Professional Documents

Culture Documents

Handouts Lung Center of The Philippines vs. Quezon City

Uploaded by

Steph0 ratings0% found this document useful (0 votes)

43 views2 pagesThe Lung Center of the Philippines owns a hospital building in Quezon City that is used to treat both paying and non-paying patients. However, portions of the building are leased to private entities for commercial purposes. While the Lung Center argued it was a charitable institution exempt from property taxes, the court ruled that the portions leased commercially were not exempt as they were not used directly and exclusively for charitable purposes. The court affirmed the Lung Center was a charitable institution overall but only the areas used for hospital operations were tax exempt.

Original Description:

lung center v qc

Original Title

Handouts Lung Center of the Philippines vs. Quezon City

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Lung Center of the Philippines owns a hospital building in Quezon City that is used to treat both paying and non-paying patients. However, portions of the building are leased to private entities for commercial purposes. While the Lung Center argued it was a charitable institution exempt from property taxes, the court ruled that the portions leased commercially were not exempt as they were not used directly and exclusively for charitable purposes. The court affirmed the Lung Center was a charitable institution overall but only the areas used for hospital operations were tax exempt.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views2 pagesHandouts Lung Center of The Philippines vs. Quezon City

Uploaded by

StephThe Lung Center of the Philippines owns a hospital building in Quezon City that is used to treat both paying and non-paying patients. However, portions of the building are leased to private entities for commercial purposes. While the Lung Center argued it was a charitable institution exempt from property taxes, the court ruled that the portions leased commercially were not exempt as they were not used directly and exclusively for charitable purposes. The court affirmed the Lung Center was a charitable institution overall but only the areas used for hospital operations were tax exempt.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

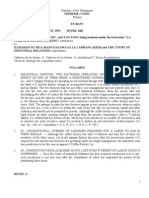

FACTS: ISSUE & RULING:

Petitioner, a non-stock and

IS LUNG CENTER A

non-profit entity, is the

registered owner of a lot

CHARITABLE INSTITUTION?

located in Quezon City. YES. A charitable institution

does NOT lose its character

Erected in the middle of the

as such and its exemption

aforesaid lot is a hospital. from taxes simply because it

and a big space at the ground derives income from paying

floor is being leased to private patients or receives subsidies

parties, for canteen and small from the government, so long

store spaces and private as the money received is

clinics. Almost one-half of the devoted or used altogether to

the charitable object which it

entire area on the left side of the

is intended to achieve; and no

building is vacant and idle, while a money inures to the private

big portion on the right side, is being benefit of the persons

leased for commercial purposes to a managing or operating the

private enterprise, the Elliptical Orchids and institution.

Garden Center. Petitioner accepts paying and

non-paying patients. Aside from its income from

paying patients, the petitioner receives annual

subsidies from the government. IS LUNG CENTER

Thereafter, both the land and the hospital EXEMPT FROM REAL

building of the petitioner were assessed for PROPERTY TAXES?

real property taxes by the City Assessor of

The portion of its real property

Quezon City. Petitioner filed a Claim for

LUNG CENTER OF Exemption from real property taxes with the

LEASED to private entities are

NOT EXEMPT from real property

taxes. What is meant by actual,

City Assessor, predicated on its claim that it is

THE PHILIPPINES a charitable institution. The petitioner’s direct and exclusive use of the

property for charitable purposes

request was denied, and a petition was,

VS. thereafter, filed before the Local Board of

is the direct and immediate and

actual application of the property

Assessment Appeals of Quezon City for the itself to the purposes for which

QUEZON CITY reversal but the same was dismissed. Both the charitable institution is

organized. It is not the use of the

the Central Board of Assessment Appeals of

GROUP 3 - ABELARDO, ILACAD, income from the real property that

Quezon City and Court of Appeals affirmed is determinative of whether the

MANUEL, RAMAJO, REAL

the assailed decision. Hence, this petition. property is used for tax-exempt

purposes.

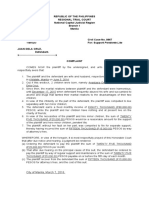

FACTS: ISSUE & RULING:

Petitioner, a non-stock and

non-profit entity, is the IS LUNG CENTER A

registered owner of a lot CHARITABLE INSTITUTION?

located in Quezon City. YES. A charitable institution

Erected in the middle of the does NOT lose its character

aforesaid lot is a hospital. as such and its exemption

and a big space at the ground f r o m t a x e s s i m p l y b e c a u s e i t

derives income from paying

floor is being leased to private

patients or receives subsidies

parties, for canteen and small f r o m t h e g o v e r n m e n t , s o l o n g

store spaces and private as the money received is

clinics. Almost one-half of the d e v o t e d o r u s e d a l t o g e t h e r t o

entire area on the left side of the the charitable object which it

building is vacant and idle, while a is intended to achieve; and no

big portion on the right side, is being money inures to the private

benefit of the persons

leased for commercial purposes to a

managing or operating the

private enterprise, the Elliptical Orchids and institution.

