Professional Documents

Culture Documents

PremiumContributionTable PDF

Uploaded by

Tammy SelaromOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PremiumContributionTable PDF

Uploaded by

Tammy SelaromCopyright:

Available Formats

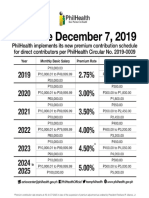

PREMIUM CONTRIBUTIONS FOR EMPLOYED

SECTOR EFFECTIVE JANUARY 2018

(per PhilHealth Circular No. 2017-0024)

New rate: @2.75% computed straight based on the monthly basic salary (MBS)

Sample Computations

Salary floor/ceiling and computation of MBS multiplied to 2.75 percent

Monthly Basic Salary x Monthly Personal Employer

2.75% Premium Share Share

P10,000 and below P275.00 P137.50 P137.50

P10,000.01 up to P275.00 up to P137.50 up to P137.50 up to

P39,999.99 P1,099.99 P549.99 P549.99

P40,000.00 and above P1,100.00 P550.00 P550.00

Rounding off to the nearest hundredths to display the two (2) digit centavos

Monthly Basic Monthly Premium Personal Employer

Salary (MBS) (@2.75% of MBS) Share Share

P8,999.99 P275.00 Based on P10,000.00 floor P137.50 P137.50

P309.375 Round off to nearest

P11,250.00 P154.69 P154.69

hundredths = P309.38

P698.775 Round off to nearest

P25,410.00 P349.39 P349.39

hundredths = P698.78

P41,999.99 P1,100.00 Based on P40,000.00 ceiling P550.00 P550.00

If an excess centavo will occur when equally sharing the computed monthly premium, deduct

excess centavo from Employee’s share to get the monthly premium due

Monthly Basic Monthly Premium Premium per Personal Employer

Salary (MBS) (@2.75% of MBS) Share Share Share

P22,500.00 P618.75 (P618.76) P309.375 Round (P309.38) P309.38

off to the nearest

hundredths = P309.38 P309.37*

*since P309.38 per share will result to total of P618.76, the centavo is deducted from the Personal Share

Premium Contributions for Kasambahay

The premium contributions of the Kasambahay shall be shouldered solely by the employer. How-

ever, if the Kasambahay is receiving a monthly salary of five thousand pesos (P5,000.00) or above,

the Kasambahay shall pay his/her proportionate share.

Note: The above sample computations shall also apply to Manning Agencies handling the monthly deduction

of their seafarers.

You might also like

- Tax Updates Vs Tax Code OldDocument7 pagesTax Updates Vs Tax Code OldGianna Chloe S Victoria100% (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Does That Sound Fair?Document5 pagesDoes That Sound Fair?Nick van ExelNo ratings yet

- Loan SyndicationDocument57 pagesLoan SyndicationSandya Gundeti100% (1)

- Slavery PamphletDocument41 pagesSlavery PamphletCassianoPereiradeFariasNo ratings yet

- BUSINESS MATHEMATICS Lesson 4 IONDocument5 pagesBUSINESS MATHEMATICS Lesson 4 IONPurple. Queen95100% (2)

- Intentional Torts TableDocument66 pagesIntentional Torts TableShannon LitvinNo ratings yet

- Module 3 Grade 8Document5 pagesModule 3 Grade 8Mud VayneNo ratings yet

- OFS - Installation GuideDocument11 pagesOFS - Installation GuideAnatolii Skliaruk100% (1)

- SOLMAN Chapter 3Document18 pagesSOLMAN Chapter 3Na JaeminNo ratings yet

- Parcor Baysa Chapter 3 Parcor Baysa Chapter 3Document17 pagesParcor Baysa Chapter 3 Parcor Baysa Chapter 3FranciscoViloriaFrankNo ratings yet

- Income Tax On Employed Taxpayer and Mixed Income EarnerDocument20 pagesIncome Tax On Employed Taxpayer and Mixed Income EarnerFritzie Grace C. FraycoNo ratings yet

- Science 8 Summative Test Mod 2 Unit 2Document2 pagesScience 8 Summative Test Mod 2 Unit 2Jboy Mnl85% (75)

