Professional Documents

Culture Documents

Alaska Paper

Uploaded by

Nicki SalcedoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alaska Paper

Uploaded by

Nicki SalcedoCopyright:

Available Formats

Strategic Management for Alaska Milk Corporation

CHAPTER I - EXECUTIVE SUMMARY

ALASKA MILK CORPORATION (AMC) is a leading milk manufacturer of milk

products in the Philippines. It has established a strong brand heritage and recognition

among Filipino consumers wit its traditional liquid canned milk products, marketed under

the Alaska Brand. In addition, the company has developed a strong competitive position

in the powdered milk category. Alaska Milk Company delivered another year of solid

performance ending 2017, with a net income of P1.87 billion, a 29% improvement over

the 1.41 billion net income earned in 2016. Fueling the growth was the strong sales

volume expansion across the company’s portfolio of milk product alongside lower input

costs as well as prudent spending. Sales/Revenue ending 2017 is P658,153 sales

growth of 16.43%. in addition, sustained advertising campaign and demand-generating

promotional initiatives help push sales volumes higher year on year.

Alaska Milk Corporation current market share, based from its revenue in 2018,

PHP 39.56 billion, is 17.23% in the dairy industry. Its major competitors are Century

Food Pacific Incorporation and Nestle.

A situational analysis, both for the internal and external environment, was made

for Alaska Milk Corporation. It was found out that major strengths of the firm includes a

very well-known and trusted brand, variety of their products, have timely and updated

television and radio advertisement, affordability of the products, innovative

pasteurization and processing of dairy products. Alaska Milk Corporation opportunities

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 1 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

include continuous growth of the population in the country, exporting Alaska products in

other countries, rapid technological advances and product innovation.

By using matrixes to filter appropriate strategy to fulfill Alaska’s objectives

recommended strategy is to continously offer different variety of products using

innovated production process and continous promotion in mainstream media and the

community. Financial and strategic objectives, businesss and organizational strategies,

action plan and programs, and a balances scorecard are further recommended.

CHAPTER II – COMPANY’S BACKGROUND

Alaska Milk products were first manufactured in the Philippines in 1972 through

Holland Milk Products, Inc. (HOMPI), a partnership between AMC's former parent

company, General Milling Corporation (GMC), an industrial foods company with interests

in flour, feed and soy bean milling, and a Dutch dairy company, Holland Canned Milk

International B.V. HOMPI initially manufactured liquid canned filled milk products,

(evaporated and sweetened condensed milk) and eventually expanded to manufacture

powdered filled milk and UHT milk products division up until AMC's spinoff and

incorporation as a separate and independent corporate entity in 1994. It was also a time

when the company embarked on a major expansion program which prompted the

company to tap the capital markets through an initial public offering (IPO) to raise funds

for the capacity expansion of its powdered milk facilities. Alaska Milk shares were listed

in the Philippine Stock Exchange in 1995. Post-IPO, GMC held 66% of AMC while 34%

was left in free float to the public. In mid-1997, however, GMC transfered its 66%

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 2 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

ownership in AMC to individual shareholders of GMC through a property dividend, thus

fully divesting its interest in AMC and enabling management to consolidate and focus its

efforts in pursuing AMC's interests in the consumer foods industry. Currently,

management and strategic partner Campina Melkunie hold 56% while 44% is in public

free float.

For over thirty years, AMC has emerged as one of only two major players in the

Philippine milk industry, consistently maintaining brand leadership in the liquid canned

milk category and holding a strong and growing position in powdered milk. It has also

expanded into higher value-added milk products, particularly in UHT/Ready-to-Drink milk

category. Apart from growing its core businesses, AMC endeavors to diversity and

explore opportunities in related consumer products with global food companies that will

complement AMC's existing revenue base.

Mr. Wilfred Uytengsu, Sr. is the Chairman of AMC and Mr. Wilfred Steven

Uytengsu, Jr. is the President and Chief Executive Officer.

Alaska produces 8 different milk products: Alaska evaporated milk, Alaska

condensed milk, Alaska evaporated creamer and Alaska condensed creamer, Alaska

powdered filled milk and ready-to-drink milk such as Alaska Fresh and Alaska Slim milk

and Yamoo flavored milk.

The company partnered with Gawad Kalinga and the Municipality of San Pedro,

Laguna in order to construct 100 homes in the six-hectare relocation site in

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 3 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Bayanbayanan, Barangay San Vicente. The village will be the new home for some of the

municipality's squatters. The company chose San Pedro, Laguna because it has been

the home of AMC's manufacturing plant since 1972 and is Alaska's turn to give to the

residents who welcomed them into their municipality.

To promote good nutrition for kids, Alaska Milk Corporation has formed ties with

Children's Hour as well. Company employees and even Alaska Aces players and

coaching staff are invited to donate a percentage of their salaries to the fund. Alaska

Milk Corporation’s has a total of 501-1,000 employees.

Alaska Milk Corporation (AMC) is the leading milk company in the Philippines. It

has consistently maintained its leadership in the canned liquid milk category (evaporated

and sweetened condensed), thus, paving the way into growing Alaska into a mega-

brand by competing in the powdered, ready-to-drink, and creams market, among others.

In 2007, AMC further expanded its liquid milk portfolio by licensing Carnation and

Milkmaid from Nestle and acquiring Alpine, Liberty and Krem-Top. This development led

to AMC’s move to a dominant position in the category.

Apart from growing its core businesses, AMC endeavors to diversify and explore

opportunities in related consumer product categories. In March 2012, Alaska Milk

Corporation partnered with Royal Fries land Campina, the fifth largest dairy company in

the world.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 4 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

AMC continues to further its mission of nourishing Filipino dreams, bringing in

affordable nutrition across different life stages to every Filipino home for over 40 years. It

is committed in providing nutrition to Filipino households, ensuring high quality standards

in its products, developing innovative marketing plans and programs, and promoting

outdoor sports as part of a healthy lifestyle.

AMC looks beyond selling milk– it sells nutrition and by doing so, the Company

and brand Alaska is doing its part in nation building. Through youth sports development

programs, Alaska Milk is able to help nourish children for them to develop into

champions in the field of interest and, in general, in life.

Today, Alaska is still best known for its tagline “Sa sustansiya’t lasa, wala pa ring

tatalo sa Alaska” (In nutrition and taste, nothing beats Alaska).

CHAPTER III – COMPANY’S VISION AND MISSION

Their Vision

To be the leading providers of affordable nutrition by offering families and children

a wide range of delicious, high quality dairy, and dairy-based products. Alaska Milk

Corporation’s valued commitment is to bring nutrition to every Filipino across all stages

and occasions of their lives. Alaska Milk faces up to the challenge of pursuing the efforts

to help raise milk consumption levels in the country.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 5 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Today, the Philippines remains to have lower per capita dairy consumption levels

when compared to our Asian neighbors. By providing dairy products in the right formats

and price points, Alaska Milk helps provide good health to every child in every Filipino

home and contributes in bringing down malnutrition levels in the Philippines and in the

world.

Their Mission

Product Development

We pledge to continue building on the strengths and competitive attributes of our

brands and develop their full product potential. We will continue to identify market

opportunities while developing new products, mindful of our task to be responsive to the

ever-changing and growing needs of our consumers.

Customer Service

Customer relationship is an integral part of building the Alaska business. We aim to

provide our partners in trade the best and most efficient service, making use of leading

edge technology to ensure timely product availability and accessibility. We strive to know

and understand our customers fully to bridge the gap between what they need and what

we can give.

