Professional Documents

Culture Documents

IOP One Pager Jan 2019

Uploaded by

Ashwin HasyagarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IOP One Pager Jan 2019

Uploaded by

Ashwin HasyagarCopyright:

Available Formats

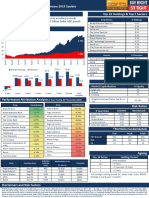

IOP Strategy January 2019 Update

Investment Objective Holdings & Top 5 Sectors

The Strategy aims to generate long term capital appreciation by creating a Scrip Names % Holdings

focused portfolio of high growth stocks having the potential to grow more than Development Credit Bank Ltd 9.60

the nominal GDP for next 5-7 years across and which are available at reasonable AU Small Finance Bank Ltd 7.20

market prices. TTK Prestige Ltd 7.00

Birla Corporation Ltd 6.98

Performance Aegis Logistics Ltd 6.84

45 Gabriel India Ltd 6.43

India Opportunity Portfolio Strategy Nifty Smallcap 100 Mahanagar Gas Ltd 5.84

40 2.88X

35 Alkem Laboratories Ltd 5.47

30 Kajaria Ceramics Ltd 4.70

25 Blue Star Ltd 4.48

2.71X

20 Quess Corp Ltd 4.05

15 1.86X Dr Lal Pathlabs Ltd 4.04

10 Dishman Carbogen Amcis Ltd 4.02

5 Canfin Homes Ltd 3.91

0 Lakshmi Vilas Bank Ltd 3.67

ITD Cementation India Ltd 2.67

Oct-10

Oct-11

Oct-12

Oct-13

Oct-14

Oct-15

Oct-16

Oct-17

Oct-18

Jun-10

Jun-11

Feb-12

Jun-12

Jun-13

Jun-14

Jun-15

Jun-16

Jun-17

Jun-18

Feb-10

Feb-11

Feb-13

Feb-14

Feb-15

Feb-16

Feb-17

Feb-18

IIFL Holdings Ltd 2.49

Dhanuka Agritech Ltd 2.17

Bayer Cropscience Ltd 2.10

India Opportunity Portfolio Strategy Nifty Smallcap 100

Suprajit Engineering Ltd 2.04

16.69 16.94

13.17

VIP Industries Ltd 1.71

11.54 9.95 13.64 12.66

5.16 GlaxoSmithkline Consumer Healthcare Ltd 1.56

4.90 5.62 4.49 7.23

V-Mart Retail Ltd 0.98

5Paisa Capital Ltd 0.04

%

-27.43 -29.08

Sectors

Allocation

1 year 2 Year 3 Years 4 years 5 years 7 years Since Banking & Finance 26.91

Inception Pharmaceuticals 13.54

Performance Attribution Analysis (1 Year Trailing 31st December 2018) Oil & Gas 12.68