- Science 8 Summative Test Mod 2 Unit 2Document2 pagesScience 8 Summative Test Mod 2 Unit 2Jboy Mnl85% (75)

- Ch. 1-Fundamentals of Accounting IDocument20 pagesCh. 1-Fundamentals of Accounting IDèřæ Ô MáNo ratings yet

- Bread and Pastry NC II CGDocument16 pagesBread and Pastry NC II CGRenato NatorNo ratings yet

- 2018 Electrical Toolbox Talk #3 Power Lines Live WorkDocument1 page2018 Electrical Toolbox Talk #3 Power Lines Live WorkEsmatullah FarahmandNo ratings yet

- Science 10 2nd Quarter TOSDocument1 pageScience 10 2nd Quarter TOSTammy SelaromNo ratings yet

- Premium Contribution TableDocument1 pagePremium Contribution TableCarlos MontonNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFMary Ann AlcantaraNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFMika VillanuevaNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFKaren BugingNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFRoselyn DucayNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFAlexandra aliporoNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFGlenn PadilloNo ratings yet

- PremiumContributionTable PHIC PDFDocument1 pagePremiumContributionTable PHIC PDFEdwin Tapit JrNo ratings yet

- PremiumContributionTable PhilhealthDocument1 pagePremiumContributionTable PhilhealthLala LanibaNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFjose manaloNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFDairul NacesNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFcelNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFadrianneNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFChristian Dela PenaNo ratings yet

- PhilHealth Premium Contribution Table PDFDocument1 pagePhilHealth Premium Contribution Table PDFDaniel B. BalmoriNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFChristian Dela PenaNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFA BNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFlynn payumoNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFRambell John RodriguezNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFJayzleCarriagaAranasNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFNoli Heje de Castro Jr.No ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFKerwin CruzNo ratings yet

- PremiumContributionTable PDFDocument1 pagePremiumContributionTable PDFAnthony Dela TorreNo ratings yet

- Phic PDFDocument1 pagePhic PDFKerwin CruzNo ratings yet

- Sample Premium Computation of The Formal SectorDocument2 pagesSample Premium Computation of The Formal SectorFrancis MacasaetNo ratings yet

- Advisory 2018-0003 - Sample Premium Computation - Formal Sector - Jan162018 - UpdatedDocument2 pagesAdvisory 2018-0003 - Sample Premium Computation - Formal Sector - Jan162018 - UpdatedSeasaltandsandNo ratings yet

- 2023 Philhealth Contribution TableDocument1 page2023 Philhealth Contribution TableJenn TorrenteNo ratings yet

- 8-10 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument7 pages8-10 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Simple Interest: I PV X I X NDocument4 pagesSimple Interest: I PV X I X NLorrianne RosanaNo ratings yet

- Old Tax Law Vs Train Law Tax PH Lessons - CompressDocument7 pagesOld Tax Law Vs Train Law Tax PH Lessons - CompressRonron De ChavezNo ratings yet

- Philhealth ContributionDocument1 pagePhilhealth ContributionJovylyn Balbines LictagNo ratings yet

- CommissionDocument30 pagesCommissionVince Clifford VestalNo ratings yet

- BusMath01 - Amortization & Commission - Activity - Answer Key PDFDocument2 pagesBusMath01 - Amortization & Commission - Activity - Answer Key PDFsheisbonjing PHNo ratings yet

- BusMath01 - Amortization & Commission - Activity - Answer Key PDFDocument2 pagesBusMath01 - Amortization & Commission - Activity - Answer Key PDFsheisbonjing PHNo ratings yet

- Income Tax Credits - ReviewerDocument10 pagesIncome Tax Credits - Reviewer버니 모지코No ratings yet

- Roxas Seatwork-4Document14 pagesRoxas Seatwork-4Ronna Mae RedublaNo ratings yet

- RTGS 2022 August-December 2022 Tax TablesDocument1 pageRTGS 2022 August-December 2022 Tax TablesGodfrey MakurumureNo ratings yet

- Tax TablesDocument6 pagesTax TablesGeromil HernandezNo ratings yet

- August To December 2019 RTGS Tax TablesDocument1 pageAugust To December 2019 RTGS Tax TablesAlton MadyaraNo ratings yet