Quality

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 6 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Ultimately, the consumer whom we serve and their level of satisfaction with our

products become our final judge and jury. We are committed to deliver high quality milk

and other consumer food products from production to consumption. We will respond to

the call to deliver higher quality nutrition to every Filipino home.

People

We recognize that our people, the Alaska Team Members, are one of our most

important assets and we are committed to promote their safety and welfare. Their wealth

of experience, ideas, dedication and strong work ethic lay the foundation for the

Company’s continued success. It is our goal as much as it is theirs, to pursue and reach

their full potentials through continuing education, training, and skills enhancement

programs. We challenge each individual by providing the opportunity to contribute to the

Company’s endeavours.

Profitable Growth

Growth that creates value for our shareholders is paramount. We will deploy our

resources on investment opportunities that are within our core competence and yield

excellent returns relative to its risks and which are consistent with our growth objectives.

Social Responsibility

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 7 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

We recognize our role in nation building by promoting the protection of the

environment and taking part in various community-building projects that help enhance

and uplift the quality of life of the underprivileged and the marginalized sectors of our.

Using David’s evaluation matrix of mission statements, a table below is used to evaluate

Alaska Milk Corporation’s Mission Statement.

Components YES NO

01 Customers

02 Products/Services

03 Markets

04 Technology

05 Concern for Survival,

Growth, and Profitability

06 Philosophy

07 Self-concept

08 Concern for Public Image

09 Concern for Employees

Revised Vision

The vision statement of Alaska Milk Corporation is as follows:

To be the leading provider of quality yet affordable dairy products that it is still

nutritious and can be afford even the lower-class Filipinos nationwide.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 8 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Revised Mission

On the other hand, the mission statement of Alaska Milk Corporation are as

follows:

The company will continue to nurture and develop Alaska products.

Customers

By giving them the most nutritious dairy products that will still be affordable

to all types of customers.

Product

To be a competitive dairy product company that will pass or suit the

international standards.

Markets

To be a trending and leading market that can give dairy products that is

well-known and innovative.

Technology

To have and advance technology that can use to innovate dairy products

that will lead for the dairy products to be safe in consumption.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 9 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Concern for Survival, Growth and Profitability

To be a competitive market that will can increase sales across international

dairy companies. Also, to empower the people, create partnerships and

coordinate the resources to grow the profitability of Alaska dairy industry.

Philosophy

To supply and provide quality and affordable products that will commit to

develop and grow our team so that they are able to operate in safe, caring and

secure environment.

Self-Concept

To secure the highest value of the Alaska dairy products while creating

opportunities for their growth.

Concern for Public Image

To promote the image and consumption of Alaska dairy products amongst

consumer and the broader population.

Concern for Employees

To be a leading, competitive dairy products company delivering improved

shareholder value by being a preferred corporate citizen, preferred employer, and

preferred supplier selling preferred products.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 10 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Using Fred David’s evaluation matrix of mission statements, a table below is used

to evaluate the recommended Alaska Milk Corporation mission statement:

Components Comment/s

01 Customers “All types of consumer.”

02 Products/Services “That will pass or suit the international standards.”

03 Markets “Be a trending and leading market.”

04 Technology “To have and advance technology.”

05 Concern for Survival, “Empower the people, create partnerships and coordinate

Growth, and Profitability the resources.”

06 Philosophy “To supply and provide quality and affordable products,”

07 Self-concept “Creating opportunities for their growth.”

08 Concern for Public Image “Promote the image and consumption.”

09 Concern for Employees “Delivering improved shareholder value by being a

preferred corporate citizen, preferred employer, and

preferred supplier selling preferred products.”

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 11 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

CHAPTER IV – EXTERNAL ANALYSIS

A. General Environment

1. Economic Developments

Alaska chairman Wilfred Uytengsu Jr. told that they are hoping to have double-

digit sales growth this year. He said that the company expects demand and consumption

of milk products to grow following the increase in income or spending power of

consumers. As disposable income rises, food is generally a beneficiary of that growth,

so they would expect to be part of that,” he said. He said the first package of the

government’s tax reform program has contributed to improving consumption.

Under the Tax Reform for Acceleration and Inclusion law which took effect earlier

this year, the government reduced personal income tax rates and imposed higher taxes

on fuel, cars, tobacco and sugar beverages to offset foregone revenues. With prices of

consumer goods on the rise, Uytengsu said the company is keeping its prices in check in

order to grow sales. While prices of Alaska’s milk products have remained steady, he

said the company is keeping a close watch on the cost of skim milk powder, as well as

the exchange rate. Alaska imports 100 percent of its skim milk powder, which accounts

for almost 50 percent of its total cost. The company has a production facility in San

Pedro, Laguna which recently completed its modernization program. Uytengsu said the

company spent almost P1 billion two years ago to increase the plant’s capacity and

improve safety. While the company ships products based on orders from traders to

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 12 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

countries with a small Filipino population, he said bulk of the sales still comes from the

domestic market.

2. Socio-Cultural, Demographic Trends, and Lifestyle Changes

The company VP Marketing, Ma. Belen M. Fernando. expressed that Alaska Milk

Corp. was a far second to Bear Brand. Its share was only about 10 percent. So they put

a major plan to relaunch the Alaska Powdered Milk Drink, touching the 6Ps. With the

concept using milk as a way of improving the lives of Filipino families. We priced this at

20 percent less than the heritage/classic line in order to capture those who had tuned

out of the category over the past years. The target were housewives who wanted to help

augment their family’s income so that they could have a better life. They are called

“mompreneurs,” the negosyantes who would open small businesses.

3. Technological Developments

Uytengsu-led Alaska Milk Corp. plans to spend P230 million this year largely for

maintenance and the upgrade of manufacturing facilities, the company said in a filing

with the Securities and Exchange Commission. The amount is 27.67% lower than the

P318 million in expenditures last year, used primarily for the expansion of Alaska Milk’s

manufacturing facilities and the construction of a warehouse. It has completed a new

instant filled milk powder plant in San Pedro, Laguna, consisting of a recombined milk

processing plant, equipment for spray-drying, and filling and packaging lines. "The

company does not foresee the need to raise additional funds externally to meet its

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 13 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

working capital requirements and planned capital expenditure for 2008," the listed

company said. For 2008, Alaska Milk said it would continue to focus on growing its core

milk business by expanding to other categories within the domestic milk market, either

through a new product or through strategic alliances such as licensing agreements, joint

ventures, or business acquisitions. Alaska Milk offers a wide range of milk products

beyond the traditional canned evaporated filled and sweetened condensed filled milk,

powdered filled milk and plain and chocolate-flavored UHT (ultra-high temperature) milk

in Tetra briks" Today, Alaska Milk has a dominant position in the liquid milk category,

accounting for about 80% of the market," the milk company said. Alaska Milk saw a 66%

year-on-year increase in net income at P669.04 million in 2007 from P402.58 million in

2006 amid inflationary pressure from cost increases for many of its major ingredients

and packaging materials. As domestic consumption of milk products recovered last year,

net sales grew by 53.38% to P9.08 billion from P5.92 billion through aggressive sales

and marketing.

Ecological Aspects

Alaska Milk Corporation’s Safe, Healthy and Environmental Policy consider its

environmental sustainability and states that they are commited to protect the

environment and sustain resource use. As of 2018, Alaska Milk Corporation’s signed an

agreement with Lingkod Kapamilya Foundation’s Bantay Kalikasan which is owned by

ABS-CBN. Alaska agreed to be part of Bantay Kalikasan (BK) because they want to

properly disposed the used lead-acid batteries from vehicles and used oil from their

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 14 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

industrial plant. Through partnering with BK, the company Director of Operations, Jan

Wegenaar, expressed and stated the Alaska’s efforts to reduce their carbon footprint

and that the company aims to be as minimal as possible and be less and less over time

and are actually investing in smart solutions in order to make sure that the amount of

energy used will be less than what we are using today.

