Professional Documents

Culture Documents

IT Returns Procedure

IT Returns Procedure

Uploaded by

Umesh NayakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IT Returns Procedure

IT Returns Procedure

Uploaded by

Umesh NayakCopyright:

Available Formats

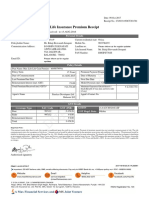

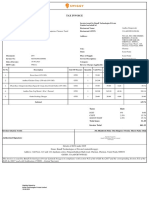

Bajaj Allianz Life Insurance Co. Ltd.

Certificate For Premium Paid

(01-Apr-2017 to 31-Mar-2018)

Date: 03/03/2018

This is to certify that the premium under the following policies taken by the policy holder MR D. M. UMESH has been received by Bajaj Allianz Life Insurance Company

Limited during the financial year 2017-2018.

Policy No Product Premium Due Sum Assured Premium Premium Life Insurance Health Care Service Financial Year

Date Adjustment Amount Premium(1) Premium(2) Tax/GST

Date Received Including cess

PROTECTION

0229653320 INSURANCE 04/AUG/2017 165000 07/08/17 15000 15000 0 0 2017-18

PLAN

Total : 15000.0 15000.0 0.0 0.0

Note:

Receipts issued subject to realization of cheques.

(1) Life Insurance Premium is eligible for tax rebate/deduction under Section 80C.

(2) HCB/C1/Post Hospitalization/Surgical Benefit Rider Premium is eligible for tax rebate/deduction under Section 80D..

* Single Premium Policies with cover less than 5 times the premium paid will not be eligible for tax deduction under section 80C. This

certificate is issued for the purpose of claiming deductions, rebates as per the provisions of Income Tax Act, 1961.

For your actual eligibility please refer to provisions of IT Act 1961 as modified and consult your tax consultant.

In compliance of the provisions relating to deduction of tax at source under section 194 DA of Income Tax Act, 1961 as introduced by Finance Act, 2014, any

payment (except payment exempted u/s 194DA) made by Bajaj Allianz Life Insurance Company Limited shall be subject to deduction of applicable TDS. In absence

of PAN details, TDS would be deducted @ 20% instead of 1% in case where PAN is provided. TDS once deducted shall not be refunded.

Please update your PAN immediately. Kindly ignore if PAN details already provided.

For further details, please consult your Income Tax advisor/consultant.

Note: This is a computer-generated letter and does not required a signature.

You might also like

- Geis G. Corporate Law. Course Guidebook, 2020 PDFDocument120 pagesGeis G. Corporate Law. Course Guidebook, 2020 PDFsverdlikNo ratings yet

- Bankruptcy QuestionnaireDocument36 pagesBankruptcy QuestionnaireJody SomersNo ratings yet

- Aditya Life InsuranceDocument2 pagesAditya Life InsuranceMirzaNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyShashank SinghNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyAmit KumarNo ratings yet

- Bajaj Allianz Life Insurance Co. LTD.: Certificate For Premium PaidDocument1 pageBajaj Allianz Life Insurance Co. LTD.: Certificate For Premium Paidsanthan1986No ratings yet

- Part Iithe Development of Public FinanceDocument6 pagesPart Iithe Development of Public FinanceJo Che RenceNo ratings yet

- Renewal of Your Easy Health Floater Standard Insurance PolicyDocument4 pagesRenewal of Your Easy Health Floater Standard Insurance PolicyAhesan Ali MominNo ratings yet

- New VinothDocument3 pagesNew VinothRenga NathanNo ratings yet

- Birla Sun Life PremiumDocument1 pageBirla Sun Life PremiumBALAJI NAIK MudavatuNo ratings yet

- Cir V LednickyDocument2 pagesCir V LednickyShariqah Hanimai Indol Macumbal-YusophNo ratings yet

- Pay CertificateDocument1 pagePay CertificateRakesh NayakNo ratings yet

- Bajaj Allianz Life Insurance Co. LTD.: Certificate For Premium PaidDocument1 pageBajaj Allianz Life Insurance Co. LTD.: Certificate For Premium PaiddharmenderimrNo ratings yet

- Bajaj Allianz Life Insurance Co. LTD.: Certificate For Premium PaidDocument1 pageBajaj Allianz Life Insurance Co. LTD.: Certificate For Premium PaidsukujeNo ratings yet

- 15 Pay 1cr Cover Till 70Document5 pages15 Pay 1cr Cover Till 70venkyNo ratings yet

- Book 2Document10 pagesBook 2Devyani HajareNo ratings yet

- Ipru Pension 10 Year X 2 LacDocument5 pagesIpru Pension 10 Year X 2 LacHK Option LearnNo ratings yet

