Professional Documents

Culture Documents

Jawaban E 5-7 E5-8

Jawaban E 5-7 E5-8

Uploaded by

Mutia WardaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jawaban E 5-7 E5-8

Jawaban E 5-7 E5-8

Uploaded by

Mutia WardaniCopyright:

Available Formats

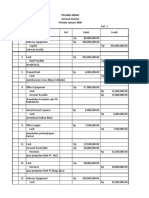

E 5-7 Downstream sale of inventory

Xuma SA was a subsidiary of Fabian SA. Fabian SA had a policy to sell its merchandise at a mark-up of

10 percent. The beginning balance of Xuma’s inventory in 2014, which was sold in the current year,

was $220,000. Half of this beginning inventory included merchandise purchased from Fabian SA.

During 2014, Fabian SA sold merchandises to Xuma SA for $550,000. Xuma has sold $440,000 of these

merchandises to the third parties. The data of the sales and the cost of sales for both companies are

as follows:

Fabian SA Xuma SA

Sales $2,200,000 $1,700,000

Cost of Sales $2,000,000 $1,500,000

REQuIRED

1. What is the amount of sales that should appear on the consolidated income statement?

Penyesuaian BI:

Investasi 10k

COGS 10k

(realisasi dari URP yg sebelumnya ditunfa pada BI)

2. What is the cost of sales that should appear on the consolidated income statement?

Sales 550k

COGS 550K

(eliminasi penjualan intercompany th 2014)

COGS 10k

Inventory 10k

(menunda atau mendefer URP pada EI)

1. Fabian SA sales $2,200,000

Xuma SA sales $1,700,000

Less: Intercompany sales ($550,000)

Consolidated sales for Fabian SA and subsidiary $3,350,000

2. Fabian SA cost of sales $2,000,000

Xuma SA cost of sales $1,500,000

Realized profit from beginning inventory ($ 20,000)

($220,000 x 10 / 110)

Unrealized profit from ending inventory $ 10,000

(($550,000 - $440,000) x 10 /110)

Consolidated cost of sales for Fabian SA and subsidiary $3,490,000

Dari Bu Zuni

Fabian SA cost of sales $2,000,000

Xuma SA cost of sales $1,500,000

($ 10,000)

550,000

Unrealized profit from ending inventory $ 10,000

(($550,000 - $440,000) x 10 /110)

Consolidated cost of sales for Fabian SA and subsidiary $2,950,000

E 5-8 Downstream sale of inventory

Wikan Tbk acquired 80 percent ownership of Budi Tbk several years ago at book value. During 2014,

Wikan Tbk sold merchandise to Budi Tbk for $1,000,000 at a gross profit of 20 percent. Budi Tbk sold

90 percent of this merchandise to outside parties. At the end of the year, Budi Tbk reported a net

income of $400,000.

REQuIRED

1. Determine income from Budi Tbk for 2014.

Intercompany sales 1200k

Cost 1000k

Gross profit 200k

Sebesar 10% belum terjual ke pihak luar. URP = 10%*200k = 20k

1) Laba utk induk = (80%*400k)) - 20k = $300k

2) Laba utk NCI (NCI Share) = 20% * 400k = 80k

3) Laba konsolidasian -> tdk ada info mengenai laba induk

Jika upstream -> laba dari induk

anak

2. Determine noncontrolling interest share for 2014.

1. 80% of $400,000 Budi Tbk’s net income $320,000

Unrealized profit from ending inventory ($20,000)

($1,000,000 x 20% x 10%)

Income from Budi Tbk for 2014 $300,000

2. Noncontrolling interest share for 2014:

20% of $400,000 Budi Tbk net income $ 80,000

You might also like

- Income Taxation Tabag Answer Keypdf PDF FreeDocument34 pagesIncome Taxation Tabag Answer Keypdf PDF FreeFreda Mae Pomilban Lumayyong100% (2)

- Fundamentals of Accounting Notes 1Document18 pagesFundamentals of Accounting Notes 1deo omach100% (2)

- Summary of CH 9 Assessing The Risk of Material MisstatementDocument19 pagesSummary of CH 9 Assessing The Risk of Material MisstatementMutia WardaniNo ratings yet

- P4Document21 pagesP4nancy tomanda100% (2)

- AKL P6-2 Achmad Faizal AzmiDocument5 pagesAKL P6-2 Achmad Faizal AzmiTiara Eva Tresna100% (1)

- Jawaban E15-18 Dan E15-22 Intermediate Accounting WKKDocument6 pagesJawaban E15-18 Dan E15-22 Intermediate Accounting WKKMutia Wardani67% (3)