B. Industry and Competitor Analysis

1. Industry Situation

The dairy supply situation for 2017 is characterized by increasing local milk

production and decreasing imports and exports of milk and dairy products. The net

supply stood at 439.83 million kg., 50% lower than last year’s net supply of 445.67

million kg. Local production grew by 8% while imports and exports down by 8% and 9%

respectively.

For 2017, imports of milk and dairy products declined by 8% (from 452.99 million

kg. to 417.07 million kg.). In terms of value, it went up to 12% (from total dairy import bill

of US$807.72 million to US$903.10 million) indicating an increase in unit import cost of

21% and 29% in dollar terms and in pesos respectively.

The increase in local production of 8% accompanied by a decrease in imports of

liquid milk by 11%, resulted in 27% share of local production to total liquid milk supply

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 15 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

(higher than the previous year’s level of 24% share). Hence, local production contributed

more than one glass out of four glasses of liquid milk supply.

In terms of sources and value share, New Zealand remained to be the leading source of

imported dairy products, accounting for 40% to total dairy import bill. USA ranked as

second supplier, followed by Germany and Netherlands with 22%, 5% and

5%respectively.

The volume of exports reached 25.86 million kilograms, lower by 9% compared to last

year’s volume of 28.48 million kilograms.

Ice cream/ice cream mixes and condensed milk were the big export items during the

year. Condensed milk, cream, ice cream/ice cream mixes and other milk & cream

products posted also an increase. On the other hand, liquid milk, whole milk powder and

evaporated milk and butter/butterfat recorded decrease in exports.

Malaysia and Singapore were the top market of Philippine dairy products, accounting for

18%and 14% respectively of the entire dairy export value. Next was United Arab

Emirates that took 12% of the total value and with other countries of destination that

include Vietnam and Canada with shares of around 11% and 8%, respectively.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 16 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Gross earnings in the dairy sector recorded 13% increase from P715.42 million in 2016

to P809.33 million this year. The dairy sector accounted for 0.05% and 0.28% of the total

agricultural and livestock production value (at current prices) of Php1,714.93 billion and

Php291.57 billion, respectively.

2. The Porter’s Five-Forces

Threat of New Competition/Entrants

As A relatively capital-intensive industry, with commodity product, the threat of

new entrants is low.

Threat of Substitute Products

With the other products being used to produce milk power such as soya, oats,

rice and artificial flavors, natural milk powders have more competition, this trend is likely

to grow.

Bargaining Power of Buyer

The consumer power is high because of a lot of competitors, buyers have a lot of

choices in what their preference.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 17 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Bargaining Power of Suppliers

Merging with farmers or working with co-ops and a general trend way from

farming by youth, availability of the raw milk is reducing, so suppliers are getting

stronger.

Intensity of Competitive Rivalry

This is low with many milk powder providers being relatively local or with a small

number of big providers per country. This appears to be relatively stable.

3. Competitors Analysis

For this strategic marketing management paper, two competitors were

considered for the competitive profile matrix:

A) The major competitors of Alaska Milk, Corporation are Nestlé Philippines,

Incorporation and Century Pacific Foods, Incorporation. We chose these two brands as

our competitors because they have different products that can offer to the market and

also, they are both have affordable price in terms of selling their milk products.

Competitor’s Profile

Nestlé

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 18 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Nestlé is a Swiss transnational food and drink company headquartered in Vevey,

Vaud, Switzerland. It is the largest food company in the world, measured by revenues

and other metrics, since 2014. It ranked No. 64 on the Fortune Global 500 in 2017 and

No. 33 on the 2016 edition of the Forbes Global 2000 list of largest public companies.

Nestlé’s Products

Bear brand

Cerelac

Chuckie

Carnation

Coffee-mate

Kitkat

Milo

Nescafe

Nido

Nestlé’s Price

Bear brand 600g – Php 260.00

Coffee-mate 450g – Php 110.00

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 19 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Carnation Evaporated Milk 370ml – Php 42.00

Nestle Cream – Php 70.00

Century Pacific Food Incorporation

Century Pacific Food Inc. (CPFI) is a Filipino food company based in Pasig City,

Philippines. The company was founded as Century Canning Corporation by Ricardo S.

Po, Sr. in 1978. It changed its name to Century Pacific Food in 2014.

Century Pacific Food Incorporation’s Product

555 (canned tuna, sardines, mackerel, carne norte)

Angel (condensed milk, evaporated milk & coffee creamer)

Argentina

Birch Tree (powdered milk)

Blue Bay (canned tuna, sardines, and mackerel)

Century Quality

Century Tuna (canned tuna)

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 20 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Century Pacific Food Incorporation’s Price

Birch Tree 300g – Php 98.00

Krem Top 250g – Php 50.00

Angel Evaporated Milk 410mL – Php 39.00

Angel Condense Milk 380mL – Php 56.00

Competitor Analysis

The major competitors of Alaska Milk Corporation are Nestlé Philippines,

Incorporation and Century Pacific Foods, Incorporation. We chose these two brands as

our competitors because they have different products that can offer to the market and

also, they are both have affordable price in terms of selling their milk products.

Nestlé is a Swiss transnational food and drink company headquartered in Vevey,

Vaud, Switzerland. It is the largest food company in the world, measured by revenues

and other metrics, since 2014. It ranked No. 64 on the Fortune Global 500 in 2017 and

No. 33 on the 2016 edition of the Forbes Global 2000 list of largest public companies.

Nestle Philippines Incorporation was established in 1911.

Century Pacific Food Incorporation, on the other hand, is a Filipino food company

based in Pasig City, Philippines. The company was founded as Century Canning

Corporation by Ricardo S. Po, Sr. in 1978. It changed its name to Century Pacific Food

in 2014.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 21 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

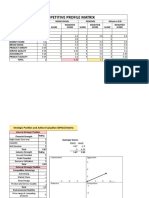

Competitive Profile Matrix (CPM)

Alaska Milk, Nestlé Century Pacific

Corporation Philippines, Inc. Foods, Inc.

Critical Weight Rating Weighted Rating Weighted Rating Weighted

Success Scale Scale Scale

Factors

Promotional 0.08 3.00 0.24 4.00 0.32 2.00 0.16

Tools

Longevity in 0.08 3.00 0.24 4.00 0.32 2.00 0.16

the Industry

Assortment of 0.12 2.00 0.24 4.00 0.48 3.00 0.36

Products

Food Quality 0.14 3.00 0.42 4.00 0.56 2.00 0.28

Human 0.08 3.00 0.24 4.00 0.32 2.00 0.16

Resource

Management

Affordability 0.14 4.00 0.56 2.00 0.28 3.00 0.42

of the

Products

Corporate 0.08 3.00 0.24 4.00 0.32 2.00 0.16

Social

Responsibility

Innovation of 0.12 3.00 0.36 4.00 0.48 2.00 0.24

the

Machineries

TOTAL 1.0 2.54 3.08 1.94

The ratings in the CPM refers on how well companies doing in each area, they

range from 4 to 1, 4 means a major strength, 3 minor strength, 2 minor weakness and 1

as a major weakness. We put the highest weight in the food quality and the

affordability of the products, the reason for this is, as a consumer they must be

satisfied with what they buy and also, they want to spend their limited income wisely. In

the result, the Nestle Philippines is the strongest performer.

