Professional Documents

Culture Documents

Model Journal Entries: If Credit

Uploaded by

jaivik_ce75840 ratings0% found this document useful (0 votes)

7 views3 pagesThis document provides 29 journal entries for common business transactions including:

1) Starting a business by recording cash, debtors, creditors, loans, furniture, and goods accounts.

2) Recording personal expenses by debiting the drawings account.

3) Recording returned purchases and sales by debiting supplier/customer accounts and crediting purchase/sales return accounts.

4) Recording purchase and sale of goods with a profit by debiting purchase and customer accounts and crediting sales.

5) Recording damaged, stolen, or destroyed goods by debiting loss accounts and crediting goods accounts.

Original Description:

Class 11 Accountancy

Original Title

Class 11 Accountancy

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides 29 journal entries for common business transactions including:

1) Starting a business by recording cash, debtors, creditors, loans, furniture, and goods accounts.

2) Recording personal expenses by debiting the drawings account.

3) Recording returned purchases and sales by debiting supplier/customer accounts and crediting purchase/sales return accounts.

4) Recording purchase and sale of goods with a profit by debiting purchase and customer accounts and crediting sales.

5) Recording damaged, stolen, or destroyed goods by debiting loss accounts and crediting goods accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesModel Journal Entries: If Credit

Uploaded by

jaivik_ce7584This document provides 29 journal entries for common business transactions including:

1) Starting a business by recording cash, debtors, creditors, loans, furniture, and goods accounts.

2) Recording personal expenses by debiting the drawings account.

3) Recording returned purchases and sales by debiting supplier/customer accounts and crediting purchase/sales return accounts.

4) Recording purchase and sale of goods with a profit by debiting purchase and customer accounts and crediting sales.

5) Recording damaged, stolen, or destroyed goods by debiting loss accounts and crediting goods accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

Model Journal entries

1. Started a business with cash, debtors, creditor, loan, furniture, goods

Cash account Dr.

Debtor account Dr.

Furniture account Dr.

Goods account Dr.

To creditor account

To loan’s account

To capital account

2. Paid for fees of son, saree for wife and for personal use .

Drawing account Dr.

To, cash account

3. Purchase goods returned

If credit

Supplier’s account Dr.

To purchase return account

If cash

Cash account Dr.

To purchase return account

4. Sales return

If credit

Sales return account Dr.

To customer’s 'A'

If cash

Sales return account Dr.

To cash account

5. Goods purchase from 'A' for Rs. 100 and sell it to 'B' at a profit of 10%

Purchase account Dr. (Rs. 100)

To ‘A’s account

‘B’s account Dr. (Rs. 110)

To sales account

6. Goods damaged by fire

Loss by fire account Dr.

To goods burnt by fire account

7. Goods damaged by fire and which is insured

Goods worth of Rs. 2000 damaged by fire. For which sum of Rs. 1500 is received from

insurance company, Rs. 200 received from sale of the scrap.

Insurance co’s account Dr. 1500

Cash account Dr. 200

Loss by fire account Dr. 300

To goods burnt by fire account 2000

8. Goods stolen away

Loss by theft account Dr.

To goods stolen account

9. Goods destroyed by rain

Loss due to rain account Dr.

To goods destroyed by rain account

10. Goods given for charity

Charity account Dr.

To goods given as charity account

11. Goods distributed as advertise

Advertisement exp. Account Dr.

To goods given as sample account

12. Goods received as a free sample

Non financial / economical transaction

13. Goods received as a free sample are sold

Cash account Dr.

To Goods received as a free sample account

(at the price of sales)

14. Due amount settled with discount/ paid at a discount

Creditor’ account (person who is reciever) Dr.

To discount received/allowance account

To cash account

15. Due amount received with discount

Cash account Dr.

Discount allowed/allowance account Dr.

To debtor’s account (person who is payer/giver)

16. Purchase a machine and also paid for installing charges

Machinery account Dr.

To cash account

Or

Machinery account Dr.

Installation charges account Dr.

To cash

17. Purchase asset in exchange

Eg: purchase a computer for Rs. 20000 in exchange of goods of Rs. 10000

Computer account Dr. 20000

To sales 20000

( Purchase a computer of Rs. 20000 and given goods for Rs. 10000 in exchange)

18. Borrowed a loan

Cash account Dr.

To xxx loan account (giver’s name)

19. Issued/granted a loan

Xxx loan’s account Dr.

To cash account

20. Paid the interest of a loan

Interest on xxx loan account Dr.

To cash account

21 .Amount debited as a charges by bank

Bank charges account Dr.

