Professional Documents

Culture Documents

Benefit Illustration For DHFL Pramerica Flexi Cash

Uploaded by

Sriram NaiduOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benefit Illustration For DHFL Pramerica Flexi Cash

Uploaded by

Sriram NaiduCopyright:

Available Formats

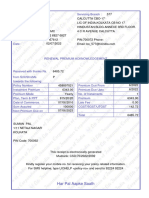

URN:

BI712769413 Proposal No. Policy No.

Benefit Illustration for DHFL Pramerica Flexi Cash

UIN: 140N040V02 Illustration generated by : dpli

Product Code : T10 Illustration Date : Sat Aug 03 2019

Dear Valued Customer

The illustration is in accordance with the guidelines set by Life Insurance Council & Insurance Regulatory and Development Authority of India. Some benefits are guaranteed and

some benefits are variable with returns based on the future performance of with-profit fund of the Company. If your policy offers guaranteed returns then these will be clearly

marked as "guaranteed" in the illustration table. If your Policy offers variable returns then the illustration will show two different rates of assumed future investment returns.

These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your Policy is dependent on a number of

factors including future investment returns.

For the purpose of illustrating non guaranteed benefits we have assumed 4% per annum and 8% per annum respectively as the lower and the higher rates of investment return

on the with-profit fund of the Company. These assumed rates are not guaranteed and they are not upper or lower limits of what you might get back.

Life to be insured information Base Coverage Information

Name Valued Customer Plan Name DHFL Pramerica Flexi Cash

Age 34 Base Sum Assured (Rs.) 198682

Gender Male Premium Payment Term (Years) 5 Years

Mode of Premium Payment Annual Policy Term (Years) 15 Years

Annualized Premium**(Rs.) 40191 Occupational Extra Rates(If Applicable)

Modal Premium: 1st Policy Year(Rs.) 42000

NA

Modal Premium: 2nd Policy Year Onwards(Rs.) 41095

Communication Address:

DHFL Pramerica Life Insurance Co. Ltd.4th Floor, Building No-9B,DLF Cyber City, Phase - III,Gurgaon - 122002, Haryana, Registration No. 140

Company Salesperson's Signature:_______________________________ Proposer's Signature:_______________________________

DECIMAL Version No. 1.13.0 Page: 1/3

Non-Guaranteed Benefits

Guaranteed Total Benefits @ 4% Total Benefits @ 8%

Age at the

end of Policy Annual Death Maturity Death Maturity Death Maturity

Policy Surrender Surrender Surrender

Year (Issue Premium Sum Benefit/Guaranteed Benefit Benefit/Guaranteed Benefit Benefit/Guaranteed

Year Value Value* Value*

Age=34 Payable Assured Loyalty Benefit Payable Loyalty Benefit Payable Loyalty Benefit

Years)

1 35 40191 401914 0 0 402291 0 0 405291 0 0

2 36 40191 401914 20096 4019 402670 49800 4019 408726 49800 4019

3 37 40191 401914 28134 4019 403048 76253 4019 412220 81399 4019

4 38 40191 401914 68325 4019 403428 104634 4019 415773 112149 4019

5 39 40191 401914 94449 4019 403808 135559 4019 419386 145851 4019

6 40 0 401914 104497 0 404190 146805 0 423060 160341 0

7 41 0 401914 114545 0 404571 159029 0 426798 176343 0

8 42 0 401914 124593 0 404954 172329 0 430598 194031 0

9 43 0 401914 134640 0 405337 186806 0 434463 213594 0

10 44 0 401914 134640 0 410834 207603 0 450390 247158 0

11 45 0 401914 134640 0 416077 212845 0 462998 259766 0

12 46 0 401914 134640 0 421451 218219 0 476248 273016 0

13 47 0 401914 134640 0 426961 223730 0 490175 286943 0

14 48 0 401914 134640 0 432611 229379 0 504812 301580 0

15 49 0 401914 134640 198682 438403 235171 235171 520195 316964 316964

*Surrender Value is higher of Guaranteed Surrender Value and Special Surrender Value. Surrender value illustrated is subject to change basis change in special surrender value.