In Longevity in the Industry, our basis is as follows: Alaska Milk Corporation was

founded 1972, Nestle Philippines founded in 1911 and Century Pacific Foods founded in

1978.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 22 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

In Affordability of the Products, our basis is the price of the Powdered Milk they

sell. In Alaska, they have Alaska Powdered Milk 300g for Php 104.00, in Nestle, they

have Bear Brand 300g for Php 135.00, and in Century Pacific Foods, they have Birch

Tree Full Cream Milk 300g for Php 129.30.

In Assortment of Products, our basis is Nestle has over 2000 brands with a wide

range of products across several markets, including coffee, bottled water, milkshakes

and other beverages, breakfast cereals, infant foods, performance and healthcare

nutrition, seasonings, soups and sauces, frozen and refrigerated foods, and pet food.

Century Pacific Foods produced canned and processed fish, canned meat, tuna export,

and dairy and mixes. The canned and processed fish segment produces and markets a

range of tuna, sardine, other fish and seafood-based products under the Century Tuna,

555, Blue Bay, Fresca and Lucky 7 brands. Dairy products, such as evaporated milk,

condensed milk, full cream powdered milk and creamer under the Angel and Birch Tree.

Alaska is more on selling canned milk and powdered milk.

The basis for the promotional tools and other critical success factor is that, Nestle

is the largest food company in the world, measured by revenues and other metrics, since

2014. It ranked No. 64 on the Fortune Global 500 in 2017 and N0. 33 on the 2016

edition of the Forbes Global 2000 list of largest public companies. Alaska Milk

Corporation is the second milk leading company in the Philippines and Alaska Powdered

Milk was a far second to Bear Brand which is produced by Nestle Philippines.

C. Summary and Conclusion

1. Using the results of your general environment and industry analyses, identify

and summarize the major opportunities and threats.

• Opportunities

Continuous growth of the population in the country

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 23 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

- having dairy products which is a commodity, population growth means steady

flows of new customers and more demand for the product.

Strategic Alliances – Alaska’s partnership with Royal Friesland Campina- one of

the top five dairy companies of the world, will boost the prospects of an overseas

presence of Alaska.

Rapid technological advances

- the integration of production methods with the latest developments in

computers certainly has the potential to make manufacturing autonomous,

cheaper and more efficient. In addition to that, technology through the use of the

Internet also gives businesses an effective platform for showcasing what they

have to offer. Whether it’s a portfolio and testimonials from clients on a website,

or an album on a Facebook page with photos of your newest products, it has

never been easier to let the world know what you have to offer. With a few simple

clicks, your customers can see what you’re all about. An online presence is an

extension of your brand that never sleeps.

Product Innovation

-Introducing products that meet changing customer needs. New Product

formulations that will respond to the trend towards consumer leading healthier

lifestyles. Innovative dairy products, protein drinks and extended shelf life

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 24 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

beverages. Low fat, Fat-free, reduce sodium and sugar, lactose-free, organic,

probiotic cultures, fortified with nutrients, calcium and protein.

•Threats

Competitors

- A lot of new brands that have been entering the market and they are usually

packaged in a cheaper price compared to Alaska products. It is getting the market

for small enterprises and for regular consumers, it is usually preferred since

consumers can save money and not all of the consumers give that much

importance on brands. They can switch easily if the situation permits.

Increase cost of raw materials, increase cost of utilities (i.e. diesel, electricity,

water) and Increase inflation rate (6.7% as of September 2018)

- Manufacturers is greatly affected by TRAIN LAW, its inflationary pressure impact

on the cost of production with a higher raw material cost. As a result, the prices of

commodities will be higher affecting Alaska products.

Preference over other beverages

-Filipinos are not considered as milk drinkers. They tend to drink a lot more of

other beverages such as coffee, tea, or water. Filipino children’s milk intake is

also declining and their milk consumption is way below than recommended by

nutrition experts.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 25 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

2. External Factor Evaluation (EFE) Matrix

The External Factor Evaluation (EFE) Matrix is concerned with external factors.

These factors are one that is subjected to the will of social, economic, political and legal

forces. The firm’s strategies effectively take advantage of existing opportunities and

minimize the potential adverse effects of external threats. The opportunities and threats

here are the critical success factors in the external environment that can help position

the industry to be profitable. A rating of 4 (superior) for was given to adding new variety

products. The average total weighted average score is 2.67. Alaska Milk Corporation is

effectively taking the advantage of existing opportunities and minimizes potential

adverse effects of external threats.

Key External Factor Weight Rating Score

Opportunities

01 Continuous growth of the 0.15 3 0.45

population in the country.

02 Strategic Alliances 0.09 2 0.18

03 Rapid technological 0.17 3 0.51

advances.

04 Product Innovation 0.12 3 0.36

Threats

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 26 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

01 Competitors 0.12 2 0.24

02 Increase cost of raw 0.17 3 0.51

materials

03 Increase cost of utilities 0.12 2 0.24

04 Preference over other 0.06 3 0.18

beverages

TOTAL 1.0 2.67

Alaska taking an advantage in the opportunity of technological advances and

rapid population growth. Rapid population growth means steady flows of new customers

and more demand for the product. The increasing cost of raw materials and cost of

utilities could be address by the usage of new technological innovations that leads to a

higher operational efficiency.

Alaska, until now, is a household brand that every consumer trusts. It have been

a staple in the Filipino kitchen providing products for households and businesses alike.

Whether you are feeding a family or running a business. Consumer’s love for the quality

of the dish they are making are the primary source of the loyal customers whom despite

of new emerging cheaper brands, still chooses Alaska for its premiere quality.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 27 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

CHAPTER V – INTERNAL/COMPANY ANALYSIS

ALASKA MILK CORPORATION is a leading milk manufacturer of milk products in

the Philippines. It has established a strong brand heritage and recognition among

Filipino consumers with its traditional liquid canned milk products, marketed under the

Alaska Brand. In addition, the company has developed a strong competitive position in

the powdered milk category. Alaska Milk Company delivered another year of solid

performance ending 2017, with a net income of P1.87 billion, a 29% improvement over

the 1.41 billion net income earned in 2016. Fueling the growth was the strong sales

volume expansion across the company’s portfolio of milk product alongside lower input

costs as well as prudent spending. Sales/revenue ending 2017 is P658,153 sales growth

of 16.43%. In addition, sustained advertising campaign and demand-generating

promotional initiatives help push sales volumes higher year on year.

Operating expenses for the year increased significantly. The increase can be

attributed to higher advertising and promotional spending to boost consumer demand for

Alaska Milk ProAlaska Milk Corporation recognizes that their people, the Alaska team

members are one of their most important assets and there are committed to promote

their safety and welfare. Their wealth of experience, ideas, dedication and strong work

ethic lay the foundation continued success. It is the company’s goal as much as its theirs

to pursue and reach their full potential through continuing education, training and skills

enhancement programs. They challenge each individual by providing opportunities to

contribute to the company’s endeavors.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 28 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

The Company’s first generation of milk products are Alaska Evaporated Filled

Milk and Alaska Sweetened Condensed Filled Milk. Alaska Evaporada and Alaska

Condensada are the perfect enhancers various food and beverages preparations.

