Professional Documents

Culture Documents

BSP 530 Series of 2006

BSP 530 Series of 2006

Uploaded by

Jesse Myl MarciaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BSP 530 Series of 2006

BSP 530 Series of 2006

Uploaded by

Jesse Myl MarciaCopyright:

Available Formats

Date Issued: 05.19.

2006

Number: 0530

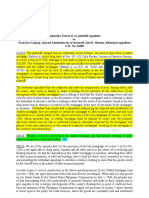

CIRCULAR NO. 530*

Series of 2006

The Monetary Board, in its Resolution No. 306 dated February 28, 2002, approved the following amendments to

Section X378 of the Manual of Regulations for Banks pursuant to Sections 25, 28 and 31 of Republic Act No. 8791.

"SEC. X378. Limits on Investment in the Equities of Financial Allied Undertakings. The equity investment of a

bank in a single financial allied undertaking shall be within the following ratios in relation to the total subscribed capital

stock and to the total voting stock of the allied undertaking:

ACTIVITIES INVESTOR

UB KB TB RB COOP

Publicly-listed Not listed Publicly-listed Not listed

Allied enterprises

Financial Allied Undertakings

Universal Banks 100% 49% 100% 49% 49% 49% 49%

Commercial Banks 100% 49% 100% 49% 49% 49% 49%

Thrift Banks 100% 100% 49% 49% 49%

Rural Banks 100% 100% 49% 49% 100%

Coop Banks NA NA NA NA 30%

Insurance companies 100% NA NA NA NA

VCCs 60% 60% 60% 49% 49%

Others 100% 49% 40% 40% 40%

To promote competitive conditions, the Monetary Board may further limit the equity investments in quasi-banks of

universal and commercial banks to forty percent (40%).

A publicly listed UB or KB may own up to one hundred percent (100%) of the voting stock of only one other UB or

KB. Otherwise, it shall be limited to a minorty holding.

The existing investment of a bank in another bank under R.A. No. 7721 shall be governed by Sec. X121 insofar as it is

consistent with Republic Act No. 8791.

All Circulars previously issued which are inconsistent herewith are hereby superceded.

This Circular shall take effect immediately.

FOR THE MONETARY BOARD

AMANDO M. TETANGCO, JR.

Governor

*corrected copy

You might also like

- Discover Statement 20150825 5843Document6 pagesDiscover Statement 20150825 5843teudyNo ratings yet

- E StatementDocument4 pagesE StatementJonathan Seagull LivingstonNo ratings yet

- Loan Acknowledgement: (Debtor) (Creditor)Document4 pagesLoan Acknowledgement: (Debtor) (Creditor)Ma Arnee LopezNo ratings yet

- Fim 3B November Examination 2013Document13 pagesFim 3B November Examination 2013Dolly VongweNo ratings yet

- SFM 230217Document82 pagesSFM 230217María Victoria AlbanesiNo ratings yet

- 2016 Legal Framework of BankingDocument153 pages2016 Legal Framework of BankingLynn PalisNo ratings yet

- All Document Reader 1711226255108Document22 pagesAll Document Reader 1711226255108Md Rifat HassanNo ratings yet

- Capital Adequacy Norms Capital Adequacy NormsDocument37 pagesCapital Adequacy Norms Capital Adequacy Normsarpitasharma_301No ratings yet

- 07a Hedge Funds and Performance EvaluationDocument66 pages07a Hedge Funds and Performance EvaluationdesbiauxNo ratings yet

- Bank Swift CodeDocument6 pagesBank Swift CodeYew HongNo ratings yet

- Max Diversified Equity FundDocument1 pageMax Diversified Equity FundNimish PavanNo ratings yet

- IKE - What Is It?Document17 pagesIKE - What Is It?Tomasz SzerzadNo ratings yet

- 2.capital Structure QB 25-40Document12 pages2.capital Structure QB 25-40Towhidul IslamNo ratings yet

- MS TS24 06 2015 - XS1255042993 - Reoffer94 - 10Y USD STEP-UP COUPON NOTE - Morgan Stanley - PDF 6Document6 pagesMS TS24 06 2015 - XS1255042993 - Reoffer94 - 10Y USD STEP-UP COUPON NOTE - Morgan Stanley - PDF 6crescendo.mskNo ratings yet

