Professional Documents

Culture Documents

Convertible Debt Financing Is A Key Fund-Raising Tool: Banking/Financial Services Quarterly

Uploaded by

no name0 ratings0% found this document useful (0 votes)

7 views1 pageconvertible debt

Original Title

BBJ

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentconvertible debt

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageConvertible Debt Financing Is A Key Fund-Raising Tool: Banking/Financial Services Quarterly

Uploaded by

no nameconvertible debt

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

September 12-18, 2008

BANKING/FINANCIAL SERVICES QUARTERLY

Convertible debt financing is a key fund-raising tool

Today’s down economy poses additional By issuing promissory notes purchase capital stock of the company.

hurdles for startup companies that are try- The discount is typically between 10 per-

ing to raise money from institutional inves- that convert into equity as cent and 30 percent of the price paid in the

tors. However, a valuable fundraising tool financing. The warrant is a right to purchase

in a down economy, which many entrepre- part of a future preferred shares of capital stock of the company at

neurs are not familiar with, is a convertible stock financing, companies an exercise price based on the fair market

debt, or bridge, financing. value of the stock at the time of issuance of

By issuing promissory notes that con- can raise capital to “bridge” the warrant. The number of shares underly-

vert into equity as part of a future preferred ing the warrant is based on a percentage,

stock financing, companies can raise capi- them to the future. generally 10 percent to 30 percent, of the

tal to “bridge” them to the future. principal amount of the debt divided by the

As part of a convertible debt financing, ny and investors do not need to agree upon price per share paid in the preferred stock

companies issue promis- valuation, which will be determined at the financing.

time of the next round of financing. Valuing • Familiarity. A convertible debt financing

INSIDER sory notes. The principal

and accrued interest un- the company at the time of the next round is generally not likely to present obstacles

VIEW der each note are not re- is helpful because the company will be fur- to completing a preferred stock financing

paid by the company in ther along in its development and therefore, in the future because venture capital firms

Mick installments over time, can be easier to value. In addition, investors and institutional investors, which could

Bain but instead become due in the next round may be more experienced participate in the future, are familiar with

and and payable in full on in conducting valuations. the structure.

Joshua the maturity date, typi- • Efficiency. A preferred stock financing • No impact on common stock. Some en-

Fox cally one to two years involves the preparation and negotiation of trepreneurs consider selling common stock

after the date of issuance more extensive documentation than a con- to raise capital, to avoid having to complete

of the note, unless the company completes vertible debt financing. With fewer and less a more complicated, less favorable preferred

a “qualified financing” prior to the maturity complicated documents, a convertible debt stock financing. However, selling common

date. financing can be completed more quickly stock for fundraising purposes typically re-

A “qualified financing” is a preferred and at a lower cost. sults in a high purchase price, and hence,

stock financing that meets certain criteria, • Attractiveness. In order to successfully high fair market value of common stock,

including a minimum amount of money raise capital, a company must present an at- making it difficult for a company to offer

raised. Upon completion of the financing, tractive opportunity to potential investors. equity incentives to potential employees at

the debt converts into shares of the same Convertible debt financings have features a low price. Convertible debt financings do

series of preferred stock issued to other in- that are attractive to investors. Holders of not present this issue because they do not

vestors. promissory notes are creditors, and as such, affect common stock valuation.

Structuring an early-stage investment as would receive preferential treatment as A convertible debt financing is a cost-ef-

convertible debt has the following advan- compared with equity holders in the event fective method of raising capital for a com-

tages: of a bankruptcy or liquidation of the com- pany that needs money in the short-term,

• No valuation. Selling equity requires the pany. And holders of promissory notes of- but that plans to raise more money at some

company and investors to negotiate a value ten receive a “sweetener”: Either the notes point in the future.

for the company, which can be difficult for convert into preferred stock in the future

early-stage companies, especially if inves- round of financing at a “discount” to the Mick Bain is a partner and Joshua Fox

tors are not experienced in performing val- price paid by other investors in that financ- is counsel in the venture group at WilmerHale.

uations. With convertible debt, the compa- ing or the note holders receive a warrant to They are based in the firm’s Waltham office.

Reprinted for web use with permission of Boston Business Journal. ©2008, all rights reserved.

