Professional Documents

Culture Documents

Sarah - Journal Summary

Uploaded by

siti_sarah1460 ratings0% found this document useful (0 votes)

24 views17 pagesThis document summarizes 4 studies on the relationship between CEO compensation and corporate social responsibility (CSR).

The first study found that pay-performance sensitivity increases the relevance of negative consequences from poor social performance. The second used a large sample to show environmentally friendly firms pay CEOs less and rely less on incentive pay.

The third examined over 11,000 firm-years and found that lagging CSR adversely affects total and cash compensation. An increase in CSR leads to decreases in both types of pay.

The fourth covered over 5,700 firms from 1992-2006 and showed that non-equity stakeholder incentives decrease leverage and increase cash holdings, after controlling for other factors.

Original Description:

Journal summary for CSR and CEO COMPENSATION

Original Title

Sarah _journal Summary

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes 4 studies on the relationship between CEO compensation and corporate social responsibility (CSR).

The first study found that pay-performance sensitivity increases the relevance of negative consequences from poor social performance. The second used a large sample to show environmentally friendly firms pay CEOs less and rely less on incentive pay.

The third examined over 11,000 firm-years and found that lagging CSR adversely affects total and cash compensation. An increase in CSR leads to decreases in both types of pay.

The fourth covered over 5,700 firms from 1992-2006 and showed that non-equity stakeholder incentives decrease leverage and increase cash holdings, after controlling for other factors.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views17 pagesSarah - Journal Summary

Uploaded by

siti_sarah146This document summarizes 4 studies on the relationship between CEO compensation and corporate social responsibility (CSR).

The first study found that pay-performance sensitivity increases the relevance of negative consequences from poor social performance. The second used a large sample to show environmentally friendly firms pay CEOs less and rely less on incentive pay.

The third examined over 11,000 firm-years and found that lagging CSR adversely affects total and cash compensation. An increase in CSR leads to decreases in both types of pay.

The fourth covered over 5,700 firms from 1992-2006 and showed that non-equity stakeholder incentives decrease leverage and increase cash holdings, after controlling for other factors.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 17

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

CEO COMPENSATION AND CSR

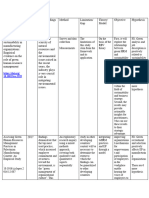

Reference Objectives Theory/ Model Variables Sample Findings Remarks

1 Mcguire, J., Oehmichen, J., analyze Behavioural Since the 84 -the This journal

Wolff, M., & Hilgers, R. how two Agency Model information needed companies performance can be a main

(2017). Do Contracts compensation -Prospect to calculate our excluded sensitivity of reference to

Make Them Care ? The design Theory compensation financial CEO pay is the next study

characteristics, variables is not firms and negatively as there are not

Impact of CEO -Agency

pay-performance provided in firms with associated with so many

Compensation Design on sensitivity and

Theory common missing data poor studies doing

Corporate Social duration of CEO compensation (2006-2011) social research in this

Performance. Journal of compensation, databases such as performance but area.

Business Ethics. affect corporate Execucomp, we also negatively

https://doi.org/10.1007/s social hand-collected all affects strong

10551-017-3601-8 performance. Compensation social

related data from performance.

firm proxy

statements. -pay-

performance

sensitivity

increases the

relevance of

potential

negative

consequences of

poor social

performance

2 Francoeur, C., Melis, A., Environmental Theory: Dependent Variable 520 large environment This study use

Gaia, S., & Aresu, S. stewardship, a Stewardship the 2009 CEO listed firms friendly firms a large of

(2017). Green or Greed ? stakeholder- theory compensation pay their CEOs sample and

An Alternative Look at enlarged view of less total using different

stewardship Model: The proportion compensation model instead

CEO Compensation and

theory, and OLS regression and rely less on of model jones

Corporate institutional models with

Environmental

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

Commitment. Journal of theory to analyze industry-fixed of incentive-based incentive-based

Business Ethics, 140(3), the relationship effects compensation and compensation

439–453. between CEO total compensation. than

https://doi.org/10.1007/s compensation and environment

10551-015-2674-5 firms’ careless firms.

environmental Independent This negative

commitment variable: relationship is

Environmental stronger in

performance (EP). institutional

contexts where

national

environmental

regulations are

weaker.

3 Cai, Y, Jo, H., & Pan, C. examine the Theory: Independent 11,215 firm- the lag of CSR This study

(2011). Vice or Virtue? impact of corpo- agency theory variable: estimated year (1,946 adversely

The Impact of Corporate rate social CSR index from firms) affects both total

Social Responsibility on responsibility first-stage observations compensation

Executive (CSR) on CEO regressions during the and cash

compensation period of compensation,

Compensation. Journal Dependent Variable 1996–2010, after controlling

of Business Ethics, : employee relation, for various firm

104(2), 159–173. and use industry- and board

https://doi.org/10.1007/s median employee characteristics.