Garden Center. Petitioner accepts paying and

non-paying patients. Aside from its income from

paying patients, the petitioner receives annual

subsidies from the government. IS LUNG CENTER

Thereafter, both the land and the hospital EXEMPT FROM REAL

building of the petitioner were assessed for PROPERTY TAXES?

real property taxes by the City Assessor of

The portion of its real property

LUNG CENTER OF Quezon City. Petitioner filed a Claim for

Exemption from real property taxes with the

LEASED to private entities are

NOT EXEMPT from real property

THE PHILIPPINES City Assessor, predicated on its claim that it is

a charitable institution. The petitioner’s

taxes. What is meant by actual,

direct and exclusive use of the

VS. request was denied, and a petition was,

thereafter, filed before the Local Board of

property for charitable purposes

is the direct and immediate and

actual application of the property

QUEZON CITY Assessment Appeals of Quezon City for the

reversal but the same was dismissed. Both

itself to the purposes for which

the charitable institution is

organized. It is not the use of the

the Central Board of Assessment Appeals of

GROUP 3 - ABELARDO, ILACAD, income from the real property that

Quezon City and Court of Appeals affirmed is determinative of whether the

MANUEL, RAMAJO, REAL

the assailed decision. Hence, this petition. property is used for tax-exempt

purposes.

You might also like

- Tan Vs Del Rosario - Power of Taxation - CongressDocument2 pagesTan Vs Del Rosario - Power of Taxation - CongressprincessairellaNo ratings yet

- Sea-Land Service v. CA 357 SCRA 441Document2 pagesSea-Land Service v. CA 357 SCRA 441Kyle DionisioNo ratings yet

- PAGCOR Vs CIRDocument2 pagesPAGCOR Vs CIRMystic YuèliàngerNo ratings yet

- MGC Vs Collector SitusDocument5 pagesMGC Vs Collector SitusAira Mae P. LayloNo ratings yet

- The Philippine Guaranty Co., Inc. v. CIRDocument1 pageThe Philippine Guaranty Co., Inc. v. CIRMary BoaquiñaNo ratings yet

- Naldtra vs. CSCDocument1 pageNaldtra vs. CSCBennet GubatNo ratings yet

- Gotamco Case CirDocument2 pagesGotamco Case Cirnil qawNo ratings yet

- Malonzo Vs ZamoraDocument1 pageMalonzo Vs ZamorabxnakNo ratings yet

- REMEDIAL - Alonso Vs Cebu Country Club - Real Parties in InterestDocument14 pagesREMEDIAL - Alonso Vs Cebu Country Club - Real Parties in InterestAlandia GaspiNo ratings yet

- CIR Vs ST Luke S Medical CenterDocument6 pagesCIR Vs ST Luke S Medical CenterOlan Dave LachicaNo ratings yet

- Alcan Packaging Starpack Corp. v. The Treasurer of The City of ManilaDocument2 pagesAlcan Packaging Starpack Corp. v. The Treasurer of The City of ManilaCharles Roger RayaNo ratings yet

- Air Canada V CIRDocument2 pagesAir Canada V CIRNikita BayotNo ratings yet

- CIR vs. BOACDocument2 pagesCIR vs. BOACHappy KidNo ratings yet

- Cir VS DlsuDocument3 pagesCir VS DlsuAnonymous 5MiN6I78I0No ratings yet

- CIR vs. BOACDocument1 pageCIR vs. BOACPat EspinozaNo ratings yet

- Conwi v. Cir, 213 Scra 83Document4 pagesConwi v. Cir, 213 Scra 83Anonymous iOYkz0wNo ratings yet

- Rule 130, Section 40, (One of The Execptions To The Hearsay Rule) ProvidesDocument2 pagesRule 130, Section 40, (One of The Execptions To The Hearsay Rule) ProvidesVon Lee De LunaNo ratings yet

- M. Construction and Interpretation I. Cir vs. Puregold Duty Free, Inc. G.R. NO. 202789, JUNE 22, 2015Document3 pagesM. Construction and Interpretation I. Cir vs. Puregold Duty Free, Inc. G.R. NO. 202789, JUNE 22, 2015Marry LasherasNo ratings yet

- CIR V Bishop of Missionary DistrictDocument7 pagesCIR V Bishop of Missionary Districtnichols greenNo ratings yet

