Professional Documents

Culture Documents

SDE Compensation PDF

Uploaded by

Siddhartha mishraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SDE Compensation PDF

Uploaded by

Siddhartha mishraCopyright:

Available Formats

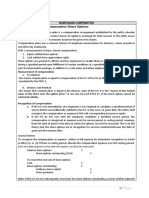

Amazon SDE Intern and FTE Roles Compensation

SDE Intern Stipend

Component Package (INR)

Stipend 45,000

SDE OFFER

Component Package (INR)

Base 13,00,000

1st Year Sign On 3,50,000

2nd Year Sign On 2,25,000

RSU Value vested over 4

Years

Year 1 – 5%

Year 2 – 15%

Year 3 – 40%

Year 4 – 40% 10,00,000

Base Pay: Base pay is the fixed pay that is given to the employee during the 1st year of their

employment in 12 equal installments also called monthly salary. This also includes standard deductions

as per the guidelines of income tax and basis individual tax planning.

SB1: Sign-on Bonus Year 1 is the amount given to the employee in 12 equal installments along with their

monthly salary during their 1st year of employment and is part of their overall compensation for the 1st

year. Taxes are deducted in accordance with the income tax guidelines and individual tax planning.

SB2: Sign-on Bonus Year 2 is the amount given to the employee in 12 equal installments along with their

monthly salary during their 2nd year of employment and is part of their overall compensation for the

2nd year. Taxes are deducted in accordance with the income tax guidelines and individual tax planning.

RSU: Restricted Stock Units is the total value of the stocks that an employee would get across 4 years.

Each year the schedule of RSU vesting differs and is as follows: 1st year - 5%, 2nd year - 15% and for 3rd

and 4th year, 20% of stocks vest every 6 months. At the time of vest, since you get actual Amazon stocks

as per your vesting schedule, there can be no fractional stock vests. Any fractional stocks on a particular

vest date are carried forward to the next vest date. The value of your RSUs is considered taxable income

and is governed by Tax laws in your country. You will have access to complete information related to

taxes on RSUs once you join Amazon

You might also like

- Internship Stipend and Compensation - Amazon 2022Document2 pagesInternship Stipend and Compensation - Amazon 2022Omkar KondakaNo ratings yet

- 1194 Sneha Babu-Teleperformance (CSE) 2019-2020Document3 pages1194 Sneha Babu-Teleperformance (CSE) 2019-2020Popi BhowmikNo ratings yet

- ADOBE - Compensation Breakup - Member of Technical StaffDocument2 pagesADOBE - Compensation Breakup - Member of Technical Staffdehejar970No ratings yet

- Amazon Compensation DetailsDocument1 pageAmazon Compensation DetailsAkankshaSinghNo ratings yet

- Employee Benefits Lecture Notes-2Document18 pagesEmployee Benefits Lecture Notes-2machabelanosiphoNo ratings yet

- Higher Pension - SimulatorDocument8 pagesHigher Pension - SimulatorShashikant ChaudhariNo ratings yet

- 1194 Sneha Babu-Teleperformance (CEE) 2019-2020Document3 pages1194 Sneha Babu-Teleperformance (CEE) 2019-2020Dipa PaulNo ratings yet

- Assignment 2 ECBMDocument11 pagesAssignment 2 ECBMchakradhar pmNo ratings yet

- 2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMDocument1 page2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMMohammad MAAZNo ratings yet

- Arul Mozhi Varman - MOUDocument2 pagesArul Mozhi Varman - MOUV G P ARUL MOZHI VARMANNo ratings yet

- Digital Learning & Development ManagerDocument3 pagesDigital Learning & Development ManagerArun KumarNo ratings yet

- Public Sector Enterprises Componsation ManagementDocument12 pagesPublic Sector Enterprises Componsation ManagementDhamodara MNo ratings yet

- Ias 19 - Employee Benefits Lecture 1Document14 pagesIas 19 - Employee Benefits Lecture 1NqubekoNo ratings yet

- Unthinkable Solutions LLPDocument1 pageUnthinkable Solutions LLPTarunNo ratings yet

- DT 5Document83 pagesDT 5AnkitaNo ratings yet

- EmpBen Practice SetDocument1 pageEmpBen Practice SetCassyNo ratings yet

- d5eb67b6-6d69-484a-aa38-b800024e6693Document14 pagesd5eb67b6-6d69-484a-aa38-b800024e6693pixeljoyNo ratings yet

- Rahul Kumar - CM Assignment - 1Document12 pagesRahul Kumar - CM Assignment - 1Rahul KumarNo ratings yet

- Mohit MishrikotiDocument4 pagesMohit MishrikotiKunalNo ratings yet

- AtlassianDocument2 pagesAtlassianAnunay JoshiNo ratings yet

- InstructionsDocument8 pagesInstructionssathyanarayana medaNo ratings yet

- 2 - 2268903 - Salary - Annexure - 1 - 18 - 2022 8 - 08 - 01 PMDocument1 page2 - 2268903 - Salary - Annexure - 1 - 18 - 2022 8 - 08 - 01 PMrevanthNo ratings yet

