Professional Documents

Culture Documents

Indirect Costs To Contracts

Indirect Costs To Contracts

Uploaded by

Christian Nicolaus MbiseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indirect Costs To Contracts

Indirect Costs To Contracts

Uploaded by

Christian Nicolaus MbiseCopyright:

Available Formats

3

Indirect Costs of Contracts

Fred Shelton, Jr., CPA, MBA, CVA and Mason Brugh, CPA

EXECUTIVE SUMMARY

• Construction, by its very nature, is a risky business. Estimating is part of what makes it risky.

• Contractors estimating projects without a complete understanding of the cost components, including indirect costs, are

unnecessarily increasing their risk and exposure to losses.

unnecessarily increasing their risk and

S

tatement of Position 81–1,

Accounting for Performance of exposure to losses. One certainly wouldn’t

Construction-Type and Certain drive across the country without a road

Production-Type Contracts, (SOP map. It would not be an efficient under-

81-1), contains a paragraph taking. By taking the time to analyze the FRED SHELTON, JR., is

Managing Director of

that states: components that should be included to Shelton & Company,

arrive at an accurate bid, or estimate, con- CPAs, P.C., an accounting

Contract costs generally include all tractors can develop their own map, or and consulting firm located

direct costs, such as materials, direct in Central Virginia. The

plan, to guide their business decisions. practice consists almost

labor, and subcontracts, and indirect On any construction project, the poten- exclusively of audits and

costs identifiable with or allocable to tial profit to be earned is limited by cer- reviews of, and consulting

the contracts. with, contractors and their

tain constraints, but losses are not so con- related businesses, includ-

strained. That is why the original estimate ing assistance with the spe-

The Statement of Position was issued by is so important! To be able to earn profits, cial tax and financial

problems faced by contrac-

an accurate job estimate is essential. No

the Accounting Standards Division of the tors. Mr. Shelton has

matter how efficient a contractor is, if a taught courses in account-

American Institute of Certified Public

project has unknowingly been bid at a ing and taxation for con-

Accountants. It gives accounting guidance tractors for the Virginia

loss, it will be almost impossible to sal- Society of Certified Public

to construction contractors. vage profitability. Accountants, and other

This article discusses the “indirect Construction, by its very nature, is a professional organizations,

costs identifiable with or allocable to the risky business. Estimating is part of what and has been a frequent

contracts” referred to above. Those costs guest speaker and lecturer

makes it risky. After all, the term for the for various trade and busi-

are often referred to as overhead. contract proposal is “estimate,” indicating ness groups.

However, it should be made clear that imprecision. MASON BRUGH is

general and administrative costs are also Director of Consulting for

referred to as overhead, and in fact are Shelton & Company,

CPAs, P.C. He has over

part of the contractor’s total overhead. CONTRACT COSTS eight years’ experience in

A contractor needs an understanding of The cost components used to arrive at an the construction industry,

indirect costs for estimating purposes, for serving as a controller for

estimate can vary tremendously among a systems contractor and

tracking the individual jobs or projects, contractors even within the same line of as a CPA for Shelton &

and for financial statement preparation. business. By breaking down the specific Company. He received

Contractors estimating projects without a BA in history from

items included in gross profit, the differ- Hampden-Sydney College

a complete understanding of the cost com- ences among contractors may have less to and a BA in Accounting

ponents, including indirect costs, are do with the uniqueness of their operations, from Lynchburg College.