Consumer Durable 11.70

Scrip Contribution Cement & Infrastructure 9.65

VIP Industries 0.26% Cash -

Glaxosmithkline Consumer Healthcare 0.17%

Market Capitalization

TTK Prestige 0.09%

Dr Lal PathLabs 0.06% Market Capitalization % Equity

V-Mart Retail 0.05% Large cap -

5Paisa Capital -0.02% Midcap 23

Bayer CropScience India -0.11% Smallcap 77

AU Small Finance Bank -0.48% Weighted Average Market Cap (Rs) 8394 Crs

Alkem Laboratories -0.59%

Suprajit Engineering -0.68% Risk Ratios

Mahanagar Gas -0.73%

3 Year Data Scheme Benchmark

IIFL Holdings -0.76%

Std Dev 16.27% 16.66%

Dhanuka Agritech -0.96%

Blue Star Beta 0.79 1.00

-1.00%

Development Credit Bank -1.10% Sharpe Ratio 0.19 0.19

Kajaria Ceramics -1.46% Upside Capture 0.48 1.00

Dishman Carbogen Amcis -1.52% Downside Capture 0.97 1.00

Gabriel India -1.70%

Lakshmi Vilas Bank -1.78% *Portfolio Fundamentals

ITD Cementation India -1.86%

Can Fin Homes -1.93% TTM FY19E FY20E

Aegis Logistics -2.01% PAT Growth 19% 17% 26%

Quess Corp -2.69% RoE 13% 15% 17%

Birla Corporation -4.82% PE 30 26 17

Disclaimers and Risk Factors

OP Strategy Inception Date: 15th Feb 2010; Data as on 31st December 2018; Data Source: MOAMC Internal Research; RFR – 7.25%; * Earnings as of Sept 2018 quarter and market price as on 31st December 2018

Please Note: The above strategy returns are of a Model Client as on 31st December 2018. Returns of individual clients may differ depending on time of entry in the Strategy. Past performance may or may not be

sustained in future and should not be used as a basis for comparison with other investments. Returns below 1 year are absolute and above 1 year are annualized. Strategy returns shown above are post fees &

expenses. The stocks forming part of the existing portfolio under IOP Strategy may or may not be bought for new client. Name of the PMS Strategy does not in any manner indicate its future prospects and returns.

The Company names mentioned above is only for the purpose of explaining the concept and should not be construed as recommendations from MOAMC

You might also like

- BOP One Pager Jan 2019Document1 pageBOP One Pager Jan 2019Ashwin HasyagarNo ratings yet

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundHarsh SrivastavaNo ratings yet

- UTIFLEXICAPFUNDDocument2 pagesUTIFLEXICAPFUNDmeghaNo ratings yet

- Utimidcapfund 16020220823 053119Document2 pagesUtimidcapfund 16020220823 053119meghaNo ratings yet

- Tata Whole Life Mid Cap Equity FundDocument1 pageTata Whole Life Mid Cap Equity FundK Dviya VennelaNo ratings yet

- NIFTY Midcap Select Jan2022Document1 pageNIFTY Midcap Select Jan2022Arati DubeyNo ratings yet

- IOP V2 Product Note 31st October 2020Document2 pagesIOP V2 Product Note 31st October 2020Swades DNo ratings yet

- EMERGING OPPORTUNITIES FUND INVESTMENT REPORTDocument1 pageEMERGING OPPORTUNITIES FUND INVESTMENT REPORTJeremiah SolomonNo ratings yet

- 590784414monthly Communique March, 2022Document12 pages590784414monthly Communique March, 2022Dhairya BuchNo ratings yet

- IOP Strategy Generates 2.3X Returns Over Nifty Smallcap 100Document2 pagesIOP Strategy Generates 2.3X Returns Over Nifty Smallcap 100HetanshNo ratings yet

- Top 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110Document1 pageTop 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110editor's cornerNo ratings yet

- Sbi Life Balanced Fund PerformanceDocument1 pageSbi Life Balanced Fund PerformanceVishal Vijay SoniNo ratings yet

- Utiniftyindexfund 12820200210 213216Document2 pagesUtiniftyindexfund 12820200210 213216VarathavasuNo ratings yet

- PSU Vaccancy Details - by Sumit SirDocument6 pagesPSU Vaccancy Details - by Sumit SirOhol Rohan BhaskarNo ratings yet

- Tax Suppliers For SurfaDocument6 pagesTax Suppliers For Surfaapi-19711841No ratings yet

- Utivalueopportunitiesfund 193Document2 pagesUtivalueopportunitiesfund 193201 TVNo ratings yet

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundJeremiah SolomonNo ratings yet

- Lubricant Market Statistics 2021 Q3Document21 pagesLubricant Market Statistics 2021 Q3udara pushpakumaraNo ratings yet

- Top 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110Document1 pageTop 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110Prafful TriPathiNo ratings yet

- Uti Children'S Career Fund - Investment Plan: JANUARY 2023Document3 pagesUti Children'S Career Fund - Investment Plan: JANUARY 2023rout.sonali20No ratings yet