Today, Alaska Milk Corporation has a dominant position in liquid canned milk category,

accounting for nearly 80% of the market. Alaska Condensed milk, Alaska Sweetened

condensed milk, Cowbell condensada , Alaska Evaporada , Alaska Condensada, Alaska

Creamer etc. )

The company has likewise built a solid position in a Powdered Milk Category.

With the heritage gained by the Alaska line of liquid canned milk products, the

Company’s Alaska Powdered Milk drink, the most nutritious powdered milk drink , has

emerged as the second leading brand in the market.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 29 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

THREE-YEAR Revenue/Sales Review

Net Revenues

34496

28288

23325

2015 2016 2017

Based from its three-year revenue/sales review, the revenue/sales is in increasing

trend within a year. But in the year of 2018, a short-coming occured and can be

observed.

CHANGE IN

REVENUE

QUARTER PERCENT (%)

2016 2017

Q1 PHP 6.4 B PHP 7.48 B 16.87%

Q2 PHP 13 B PHP 16.05 B 23.46%

Q3 PHP 20.96 B PHP 25.27 B 20.56%

Q4 PHP 28.29 B PHP 34.50 B 21.95%

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 30 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

2017 2018

Q1 HP 7.48 B PHP 9.13 B 22.06%

Q2 HP 16.05 B PHP 19.32 B 20.37%

Q3 HP 25.27 B PHP 29.48 B 16.66%

Q4 HP 34.50 B PHP 39.56 B 14.77%

Based from the horizontal analysis of Alaska Milk Corporation’s revenue per

quarter increases in volatile rate. But also has a decrease in yearly and quarterly

revenue/sales growth.

B. Internal Factor Evaluation (IFE) Matrix

This strategy formulation tool summarizes and evaluates the major strengths and

weaknesses in the functional areas of business, and it also provides a basis for

identifying and evaluating relationship among those areas. The Internal Evaluation

Factor (IFE) Matrix found below the list of ten key internal factors. Five of these factors

are considered strengths of Alaska Milk Corporation while the other three are

weaknesses. The rate suggests whether internal factors are the major

strength/weakness and minor strength/ weakness. With the total weighted scale of 2.98,

Alaska Milk Corporation has a strong internal position.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 31 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Key External Factor Weight Rating Score

Strengths

01 Very well-known and 0.15 4 0.6

trusted brand.

02 Variety of their products. 0.12 3 0.36

03 Have timely and updated 0.11 3 0.33

television and radio

advertisements.

04 High Quality of product 0.18 4 0.72

05 Experienced and well 0.14 4 0.56

trained employees.

Weaknesses

01 High Cost turnover 0.10 2 0.10

02 Few distributions in rural 0.09 1 0.09

areas.

03 Higher Price than 0.11 2 .22

competitors

TOTAL 1.0 2.98

C. Summary and Conclusion

Note that in the IFE Matrix, High Quality of the product are the most advantages

in Alaska Milk Corporation. When AMC gain the confidence and loyalty of consumers,

they can do more with business, such as raise prices. The high quality of AMC product is

one way to help get consumers to appreciate and believe in what they have to offer.

While the highest factor of weaknesses in AMC is there price is higher than Its

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 32 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

competitors. Company that produces high quality product but sells in lower price than

AMC, will increases their customer and always tend to buy their products than AMC

products.

VI. STRATEGY FORMULATION

STRENGTHS WEAKNESSES

1. Very well-known 1. High Cost turnover

and trusted brand.

2. Few distributions in

2. Variety of their rural areas.

products.

3. Higher Price than

3. Have timely and competitors

updated television

and radio

advertisements.

4. High quality

products.

5. Experienced and

well trained

employees.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 33 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

OPPORTUNITIES SO STRATEGIES WO STRATEGIES

1. Continuous growth of the Select an artist, Have a great

population in the country. celebrities and expertise in

personalities to management which

2. Strategic Alliances

endorse the product enable to perform

3. Rapid technological

in TV ad. (S1, S2 managerial task

advances.

,S3, O2,) effectively and

4. Product Innovation. effiently. (W1, W2,

Invest on research

W3, O2, O3)

and development

and also the Expansion of the

technology for the manufacturing plants

innovation of the and new equipment

process of the dairy that the company will

products. (S5, O3, be using. (W2, W3,

04) O3)

Make new products Lead a statistical

that will suit the surveying where the

taste of your new product has a higher

consumer. (S1, S4, utilization. (W2 , O1)

O1, O2)

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 34 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

THREATS ST STRATEGIES WT STARTEGIES

1. Competitors Cut down Have a great

operational costs. management team to

2. Increase cost of raw

(S4, S5, T2, T3) maintain the

materials.

operational cost (T2,

Make a good

3. Increase cost of utilities.

T3, W1, W3)

reputation with the

4. Preference over other

consumer and the Bringing down the

beverages

retailer. (S1, S2, price to have an edge

S3, T1, T4) to different

contenders. (T1, T4,

W2, W3)

Strategic Position and Action Evaluation (SPACE) Matrix

The SPACE Matrix has four- quadrant network whether aggressive, conservative,

defensive or competitive strategies are most appropriate for a given organization. The x-

axis represents two internal dimensions (financial strength [FS] and competitive

advantage [CA]) while the y-axis represents two external dimensions (environmental

stability [ES] and industry strength [IS])

Financial Strength (FS) (+1 Worst, Rate Competitive Advantage Rate

+6 Best) (CA)

(-6 Worst, -1 Best)

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 35 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Liquidity (22% as of 2017) +4.00 Customer Loyalty -3.00

Return on Investment (-43% as of +1.00 Product Quality -1.00

2017)

Inventory Turnover (21% as of 2017) +4.00 Promotional Tools -1.00

TOTAL +9.00 -5.00

Environmental Stability (ES) Industry Strength (IS) (+1

Worst, +6 Best)

(-6 Worst, -1 Best)

Flexible to Technological Changes -2.00 Diversification of Products +4.00

Inflation Rate -4.00 Resources Availability +5.00

Flexible to Trends -1.00 Longevity in the Industry +5.00

TOTAL -7.00 +14

y- axis x-axis

Environmental Stability = -7 ÷ 3 = - Competitive Advantage = -5 ÷ 3 = -

2.33 1.66

Industry Strength = 14 ÷ 3 = 4.66 Financial Strength = 9 ÷ 3 = 3.00

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 36 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

AVERAGE +2.33 +1.34

6

5

4

Conservative 3

Aggressive

2

1

0

-6 -5 -4 -3 -2 -1 -1 0 1 2 3 4 5 6

-2

Defensive -3 Competitive

-4

-5

-6

The table above demonstrate that AMC rate in financial strength is +3.00. This is

a result of the positive income of the corporation when contrasted with the earlier year.

Its environmental stability is at -2.33 with a good result. Even if there are many strong

competitors AMC still got a -1.66 results contrasted with its rivals. Ultimately a +4.66 rate

is given to AMC a normal rate since most rate is in nature.

Plotting these points on graph, where the sum of the financial position and

competitive advantage is +1.34 (X coordinate), and the sum of the industry strength and

environmental stability +2.33 (X coordinate), this implies that AMC budgetary quality is

an overarching factor in the business. This infers AMC may design much procedure to

have more noteworthy offer in the market since its funds is sufficient for its systems. In

addition, this implies AMC is a good position to utilize its inward qualities to exploit the

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 37 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

outside circumstances, conquer inside short comings, and evades or limits outer danger.

Since it falls in the aggressive quadrant (+, +), AMC may have aggressive strategies

such as backward, forward, horizontal integration, market penetration, market

development,

INTERNAL

SPACE MATRIX

SWOT MATRIX EXTERNAL

MATRIX

STRATEGY CATEGORY

Select an artist, celebrities and Market Forward Forward

personalities to endorse the Penetration Integration Integration

product in TV ad.