Reprinted exclusively by Scoop ReprintSource 1-800-767-3263.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Managerial Economics GuideDocument6 pagesManagerial Economics GuideJenz Alemana100% (6)

- Elasticity of DemandDocument39 pagesElasticity of Demandarpit_is_dube6986% (7)

- Convertible BondsDocument2 pagesConvertible Bondsno nameNo ratings yet

- K9 - 2002 Creative Industries Contracts Between Art and Commerce2 1Document3 pagesK9 - 2002 Creative Industries Contracts Between Art and Commerce2 1deboraNo ratings yet

- What To Do With Excess Cash - UBSDocument48 pagesWhat To Do With Excess Cash - UBSno nameNo ratings yet

- Gross Margin AnalysisDocument10 pagesGross Margin Analysisjayson0% (1)

- Employee Stock Options: A Concise GuideDocument26 pagesEmployee Stock Options: A Concise GuideMurtaza VadiwalaNo ratings yet

- UTF-8 Stanford Cisco Expansion 2000Document23 pagesUTF-8 Stanford Cisco Expansion 2000Krishan Kumar SharmaNo ratings yet

- Term Sheet 970Document11 pagesTerm Sheet 970no nameNo ratings yet

- Watson Wyatt PresentationDocument18 pagesWatson Wyatt Presentationno nameNo ratings yet

- Best Practices in Corporate RestructuringDocument16 pagesBest Practices in Corporate Restructuringno nameNo ratings yet

- Investment Basics I: ObjectivesDocument14 pagesInvestment Basics I: Objectivesno nameNo ratings yet

- A. Bernstein - 03.26.08Document48 pagesA. Bernstein - 03.26.08no nameNo ratings yet

- Structuring and Negotiating A Convertible Note Offering: By: John P. ClearyDocument4 pagesStructuring and Negotiating A Convertible Note Offering: By: John P. Clearyno nameNo ratings yet

- Eqshare 9Document16 pagesEqshare 9gagan585No ratings yet

- Convertible Bond Analysis: Key Figures and CalculationsDocument1 pageConvertible Bond Analysis: Key Figures and Calculationsno nameNo ratings yet

- The Business Appraiser As ESOP Trustee: by Allan Lannom - Chicago OfficeDocument4 pagesThe Business Appraiser As ESOP Trustee: by Allan Lannom - Chicago Officeno nameNo ratings yet

- Convertible NoteDocument4 pagesConvertible Noteno nameNo ratings yet

- Converts PrimerDocument6 pagesConverts Primerjunjun07_01No ratings yet

- Convertible bonds as an asset class overviewDocument97 pagesConvertible bonds as an asset class overviewno nameNo ratings yet

- Moodys 66988Document20 pagesMoodys 66988no nameNo ratings yet

- Example: Cost of Capital For Amgen: $5.11 BillionDocument2 pagesExample: Cost of Capital For Amgen: $5.11 Billionno nameNo ratings yet

- CDIAC Role of FA and UnderwriterDocument14 pagesCDIAC Role of FA and Underwriterno nameNo ratings yet

- 22Nd Annual Ohio Employee Ownership Conference: Abcs of Stock Valuation For Employee-OwnersDocument20 pages22Nd Annual Ohio Employee Ownership Conference: Abcs of Stock Valuation For Employee-Ownersno nameNo ratings yet

- ESOP Repurchase Liability and LiquidityDocument56 pagesESOP Repurchase Liability and Liquidityno nameNo ratings yet

- 22Nd Annual Ohio Employee Ownership Conference: Abcs of Stock Valuation For Employee-OwnersDocument20 pages22Nd Annual Ohio Employee Ownership Conference: Abcs of Stock Valuation For Employee-Ownersno nameNo ratings yet

- Esops in Government Contracting Firms: A Natural FitDocument29 pagesEsops in Government Contracting Firms: A Natural Fitno nameNo ratings yet

- Financing An ESOPDocument43 pagesFinancing An ESOPno nameNo ratings yet

- Using Esops in Corporate TransactionsDocument12 pagesUsing Esops in Corporate Transactionsno nameNo ratings yet

- Lending Issues in ESOP BuyoutDocument27 pagesLending Issues in ESOP Buyoutno nameNo ratings yet

