Professional Documents

Culture Documents

GST Mismatch Report (GSTR 1 - GSTR 3b)

Uploaded by

NIKUNJ GUPTA0 ratings0% found this document useful (0 votes)

42 views2 pagesgst

Original Title

Gst Mismatch Report (Gstr 1 -Gstr 3b)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgst

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

42 views2 pagesGST Mismatch Report (GSTR 1 - GSTR 3b)

Uploaded by

NIKUNJ GUPTAgst

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

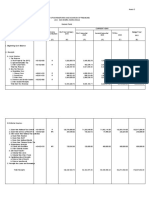

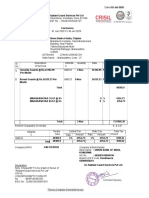

GST REPORT OF RABIN PATRA GSTIN:19AKLPP5937A1ZX FOR FY 2018-19

REFLECTS DIFFERENCE IN GSTR 3B AND GSTR 1 DATA (NEEDS CLARIFICATION)

TAX DIFFERENCE DUE TO GSTR1 MISMATCH WITH GSTR 3B DATA

MONTH LEVEL FIRST QUARTER FOR THE FINANCIAL YEAR 2018-19

SUMMARY

Return Periods Apr 2018 May 2018 Jun 2018

Taxable Value CGST SGST Taxable Value CGST SGST Taxable Value CGST SGST

(A) Outward Supplies

as per GSTR-3B 36,73,488.88 3,22,203.57 3,22,203.57 9,69,166.34 85,483.90 85,483.90 13,63,836.64 1,21,978.69 1,21,978.69

(B) Outward Supplies

as per GSTR-1 36,73,488.88 3,22,203.59 3,22,203.59 9,69,166.34 85,483.90 85,483.90 13,91,668.23 1,25,318.81 1,25,318.81

(a) Outward

Supplies for Current

month 36,73,488.88 3,22,203.59 3,22,203.59 9,69,166.34 85,483.90 85,483.90 13,91,668.23 1,25,318.81 1,25,318.81

(b) Additions

related to previous

months 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(c) Amendment

related to the previous

months (Diff Value)

((i)-(ii)) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(i) Amendment Value 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(ii) Orginal Value 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(C) Difference = (A)

minus (B) 0 -0.02 -0.02 0 0.00 0.00 -27,831.59 -1,669.92 -1,669.92

(D) % Tax difference

w.r.t (C/A) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 -1.40 -1.40

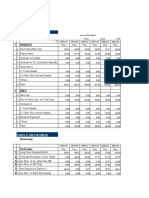

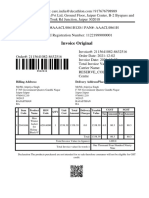

MONTH LEVEL SECOND QUARTER FOR THE FINANCIAL YEAR 2018-19

SUMMARY

Return Periods Jul 2018 Aug 2018 Sep 2018

Taxable Value CGST SGST Taxable Value CGST SGST Taxable Value CGST SGST

(A) Outward Supplies

as per GSTR-3B 10,02,186.74 82,749.06 82,749.06 22,73,936.58 1,92,004.55 1,92,004.55 6,05,784.18 54,532.29 54,532.29

(B) Outward Supplies

as per GSTR-1 10,02,186.74 82,749.08 82,749.08 22,73,936.58 1,92,004.56 1,92,004.56 13,23,511.40 1,28,840.68 1,28,840.68

(a) Outward

Supplies for Current

month 10,02,186.74 82,749.08 82,749.08 22,73,936.58 1,92,004.56 1,92,004.56 13,23,511.40 1,28,840.68 1,28,840.68

(b) Additions

related to previous

months 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(c) Amendment

related to the previous

months (Diff Value)