- Intercontinental Broadcasting Corp. vs. Noemi B. Amarilla, Et Al., G.R. No. 162775, October 27, 2006Document2 pagesIntercontinental Broadcasting Corp. vs. Noemi B. Amarilla, Et Al., G.R. No. 162775, October 27, 2006xxxaaxxxNo ratings yet

- Martin vs. RevillaDocument4 pagesMartin vs. RevillaXsche XscheNo ratings yet

- CIR Vs CA and AteneoDocument2 pagesCIR Vs CA and AteneoMariel Grace DelinNo ratings yet

- Ferreras Vs EclipseDocument1 pageFerreras Vs EclipseBryan-Charmaine ZamboNo ratings yet

- 027-Lutz v. Araneta, 98 Phil 148Document3 pages027-Lutz v. Araneta, 98 Phil 148Jopan SJ100% (1)

- Commissioner of Internal Revenue vs. Standard InsuranceDocument3 pagesCommissioner of Internal Revenue vs. Standard InsuranceJudel MatiasNo ratings yet

- 67 CIR V Procter GambleDocument2 pages67 CIR V Procter GambleNaomi QuimpoNo ratings yet

- CALTEX (PHILIPPINES), INC., Petitioner, vs. The Intermediate Appellate Court and Asia PACIFIC AIRWAYS, INC., RespondentsDocument5 pagesCALTEX (PHILIPPINES), INC., Petitioner, vs. The Intermediate Appellate Court and Asia PACIFIC AIRWAYS, INC., RespondentspatrickNo ratings yet

- American Bible Society Vs City of Manila (SUMMARY)Document3 pagesAmerican Bible Society Vs City of Manila (SUMMARY)ian clark MarinduqueNo ratings yet

- Philippine National Bank Vs Palma Gil (Partnership)Document2 pagesPhilippine National Bank Vs Palma Gil (Partnership)MasterboleroNo ratings yet

- Cir Vs Marubeni Corporation, G.R. No. 137377 FactsDocument2 pagesCir Vs Marubeni Corporation, G.R. No. 137377 FactsAaliyah AndreaNo ratings yet

- Republic vs. Patanao (GR No. L-22356, July 21, 1967)Document3 pagesRepublic vs. Patanao (GR No. L-22356, July 21, 1967)anaNo ratings yet

- CIR v. Asalus CorpDocument9 pagesCIR v. Asalus CorpMeg ReyesNo ratings yet

- Consti2Digest - PN-012 Tolentino Vs Secretary, 235 SCRA 632 (1994)Document2 pagesConsti2Digest - PN-012 Tolentino Vs Secretary, 235 SCRA 632 (1994)Lu CasNo ratings yet

- Pepsi v. TanauanDocument2 pagesPepsi v. TanauanKhian JamerNo ratings yet

- Calasanz V CIRDocument6 pagesCalasanz V CIRjonbelzaNo ratings yet

- Communication Materials V CA)Document1 pageCommunication Materials V CA)Junsi AgasNo ratings yet

- CIR v. CA and CDCP Mining CorpDocument3 pagesCIR v. CA and CDCP Mining CorpEva TrinidadNo ratings yet

- United Cadiz Sugar Farmers Association Multi-Purpose Cooperative v. CommissionerDocument6 pagesUnited Cadiz Sugar Farmers Association Multi-Purpose Cooperative v. CommissionerEryl YuNo ratings yet

- Tax VAT CIR Vs GotamcoDocument3 pagesTax VAT CIR Vs GotamcoRhea Mae A. SibalaNo ratings yet

- Aberca v. Ver, 160 SCRA 590 (1988)Document13 pagesAberca v. Ver, 160 SCRA 590 (1988)romelamiguel_2015No ratings yet

- PHILIPPINE MOVIE PICTURES WORKERS' ASSOCIATION v. PREMIERE PRODUCTIONS PDFDocument5 pagesPHILIPPINE MOVIE PICTURES WORKERS' ASSOCIATION v. PREMIERE PRODUCTIONS PDFBianca BncNo ratings yet

- 14 August 2019Document180 pages14 August 2019A. S.No ratings yet

- 66 Central Bank v. CloribelDocument3 pages66 Central Bank v. CloribelYaneeza MacapadoNo ratings yet

- BIR vs. CA and Sps. Antonio Manly and Ruby ManlyDocument16 pagesBIR vs. CA and Sps. Antonio Manly and Ruby Manlyred gynNo ratings yet

- CIR v. Metro Star SupremaDocument3 pagesCIR v. Metro Star SupremaNichol Uriel ArcaNo ratings yet