The Policyholder can contact the Company regarding the latest available surrender value under the Policy.

**Annualized Premium is the total premium excluding GST, underwriting extra and modal loadings (if any).

Communication Address:

DHFL Pramerica Life Insurance Co. Ltd.4th Floor, Building No-9B,DLF Cyber City, Phase - III,Gurgaon - 122002, Haryana, Registration No. 140

Company Salesperson's Signature:_______________________________ Proposer's Signature:_______________________________

DECIMAL Version No. 1.13.0 Page: 2/3

Conditions applicable specific to this product:

1. The illustrated benefits are assumed as at end of the Policy Year including Maturity Benefit as applicable.

2. This plan provides Guaranteed loyalty benefit payable at the start of Policy Year during premium payment term from the 2nd policy year provided the Policy is in force for

full risk benefits and Premium for previous Policy year have been paid in full. This benefit equals 10% of Annualized premium**.

3. If the death occurs during the policy term, Death sum assured plus Accrued Reversionary Bonuses plus Final bonus if any would be paid. The Death Sum Assured together

with bonuses shall be at least equal to 105% of sum of all Premium paid (excluding underwriting extra and GST) as on date of death. For more details please refer to Policy

Document.

4. On survival to maturity, Maturity Benefit shall be payable which would be equal Base Sum Assured plus Accrued Reversionary Bonuses, plus Final Bonus, if any.

5. The policy will acquire Surrender value after payment of at least two year's Premium in full. Thereafter, if the customer decides not to pay further Premiums, he/she would

have the option to either surrender the Policy or let the Policy continue with reduced benefits in accordance with Policy Document.

6. DHFL Pramerica Flexi Cash is only the name of the Policy and does not in any way indicate the quality of the policy, its future prospects or returns.

7. The Guaranteed Surrender Value shown above is a percentage of Premium paid (excluding underwriting extras) and does not include the Guaranteed Surrender Value of

bonuses.

General Conditions:

1. The illustrative benefits above assume that all Premium are paid on due date.

2. The Modal Premium mentioned above is the Premium payable on the due date and includes GST which is levied as per the applicable tax laws.

3. Annual Premium payable is the total Premium for the year excluding GST.

4. Total Benefits defined above includes guaranteed as well as non-guaranteed benefits. The non-guaranteed benefits include bonuses.

5. Bonuses (including final bonus, if any) are not guaranteed and will depend on the experience of the Company in terms of investment return, mortality experience,

expenses, etc.

6. Past Performance of any plan of the company is not necessarily indicative of the future performance of any of the plans.

7. For more details on risk factors, description of benefits or for any other benefit available under the policy, please refer to the sales brochure and policy document.

8. For any further clarifications, please feel free to get in touch with your Company Salesperson.

9. Please contact the Company for further details on various premium paying mediums available under the plan.

10. Tax Benefits are subject to the prevailing Income Tax laws.

11. Insurance is the subject matter of solicitation.

I ________________________________________, have explained the features and benefits and risks associated with the plan to the proposer to the best of my knowledge.

Company Salesperson's signature:________________________________________

I ________________________________________, having received the information with respect to the above, Have understood the above illustration and statements before entering into

the contract.

Proposer's signature:________________________________________

Company Seal:

Place:

Date:

Communication Address:

DHFL Pramerica Life Insurance Co. Ltd.4th Floor, Building No-9B,DLF Cyber City, Phase - III,Gurgaon - 122002, Haryana, Registration No. 140

Company Salesperson's Signature:_______________________________ Proposer's Signature:_______________________________

DECIMAL Version No. 1.13.0 Page: 3/3

You might also like

- Report - Mr. - Abraham Kuruvila - 936 - 16 - 10 - Age - 44 - SA - 2300000Document4 pagesReport - Mr. - Abraham Kuruvila - 936 - 16 - 10 - Age - 44 - SA - 2300000anoopapNo ratings yet

- Conditions Governing The Benefits Illustration Shown in The Subsequent PagesDocument4 pagesConditions Governing The Benefits Illustration Shown in The Subsequent PagesAshfaque SayedNo ratings yet

