Professional Documents

Culture Documents

Chapter 17.4 A

Uploaded by

agniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 17.4 A

Uploaded by

agniCopyright:

Available Formats

Chapter 17.

4 A

Department A Department B

Direct labor ………………………………………………………………………. $ 420,000 $ 300,000

Manufacturing overhead ………………………………………………….. 540,000 412,500

Machine-hours …………………………………………………………………. 18,000 1,900

Direct labor hours …………………………………………………………….. 28,000 25,000

Cost record for production of 4,000 tachometer (job no. 399) as follows:

Department A Department B

Job no. 399 (4,000 units of product):

Cost of materials used on job ………………………………………. $ 6.800 $ 4,500

Direct labor cost …………………………………………………………… 8,100 7,200

Direct labor hours ………………………………………………………… 540 600

Machine-hours …………………………………………………………….. 250 100

a. Overhead rate of job no. 399

Overhead rate for department A = manufacturing overhead A / Machine-hours A

= $ 540,000 / $ 18,000

= $ 30

Overhead rate for department B = manufacturing overhead B / Direct labor hours B

= $ 412,500 / $ 25,000

= $ 16.50

b. Total cost of job no. 399 and cost per unit

Manufacturing overhead department A = Overhead rate x Machine-hours required for job no. 399

= $ 30 x 250

= $ 7,500

Manufacturing overhead department B = Overhead rate x Direct labor -hours required for job no. 399

= $ 16.5 x 600

= $ 9,900

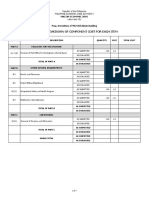

Total cost for job no. 399:

Department A Department B Total

Cost of materials used on job $ 6.800 $ 4,500 $ 11,300

Direct labor cost 8,100 7,200 15,300

Manufacturing overhead 7,500 9,900 17,400

Total cost 22,400 21,600 44,000

Cost per unit = Total cost / number of unit

= 44,000 / 4,000

= $ 11 per tachometer

c. Journal entries required to record the sale (on account) of 1,000 of the tachometers to SkiCraft

Boats. The total sales price was $19,500

Account receivable ………………………………………………………. 19,500

Sales …………………………………………………….……………………… 19,500

Sold 1,000 of tachometers to SkiCraft

d. Determining the over or under applied overhead in each department

Manufacturing overhead applied to jobs in Department A

= Actual machine hours in Department A x Overhead rate for department A

= 17,000 x $ 30

= $ 510,000

Manufacturing overhead applied to jobs in Department B

= Actual labor hours in Department B x Overhead rate for department B

= 26,000 x $ 16.5

= $ 429,000

Details Department A Department B

Actual manufacturing overhead for January $ 517,000 $ 424,400

Less: Manufacturing overhead applied to jobs $ 510,000 $ 429,000

Over or under applied overhead $ 7,000 - $ 4,600

Refer to table above, so Under applied overhead of Department A is $ 7,000; meanwhile over

applied overhead of Department B is $ 4,600.

You might also like

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- Acc123 ReviewerDocument6 pagesAcc123 ReviewerYuki GraceNo ratings yet

- Acc123 Reviewer With AnswerDocument11 pagesAcc123 Reviewer With AnswerLianaNo ratings yet

- (W5) Tutorial Answer Chapter 3 JOCDocument4 pages(W5) Tutorial Answer Chapter 3 JOCMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- Job Order Costing QuizbowlDocument27 pagesJob Order Costing QuizbowlsarahbeeNo ratings yet

- Assignment Cover Sheet: Northrise UniversityDocument6 pagesAssignment Cover Sheet: Northrise UniversitySapcon ThePhoenixNo ratings yet

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- Kerjakan 4-12 Dan 4 - 17: 1. "Plantwide"Document4 pagesKerjakan 4-12 Dan 4 - 17: 1. "Plantwide"natan. lieNo ratings yet

- Job CostingDocument3 pagesJob Costingshakibsahel0No ratings yet

- Chapter 8 Solutions ExercisesDocument25 pagesChapter 8 Solutions Exerciseswajeeda awadNo ratings yet

- Key Chapter 2 & 3Document9 pagesKey Chapter 2 & 3bxp9b56xv4No ratings yet

- Ppce Unit-5Document21 pagesPpce Unit-5Jackson ..No ratings yet

- Assignment ABC CostingDocument2 pagesAssignment ABC CostingdonneriNo ratings yet

- CH 3Document12 pagesCH 3Firas HamadNo ratings yet

- Managerial AccountingDocument6 pagesManagerial Accountingnischal subediNo ratings yet

- Tutorial 5 - Job, Batch& Service CostingDocument3 pagesTutorial 5 - Job, Batch& Service CostingPUI TUNG CHONG100% (1)

- Quiz 1 - Cost AccountingDocument6 pagesQuiz 1 - Cost AccountingKrisha MilloNo ratings yet