- Fort Bonifacio Development Corporation vs. Commissioner of Internal RevenueDocument28 pagesFort Bonifacio Development Corporation vs. Commissioner of Internal RevenueAriel AbisNo ratings yet

- CIR Vs Isabela Cultural CorporationDocument2 pagesCIR Vs Isabela Cultural CorporationLauren KeiNo ratings yet

- Bertillo - Phil. Guaranty Co. Inc. Vs CIR and CTADocument2 pagesBertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAStella BertilloNo ratings yet

- Digested CasesDocument36 pagesDigested CasesJepoy Nisperos ReyesNo ratings yet

- Lutz V AranetaDocument2 pagesLutz V AranetaCAMILLENo ratings yet

- Nursery Care Vs AcevedoDocument4 pagesNursery Care Vs AcevedoKenmar NoganNo ratings yet

- La Campana Vs Kaisahan NG ManggagawaDocument5 pagesLa Campana Vs Kaisahan NG ManggagawaBilly RavenNo ratings yet

- Train Law 2018Document55 pagesTrain Law 2018Mira Mendoza100% (1)

- Revenue Regulations 2-1998Document44 pagesRevenue Regulations 2-1998Jaypee LegaspiNo ratings yet

- CIR-vs-Isabela-Cultural-CorpDocument1 pageCIR-vs-Isabela-Cultural-CorpLizzy WayNo ratings yet

- CIR Vs ST LukesDocument4 pagesCIR Vs ST LukesJohn Dexter FuentesNo ratings yet

- 8.cir V Roh Auto ProductsDocument2 pages8.cir V Roh Auto ProductsQuengilyn QuintosNo ratings yet

- Marinduque Vs Placer Dome DigestDocument2 pagesMarinduque Vs Placer Dome DigestIra Agting100% (1)

- Lung Center VS Quezon CityDocument4 pagesLung Center VS Quezon CityJesstonieCastañaresDamayoNo ratings yet

- 35 Lung Center of The Philippines Vs Quezon City Government, GR No. 144104, June 29, 2004Document17 pages35 Lung Center of The Philippines Vs Quezon City Government, GR No. 144104, June 29, 2004Sarah Jean SiloterioNo ratings yet

- Bank of The Philippine Islands v. BPI20210424-14-1d8gprgDocument58 pagesBank of The Philippine Islands v. BPI20210424-14-1d8gprgStephNo ratings yet

- Petitioner Respondent: B. Van Zuiden Bros., LTD., - GTVL Manufacturing Industries, Inc.Document6 pagesPetitioner Respondent: B. Van Zuiden Bros., LTD., - GTVL Manufacturing Industries, Inc.StephNo ratings yet

- En Banc: SyllabusDocument26 pagesEn Banc: SyllabusStephNo ratings yet

- Ponce - v. - Alsons - Cement - CorpDocument14 pagesPonce - v. - Alsons - Cement - CorpSeok Gyeong KangNo ratings yet

- Case Doctrines WillsDocument9 pagesCase Doctrines WillsKelvin ZabatNo ratings yet

- Petitioners Respondents Wenceslao S. Fajardo Romulo M. JubayDocument11 pagesPetitioners Respondents Wenceslao S. Fajardo Romulo M. JubayChingNo ratings yet

- Patents Case DigestsDocument16 pagesPatents Case DigestsStephNo ratings yet

- 2017 SSS GuidebookDocument134 pages2017 SSS GuidebookChimney sweep100% (2)

- 2016 Civil Procedure DoctrinesDocument8 pages2016 Civil Procedure DoctrinesannedefrancoNo ratings yet

- 2017 SSS GuidebookDocument134 pages2017 SSS GuidebookChimney sweep100% (2)

- Garcia V KJSDocument6 pagesGarcia V KJSStephNo ratings yet

- 7Document9 pages7Yanhicoh CySaNo ratings yet

- Be A Role ModelDocument11 pagesBe A Role ModelStephNo ratings yet

- Admin Law and Law On Public Officers Syllabus (11march2019)Document8 pagesAdmin Law and Law On Public Officers Syllabus (11march2019)StephNo ratings yet

- Divinagracia To Gloria (8 Cases)Document7 pagesDivinagracia To Gloria (8 Cases)StephNo ratings yet

- Research On Organized CrimeDocument15 pagesResearch On Organized CrimeRetchel Mae MaribaoNo ratings yet

- IARYCZOWER ET AL. - Judicial Independence in Unstable Environments, Argentina 1935-1998Document19 pagesIARYCZOWER ET AL. - Judicial Independence in Unstable Environments, Argentina 1935-1998Daniel GOMEZNo ratings yet