JOURNAL OF CONSTRUCTION ACCOUNTING AND TAXATION July/August 2002

4 INDIRECT COSTS OF CONTRACTS

and more to do with the understanding or necessary to run the business, but are not

the misunderstanding of the cost compo- assignable to a specific job or project.

nents used to arrive at a project estimate. Examples of these types of costs are

When preparing an estimate, key cost advertising, dues and subscriptions, office

components such as labor, material, sub- supplies, office salaries, salesman salaries,

contract, equipment rental, and travel are legal and accounting fees, taxes and

analyzed as to the amount of resources licenses, office rent, building mainte-

needed to perform the job. Those costs nance, depreciation on software, office

are relatively straightforward and easily equipment and furniture, owner’s salary,

understood. These costs are charged by and utilities.

the specific identification method. General and administrative costs are

usually relatively stable and are often pre-

dictable as a percentage of volume over

INDIRECT JOB COSTS time. Per SOP 81-1:

(OVERHEAD)

General and administrative costs ordi-

After the direct costs are determined, con-

narily should be charged to expense

tractors usually apply an “overhead factor”

as incurred . . .

to labor, total cost, etc. in order to establish

a complete job cost estimate. However,

overhead is a broad term and is often used

differently by different contractors. It is SEPARATING COSTS

important for a contractor to distinguish Separating general and administrative costs

between different types of overhead. For a from indirect job costs often causes the

construction contractor, overhead falls into greatest discrepancies among contractors.

two different cost pools. The first pool con- The key to remember when categorizing

sists of indirect job costs, and the second expenses is the phrase “identifiable with or

pool consists of general and administrative allocable to the contracts.” Even though a

costs. Both groups of costs must be recov- cost cannot be identified to a specific job, it

ered to be profitable. does not necessarily mean it is not a cost of

Indirect job costs are costs necessary for the job. The contractor must examine all

the performance of the job but are diffi- overhead costs thoroughly to determine

cult to identify to a specific contract. which costs are identifiable to the jobs indi-

According to SOP 81–1: vidually or the company as a whole. This will

vary from contractor to contractor. The suc-

Indirect costs allocable to contracts

cess of the contractor is often dependent on

include the costs of indirect labor,

a clear understanding of what cost compo-

contract supervision, tools and equip-

nents drive the jobs.

ment, supplies, quality control and

The amount of indirect costs an

inspection, insurance, repairs and

employee or a piece of equipment can

maintenance, depreciation and amor-

generate is often significant. For example,

tization, and, in some circumstances,

along with an employee’s salary, contrac-

support costs, such as central prepa-

tors will generally incur payroll taxes,

ration and processing of payrolls.

health insurance, workers’ compensation

(subject to an annual audit adjustment),

vacation, bonuses, vehicle allowances,

GENERAL AND training, and drug testing expense.

ADMINISTRATIVE COSTS Equipment will generate expenses for

While indirect job costs are related to con- fuel, external repairs and maintenance,

tract performance, general and administra- internal labor for repairs, storage costs,

tive costs are related to the functioning of insurance, and personal property taxes.

the company as a whole. These costs are The contractor must examine costs such

JOURNAL OF CONSTRUCTION ACCOUNTING AND TAXATION July/August 2002

INDIRECT COSTS OF CONTRACTS 5

Exhibit 1

Sample Grading Contractor—Statement of Income

CONTRACT REVENUES $2,300,000 100%

CONTRACT COSTS:

Labor $ 340,000

Materials 400,000

Subcontract 560,000

Equipment 506,000

Other costs 183,000

1,989,000 86%

GROSS PROFIT 311,000 14%

GENERAL AND ADMINISTRATIVE EXPENSE 207,000 9%

NET INCOME FROM OPERATIONS 104,000 5%

OTHER INCOME (EXPENSE) (4,000) 0%

NET INCOME $ 100,000 4%

as these to determine how much will be utilities are relatively stable over time.

allocable to the contracts. Therefore, as a general rule, indirect costs

are predicted as a percentage of direct

labor or another appropriate base, while

ALLOCATING INDIRECT general and administrative costs, as stated

COSTS above, are often predictable as a percent-

Indirect job costs must be separated from age of volume over time.

general and administrative costs. Once the In allocating indirect costs, most con-

pool of indirect costs has been identified, tractors use one of several methods:

the method used to allocate indirect costs (1) Percentage of total direct costs

among the contracts must be evaluated to (2) Percentage of direct labor costs

determine if it makes sense under the cir-

cumstances. The key is to look for causal (3) Percentage of direct labor hours

relationships. Per SOP 81-1: (4) Percentage of direct labor costs and

equipment charges

Methods of allocating indirect costs

should be systematic and rational.