Invest on research and Product Diversification Forward

development and also the Development Strategy Integration

technology for the innovation Strategy

of the process of the dairy

products.

Make new products that will Product Product Product

suit the taste of your new

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 38 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

consumer. Development Development Development

Have a great expertise in Market Market Market

management which enable to Penetration Penetration

Penetration

perform managerial task

effectively and effiently.

Expansion of the Diversification Market Market

manufacturing plants and new Strategy Development Development

equipment that the company

will be using.

Lead a statistical surveying Market Market Product

where the product has a higher Development Penetration Development

utilization.

Cut down operational costs. Diversification Product Product

Strategy Development Development

Make a good reputation with Product Market Market

the consumer and the retailer. Development Penetration Penetration

Have a great management Diversification Market Market

team to maintain the Strategy Penetration Penetration

operational cost.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 39 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Bringing down the price to Market Horizontal Forward

have an edge to different Penetration Integration Integration

contenders.

From summarizing the tale presented above summarizing strategies that were

found out of the matrixes used earlier, four strategies were common – forward

integration, backward integration, market penetration and market development. To

assess which among strategies presented in the SWOT Matrix will be prioritized; a

Quantitative Strategic Planning will be used.

Quantitative Strategic Planning Matrix QSPM

The strategy that has the highest weighted attractiveness score is best strategy to

implement. Invest on research and development and also the technology for the

innovation of the process of the dairy products (6.70) is more attractive strategy when

compared to Make a good reputation with the consumer and the retailer (5.59), Taking

into account both the external and internal factors that would affect the company, the

QSPM suggests that Alaska Milk, Corporation should engage into a product

development.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 40 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

VII. OBJECTIVES, STRATEGY RECOMMENDATIONS AND ACTION PLANS

Factors 2018 % 2019 % 2020 % 2021

01 Revenue/Sales 811.2M 15% 932.9M 20.5% 973.4% 25% 1.014B

02 Market Share 20% 22% 24.40% 22% 29.77% 22% 35.72%

03 Return on 11.73% 10% 12.90% 10% 14.19% 10% 15.61%

Investment

04 Brand used 10% 13% 11.30% 13% 12.77% 13% 14.43%

more often

(BUMO)

Financial Objectives

-To increase Alaska Milk Corporation’s revenue by 5% per year in 2019-2021

over 2018 revenue of P811.2 Million.

-To increase Alaska Milk Corporation’s return on Invested Capital by 10% per

year in 2019-2021 from 2018 return on investment of 11.73%

-Last public update, Alaska Milk Corporation, cut its cost of sales and operating

expenses for rising from P3.73 billion to P4.41 billion.

Strategic Objectives

-To increase Alaska Milk Corporation’s market share by 22% per year in 2019-

2021 from 2018 market share of 20%.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 41 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

-To increase Alaska Milk Corporation’s brand used more often (BUMO) by 13%

per year in 2019-2021 from 2018 range of 10%.

-Product advertisement of Alaska Milk Corporation has been iconic and

remarkable to its product buyers because of its jingle which firmly ingrained in the heart

of Filipinos. - Last public update of Alaska Milk Corporation, Uytengsu family set aside

P250 million for its continuing business expansion and refurnish existing manufacturing

facilities.

Business and Organizational Strategies

The proposed strategy, as it was filtered with into six matrixes, is:

"To reduce operating cost in the production process."

The following are the business strategies to achieve the objectives:

• It is important that the we are all heading to one goal and that goal must be

known from the top management to the different functional areas. It must be

communicated to them that our goal is to reduce operational cost.

• We will have strategic alliances, partnership with one of the best dairy companies

in the world would be great opportunity for Alaska to have a presence abroad.

• The company will use the advancement of technology because it is cheaper and

more efficient. Through the use of internet, we will have an online platform like a

website for the customers to have an access in our products.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 42 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

• We will have an evaluation and assessment to cut down operational costs.

Through this we can identify the inefficiencies in both materials and time, so we

can reduce waste.

• The company will have a product innovation, new product formulations in the

dairy products that will respond towards consumer leading healthier lifestyle.

• The company will target the rural areas for the distribution of dairy products. We

will make sure that Alaska products will distribute to the retailer stores in the rural

areas.

• The company's research and development group will have a research on the

possibility of not importing skimmed milk powder to cope up with the operational

cost due to importation cost and changes in exchange rate.

Invest on research and Make a good

development and also the reputation with the

technology for the innovation consumer and the

of the process of the dairy retailer.

products

OPPORTUNITIES W AS TAS AS TAS

Continuous growth of the .18 2 0.36 4 0.72

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 43 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

population in the country.

Strategic Alliances .15 4 0.60 3 0.45

Rapid technological .14 4 0.56 2 0.28

advances.

Product Innovation .14 4 0.56 3 0.42

THREATS

Competitors .09 4 0.36 3 0.27

Increase cost of raw .10 4 0.40 - -

materials

Increase cost of utilities .10 3 0.30 - -

Preference over other .10 3 0.30 4 0.40

beverages

TOTAL 1.0 3.44 2.54

STRENGTHS

Very well-known and .10 3 0.30 4 0.40

trusted brand.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 44 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

Variety of their products. .15 4 0.60 3 0.45

Have timely and updated .12 3 0.36 2 0.24

television and radio

advertisements.

High Quality of product .20 4 0.80 3 0.60

Experienced and well .14 3 0.42 4 0.56

trained employees.

WEAKNESSES

High Cost turnover .09 2 0.18 - -

Few distributions in rural .10 3 0.30 4 0.40

areas.

Higher Price than .10 3 0.30 4 0.40

competitors

TOTAL 1.0 3.26 3.05

TAS 6.70 5.59

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 45 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

VIII. STRATEGY IMPLEMENTATION

Activity Time Table Expected Person/s Responsible

Output

Meeting per June 2019- One goal and Top

functional areas July 2019 attainment of Management

objectives are Managers from

clearly all functional

communicated areas

from top Supervisory

management Employees

up to

supervisory

management

Current Product July 2019- Assessing Marketing Dept

Research Dept

Line August 2019 different

Assessment products being

offered. From

that, we can

know what

more can we

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 46 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

offer

Creating product September A Marketing Dept

Research Dept

innovation for 2019-October comprehensive

the product line 2019 research of

advertising

focusing on the

core purpose

of the

company

which is proper

nutrition

resulting to a

healthy

consumer

Implementing October 2019 More than 95% Marketing Dept

product Research Dept

- November of the

innovation

2019 advertising

plans were

able to be

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 47 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

implemented

Evaluation of November 90% of the Marketing Dept

product 2019 innovation

innovation goals and

objectives

were achieved

by Alaska

Creating a plan November Research Research Dept

to cut down regarding the Production Dept

2019-

operational cost possibility of

December

not doing

2019 imports for an

ingredient.

Research on

new

technology that

can help

improve the

production

process and to

reduce waste.

Implementing December More than 95% Production

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 48 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

plans on cutting 2019-January of the plan Dept.

down

2020 were able to Finance Dept

operational cost.

be

implemented

Evaluation on January 2020 90% of the Production

plans on cutting

plan were able Dept.

down

to be

operational cost

implemented.

