Professional Documents

Culture Documents

Credit Note Form

Credit Note Form

Uploaded by

Ade TriefOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Note Form

Credit Note Form

Uploaded by

Ade TriefCopyright:

Available Formats

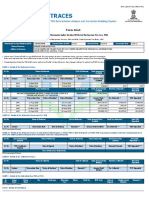

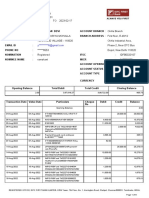

CREDIT NOTE

Requests will be returned if the information is not complete

*Business Unit: Select Business Unit

*Customer No: ALL Customer Name:

*INVOICE NO *INVOICE DATE *AMOUNT Diskon GST AMOUNT TOTAL

07-TB-2018 19 OKTOBER 2018 18,800,000 2% 376,000 19,176,000

08-TB-2018 22 November 2018 21,300,000 2% 426,000 21,726,000

09-TB-2019 22 November 2018 31,000,000 2% 620,000 31,620,000

12-TB-2019 22 November 2018 73,094,000 2% 1,461,880 74,555,880

TOTAL 144,194,000 2,883,880 147,077,880 Bill

Boo

*Justification for Credit Note: Price Adjustment

Credit Note Header Comment: Permintaan Diskon 2%

This section must be filled out for all Credit Note Requests

Has all the relevant supporting documentation been attached ?

Raised by: Signature: Date:

Business Unit Admin Officer

This section is required for all Credit Note Requests from AUD $1.00 to AUD$100,000.00

Recommended by: Signature: Date:

Finance Manager / Executive Officer

This section is required for all Credit Note Requests greater than AUD$100,000.00

Recommended by: Signature: Date:

Other / Head of School

Authorised by: Signature: Date:

Director of Operational Financial / CFO

Office Use Only Credit Note Number: CN-001-TB-2018

Date Received: Authorised by AR Manager:

Date Entered: Entered by:

INSTRUCTIONS FOR CREDIT NOTE FORM

This form is completed to enable an AR Team member to enter a Credit Note on your behalf.

All Credit Notes for external parties are raised by AR Team.

All Credit Notes for Related Entities, eg: Facilities Management, are raised by the central AR Team and

should be e-mailed to financehelp@unsw.edu.au.

All Credit Notes for Internal Entities within UNSW, eg: Internal Crediting between Faculties, Schools and

Divisions should be done via a journal rather than raising a Credit Note. We are all the same ABN

number, so there is no tax/GST implications, therefore a Credit Note is not required. Please refer to your

Client Services Accountant for guidance.

Grey cells contain formulas and you should not enter any information here.

Some cells contain drop downs and you should select the appropriate code, such as Business Unit, GST

code and Justification.

Those cells with an asterix (*) are mandatory and must be completed.

To find Customer Details: Navigation: Customer > Customer Information > General Information Search

Customer's Name

When complete, save this file using the Customer's Name (or an abbreviation of it) and Today's Date, eg:

Princewales250607. This file should then be e-mailed to your local Finance and Admin person for their

approval before sending to AR.

Any queries can be referred to Finance Help on x53330 or email them at financehelp@unsw.edu.au

You might also like

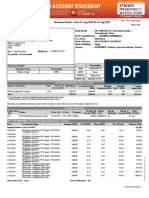

- Sep2022 - Indus Ind-Statement PDFDocument5 pagesSep2022 - Indus Ind-Statement PDFChandrashekar BGNo ratings yet

- Education LoanDocument1 pageEducation LoanAjinkya Bagade100% (1)

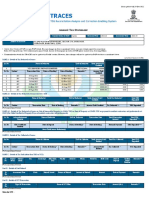

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961pritam kumar DasNo ratings yet

- IDFCFIRSTBankstatement 10068100037 163706819Document1 pageIDFCFIRSTBankstatement 10068100037 163706819Rajanala Vignesh NaiduNo ratings yet

- Estmt - 2022 05 31Document10 pagesEstmt - 2022 05 31Katelynn LiuNo ratings yet

- 12154560Document3 pages12154560anuradhaNo ratings yet

- Determination Rule in SAP SDDocument3 pagesDetermination Rule in SAP SDraky0369100% (1)