- Paul Krugman EIDocument48 pagesPaul Krugman EIVhy Vhy JHNo ratings yet

- Solution P4-4 Advanced AccountingDocument4 pagesSolution P4-4 Advanced AccountingAyu Cintya Dewi100% (2)

- Ch7 Problems SolutionDocument22 pagesCh7 Problems Solutionwong100% (8)

- P4Document21 pagesP4reviska100% (1)

- Aud Rev, Investments Wit Ans KeyDocument17 pagesAud Rev, Investments Wit Ans KeyAngela RamosNo ratings yet

- Intercompany Profit Transactions - Inventories: Answers To Questions 1Document22 pagesIntercompany Profit Transactions - Inventories: Answers To Questions 1NisrinaPArisanty100% (1)

- Beams Aa13e SM 01Document14 pagesBeams Aa13e SM 01jiajiaNo ratings yet

- CHP 8Document32 pagesCHP 8sugenghidayatNo ratings yet

- Beams - Intercom Profit Transaction - BondsDocument12 pagesBeams - Intercom Profit Transaction - BondsAnggit Ponco100% (1)

- Tugas Pertemuan 4 - Alya Sufi Ikrima - 041911333248Document5 pagesTugas Pertemuan 4 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- Solution - Chapter 1Document8 pagesSolution - Chapter 1Nezo Qawasmeh75% (4)

- ch09 Beams12ge SMDocument31 pagesch09 Beams12ge SMMutia Wardani50% (2)

- ch09 Beams12ge SMDocument31 pagesch09 Beams12ge SMMutia Wardani50% (2)

- Chapter 4 Advanced AccountingDocument48 pagesChapter 4 Advanced AccountingMarife De Leon Villalon100% (3)

- Ch03 Beams12ge SMDocument22 pagesCh03 Beams12ge SMWira Moki50% (2)

- Jawaban Kuis No.1 Akl 2 - Post - TM 3 - Renanda Putri - 43216120238Document2 pagesJawaban Kuis No.1 Akl 2 - Post - TM 3 - Renanda Putri - 43216120238Renanda PutriNo ratings yet

- Inventory Part2Document13 pagesInventory Part2Elai grace Fernandez100% (3)

- Ch11 Beams12ge SMDocument28 pagesCh11 Beams12ge SMKharisma Pardede33% (3)

- Chapter 7 - 12thEDITIONDocument22 pagesChapter 7 - 12thEDITIONHyewon50% (2)

- Pindi Yulinar Rosita - 008201905023 - Exercise Chapter 2Document43 pagesPindi Yulinar Rosita - 008201905023 - Exercise Chapter 2Pindi Yulinar100% (5)

- Advanced CHP 16 Bagian Exercise Yg Salah Buat Prnya!!!!!!!!!!!!!1Document4 pagesAdvanced CHP 16 Bagian Exercise Yg Salah Buat Prnya!!!!!!!!!!!!!1AschNo ratings yet

- 2 Limpan Investment Corporation vs. Commissioner, 17 SCRA 703Document9 pages2 Limpan Investment Corporation vs. Commissioner, 17 SCRA 703Anne Marieline BuenaventuraNo ratings yet

- Sheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalanceDocument4 pagesSheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalancePrince Frederic Mangambu100% (1)

- E 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Document10 pagesE 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Lusiana Purnama SariNo ratings yet

- AKL Kel 8 - P5-1 P5-4 P5-8 - Eka NisrinaDocument8 pagesAKL Kel 8 - P5-1 P5-4 P5-8 - Eka NisrinaNur Ayu Mariya67% (3)

- Chapter 4 - 12thEDITIONDocument49 pagesChapter 4 - 12thEDITIONHyewon78% (9)

- Chp3 Advanced Acc Beams 11eDocument21 pagesChp3 Advanced Acc Beams 11eFelixNovendraNo ratings yet

- Summary of CH 8 Auditing Planning and MaterialityDocument17 pagesSummary of CH 8 Auditing Planning and MaterialityMutia WardaniNo ratings yet

- Tugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Alya Sufi Ikrima0% (1)

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- Kunci Jawaban Advance Accounting Chapter 3Document25 pagesKunci Jawaban Advance Accounting Chapter 3jiajia67% (6)

- Solution Manual For Beams Chapter 8Document36 pagesSolution Manual For Beams Chapter 8Zulfi Rahman Hakim67% (6)

- Buku Ajar Ak. Keu. Lanj. Ii WorkpaperDocument85 pagesBuku Ajar Ak. Keu. Lanj. Ii Workpapermirna nurwenda100% (2)