- The ESOP Solution: Employee Ownership ExplainedDocument25 pagesThe ESOP Solution: Employee Ownership Explainedno nameNo ratings yet

- Employee Stock Ownership Plans PDFDocument55 pagesEmployee Stock Ownership Plans PDFno nameNo ratings yet

- Top 10 Issues in Auditing Esops What Is Up With Esops?Document13 pagesTop 10 Issues in Auditing Esops What Is Up With Esops?no nameNo ratings yet

- Internship Report: On Bashundhara Cement in B2B SectorDocument32 pagesInternship Report: On Bashundhara Cement in B2B SectorAKASH CHANDRA PAULNo ratings yet

- PSU IVY Fundamentals of EconomicsDocument118 pagesPSU IVY Fundamentals of Economics808kailuaNo ratings yet

- Lesson 4 EntrepDocument2 pagesLesson 4 Entrepzelz 7u7No ratings yet

- Economics Chapter 3Document15 pagesEconomics Chapter 3cyndaleaNo ratings yet

- Module 3Document13 pagesModule 3Piyush AneejwalNo ratings yet

- Submission On Sunbeam Coffee From ITCDocument7 pagesSubmission On Sunbeam Coffee From ITCGautamNo ratings yet

- 46712bosfnd p4 Part2 Cp6Document26 pages46712bosfnd p4 Part2 Cp6RushikeshNo ratings yet

- SA Syl12 Jun2014 P10 PDFDocument21 pagesSA Syl12 Jun2014 P10 PDFpatil_viny1760No ratings yet

- Business: Economic Issues: An IntroductionDocument15 pagesBusiness: Economic Issues: An Introduction李嘉威No ratings yet

- The Behavior of Interest RateDocument30 pagesThe Behavior of Interest RateSari Adinda PasaribuNo ratings yet

- Usulan Perancangan Sistem Customer Relationship Management (CRM) Outlet Air Minum Isi Ulang Daily Fresh Water Menggunakan Metode CRM-IRISDocument10 pagesUsulan Perancangan Sistem Customer Relationship Management (CRM) Outlet Air Minum Isi Ulang Daily Fresh Water Menggunakan Metode CRM-IRISIrfan PrimantoNo ratings yet

- Reflection of Financial ManagementDocument1 pageReflection of Financial ManagementNitanshu ChavdaNo ratings yet

- Basics of Financial Market: Report By: Rahul SinghDocument47 pagesBasics of Financial Market: Report By: Rahul Singhrrajpoot_1No ratings yet

- Chapter 4-QuestionDocument3 pagesChapter 4-Questionnurhanikhalilah21No ratings yet

- Chapter 15Document29 pagesChapter 15Minhazul SiamNo ratings yet

- Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test BankDocument7 pagesModern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bankamywrightrcnmqbajyg100% (13)

- Om AssignmentDocument5 pagesOm AssignmentDarshini Darshu100% (1)

- Call Money and Repo RateDocument20 pagesCall Money and Repo RateShashank JoganiNo ratings yet

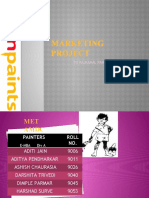

- AsianPaints Marketing ProjectDocument20 pagesAsianPaints Marketing ProjectNeha LakhaniNo ratings yet

- Answers To Quiz 4 Summer 2013Document2 pagesAnswers To Quiz 4 Summer 2013Melissa Vásquez TrujilloNo ratings yet

- ME Presentation TATA NANODocument14 pagesME Presentation TATA NANOsagaranjosNo ratings yet

- Viral Marketing: A Promotional Method That Spreads RapidlyDocument9 pagesViral Marketing: A Promotional Method That Spreads RapidlyMani VardhanNo ratings yet

- Using The Marketing Mix To Drive ChangeDocument6 pagesUsing The Marketing Mix To Drive ChangeTengo ÑañarasNo ratings yet

- Group Assignment 1 PDFDocument13 pagesGroup Assignment 1 PDFeffer scenteNo ratings yet

- Shabysal: Final Exam Business PlanDocument13 pagesShabysal: Final Exam Business PlanClarisa MarshaNo ratings yet

- Venn Diagram Infographics Marketing ProcessDocument20 pagesVenn Diagram Infographics Marketing ProcessjameelrahmanNo ratings yet