- KFD New06012024143830079 T51Document5 pagesKFD New06012024143830079 T51Mayur NagdiveNo ratings yet

- C259750994 U36401 U36401 Multioption Counter Offer LetterDocument2 pagesC259750994 U36401 U36401 Multioption Counter Offer LetterNILESHNo ratings yet

- United India Insurance Company LimitedDocument3 pagesUnited India Insurance Company LimitedBabjee ReddyNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)shashank pathakNo ratings yet

- KFD New04122022004727946 E28Document5 pagesKFD New04122022004727946 E28Ashfaq hussainNo ratings yet

- GST Information LICDocument2 pagesGST Information LICBalaji PalaniNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)ShreyaNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?ShreyaNo ratings yet

- KFD New E36Document6 pagesKFD New E36Gaurav ShahNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- Age 67 12 PayDocument5 pagesAge 67 12 PayRohit yadavNo ratings yet

- Section 80CCD - Deduction For NPS Contribution - Budget 2016Document6 pagesSection 80CCD - Deduction For NPS Contribution - Budget 2016debajyoti dasNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- KFD New14022024162942806 E28Document5 pagesKFD New14022024162942806 E28Mayur NagdiveNo ratings yet

- Icici Lakshya - 10kDocument5 pagesIcici Lakshya - 10kManjunath RNo ratings yet

- KFD New17082022140700359 E28Document5 pagesKFD New17082022140700359 E28sb RogerdatNo ratings yet

- C Endowment 25 YrsDocument5 pagesC Endowment 25 YrsSaurabh GargNo ratings yet

- Hhlkal00211208 17-18Document1 pageHhlkal00211208 17-18RohanNo ratings yet

- Policy No. Name Address:: 7000054772-02: MR Arbind Kumar Sinha: F-3,202 Shankeshwar Nagar, Manpad RoadDocument18 pagesPolicy No. Name Address:: 7000054772-02: MR Arbind Kumar Sinha: F-3,202 Shankeshwar Nagar, Manpad Roadbinitasinha100No ratings yet

- Ubum FranchiseDocument77 pagesUbum FranchiseShah PratikNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Meenu SinghNo ratings yet

- Os19611729 EbiDocument4 pagesOs19611729 EbiSoumya SwainNo ratings yet

- 001 Insurance Matrix LCC MR 26Document2 pages001 Insurance Matrix LCC MR 26Siva Naga Prasad TadipartiNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyHoooooNo ratings yet

- Annex-II Consent Form Policy B 2022-23Document4 pagesAnnex-II Consent Form Policy B 2022-23DdNo ratings yet

- 2023 PDF1681368243183Document2 pages2023 PDF1681368243183RpPaNo ratings yet

- Number of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedDocument1 pageNumber of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedPadamNo ratings yet

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantNo ratings yet

- Policy Number: - Premium Paid Certificate For FY: #Total Amount Paid During The Financial YearDocument1 pagePolicy Number: - Premium Paid Certificate For FY: #Total Amount Paid During The Financial YearGeogy GeorgeNo ratings yet

- Premium Paid Certificate: Service tax/GST & Other Applicable SurchargesDocument1 pagePremium Paid Certificate: Service tax/GST & Other Applicable Surchargeshimmatbanna93No ratings yet

- Null - 2022-12-14T183756.993Document5 pagesNull - 2022-12-14T183756.993Mayur NagdiveNo ratings yet

- Pradhan Mantri Suraksha Bima Yojana in DetailDocument7 pagesPradhan Mantri Suraksha Bima Yojana in DetailRAJ PATELNo ratings yet

- Number of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedDocument1 pageNumber of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedApratim BiswasNo ratings yet

- Date: March 28.2022: Premium Paid Certificate For The Financial Year 2021 - 2022Document2 pagesDate: March 28.2022: Premium Paid Certificate For The Financial Year 2021 - 2022sandeep kumarNo ratings yet

- KFD New18032024162138470 E28Document5 pagesKFD New18032024162138470 E28Suraj BhasmeNo ratings yet

- HHLHYD00208643 ProvisionalDocument1 pageHHLHYD00208643 ProvisionalPranab PaulNo ratings yet

- Benefit IllustrationDocument3 pagesBenefit IllustrationhanamasagarNo ratings yet

- 1181221-Annex-II Consent Form Policy B 2022-23Document4 pages1181221-Annex-II Consent Form Policy B 2022-23MaverickRohanNo ratings yet

- Insurance Receipt For Tax LatestDocument1 pageInsurance Receipt For Tax Latestthetrilight2023No ratings yet

