Professional Documents

Culture Documents

Manner of Filing and Payment of Income Tax Returns For Taxable Year 2018 PDF

Manner of Filing and Payment of Income Tax Returns For Taxable Year 2018 PDF

Uploaded by

RAS Consultancy0 ratings0% found this document useful (0 votes)

16 views1 pageOriginal Title

Manner of Filing and Payment of Income Tax Returns for Taxable Year 2018.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageManner of Filing and Payment of Income Tax Returns For Taxable Year 2018 PDF

Manner of Filing and Payment of Income Tax Returns For Taxable Year 2018 PDF

Uploaded by

RAS ConsultancyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

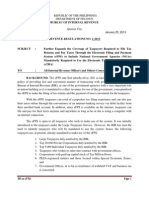

MANNER OF FILING AND PAYMENT OF INCOME TAX RETURNS FOR TAXABLE YEAR 2018

BIR FORM WORK AROUND PROCEDURE

DESCRIPTION

NO. FILING PAYMENT

1700 Annual Income Tax Return – Individuals Earning Use manual return (download the form in the BIR website under

January 2018 (ENCS) Purely Compensation Income (Including Non- the BIR Forms-Income Tax Return section) and manually file the I. Manual and eBIRForms-mandated Filers

Business/Non-Profession Income) return: a.) Manual Payment-

With tax due – file with any AAB located within the jurisdiction Authorized Agent Bank (AAB) located

of the RDO where the taxpayer is registered within the territorial jurisdiction of the

Without tax due/payment – file in the RDO/RCO where the Revenue District Office (RDO) where the

taxpayer is registered taxpayer is registered.

1701 Annual Income Tax Return for Individuals (including In places where there are no AABs, the

January 2018 (ENCS) MIXED Income Earner), Estates and Trusts return shall be filed and the tax due shall

Use eBIRForms Offline Packagev7.4 to file the return (Manual, be paid with the concerned Revenue

1701A (NEW) Annual Income Tax Return for Individuals Earning

eBIRForms and eFPS Filers) Collection Officer (RCO) under the

Income PURELY from Business/Profession (Those

With tax due – file with any AAB located within the jurisdiction jurisdiction of the RDO using MRCOS

January 2018 under the graduated income tax rates with Optional

of the RDO where the taxpayer is registered facility.

Standard Deduction (OSD) as mode of deductions

Without tax due/payment – file thru the eBIRForms System

OR those who opted to avail of the 8% flat income

tax rate) b.) Online Payment-

Thru GCash Mobile Payment

1702-RT Annual Income Tax Return – Corporation, Manual Filers - use the newly revised return Landbank of the Philippines (LBP) Linkbiz

January 2018 (ENCS) Partnership and Other Non-Individual Taxpayer With tax due – file with any AAB located within the jurisdiction Portal, for taxpayers who have ATM

Subject Only to REGULAR Income Tax Rate of the RDO where the taxpayer is registered account with LBP and/or holders of

Without tax due/payment – file thru the eBIRorms System Bancnet ATM/Debit Card

1702-EX Annual Income Tax Return – Corporation, eBIRForms-mandated Filers – use the existing/old version of the DBP Tax Online, for holders of VISA/

January 2018 (ENCS) Partnership and Other Non-Individual Taxpayer form in the latest eBIRForms Offline Package Master Credit Card and/or Bancnet

EXEMPT under the Tax Code, as amended [Section With tax due – file with any AAB located within the ATM/ Debit Card

30 and those exempted in Sec. 27 (C)], and Other jurisdiction of the RDO where the taxpayer is registered

Special Laws, with NO Other Taxable Income. Without tax due/payment – file thru the eBIRForms System

eFPS-mandated Filers

Use the existing/old version of the form in eFPS II. eFPS-mandated Filers

ePay thru the eFPS Facility

1702-MX Annual Income Tax Return for Corporation, Manual Filers – use the new return

January 2018 (ENCS) Partnership and Other Non-Individual with MIXED • With tax due – file with any AAB located within the jurisdiction

Income Subject to Multiple Income Tax Rates or with of the RDO where the taxpayer is registered