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 49 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

IX. Strategy Evaluation, Monitoring and Control

Strategic Objectives Measures Targets Programs

Priorities

Financial Decreasing Effective Financial Minimize cost Evaluation

Operational and Statement. and expenses in Operating

Cost to efficient Financial used in Expenses

increase production Ratio operations

revenue/profit plans

Customer Keep Consumer KPI or Key Expanding Introduce

Consumer- Behavior Performance the additional

Buyer trends Indicator or relationship benefits for

Relationship towards Survey between customers

quality current and

service new

customers

Internal Recognizing Increase KPI or Key Increasing Market

the the number Performance understanding Share

employees of Alaska Indicator or and Performance

by training members Survey appreciation Evaluation

and with strong of Employees

enhancing work ethics

their skills

Learning Continue Effective Research, Taking the Marketing

& Growth investing the Market Survey and opportunity to Strategy and

brand and Penetration Analytic grow more Product

Improve high Strategies Report Strategy

quality of

products

Bibliography

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 50 of 51

ACTP01 Ms. Arlene San Pablo

Strategic Management for Alaska Milk Corporation

https://phdessay.com/marketing-plan-alaska/?fbclid=IwAR3YjlCNIQLLL-

TOI6K47AvurpTuc2IrNQ-NjiZ4gFEHqQ_hxK9LDBjwH_M

https://www.gmanetwork.com/news/money/content/85381/alaska-milk-lowers-capital-

outlay-for-

08/story/?fbclid=IwAR3kFO8cAATIelFxlcEc9FFwsJFDWTuMjDq_kFxB4Lyw6Tr_LOEyW

XN_PUM

Astoveza, Butor, Coronacion, Repolles, Salcedo, Santiago Page 51 of 51

ACTP01 Ms. Arlene San Pablo

You might also like

- Alaska Milk Corporation (Body Paper) PDFDocument199 pagesAlaska Milk Corporation (Body Paper) PDFChristian Dass100% (3)

- ALASKA AR10 Per Page LowDocument84 pagesALASKA AR10 Per Page LowJanina Angela 蔡真真No ratings yet

- Selecta Fortified MilkDocument40 pagesSelecta Fortified MilkRochelle TyNo ratings yet

- AlaskaDocument15 pagesAlaskaAnonymous 9385BXgNo ratings yet

- Dianne Samante - Beverage Industry Analysis - Alaska - Environmental Analysis - 11oct2013Document36 pagesDianne Samante - Beverage Industry Analysis - Alaska - Environmental Analysis - 11oct2013deeNo ratings yet

- Executive Summary Marketing PlanDocument10 pagesExecutive Summary Marketing PlanMark Elvin ChavezNo ratings yet

- Marketing Plan of Alaska Fortified MilkDocument16 pagesMarketing Plan of Alaska Fortified MilkKim Justine Dela CruzNo ratings yet

- CenturyDocument35 pagesCenturyKathy V. Chua-Grimme0% (2)

- External Factor Evaluation (EFE) Matrix, Internal Factor Evaluation (IFE) MatrixDocument5 pagesExternal Factor Evaluation (EFE) Matrix, Internal Factor Evaluation (IFE) MatrixBaby Joy Bautista100% (1)

- MA Final OutputDocument26 pagesMA Final OutputB.I.No ratings yet

- Puregold Price Club Inc in RetailingDocument2 pagesPuregold Price Club Inc in Retailingjoventilador100% (2)

- Internal Factor Evaluation Key Internal FactorDocument3 pagesInternal Factor Evaluation Key Internal FactorRoan Jane Gonzales Garcia0% (2)

- Julie BakeshopDocument16 pagesJulie BakeshopSamas James67% (9)

- Lamoiyan CorporationDocument6 pagesLamoiyan CorporationJayvie Dizon Salvador67% (3)

- Marketing Plan - SelectaDocument5 pagesMarketing Plan - SelectaAyms Cueva de Gracia100% (1)

- Strategic Management MidtermDocument5 pagesStrategic Management MidtermBrady Shiplet67% (3)

- Chapter Vi SocioDocument5 pagesChapter Vi SocioLaurence DonidaNo ratings yet

- Nutriasia Final PresentationDocument59 pagesNutriasia Final Presentationjoyralynabilon57% (7)

- Barkin' Blends Dog Café Success StoryDocument18 pagesBarkin' Blends Dog Café Success StoryZia Irra Alegre0% (1)

- My Greenwich Case StudyDocument5 pagesMy Greenwich Case StudyKriztine May SeraficoNo ratings yet

- STRAMA The Final Showdown!!Document48 pagesSTRAMA The Final Showdown!!Mikko Bolivar100% (16)

- Marketing 101 Final Pass March 6 UpdateDocument92 pagesMarketing 101 Final Pass March 6 Updatejasminn_283% (6)

- Mang Inasal Marketing, Tactical, Operational, and HR StrategiesDocument2 pagesMang Inasal Marketing, Tactical, Operational, and HR StrategiesAriel Dimalanta100% (1)

- Si PedroedtdDocument15 pagesSi Pedroedtdpolar beer0% (1)

- Zest o 2Document30 pagesZest o 2Carlo Medenilla0% (1)

- Industry Analysis of RFM CorporationDocument4 pagesIndustry Analysis of RFM CorporationMaybelyn Umali Catindig100% (2)

- Nina Cabrera's Colourette Cosmetics Success StoryDocument20 pagesNina Cabrera's Colourette Cosmetics Success StoryTristan Zambale100% (1)

- Coca-Cola company profile highlights history, products, visionDocument10 pagesCoca-Cola company profile highlights history, products, visionAngelo Magadia50% (4)

- LBC ExpressDocument3 pagesLBC ExpressArmae AguduloNo ratings yet

- RFM SummaryDocument4 pagesRFM SummaryBernabeth Wong Mendoza100% (1)

- DocxDocument48 pagesDocxjikee1150% (2)

- Nature of The Businessjolibee Food CorporationsDocument5 pagesNature of The Businessjolibee Food CorporationsAljonEscoberNo ratings yet

- Coke and Pepsi Case AnalysisDocument4 pagesCoke and Pepsi Case AnalysisKeeley Q JianNo ratings yet

- Jollibee Swot MatrixDocument2 pagesJollibee Swot MatrixAnne MartirezNo ratings yet

- JOLLIBEE'S HR PLAN AND ORG STRUCTUREDocument11 pagesJOLLIBEE'S HR PLAN AND ORG STRUCTUREJovie Cabanlit100% (3)

- Consumer Behavior Paper PLDTDocument6 pagesConsumer Behavior Paper PLDTAngeline Santiago100% (2)

- Swot Company BGDocument2 pagesSwot Company BGKriztelle BejarinNo ratings yet

- Starbucks Case StudyDocument4 pagesStarbucks Case StudyMaria Aleni100% (1)

- UPDATED SELECTA Marketing Research On Research and Development and PromotionDocument23 pagesUPDATED SELECTA Marketing Research On Research and Development and PromotionAJ Magno33% (3)

- Marketing Plan Activity PaperDocument11 pagesMarketing Plan Activity PaperLamNong100% (1)

- Case Study 2 Natasha BDocument4 pagesCase Study 2 Natasha BJude Guzman67% (3)

- Case Study FormatDocument5 pagesCase Study Formatmatthew lomongoNo ratings yet

- URC Strategic Management Paper AnalysisDocument38 pagesURC Strategic Management Paper AnalysisIris Cadet Macaspac100% (2)

- Strategic Marketing PlanDocument17 pagesStrategic Marketing Planfelix madayag del rosarioNo ratings yet

- Analyze The Gardenia in Porter Five Competitive ForcesDocument7 pagesAnalyze The Gardenia in Porter Five Competitive ForcesChesca AlonNo ratings yet

