Professional Documents

Culture Documents

Lesson 1-Introduction To Accounting

Uploaded by

delgadojudithOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 1-Introduction To Accounting

Uploaded by

delgadojudithCopyright:

Available Formats

Subject: ABM1

Lesson 1: Introduction to Accounting

“Accounting is the process of IDENTIFYING, RECORDING, and COMMUNICATING economic events of an

organization to interested users.” (Weygandt, J. et. al)

Explain the three highlighted words in the graphic:

IDENTIFYING – this involves selecting economic events that are relevant to a particular business

transaction. The economic events of an organization are referred to as transactions. Examples of

economic events or transactions - In a bakery business:

• sales of bread and other bakery products

• purchases of flour that will be used for baking

• purchases of trucks needed to deliver the products

RECORDING – this involves keeping a chronological diary of events that are measured in pesos. The

diary referred to in the definition are the journals and ledgers which will be discussed in future chapters.

COMMUNICATING – occurs through the preparation and distribution of financial and other accounting

reports.

Nature of accounting

• Accounting is a service activity. Accounting provides assistance to decision makers by providing them

financial reports that will guide them in coming up with sound decisions.

• Accounting is a process: A process refers to the method of performing any specific job step by step

according to the objectives or targets. Accounting is identified as a process, as it performs the specific

task of collecting, processing and communicating financial information. In doing so, it follows some

definite steps like the collection, recording, classification, summarization, finalization, and reporting of

financial data.

• Accounting is both an art and a discipline. Accounting is the art of recording, classifying, summarizing

and finalizing financial data. The word ‘art’ refers to the way something is performed. It is behavioral

knowledge involving a certain creativity and skill to help us attain some specific objectives. Accounting is

a systematic method consisting of definite techniques and its proper application requires skill and

expertise. So by nature, accounting is an art. And because it follows certain standards and professional

ethics, it is also a discipline.

• Accounting deals with financial information and transactions: Accounting records financial

transactions and data, classifies these and finalizes their results given for a specified period of time, as

needed by their users. At every stage, from start to finish, accounting deals with financial information

and financial information only. It does not deal with non-monetary or non-financial aspects of such

information.

• Accounting is an information system: Accounting is recognized and characterized as a storehouse of

information. As a service function, it collects processes and communicates financial information of any

entity. This discipline of knowledge has evolved to meet the need for financial information as required

by various interested groups.

Function of accounting in business

Accounting is the means by which business information is communicated to business owners and

stakeholders. The role of accounting in business is to provide information for managers and owners to

use in operating the business. In addition, accounting information allows business owners to assess the

efficiency and effectiveness of their business operations. Prepared accounting reports can be

compared with industry standards or to a leading competitor to determine how the business is doing.

Business owners may also use historical financial accounting statements to create trends for analyzing

and forecasting future sales.

Accounting helps the users of these financial reports to see the true picture of the business in financial

terms. In order for a business to survive, it is important that a business owner or manager be well-

informed.

With the help of accounting, the following questions can be answered;

Is my business earning? (profitability)

How much daily or monthly sales do I need in order to recover my fixed-cost? (break-even)

Do I need to hire additional workers to help me with my production?

Can I afford to set up a new store in another place? Where do I get funds?

Can I afford to pay back the loans?

Is accounting important to you?

Does it affect your daily activities? How?”

History of accounting

Following is the evolution of accounting:

• The Cradle of Civilization

Around 3600 B.C., record-keeping was already common from Mesopotamia, China and India to Central

and South America. The oldest evidence of this practice was the “clay tablet” of Mesopotamia which

dealt with commercial transactions at the time such as listing of accounts receivable and accounts

payable.

• 14th Century - Double-Entry Bookkeeping

The most important event in accounting history is generally considered to be the dissemination of

double entry bookkeeping by Luca Pacioli (‘The Father of Accounting’) in 14th century Italy. Pacioli was

much revered in his day, and was a friend and contemporary of Leonardo da Vinci. The Italians of the

14th to 16th centuries are widely acknowledged as the fathers of modern accounting and were the first

to commonly use Arabic numerals, rather than Roman, for tracking business accounts. Luca Pacioli

wrote Summa de Arithmetica, the first book published that contained a detailed chapter on double-

entry bookkeeping.