- Placements 2018 19Document7 pagesPlacements 2018 19SHUBHAM RAJNo ratings yet

- Campus Recruitment Programme 2014-15 Placement Data - BIT Mesra Campus As On The16th April, 2015Document2 pagesCampus Recruitment Programme 2014-15 Placement Data - BIT Mesra Campus As On The16th April, 2015Shubham PandeyNo ratings yet

- Tata Super Select Equity FundDocument1 pageTata Super Select Equity FundAbdulazeezNo ratings yet

- 578380618monthly Communique May, 2022Document12 pages578380618monthly Communique May, 2022Dhairya BuchNo ratings yet

- Canara Robeco Emerging Equities PDFDocument1 pageCanara Robeco Emerging Equities PDFJasmeet Singh NagpalNo ratings yet

- Tata India Consumption FundDocument1 pageTata India Consumption FundJeremiah SolomonNo ratings yet

- Multi Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110Document1 pageMulti Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110editor's cornerNo ratings yet

- 8ccff Pms Communique August 22Document13 pages8ccff Pms Communique August 22pradeep kumarNo ratings yet

- NTDOP Product Note 31st October 2020Document2 pagesNTDOP Product Note 31st October 2020Swades DNo ratings yet

- Top constituents of NIFTY PSE indexDocument1 pageTop constituents of NIFTY PSE indexArati DubeyNo ratings yet

- HDFC MF Factsheet April 2023-1Document1 pageHDFC MF Factsheet April 2023-1Jayashree PawarNo ratings yet

- April 30, 2020: Constituents of NIFTY PSEDocument1 pageApril 30, 2020: Constituents of NIFTY PSEamitNo ratings yet

- NIFTY100 Liquid 15 Apr2020Document1 pageNIFTY100 Liquid 15 Apr2020amitNo ratings yet

- NIFTY Next 50 Nov2020Document2 pagesNIFTY Next 50 Nov2020Games ZoneNo ratings yet

- Cfap 5 2019 PKDocument194 pagesCfap 5 2019 PKSummar FarooqNo ratings yet

- Whole Life Mid Cap Equity Fund: ULIF 009 04/01/07 WLE 110 Fund Assure, Investment Report, January 2021Document1 pageWhole Life Mid Cap Equity Fund: ULIF 009 04/01/07 WLE 110 Fund Assure, Investment Report, January 2021Abhishek BadalNo ratings yet

- Lubricant Market Statistics 2021 v2Document27 pagesLubricant Market Statistics 2021 v2Dharshan MylvaganamNo ratings yet

- Cfap 2 2021 PKDocument288 pagesCfap 2 2021 PKMaham FatimaNo ratings yet

- Placements 2017 18Document7 pagesPlacements 2017 18Shreyash TaoriNo ratings yet

- Cfap 1 Aafr PKDocument336 pagesCfap 1 Aafr PKArslan Shafique Ch100% (1)

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- RSPO WEB TradersLicensePDFDocument58 pagesRSPO WEB TradersLicensePDFshraone raoNo ratings yet

- Tata Quant PortfolioDocument1 pageTata Quant PortfolioDeepanshu SatijaNo ratings yet

- 2020756102monthly Communique June, 2022Document13 pages2020756102monthly Communique June, 2022Dhairya BuchNo ratings yet

- Nifty Next 50 Jan2022Document2 pagesNifty Next 50 Jan2022Arati DubeyNo ratings yet

- NIFTY Midcap Liquid 15 Apr2020Document1 pageNIFTY Midcap Liquid 15 Apr2020amitNo ratings yet

- Sub: Submission of Analysts/Investors Presentation Ref: Letter Dated April 20, 2022 Informing About Analysts/Investors CallDocument26 pagesSub: Submission of Analysts/Investors Presentation Ref: Letter Dated April 20, 2022 Informing About Analysts/Investors CallAMRISH SATISH DOLASNo ratings yet