The choice of overhead allocation formula

They include, for example, alloca-

depends on many factors. The type of

tions based on direct labor costs,

accounting systems and information avail-

direct labor hours, or a combination

able may make some allocation formulas

of direct labor and material costs.

almost impossible.

The appropriateness of allocations of

indirect costs and the methods of

allocation depend on the circum- SAMPLE GRADING

stances and involve judgment. CONTRACTOR

When considering overhead, it must be Exhibit 1 contains the statement of

remembered that direct costs affect the income of a small grading contractor oper-

two pools of costs in different ways. If ating in the southeastern United States.

direct labor increases, so too will items As additional information, the company

such as payroll taxes, health insurance, has elected to be taxed as a Subchapter S

and gas. However, items such as rent, type corporation. There is therefore, no

building maintenance, office supplies, and provision for corporate income taxes.

JOURNAL OF CONSTRUCTION ACCOUNTING AND TAXATION July/August 2002

6 INDIRECT COSTS OF CONTRACTS

Exhibit 2

Sample Grading Contractor—Direct and Indirect Costs

DIRECT COST:

Labor $ 340,000

Materials 400,000

Subcontract 560,000

Equipment (leased for specific projects) 25,000

Other costs 15,000

1,340,000

EQUIPMENT COST INDIRECT

Gasoline (can be direct if costed to project) 70,000

Repairs and maintenance 110,000

Mechanics labor and burden 50,000

Depreciation 180,000

Insurance 16,000

Equipment lease (not chargeable to a specific job) 55,000

481,000

OTHER INDIRECT COSTS

Health insurance 40,000

Payroll Burden (can be direct if costed to project) 65,000

Workers’ Compensation Insurance 15,000

Mobile phone expense 3,000

Project Manager’s salary 45,000

168,000

TOTAL COST OF CONTRACT REVENUE $1,989,000

Sample Grading Contractor has signifi- overhead costs to construction projects for

cant indirect equipment and other costs. the year.

The success or failure of a project may be The three methods will be based on:

determined by accurately estimating the 1. TOTAL DIRECT COSTS

indirect costs. Estimating equipment cost

2. DIRECT LABOR COSTS

can be involved. Many contractors estab-

lish an equipment rate for each piece of 3. DIRECT LABOR COSTS AND

equipment based on hours of usage. Each EQUIPMENT HOURS

job is then charged costs based on the

rates and hours of use for each piece of Using acceptable theoretical methods can

equipment. The total amounts charged to produce different results. One must be

careful to select the most appropriate

all the jobs are then compared to the

method for the circumstances.

actual costs. The difference between the

Exhibit 3 contains sample schedules for

two is referred to as a variance. the three methods. The first method is

Exhibit 2 provides example direct and one based on total direct costs only. The

indirect costs of Sample Grading second method analyzed will be one of

Contractor for the statement of income. direct labor only. The third method is one

based on direct labor costs and equipment

hours.

ALLOCATIONS OF INDIRECT As can be seen by the three examples,

COSTS one can obtain different results for indi-

Assume Sample Grading Contractor is vidual projects based upon the method of

reviewing three methods of allocating overhead cost allocations. Notice that pro-