To bank account

22. Amount credited by bank on behalf of us

Bank account Dr.

To interest/dividend account

23. Sold goods and paid the expences on behalf of purchaser

Debtor’s account Dr.

To sales account (sales price)

To cash account ( exp.made)

24. An amount reciavable is to be written off

Bad debts account Dr.

To debtor’s account

25. A debtor became insolvent and some money only recieved from him

Bad debts account (Amt. Not recieved) Dr.

Cash account (Amt. Recieved) Dr.

To debtor’s account

26. Bad debt written off recovered

Cash account Dr.

To bad debt reciverd account

27. Purchase a goods on cash discount and trade discount and half payment is made

by cash+bank and rest is due

Purchase account Dr.

To bank account

To cash account

To cash discount account

To debtor’s/purchaser account (due amount)

28. Sale of goods on cash discount and trade discount and half amount is recieved by

cash+bank and rerst is due

Bank account Dr.

Cash account Dr.

Cash discount account Dr.

Creditor’s account Dr.

To sales account

29. Purrchase of balance and weights

Dead stock account Dr.

To cash

( on purchasing of any asset it will dr. With its name only i.e. building a/c,furniture a/c etc.)

You might also like

- Ultimate Guide To Investments For BeginnersDocument18 pagesUltimate Guide To Investments For BeginnersArkya MojumderNo ratings yet

- GB Training & Placement Centre: Tally ERP 9 Certificate CourseDocument2 pagesGB Training & Placement Centre: Tally ERP 9 Certificate CourseswayamNo ratings yet

- MR - Vijaya Gopal Medisetti: Page 1 of 2 M-6008439Document2 pagesMR - Vijaya Gopal Medisetti: Page 1 of 2 M-6008439anilvishaka7621No ratings yet

- Airbus Aircraft AC A380 PDFDocument327 pagesAirbus Aircraft AC A380 PDFLaura MoraNo ratings yet

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- Basics of Accounting - QBDocument7 pagesBasics of Accounting - QBsujanthqatarNo ratings yet

- Tally Interview Questions PDFDocument6 pagesTally Interview Questions PDFRuqaya AhadNo ratings yet

- Accountancy Handout RevisionDocument181 pagesAccountancy Handout RevisionSIMARNo ratings yet

- Tax FinalDocument23 pagesTax FinalJitender ChaudharyNo ratings yet

- Grdae 9 - Ems - Financial Literacy SummaryDocument17 pagesGrdae 9 - Ems - Financial Literacy SummarykotolograceNo ratings yet

- ACD2501 Day 6 Aircraft StructuresDocument71 pagesACD2501 Day 6 Aircraft StructuresMemyah AlNo ratings yet

- Tally 036Document191 pagesTally 036anjalishah7No ratings yet

- Ap (Accounts Payable) ProcessDocument10 pagesAp (Accounts Payable) ProcessRabin DebnathNo ratings yet

- Self Study - Week 1 - Journal RevisionDocument7 pagesSelf Study - Week 1 - Journal RevisionMehak Gupta100% (1)

- Tally E Book 2Document154 pagesTally E Book 2anjali44499No ratings yet

- STUDY MATERIAL AccountingcomClass XIDocument144 pagesSTUDY MATERIAL AccountingcomClass XImalathi SNo ratings yet

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocument380 pages1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNo ratings yet

- GST Practical Record 40-50Document48 pagesGST Practical Record 40-50Aditya raj ojhaNo ratings yet

- Chapter 7 LedgerDocument18 pagesChapter 7 LedgerJumayma MaryamNo ratings yet

- TYBCom Sem VI Financial Accounting and Auditing Paper IX Financial AccountingDocument181 pagesTYBCom Sem VI Financial Accounting and Auditing Paper IX Financial Accountingarbazshaha121No ratings yet

- Accounting BasicsDocument21 pagesAccounting BasicsasifparwezNo ratings yet

- Personal Finance and Planning: Skill Enhancement Course (SEC)Document37 pagesPersonal Finance and Planning: Skill Enhancement Course (SEC)Babita DeviNo ratings yet

- Test 2Document10 pagesTest 2himanshuNo ratings yet

- Oops TutorialDocument20 pagesOops TutorialRajesh MandadapuNo ratings yet

- Tally Assignment Yash ComDocument9 pagesTally Assignment Yash Comraj S.NNo ratings yet

- Tally Record NoteDocument74 pagesTally Record NoteBarani DharanNo ratings yet

- Insurance Law. Course OutlineDocument10 pagesInsurance Law. Course OutlineKimberly SendinNo ratings yet