- Table of Contents. Clayton Makepeace PDFDocument234 pagesTable of Contents. Clayton Makepeace PDFJuan Isaac100% (3)

- Yates Logistics BofA SepDocument7 pagesYates Logistics BofA SepJonathan Seagull LivingstonNo ratings yet

- A 36 Sonal Nagar Part 2 Chandlodiall Opp Gota Road AHMEDABAD - 380060 Gujarat, IndiaDocument2 pagesA 36 Sonal Nagar Part 2 Chandlodiall Opp Gota Road AHMEDABAD - 380060 Gujarat, IndiaNilesh ChauhanNo ratings yet

- Education LoanDocument2 pagesEducation Loanzuheb80% (10)

- 558 /5 Sanghrajka House Adenwala Road Near Five Garden Matunga MUMBAI - 400019 Maharashtra, IndiaDocument2 pages558 /5 Sanghrajka House Adenwala Road Near Five Garden Matunga MUMBAI - 400019 Maharashtra, IndiaPankaj GuptaNo ratings yet

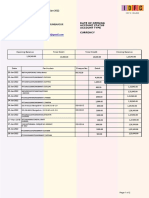

- MR Muhammed Ashik C E: Opening Balance Total Debit Total Credit Closing BalanceDocument2 pagesMR Muhammed Ashik C E: Opening Balance Total Debit Total Credit Closing BalanceSneha AshikNo ratings yet

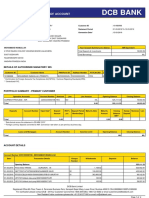

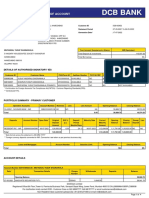

- DCB Bank: Consolidated Statement of AccountDocument2 pagesDCB Bank: Consolidated Statement of AccountMohammed InamullahNo ratings yet

- Dario JunioDocument6 pagesDario JunioManuela Granda VallejoNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- ADG-541-AR-SPC-0001 - 0B - Architectural Works Specifications PDFDocument326 pagesADG-541-AR-SPC-0001 - 0B - Architectural Works Specifications PDFAbdelazim Ahmed ElzairyNo ratings yet

- Supplier Quality/Purchasing Controls Successful PracticesDocument23 pagesSupplier Quality/Purchasing Controls Successful PracticesJessica Christy Sitio100% (1)

- IDFCFIRSTBankstatement 10027354401 154032854Document6 pagesIDFCFIRSTBankstatement 10027354401 154032854SAGAR YADAVNo ratings yet

- Elitecarfumes CDocument42 pagesElitecarfumes CAnjieuana Selle AlabadoNo ratings yet

- CSOAStatement 028102952Document4 pagesCSOAStatement 028102952Mufaddal DaginawalaNo ratings yet

- Transaction Review RKPL, Draft ReportDocument13 pagesTransaction Review RKPL, Draft ReportJoni alauddinNo ratings yet

- INDIA Expense ReimbursementDocument3 pagesINDIA Expense ReimbursementVicky RajputNo ratings yet

- Pol 129298Document2 pagesPol 129298summu paulNo ratings yet

- Statement: of AccountDocument1 pageStatement: of Accountwaseem akhtarNo ratings yet

- IDFCFIRSTBankstatement 10086745019Document1 pageIDFCFIRSTBankstatement 10086745019rohit kumarNo ratings yet

- Rajeev Sharma: Account StatementDocument7 pagesRajeev Sharma: Account StatementRajSharmaNo ratings yet

- Meskerem Kidane FinalDocument16 pagesMeskerem Kidane FinallikmezekerNo ratings yet

- Jawaban Modul PA Jilid 1 (2022-2023) (AutoRecovered)Document26 pagesJawaban Modul PA Jilid 1 (2022-2023) (AutoRecovered)k kNo ratings yet

- Sol 2019 CfsDocument4 pagesSol 2019 CfsEpic Gaming MomentsNo ratings yet

- RfunprDocument1 pageRfunprROSLAILY BINTI ROSLI STUDENTNo ratings yet

- View SoaDocument4 pagesView SoaChristian Vincent Tampus AliñoNo ratings yet

- Date: 26/11/2018 FILE No.: 875146: Instrument Type Instrument No. Instrument Date Amount (INR) Infavour ofDocument21 pagesDate: 26/11/2018 FILE No.: 875146: Instrument Type Instrument No. Instrument Date Amount (INR) Infavour ofYogesh WadhwaNo ratings yet