10551-011-0909-7 relation as an Our estimates

instrument (pg170) show that an

interquartile

increase in CSR

is followed by a

4.35% (2.78%)

decrease in total

(cash)

compensation

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

4 F.Yang. (2015). Corporate how such Theory: The impact of CSR covers the that non-equity

Social Responsibility incentives affect Stakeholder residual incentive period from stakeholder

and Managerial firm leverage and Theory on LEVERAGE 1992 to 2006 incentives

Incentives, (August). cash holding Shareholder for 5727 decrease

Theory The impact of CSR firms leverage and

total incentive on increase cash

LEVERAGE holding, after

The impact of CSR controlling for

residual incentive CEO managerial

on CASH incentives and

other firm

The impact of CSR characteristics

total incentive on

CASH

This

5 Vromen, A. (2012). The effect a relationship agency theory Control variables : 584 U.S. larger firms

of incentive between CEO and stakeholder firm size, firm age, firms over have better CSP

compensation on compensation and theory industry sector and the years and that older

corporate social corporate social risk (pg23) 2003 until firms have

performance. performance. 2010 worse CSP. CSP

has increased

during the

financial crisis,

although a

causal

relationship

between the two

could not be

established

6 Macdonald, T. (2016). CEO relation between Agency theory Dependent 1995-2010 delta has no

Wealth Sensitivity and CEO variable: significant

Corporate Social compensation Ceo Compensation effect on CSR

Responsibility. structure and firm rating, while

Independent vega has a

variable: strong causal

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

corporate social Firm Performance relation with

responsibility CSR

(CSR)

7 Rekker, S. A. C., Benson, K. examine the Agency Theory Dependent 1988 firms disaggregation

L., & Faff, R. W. (2014). relation between Variables: with 12,311 of CSR into its

Journal of Economics corporate social Salary, Bonus, firm-year components

and Business Corporate responsibility Long term observations matters. We

(CSR) and CEO compensation and document

social responsibility and

compensation Total evidence

CEO compensation

compensation. suggesting that

revisited: Do while employee

disaggregation , market relations, the

stress , gender matter ? environment

Journal of Economics and diversity are

and Business, 72, 84– important,

103. generally,

https://doi.org/10.1016/j. community and

jeconbus.2013.11.001 product quality

are not.both

times of crisis

and gender

matter. Once

they are

accounted for

interactively in

the model, the

general

relationship

between CSR

and CEO

compensation

weakens

8 Davidson, R. H., & Smith, A. the role of Agency Theory Dependent : Ceo a large CSR scores in

(2016). CEO individual CEOs compensation sample of firms with

Materialism and in explaining firms materialistic

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

Corporate Social corporate social Independent: Firm CEOs are

Responsibility, 0–69. responsibility Performance unrelated to

(CSR) scores. We profitability on

average;

however this

association is

decreasing in

CEO power.

9 Cooper, E. (2017). Corporate to explore the support for the Dependent a large Firms with

social responsibility , research question stakeholder variable: CEO sample of better social

gender , and CEO whether corporate theory of CSR turnover firms over a performance

turnover. social and does not 21-year have higher

responsibility support period from rates of CEO

https://doi.org/10.1108/

(CSR) and gender entrenchment 1992 to 2013 turnover,

MF-02-2016-0049 influence the theory taken from performance

likelihood of firms cross- notwithstanding.

CEO turnover listed in the Further, for

ESG STATS, firms with

Execucomp, decreasing

and financial

Compustat performance, it

databases. is more likely

they will replace

their CEO if

they have strong

CSR vs firms

with weak CSR

records

10 Miles, P. C., & Miles, G. to explore Agency Theory CEO remuneration 1000 results indicate

(2013). Corporate social whether socially Company companies that companies

responsibility and responsible firms performance pulled from identified as

executive compensation : recognize the across more good corporate

exploring the link, 9(1), potential conflicts than 15 social

that come with industries performers do in

76–90. higher levels fact have lower

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

https://doi.org/10.1108/1 ofexecutive levels of

7471111311307822 compensation, executive

and thus limit compensation

executive pay and there is

relative to what is some support

being paid in found for a

other firms positive

relationship

between social

and financial

performance

11 Ju Ahmad, N., Ahmad, J., to examine the Agency Theory Independent companies implies that dual

Rashid, A., & Gow, J. impact of CEO Stewardship Variable: CEO listed on the leadership

(2017). CEO Duality and duality on Theory duality Main Market structure

Corporate Social Corporate Social of Bursa reduces checks

Responsibility Dependent Malaysia and balance and

Responsibility

(CSR) reporting variable: Content from 2008 makes CEOs

Reporting : Evidence by public listed analysis until 2013. less accountable

from Malaysia, 14(2), companies in to all

69–81. Malaysia. stakeholders. As

https://doi.org/10.22495/ for regulators,

cocv14i2art7 this study will

provide valuable

input to assist in

their continuous

efforts to

improve

corporate

governance and

social

responsibility

practices that

may promote

the interest of

all stakeholders.