Income Subject to SPECIAL/ PREFERENTIAL RATE • Without tax due/payment – file in the RDO/RCO where the

taxpayer is registered

eBIRForms-mandated Filers – use the existing/old version of the

form in the latest eBIRForms Offline Package except for those

availing of OSD for the regular tax regime which shall use the

new return and file manually

With tax due – file with any AAB located within the

jurisdiction of the RDO where the taxpayer is registered

Without tax due/payment – file thru the eBIRForms System

eFPS-mandated Filers

Use the existing/old version of the form in eFPS except for

those availing of OSD for the regular tax regime which shall

use the new return and file manually

You might also like

- Exercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingDocument4 pagesExercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingCynthia WongNo ratings yet

- Operations Memo 2016-04-01Document7 pagesOperations Memo 2016-04-01Renniel DimalantaNo ratings yet

- Question and Answer - 57Document30 pagesQuestion and Answer - 57acc-expert100% (1)

- Annex "A": Filing and Payment of Income Tax Returns For Taxable Year 2018Document1 pageAnnex "A": Filing and Payment of Income Tax Returns For Taxable Year 2018Md PrejulesNo ratings yet

- RMC No. 44-2022 Annex A (Manner of Filing of AITR)Document2 pagesRMC No. 44-2022 Annex A (Manner of Filing of AITR)wendy lynn amanteNo ratings yet

- RMC No. 42-2020 Annex ADocument1 pageRMC No. 42-2020 Annex Acris gerard trinidadNo ratings yet

- 325862-2022-Guidelines in The Filing of Annual Income Tax20220719-11-Pqk5qxDocument3 pages325862-2022-Guidelines in The Filing of Annual Income Tax20220719-11-Pqk5qxRen Mar CruzNo ratings yet

- Revenue Memorandum Circular No. 17-2019: SubjectDocument3 pagesRevenue Memorandum Circular No. 17-2019: SubjecttarteinNo ratings yet

- RMC No 32-2018 PDFDocument4 pagesRMC No 32-2018 PDFzooeyNo ratings yet

- Revenue Memorandum Circular No. 24-2018 Subject:: Bureau of Internal RevenueDocument6 pagesRevenue Memorandum Circular No. 24-2018 Subject:: Bureau of Internal RevenuePaul GeorgeNo ratings yet

- RMC No 24-2018 (Guidelines For FS)Document6 pagesRMC No 24-2018 (Guidelines For FS)GoogleNo ratings yet

- Rdo 56 - Guidelines For Itr FilingDocument64 pagesRdo 56 - Guidelines For Itr FilingrandolphsabenorioNo ratings yet

- RMC 37-2019Document1 pageRMC 37-2019Lhance BabacNo ratings yet

- Filing of Income Tax ReturnDocument11 pagesFiling of Income Tax Returnkirko100% (1)

- RMC 88-2018Document1 pageRMC 88-2018KevinPesaseNo ratings yet

- RMC No. 40-2023Document1 pageRMC No. 40-2023Nadine CruzNo ratings yet

- Revenue Memorandum Circular No. 26-2018: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 26-2018: Bureau of Internal RevenuePaul GeorgeNo ratings yet

- BIR 2019 Income Tax DescriptionDocument20 pagesBIR 2019 Income Tax DescriptionRiselle Ann SanchezNo ratings yet

- Ta081 2023Document1 pageTa081 2023sandraNo ratings yet

- 1702 RTsasaDocument4 pages1702 RTsasaEysOc11No ratings yet

- 1702-MX June 2013 GuidelinesDocument4 pages1702-MX June 2013 GuidelinesvicsNo ratings yet

- Guidelines and Instruction For BIR Form No. 1701: - Who Shall File? - When and Where To File and PayDocument5 pagesGuidelines and Instruction For BIR Form No. 1701: - Who Shall File? - When and Where To File and Payromeojr sibullasNo ratings yet