JOURNAL OF CONSTRUCTION ACCOUNTING AND TAXATION July/August 2002

INDIRECT COSTS OF CONTRACTS 7

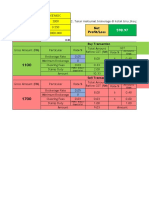

Exhibit 3

Sample Grading Contractor—Allocation Based on Three Methods

1. ALLOCATION BASED ON TOTAL DIRECT COSTS

Direct Costs % Indirect Costs Equip. Costs Total Costs

A $ 375,000 28% $ 47,015 $ 134,608 $ 556,623

B 150,000 11% 18,806 53,843 222,649

C 225,000 17% 28,209 80,765 333,974

D 425,000 32% 53,284 152,556 630,840

E 165,000 12% 20,687 59,228 244,914

$ 1,340,000 100% $ 168,000 $ 481,000 $ 1,989,000

2. ALLOCATION BASED ON DIRECT LABOR COSTS

Direct Costs Direct Labor % Indirect Costs Equip. Costs Total Costs

A $ 375,000 $ 95,000 28% $ 46,941 $ 134,397 $ 556,338

B 150,000 15,000 4% 7,412 21,221 178,632

C 225,000 70,000 21% 34,588 99,029 358,618

D 425,000 115,000 34% 56,824 162,691 644,515

E 165,000 45,000 13% 22,235 63,662 250,897

$ 1,340,000 $ 340,000 100% $168,000 $ 481,000 $ 1,989,000

For Sample Grading Contractor, the indirect other costs are roughly 49% of direct labor. In preparing an esti-

mate, Sample Contractor will add 49% of direct labor to the cost of the job to include an estimate of indirect

other costs to be incurred. Equipment costs will add another 140% of labor.

3. ALLOCATION BASED ON DIRECT LABOR COSTS AND EQUIPMENT HOURS

Indirect Equip. Equip. Total

Direct Costs Direct Labor % Costs Hours % Costs Costs

A $ 375,000 $ 95,000 28% $ 46,941 475 30% $ 142,797 $ 564,738

B 150,000 15,000 4% 7,412 90 6% 27,056 184,468

C 225,000 70,000 21% 34,588 275 17% 82,672 342,260

D 425,000 115,000 34% 56,824 650 41% 195,406 677,230

E 165,000 45,000 13% 22,235 110 7% 33,069 220,304

$ 1,340,000 $ 340,000 100% $ 168,000 1,600 100% $ 481,000 $1,989,000

ject B varies in cost from a low of $178,632 directly on used hours on the job with a sep-

to a high of $222,649, depending upon arate rate for idle time. This process often

overhead allocation methodology. That is results in an over or under utilization of the

a significant variance in assumed total equipment factor, with an attendant over or

costs. It illustrates the fact that indirect under charge to the various projects, a vari-

allocation methods can influence the deci- ance. As to this equipment variance, the

sion of what projects to pursue. cause of a large variance may mean obsolete

Many contractors use calculated rates for equipment rates, a significant change in vol-

each piece of equipment specifically identi- ume, or a significant increase in one of the

fied. The charges are then made based cost components such as insurance or gas. In

JOURNAL OF CONSTRUCTION ACCOUNTING AND TAXATION July/August 2002

8 INDIRECT COSTS OF CONTRACTS

Exhibit 4

Sample Grading Contractor—Benchmarking

According to the year 2001 CFMA Annual Survey of Highway Contractors, heavy and highway con-

tractors for the Southeast Region of the U.S. had the following:

Gross profit percentage earned on contracts 14.3%

Selling, general and administrative expense 9.2%

Income from operations (before taxes) 5.1%

Net income after income taxes 3.6%

any case, it is vital to the success of the jobs If indirect costs are omitted from the esti-

that the rates truly reflect actual costs. mated costs to complete, the percentage

Methods may vary, as long as they allow the of completion calculations will be inaccu-

contractor to estimate equipment costs rate. This could result in the contractor

within a range that is immaterial to the finan- reporting net income that is materially

cial statements. Through this process, con- misstated. Allocation to costs to complete

tractors can then develop their own accurate must be consistent with allocations to

internal equipment rates to be used when actual costs incurred.