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

12 Bezuidenhout, M. L. (2016). The main purpose Agency Theory Dependent secondary there is a

The relationship between of the study was Stewardship Variables: The data from the relationship

CEO remuneration and to determine Theory components of annual between CEO

company performance in whether there is a CEO remuneration reports of 18 remuneration

South African state- relationship will be the Schedule 2 and company

between CEOs’ SOEs. performance

owned entities, remuneration and Independent (mainly an

(November). company Variables : inverse

performance in Company relationship),

South Africa’s performance with no

Schedule 2 SOEs. CEO demographic consistent trend

Company Size between the

constructs

13 Fabrizi, M., & Mallin, C. explore the role of Agency theory the model with sample of both monetary

(2012). The role of Chief Executive CSR as dependent 597 US firms and non-

CEO’s personal Officers’ (CEOs’) variable over the monetary

incentives in driving incentives, split period 2005- incentives have

between monetary 2009. an effect on

corporate social

and non-monetary CSR decisions.

responsibility Michele (career concerns, Specifically,

Fabrizi, (September). incoming/departin monetary

g CEOs, power incentives

and designed to

entrenchment) in align the CEO’s

relation to and

corporate social shareholders’

responsibility interests have a

(CSR). negative effect

on CSR and

non-monetary

incentives have

a positive effect

on CSR.

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

14 Heron, N. M. (2016). An examines the Agency theory CEO compensation a sample of no significant

Analysis of the relationship Stewardship and CSR US firms for association. then

Relationship between between CEO Theory Disclosure the period disaggregate the

CEO Compensation and compensation and 2007 through CSR firms by

Corporate Social corporate social 2014 disclosure type

responsibility and provide

Responsibility (CSR) disclosure evidence that:

Disclosure Type and type and quality. (1) relative to

Quality. non-CSR firms,

CEO

compensation is

lower in firms

providing only

corporate

governance-

related CSR

disclosures; (2)

CEO

compensation is

higher in firms

providing both

corporate

governance-

related and

social-related

CSR disclosure,

as compared to

firms providing

only corporate

governance-

related CSR

disclosure

15 Isaksson, L. (2010). “ investigated Market Independent firms were found predictive

Corporate Social publicly traded Orientation Variable: CSR all listed on support that

Responsibility : A Study multi-national Theory the enables

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

of Strategic Management enterprises Communication Stockholm practitioners and

and Performance in (MNE’s) on the Timing stock academics to

Swedish Firms ”. Bond Stockholm Stock Since exchange and assess how their

University School of Exchange represented firm could

Business “ Corporate Index Variable: on the Index. structure (how

CSR This to specifically

Social Responsibility : A Dependent ‘set-up’) their

Study of Strategic Variable: Firm external- and

Management and Performance The internal

Performance in Swedish orientation to

Firms ”. Control Variable: increase their

Firm Size level of CSR.

16 Al, H., & Mahbub, S. (2017). examines the Agency Theory controlling for f UK the potential of

CEO Compensation and relationship governance and FTSE350 assured

Sustainability Reporting between firm characteristics, companies sustainability

Assurance : Evidence sustainability for 2011– reports in

from the UK. Journal of committees and 2015 assessing CEO

independent performance in

Business Ethics, external assurance sustainability-

(0123456789). on the inclusion related tasks,

https://doi.org/10.1007/s of sustainability- especially when

10551-017-3735-8 related targets in sustainability

CEO metrics are

compensation included in CEO

contracts. compensation

contracts.

Overall, our

results suggest

companies that

invest in

voluntary assur-

ance are more

likely to monitor

management’s

behaviour and

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

be concerned

about the

achievement of

sustainability

goals.compensat

ion contracts.

Sustainability-

related

17 Hong, B., Li, Z., & Minor, D. to derive Social network CSR level- top five corporate

(2016). Corporate theoretical theory dependent variable executives governance as a

Governance and predictions about working at determinant of

Executive Compensation the relationship Independent each firm in managerial

between corporate variables: the Standard incentives for

for Corporate Social

gov- ernance and Executive and Poor’s social perfor-

Responsibility. Journal the existence of characteristics 500 Index mance, and

of Business Ethics, executive Firm characteristics (S&P 500) suggest that

136(1), 199–213. compensation Governance CSR activities

https://doi.org/10.1007/s incentives for characteristics are more likely

10551-015-2962-0 CSR. to be beneficial

to shareholders,

as opposed to an

agency cost.