((i)-(ii)) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(i) Amendment Value 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(ii) Orginal Value 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(C) Difference = (A)

minus (B) 0 -0.02 -0.02 0 -0.01 -0.01 -717727.22 -74,308.39 -74,308.39

(D) % Tax difference

w.r.t (C/A) 0.00 0.00 0.00 0.00 0.00 0.00 -118.50 -136.30 -136.30

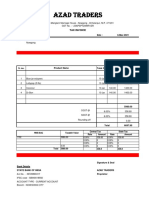

MONTH LEVEL THIRD QUARTER FOR THE FINANCIAL YEAR 2018-19

SUMMARY

Return Periods Oct-18 Nov 2018 Dec 2018

Taxable Value CGST SGST Taxable Value CGST SGST Taxable Value CGST SGST

(A) Outward Supplies

as per GSTR-3B 15,39,965.76 1,38,596.92 1,38,596.92 37,00,107.94 3,04,307.88 3,04,307.88 15,09,100.20 1,16,175.55 1,16,175.55

(B) Outward Supplies

as per GSTR-1 15,39,965.76 1,38,596.92 1,38,596.92 37,00,107.94 3,04,307.88 3,04,307.88 15,09,100.20 1,16,175.55 1,16,175.55

(a) Outward

Supplies for Current

month 6,07,455.02 54,670.95 54,670.95 37,00,107.94 3,04,307.88 3,04,307.88 15,09,100.20 1,16,175.55 1,16,175.55

(b) Additions

related to previous

months 9,32,510.74 83,925.97 83,925.97 0.00 0.00 0.00 0.00 0.00 0.00

(c) Amendment

related to the previous

months (Diff Value)

((i)-(ii)) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(i) Amendment Value 7,13,172.05 64,185.49 64,185.49 0.00 0.00 0.00 0.00 0.00 0.00

(ii) Orginal Value 7,13,172.05 64,185.49 64,185.49 0.00 0.00 0.00 0.00 0.00 0.00

(C) Difference = (A)

minus (B) 0 0.00 0.00 0 0.00 0.00 0 0.00 0.00

(D) % Tax difference

w.r.t (C/A) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

MONTH LEVEL FOURTH QUARTER FOR THE FINANCIAL YEAR 2018-19

SUMMARY

Return Periods Jan 2019 Feb 2019 Mar 2019

Taxable Value CGST SGST Taxable Value CGST SGST Taxable Value CGST SGST

(A) Outward Supplies

as per GSTR-3B 8,73,589.68 52,415.38 52,415.38 9,72,581.00 87,532.29 87,532.29 14,71,110.25 1,02,150.64 1,02,150.64

(B) Outward Supplies

as per GSTR-1 8,73,589.68 52,415.38 52,415.38 9,72,581.00 87,532.29 87,532.29 14,71,110.22 1,02,150.63 1,02,150.63

(a) Outward

Supplies for Current

month 8,73,589.68 52,415.38 52,415.38 9,72,581.00 87,532.29 87,532.29 14,49,682.22 1,00,222.11 1,00,222.11

(b) Additions

related to previous

months 0.00 0.00 0.00 0.00 0.00 0.00 21,428.00 1,928.52 1,928.52

(c) Amendment

related to the previous

months (Diff Value)

((i)-(ii)) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

(i) Amendment Value 0.00 0.00 0.00 0.00 0.00 0.00 2,48,257.96 14,895.48 14,895.48

(ii) Orginal Value 0.00 0.00 0.00 0.00 0.00 0.00 2,48,257.96 14,895.48 14,895.48

(C) Difference = (A)

minus (B) 0 0.00 0.00 0 0.00 0.00 0.03 0.01 0.01

(D) % Tax difference

w.r.t (C/A) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

You might also like

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- GSTR9 33AAACA7962L1ZH 032022-FinalDocument8 pagesGSTR9 33AAACA7962L1ZH 032022-FinalVASUMATHY SURESHNo ratings yet

- Chandra Gira 071-072 ProjectedDocument8 pagesChandra Gira 071-072 ProjectedBright Tone Music InstituteNo ratings yet