estimating a project. By comparing historical costs over time,

The key to analyzing profitability for one can reasonably predict the amount of

a construction contractor is to examine overhead costs that must be recovered to

every contract as a profit/cost center. remain profitable, before anticipated

Only then can one begin to understand increases. A contractor should never use a

the performance of the company. By “rough estimate” of overhead applied to

allocating cost to the original estimate, labor or total cost. The actual overhead

and to the actual costs as they are costs by type, indirect, or general and

incurred, the contractor will receive a administrative should be known and

more accurate picture of performance adjusted periodically.

of the individual jobs. Furthermore, the If a contractor cannot recover overhead

adjustment to revenue for costs in costs and remain competitive, this often

excess of billings and billings in excess signals a problem of excess overhead.

of costs for the contracts in progress

will be more accurate. If this adjust-

ment is incorrect, the contractor’s rev- BENCHMARKING

enue will be incorrect, thus distorting It is also useful to benchmark a company

the gross profit for the individual jobs to determine how it is performing when

and the company as a whole. compared to others in the industry. There

is an annual survey of highway contrac-

tors’ financial data developed by the

COST TO COMPLETE Construction Financial Management

Preparing financial statements requires Association. Exhibit 4 presents information

the contractor to estimate the cost to com- from the year 2001 edition.

plete the jobs in progress. The cost to A highway contractor in the Southeast

complete the jobs in progress must also United States can make general compar-

include indirect costs. SOP 81–1 states: isons to determine if it is obtaining similar

results (caution, the above data is for all

In computing estimated gross profit

highway contractors, both large and

or providing for losses on contracts,

small). Sample Grading Contractor

estimates of cost to complete should

appears to have operations consistent with

reflect all of the types of costs

what the survey indicates as normal.

included in contract costs.

JOURNAL OF CONSTRUCTION ACCOUNTING AND TAXATION July/August 2002

INDIRECT COSTS OF CONTRACTS 9

CONCLUSION surety industries post September 11th,

An understanding of the relationship of and now post Enron.

indirect costs to the individual jobs of a As a company changes over time, so

construction contractor is very important. will its estimating practices. With the costs

Underestimating the costs when bidding a of contracting constantly increasing, it

job usually results in a loss. doesn’t take long for an overhead alloca-

Overestimating the same costs means that tion formula to become outdated.

quite probably the contractor will not be

Companies should develop and test their

able to obtain new contracts, due to the

competitiveness of today’s markets. The overhead allocations periodically in order

costs are never static as witness the to maintain accuracy in their estimating

increasing costs of both the insurance and process. ■

JOURNAL OF CONSTRUCTION ACCOUNTING AND TAXATION July/August 2002

You might also like

- Stop Order NoticeDocument2 pagesStop Order Noticeapi-37083620% (2)

- QBO Certification 1st PartDocument17 pagesQBO Certification 1st PartRa MenaceNo ratings yet

- Government Accounting NotesDocument24 pagesGovernment Accounting Noteszee abadilla100% (1)

- Gas Station Plaridel BypassDocument19 pagesGas Station Plaridel BypassEladio AbquinaNo ratings yet

- Motion To DismissDocument25 pagesMotion To Dismiss10News WTSPNo ratings yet

- The Management of Construction Company Overhead CostsDocument9 pagesThe Management of Construction Company Overhead CostsAlfred De Vera GabuatNo ratings yet

- Contract CostingDocument15 pagesContract CostingUjjwal BeriwalNo ratings yet

- Outline: Definition and InterpretationDocument31 pagesOutline: Definition and InterpretationHayelom Tadesse Gebre100% (1)

- B10900182S219Document5 pagesB10900182S219vincent rotichNo ratings yet

- A Comprehensive Literature Review On Construction Project Risk Analysis PDFDocument16 pagesA Comprehensive Literature Review On Construction Project Risk Analysis PDFAsif HameedNo ratings yet

- Resource and Cost SchedulingDocument21 pagesResource and Cost SchedulingUsama DhillonNo ratings yet