- Ch2Premium LiabilityDocument20 pagesCh2Premium LiabilityCrysta Lee100% (1)

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- Tax Tables RTGS 2020Document1 pageTax Tables RTGS 2020Mai CarolNo ratings yet

- RTGS Tax Tables 2022Document1 pageRTGS Tax Tables 2022Godfrey MakurumureNo ratings yet

- New Booklet Water September 22 2023Document2 pagesNew Booklet Water September 22 2023AIREEN CLORESNo ratings yet

- RAB Driver Harbun 2020 5 Personnel ApprovedDocument1 pageRAB Driver Harbun 2020 5 Personnel Approvedbimo anggoroNo ratings yet

- Aug - Dec 2020 Tax Tables RTGSDocument1 pageAug - Dec 2020 Tax Tables RTGSTanaka MachanaNo ratings yet

- Project Cost Fixed AssetsDocument51 pagesProject Cost Fixed AssetsRuffa Mae MatiasNo ratings yet

- Wealth MGMT - FA ADocument19 pagesWealth MGMT - FA Achinmay manjrekarNo ratings yet

- Daily 1 2 3 4 5 6: Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022Document2 pagesDaily 1 2 3 4 5 6: Revised Withholding Tax Table Effective January 1, 2018 To December 31, 2022DENR-NCR Legal DivisionNo ratings yet

- Assignment For Week 4 Answers - Chap 7Document4 pagesAssignment For Week 4 Answers - Chap 7silosodraregNo ratings yet

- Franchise Accounting: Installment MethodDocument3 pagesFranchise Accounting: Installment MethodJason BautistaNo ratings yet

- Action Plan Step 1Document2 pagesAction Plan Step 1Tammy SelaromNo ratings yet

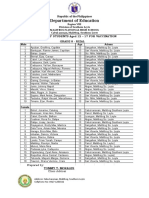

- Department of Education: Republic of The PhilippinesDocument5 pagesDepartment of Education: Republic of The PhilippinesTammy SelaromNo ratings yet

- Grade 8 Rizal List For VACINATIONDocument1 pageGrade 8 Rizal List For VACINATIONTammy SelaromNo ratings yet

- P R o Je C T o V e R V I e W: Name of Project: Subject/Course: Other Subject Areas To Be IncludedDocument5 pagesP R o Je C T o V e R V I e W: Name of Project: Subject/Course: Other Subject Areas To Be IncludedTammy SelaromNo ratings yet

- Schoolform1 (Sf1) Schoolregister: S Chool Id 305533 Re Gion Viii Divis Ion S Outhe RN Le YteDocument1 pageSchoolform1 (Sf1) Schoolregister: S Chool Id 305533 Re Gion Viii Divis Ion S Outhe RN Le YteTammy SelaromNo ratings yet

- Grade 7 Monitoring Tool 3rd GradingDocument12 pagesGrade 7 Monitoring Tool 3rd GradingTammy SelaromNo ratings yet

- Tle10 He Foodandbeverageservices q1 Mod1 Providinglinkbetweenkitchenandserviceareas v1Document46 pagesTle10 He Foodandbeverageservices q1 Mod1 Providinglinkbetweenkitchenandserviceareas v1Tammy SelaromNo ratings yet

- Recognition Program CoverDocument1 pageRecognition Program CoverTammy SelaromNo ratings yet

- Creation of the-WPS OfficeDocument3 pagesCreation of the-WPS OfficeTammy SelaromNo ratings yet

- Kenneth E. Delapena: Position Applied: PromodiserDocument3 pagesKenneth E. Delapena: Position Applied: PromodiserTammy SelaromNo ratings yet

- Acr Maravillas Week3Document1 pageAcr Maravillas Week3Tammy SelaromNo ratings yet

- Malitbog National High School: Department of Education Region VIII Division of Southern Leyte Malitbog, Southern LeyteDocument2 pagesMalitbog National High School: Department of Education Region VIII Division of Southern Leyte Malitbog, Southern LeyteTammy SelaromNo ratings yet

- Science 7 DLP q3w9d4 & w10d1Document4 pagesScience 7 DLP q3w9d4 & w10d1Tammy SelaromNo ratings yet