- TBAC 2 Month Bill DiscussionDocument19 pagesTBAC 2 Month Bill DiscussionZerohedgeNo ratings yet

- REFI - CMBS 101 - Trepp's Essential Guide To Commercial Mortgage-Backed SecuritiesDocument7 pagesREFI - CMBS 101 - Trepp's Essential Guide To Commercial Mortgage-Backed SecuritiespierrefrancNo ratings yet

- Agricultural Finance and Agricultural Cooperative Financial System in KoreaDocument46 pagesAgricultural Finance and Agricultural Cooperative Financial System in KoreaBalasubramanian RudrasamyNo ratings yet

- Research On UB, TB and RBDocument8 pagesResearch On UB, TB and RBdignaNo ratings yet

- Summary of Passive Income and Capital Gains Taxes - MaupoDocument4 pagesSummary of Passive Income and Capital Gains Taxes - MaupoMae MaupoNo ratings yet

- Microfinance in Russia - Group Pres - 20181202Document27 pagesMicrofinance in Russia - Group Pres - 20181202SteveDelucchiNo ratings yet

- Calculating The Liquidity Buffer Requirement v0.3Document8 pagesCalculating The Liquidity Buffer Requirement v0.3mbhat2011No ratings yet

- Monetry Policy Highlights 2079-80Document15 pagesMonetry Policy Highlights 2079-80ramita sahNo ratings yet

- Paper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementDocument30 pagesPaper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementNirupa ChoppaNo ratings yet

- Pest AnalysisDocument18 pagesPest Analysisrayjay99660% (1)

- Survey of Bank Charges 2021 Q1-V3Document27 pagesSurvey of Bank Charges 2021 Q1-V3Fuaad DodooNo ratings yet

- A Company Has An Existing Capital StructureDocument5 pagesA Company Has An Existing Capital StructureMesajalNo ratings yet

- Sample Financial Plan Valuecurve Financial SolutionsDocument19 pagesSample Financial Plan Valuecurve Financial Solutionswasana sandamali 2No ratings yet

- Oligopoly: Measuring Market ConcentrationDocument10 pagesOligopoly: Measuring Market ConcentrationYash KalaNo ratings yet

- Statistik SLIK OJK - November 2022Document2 pagesStatistik SLIK OJK - November 2022Puteri PaulinaaNo ratings yet

- PreviewDocument6 pagesPreviewiebikereNo ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- FR MTP Nov'22Document27 pagesFR MTP Nov'22Kushagra SoniNo ratings yet

- Table 4: Claims On Banks Incorporated in India and Foreign Bank Branches in IndiaDocument1 pageTable 4: Claims On Banks Incorporated in India and Foreign Bank Branches in IndiaJagmeet SinghNo ratings yet

- Financial Management: Strategic Management and Leadership (7DI)Document8 pagesFinancial Management: Strategic Management and Leadership (7DI)Jai BawaNo ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- Ca Final SFM List of Important Qa For May 2022Document110 pagesCa Final SFM List of Important Qa For May 2022PapuNo ratings yet

- Monthly Factsheet Working All Funds August21Document33 pagesMonthly Factsheet Working All Funds August21Sirish N RaoNo ratings yet

- Ra 8791 - General Banking Law of 2000Document18 pagesRa 8791 - General Banking Law of 2000abc xyzNo ratings yet

- Max High Growth FundDocument1 pageMax High Growth Funddaskaran3141No ratings yet

- Highlights of Monitary Policy 2020Document15 pagesHighlights of Monitary Policy 2020Raushan KumarNo ratings yet

- Case Study: Security Analysis Abc Bank LTDDocument3 pagesCase Study: Security Analysis Abc Bank LTDSiddharajsinh GohilNo ratings yet

- Botm Tutorial 2Document2 pagesBotm Tutorial 2Zhiyu KamNo ratings yet

- HOUSE Series A Due 2020 Series B Due 2022 and Series C Due 2025 Prospectus 25 Jun 2015Document146 pagesHOUSE Series A Due 2020 Series B Due 2022 and Series C Due 2025 Prospectus 25 Jun 2015jake.m.reynaldo.09No ratings yet

- Financial Intermediation and Monetary Policy: Tobias Adrian and Hyun Song ShinDocument32 pagesFinancial Intermediation and Monetary Policy: Tobias Adrian and Hyun Song Shinapi-26091012No ratings yet