- Faith Job Costing ProblemsDocument10 pagesFaith Job Costing Problemsfaith olaNo ratings yet

- 4322302Document3 pages4322302mohitgaba19No ratings yet

- BBA211 Vol8 JobCostingDocument10 pagesBBA211 Vol8 JobCostingAnisha SarahNo ratings yet

- Cost and MGT Acct AssignmentDocument3 pagesCost and MGT Acct Assignmentasnake libsieNo ratings yet

- Job Costing TutorialDocument1 pageJob Costing TutorialSULEIMANNo ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- Chapter 6: Job Order Costing Exercise 6-1Document25 pagesChapter 6: Job Order Costing Exercise 6-1Iyah AmranNo ratings yet

- Answers Homework # 16 Cost MGMT 5Document7 pagesAnswers Homework # 16 Cost MGMT 5Raman ANo ratings yet

- Questions Part2 Srikant and Datar TextbookDocument5 pagesQuestions Part2 Srikant and Datar TextbookUmar SyakirinNo ratings yet

- Job Order 2Document15 pagesJob Order 2Ace LimpinNo ratings yet

- Cost AccountingDocument16 pagesCost AccountingKezia SantosidadNo ratings yet

- Handout Part Two March 31-2Document19 pagesHandout Part Two March 31-2Mohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet

- AsheSheet - UTS Manacc Sem 3Document37 pagesAsheSheet - UTS Manacc Sem 3bendiNo ratings yet

- Core2 - English - Dashboard - Assessment ReviewDocument130 pagesCore2 - English - Dashboard - Assessment Reviewpawand347No ratings yet

- Problems SolvingDocument4 pagesProblems SolvingAhmed RaeisiNo ratings yet

- Activity Based Costing-ExerciseDocument4 pagesActivity Based Costing-ExerciseKevin James Sedurifa OledanNo ratings yet

- Flexible Budget and VarianceDocument8 pagesFlexible Budget and VarianceLhorene Hope DueñasNo ratings yet

- Pinnacle First Preboards May 2023 SECUREDDocument109 pagesPinnacle First Preboards May 2023 SECUREDhotdoughhuhuhuNo ratings yet

- Reviewer Cost PrelimsDocument10 pagesReviewer Cost PrelimsClarence John G. BelzaNo ratings yet

- Answers CH 2,3 and 4Document18 pagesAnswers CH 2,3 and 4Yousef Abdullah GhundulNo ratings yet

- Problem 1.: Beginnin G EndingDocument3 pagesProblem 1.: Beginnin G EndingMarsha Zhafira ANo ratings yet

- Prelim Cost AcctngDocument2 pagesPrelim Cost AcctngAnonymous JgyJLTqpNS0% (1)

- JAVIER CA Wk13 Les JO Cost AccountingDocument5 pagesJAVIER CA Wk13 Les JO Cost AccountingCharlize Adriele C. Comprado3210183No ratings yet

- CH 7 ExcelDocument44 pagesCH 7 ExcelssdsNo ratings yet

- Assignment 1 - Engineering EconomicsDocument15 pagesAssignment 1 - Engineering EconomicsDhiraj NayakNo ratings yet

- 05 Job Order Costing-1Document15 pages05 Job Order Costing-1RodelLaborNo ratings yet

- Job CostingDocument18 pagesJob CostingBiswajeet DashNo ratings yet

- Financial Accounting Questions and Solutions Chapter 3Document7 pagesFinancial Accounting Questions and Solutions Chapter 3bazil360No ratings yet

- Chapter 6 AnswersDocument8 pagesChapter 6 AnswersYusuf HusseinNo ratings yet

- Manacc Ans KeyDocument4 pagesManacc Ans KeyJimmer CapeNo ratings yet

- Exercises Lesson 3Document2 pagesExercises Lesson 3Nino LANo ratings yet

- 4 Job Order Costing Sample ProblemsDocument6 pages4 Job Order Costing Sample ProblemsJohn Walker100% (1)

- 05.job Order Costing PDFDocument15 pages05.job Order Costing PDFArden GenesNo ratings yet

- Absorption Costing QuestionsDocument10 pagesAbsorption Costing QuestionsJean LeongNo ratings yet

- Assignment of Chapter 1 - Muad TabounDocument1 pageAssignment of Chapter 1 - Muad TabounMoad NasserNo ratings yet

- Activity Based Costing SystemDocument18 pagesActivity Based Costing SystemMAXA FASHIONNo ratings yet

- Assignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Document2 pagesAssignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Jamvy Jose FernandezNo ratings yet

- Tutorial Topic 3 Overhead CostingDocument5 pagesTutorial Topic 3 Overhead CostingPuneetNo ratings yet

- Answers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyDocument10 pagesAnswers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyAnonymous vA2xNfNo ratings yet