- Ap Physics B Lesson 64 76 Fluid MechanicsDocument58 pagesAp Physics B Lesson 64 76 Fluid MechanicsTammy SelaromNo ratings yet

- In Line With The DepEd Order 24Document1 pageIn Line With The DepEd Order 24william felisildaNo ratings yet

- Questions Using Blooms TaxonomyDocument2 pagesQuestions Using Blooms TaxonomyPriscilla Ruiz100% (1)

- Ways of Promoting Cultural Ecotourism For Local Communities in Sibiu AreaDocument6 pagesWays of Promoting Cultural Ecotourism For Local Communities in Sibiu AreaTammy SelaromNo ratings yet

- Application For Leave Application For Leave: NOT Requested NOT RequestedDocument1 pageApplication For Leave Application For Leave: NOT Requested NOT RequestedTammy SelaromNo ratings yet

- Voltaire - Wikipedia, The Free EncyclopediaDocument16 pagesVoltaire - Wikipedia, The Free EncyclopediaRAMIZKHAN124No ratings yet

- DFM Guidebook Sheetmetal Design Guidelines Issue XVDocument11 pagesDFM Guidebook Sheetmetal Design Guidelines Issue XVRushil ShahNo ratings yet

- UP NHM ANM Recruitment 2021Document6 pagesUP NHM ANM Recruitment 2021Rajesh K KumarNo ratings yet

- Annexure (1) Scope of Work of S4 HANA ImplementationDocument2 pagesAnnexure (1) Scope of Work of S4 HANA Implementationmanishcsap3704No ratings yet

- Braulio de Diego - Problemas Oposiciones Matemáticas Vol 2 (81-87)Document10 pagesBraulio de Diego - Problemas Oposiciones Matemáticas Vol 2 (81-87)laura caraconejo lopezNo ratings yet

- AMLA SingaporeDocument105 pagesAMLA SingaporeturkeypmNo ratings yet

- Unitary TheoryDocument5 pagesUnitary TheorySuhag100% (1)

- Buying PlanDocument26 pagesBuying PlanSamarth TuliNo ratings yet

- F An Economic Analysis of Financial Structure: (Ch.8 in The Text)Document12 pagesF An Economic Analysis of Financial Structure: (Ch.8 in The Text)Ra'fat JalladNo ratings yet

- State EmergencyDocument28 pagesState EmergencyVicky DNo ratings yet

- SEBI Circular Compliance AuditDocument34 pagesSEBI Circular Compliance AuditAnkit UjjwalNo ratings yet

- Project IPC-IIDocument10 pagesProject IPC-IIAkanksha YadavNo ratings yet

- Risk Management and InsuranceDocument64 pagesRisk Management and InsuranceMehak AhluwaliaNo ratings yet

- WWW Judicialservicesindia Com Indian Evidence Act Multiple Choice Questions On Indian Evidence Act 13327Document20 pagesWWW Judicialservicesindia Com Indian Evidence Act Multiple Choice Questions On Indian Evidence Act 13327Rekha SinhaNo ratings yet

- Anti Bouncing Check Law 2023Document5 pagesAnti Bouncing Check Law 2023Michael BongalontaNo ratings yet

- Intra Court AppealDocument18 pagesIntra Court AppealAdnan AdamNo ratings yet

- Pando Whitepaper enDocument28 pagesPando Whitepaper enIsal AbiNo ratings yet

- Conditional QuestionsDocument2 pagesConditional QuestionsKumarNo ratings yet

- Interpretation of Statutes Course OverviewDocument11 pagesInterpretation of Statutes Course OverviewCD20100130No ratings yet

- Chapter 2 - Transfer Taxes and Basic SuccessionDocument5 pagesChapter 2 - Transfer Taxes and Basic SuccessionRitzchalle Garcia-OalinNo ratings yet

- AmeriMex Blower MotorDocument3 pagesAmeriMex Blower MotorIon NitaNo ratings yet

- 4 05A+WorksheetDocument3 pages4 05A+WorksheetEneko AretxagaNo ratings yet

- Business Plan AluminiumDocument11 pagesBusiness Plan AluminiumSaravanakumar SaravanaNo ratings yet