- This Study Resource Was: Consolidation Workpapers (Upstream Sales, Noncontrolling Interest)Document9 pagesThis Study Resource Was: Consolidation Workpapers (Upstream Sales, Noncontrolling Interest)Muhammad MalikNo ratings yet

- Chp9 BeamsDocument27 pagesChp9 BeamsGustina Sirait100% (3)

- Chapter 3 - 12thEDITIONDocument21 pagesChapter 3 - 12thEDITIONHyewon43% (7)

- Materials For How To Handle BIR Audit Common Issues - 2021 Sept 21Document71 pagesMaterials For How To Handle BIR Audit Common Issues - 2021 Sept 21cool_peach100% (1)

- Nurul Aryani - AKL1 - QUIZ 4 - SOAL 1Document1 pageNurul Aryani - AKL1 - QUIZ 4 - SOAL 1Nurul AryaniNo ratings yet

- Tugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Document5 pagesTugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- Tugas 10Document3 pagesTugas 10Reyhan ArioNo ratings yet

- Tugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- P2 1Document2 pagesP2 1Febi100% (1)

- Yustika Adiningsih, AKL 1a 2021 E3-4Document1 pageYustika Adiningsih, AKL 1a 2021 E3-4yes iNo ratings yet

- Soal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)Document2 pagesSoal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)SECRET MENUNo ratings yet

- Jawaban E6-7Document1 pageJawaban E6-7UNY Wayan anissatunNo ratings yet

- Chapter 5 Advanced AccountingDocument19 pagesChapter 5 Advanced AccountingMarife De Leon VillalonNo ratings yet

- ACCT 412 Chapter 7 SolutionsDocument13 pagesACCT 412 Chapter 7 SolutionsJose T100% (2)

- Kelompok3 Tugas3 AKLDocument4 pagesKelompok3 Tugas3 AKLsyifa fr100% (1)

- Pert 1 - AKL - CH 3 - 2019-2020Document2 pagesPert 1 - AKL - CH 3 - 2019-2020Nova Yuliani0% (1)

- NURUL ARYANI - AKL1 - Forum 2Document3 pagesNURUL ARYANI - AKL1 - Forum 2Nurul AryaniNo ratings yet

- Advance Accounting Chapter 15Document3 pagesAdvance Accounting Chapter 15brew167525% (4)

- CH 8Document13 pagesCH 8doc nurfatkhiyahNo ratings yet

- Pindi Yulinar Rosita - Excercise Chapt 5Document32 pagesPindi Yulinar Rosita - Excercise Chapt 5Pindi YulinarNo ratings yet

- Name: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Document4 pagesName: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Eigha apriliaNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- Ias 02Document2 pagesIas 02Nguyễn PhươngNo ratings yet

- Chapter 5: Intercompany Profit Transactions - InventoriesDocument38 pagesChapter 5: Intercompany Profit Transactions - InventoriesRizki BayuNo ratings yet

- Diskusi After UTS - 5I - Mutia Maulida - 2102015028 - Consolidation With Loss On Intercompany SaleDocument6 pagesDiskusi After UTS - 5I - Mutia Maulida - 2102015028 - Consolidation With Loss On Intercompany SaleNova AnggrainiNo ratings yet

- ITF InventoriesDocument36 pagesITF InventoriesRisa MonitaNo ratings yet

- Tugas Aklan TM7Document7 pagesTugas Aklan TM7AdnanNo ratings yet

- Pilihan Ganda Exercise: Use The Following Information in Answering Questions 2 and 3Document9 pagesPilihan Ganda Exercise: Use The Following Information in Answering Questions 2 and 3Desi AprilianiNo ratings yet

- Account Titles Trial Balance Adjustment DR CR DR: Vang Management ServicesDocument9 pagesAccount Titles Trial Balance Adjustment DR CR DR: Vang Management ServicesMutia WardaniNo ratings yet

- AKM CH 2Document8 pagesAKM CH 2Mutia WardaniNo ratings yet

- TA Chapter 17 PDFDocument26 pagesTA Chapter 17 PDFMutia WardaniNo ratings yet

- Cp7-1 Principal EccountingDocument6 pagesCp7-1 Principal EccountingMutia WardaniNo ratings yet

- Kuliah 10 The Basic of Capital BudgetingDocument31 pagesKuliah 10 The Basic of Capital BudgetingMutia WardaniNo ratings yet

- Kuliah 8 Stock and Their ValuationDocument31 pagesKuliah 8 Stock and Their ValuationMutia WardaniNo ratings yet