- 2015 - Poirier E.A. Et Al - Measuring The Impact of BIM On Labor Productivity in A Small Specialty Contracting Enterprise PDFDocument11 pages2015 - Poirier E.A. Et Al - Measuring The Impact of BIM On Labor Productivity in A Small Specialty Contracting Enterprise PDFKaueTKNo ratings yet

- Construction ContractDocument7 pagesConstruction Contracttesfu tadesseNo ratings yet

- Baseline Compliance Analysis: Dr. Dan Patterson, PMPDocument10 pagesBaseline Compliance Analysis: Dr. Dan Patterson, PMPCad NoviceNo ratings yet

- Construction Process ManagementDocument9 pagesConstruction Process ManagementAsrul AfiqNo ratings yet

- Guideline For Construction ProjectDocument106 pagesGuideline For Construction ProjectAuslawrenceNo ratings yet

- 1 Project Planning Vs Scheduling - 113002Document14 pages1 Project Planning Vs Scheduling - 113002Andy KishNo ratings yet

- Cost Control, Monitoring and AccountingDocument27 pagesCost Control, Monitoring and AccountingnandhuNo ratings yet

- Overhead Guidance PDFDocument9 pagesOverhead Guidance PDFanuarNo ratings yet

- Project PROCUREMENT ManagementDocument11 pagesProject PROCUREMENT Managementmadry6960% (1)

- Construction ContractsDocument25 pagesConstruction ContractsTrevor T ParazivaNo ratings yet

- Chapter 10 PDFDocument30 pagesChapter 10 PDFPandaNo ratings yet

- Audit Planning ProcessDocument7 pagesAudit Planning ProcessDelelegn AyalikeNo ratings yet

- Cost ManagementDocument38 pagesCost Management101183No ratings yet

- Extra Questions For Chapter 3 Cost Assignment: 3.1 Intermediate: Job Cost CalculationDocument72 pagesExtra Questions For Chapter 3 Cost Assignment: 3.1 Intermediate: Job Cost Calculationjessica_joaquinNo ratings yet

- Zimbabwe Institute of Management: Module: Project Planning ADocument94 pagesZimbabwe Institute of Management: Module: Project Planning ATatenda MarwodziNo ratings yet

- Financial Risks in Construction ProjectsDocument5 pagesFinancial Risks in Construction Projectsalaa jalladNo ratings yet

- A1 - Critical Review of The Causes of Cost Overrun in Construction Industries in Developing CountriesDocument10 pagesA1 - Critical Review of The Causes of Cost Overrun in Construction Industries in Developing CountriesTong Yi NieNo ratings yet

- Importance of Measurement of Labour Productivity in Construction by Pravin Minde & Prachi GhateDocument5 pagesImportance of Measurement of Labour Productivity in Construction by Pravin Minde & Prachi GhatePravin MindeNo ratings yet

- Pages From Cost Management For Engineers 01Document79 pagesPages From Cost Management For Engineers 01Lam NguyenNo ratings yet

- Conduct ProcurementDocument11 pagesConduct ProcurementRey Dominique VillarNo ratings yet

- Labour, Material and Euipment UtilisationDocument28 pagesLabour, Material and Euipment UtilisationnandhuNo ratings yet

- CH 2 Project CycleDocument16 pagesCH 2 Project CycleMebratu SimaNo ratings yet

- تحليل المخاطر بمشروع المنارة للاتصالاتDocument23 pagesتحليل المخاطر بمشروع المنارة للاتصالاتSuleiman BaruniNo ratings yet

- Construction Accounting and Financial ManagementDocument3 pagesConstruction Accounting and Financial ManagementSon Go HanNo ratings yet

- Overhead Costs AssessmentDocument7 pagesOverhead Costs AssessmentChristian Nicolaus MbiseNo ratings yet

- Construction Auditingby Ron RisnerDocument2 pagesConstruction Auditingby Ron RisnerdemirciferhatNo ratings yet