- GSTR9 18acvpa7546a1zk 032022Document8 pagesGSTR9 18acvpa7546a1zk 032022SUBHASH MOURNo ratings yet

- Subidha Chhatrabas 070-071Document5 pagesSubidha Chhatrabas 070-071Junu MainaliNo ratings yet

- Budget Expenditures and Sources of FinancingDocument5 pagesBudget Expenditures and Sources of FinancingkQy267BdTKNo ratings yet

- Account Report MKI March P 2022 06287869e514ab8 81622922Document19 pagesAccount Report MKI March P 2022 06287869e514ab8 81622922Animesh KumarNo ratings yet

- GSTR9 09bwbpk7755a1zk 032021Document8 pagesGSTR9 09bwbpk7755a1zk 032021Ankit JainNo ratings yet

- GSTR9Document8 pagesGSTR9legendry007No ratings yet

- Ga2 - Far460 - Equity - Note On PpeDocument2 pagesGa2 - Far460 - Equity - Note On PpeAmniNo ratings yet

- RAJGHARANADocument20 pagesRAJGHARANAPriyanshu tripathiNo ratings yet

- Ashirbad Production HomeDocument4 pagesAshirbad Production Homeanon_913070355No ratings yet

- 20092010form16 004355Document3 pages20092010form16 004355Hemen BrahmaNo ratings yet

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- Bio Herbal Bank Statement 068-69 N 69-70 ProjectedDocument7 pagesBio Herbal Bank Statement 068-69 N 69-70 Projectedanon_913070355No ratings yet

- Joyti Audited 068-069 Anuall (Vat)Document20 pagesJoyti Audited 068-069 Anuall (Vat)anon_913070355No ratings yet

- GSTR9 29aaqfm8617b1zz 032022Document8 pagesGSTR9 29aaqfm8617b1zz 032022helloNo ratings yet

- GSTR9 22aabcn2864p1z7 032018Document8 pagesGSTR9 22aabcn2864p1z7 032018Sumit K JhaNo ratings yet

- Appendix 1 Project Report Format 1: Quarterly Implementation Progress Report # 32 PSRSPDocument47 pagesAppendix 1 Project Report Format 1: Quarterly Implementation Progress Report # 32 PSRSPRani Arun ShakarNo ratings yet

- GSTR9 19anypg3791m1zy 032022 PDFDocument8 pagesGSTR9 19anypg3791m1zy 032022 PDFManprit MahalNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- SSBPloanDocument6 pagesSSBPloanSyahmi Samsudin100% (1)

- Solutions Ch07Document15 pagesSolutions Ch07KyleNo ratings yet

- AUD315 Q2 quiz accounting problems and solutionsDocument6 pagesAUD315 Q2 quiz accounting problems and solutionsLorraineMartinNo ratings yet

- Activity Data DashboardDocument9 pagesActivity Data DashboardAngel Yohaiña Ramos SantiagoNo ratings yet

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- ACCT 328 - Assignment 2Document7 pagesACCT 328 - Assignment 2MalekNo ratings yet

- Budget Preparation 2022 TreasDocument11 pagesBudget Preparation 2022 TreasMary Jane Sande GelbolingoNo ratings yet

- 547 Abr 0000000083Document6 pages547 Abr 0000000083BERNACRIS REYESNo ratings yet

- A MukherjeeDocument3 pagesA MukherjeeBrahmankhanda Basapara HIGH SCHOOLNo ratings yet

- GSTR9 09abepk8302l1zh 032018Document8 pagesGSTR9 09abepk8302l1zh 032018Capraful PrabhakaranNo ratings yet

- Revised Financial Results For December 31, 2016 (Result)Document4 pagesRevised Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- GSTR9 08aaafu3205h1zh 032022Document8 pagesGSTR9 08aaafu3205h1zh 032022Deepanshu AgarwalNo ratings yet