- Accounting For Manufacturing OverheadsDocument18 pagesAccounting For Manufacturing Overheadshi_monestyNo ratings yet

- IG5336.9201 ch1 ADocument2 pagesIG5336.9201 ch1 AHnamMahpNo ratings yet

- CHPT 19 Answer MFRS 118 Revenue-180214 - 050144Document3 pagesCHPT 19 Answer MFRS 118 Revenue-180214 - 050144Navin El Nino50% (2)

- Me8793 Process Planning and Cost EstimationDocument30 pagesMe8793 Process Planning and Cost EstimationVenkadesh Arumugam (Esaikaathalan)No ratings yet

- Part I: Nature and Scope of Managerial Economics DescriptionDocument8 pagesPart I: Nature and Scope of Managerial Economics DescriptionGamers PhilippinesNo ratings yet

- FDD-06 - JOYALUKKAS-OLD GOLD MANAGEMENT-Ver-05Document28 pagesFDD-06 - JOYALUKKAS-OLD GOLD MANAGEMENT-Ver-05yoginderNo ratings yet

- Crinkle Is Committed To Producing The Finest Hand-Crafter Christmas Ornaments This Side of The North PoleDocument9 pagesCrinkle Is Committed To Producing The Finest Hand-Crafter Christmas Ornaments This Side of The North PoleSuraj ManikNo ratings yet

- Cost DefinitionsDocument2 pagesCost DefinitionsMonina CabalagNo ratings yet

- ENGINEERING DESIGN GUILDLINE General Plant Cost Estimating Rev01web PDFDocument27 pagesENGINEERING DESIGN GUILDLINE General Plant Cost Estimating Rev01web PDFKetan RasalNo ratings yet

- Session-Costing and PricingDocument16 pagesSession-Costing and PricingDivyanshJainNo ratings yet

- Cost ClassificationDocument8 pagesCost Classificationyashwant ashokNo ratings yet

- Borrowing CostsDocument17 pagesBorrowing CostsJatin SunejaNo ratings yet

- Production Costs CalculationDocument4 pagesProduction Costs CalculationDheeraj Y V S RNo ratings yet

- Difference Between Activity Types and SKFDocument15 pagesDifference Between Activity Types and SKFSATYANARAYANA MOTAMARRINo ratings yet

- Datar 17e Accessible Fullppt 05Document29 pagesDatar 17e Accessible Fullppt 05giofani22aktpNo ratings yet

- A &B BakeryDocument13 pagesA &B BakeryKarla Therese LicosNo ratings yet

- Detailed Breakdown of Component Cost For Each Item: Mactan Economic ZoneDocument7 pagesDetailed Breakdown of Component Cost For Each Item: Mactan Economic ZoneJM PanganibanNo ratings yet

- Problem SolvingDocument2 pagesProblem SolvingGileah ZuasolaNo ratings yet

- Cost Concept and ClassificationDocument45 pagesCost Concept and ClassificationMountaha0% (1)

- Evolution & Growth of HRMDocument69 pagesEvolution & Growth of HRMAnjana AnilkumarNo ratings yet

- Cost Acctg 1617 2ndsem CE AKDocument10 pagesCost Acctg 1617 2ndsem CE AKanon_684731700% (1)

- Required: 1a. Assuming That The Company Has No Alternative Use For The Facilities Now Being Used ToDocument2 pagesRequired: 1a. Assuming That The Company Has No Alternative Use For The Facilities Now Being Used ToErica AbegoniaNo ratings yet

- Coop Chart of AccountsDocument30 pagesCoop Chart of AccountsAmalia Dela Cruz100% (16)

- COST SHEET NumericalsDocument9 pagesCOST SHEET Numericalsmisaki chanNo ratings yet

- Natural Resource EconDocument11 pagesNatural Resource EconSarvesh JP NambiarNo ratings yet

- Test Bank For Accounting Principles 6th Canadian Edition Volume 1 Jerry J Weygandt Donald e Kieso Paul D Kimmel Barbara Trenholm Valerie Kinnear Joan e Barlow 2Document31 pagesTest Bank For Accounting Principles 6th Canadian Edition Volume 1 Jerry J Weygandt Donald e Kieso Paul D Kimmel Barbara Trenholm Valerie Kinnear Joan e Barlow 2cynthiaacostabsjeiaxmqk100% (32)

- Tahmina Ahmed Instructor Cost AccountingDocument19 pagesTahmina Ahmed Instructor Cost Accountingfaraazxbox1No ratings yet

- Activity Based Costing in S4 HanaDocument9 pagesActivity Based Costing in S4 HanaAtul MadhusudanNo ratings yet

- Rera-Form-2-Engineer's CertificateDocument3 pagesRera-Form-2-Engineer's CertificateCA Amit RajaNo ratings yet

- HR Valuation and AccountingDocument10 pagesHR Valuation and AccountingSanskar YadavNo ratings yet