- RMC No. 73-2018Document3 pagesRMC No. 73-2018Madi KomoaNo ratings yet

- Module 7 TAXDocument8 pagesModule 7 TAXgracevylmae04No ratings yet

- RMC 3-2018 (DST)Document2 pagesRMC 3-2018 (DST)sanNo ratings yet

- RMO No. 5-2002Document13 pagesRMO No. 5-2002lantern san juanNo ratings yet

- Individuals: Income Tax DescriptionDocument17 pagesIndividuals: Income Tax DescriptionMichael Olmedo NeneNo ratings yet

- Filepay Ver2Document1 pageFilepay Ver2Aries ParazoNo ratings yet

- Electronic Filing and Payment SystemDocument33 pagesElectronic Filing and Payment SystemJeannie de leonNo ratings yet

- Tax Reviewer - Train LawDocument8 pagesTax Reviewer - Train LawCelestiaNo ratings yet

- Revenue Regulation 1-2013Document7 pagesRevenue Regulation 1-2013Jerwin DaveNo ratings yet

- Income Tax PDFDocument19 pagesIncome Tax PDFPhia CustodioNo ratings yet

- 29133rmo 10-2006Document15 pages29133rmo 10-2006Denzel Edward CariagaNo ratings yet

- 68120RR 1-2013Document6 pages68120RR 1-2013Allan AlcantaraNo ratings yet

- Index For Income TaxDocument20 pagesIndex For Income TaxMark Joseph BajaNo ratings yet

- Income TaxDocument15 pagesIncome TaxJessNo ratings yet

- TAX-1401 (Income Tax Return & Payment of Tax)Document5 pagesTAX-1401 (Income Tax Return & Payment of Tax)Hilo MethodNo ratings yet

- eFPS eBIR PresentationDocument91 pageseFPS eBIR PresentationMartin LubongNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 2-2018 Issued On January 8, 2018 ProvidesDocument2 pagesREVENUE MEMORANDUM CIRCULAR NO. 2-2018 Issued On January 8, 2018 ProvidesAnonymous HQymOK61No ratings yet

- Income TaxDocument20 pagesIncome TaxEjNo ratings yet

- 68120RR 1-2013 PDFDocument6 pages68120RR 1-2013 PDFandrew estimoNo ratings yet

- Income Tax Description: IndividualsDocument13 pagesIncome Tax Description: IndividualsJAYAR MENDZNo ratings yet

- RMC 19-2015Document9 pagesRMC 19-2015reseljanNo ratings yet

- Income Tax - Bureau of Internal RevenueDocument21 pagesIncome Tax - Bureau of Internal Revenue홍혜연No ratings yet

- Tax Filing Reminders: OutlineDocument30 pagesTax Filing Reminders: OutlineMarc Nathaniel RanayNo ratings yet

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Document9 pagesGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresNo ratings yet

- Accounting Technician Level 3 - Module 3 Part 2Document4 pagesAccounting Technician Level 3 - Module 3 Part 2Rona Amor MundaNo ratings yet

- Bacore 3 Course Packet 2Document15 pagesBacore 3 Course Packet 2Jenifer Borja BacayoNo ratings yet

- Revenue Memorandum Circular No. 37-2019Document2 pagesRevenue Memorandum Circular No. 37-2019Rustan FrozenNo ratings yet

- Income Tax Requirements of Newly Registered OPC As of January 2021Document2 pagesIncome Tax Requirements of Newly Registered OPC As of January 2021mika gutzNo ratings yet

- How To File BIR Form 1700 (Step-By-Step Process)Document5 pagesHow To File BIR Form 1700 (Step-By-Step Process)Nabi HanNo ratings yet

- Bir Form 1702Document16 pagesBir Form 1702Christine Ann GamboaNo ratings yet

- Income TaxDocument14 pagesIncome TaxArielle CabritoNo ratings yet

- Individual CitizenDocument2 pagesIndividual CitizenSky LeeNo ratings yet

- BIR RMC 28-2017 Annex ADocument1 pageBIR RMC 28-2017 Annex AAnonymous yKUdPvwjNo ratings yet