18 Bian, C. (2016). CEO Option aims at examining Tobin’s Q Dependent : 137 largest The results also

Incentives, Firm Risk- the effects of executive (by market document

Taking and Shareholder Chief Executive compensation capitalisation positive

Value: Evidence from Officers’ (CEOs) ) Australian association

option incentives Independent: public firms, between CER

Australia.

on corporate risk- Managerial for the period and CFP only in

taking and share Characteristics 2003 to 2012 an industry’s

market cooling-off

performance period.

based

19 Kang, J. (2010). The Influence examine the role Stakeholder Dependent social temporal

of Ceo Decision-Making of CEOs and theory Variable: Financial performance difference in

and Corporate Strategy corporate Performance data for the financial

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

on Corporate Social diversification on sample firms performance

Performance The corporate social Explanatory were and change

Influence of Ceo performance Variable : collected in stakeholder

Decision-Making and (CSP). Corporate social from the perceptions

Corporate Strategy on. performance (CSP) Kinder, toward CSP, can

Lydenberg, help researchers

Domini uncover fine-

(KLD) Social grained

Ratings relationships

database, between CSP

and financial

performance.

20 Pastorelli, R. (2014). Master to analyse the link Stakeholder Dependent Using a CEOs is

Dissertation CEO between CEOs Theory Variables: sample of 25 negatively

Characteristics and Firm characteristics -environmental firms from correlated with

CSR practices Author : and score the French their chances to

Romain Pastorelli organizational -social score CAC 40 over carry

outcomes, a seven-year environmental

Advisor : Martin especially CEOs’ Independent period CSR practices.

Goossen May 2014, likeliness to carry Variables: 2004 to 2010 the effect of

(May), 0–47. out corporate -CEO education CEO

https://doi.org/10.13140/ social -Nobility characteristics

2.1.3677.6008 responsibility -political on firm social

(CSR) connection and

environmental

strategy. It also

contributes to

the literature on

corporate social

responsibility by

identifying the

CEO as an

important

antecedent of

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

firm CSR

practices

21 Mohammad, S. (2016). study the Legitimacy The independent 50 top listed companies listed

Corporate social Corporate Social Theory variable: company companies in in FTSE4Good

disclosure by the top Disclosure (CSD) ownership Malaysia Index and

malaysian listed report structure, the age of government-

companies. companies or related

businesses , or companies were

either it is listed in significantly

the FTSE4Good positive with

Index and extended dependant

reports variable of

Corporate

Social

Disclosure

(CSD).

Environment of

workplace and

Community

were also one of

the factors

having high

information in

Extended

Report of

company

samples.

22 Cieślak, K. (2018). Agency Relationship Agency theory The dependent 2465 firm- Type II agency

conflicts , executive between Agency variable is the yea, Swedish conflicts

compensation conflicts, natural logarithm of listed firms between

regulations and CEO pay executive the CEO total pay in the years controlling and

‑ performance compensation 2001–2013 non-controlling

regulations and The independent share- holders

sensitivity : evidence. CEO variables are are potentially

Journal of Management defined as follows: important for

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

and Governance, 22(3), pay‑performance StockRet: the many European

535–563. sensitivity annual stock price companies

https://doi.org/10.1007/s return, ROA: return

10997-018-9410-3 on assets

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

CSR AND EARNING MANAGEMENT

Reference Objectives Theory/ Model Variables Sample Findings Remarks

1 Laux, C., & Laux, V. (2009). analyze the board show that an

Board Committees, of directors' increase in CEO

CEO Compensation, and equilibrium equity incentives

Earnings strategies for does not

setting CEO necessarily

Management. The

incentive pay and increase earnings

Accounting overseeing management

Review, 84(3), 869-891. financial because directors

Retrieved from reporting and adjust their

http://www.jstor.org/stab their effects on oversight effort in

le/27784197 the level of response to a

earnings change in CEO

management. incentives

2 Hassen, R. B. E. N. (2014). to examine one of Model: Dependent : French Show that This journal

Executive compensation the motivations Model of The absolute value companies executive focusing on

and earning that could Dechow and of accruals listed on compensation is few things

management, 4(1), 84– encourage Dichev (2002), the SBF determined by the which are

managers to modified by Independent: 120, (2007 requirements of -Performance

105.

manage the Ball and -The total to 2010) earning (ROI)

https://doi.org/10.5296/ij accounting Shivakumar remuneration of Eliminated management. -The size of

afr.v4i1.5453 results, namely (2005b). directors financial firm

the managerial -The variable institutions It is indicate that -The share

remuneration. Jones model remuneration of and firms total leader

(Absolute value directors with compensation is -Growth

of accruals) missing negatively related -Opportunities

Control Variable: data. to the absolute -Cashflows

Theory : -Performance value of accruals. -Auditor

-agency theory (ROI) Finally 80

-contractual -The size of firm companies

political theory -The share leader to be tested

-Growth

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

-Opportunities

-Cashflows

-Auditor

3 Zulfiqar, S., Shah, A., & Butt, Examines the Modified Cross Dependent Variable 53 listed Quality of This journal

S. A. (2014). Corporate relationship Sectional Jones : companies corporate focusing on

Governance and between quality Model Discretionary Excluded governance has few things