- APL (Autosaved)Document41 pagesAPL (Autosaved)MisbahNo ratings yet

- Lubricant Market Statistics 2023 Q2 ED1Document23 pagesLubricant Market Statistics 2023 Q2 ED1Dharshan MylvaganamNo ratings yet

- Axis Growth Opportunities FundDocument1 pageAxis Growth Opportunities FundManoj JainNo ratings yet

- Top constituents of NIFTY50 Value 20 indexDocument1 pageTop constituents of NIFTY50 Value 20 indexArati DubeyNo ratings yet

- Placement-Record-2022-23Document15 pagesPlacement-Record-2022-23Kunal SalunkheNo ratings yet

- 01362e2e-084f-4249-b643-6044e97aa9dbDocument23 pages01362e2e-084f-4249-b643-6044e97aa9dbAMRISH SATISH DOLASNo ratings yet

- Tracing Missing ShareholdersDocument19 pagesTracing Missing Shareholdersmrpatel121152No ratings yet

- Nippon India Multicap FundDocument2 pagesNippon India Multicap FundScribbydooNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- ACC LTD.: SL No. Page NoDocument14 pagesACC LTD.: SL No. Page NoArun K VNo ratings yet

- Value Product Note October-20Document2 pagesValue Product Note October-20Swades DNo ratings yet

- NIFTY Smallcap 50 Jan2022Document2 pagesNIFTY Smallcap 50 Jan2022Arati DubeyNo ratings yet

- Old Bridge 5-Year PerformanceDocument3 pagesOld Bridge 5-Year PerformanceAshwin HasyagarNo ratings yet

- EV Landscape - Opportunities For India's Auto Component IndustryDocument112 pagesEV Landscape - Opportunities For India's Auto Component IndustryPreran PrasadNo ratings yet

- NTDOP One Pager Jan 2019Document1 pageNTDOP One Pager Jan 2019Ashwin HasyagarNo ratings yet

- AlchemyDocument8 pagesAlchemyAshwin HasyagarNo ratings yet

- From The Desk of Business Head and CIO - January 2019: Mr. Prateek AgrawalDocument4 pagesFrom The Desk of Business Head and CIO - January 2019: Mr. Prateek AgrawalAshwin HasyagarNo ratings yet

- Product Labelling: Birla Sun Life Resurgent India Fund - Series 3 (A Closed Ended Equity Scheme)Document28 pagesProduct Labelling: Birla Sun Life Resurgent India Fund - Series 3 (A Closed Ended Equity Scheme)Ashwin HasyagarNo ratings yet

- VIDF - Monthly Returns May 2017Document2 pagesVIDF - Monthly Returns May 2017Ashwin HasyagarNo ratings yet

- VallumDiscovery Stakeholders March2016Document4 pagesVallumDiscovery Stakeholders March2016Ashwin HasyagarNo ratings yet

- ICICI Pru Large - CapDocument4 pagesICICI Pru Large - CapAshwin HasyagarNo ratings yet

- CEP Risk Ratios PDFDocument1 pageCEP Risk Ratios PDFAshwin HasyagarNo ratings yet

- ICICI Pru Absolute - ReturnDocument4 pagesICICI Pru Absolute - ReturnAshwin HasyagarNo ratings yet

- Transformer IndustryDocument6 pagesTransformer IndustryAshwin HasyagarNo ratings yet

- Lab Practice # 01 An Introduction To MatlabDocument10 pagesLab Practice # 01 An Introduction To MatlabGhulam Abbas LashariNo ratings yet

- Quality Control and Quality AssuranceDocument7 pagesQuality Control and Quality AssuranceMoeen Khan Risaldar100% (1)

- COVID-19 and Flu Vaccination Walgreens Immunization ServicesDocument1 pageCOVID-19 and Flu Vaccination Walgreens Immunization ServicesAitana MaldonadoNo ratings yet

- XII Class Assignment Programs 2023-24Document8 pagesXII Class Assignment Programs 2023-24Sudhir KumarNo ratings yet

- Petol Ps 460-5G: Technical SheetDocument2 pagesPetol Ps 460-5G: Technical SheetA MahmoodNo ratings yet