- Lecture 3 - Types of ProjectsDocument32 pagesLecture 3 - Types of ProjectsMarco Vincenti ZakhiaNo ratings yet

- Objectives of Cost Analysis ControlDocument19 pagesObjectives of Cost Analysis Controlprecious omokhaiyeNo ratings yet

- Estimating Project BudjetDocument20 pagesEstimating Project BudjetMIAN M NADEEMNo ratings yet

- Software Project Management Class NotesDocument42 pagesSoftware Project Management Class NotesRohit BhardwajNo ratings yet

- Final ProjectDocument126 pagesFinal ProjectMouaz HamedNo ratings yet

- Riks ManagementDocument4 pagesRiks ManagementAkhileshkumar PandeyNo ratings yet

- Delft Management of Engineering ProjectsDocument222 pagesDelft Management of Engineering ProjectsEirinaios ChatzillariNo ratings yet

- 7e Extra QDocument72 pages7e Extra QNur AimyNo ratings yet

- EPC Contract and Project Management How To Reach MilestonesDocument2 pagesEPC Contract and Project Management How To Reach MilestonespamlidNo ratings yet

- Construction Contracts DocuementsDocument48 pagesConstruction Contracts DocuementsChristian AntonioNo ratings yet

- Factors Affecting Construction Labour Productivity in Trinidad and TobagoDocument9 pagesFactors Affecting Construction Labour Productivity in Trinidad and TobagoNonkosi DlaminiNo ratings yet

- Forecasting Construction Duration in A ProjectDocument11 pagesForecasting Construction Duration in A Projectkian hongNo ratings yet

- Critical Factors Affecting Construction Labor Productivity in Egypt PDFDocument6 pagesCritical Factors Affecting Construction Labor Productivity in Egypt PDFFadlyAzhariMelchiorMarpaungNo ratings yet

- Change Orders in Construction - 2 PDFDocument151 pagesChange Orders in Construction - 2 PDFAhed NabilNo ratings yet

- Group 5 Construction Methods and OperationsDocument48 pagesGroup 5 Construction Methods and Operationsjolmarie llantoNo ratings yet

- SCHEDULING AND PLANING COTM IntroductionnDocument5 pagesSCHEDULING AND PLANING COTM Introductionnnahom antenehNo ratings yet

- Project Accouting and Financial Managment (Chapter 1 and 2)Document66 pagesProject Accouting and Financial Managment (Chapter 1 and 2)Jeylan Umer100% (1)

- Project Management Power Point Presentation PPT PDF NotesDocument46 pagesProject Management Power Point Presentation PPT PDF NotesDevesh ChauhanNo ratings yet

- S08 - Cash Flow StatementDocument55 pagesS08 - Cash Flow StatementYassin DyabNo ratings yet

- Riskanalysissimplified PDFDocument12 pagesRiskanalysissimplified PDFmirakulNo ratings yet

- Business Case TemplateDocument10 pagesBusiness Case TemplateDavid MNo ratings yet

- Implementation of Lean Construction Techniques For Minimizing The Risks Effect On Construction ProjectDocument49 pagesImplementation of Lean Construction Techniques For Minimizing The Risks Effect On Construction ProjectJohn PaulNo ratings yet

- LR5 Cap 9 Cost Estimating - Scott Amos - Skills Knowledge of Cost Engineering - AACEI - 2004Document36 pagesLR5 Cap 9 Cost Estimating - Scott Amos - Skills Knowledge of Cost Engineering - AACEI - 2004apzambonNo ratings yet

- PM Lec 1&2-IntroductionDocument30 pagesPM Lec 1&2-IntroductionEyad_m94No ratings yet

- W2 - Project Life Cycle Models & Project SelectionDocument58 pagesW2 - Project Life Cycle Models & Project SelectionThảo My TrươngNo ratings yet