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- CH 28: Receivables Management & Factoring Chapter 28: Accounts Receivable Management and FactoringDocument5 pagesCH 28: Receivables Management & Factoring Chapter 28: Accounts Receivable Management and FactoringMukul KadyanNo ratings yet

- Army Institute of Management, Kolkata Fee Structure MBA - 24 (2020 - 2022)Document1 pageArmy Institute of Management, Kolkata Fee Structure MBA - 24 (2020 - 2022)karan mehtaNo ratings yet

- Partnership Accounts-1Document27 pagesPartnership Accounts-1g.indu3009No ratings yet

- Group Assignment B - Amni - Merc - LioniDocument5 pagesGroup Assignment B - Amni - Merc - LioniAmniNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Chandragiri 071-072 ProvsionalDocument9 pagesChandragiri 071-072 ProvsionalBright Tone Music InstituteNo ratings yet

- GSTR9 09aaact9363l1zq 032023Document8 pagesGSTR9 09aaact9363l1zq 032023sachinkumar.rkcjNo ratings yet

- SDP Stone Term Laon MarbleDocument72 pagesSDP Stone Term Laon MarbleSURANA1973No ratings yet

- General-Annual-Fund-Budget-2022Document7 pagesGeneral-Annual-Fund-Budget-2022Richard MendezNo ratings yet

- Figure in Lakh Prepared by - Ca. Shivam GuptaDocument11 pagesFigure in Lakh Prepared by - Ca. Shivam GuptaAayush LohanaNo ratings yet

- Proposed New Appropriations, by Object of Expenditures Secretary To The SanggunianDocument9 pagesProposed New Appropriations, by Object of Expenditures Secretary To The SanggunianVIRGILIO OCOY IIINo ratings yet

- IPC115 ESACK+Nim WestDocument47 pagesIPC115 ESACK+Nim WestArif AbedinNo ratings yet

- Antipolo Rizal Budget 2022Document59 pagesAntipolo Rizal Budget 2022Kakam PwetNo ratings yet

- Error-and-Corrections-Solutionpa-checkDocument5 pagesError-and-Corrections-Solutionpa-checkmartinfaith958No ratings yet

- Sadguru Construction Cma 16-17 To 2020-21Document8 pagesSadguru Construction Cma 16-17 To 2020-21vdtaudit 1No ratings yet

- Fund Utilization Report - 4th Quarter of 2021Document4 pagesFund Utilization Report - 4th Quarter of 2021Daezelle PerniaNo ratings yet

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- August 11, 2023: 153/LG/SE/AUG/2023/GBSLDocument8 pagesAugust 11, 2023: 153/LG/SE/AUG/2023/GBSLmd zafarNo ratings yet

- Provisions, Contingencies and Other Liabilities ProblemsDocument7 pagesProvisions, Contingencies and Other Liabilities ProblemsGiander100% (1)

- Project Payback & IRR AnalysisDocument5 pagesProject Payback & IRR AnalysisYashwini KomagenNo ratings yet

- Form 16 Salary DetailsDocument2 pagesForm 16 Salary DetailsSanjay DuaNo ratings yet

- V!s!t!l!ty Statement of Financial Performance Table 1Document15 pagesV!s!t!l!ty Statement of Financial Performance Table 1Carl Toks Bien InocetoNo ratings yet

- Afar SolutionDocument8 pagesAfar SolutionAsnifah AlinorNo ratings yet

- Jawaban Soal Quiz No 2 Dan 3Document4 pagesJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNo ratings yet

- Annual Budget For Cy-2024 - FinalDocument26 pagesAnnual Budget For Cy-2024 - FinalJanelkris PlazaNo ratings yet

- NPV Lesson 2Document5 pagesNPV Lesson 2Barack MikeNo ratings yet

- 98888Document2 pages98888Aryan jaiswalNo ratings yet

- Jain Medical IndranaDocument1 pageJain Medical Indranaratnesh soniNo ratings yet