Earnings Management an of Corporate accruals financial been found which are

Governance and institutions significantly -Performance

Empirical Evidence

Earnings Independent and firms positively related -Auditor

Form Pakistani Listed

Management Variable: with with

Companies, (January quality of corporate missing discretionary Basically this

2009). Governance data. accruals journal is not

which means covering many

quality of elements as

corporate Hassen, R. B.

governance is E. N. (2014)

positively and the sample

related with is small.

earnings

management

4 Klerk, M. De, & Villiers, C. Examines one Model: Social Responsible 214 Companies with

De. (2018). Corporate type of corporate used a modified Investment and companies better CSR

social responsibility and misconduct, Jones’ (1991) CSR performance in Africa performance were

earnings management of namely, earnings model as (KIV) by Industry more likely to

management specified by engage in EM

South African

Dechow, Sloan through income

companies, (March). and Sweeney increasing

https://doi.org/10.4102/s (1995) discretionary

ajems.v21i1.1849 accruals. This

suggests that

managers who

inflate earnings

may engage in

CSR activities to

avoid unwanted

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

scrutiny from

stakeholders.

5 Chih, H., Shen, C., & Kang, F. To investigate Econometric EM, CSR, Investor 1,653 a firm with CSR

(2016). Corporate Social whether the CSR- model protection and firm corporation in mind tends not

Responsibility, Investor related features of specific financial s in 46 to smooth

Protection, and Earnings 1,653 variables across countries earnings, and

Corporate Social corporations in 46 firms of 46 displays less

countries had a countries. interest in

Responsibility, Investor positive or CSR, Investor

Protection, and Earnings negative effect on Protection and

Management : Some the quality of Earnings

International Evidence, their publicly Management 195

(February released financial avoiding earnings

2008).https://doi.org/10. information losses and

1007/s10551-007-9383- during the 1993– decreases. It is,

7 2002 period. however,

prone to engage

in more earnings

aggressiveness,

but this tendency

can be mitigated

in a country

with strong legal

enforcement.

6 Yin, J. (2018). The Effects of examines the modified Jones Dependent Variable 2640 firms Chinese firms’

Corporate Social relationship model REM & AEM from year enhanced CSR

Responsibility on Real between Chinese Real Earning 2009-2014 generally

and Accrual-based firms’ corporate Management and decreases their

Earnings Management : social Accrual Earning EM practices.

responsibility Management On the contrary,

Evidence from China : (CSR) and their state-controlled

CSR and Real- and earnings firms and firms

Accrual-based Earnings management operating in more

Management, (May). (EM) practices. institutionally

https://doi.org/10.1111/a

NAME: SITI SARAH BINTI ISKANDAR SHAH

REG NUMBER: M20181001447

uar.12235 developed regions

are more

likely to engage

in REM, while

increasing their

CSR activities.

These findings

provide new

evidence that

managers in

Chinese firms

tend to

opportunistically

adopt CSR

practices

according to the

firm’s

institutional

environment.

You might also like

- Effect of Corporate Social Responsibility Scores On Bank Efficiency: The Moderating Role of Institutional ContextDocument13 pagesEffect of Corporate Social Responsibility Scores On Bank Efficiency: The Moderating Role of Institutional ContextWihelmina DeaNo ratings yet

- The Academy of Management JournalDocument8 pagesThe Academy of Management JournalWanita DewkalieNo ratings yet

- Area of Research Objectives of PaperDocument2 pagesArea of Research Objectives of PaperVishesh GuptaNo ratings yet

- Corporate Social Responsibility and CEO Compensation StructureDocument15 pagesCorporate Social Responsibility and CEO Compensation StructuredessyNo ratings yet

- Boğan & Dedeoğlu 2019Document18 pagesBoğan & Dedeoğlu 2019Beytullah YıldırımNo ratings yet

- Linking Corporate Social Responsibility (CSR) and Organizational Performance: The Moderating Effect of Corporate ReputationDocument10 pagesLinking Corporate Social Responsibility (CSR) and Organizational Performance: The Moderating Effect of Corporate ReputationAyu MonalisaNo ratings yet

- 6 ManagerialeffectDocument14 pages6 ManagerialeffectBrenda Hernandez LarreaNo ratings yet

- Kusi Et Al 2021Document18 pagesKusi Et Al 2021Đông TàNo ratings yet

- ESG Rating and Ownership Structure in U.S. FirmsDocument26 pagesESG Rating and Ownership Structure in U.S. FirmsadsxzNo ratings yet

- 12 Ijmres 10012020Document9 pages12 Ijmres 10012020International Journal of Management Research and Emerging SciencesNo ratings yet