- Jeevan SaralDocument11 pagesJeevan SaralParamjeet K GadhriNo ratings yet

- UntitledDocument2 pagesUntitledAmeet ChandanNo ratings yet

- 109 SIPcomboDocument2 pages109 SIPcombo1947 Abhishek TripathiNo ratings yet

- Future GainDocument9 pagesFuture GainSantosh DasNo ratings yet

- Gip 202212021333106Document3 pagesGip 202212021333106gaurav sharmaNo ratings yet

- Pension PlusDocument2 pagesPension PlusAmol PatilNo ratings yet

- Illustration For Your HDFC Life Click 2 Protect 3D PlusDocument2 pagesIllustration For Your HDFC Life Click 2 Protect 3D Plusanjan0No ratings yet

- Benefit Illustration For Shriram Life Golden Premier Saver Plan 128N088V02Document2 pagesBenefit Illustration For Shriram Life Golden Premier Saver Plan 128N088V02dharam singhNo ratings yet

- Plan Details, Benefits, Presentation and Ready Reckoner: Compiled By: Kamlesh Gurbuxani, AIII, CFP Development OfficerDocument12 pagesPlan Details, Benefits, Presentation and Ready Reckoner: Compiled By: Kamlesh Gurbuxani, AIII, CFP Development OfficerSeshadri VenkatNo ratings yet

- GSP202301121224108Document3 pagesGSP202301121224108mantoo kumarNo ratings yet

- Shivang 10Document2 pagesShivang 10Ameet ChandanNo ratings yet

- Report Mr. VV 920 20 15 Age 31 SA 305000Document5 pagesReport Mr. VV 920 20 15 Age 31 SA 305000arvindNo ratings yet

- Jeevan Saral Plan Presentation: R. SubramaniDocument3 pagesJeevan Saral Plan Presentation: R. SubramaniSiva GNo ratings yet

- Mr. Mariyappan: 945 - LIC's Jeevan UmangDocument9 pagesMr. Mariyappan: 945 - LIC's Jeevan UmangPranav SNo ratings yet

- Mixing - 25-1-2021 2.25.8Document7 pagesMixing - 25-1-2021 2.25.8..No ratings yet

- As 936 16 10 Age 44 SA 200000Document5 pagesAs 936 16 10 Age 44 SA 200000SUMIT KUMARNo ratings yet

- IllustrationForm S000045685006Document2 pagesIllustrationForm S000045685006Prachi JainNo ratings yet

- Mr. Kumar Gaurav: Insurance Proposal ForDocument6 pagesMr. Kumar Gaurav: Insurance Proposal ForHarish ChandNo ratings yet

- Invest Builder - Product SummaryDocument30 pagesInvest Builder - Product SummaryJun Rui ChngNo ratings yet

- Benefit Illustration LIC's Amrit BaalDocument3 pagesBenefit Illustration LIC's Amrit BaalVENKATESHNo ratings yet

- SA1N03022024173148Document2 pagesSA1N03022024173148Nitin KumarNo ratings yet

- Icici Prudential AceDocument3 pagesIcici Prudential AceugandharjNo ratings yet

- Lease Versus PurchasingDocument10 pagesLease Versus PurchasingnirmalajNo ratings yet

- Life Insurance Company The Whole Life Policy-Single PremiumDocument13 pagesLife Insurance Company The Whole Life Policy-Single PremiumNazneenNo ratings yet

- Illustration For Your HDFC Life Click 2 Protect 3D PlusDocument2 pagesIllustration For Your HDFC Life Click 2 Protect 3D PlusAkhilesh RastogiNo ratings yet

- BenefitIllustration-1679808210447 230326 105345Document1 pageBenefitIllustration-1679808210447 230326 105345Ameet ChandanNo ratings yet

- C Endowment 25 YrsDocument5 pagesC Endowment 25 YrsSaurabh GargNo ratings yet

- BenefitIllustrations 1Document2 pagesBenefitIllustrations 1vonamal985No ratings yet

- ATAL PENSION YOJNA - DetailsDocument4 pagesATAL PENSION YOJNA - Detailsbhavesh sangtaniNo ratings yet