- SFM Series 2 QuesDocument6 pagesSFM Series 2 Queskomalchandwani.dnlNo ratings yet

- UB V KBDocument3 pagesUB V KBJo-ana DesuyoNo ratings yet

- Notes - General Banking LawDocument4 pagesNotes - General Banking LawJingle BellsNo ratings yet

- Mutual Funds DisclosureDocument1 pageMutual Funds DisclosureSateesh ChowturuNo ratings yet

- Bank AccountingDocument11 pagesBank AccountingAlly MasilangNo ratings yet

- ARN-EUIN-RenewalFeesstructureDocument1 pageARN-EUIN-RenewalFeesstructureShubh Raj BhagatNo ratings yet

- Additional Questions - Risk and UncetanityDocument4 pagesAdditional Questions - Risk and UncetanityChampathi TennakoonNo ratings yet

- Monthly Business Target-Apr24 For Wealth ExecutivesDocument1 pageMonthly Business Target-Apr24 For Wealth Executivesragner.lothbrokarcNo ratings yet

- Commission Structure - May 2019Document16 pagesCommission Structure - May 2019Sabuj MollaNo ratings yet

- Easter ChickDocument3 pagesEaster Chickmarythorne17No ratings yet

- SfsryhtjfhthrDocument74 pagesSfsryhtjfhthrchloe angelinaNo ratings yet

- Syndicate FinalDocument275 pagesSyndicate Finalnikhar022No ratings yet

- Industry Introduction: What Is Banking?Document24 pagesIndustry Introduction: What Is Banking?deeksha singhNo ratings yet

- TDS Rates For AY 10-11 PDFDocument1 pageTDS Rates For AY 10-11 PDFjiten1986No ratings yet

- Nigerian AMCON UpdateDocument7 pagesNigerian AMCON UpdateOluwatosin AdesinaNo ratings yet

- Cost of Doing BusinessDocument24 pagesCost of Doing BusinessjessinalamtongaNo ratings yet

- WPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveDocument29 pagesWPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveFahim Khan0% (1)

- African Union Public Administration Cabinet & State of Somalia Public Administration Cabinet: Volume IiFrom EverandAfrican Union Public Administration Cabinet & State of Somalia Public Administration Cabinet: Volume IiNo ratings yet

- Culture As History by Nick JoaquinDocument7 pagesCulture As History by Nick JoaquinJesse Myl MarciaNo ratings yet

- KMP v. TrajanoDocument8 pagesKMP v. TrajanoJesse Myl MarciaNo ratings yet

- 17 - Municipality of Victorias v. CADocument3 pages17 - Municipality of Victorias v. CAJesse Myl MarciaNo ratings yet

- Sample Affidavit of Loss of DriverDocument2 pagesSample Affidavit of Loss of DriverJesse Myl MarciaNo ratings yet

- 54 - Upjohn Company v. USDocument2 pages54 - Upjohn Company v. USJesse Myl MarciaNo ratings yet

- Culture of The Philippines EssayDocument3 pagesCulture of The Philippines EssayJesse Myl Marcia100% (1)

- 3 - Sermonia Vs CADocument2 pages3 - Sermonia Vs CAJesse Myl MarciaNo ratings yet

- Tabas CaseDocument6 pagesTabas CaseJesse Myl MarciaNo ratings yet

- ReinstatementDocument4 pagesReinstatementJesse Myl MarciaNo ratings yet

- FRANCISCO V NLRCDocument8 pagesFRANCISCO V NLRCJesse Myl MarciaNo ratings yet

- Salvacion v. Central BankDocument14 pagesSalvacion v. Central BankJesse Myl MarciaNo ratings yet

- Credits Week 9 Full TextDocument54 pagesCredits Week 9 Full TextJesse Myl MarciaNo ratings yet

- Intellectual Property Fridays, 6pm To 9pm: Assignment For August, 2, 2019Document1 pageIntellectual Property Fridays, 6pm To 9pm: Assignment For August, 2, 2019Jesse Myl MarciaNo ratings yet

- Week 10Document55 pagesWeek 10Jesse Myl MarciaNo ratings yet

- Philippine Global Communication v. de VeraDocument19 pagesPhilippine Global Communication v. de VeraJesse Myl MarciaNo ratings yet