- Akzpg4833g 2023Document6 pagesAkzpg4833g 2023Md Pervez ZaidiNo ratings yet

- FORM 83 - FormDocument7 pagesFORM 83 - FormcallvkNo ratings yet

- Case Study InformationDocument3 pagesCase Study InformationNafilah RahmaNo ratings yet

- 10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDODocument2 pages10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDOADNo ratings yet

- Valid For: DD/Cash/Fund Transfer (Isure Pay) Icici Bank LTD Bank Copy New Okhla Industrial Development AuthorityDocument5 pagesValid For: DD/Cash/Fund Transfer (Isure Pay) Icici Bank LTD Bank Copy New Okhla Industrial Development AuthoritySagar SehgalNo ratings yet

- (Template) Formulir Manual-Kas Kecil Rev.01 - FinalDocument7 pages(Template) Formulir Manual-Kas Kecil Rev.01 - FinalAnggun GuelNo ratings yet

- KotakDocument2 pagesKotakRandhir RanaNo ratings yet

- Financial InformationDocument2 pagesFinancial Informationeprints cebuNo ratings yet

- MR - Radadiya Mitul Rameshbhai: Page 1 of 2 M-87654312-1Document2 pagesMR - Radadiya Mitul Rameshbhai: Page 1 of 2 M-87654312-1tapanNo ratings yet

- FNSTPB412 AE Sk2of4 Appx FrasersElectricalEmployeeDataDocument34 pagesFNSTPB412 AE Sk2of4 Appx FrasersElectricalEmployeeDataChoo Li ZiNo ratings yet

- Policy and Payment Details: Premium Paid CertificateDocument1 pagePolicy and Payment Details: Premium Paid CertificateAbhishek Kumar SinghNo ratings yet

- Ubs Exercise 1Document11 pagesUbs Exercise 1Nor Irdina SofirnaNo ratings yet

- Kan Taxes and Accounting ServicesDocument28 pagesKan Taxes and Accounting Servicessean.lloyd1124No ratings yet

- Jul2019 PDFDocument2 pagesJul2019 PDFGaurav KumarNo ratings yet

- Intacc 1 Notes - AR StartDocument6 pagesIntacc 1 Notes - AR StartKing BelicarioNo ratings yet

- FA Dec 2020Document9 pagesFA Dec 2020Shawn LiewNo ratings yet

- Handover - SagarDocument6 pagesHandover - SagarVamc KrishnaNo ratings yet

- Vendor: Partner Accreditation FormDocument2 pagesVendor: Partner Accreditation FormAbdul HadiNo ratings yet

- Financial Accounting #1Document12 pagesFinancial Accounting #1Wallace TamNo ratings yet

- Accounting For Assets - DebtorsDocument28 pagesAccounting For Assets - DebtorsMadhusudhan JoshiNo ratings yet

- Financial Statements OF: Prepared byDocument15 pagesFinancial Statements OF: Prepared byLE X USNo ratings yet

- OnlineWL 8378 03 Apr 19 070849Document15 pagesOnlineWL 8378 03 Apr 19 070849velmurug_balaNo ratings yet

- Activity With Answer - Xinyu PartDocument23 pagesActivity With Answer - Xinyu PartChoon WaiNo ratings yet

- Estatement20221231 000049277Document1 pageEstatement20221231 000049277purnima.wijendraNo ratings yet

- Ramesh GPFDocument2 pagesRamesh GPFSHARANUNo ratings yet

- Sta Lucia - SOA For Marketing TrendsDocument1 pageSta Lucia - SOA For Marketing TrendsChandria CalderonNo ratings yet

- Ringkasan / at A Glance: Rekening Koran / Statement of AccountDocument4 pagesRingkasan / at A Glance: Rekening Koran / Statement of AccountNovi LegitaNo ratings yet

- Abgpi5760g 2023Document4 pagesAbgpi5760g 2023JAGDISH KUMARNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- BDSPJ9900J 2023Document4 pagesBDSPJ9900J 2023ShubhamNo ratings yet