- The Impact of Environmental, Social and GovernanceDocument8 pagesThe Impact of Environmental, Social and GovernanceEleven Schienza UnoNo ratings yet

- Green HR Research TableDocument4 pagesGreen HR Research TableJabed HossainNo ratings yet

- Corporate Social Responsibility in Agro Processing and Garment Industry Evidence From EthiopiaDocument26 pagesCorporate Social Responsibility in Agro Processing and Garment Industry Evidence From EthiopiaLOUIS OPPONGNo ratings yet

- Accounting Performance and Executive Compensation of Nigerian Listed BanksDocument16 pagesAccounting Performance and Executive Compensation of Nigerian Listed BanksrudyhanandaNo ratings yet

- Corporate Governance and Corporate Social ResponsibilityDocument1 pageCorporate Governance and Corporate Social ResponsibilityMiguel VienesNo ratings yet

- 2009 - Berrone, P., & Gomez-Mejia - Environmental Performance and Executive Compensation An Integrated Agency-Institutional PerspectiveDocument25 pages2009 - Berrone, P., & Gomez-Mejia - Environmental Performance and Executive Compensation An Integrated Agency-Institutional Perspectiveahmed sharkasNo ratings yet

- Corporate Social and Financial Performance: An Extended Stakeholder Theory, and Empirical Test With Accounting MeasuresDocument12 pagesCorporate Social and Financial Performance: An Extended Stakeholder Theory, and Empirical Test With Accounting MeasuresAfif MusthafaNo ratings yet

- Kuala Lumpur Stock ExchangeDocument2 pagesKuala Lumpur Stock ExchangeDaniel RoberthoNo ratings yet

- Literature Review - 20202126Document10 pagesLiterature Review - 20202126ayushi biswasNo ratings yet

- Journal of Business ResearchDocument13 pagesJournal of Business ResearchCao Lê Hoàng Oanh (FAI HCM)No ratings yet

- Neville Bell Meng Uc 05 On Corporate ReputationDocument15 pagesNeville Bell Meng Uc 05 On Corporate ReputationKhadra HalataaNo ratings yet

- Corporate Social Responsibility's Influence On Firm Risk and Firm Performance: The Mediating Role of Firm ReputationDocument15 pagesCorporate Social Responsibility's Influence On Firm Risk and Firm Performance: The Mediating Role of Firm ReputationabdullahNo ratings yet

- Relations SocialesDocument28 pagesRelations SocialesoussamaNo ratings yet

- Resource Orchestration in Business Ecosystem - RezaDocument24 pagesResource Orchestration in Business Ecosystem - RezaAsyrafinafilah HasanawiNo ratings yet

- Job Satisfaction Effort and Performance A ReasonedDocument14 pagesJob Satisfaction Effort and Performance A ReasonedMariam DatusaniNo ratings yet

- 2020 Corporate Social ResponsibilityDocument17 pages2020 Corporate Social ResponsibilityAhmed EldemiryNo ratings yet

- Area of Research Objectives of Paper Research ProblemDocument2 pagesArea of Research Objectives of Paper Research ProblemVishesh GuptaNo ratings yet

- JSBED-2-Resource Type and SME Alliance Formation - The Contingent Role of Perceived Environmental UncertaintyDocument18 pagesJSBED-2-Resource Type and SME Alliance Formation - The Contingent Role of Perceived Environmental UncertaintyUSMAN SARWARNo ratings yet

- Journal of Business Research: David Han-Min Wang, Pei-Hua Chen, Tiffany Hui-Kuang Yu, Chih-Yi HsiaoDocument5 pagesJournal of Business Research: David Han-Min Wang, Pei-Hua Chen, Tiffany Hui-Kuang Yu, Chih-Yi HsiaoSabil Al RasyadNo ratings yet

- Base Paper Employer BrandingDocument13 pagesBase Paper Employer BrandingA K SubramaniNo ratings yet

- ESG Framework Metrics - Day 1Document32 pagesESG Framework Metrics - Day 1Mallikarjun GuttulaNo ratings yet

- The Effects of Customer Relationships and Social Capital On Firm Performance - LUO Et Al - 2004Document22 pagesThe Effects of Customer Relationships and Social Capital On Firm Performance - LUO Et Al - 2004trihaminhNo ratings yet

- Srinivasan 2014Document19 pagesSrinivasan 2014Ervin ChaiNo ratings yet

- Jebv Vol 4 Issue 1 2024 14Document16 pagesJebv Vol 4 Issue 1 2024 14Journal of Entrepreneurship and Business VenturingNo ratings yet

- CSR & FinancialperformanceDocument19 pagesCSR & FinancialperformanceHarshika VermaNo ratings yet

- Article 4 Corporate GovernanceDocument17 pagesArticle 4 Corporate GovernanceAayushCNo ratings yet

- Aouadi & Marsat, 2016Document22 pagesAouadi & Marsat, 2016Chantal DeLarentaNo ratings yet