- Building Lean Supply ChainsDocument33 pagesBuilding Lean Supply ChainsJefri MustaphaNo ratings yet

- Value YourselfDocument7 pagesValue YourselfTalha KhalidNo ratings yet

- The Secret Science of Shaktipat - Guide To Initiation 13 September 2020Document77 pagesThe Secret Science of Shaktipat - Guide To Initiation 13 September 2020Patrick JenksNo ratings yet

- The Historical Foundations of Law. Harold BermanDocument13 pagesThe Historical Foundations of Law. Harold BermanespinasdorsalesNo ratings yet

- Nord Stage Factory Patches v3 v4 v5Document18 pagesNord Stage Factory Patches v3 v4 v5Danilo Giuliani DobermannNo ratings yet

- Sapamine CSN Textile Softener: Technical Data SheetDocument5 pagesSapamine CSN Textile Softener: Technical Data SheetsaskoNo ratings yet

- Results and DiscussionsDocument13 pagesResults and DiscussionsEdpher Leo SindolNo ratings yet

- Integrated Marketing Communication PlanDocument5 pagesIntegrated Marketing Communication Planprojectwork185No ratings yet

- Endocrine System Diagnostic Text and Some DiseasesDocument3 pagesEndocrine System Diagnostic Text and Some Diseasesevangelo22656No ratings yet

- Signals and Systems Analysis: NET 351 Instructor: Dr. Amer El-Khairy يريخلا &رماع .دDocument44 pagesSignals and Systems Analysis: NET 351 Instructor: Dr. Amer El-Khairy يريخلا &رماع .دمصعب جاسمNo ratings yet

- Accounting For Non Specialists Australian 7th Edition Atrill Test BankDocument26 pagesAccounting For Non Specialists Australian 7th Edition Atrill Test BankJessicaMitchelleokj100% (49)

- Chapter 11 RespirationDocument2 pagesChapter 11 Respirationlock_jaw30No ratings yet

- DS-RTCD905 H6W4Document2 pagesDS-RTCD905 H6W4david fonsecaNo ratings yet

- Examining The Structural Relationships of Destination Image, Tourist Satisfaction PDFDocument13 pagesExamining The Structural Relationships of Destination Image, Tourist Satisfaction PDFAndreea JecuNo ratings yet

- Julia Henzler - Resume 2 27Document1 pageJulia Henzler - Resume 2 27api-491391730No ratings yet

- Sliding Sleeves Catalog Evolution Oil ToolsDocument35 pagesSliding Sleeves Catalog Evolution Oil ToolsEvolution Oil Tools100% (1)

- Group ActDocument3 pagesGroup ActRey Visitacion MolinaNo ratings yet

- T2-1 MS PDFDocument27 pagesT2-1 MS PDFManav NairNo ratings yet

- New Translation and Deciphering of ChineDocument14 pagesNew Translation and Deciphering of ChineRémyNo ratings yet

- BCG ReportDocument9 pagesBCG Reportjlgjlj ljglkhNo ratings yet

- Rotorvane Tea OrthodoxDocument9 pagesRotorvane Tea OrthodoxyurinaNo ratings yet

- 1866 Lee Animal Magnetism and Magnet Lucid SomnambulismDocument354 pages1866 Lee Animal Magnetism and Magnet Lucid SomnambulismtvosNo ratings yet

- 02.casebook - BLDG Repairs & Maint - Chapter 1 - 2011 (Water Seepage)Document13 pages02.casebook - BLDG Repairs & Maint - Chapter 1 - 2011 (Water Seepage)Hang kong TseNo ratings yet

- GRP 10 JV'sDocument43 pagesGRP 10 JV'sManas ChaturvediNo ratings yet

- Conditions For The Emergence of Life On The Early Earth: Summary and ReflectionsDocument15 pagesConditions For The Emergence of Life On The Early Earth: Summary and Reflectionsapi-3713202No ratings yet