- Continue To Next Pagee ...Document2 pagesContinue To Next Pagee ...Javed MojanidarNo ratings yet

- Trademark CasesDocument7 pagesTrademark CasesAlbert Jerome RamosNo ratings yet

- PGD - Subject: ProcurementDocument4 pagesPGD - Subject: ProcurementAbid RazaNo ratings yet

- Amity University: - Uttar PradeshDocument2 pagesAmity University: - Uttar PradeshIshan MehraNo ratings yet

- Wcms 215344Document84 pagesWcms 215344SKH CultureNo ratings yet

- United International University: Mid-Term Assessment Question - 2Document5 pagesUnited International University: Mid-Term Assessment Question - 2Shobha SheikhNo ratings yet

- Training Within Industry and Toyota: John Shook The First TWI Summit Orlando Florida June 6, 2007Document52 pagesTraining Within Industry and Toyota: John Shook The First TWI Summit Orlando Florida June 6, 2007Igor GrishkoNo ratings yet

- Solanki Henil Umedbhai 65000231Document3 pagesSolanki Henil Umedbhai 65000231pavnijainNo ratings yet

- My CV Shortlisted by Employer and CV Selected For Next RoundDocument7 pagesMy CV Shortlisted by Employer and CV Selected For Next Roundkashinath.abansodeNo ratings yet

- Auditing FYBAF SEM2Document8 pagesAuditing FYBAF SEM2VIKAS MISHRANo ratings yet

- Demand Forecasting in A Supply Chain: Chopra and Meindl, Chapter 4Document43 pagesDemand Forecasting in A Supply Chain: Chopra and Meindl, Chapter 4Girish Dey0% (1)

- Job Responsibilities:: Position: Technical SuperintendentDocument1 pageJob Responsibilities:: Position: Technical SuperintendentAspire SuccessNo ratings yet

- Connecting The DotsDocument2 pagesConnecting The DotsAnna Hessellund DiedrichsenNo ratings yet

- Risk Assessment UninaDocument138 pagesRisk Assessment UninaAlessandro PozielloNo ratings yet

- Mergers and Acquisitions A Synthesis of Theories ADocument4 pagesMergers and Acquisitions A Synthesis of Theories ANaison Shingirai PfavayiNo ratings yet

- Introduction To The EU-BIC Quality SystemDocument9 pagesIntroduction To The EU-BIC Quality SystemEnes Buladı100% (1)

- Admin CV 2023 - Prasad. Latest 7th FebDocument3 pagesAdmin CV 2023 - Prasad. Latest 7th FebvanpratandelNo ratings yet

- Welspun SpecialityDocument146 pagesWelspun SpecialityAteeque MohdNo ratings yet

- Logistics Performance MeasurementDocument24 pagesLogistics Performance MeasurementBelayneh TadesseNo ratings yet

- Chapter 5 QuizDocument4 pagesChapter 5 QuizAstron Smart TVNo ratings yet

- Bai Thi Cuoi Ky Mon Thanh Toan Quoc TeDocument6 pagesBai Thi Cuoi Ky Mon Thanh Toan Quoc TeNhi Tô Thị ThanhNo ratings yet

- Application DocsDocument54 pagesApplication Docsthe next miamiNo ratings yet

- Assignment Session 3 - Bunga Shiva Kamilia - 2206820176Document5 pagesAssignment Session 3 - Bunga Shiva Kamilia - 2206820176Bunga Shiva KamiliaNo ratings yet

- Velammal Engineering College, Chennai-66 Department of Management Sciences Cycle Test 1 - Exam Schedule 2014-2015 Ii Year/ Iii Semester MbaDocument2 pagesVelammal Engineering College, Chennai-66 Department of Management Sciences Cycle Test 1 - Exam Schedule 2014-2015 Ii Year/ Iii Semester MbaAbhilash AbhiNo ratings yet

- عبدالحليم العزب cv بلاس خطاب طلب توظيفDocument5 pagesعبدالحليم العزب cv بلاس خطاب طلب توظيفhalimazab070No ratings yet

- CEO Email List Database SampleDocument18 pagesCEO Email List Database SampleGokila NairNo ratings yet