- Construction Industry: Taxation Refers To The Act of A Taxing Authority Actually LevyingDocument2 pagesConstruction Industry: Taxation Refers To The Act of A Taxing Authority Actually LevyingArDaveAnandNo ratings yet

- MarkupDocument6 pagesMarkupBTconcordNo ratings yet

- Taxpayers' Tax Compliance Behavior - Business Profit Taxpayers' of Addis Ababa City AdministrationDocument126 pagesTaxpayers' Tax Compliance Behavior - Business Profit Taxpayers' of Addis Ababa City AdministrationGELETAW TSEGAW80% (5)

- CGST Act Amended With Notification04.03.2021Document450 pagesCGST Act Amended With Notification04.03.2021Tax NatureNo ratings yet

- Statement of Financial Position: Samba Bank Annual Report 2021Document2 pagesStatement of Financial Position: Samba Bank Annual Report 2021Ahmad KhalidNo ratings yet

- P4014 Payslip Oct2019Document1 pageP4014 Payslip Oct2019Swapnil AmbhoreNo ratings yet

- CCNG 2015 Michael PolkinghorneDocument19 pagesCCNG 2015 Michael PolkinghorneLORD. JAPHET NDONGONo ratings yet

- Income Tax Calculation Form 2019-20Document2 pagesIncome Tax Calculation Form 2019-20Ishwar MittalNo ratings yet

- ISupplier Create Invoice FunctionalityDocument35 pagesISupplier Create Invoice FunctionalitynaveenravellaNo ratings yet

- 3.9 International MarketsDocument7 pages3.9 International MarketsVũ Như NgọcNo ratings yet

- Tutorial 1Document4 pagesTutorial 1easoncho29No ratings yet

- Capital GainsDocument48 pagesCapital GainsToofan KhanNo ratings yet

- ComfortDelGro - Audited Financial Statement FY31.12.2022Document31 pagesComfortDelGro - Audited Financial Statement FY31.12.2022Genevieve TayNo ratings yet

- Encounters Following D-Day Invasion Turn Into Friendship Decades LaterDocument12 pagesEncounters Following D-Day Invasion Turn Into Friendship Decades LaterKristina HicksNo ratings yet

- BIR Form 1902Document1 pageBIR Form 1902Gizelle Taguas33% (3)

- Vertical Analysis of URC Income StatementDocument1 pageVertical Analysis of URC Income StatementMalou De MesaNo ratings yet

- Formula For Success: Adding High-Quality Pre-K To State School Funding FormulasDocument20 pagesFormula For Success: Adding High-Quality Pre-K To State School Funding FormulasJonathan AllenNo ratings yet

- 5 Philippine Phospate Fertilizer Corp Vs CIRDocument21 pages5 Philippine Phospate Fertilizer Corp Vs CIRAnjNo ratings yet

- Klabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document66 pagesKlabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Klabin_RINo ratings yet

- DHL Delivery ReceiptDocument2 pagesDHL Delivery ReceiptsignulitraNo ratings yet

- Calculator SahamDocument3 pagesCalculator SahamRizuan MuhammadNo ratings yet

- Unit 4 Profits and Gainsfrom Bus or ProfessionDocument11 pagesUnit 4 Profits and Gainsfrom Bus or ProfessionSahana SadanandNo ratings yet

- TL105 2022 Slides 4 Per PGDocument60 pagesTL105 2022 Slides 4 Per PGBryan SinqaduNo ratings yet

- Environment CodeDocument41 pagesEnvironment CodeWhere Did Macky GallegoNo ratings yet

- Deed of Partition-Deeds-Partition-953Document3 pagesDeed of Partition-Deeds-Partition-953Robin singhNo ratings yet

- PO - Simple SolutionsDocument3 pagesPO - Simple SolutionsAditya SinghNo ratings yet

- UNIT-5 Incidence and Shifting of Taxes: FirstDocument44 pagesUNIT-5 Incidence and Shifting of Taxes: FirstmelaNo ratings yet