- Report Mr. Kakani 936 16 10 Age 58 SA 200000Document4 pagesReport Mr. Kakani 936 16 10 Age 58 SA 200000Omi RamaniNo ratings yet

- EquoteDocument3 pagesEquoteVinay MishraNo ratings yet

- LIC - Retire and EnjoyDocument4 pagesLIC - Retire and EnjoyThiagarajan VasuNo ratings yet

- 313 PCDRDocument3 pages313 PCDRkahwai ngNo ratings yet

- Report Mr. Amit 945 76 12 Age 24 SA 2020000Document6 pagesReport Mr. Amit 945 76 12 Age 24 SA 2020000Sudeep MandalNo ratings yet

- Report Master. V 874 Age 2 SA 1000000Document4 pagesReport Master. V 874 Age 2 SA 1000000basavarajbalagod8No ratings yet

- Leveraged Buyout Model Calculator V 1.2Document3 pagesLeveraged Buyout Model Calculator V 1.2john hirshNo ratings yet

- National University of Modern Languages Department of Management Sciences Main CampusDocument6 pagesNational University of Modern Languages Department of Management Sciences Main CampusRabail ShahzadiNo ratings yet

- Illustration For Your HDFC Life Click 2 Protect 3D PlusDocument2 pagesIllustration For Your HDFC Life Click 2 Protect 3D PlusCharanNo ratings yet

- Mithun - NewEndowment - 11-11-2023 3.48.42Document6 pagesMithun - NewEndowment - 11-11-2023 3.48.42VENUGOPAL VNo ratings yet

- Report Mr. Tharun 936 25 16 Age 18 SA 500000Document5 pagesReport Mr. Tharun 936 25 16 Age 18 SA 500000tharunshanmugam25No ratings yet

- BenefitIllustartion Early Cash Plan 15102022173146Document2 pagesBenefitIllustartion Early Cash Plan 15102022173146dharam singhNo ratings yet

- Critical Net WorthDocument3 pagesCritical Net WorthXicaveNo ratings yet

- Mr. Rakesh Chaturvedi: Insurance Proposal ForDocument5 pagesMr. Rakesh Chaturvedi: Insurance Proposal ForHarish ChandNo ratings yet

- 214 FGPlusDocument4 pages214 FGPlussurjeet1983No ratings yet

- Ntorq, Raider & RoninDocument1 pageNtorq, Raider & Roninmuralid17No ratings yet

- Income BrochureDocument20 pagesIncome BrochureGaurav Mishra 23No ratings yet

- Benefit Illustration-Metlife Major Illness Premium Back CoverDocument4 pagesBenefit Illustration-Metlife Major Illness Premium Back CoverGD SinghNo ratings yet

- Portfolio & Risk Management: Presented By:-Shubham Dave Roll No:-02Document8 pagesPortfolio & Risk Management: Presented By:-Shubham Dave Roll No:-02vipul sutharNo ratings yet

- Solution To QB QuestionsDocument3 pagesSolution To QB QuestionsSurabhi Suman100% (1)

- PGS BrochureDocument17 pagesPGS BrochureAlexNo ratings yet

- LIC S Jeevan Samridhi - 512N215V01Document6 pagesLIC S Jeevan Samridhi - 512N215V01azizsultanNo ratings yet

- 401 (K) Mirror PlansDocument4 pages401 (K) Mirror PlansBill BlackNo ratings yet

- Anikit Pradhan - 11Document4 pagesAnikit Pradhan - 11Anurag pradhanNo ratings yet

- Gsip For 15 YrsDocument3 pagesGsip For 15 YrsJoni SanchezNo ratings yet

- Mr. Neelam Aggarwal: Presentation Specially Prepared ForDocument4 pagesMr. Neelam Aggarwal: Presentation Specially Prepared ForHarish ChandNo ratings yet

- Parul Sharma BIpdfDocument2 pagesParul Sharma BIpdfdharam singhNo ratings yet

- Tax Planning and Compliance for Tax-Exempt Organizations: Rules, Checklists, Procedures - 2015 Cumulative SupplementFrom EverandTax Planning and Compliance for Tax-Exempt Organizations: Rules, Checklists, Procedures - 2015 Cumulative SupplementNo ratings yet