• French Revolution (1700s)

The thorough study of accounting and development of accounting theory began during this period.

Social upheavals affecting government, finances, laws, customs and business had greatly influenced the

development of accounting.

• The Industrial Revolution (1760-1830)

Mass production and the great importance of fixed assets were given attention during this period.

• 19th Century – The Beginnings of Modern Accounting in Europe and America

The modern, formal accounting profession emerged in Scotland in 1854 when Queen Victoria granted a

Royal Charter to the Institute of Accountants in Glasgow, creating the profession of the Chartered

Accountant (CA). In the late 1800s, chartered accountants from Scotland and Britain came to the U.S. to

audit British investments. Some of these accountants stayed in the U.S., setting up accounting practices

and becoming the origins of several U.S. accounting firms. The first national U.S. accounting society was

set up in 1887. The American Association of Public Accountants was the forerunner to the current

American Institute of Certified Public Accountants (AICPA). In this period rapid changes in accounting

practice and reports were made. Accounting standards to be observed by accounting professionals

were promulgated. Notable practices such as mergers, acquisitions and growth of multinational

corporations were developed. A merger is when one company takes over all the operations of another

business entity resulting in the dissolution of another business. Businesses expanded by acquiring other

companies. These types of transactions have challenged accounting professionals to develop new

standards that will address accounting issues related to these business combinations.

• The Present - The Development of Modern Accounting Standards and Commerce

The accounting profession in the 20th century developed around state requirements for financial

statement audits. Beyond the industry's self-regulation, the government also sets accounting standards,

through laws and agencies such as the Securities and Exchange Commission (SEC). As economies

worldwide continued to globalize, accounting regulatory bodies required accounting practitioners to

observe International Accounting Standards. This is to assure transparency and reliability, and to obtain

greater confidence on accounting information used by global investors. Nowadays, investors seek

investment opportunities all over the world. To remain competitive, businesses everywhere feel the

need to operate globally. The trend now for accounting professionals is to observe one single set of

global accounting standards in order to have greater transparency and comparability of financial data

across borders.

You might also like

- Users of Accounting InformationDocument21 pagesUsers of Accounting InformationEllegor Eam Gayol (girl palpak)No ratings yet

- Elements of Accounting LectureDocument43 pagesElements of Accounting LectureRaissa Mae100% (1)

- Fabm 1 Peta 1 Chart of AccountsDocument4 pagesFabm 1 Peta 1 Chart of AccountsJenneriza DC Del Rosario100% (1)

- FABM 1 - Week 1Document19 pagesFABM 1 - Week 1RD SuarezNo ratings yet

- Learning Module: Community Colleges of The PhilippinesDocument44 pagesLearning Module: Community Colleges of The PhilippinesGianina De LeonNo ratings yet

- Accounting Cycle of A Service Business-Step 2-JournalizingDocument31 pagesAccounting Cycle of A Service Business-Step 2-Journalizingdelgadojudith100% (3)

- ABM2 - Fundamentals of ABM 2 FS AnalysisDocument45 pagesABM2 - Fundamentals of ABM 2 FS AnalysisCharles Carlos100% (1)

- Abm - PR2 - Key Success Factors of Micro Small Enterprises in Bauang La Union BodDocument79 pagesAbm - PR2 - Key Success Factors of Micro Small Enterprises in Bauang La Union BodARNEL BARROGANo ratings yet

- Lesson Title: Most Essential Learning Competencies (Melcs)Document4 pagesLesson Title: Most Essential Learning Competencies (Melcs)Maria Lutgarda Tumbaga100% (2)

- Test Question For Exam Chapter 1 To 6Document4 pagesTest Question For Exam Chapter 1 To 6Cherryl ValmoresNo ratings yet

- Users of Accounting InformationDocument37 pagesUsers of Accounting InformationAbby Rosales - Perez100% (3)

- Salary, Wage, Income, Gross Earnings & Net Earnings 1. Computing The Salaries and WagesDocument9 pagesSalary, Wage, Income, Gross Earnings & Net Earnings 1. Computing The Salaries and WagesAlmirah H. AliNo ratings yet