- Accounting Theory: Conceptual Issues in A Political and Economic EnvironmentDocument29 pagesAccounting Theory: Conceptual Issues in A Political and Economic EnvironmentdevitaNo ratings yet

- cp7-1 Principal EccountingDocument6 pagescp7-1 Principal EccountingMutia WardaniNo ratings yet

- CH 5 - Intercompany Transaction - InventoriesDocument14 pagesCH 5 - Intercompany Transaction - InventoriesMutia WardaniNo ratings yet

- TA Chapter 7 PDFDocument29 pagesTA Chapter 7 PDFMutia WardaniNo ratings yet

- Integrated Case 8-23 Financial ManagementDocument1 pageIntegrated Case 8-23 Financial ManagementMutia WardaniNo ratings yet

- BRIEF EXERCISE Chapter 15 Number 1-3 Solution Intermediate AccountingDocument1 pageBRIEF EXERCISE Chapter 15 Number 1-3 Solution Intermediate AccountingMutia WardaniNo ratings yet

- Jawaban CH 3Document2 pagesJawaban CH 3Mutia WardaniNo ratings yet

- Jawaban P5-6 Intermediate AccountingDocument3 pagesJawaban P5-6 Intermediate AccountingMutia WardaniNo ratings yet

- Unit No-1-Introduction To Financial PlanningDocument28 pagesUnit No-1-Introduction To Financial PlanningpujaskawaleNo ratings yet

- Tugas AulaDocument5 pagesTugas AulaZuriafNo ratings yet

- 02 08 PPE CapEx Depreciation BeforeDocument6 pages02 08 PPE CapEx Depreciation BeforeShaheer AhmedNo ratings yet

- Financial Management Note WK 1 2 PDFDocument58 pagesFinancial Management Note WK 1 2 PDFJiaXinLimNo ratings yet

- CAF 01 - FAR-1 All Tests by Sir Jawad Mehmood (S24)Document45 pagesCAF 01 - FAR-1 All Tests by Sir Jawad Mehmood (S24)manzoorabdullah585No ratings yet

- Income Taxation of Proprietary Educational InstitutionsDocument2 pagesIncome Taxation of Proprietary Educational InstitutionsRegina Grace GadoNo ratings yet

- Income Taxation Chapter 2Document5 pagesIncome Taxation Chapter 2Jasmine OlayNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2Document31 pagesFundamentals of Accountancy, Business, and Management 2Honey ShenNo ratings yet

- Profit N Loss of ParleDocument3 pagesProfit N Loss of ParleHoney AliNo ratings yet

- ILLUSTRATIVE PROBLEMS - Methods of Dividing Profits or LossesDocument7 pagesILLUSTRATIVE PROBLEMS - Methods of Dividing Profits or LossesAntoniete OpladoNo ratings yet

- Compound Interest 2Document2 pagesCompound Interest 2bdbndNo ratings yet

- 1 Income Tax Chart Fy 09 10Document2 pages1 Income Tax Chart Fy 09 10jayant_2612No ratings yet

- Final Term Paper of FIN101 04Document32 pagesFinal Term Paper of FIN101 04a b siddique rifatNo ratings yet

- Rosen SummaryDocument20 pagesRosen SummaryNurun Nabi MahmudNo ratings yet

- Uneeso Ent P2Document4 pagesUneeso Ent P2Otai Ezra100% (1)

- Safari - 10 Nov 2018 at 22:02Document1 pageSafari - 10 Nov 2018 at 22:02berekettsegaye215No ratings yet

- Economics GR 12 MEMO Paper 1 - 1Document18 pagesEconomics GR 12 MEMO Paper 1 - 1blackmanwinning325No ratings yet

- XYZ CorporationDocument5 pagesXYZ CorporationredNo ratings yet

- 1 Laporan Laba RugiDocument1 page1 Laporan Laba Rugisastra watiNo ratings yet

- Impartial Fulfillment in Principles of AccountingDocument177 pagesImpartial Fulfillment in Principles of AccountingIlarde, Charles Ezra S.No ratings yet

- Siklus Akt PELANGI INDAHDocument14 pagesSiklus Akt PELANGI INDAHKhairul AnnisaNo ratings yet

- Tax Facts and Figures 2008Document56 pagesTax Facts and Figures 2008Nana AddoNo ratings yet

- Megaworld Corp.Document11 pagesMegaworld Corp.Louise Merinelle Amores PosoNo ratings yet

- April - 20223Document1 pageApril - 20223Gadhavi JitudanNo ratings yet