- Accountancy NCERT P2 (WWW - Ssctube.com)Document305 pagesAccountancy NCERT P2 (WWW - Ssctube.com)Priyankesh ChourasiyaNo ratings yet

- General Journal: Date Description Debit CreditDocument7 pagesGeneral Journal: Date Description Debit CreditAmanuel DemekeNo ratings yet

- AMFI - Investor Awareness Presentation - Jul'23Document69 pagesAMFI - Investor Awareness Presentation - Jul'23padmaniaNo ratings yet

- Short Cut Keys in Tally 9Document10 pagesShort Cut Keys in Tally 9Partha1962No ratings yet

- 59journal Solved Assignment 13-14Document12 pages59journal Solved Assignment 13-14anon_350417051No ratings yet

- Tally - Business Accounts Question BankDocument9 pagesTally - Business Accounts Question BankBhaskar bhaskarNo ratings yet

- PL SQL - Training - PpsDocument106 pagesPL SQL - Training - PpsAnuNo ratings yet

- Problem 1Document3 pagesProblem 1karthikeyan01No ratings yet

- Excise For ManufacturersDocument160 pagesExcise For ManufacturersPraveen CoolNo ratings yet

- Bank Statement EditedDocument4 pagesBank Statement EditedAllen MedinaNo ratings yet

- Journalise The Following TransactionsDocument1 pageJournalise The Following Transactionshamidalikhanscorpion50% (2)

- Oracle Apps Course ContentsDocument12 pagesOracle Apps Course ContentsRabindra P.SinghNo ratings yet

- LLB Hon. Intergrated Law Sem 1 To 8 Syllabus May 2019Document104 pagesLLB Hon. Intergrated Law Sem 1 To 8 Syllabus May 2019shah zavidNo ratings yet

- Intermediate Paper 11 PDFDocument456 pagesIntermediate Paper 11 PDFjesurajajNo ratings yet

- Tally Final ExamDocument4 pagesTally Final ExamsatyajitNo ratings yet

- Trading, Profit & Loss Acct.sDocument14 pagesTrading, Profit & Loss Acct.sSudheer SirangulaNo ratings yet

- 11th Accountancy Full Study Material English Medium 2023-24Document64 pages11th Accountancy Full Study Material English Medium 2023-24osama guyzz100% (1)

- Accountancy XiiDocument122 pagesAccountancy XiiNancy Ekka100% (1)

- Dropshipping Beginners - : Uide ForDocument49 pagesDropshipping Beginners - : Uide ForLasith Gunasekara100% (1)

- Bank ReconciliationDocument2 pagesBank Reconciliationapi-3727562No ratings yet

- Air PollutionDocument217 pagesAir Pollutionفردوس سليمانNo ratings yet

- E. Commerce. INFORMEDocument16 pagesE. Commerce. INFORMEJudith MoranNo ratings yet

- Ir21 Geomt 2022-01-28Document23 pagesIr21 Geomt 2022-01-28Master MasterNo ratings yet

- FA1 General JournalDocument5 pagesFA1 General JournalamirNo ratings yet

- Worksheet Ledger and Trial BalanceDocument4 pagesWorksheet Ledger and Trial BalanceRajni Sinha VermaNo ratings yet

- Accounting Equation Imp 1Document5 pagesAccounting Equation Imp 1hiritik gupta100% (1)

- AccountingDocument8 pagesAccountingBasil Babym50% (2)

- Advanced Tally MCQ Original - WatermarkDocument90 pagesAdvanced Tally MCQ Original - WatermarkVinod RathodNo ratings yet

- List of Ledgers: S.No Ledger Name Under: GroupDocument5 pagesList of Ledgers: S.No Ledger Name Under: GroupSuraj KumarNo ratings yet

- D2K-Report6i-by Dinesh Kumar S PDFDocument98 pagesD2K-Report6i-by Dinesh Kumar S PDFallumohanNo ratings yet

- Tally QuizDocument9 pagesTally QuizSureshBadigerNo ratings yet

- Chapter 1Document5 pagesChapter 1palash khannaNo ratings yet

- EnglishDocument82 pagesEnglishMayaNo ratings yet

- 42 Implementation of Tds in Tallyerp 9Document171 pages42 Implementation of Tds in Tallyerp 9P VenkatesanNo ratings yet

- Extra Journal QuestionsDocument3 pagesExtra Journal QuestionsMba BNo ratings yet