- Tax Invoice: Company's State Code - 24 - GujaratDocument4 pagesTax Invoice: Company's State Code - 24 - GujaratVipul RathodNo ratings yet

- Invoice for Dell Monitor Shipped to ArgentinaDocument1 pageInvoice for Dell Monitor Shipped to ArgentinaBrian Michel RomanNo ratings yet

- GSTInvoiceFormat No. 21Document1 pageGSTInvoiceFormat No. 21Asghar HussainiNo ratings yet

- GST IntroductionDocument103 pagesGST IntroductionAnonymous MhCdtwxQINo ratings yet

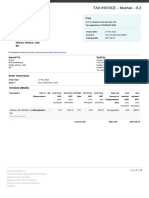

- TAX INVOICE - Mushak - 6.3: Sohail 63/2 Chawkbazar DHAKA, DHAKA, 1200 BDDocument2 pagesTAX INVOICE - Mushak - 6.3: Sohail 63/2 Chawkbazar DHAKA, DHAKA, 1200 BDAnowarul HaqueNo ratings yet

- Jan Bill PDFDocument1 pageJan Bill PDFAnkur KushwahaNo ratings yet

- Bhavnagar E-Way BillDocument2 pagesBhavnagar E-Way BillChiranjeevi ChipurupalliNo ratings yet

- Goods and Services Tax: By:-Ritvic PulwaniDocument10 pagesGoods and Services Tax: By:-Ritvic PulwaniNikhil VermaNo ratings yet

- GST INVOICE LISTDocument10 pagesGST INVOICE LISTACCOUNTS AMBIKAPURNo ratings yet

- Question of Payment of TaxDocument7 pagesQuestion of Payment of Tax7013 Arpit DubeyNo ratings yet

- Costco Invoice PDFDocument2 pagesCostco Invoice PDFvertoxmediaNo ratings yet

- Case Analysis 2Document2 pagesCase Analysis 2Gie MaeNo ratings yet

- Tax invoicesDocument192 pagesTax invoicesSangita JadhavNo ratings yet

- Cr. Note No. RJSSC 14322Document1 pageCr. Note No. RJSSC 14322amarjot chhabraNo ratings yet

- GST invoice for beverage productsDocument2 pagesGST invoice for beverage productsCuber Anay GuptaNo ratings yet

- JUN20UBIREGD1437 InvoiceDocument1 pageJUN20UBIREGD1437 InvoiceS V ENTERPRISESNo ratings yet

- Khan To Azlaan - 67 EwayDocument1 pageKhan To Azlaan - 67 Ewaymohammedashiks786No ratings yet

- Tax Invoice: DR Khushboo Rakesh MishraDocument1 pageTax Invoice: DR Khushboo Rakesh MishraJeevan jyoti vnsNo ratings yet

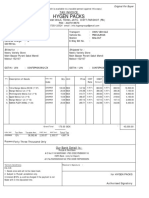

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDr Zahida Dr ZahidaNo ratings yet

- Book hotel room invoiceDocument1 pageBook hotel room invoiceAnkit SinghNo ratings yet

- Canada - Prepare Tax ReportDocument11 pagesCanada - Prepare Tax ReportMukesh SharmaNo ratings yet

- Updated List of LocationsDocument38 pagesUpdated List of LocationsSumanNo ratings yet

- InvoiceDocument1 pageInvoiceatipriya choudharyNo ratings yet

- InvoiceDocument1 pageInvoiceBrian Michel RomanNo ratings yet

- Guideline in The Transfer of Titles of Real PropertyDocument4 pagesGuideline in The Transfer of Titles of Real PropertyLeolaida AragonNo ratings yet

- Excitel Broadband BillDocument1 pageExcitel Broadband Billpritemp.23No ratings yet

- Invoice 26Document2 pagesInvoice 26asim khanNo ratings yet

- ManojDocument1 pageManojAjit pratap singh BhadauriyaNo ratings yet