- Future Perfect Latest - 4 Jul 20 v1Document51 pagesFuture Perfect Latest - 4 Jul 20 v1Gamer LastNo ratings yet

- Financial IntermediariesDocument63 pagesFinancial Intermediariesjustin razonNo ratings yet

- Agrarian Law Finals Exam: INSTRUCTIONS: Read Each Question Carefully Before Answering. Answer Sequentially and ClearlyDocument15 pagesAgrarian Law Finals Exam: INSTRUCTIONS: Read Each Question Carefully Before Answering. Answer Sequentially and ClearlyJohanna Arnaez100% (1)

- NRI Email Indeminity and Privacy ConsentADocument2 pagesNRI Email Indeminity and Privacy ConsentAvenkatesh801No ratings yet

- Case Digest - OPT and DSTDocument30 pagesCase Digest - OPT and DSTGlargo GlargoNo ratings yet

- MCQ Banking and InsuranceDocument37 pagesMCQ Banking and InsuranceShreya Makkar100% (1)

- Drill 2 (1-24) FSUU AccountingDocument12 pagesDrill 2 (1-24) FSUU AccountingRobert CastilloNo ratings yet

- 1827 PDFDocument3 pages1827 PDFhelloitskalaiNo ratings yet

- 4 8 87 921 PDFDocument4 pages4 8 87 921 PDFTwinkal PatelNo ratings yet

- Personal Financial Statement Template 42Document2 pagesPersonal Financial Statement Template 42Syrine SmaraNo ratings yet

- SPECIMEN EXAM PAPER - CM1B - IFoA - 2019 - Final 100mksDocument3 pagesSPECIMEN EXAM PAPER - CM1B - IFoA - 2019 - Final 100mkshiketNo ratings yet

- Shriram Life InsuranceDocument99 pagesShriram Life InsuranceAshish Agarwal100% (1)

- Investment Linked ProductsDocument15 pagesInvestment Linked ProductsMay BucagNo ratings yet

- Aia Health CoverDocument4 pagesAia Health CoverGilbert CalledoNo ratings yet

- Extended Health Benefits Claim FormDocument2 pagesExtended Health Benefits Claim FormHolystreamNo ratings yet

- AirtelDocument8 pagesAirtelDeepika ThakurNo ratings yet

- Addendum To Proposal Form-A4Document1 pageAddendum To Proposal Form-A4Surekha HolagundiNo ratings yet

- Fundamentals of Risk and InsuranceDocument745 pagesFundamentals of Risk and InsuranceSaR aS100% (1)

- LIC Combined ReceiptsDocument6 pagesLIC Combined Receiptssumanpal78No ratings yet

- TATA aIG pRDOUCTSDocument6 pagesTATA aIG pRDOUCTSNakul MehtaNo ratings yet

- Business Plan: Carlos Islas Jesica Islas Partners Islas 314 IncDocument15 pagesBusiness Plan: Carlos Islas Jesica Islas Partners Islas 314 IncLian Emerald SmithNo ratings yet

- 2023 New Hire GuideDocument22 pages2023 New Hire GuideKelle SuttonNo ratings yet

- Insurance ModuleDocument94 pagesInsurance ModulepradipNo ratings yet

- Krsmanc2875 BDocument97 pagesKrsmanc2875 BasitarekNo ratings yet

- Life Ic Reviewer 2017Document9 pagesLife Ic Reviewer 2017SHENNA ALLAM0% (1)

- Analysis of Bharti Axa Range of ServicesDocument88 pagesAnalysis of Bharti Axa Range of ServicesZohaib AhmedNo ratings yet

- Marine InsuranceDocument7 pagesMarine InsuranceSalman M. SaimunNo ratings yet

- Accounts of Insurance CompaniesDocument17 pagesAccounts of Insurance CompaniesCHANCHALNo ratings yet

- Regulatory Framework: Margin of SolvencyDocument14 pagesRegulatory Framework: Margin of SolvencyHazel Vera FlagaNo ratings yet

- Requirement of Insurable Interest in LifDocument15 pagesRequirement of Insurable Interest in Lifanamika tyagiNo ratings yet