- Relationship Between Managerial Ownership and Agency CostsDocument9 pagesRelationship Between Managerial Ownership and Agency CostsDr Shubhi AgarwalNo ratings yet

- Corporate Sustainability Reporting Linkage of Corporate Disclosure Information and Performance IndicatorsDocument22 pagesCorporate Sustainability Reporting Linkage of Corporate Disclosure Information and Performance IndicatorsFairly 288No ratings yet

- Jurnal SageDocument37 pagesJurnal SagePadlah Riyadi. SE., Ak., CA., MM.No ratings yet

- Association Between Corporate Social Responsibility and Firm Performance With Moderating Effects of Ceo Power: Empirical Evidence From Developing NationDocument3 pagesAssociation Between Corporate Social Responsibility and Firm Performance With Moderating Effects of Ceo Power: Empirical Evidence From Developing NationRuth NataliaNo ratings yet

- S07 Sustainability Practices and Corporate Financial PerformanceDocument20 pagesS07 Sustainability Practices and Corporate Financial PerformanceCarlos Hernandez De La TorreNo ratings yet

- Chap 5Document21 pagesChap 5Huyền PhạmNo ratings yet

- CSR 1Document17 pagesCSR 1Erika FabNo ratings yet

- Sage Publications, Inc., Johnson Graduate School of Management, Cornell University Administrative Science QuarterlyDocument18 pagesSage Publications, Inc., Johnson Graduate School of Management, Cornell University Administrative Science QuarterlyMustajab Ahmed SoomroNo ratings yet

- 2019-Maon Et Al-The Dark Side of Stakeholder Reactions Tocorporate Social Responsibility - Tensionsand Micro-Level Undesirable OutcomesDocument22 pages2019-Maon Et Al-The Dark Side of Stakeholder Reactions Tocorporate Social Responsibility - Tensionsand Micro-Level Undesirable OutcomesDuaa ZahraNo ratings yet

- 2019-Maon Et Al-The Dark Side of Stakeholder Reactions ToCorporate Social Responsibility - Tensionsand Micro-Level Undesirable OutcomesDocument22 pages2019-Maon Et Al-The Dark Side of Stakeholder Reactions ToCorporate Social Responsibility - Tensionsand Micro-Level Undesirable OutcomesDuaa ZahraNo ratings yet

- The State of Environmental Performance TrackingDocument2 pagesThe State of Environmental Performance TrackingEndah YulitaNo ratings yet

- The Role of I-Deals Negotiated by Small Business Managers in Job Satisfaction and Firm Performance - Do Company Ethics Matter?Document9 pagesThe Role of I-Deals Negotiated by Small Business Managers in Job Satisfaction and Firm Performance - Do Company Ethics Matter?Sandro CunhaNo ratings yet

- Paper35 PDFDocument7 pagesPaper35 PDFArlete AbreuNo ratings yet

- Orsato Sensitive I - 1-S2.0-S0959652617304067-MainDocument13 pagesOrsato Sensitive I - 1-S2.0-S0959652617304067-MainGutoZak GamesNo ratings yet

- Guidelines For Presentation Slides For Final Viva VoceDocument26 pagesGuidelines For Presentation Slides For Final Viva VoceMiki AberaNo ratings yet

- Impact of Working Environment On Job SatisfactionDocument6 pagesImpact of Working Environment On Job SatisfactionElena StroeNo ratings yet

- Corporate Governance Characteristics and Environmental, Social & Governance (ESG) Performance: Evidence From The Banking Sector of PakistanDocument16 pagesCorporate Governance Characteristics and Environmental, Social & Governance (ESG) Performance: Evidence From The Banking Sector of PakistanAbdul basitNo ratings yet

- Final Project - CSRDocument14 pagesFinal Project - CSRshanice hart100% (4)

- In Uence of Corporate Social Responsibility On Organizational PerformanceDocument26 pagesIn Uence of Corporate Social Responsibility On Organizational PerformanceMahmoud YagoubiNo ratings yet

- Principles - of - Sustainable - Finance - (Part - II - Sustainability S - Challenges - To - Corporates) - 2Document27 pagesPrinciples - of - Sustainable - Finance - (Part - II - Sustainability S - Challenges - To - Corporates) - 2SebastianCasanovaCastañedaNo ratings yet

- 10 1108 - Ejms 10 2022 0065Document20 pages10 1108 - Ejms 10 2022 0065Aubin DiffoNo ratings yet

- Leadership: Chapter 1 - Leadership, Strategy and CultureDocument11 pagesLeadership: Chapter 1 - Leadership, Strategy and CultureHrishikesh MsNo ratings yet

- Key Journal Compensation & CSRDocument10 pagesKey Journal Compensation & CSRsiti_sarah146No ratings yet

- RESUME - Siti SarahDocument2 pagesRESUME - Siti Sarahsiti_sarah146No ratings yet