- August 6 - IplDocument14 pagesAugust 6 - IplJesse Myl MarciaNo ratings yet

- Week 6 DigestsDocument11 pagesWeek 6 DigestsJesse Myl MarciaNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument23 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJesse Myl MarciaNo ratings yet

- Micro Finance-Lessons From International Experience: Lecture - 19811Document102 pagesMicro Finance-Lessons From International Experience: Lecture - 19811dipu jaiswalNo ratings yet

- Vouchar 2024-27Document1 pageVouchar 2024-27Muhammad Azhar LashariNo ratings yet

- ICICI Bank NewDocument23 pagesICICI Bank NewTushar DevNo ratings yet

- JAVEDDocument1 pageJAVEDMuhammad Ilhamsyah PutraNo ratings yet

- Hull OFOD10e MultipleChoice Questions Only Ch04Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch04Kevin Molly Kamrath100% (1)

- FNE311 Assignment 4 AnsDocument4 pagesFNE311 Assignment 4 Anscharles03281991No ratings yet

- Pakistan Data Sheet - Ecomm 2020Document5 pagesPakistan Data Sheet - Ecomm 2020Meekal ANo ratings yet

- Chuong3 Swaps 2013 SDocument50 pagesChuong3 Swaps 2013 Samericus_smile7474No ratings yet

- BC6B15 - MCQ - Islamic Banking ProductsDocument4 pagesBC6B15 - MCQ - Islamic Banking Products和 和了自己No ratings yet

- Berhan Bank SC: Portfolio Analysis-June 30, 2019Document10 pagesBerhan Bank SC: Portfolio Analysis-June 30, 2019martagobanaNo ratings yet

- Minor Report On "NRI Banking" Bachelor of Commerce Banking & Insurance Semester V 2010-2011Document77 pagesMinor Report On "NRI Banking" Bachelor of Commerce Banking & Insurance Semester V 2010-2011हर्ष मोहनNo ratings yet

- Debit and Credit Card Usage: Literature ReviewDocument6 pagesDebit and Credit Card Usage: Literature ReviewAdnan Akram0% (1)

- What Is Pera AgadDocument5 pagesWhat Is Pera AgadJEFREY JAY CLAUSNo ratings yet

- 12 BibliographyDocument8 pages12 BibliographyMotiram paudelNo ratings yet

- Comparative Study of Home Loans of PNB and Sbi BankDocument75 pagesComparative Study of Home Loans of PNB and Sbi Bankvsmitha122No ratings yet

- International Financial Management 11 Edition: by Jeff MaduraDocument47 pagesInternational Financial Management 11 Edition: by Jeff MaduraChourp SophalNo ratings yet

- Format Description Swift Fin Mt103: SWIFT For Corporates (S4C)Document10 pagesFormat Description Swift Fin Mt103: SWIFT For Corporates (S4C)AriefNo ratings yet

- AnandamDocument1 pageAnandamRaj Gupta100% (6)

- Consumer Arithmetic 2Document14 pagesConsumer Arithmetic 2BennyNo ratings yet

- Financial Account CIA 1 QPDocument1 pageFinancial Account CIA 1 QPPadmaja NaiduNo ratings yet

- Inside Job: The Official Teacher'S GuideDocument12 pagesInside Job: The Official Teacher'S GuideSenoirb LemhesNo ratings yet

- HDFC Questionnaire - Digital ServicesDocument3 pagesHDFC Questionnaire - Digital ServicesRamneet Parmar80% (20)

- Design of An ATM (Automated Teller Machine) Controller:, E-Mail:, PH: 9885112363 / 040 44433434Document2 pagesDesign of An ATM (Automated Teller Machine) Controller:, E-Mail:, PH: 9885112363 / 040 44433434SalmaAn MalikNo ratings yet

- IndyMac OneWest Why They Do Not Do Loan ModificationsDocument9 pagesIndyMac OneWest Why They Do Not Do Loan Modificationstraderash1020No ratings yet

- Bank of Credit and Commerce (Bcci)Document13 pagesBank of Credit and Commerce (Bcci)Shah Jamal100% (2)

- FEMA DeclarationDocument3 pagesFEMA DeclarationShijo ThomasNo ratings yet

- Book of Original Entry MCQDocument14 pagesBook of Original Entry MCQTahmina SobhanNo ratings yet