- Income TaxDocument19 pagesIncome TaxJustine BartolomeNo ratings yet

- 7 ElevenDocument17 pages7 ElevenCir Arnold Santos IIINo ratings yet

- Percentage TaxDocument5 pagesPercentage TaxGIGI BODONo ratings yet

- Income, Tax Treatment and Mode of Filing 2020Document2 pagesIncome, Tax Treatment and Mode of Filing 2020francis dungcaNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Chapter - 16 Investors' Protection FundDocument7 pagesChapter - 16 Investors' Protection FundNikhil JoharNo ratings yet

- 04c Receivables (Part 3) With AnswersDocument3 pages04c Receivables (Part 3) With Answershelaihjs100% (1)

- Arvind LTDDocument11 pagesArvind LTDVicky GuleriaNo ratings yet

- Hanuman Gurjar 102Document1 pageHanuman Gurjar 102Bamnawat JasramNo ratings yet

- Cal vs. CML vs. SML: Posted by Bill Campbell III, CFA On September 29, 2013Document4 pagesCal vs. CML vs. SML: Posted by Bill Campbell III, CFA On September 29, 2013IMZNNo ratings yet

- Pension PlanDocument49 pagesPension PlanPriscilla TranNo ratings yet

- Xy95lywmi - Midterm Exam FarDocument12 pagesXy95lywmi - Midterm Exam FarLyra Mae De BotonNo ratings yet

- ACT 2100 Worksheet IIIDocument4 pagesACT 2100 Worksheet IIIAshmini PershadNo ratings yet

- The Philippine Capital Markets and The World Interest Rate: April 2017Document8 pagesThe Philippine Capital Markets and The World Interest Rate: April 2017kim cheNo ratings yet

- Catur Sentosa Adiprana Annual Report 2014 Company Profile Indonesia Investments PDFDocument188 pagesCatur Sentosa Adiprana Annual Report 2014 Company Profile Indonesia Investments PDFDicky AlexNo ratings yet

- Min ZoDocument3 pagesMin ZoaniclazarNo ratings yet

- Risk Management BlackbookDocument80 pagesRisk Management Blackbookjaueshmahale1234No ratings yet

- Shafeek CV NewDocument2 pagesShafeek CV NewMuhammed ShafeekNo ratings yet

- Monopoly ManualDocument4 pagesMonopoly ManualRodlynMendoza100% (1)

- Detailed ResultDocument8 pagesDetailed ResultAmit PalNo ratings yet

- Contrarian CapDocument8 pagesContrarian CapjamesbrentsmithNo ratings yet

- Module 2 FM Pr8 Monetary Policy and Central BankingDocument20 pagesModule 2 FM Pr8 Monetary Policy and Central BankingFranzing LebsNo ratings yet

- ACC 1311 Introduction To Financial AccouDocument67 pagesACC 1311 Introduction To Financial AccouSharon Rose Galope100% (1)

- Conceptual Framework and Accounting Standards - Chapter 2 - NotesDocument5 pagesConceptual Framework and Accounting Standards - Chapter 2 - NotesKhey KheyNo ratings yet

- IndusInd BankDocument37 pagesIndusInd Bankpradyu1990No ratings yet

- Travis Card StatementDocument4 pagesTravis Card StatementPapa BoolioNo ratings yet

- The Complete CPA ReferenceDocument17 pagesThe Complete CPA ReferenceNguyễn Đức Tùng0% (2)

- Theories InvetoriesDocument44 pagesTheories InvetoriesllllNo ratings yet

- An.1 83Document98 pagesAn.1 83Berlinschi DinuNo ratings yet

- The Economics of Money Banking and Financial Markets Seventh Canadian Edition Frederic S Mishkin Full ChapterDocument67 pagesThe Economics of Money Banking and Financial Markets Seventh Canadian Edition Frederic S Mishkin Full Chapterdana.dalke467100% (7)

- FABM2 - 12 - Q1 - Mod4 - Statement-of-Cash-Flow - V5 FSDocument20 pagesFABM2 - 12 - Q1 - Mod4 - Statement-of-Cash-Flow - V5 FSEllah OllicetnomNo ratings yet

- Fixed IncomeDocument118 pagesFixed IncomeYash AgarwalNo ratings yet

- GS Sial - SiDocument24 pagesGS Sial - SiJeremy JiaoNo ratings yet