- Full ThesisDocument36 pagesFull Thesissiti_sarah146No ratings yet

- Proposal SarahDocument1 pageProposal Sarahsiti_sarah146No ratings yet

- Oligopoly CharacteristicsDocument2 pagesOligopoly Characteristicssiti_sarah146No ratings yet

- Theories of Corporate GovernanceDocument10 pagesTheories of Corporate GovernanceEdiliza DuhaylungsodNo ratings yet

- CFA L1 2023 FSA Corporate Issuers Fintree JuiceNotesDocument92 pagesCFA L1 2023 FSA Corporate Issuers Fintree JuiceNotesThanh Nguyễn100% (3)

- Subsequent To Date of AcquisitionDocument10 pagesSubsequent To Date of AcquisitionKRABBYPATTY PHNo ratings yet

- What Is Corporate Governance?: Key TakeawaysDocument1 pageWhat Is Corporate Governance?: Key TakeawaysFatima TawasilNo ratings yet

- Finman ReviewerDocument89 pagesFinman Reviewersharon5lotino100% (1)

- Chapter 16 The Corporate Form Operational MattersDocument18 pagesChapter 16 The Corporate Form Operational Mattersshazada shakirNo ratings yet

- Duyao - Yvonne Antonette - M4AssgnmentDocument9 pagesDuyao - Yvonne Antonette - M4AssgnmentYvonne DuyaoNo ratings yet

- Meetings of CompanyDocument2 pagesMeetings of CompanySohaibNo ratings yet

- LW-GLO - Mock TestDocument18 pagesLW-GLO - Mock Testthaisonbui3103workNo ratings yet

- The Riddle of Shareholder Rights and Corporate Social ResponsibilDocument44 pagesThe Riddle of Shareholder Rights and Corporate Social Responsibiltalk2marvin70No ratings yet

- The Corporation Code of The Philippines B.P. Blg. 68: Title 1 General Provisions Definitions and ClassificationsDocument7 pagesThe Corporation Code of The Philippines B.P. Blg. 68: Title 1 General Provisions Definitions and ClassificationsKarl KiwisNo ratings yet

- Marketable Securities PDFDocument4 pagesMarketable Securities PDFabdullah abidNo ratings yet

- HW 0309Document3 pagesHW 0309Ajeng RaraNo ratings yet

- SML AR 2017 (Final) Low ResDocument178 pagesSML AR 2017 (Final) Low ResRatih Q AnjilniNo ratings yet

- Background - Venture Capital and Stages of Financing (Ross - 7th Edition) Venture CapitalDocument8 pagesBackground - Venture Capital and Stages of Financing (Ross - 7th Edition) Venture CapitalDaniel GaoNo ratings yet

- Identification of Cash Flows: Example 1.1Document2 pagesIdentification of Cash Flows: Example 1.1Angel RodriguezNo ratings yet

- 226 Rural Bank of Lipa v. CADocument4 pages226 Rural Bank of Lipa v. CAmiyumiNo ratings yet

- Teletech Corp SolutionDocument4 pagesTeletech Corp SolutionElaine Wong100% (1)

- Corporate Governance: Theory and Practice: Dr. Malek Lashgari, CFA, University of Hartford, West Hartford, CTDocument7 pagesCorporate Governance: Theory and Practice: Dr. Malek Lashgari, CFA, University of Hartford, West Hartford, CTNaod MekonnenNo ratings yet

- B. False: Incorrect-Answer Ko Na MaliDocument4 pagesB. False: Incorrect-Answer Ko Na Malijr centenoNo ratings yet

- Midterm Examination AnswersDocument3 pagesMidterm Examination AnswersMilani Joy LazoNo ratings yet

- AKL - Chapter 11Document22 pagesAKL - Chapter 11yesNo ratings yet

- Supermax 2021Document122 pagesSupermax 2021James WarrenNo ratings yet

- One Dividend Policy by An Organization - Team 2Document15 pagesOne Dividend Policy by An Organization - Team 2Aishwarya KulkarniNo ratings yet

- Accounting ExercisesDocument17 pagesAccounting ExercisesKarenNo ratings yet

- UP BOC Commercial Law LMTDocument30 pagesUP BOC Commercial Law LMTJul A.No ratings yet

- Egaña, Jericho A. - Activity #1Document3 pagesEgaña, Jericho A. - Activity #1Jericho EganaNo ratings yet

- Business Law Mockboard 2013 With AnswersDocument7 pagesBusiness Law Mockboard 2013 With AnswersKyla DizonNo ratings yet

- A Handbook On Corporate GovernanceDocument191 pagesA Handbook On Corporate GovernanceVickyVenkataramanNo ratings yet

- Business Organizations Law School OutlineDocument28 pagesBusiness Organizations Law School OutlineSierra McGinn Smith75% (8)