- Comaparative Analysis - SampleDocument8 pagesComaparative Analysis - SampleAying IgnacioNo ratings yet

- Jollibee FoodsDocument5 pagesJollibee FoodsJean Bradley Buela33% (3)

- SMC and ANSCOR Strategic Planning ProcessDocument36 pagesSMC and ANSCOR Strategic Planning ProcessGlo GanzonNo ratings yet

- Boost Bibingkinitan's Brand RecognitionDocument83 pagesBoost Bibingkinitan's Brand RecognitionEnsot Soriano100% (1)

- GSMI Company History and External AnalysisDocument9 pagesGSMI Company History and External AnalysisJullia Belgica100% (3)

- Market AnalysisDocument5 pagesMarket AnalysisEden Dela CruzNo ratings yet

- Strama Paper Format Final 2nd SemDocument2 pagesStrama Paper Format Final 2nd Semmoniquecarzon100% (2)

- JollibeeDocument20 pagesJollibeeFabian Chong75% (4)

- ISSUES JollibeeDocument4 pagesISSUES JollibeeMelanie Joy Gopela Flores33% (6)

- Enjoy snacks and drinks in one cup with KerrimoDocument17 pagesEnjoy snacks and drinks in one cup with KerrimoChristine Mariñas50% (2)

- Servises Marketing-Red RibbonDocument4 pagesServises Marketing-Red Ribbonakii_alawiNo ratings yet

- Mang InasalDocument9 pagesMang InasalReianne Espesor100% (3)

- Puregold Price Club Inc Annual Report (SEC 17A AFS Sustainability Report) 06 29 2020Document177 pagesPuregold Price Club Inc Annual Report (SEC 17A AFS Sustainability Report) 06 29 2020JhenRMANo ratings yet

- Quality Control 1 AlaskaDocument5 pagesQuality Control 1 AlaskaSasha AbejeroNo ratings yet

- Alaska Milk CorporationDocument23 pagesAlaska Milk CorporationRosan YaniseNo ratings yet

- BIR Chart of AccountsDocument152 pagesBIR Chart of AccountsIanBesinaNo ratings yet

- Solid Group ReportDocument110 pagesSolid Group ReportNicki SalcedoNo ratings yet

- BIR Chart of AccountsDocument152 pagesBIR Chart of AccountsIanBesinaNo ratings yet

- UACS Manual for Financial ReportingDocument41 pagesUACS Manual for Financial ReportingHammurabi BugtaiNo ratings yet

- Business CombinationDocument1 pageBusiness CombinationNicki Salcedo0% (2)

- Differential Analysis: The Key To Decision MakingDocument90 pagesDifferential Analysis: The Key To Decision MakingSofia Pradnya ParamithaNo ratings yet

- Nego Exam With AnswerDocument5 pagesNego Exam With Answeraldrinmark_quintana2392% (25)

- Strama Final PDFDocument36 pagesStrama Final PDFNicki SalcedoNo ratings yet

- ALASKA (Under Edit)Document2 pagesALASKA (Under Edit)Nicki SalcedoNo ratings yet

- Gulfood Exhibitor List M - 3Document18 pagesGulfood Exhibitor List M - 3Lupu Carmen100% (1)

- Questionnaire For Brand SwitchingDocument2 pagesQuestionnaire For Brand SwitchingGopi Chandu.keerthi100% (1)

- Nelson - Salmo Pennywise Nov 12, 2013 PDFDocument56 pagesNelson - Salmo Pennywise Nov 12, 2013 PDFPennywise PublishingNo ratings yet

- Synopsis Prject On Cadbury 27.3.2013Document49 pagesSynopsis Prject On Cadbury 27.3.2013rohitjagtap100% (2)

- Lect 12 EOQ SCMDocument38 pagesLect 12 EOQ SCMApporva MalikNo ratings yet

- PepsiCo KelompokDocument8 pagesPepsiCo Kelompokdian ratnasari100% (1)

- Danone & Wrigley'sDocument10 pagesDanone & Wrigley'sZarak MirNo ratings yet

- Strategic Marketing 8th Edition - TEXT BOOKDocument385 pagesStrategic Marketing 8th Edition - TEXT BOOKcute_vampire45683% (6)

- HP Business Inkjet 2800 Printer Series - Media RecommendationsDocument3 pagesHP Business Inkjet 2800 Printer Series - Media RecommendationsmemorphNo ratings yet

- All Dealer Survey On Ice Cream IndustryDocument13 pagesAll Dealer Survey On Ice Cream IndustryAditya PatelNo ratings yet

- SWOT Analysis of Starbucks' Internal Strengths and External OpportunitiesDocument24 pagesSWOT Analysis of Starbucks' Internal Strengths and External OpportunitiesSri Mirawati100% (1)

- Marketing ResearchDocument20 pagesMarketing ResearchTahir MehmoodNo ratings yet

- Demand Analysis PDFDocument35 pagesDemand Analysis PDFSaransh AgarwalNo ratings yet

- Ja 24 FoodsDocument6 pagesJa 24 FoodspcxwaNo ratings yet

- New Microsoft Office Word DocumentDocument5 pagesNew Microsoft Office Word DocumentPradnya R. GaikwadNo ratings yet

- 1st-2nd Ipl Case DigestsDocument46 pages1st-2nd Ipl Case DigestssigfridmonteNo ratings yet

- Manchester Brand TransitionDocument19 pagesManchester Brand TransitionDan GafirovNo ratings yet

- A Unique Philosophy: Some Key Features To Be The No. 1Document21 pagesA Unique Philosophy: Some Key Features To Be The No. 1SufianNo ratings yet

- Strategic Marketing Planning: Sri Lanka Institute of MarketingDocument25 pagesStrategic Marketing Planning: Sri Lanka Institute of MarketingRufus Linton100% (2)

- Ispahani Tea: Brewing Success Through Innovation and ExcellenceDocument4 pagesIspahani Tea: Brewing Success Through Innovation and ExcellenceIOSRjournalNo ratings yet

- Discovering New Points of DifferentiationDocument29 pagesDiscovering New Points of DifferentiationNITIN GOELNo ratings yet

- Elasticity of DemandDocument20 pagesElasticity of Demandkapil_dube_1100% (2)

- ÖBB Ticket Vending Machine GuideDocument2 pagesÖBB Ticket Vending Machine GuideleechulmiuNo ratings yet

- Financial Accountant Manager Controller in Lexington KY Resume Philip WiemerDocument2 pagesFinancial Accountant Manager Controller in Lexington KY Resume Philip WiemerPhilipWeimerNo ratings yet

- Homework Finance 1Document7 pagesHomework Finance 1Chien le Ngoc33% (3)

- Topline - Online Hotel & Ticket Booking SiteDocument17 pagesTopline - Online Hotel & Ticket Booking SitefaturNo ratings yet

- Answers To The Problems and ApplicationsDocument6 pagesAnswers To The Problems and ApplicationsFaryal Mughal50% (2)

- Case Study - How Horlicks Has Avoided Getting DatedDocument4 pagesCase Study - How Horlicks Has Avoided Getting Datedkritzzy1No ratings yet

- 4P Marketing Mix Analysis and SWOT EvaluationDocument3 pages4P Marketing Mix Analysis and SWOT EvaluationHaranSundaramNo ratings yet

- Presentation On Airtel and Cell Phone Service IndustryDocument37 pagesPresentation On Airtel and Cell Phone Service Industrygagan15095895No ratings yet