- FABM 1 Accounting EquationDocument11 pagesFABM 1 Accounting EquationJohn Philip Paras100% (2)

- Accounting Cycle of A Service Business-Step 3-Posting To LedgerDocument40 pagesAccounting Cycle of A Service Business-Step 3-Posting To LedgerdelgadojudithNo ratings yet

- Books of Accounts RecordsDocument8 pagesBooks of Accounts RecordsMylene SantiagoNo ratings yet

- FABM1 Q4 Module 8 Terminologies Used in Merchandising BusinessDocument20 pagesFABM1 Q4 Module 8 Terminologies Used in Merchandising BusinessrioNo ratings yet

- Week 7-8Document8 pagesWeek 7-8Kim Albero Cubel0% (1)

- Fabm 1 Module 2 Principles and ConceptsDocument10 pagesFabm 1 Module 2 Principles and ConceptsKISHA100% (1)

- Module 4 Adjusting Entries PDFDocument21 pagesModule 4 Adjusting Entries PDFMax Dela TorreNo ratings yet

- Rev. Statistics and ProbabilityDocument298 pagesRev. Statistics and ProbabilitymilimofdemonlordNo ratings yet

- Branches of AccountingDocument8 pagesBranches of AccountingBrace Arquiza50% (2)

- FABM 1 Q2 Weeks 3 4Document11 pagesFABM 1 Q2 Weeks 3 4Maria Hannahlyn Batumbakal DimakulanganNo ratings yet

- Grade11 Fabm1 Q2 Week1Document22 pagesGrade11 Fabm1 Q2 Week1Mickaela MonterolaNo ratings yet

- FABM 2Document261 pagesFABM 2Pep AtienzaNo ratings yet

- FABM2 Q2W4 TaxationDocument9 pagesFABM2 Q2W4 TaxationDanielle SocoralNo ratings yet

- Fabm 2: LEARNING ACTIVITIES - Statement of Comprehensive Income (SCI)Document2 pagesFabm 2: LEARNING ACTIVITIES - Statement of Comprehensive Income (SCI)Cameron VelascoNo ratings yet

- FABM1 Q4 Module 14Document15 pagesFABM1 Q4 Module 14Earl Christian BonaobraNo ratings yet

- Summative Test-FABM2 2018-19Document3 pagesSummative Test-FABM2 2018-19Raul Soriano Cabanting0% (1)

- BANK Documents and ReconciliationDocument47 pagesBANK Documents and ReconciliationGlenn Altar100% (1)

- Preliminary Exam (Fabm1)Document4 pagesPreliminary Exam (Fabm1)Zybel RosalesNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Document10 pagesFundamentals of Accountancy, Business and Management 1 (FABM 1)Angelica ParasNo ratings yet

- FABM 2 Week 4Document3 pagesFABM 2 Week 4JayMoralesNo ratings yet

- Statement of Changes in Equity (SCE)Document72 pagesStatement of Changes in Equity (SCE)GSOCION LOUSELLE LALAINE D.100% (1)

- Math 11 Fabm1 Abm q2 Week 7Document14 pagesMath 11 Fabm1 Abm q2 Week 7Marchyrella Uoiea Olin JovenirNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Document13 pagesFundamentals of Accountancy, Business and Management 1 (FABM 1)Angelica ParasNo ratings yet

- Distance Education: Instructional ModuleDocument10 pagesDistance Education: Instructional ModuleRD Suarez100% (3)

- FABM 2 - Midterm ExamDocument6 pagesFABM 2 - Midterm ExamJessica Esmeña100% (1)

- Types of Major Accounts: Fundamentals of Accountancy, Business, and Management 1Document5 pagesTypes of Major Accounts: Fundamentals of Accountancy, Business, and Management 1Vanessa Lou TorejasNo ratings yet

- Accounting Books - Journal, Ledger and Trial BalanceDocument35 pagesAccounting Books - Journal, Ledger and Trial BalanceGhie Ragat100% (3)

