatankeet3No ratings yet

- Certified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Document4 pagesCertified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Aravind ReddyNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- Form No 16Document2 pagesForm No 16Anonymous 7KR8DpqNo ratings yet

- A SimDocument4 pagesA Simsana_rautNo ratings yet

- Form 16Document2 pagesForm 16Joyal JoseNo ratings yet

- Form 16Document2 pagesForm 16jwadje1No ratings yet

- The Payment of Wages Act, 1936 Form Iv Annual Returns Wages and Deductions From WagesDocument5 pagesThe Payment of Wages Act, 1936 Form Iv Annual Returns Wages and Deductions From WagesSUDHIR KUMARNo ratings yet

- Abdul Naushad SiddiquiDocument2 pagesAbdul Naushad Siddiquiahad siddiquiNo ratings yet

- 317 Form16 (2005 06)Document6 pages317 Form16 (2005 06)sachin584No ratings yet

- Form 16Document6 pagesForm 16Ravi DesaiNo ratings yet

- None - FORM IV - KA - PWDocument2 pagesNone - FORM IV - KA - PWKishore KanthrajNo ratings yet

- Short Form Return of Organization Exempt From Income TaxDocument9 pagesShort Form Return of Organization Exempt From Income TaxHalosNo ratings yet

- Form 26Document7 pagesForm 26pviveknaiduNo ratings yet

- NBR 73Document3 pagesNBR 73regforsoftNo ratings yet

- The Fallout of War: The Regional Consequences of the Conflict in SyriaFrom EverandThe Fallout of War: The Regional Consequences of the Conflict in SyriaNo ratings yet

- Middle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesFrom EverandMiddle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesNo ratings yet

- Container Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortFrom EverandContainer Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortNo ratings yet

- New PAN Application Form W.E.F. 1.11.2011Document2 pagesNew PAN Application Form W.E.F. 1.11.2011JayNo ratings yet

- Budget Highlights 2011-12Document2 pagesBudget Highlights 2011-12JayNo ratings yet

- Form 16a New FormatDocument2 pagesForm 16a New FormatJayNo ratings yet

- Electricity Bill Calculation (Residential)Document4 pagesElectricity Bill Calculation (Residential)JayNo ratings yet

- Form 16a - TDS - Blank 16aDocument1 pageForm 16a - TDS - Blank 16aJayNo ratings yet

- Obtain Tpin NumberDocument1 pageObtain Tpin NumberJayNo ratings yet

- Electricity Bill Calculation (Residential)Document4 pagesElectricity Bill Calculation (Residential)JayNo ratings yet

- List of Useful Codes With Descriptions To Be Used As Reference Status of TaxpayerDocument5 pagesList of Useful Codes With Descriptions To Be Used As Reference Status of TaxpayerJayNo ratings yet

- Organisation Chart Construction Project Manager Purchase/ Accounts Sales / AccountsDocument3 pagesOrganisation Chart Construction Project Manager Purchase/ Accounts Sales / AccountsJay50% (2)

- How To Play SargamDocument1 pageHow To Play SargamJayNo ratings yet

- Form 30 - RtoDocument2 pagesForm 30 - RtoJayNo ratings yet

- AccountantsDocument2 pagesAccountantsJoann Saballero HamiliNo ratings yet

- FINAL EXAM - TAXATION For ExamDocument7 pagesFINAL EXAM - TAXATION For ExamVincent SaavedraNo ratings yet

- 20230820-Mr G. H. Schorel-Hlavka O.W.B. To R Kershaw Chief Commissioner of AFP-Suppl 102-Shadow Banning, EtcDocument70 pages20230820-Mr G. H. Schorel-Hlavka O.W.B. To R Kershaw Chief Commissioner of AFP-Suppl 102-Shadow Banning, EtcGerrit Hendrik Schorel-HlavkaNo ratings yet

- Material MGMTDocument33 pagesMaterial MGMTHarish KumarNo ratings yet

- 12 SepDocument8 pages12 SepAnkit PrakashNo ratings yet

- Dividend Policy: Answers To QuestionsDocument10 pagesDividend Policy: Answers To QuestionsLee JNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document3 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Facts: Caltex V COA (208 SCRA 755)Document6 pagesFacts: Caltex V COA (208 SCRA 755)chard ganNo ratings yet

- Concentrix Services India Private Limited Payslip For The Month of July - 2023Document1 pageConcentrix Services India Private Limited Payslip For The Month of July - 2023Bujji BabuNo ratings yet

- A New Financial Deal For ChristchurchDocument2 pagesA New Financial Deal For ChristchurchRaf ManjiNo ratings yet

- Red Bus Bill 04.03.2024Document1 pageRed Bus Bill 04.03.2024sa jaNo ratings yet

- Uniben Post Ume Past QDocument88 pagesUniben Post Ume Past QSamuel Abiodun Ogunwale0% (1)

- Namsa Dhim PSLVDocument13 pagesNamsa Dhim PSLVgawije1409No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)DIBYAJYOTI SAMANTANo ratings yet

- CMIE SampleDocument81 pagesCMIE SampleSanjeevanee Vaidya100% (1)

- IELTS Plus 1 KeyDocument6 pagesIELTS Plus 1 KeyCecilia100% (1)

- Form12-PQB0286280-C19088-Karthi Subramanian-2021-2022Document1 pageForm12-PQB0286280-C19088-Karthi Subramanian-2021-2022Karthi SubramanianNo ratings yet

- Microsoft Partner Network Agreement Page 1 of 9Document13 pagesMicrosoft Partner Network Agreement Page 1 of 9Carl E Vic TNo ratings yet

- Financial Statement Analysis: Group MembersDocument11 pagesFinancial Statement Analysis: Group Membersk_adhikaryNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sunady MobilityNo ratings yet

- M4 - Quant Homework AssignmentDocument8 pagesM4 - Quant Homework AssignmentHACKER CHAUDHARYNo ratings yet

- The Wolverine Case StudyDocument1 pageThe Wolverine Case StudyKhánh LoanNo ratings yet

- Budgeting Case Study: Put Laura's Budget TogetherDocument2 pagesBudgeting Case Study: Put Laura's Budget TogetherUsman Ali50% (2)

- An Analyses and Evolution of Indian Retail Market in Current Scenario (A Case Study of Some Selected Companies in India After Globalization)Document7 pagesAn Analyses and Evolution of Indian Retail Market in Current Scenario (A Case Study of Some Selected Companies in India After Globalization)Rishabh JainNo ratings yet