- PPC 2016Document1 pagePPC 2016Suresh BabuNo ratings yet

- KFD New E36Document6 pagesKFD New E36vishalNo ratings yet

- c549992e-cba1-4e32-9e08-7f8ff2a6d613Document7 pagesc549992e-cba1-4e32-9e08-7f8ff2a6d613vonamal985No ratings yet

- Get Reference DetailsDocument3 pagesGet Reference Detailsniren4u1567No ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- Blank - Gold Maintenance Contract India PDFDocument5 pagesBlank - Gold Maintenance Contract India PDFJaganath PaniNo ratings yet

- Sap GST TaxinnDocument9 pagesSap GST TaxinnBhagyesh ZopeNo ratings yet

- CorporationDocument6 pagesCorporationJane TuazonNo ratings yet

- M&a - Types of AcquisitionsDocument2 pagesM&a - Types of AcquisitionsArijit SahaNo ratings yet

- Assessment of Tax Collection Problems (The Case of Wolkite Town)Document25 pagesAssessment of Tax Collection Problems (The Case of Wolkite Town)kassahun mesele100% (7)

- E-Tutorial - Online Correction - Pay 220I, LP, LD, Interest, Late Filing, LevyDocument38 pagesE-Tutorial - Online Correction - Pay 220I, LP, LD, Interest, Late Filing, LevyPrasad IyengarNo ratings yet

- Events After The Reporting Period: Pas 10, Pas 12, and Pas 16 ObjectiveDocument5 pagesEvents After The Reporting Period: Pas 10, Pas 12, and Pas 16 ObjectiveMica DelaCruzNo ratings yet

- ON MANDANAS RULING Dissent by JUSTICE LEONENDocument5 pagesON MANDANAS RULING Dissent by JUSTICE LEONENedgardo benitezNo ratings yet

- Advantages of Being A Sole TraderDocument6 pagesAdvantages of Being A Sole TradercrthinkerNo ratings yet

- Form GST REG-25: Government of India and Government of Madhya PradeshDocument1 pageForm GST REG-25: Government of India and Government of Madhya PradeshAnonymous hQpEadSf0% (1)

- 2307 Jan 2018 ENCS v3.1Document90 pages2307 Jan 2018 ENCS v3.1Lex AmarieNo ratings yet

- One Columbia Report To Mayor Steve BenjaminDocument101 pagesOne Columbia Report To Mayor Steve BenjaminThe State NewspaperNo ratings yet

- 6.revised Galvanized Iron Sheet Product Producing PlantDocument23 pages6.revised Galvanized Iron Sheet Product Producing PlantFekadie TesfaNo ratings yet

- Form12-PQB0286280-C19088-Karthi Subramanian-2021-2022Document1 pageForm12-PQB0286280-C19088-Karthi Subramanian-2021-2022Karthi SubramanianNo ratings yet

- A Report On Banking Sector of BangladeshDocument13 pagesA Report On Banking Sector of BangladeshImOn NoMiNo ratings yet

- RRL LawsDocument2 pagesRRL LawsSarah LeeNo ratings yet

- H2O - 20240215172006 - EN H2O Announcement Revised Budget 2024 BVBDocument3 pagesH2O - 20240215172006 - EN H2O Announcement Revised Budget 2024 BVBMaxim TodicaNo ratings yet

- The Taxpayer Burden of Family FragmentationDocument4 pagesThe Taxpayer Burden of Family FragmentationMichigan Family ForumNo ratings yet

- Ir255 2023Document44 pagesIr255 2023Fuckyou I'mnotsubscribingNo ratings yet

- Macroeconomics 6th Edition Hubbard Test BankDocument70 pagesMacroeconomics 6th Edition Hubbard Test Bankgrainnematthew7cr3xy100% (28)

- Tax Invoice: Taxes RateDocument1 pageTax Invoice: Taxes RateSivakrishna JammanaNo ratings yet

- Hotel SWOT Analysis in ChinaDocument17 pagesHotel SWOT Analysis in ChinaMihai PaduraruNo ratings yet

- BRACU BUS 510.2 Final Alternative Assessment Spring 2021Document3 pagesBRACU BUS 510.2 Final Alternative Assessment Spring 2021Maliha FarzanaNo ratings yet

- Start Up BudgetDocument1 pageStart Up Budgetrsi2294No ratings yet

- BIR Ruling (Da 158-05) 04-14-2005Document5 pagesBIR Ruling (Da 158-05) 04-14-2005Franz CruzNo ratings yet

- Fuji Invoice 110130363 - January 2020 Rental ChargesDocument1 pageFuji Invoice 110130363 - January 2020 Rental ChargesPius CantaNo ratings yet