- Module in Fabm 1: Department of Education Schools Division of Pasay CityDocument6 pagesModule in Fabm 1: Department of Education Schools Division of Pasay CityAngelica Mae SuñasNo ratings yet

- Effcets of Choosing AbmDocument25 pagesEffcets of Choosing AbmJanesa MaxcenNo ratings yet

- FABM 1.module 2Document21 pagesFABM 1.module 2SHIERY MAE FALCONITINNo ratings yet

- Grade11 Fabm1 Q2 Week3Document14 pagesGrade11 Fabm1 Q2 Week3Mickaela MonterolaNo ratings yet

- Completing the Accounting Cycle: Steps and StatementsDocument16 pagesCompleting the Accounting Cycle: Steps and StatementsVeniceNo ratings yet

- Business Ethics Social Responsibility 12 q1 w1 FinalDocument16 pagesBusiness Ethics Social Responsibility 12 q1 w1 FinalVan DahuyagNo ratings yet

- Understand SCI FundamentalsDocument27 pagesUnderstand SCI FundamentalsMichael Lalim Jr.No ratings yet

- Fabm2 SLK Week 8 Bank Documents 1Document11 pagesFabm2 SLK Week 8 Bank Documents 1Mylene SantiagoNo ratings yet

- Activity Sheets in Fundamentals of Accountancy, Business and Management 1 Quarter Iii, Week 2 To 3Document19 pagesActivity Sheets in Fundamentals of Accountancy, Business and Management 1 Quarter Iii, Week 2 To 3clarisse ginezNo ratings yet

- Types of Businesses by Activities: Service, Merchandising & ManufacturingDocument16 pagesTypes of Businesses by Activities: Service, Merchandising & ManufacturingAdrianChrisArciagaArevaloNo ratings yet

- Fundamentals of Accounting 1 PDFDocument130 pagesFundamentals of Accounting 1 PDFWilhelisle50% (2)

- Quarter 1 Week 5 Module 6: Fundamentals of Accountancy, Business and Management 1Document17 pagesQuarter 1 Week 5 Module 6: Fundamentals of Accountancy, Business and Management 1Taj Mahal100% (1)

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- Answer Sheet in Fundamentals of Accountancy, Business and Management 1 Quarter1 Week 8Document1 pageAnswer Sheet in Fundamentals of Accountancy, Business and Management 1 Quarter1 Week 8Florante De LeonNo ratings yet

- Fundamentals of SFP ElementsDocument33 pagesFundamentals of SFP ElementsAbyel Nebur100% (2)

- Fundamentals of Accountancy Business and Management 1 (Lehnard D. Gellor, CPA) Page 1 of 4Document6 pagesFundamentals of Accountancy Business and Management 1 (Lehnard D. Gellor, CPA) Page 1 of 4Lehnard Delos Reyes GellorNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2: ExpectationDocument131 pagesFundamentals of Accountancy, Business, and Management 2: ExpectationAngela Garcia100% (1)

- 8 Accounting Books Journal and LedgersDocument17 pages8 Accounting Books Journal and LedgersJc Coronacion100% (3)

- Introduction To AccountingDocument4 pagesIntroduction To AccountingAileen PelandeNo ratings yet

- Fundamentals of Accountancy, Business, and Management 1: The Nature of AccountingDocument6 pagesFundamentals of Accountancy, Business, and Management 1: The Nature of AccountingMylen Noel Elgincolin ManlapazNo ratings yet

- Fundamentals of Accounting, Business and ManagementDocument8 pagesFundamentals of Accounting, Business and ManagementJhon Kenneth AguadoNo ratings yet

- Types of FractionsDocument9 pagesTypes of FractionsdelgadojudithNo ratings yet

- Lesson 2-Addition of FractionDocument7 pagesLesson 2-Addition of FractiondelgadojudithNo ratings yet

- Lesson 2-Addition of FractionDocument7 pagesLesson 2-Addition of FractiondelgadojudithNo ratings yet

- Accounting Cycle of A Service Business-Step 3-Posting To LedgerDocument40 pagesAccounting Cycle of A Service Business-Step 3-Posting To LedgerdelgadojudithNo ratings yet