- TallyDocument25 pagesTallyMahesh PawarNo ratings yet

- Accountancy Higher Secondary - Second Year Volume IDocument132 pagesAccountancy Higher Secondary - Second Year Volume Iakvssakthivel100% (1)

- Key Terms and Chapter Summary 8Document3 pagesKey Terms and Chapter Summary 8Devansh DwivediNo ratings yet

- Chapter 8Document18 pagesChapter 8Mishu GuptaNo ratings yet

- 110-Chapter 3 - Books of Original Entry-Journal - WMDocument21 pages110-Chapter 3 - Books of Original Entry-Journal - WMaaditya kumar jhaNo ratings yet

- Consignment AccountsDocument4 pagesConsignment AccountsLamineNo ratings yet

- Chapter 4 - Accounting For Merchandising (Slide Notes)Document27 pagesChapter 4 - Accounting For Merchandising (Slide Notes)NUR BALQIS BINTI MOHD TAJUDDIN BGNo ratings yet

- Accounting SystemDocument5 pagesAccounting SystemJayanta SinghaNo ratings yet

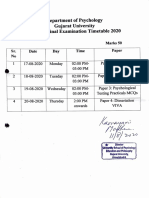

- Notification of The Gujarat UniversityDocument1 pageNotification of The Gujarat Universityjaivik_ce7584No ratings yet

- MDS Medical 14-07-2020Document2 pagesMDS Medical 14-07-2020jaivik_ce7584No ratings yet

- MEd Sem-IV (New) 03-09-2020 PDFDocument1 pageMEd Sem-IV (New) 03-09-2020 PDFjaivik_ce7584No ratings yet

- MCom Sem-IV (Reg) HPP Adv Ac & Audi 3-09-2020Document1 pageMCom Sem-IV (Reg) HPP Adv Ac & Audi 3-09-2020jaivik_ce7584No ratings yet

- FOURTH BSC (Nursing) 01-09-2020Document1 pageFOURTH BSC (Nursing) 01-09-2020jaivik_ce7584No ratings yet

- Time Table Online Exam - 2020 MLW PDFDocument2 pagesTime Table Online Exam - 2020 MLW PDFjaivik_ce7584No ratings yet

- P-G Dip Rehab. Psy 21-08-2020 PGDRPDocument1 pageP-G Dip Rehab. Psy 21-08-2020 PGDRPjaivik_ce7584No ratings yet

- MSC Sem-IV (Inte,) 12-09-2020 PDFDocument1 pageMSC Sem-IV (Inte,) 12-09-2020 PDFjaivik_ce7584No ratings yet

- Revised - BEd Sem-IV (New) 12-09-2020Document1 pageRevised - BEd Sem-IV (New) 12-09-2020jaivik_ce7584No ratings yet

- Department of Psychology Gujarat University PGDCP Final Examination Timetable 2020Document2 pagesDepartment of Psychology Gujarat University PGDCP Final Examination Timetable 2020jaivik_ce7584No ratings yet

- Revised - BEd Sem-IV (New) 12-09-2020Document1 pageRevised - BEd Sem-IV (New) 12-09-2020jaivik_ce7584No ratings yet

- P-G Dip Rehab. Psy 21-08-2020 PGDRPDocument1 pageP-G Dip Rehab. Psy 21-08-2020 PGDRPjaivik_ce7584No ratings yet

- MSC Sem-IV (Inte,) 12-09-2020 PDFDocument1 pageMSC Sem-IV (Inte,) 12-09-2020 PDFjaivik_ce7584No ratings yet

- Explain Fraudulent Transfer - Sec 53 With Decided Cases of Property ActDocument1 pageExplain Fraudulent Transfer - Sec 53 With Decided Cases of Property Actjaivik_ce7584No ratings yet

- Notification of The Gujarat University No. Exam. 4-A' /89719/ of 2020Document1 pageNotification of The Gujarat University No. Exam. 4-A' /89719/ of 2020jaivik_ce7584No ratings yet

- FOURTH BSC (Nursing) 01-09-2020Document1 pageFOURTH BSC (Nursing) 01-09-2020jaivik_ce7584No ratings yet

- LLB Sem-II 3-09-2020Document1 pageLLB Sem-II 3-09-2020jaivik_ce7584No ratings yet

- LLBSEM2Document53 pagesLLBSEM2jaivik_ce7584No ratings yet

- September: M.Sc. Semester - IVDocument1 pageSeptember: M.Sc. Semester - IVjaivik_ce7584No ratings yet