- Muslim Immigration To Spanish America By: RAFAEL A. GUEVARA BAZANDocument15 pagesMuslim Immigration To Spanish America By: RAFAEL A. GUEVARA BAZANAbuAbdur-RazzaqAl-MisriNo ratings yet

- People Vs VillaramaDocument2 pagesPeople Vs VillaramaZo HuntNo ratings yet

- Isabelo V. Velasquez For Appellant. Assistant Solicitor General Jose G. Bautista and Solicitor Jorge R. Coquia For AppelleeDocument3 pagesIsabelo V. Velasquez For Appellant. Assistant Solicitor General Jose G. Bautista and Solicitor Jorge R. Coquia For AppelleejojoNo ratings yet

- 11 Ramirez V BaltazarDocument3 pages11 Ramirez V BaltazarJulianne Nicole DeeNo ratings yet

- Social Reform Movements of IndiaDocument5 pagesSocial Reform Movements of IndiaMURALIHARAN KNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyPaolo Jamer100% (1)

- Tolbert v. Hart Et Al - Document No. 13Document7 pagesTolbert v. Hart Et Al - Document No. 13Justia.comNo ratings yet

- Juntilla V FontanarDocument2 pagesJuntilla V FontanarKirsten Denise B. Habawel-VegaNo ratings yet

- Probable: Candelaria - Wilwayco - Santiago Page 1 of 9Document9 pagesProbable: Candelaria - Wilwayco - Santiago Page 1 of 9Jasfher CallejoNo ratings yet

- Salazar vs. Philippines - GuiltyDocument6 pagesSalazar vs. Philippines - Guiltyalwayskeepthefaith8No ratings yet

- The Three Essentials Preparing For The Perfect DateDocument4 pagesThe Three Essentials Preparing For The Perfect DateJames ZacharyNo ratings yet

- De Thi Noi Mon Tieng Anh Lop 6 Hoc Ki 1Document6 pagesDe Thi Noi Mon Tieng Anh Lop 6 Hoc Ki 1Tan Tai NguyenNo ratings yet

- 19 Daily StoriesDocument1 page19 Daily StoriesRajivNo ratings yet

- Quiz No. 1: Module in Life and Works of Rizal (GEC 109) History Department, MSU-GSCDocument5 pagesQuiz No. 1: Module in Life and Works of Rizal (GEC 109) History Department, MSU-GSCJOSH NICOLE PEPITONo ratings yet

- MB vs. Reynado DigestDocument2 pagesMB vs. Reynado DigestJewel Ivy Balabag DumapiasNo ratings yet

- Examen Present and PastDocument2 pagesExamen Present and PastclarkentrNo ratings yet

- Casco v. GimenezDocument1 pageCasco v. GimenezAlni Dorothy Alfa EmphasisNo ratings yet

- Evid - Rule 128 Case DigestDocument15 pagesEvid - Rule 128 Case DigestJudy Mar Valdez, CPANo ratings yet

- Conditionals Type 0 1 2Document4 pagesConditionals Type 0 1 2Ivana PlenčaNo ratings yet

- Form No. 46 SUPPORT PENDENTE LITEDocument2 pagesForm No. 46 SUPPORT PENDENTE LITEKristianne SipinNo ratings yet

- Harassment Training and InvestigationsDocument41 pagesHarassment Training and InvestigationsurjiblateNo ratings yet

- Ephesians 6 Kids CampDocument2 pagesEphesians 6 Kids Campimsevenofnine4No ratings yet

- Political Law Syllabus-Based CodalDocument19 pagesPolitical Law Syllabus-Based CodalAlthea Angela GarciaNo ratings yet

- Article 1157Document2 pagesArticle 1157Eliza Jayne Princess VizcondeNo ratings yet

- Ylith B. Fausto, Jonathan Fausto, Rico Alvia, Arsenia Tocloy, Lourdes Adolfo and Anecita Mancita, Petitioners, vs. Multi Agri-ForestDocument1 pageYlith B. Fausto, Jonathan Fausto, Rico Alvia, Arsenia Tocloy, Lourdes Adolfo and Anecita Mancita, Petitioners, vs. Multi Agri-ForestAbby EvangelistaNo ratings yet

- Mock Trial Script: Classroom Law Project Mock Trial in The ClassroomDocument13 pagesMock Trial Script: Classroom Law Project Mock Trial in The ClassroomWilven Angeles SinlaoNo ratings yet

- Hydro Resources vs. NIADocument2 pagesHydro Resources vs. NIAIan CabanaNo ratings yet

- CPC AssignmentDocument15 pagesCPC AssignmentArhum Khan100% (2)