- Accounting Cycle of A Service Business-Step 7-Introduction To Financial StatementDocument24 pagesAccounting Cycle of A Service Business-Step 7-Introduction To Financial StatementdelgadojudithNo ratings yet

- Lesson 11 - The Accounting CycleDocument19 pagesLesson 11 - The Accounting Cycledelgadojudith100% (1)

- Accounting Cycle of A Service Business-Step 4-Trial BalanceDocument30 pagesAccounting Cycle of A Service Business-Step 4-Trial BalancedelgadojudithNo ratings yet

- Lesson 1-Introduction To AccountingDocument2 pagesLesson 1-Introduction To Accountingdelgadojudith100% (1)

- Introduction to Accounting Lesson 1Document22 pagesIntroduction to Accounting Lesson 1delgadojudith100% (1)

- Accounting Cycle of A Service Business-Step 5-Adjusting EntriesDocument18 pagesAccounting Cycle of A Service Business-Step 5-Adjusting EntriesdelgadojudithNo ratings yet

- Journal Entries & LedgerDocument16 pagesJournal Entries & LedgerdelgadojudithNo ratings yet

- Definitions and Functions of MGTDocument21 pagesDefinitions and Functions of MGTdelgadojudith100% (1)

- 4A of Lesson Planning PDFDocument1 page4A of Lesson Planning PDFMhaye CendanaNo ratings yet

- Accounting Cycle of A Service Business-Step 2-JournalizingDocument31 pagesAccounting Cycle of A Service Business-Step 2-Journalizingdelgadojudith100% (3)

- Modyul 1 (Ikatlong Markahan)Document29 pagesModyul 1 (Ikatlong Markahan)delgadojudithNo ratings yet

- Introduction to Accounting BranchesDocument4 pagesIntroduction to Accounting Branchesdelgadojudith63% (8)

- Lesson 3 - Users of Accounting InformationDocument4 pagesLesson 3 - Users of Accounting Informationdelgadojudith100% (6)

- Evolution of Management TheoriesDocument6 pagesEvolution of Management Theoriesdelgadojudith100% (2)

- Detailed Lesson Plan-Evolution of Management TheoriesDocument22 pagesDetailed Lesson Plan-Evolution of Management Theoriesdelgadojudith100% (3)

- Lesson 3-SelectionDocument4 pagesLesson 3-SelectiondelgadojudithNo ratings yet

- Functions of ManagersDocument3 pagesFunctions of ManagersdelgadojudithNo ratings yet

- Ex: Banana Que, Leche Flan, Halo-Halo: 1. Simple Business Only (Makaya Lang Nanda)Document1 pageEx: Banana Que, Leche Flan, Halo-Halo: 1. Simple Business Only (Makaya Lang Nanda)delgadojudithNo ratings yet

- Planning Process and Tools QuizDocument3 pagesPlanning Process and Tools QuizdelgadojudithNo ratings yet

- Introduction to AccountingDocument5 pagesIntroduction to Accountingdelgadojudith67% (3)

- vepBusinessPlanOutline PDFDocument20 pagesvepBusinessPlanOutline PDFMark John Christian LumindasNo ratings yet

- ABM - Organization and Management CG - 4 PDFDocument5 pagesABM - Organization and Management CG - 4 PDFHaj Heloise75% (20)

- Business Finance TGDocument339 pagesBusiness Finance TGCharisse Dianne P. Andoy100% (2)

- ABM Business Math CG 2Document5 pagesABM Business Math CG 2GRascia Ona100% (2)

- Differences Between Organisation As Structure and Organisation As ProcessDocument3 pagesDifferences Between Organisation As Structure and Organisation As ProcessdelgadojudithNo ratings yet

- Database AwsDocument15 pagesDatabase AwsHareesha N GNo ratings yet

- Mikes ResumeDocument2 pagesMikes Resumeapi-312645878No ratings yet

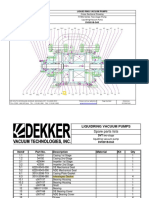

- Bomba de Vacio Part ListDocument2 pagesBomba de Vacio Part ListNayeli Zarate MNo ratings yet