- Offer Letter: Page 1 of 4Document4 pagesOffer Letter: Page 1 of 4Manish KumarNo ratings yet

- India Annexure 2023-05-24Document2 pagesIndia Annexure 2023-05-24vipin.yadavNo ratings yet

- Quantum GravityDocument2 pagesQuantum GravitySubhodeep BanerjeeNo ratings yet

- 57496bos46599cp4 PDFDocument80 pages57496bos46599cp4 PDFManoj GNo ratings yet

- Salaries: After Studying This Chapter, You Would Be Able ToDocument80 pagesSalaries: After Studying This Chapter, You Would Be Able ToSatyam Kumar AryaNo ratings yet

- Law Consulting Sales Pitch by SlidesgoDocument21 pagesLaw Consulting Sales Pitch by SlidesgoAnupriyaNo ratings yet

- Payroll Guidelines and FAQs - V1Document15 pagesPayroll Guidelines and FAQs - V1Shiva Kant VermaNo ratings yet

- Offer Letter - DraftDocument5 pagesOffer Letter - DraftyzhpgoofdNo ratings yet

- Provident FundDocument5 pagesProvident FundG MadhuriNo ratings yet

- Transfer 982950Document2 pagesTransfer 982950prathmeshNo ratings yet

- Dhruv Rajput NewDocument13 pagesDhruv Rajput NewAbhay SharmaNo ratings yet

- Salaries: After Studying This Chapter, You Would Be Able ToDocument82 pagesSalaries: After Studying This Chapter, You Would Be Able ToLilyNo ratings yet

- ESOPs Policy & CTC Structure - Urban Tribe 2022 2Document8 pagesESOPs Policy & CTC Structure - Urban Tribe 2022 2guptaaditya1108No ratings yet

- Ahad Mohammad Farooque Siddiqui Abdul EAHAABD 2023 Annual Salary Review GlobalDocument1 pageAhad Mohammad Farooque Siddiqui Abdul EAHAABD 2023 Annual Salary Review Globalahad siddiquiNo ratings yet

- PMS Dispensation: Year Individual Performance Rating (ScaleDocument1 pagePMS Dispensation: Year Individual Performance Rating (ScalecharuNo ratings yet

- Atlassian Corporation Inc - Campus SalaryDocument2 pagesAtlassian Corporation Inc - Campus SalarySubrat SahuNo ratings yet

- Quinnox OfferLetterDocument5 pagesQuinnox OfferLetterVakati HemasaiNo ratings yet

- 2.2 Employee Benefits Lecture 2Document16 pages2.2 Employee Benefits Lecture 2ThapsNo ratings yet

- MODULE - SHARE-BASED COMPENSATION (SO AND SARs)Document15 pagesMODULE - SHARE-BASED COMPENSATION (SO AND SARs)John Mark FernandoNo ratings yet

- PDF Document E64dfec87bb0 1Document75 pagesPDF Document E64dfec87bb0 120BRM051 Sukant SNo ratings yet

- Message From Gopal VittalDocument2 pagesMessage From Gopal VittalMishra AnandNo ratings yet

- Income From Salary (Chapter 6)Document4 pagesIncome From Salary (Chapter 6)Fahim Shahriar MozumderNo ratings yet

- LOI Format - CoreDocument4 pagesLOI Format - CoreBackupNo ratings yet

- Provident Fund in India - An OverviewDocument9 pagesProvident Fund in India - An Overviewedwards1steveNo ratings yet

- Presentation On Contributory Provident FundDocument4 pagesPresentation On Contributory Provident FundAli HaiderNo ratings yet

- Taxation Cia 3Document27 pagesTaxation Cia 3Soumya KesharwaniNo ratings yet

- Employment Related 202000105 Market Correction 2021Document2 pagesEmployment Related 202000105 Market Correction 2021Anurag PradhanNo ratings yet

- Annual Performance Bonus Policy - BALDocument6 pagesAnnual Performance Bonus Policy - BALPankaj KumarNo ratings yet

- HR05 Offering LetterDocument2 pagesHR05 Offering LetterMarvin SNo ratings yet

- 2 - 2551442 - Salary - Annexure - 7 - 19 - 2022 9 - 16 - 28 PMDocument1 page2 - 2551442 - Salary - Annexure - 7 - 19 - 2022 9 - 16 - 28 PMShauryaNo ratings yet

- New Incentive PLI RPLI Structure 07.04.23Document7 pagesNew Incentive PLI RPLI Structure 07.04.23duvaNo ratings yet

- Exercise Employee BenefitsDocument6 pagesExercise Employee BenefitsSarannyaRajendraNo ratings yet

- Salary StructureDocument6 pagesSalary StructureValluru SrinivasNo ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- Increment Letter - ArshChadhaDocument2 pagesIncrement Letter - ArshChadhaKASHVI SAXENANo ratings yet

- Sales ProjectionDocument20 pagesSales ProjectionjenissegemcamangonNo ratings yet

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhNo ratings yet