- Define Property and Transfer of Property and Explain in Detail The Kinds of Property Under The Transfer of Property ActDocument3 pagesDefine Property and Transfer of Property and Explain in Detail The Kinds of Property Under The Transfer of Property Actjaivik_ce7584No ratings yet

- Understanding Marketing ManagementDocument37 pagesUnderstanding Marketing Managementpenusila69410% (1)

- Preamble of Indian Constitution Question For LLB ExamDocument3 pagesPreamble of Indian Constitution Question For LLB Examjaivik_ce7584No ratings yet

- Revised - BEd Sem-IV (New) 12-09-2020Document1 pageRevised - BEd Sem-IV (New) 12-09-2020jaivik_ce7584No ratings yet

- LLB Sem-II 3-09-2020Document1 pageLLB Sem-II 3-09-2020jaivik_ce7584No ratings yet

- Aircraft Basic ConstructionDocument22 pagesAircraft Basic ConstructioncongngthanhNo ratings yet

- Chapter 5Document51 pagesChapter 5dayasanuNo ratings yet

- Environmental Pollution Control Measures: Table 6-1 Seven Categories of PollutionDocument20 pagesEnvironmental Pollution Control Measures: Table 6-1 Seven Categories of PollutionMurthy MandalikaNo ratings yet

- CH 06 Unit 03Document31 pagesCH 06 Unit 03ASIFNo ratings yet

- 543 Abdulelah Presentation DatabaseDocument12 pages543 Abdulelah Presentation Databaseapi-529533386No ratings yet

- Business Processes - Part 1Document15 pagesBusiness Processes - Part 1Malinda NayanajithNo ratings yet

- Mobile Broadcasting: Communication PrinciplesDocument23 pagesMobile Broadcasting: Communication PrinciplesSemi SmdNo ratings yet

- Bunna International Bank S.C Debit Card Personalization RequestDocument6 pagesBunna International Bank S.C Debit Card Personalization RequestSolomon TekalignNo ratings yet

- ERP Demand Apr'21Document86 pagesERP Demand Apr'21Being RonnieNo ratings yet

- Logistics Problem 19 - Shipping, Storage, & DistributionDocument35 pagesLogistics Problem 19 - Shipping, Storage, & DistributionJose F. MaestreNo ratings yet

- HDFC Apr To As On DateDocument10 pagesHDFC Apr To As On DatePDRK BABIUNo ratings yet

- Methodology For The Identification of Critical Communication Networks Links and Components - AnnexesDocument19 pagesMethodology For The Identification of Critical Communication Networks Links and Components - AnnexesJose Maximo Alvarado OyolaNo ratings yet

- International Variations in IFRS Practices: and How Spain Differs From Other Major CountriesDocument60 pagesInternational Variations in IFRS Practices: and How Spain Differs From Other Major CountriesCindyNo ratings yet

- Joint Venture Account PracticalDocument15 pagesJoint Venture Account Practicalasmita23840No ratings yet

- Fees Regulating Authority - 2023-24, Mumbai: Online Fee Approval Proposal For Academic Year 2023-24Document19 pagesFees Regulating Authority - 2023-24, Mumbai: Online Fee Approval Proposal For Academic Year 2023-24Mr Deshmukh Girish SahebraoNo ratings yet

- Unit 7 Logistics Handout 3Document7 pagesUnit 7 Logistics Handout 3Rakeem BernardNo ratings yet

- NancyDocument90 pagesNancyNancy GuchuNo ratings yet

- Anshu Bba5th SemDocument85 pagesAnshu Bba5th Semanshu jainNo ratings yet

- SPPL ConsDocument61 pagesSPPL ConsFarhan Khan MarwatNo ratings yet

- CompTIA Network N10 008 Exam ObjectivesDocument18 pagesCompTIA Network N10 008 Exam Objectivesvilese7No ratings yet

- BTP100 EN Col07-41Document1 pageBTP100 EN Col07-41Slata sahuNo ratings yet

- Finance Career Options Final - Doc RSBDocument3 pagesFinance Career Options Final - Doc RSBPrramakrishnanRamaKrishnanNo ratings yet

- Asean Tourism ContactsDocument9 pagesAsean Tourism ContactsShabori JainNo ratings yet

- CDN Overview - v0.3Document19 pagesCDN Overview - v0.3lhaddakNo ratings yet

- Stock Transport Order Without Delivery - Managing Special Stocks (MM-IM) - SAP LibraryDocument2 pagesStock Transport Order Without Delivery - Managing Special Stocks (MM-IM) - SAP LibraryPhani Sridhar ChNo ratings yet

- NAVDocument27 pagesNAVSai PrintersNo ratings yet