- Band Theory and Bloch Theorem in Solid State PhysicsDocument8 pagesBand Theory and Bloch Theorem in Solid State PhysicsVicky VickyNo ratings yet

- Bridge Manual Retaining Walls - Section 3.62 Page 3.2-2Document1 pageBridge Manual Retaining Walls - Section 3.62 Page 3.2-2lomoscribdNo ratings yet

- What is phonicsDocument244 pagesWhat is phonicsNelly FernandezNo ratings yet

- A History of Linear Electric MotorsDocument400 pagesA History of Linear Electric MotorseowlNo ratings yet

- Nursing Care Plans for ChildrenDocument4 pagesNursing Care Plans for ChildrenAlexander Rodriguez OlipasNo ratings yet

- Standard JKR Spec For Bridge LoadingDocument5 pagesStandard JKR Spec For Bridge LoadingHong Rui ChongNo ratings yet

- GRP 10 JV'sDocument43 pagesGRP 10 JV'sManas ChaturvediNo ratings yet

- Holy Week Labyrinth GuideDocument4 pagesHoly Week Labyrinth GuideEileen Campbell-Reed100% (1)

- What Is Mean?: Extrapolation InterpolationDocument2 pagesWhat Is Mean?: Extrapolation InterpolationVinod SharmaNo ratings yet

- Goethe Zertifikat b1 HorenDocument2 pagesGoethe Zertifikat b1 HorenLevent75% (4)

- Chapter 24 Study QuestionsDocument3 pagesChapter 24 Study QuestionsAline de OliveiraNo ratings yet

- But Virgil Was Not There": The Lasting Impact of Dante's Homosocial HellDocument7 pagesBut Virgil Was Not There": The Lasting Impact of Dante's Homosocial HellЮлия ЧебанNo ratings yet

- 5G Antenna Talk TWDocument48 pages5G Antenna Talk TWRohit MathurNo ratings yet

- Evbox Ultroniq V2: High Power Charging SolutionDocument6 pagesEvbox Ultroniq V2: High Power Charging SolutionGGNo ratings yet

- MMC Fiori Cheat Sheet PDFDocument2 pagesMMC Fiori Cheat Sheet PDFAleksandar KNo ratings yet

- CBSE Class 10 Science Revision Notes Chapter - 2 Acids, Bases and SaltsDocument11 pagesCBSE Class 10 Science Revision Notes Chapter - 2 Acids, Bases and Saltsmilind dhamaniyaNo ratings yet

- Toyota Genuine ATF WSDocument14 pagesToyota Genuine ATF WSKirillNo ratings yet

- ECOSYS M2030dn M2530dn M2035dn M2535dn SM UKDocument273 pagesECOSYS M2030dn M2530dn M2035dn M2535dn SM UKMaks Prost60% (5)

- Four Pillars of EducationDocument42 pagesFour Pillars of EducationWinter BacalsoNo ratings yet

- Asc2104b-T I enDocument21 pagesAsc2104b-T I enELOUNDOU EVARISTE OHANDJANo ratings yet

- Economics of Power GenerationDocument32 pagesEconomics of Power GenerationKimberly Jade VillaganasNo ratings yet

- Chapter 9: Operating SystemsDocument166 pagesChapter 9: Operating SystemsGazzzeeNo ratings yet

- AllareDocument16 pagesAllareGyaniNo ratings yet

- Samruddhi ComplexDocument7 pagesSamruddhi ComplexNews Side Effects.No ratings yet

- Mens Care Active Concepts PDFDocument19 pagesMens Care Active Concepts PDFFredy MendocillaNo ratings yet

- Top Answers to Mahout Interview QuestionsDocument6 pagesTop Answers to Mahout Interview QuestionsPappu KhanNo ratings yet

- Boston Globe Article - Jonnie Williams & Frank O'DonnellDocument3 pagesBoston Globe Article - Jonnie Williams & Frank O'DonnellFuzzy PandaNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Small Business Startup: How to Start a Business and Go from Idea and Business Plan to Marketing and ScalingFrom EverandSmall Business Startup: How to Start a Business and Go from Idea and Business Plan to Marketing and ScalingRating: 5 out of 5 stars5/5 (1)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet