Professional Documents

Culture Documents

Alpen Bank PDF

Alpen Bank PDF

Uploaded by

NikhilRPandey0 ratings0% found this document useful (0 votes)

12 views14 pagesOriginal Title

144201209-Alpen-Bank.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views14 pagesAlpen Bank PDF

Alpen Bank PDF

Uploaded by

NikhilRPandeyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 14

Introduction

• Gregory Carle -country manager of Romania (14 branches)

• Serving affluent class of over 200 000 customers with

excellent services

• Financial planning and investment services through its

wealth management program

• Credit card introduction delayed due to

– low per capita incomes

– poorly developed infrastructure of point of sales terminals

– public’s lack of experience with such facilities

– low merchant acceptance

• European union inclusion

• Recovery from recession- improved middle class

but low urban population and incomes

• 2000 onwards

– Disposal incomes of upper and upper-middle class rose

and the payment system infrastructure progressed

– Consumer preferences

– Financial cards rose by 35% from 2005-2006 but actual

usage rate was still low

• Required profit of €5million annually, skepticism

• Merchant discounts depend on the transaction volume

and are split amongst networks/card associations,

merchant acquirers and card issuers

• Interchange, annual and penalty fees and interest charges,

which are earned from ‘revolvers’, who are customers that

delay payments

• “Transactors” are customers who pay off bills in time

• Potential customers were the upper and middle class

– Upper class (earning at least €500/month) could be charged

higher and would be frequent users

– Middle class (earning over €200/month) also an attractive

segment, would expect lower charges and may not actually

utilize the credit cards

– Brand positioning may be distorted

Problems

• Major issue at hand Alpen Bank is facing is the launching of

a credit card

• Threat of losing their most profitable customers and

disturbance in financials

• Low acceptability of Credit Cards at the end of merchants

• People not aware of Credit card benefits

• Management of the bank double minded

• The need for the most cost effective marketing channel

initially

Suggestions

• Upcoming trend favored the usage of Credit Cards

(Usage increased by 35%)

• Alpen Bank needed to set its target to the upper-

middle and affluent class

• Position the credit card as a supreme brand

(Favorable to target the middle class indirectly)

• Underpenetrated market of Romania (Advertising to

attract people)

• Less risk of default of the customers of Alpen

Bank

• Increased sales of the merchants by the usage of

credit cards

• The bank can use the cross sell method

– High response rate 50% & Qualification rate 90%

– Cost per customer will be 2.2 Euros

• Second best method is the direct sales

– Response rate 50%, qualification rate 60%

– Cost per customer will be 3.3 Euros

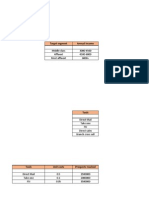

Financial Analysis

Revenues

% of total Annual Revenue

Segments Annual Income No. of customers

population per customer

Middle class 3000-4500 18.2 % 3,385,200 60.63

Affluent 4,500-6000 15% 2,790,000 123.38

Most Affluent 6,000+ 6.6% 2,399,000 209.75

Total Cardholder population = 18.6 m

Average annual Revenue per card holder (middle class & affluent) = 122.78 Euros

Average annual Revenue per card holder (affluent) = 163. 31 Euros

Cost

No. of Cost per

Prospects Response Qualificati

Unit Cost cardholder Total cost Card

reached Rate on Rate

s holder

Direct Mail 0.50 2.50 m 3.0% 60.0% 38,250 1.25m 32.68

Take One .10 2.00m 2.5% 30% 12,750 .2m 15.69

FSIs .05 3.5m 1.5% 30% 13,388 .175m 13.07

Direct

3000/ rep .06m 25% 60.0% 7,650 .03m 3.92

Sales

Branch

1.00 .05m 50.0% 90.% 19,125 .05m 2.61

Cross-sell

91,163

Total cost per customer = 1,705,000/91,163 = 18.70 Euros

Without Direct mail = 455,000/52,913 = 8.6 Euros

Affluent

No. of Cost per

Prospects Response Qualificati

Unit Cost cardholder Total cost Card

reached Rate on Rate

s holder

Direct Mail 0.50 1.25 m 3.0% 60.0% 19,125 .625m 32.68

Take One .10 2.00m 2.5% 15% 6,375 .2m 15.69

FSIs .05 3.5m 1.5% 15% 6,694 .175m 13.07

Direct

3000/ rep .06m 25% 60.0% 7,650 .03m 3.92

Sales

Branch

1.00 .05m 50.0% 90.% 19,125 .05m 2.61

Cross-sell

58,969

Total cost per customer = 1,080,000/58969 = 18.31 Euros

Without Direct mail = 455,000/39844 = 11.42 Euros

Break even analysis

# of customers 50,000 100,000 150,000 200,000

Rev. per customer 122.78 122.78 122.78 122.78

Acquisition cost 18.75 18.75 18.75 18.75

Direct Cost 20 17.5 15 12.5

Total V. Cost 38.75 36.25 33.75 31.25

Total Revenue 6.139m 12.278m 18.417m 24.556m

Fixed cost 7m 7.750m 8.5m 9.250m

V. cost 1.937m 2.687m 3.137m 3.437m

Net Profit -2.798 1.841m 6.78m 11.869m

Break even customers

122.78(X+50,000) – (7.750m) – (50,000*17.5 + 36.25*X) =

28,758

Total customers for break even = 78,758

For 5 Million ROI

122.78(X+100,000) – (8.50m) – (100,000*15 + 33.75*X) =

30,574

Total customers for break even = 130,574

Break even analysis (affluent)

# of customers 50,000 100,000 150,000 200,000

Rev. per customer 163.31 163.31 163.31 163.31

Acquisition cost 18.31 18.31 18.31 18.31

Direct Cost 20 17.5 15 12.5

Total V. Cost 38.31 35.81 33.31 30.81

Total Revenue 8.165m 16.331m 24.496m 32,662m

Fixed cost 7m 7.750m 8.5m 9.250m

V. cost 1.915m 2.665m 3.165m 3.415m

Net Profit -.75m 5.916m 12.831m 19.997m

Break even customers

163.31(X+50,000) – (7.750m) – (50,000*17.5 + 35.81*X) = 3,604

Total customers for break even = 53,604

For 5 Million ROI

163.31(X+50,000) – (7.750m) – (50,000*17.5 + 35.81*X) =

42,823

Total customers for break even = 92,823

You might also like

- Clean Edge Razor Case Study AnalysisDocument5 pagesClean Edge Razor Case Study Analysisbinzidd007100% (7)

- Chase SapphireDocument19 pagesChase SapphireKafian TriyogaNo ratings yet

- Case Analysis For Alpen BankDocument4 pagesCase Analysis For Alpen BankShweta SrivastavaNo ratings yet

- Altius Excel DSDocument6 pagesAltius Excel DSShreya Gupta0% (1)

- MGMT 59000 - Customer AnalyticsDocument15 pagesMGMT 59000 - Customer AnalyticsAaron ChenNo ratings yet

- Psi Case SolutionDocument3 pagesPsi Case Solutionsantiago bernal torresNo ratings yet

- Group3 - Pilgrim Bank (A) Customer ProfitabilityDocument13 pagesGroup3 - Pilgrim Bank (A) Customer ProfitabilitySaathwik ChandanNo ratings yet

- Alpen Bank AnalysisDocument11 pagesAlpen Bank Analysismadhavjoshi63No ratings yet

- Alpen Bank Case AnalysisDocument13 pagesAlpen Bank Case Analysisaashu1991No ratings yet

- Alpen Bank Case StudyDocument4 pagesAlpen Bank Case StudyAnson Heryanto0% (1)

- Alpen Bank LaunchingDocument7 pagesAlpen Bank LaunchingUjval BuchaNo ratings yet

- E Auction For Tea - The Indian ExperienceDocument40 pagesE Auction For Tea - The Indian ExperienceAnil Kumar Singh67% (3)

- Altius Part3Document2 pagesAltius Part3Somil GuptaNo ratings yet

- Group 4: Amit Sarda - Esha Sharma - Meeta Arya - Swati SachdevaDocument8 pagesGroup 4: Amit Sarda - Esha Sharma - Meeta Arya - Swati SachdevaAmit SardaNo ratings yet

- Case Study MMDocument4 pagesCase Study MMMehdi TaseerNo ratings yet

- Eureka ForbesDocument18 pagesEureka ForbesSanjeev Kumar SinghNo ratings yet

- Consumer Perception Towards Different TV Brands in BangladeshDocument16 pagesConsumer Perception Towards Different TV Brands in BangladeshMahmud Hasan100% (2)

- Omnitel Pronto ItaliaDocument12 pagesOmnitel Pronto ItaliaKaranpal Singh JulkaNo ratings yet

- HUL - RM B - Group12Document10 pagesHUL - RM B - Group12DEWASHISH RAINo ratings yet

- HSBC Credit Card Rewards ProgramDocument26 pagesHSBC Credit Card Rewards Programshirlydurham3466No ratings yet

- Dabur India Ltd. - Globalization: Case AnalysisDocument12 pagesDabur India Ltd. - Globalization: Case Analysis9874567100% (1)

- Alpen Case Group 3Document13 pagesAlpen Case Group 3Ruchika100% (1)

- Case Analysis For Alpen BankDocument7 pagesCase Analysis For Alpen BankKhalil AhmadNo ratings yet

- Alpen Bank AnalysisDocument14 pagesAlpen Bank AnalysisSiddharth ShettyNo ratings yet

- Bank InterDocument6 pagesBank Intermsethi2684No ratings yet

- Commerce Bank PPTDocument11 pagesCommerce Bank PPTarihantNo ratings yet

- "Think Fresh, Deliver More": A PresentationDocument63 pages"Think Fresh, Deliver More": A PresentationKapil Kumar JhaNo ratings yet

- NYTPaywall 15PGPIM45 Shankar AnanthDocument1 pageNYTPaywall 15PGPIM45 Shankar AnanthRaviTejaNo ratings yet

- Correction - Case B - Aditi - Agro - ChemicalsDocument7 pagesCorrection - Case B - Aditi - Agro - Chemicalsmridul jain100% (1)

- Chapter: One: 1.1origin of The ReportDocument38 pagesChapter: One: 1.1origin of The ReportRaihan PervezNo ratings yet

- CRMDocument23 pagesCRMAnkush GuptaNo ratings yet

- The Fashion ChannelDocument6 pagesThe Fashion ChannelSankha BhattacharyaNo ratings yet

- Air Miles CanadaDocument13 pagesAir Miles Canadaimanharyanto79No ratings yet

- American Well: The Doctor Will E-See You Now - CaseDocument7 pagesAmerican Well: The Doctor Will E-See You Now - Casebinzidd007No ratings yet

- Pilgrim Bank ADocument5 pagesPilgrim Bank ANoora BlueNo ratings yet

- Hilton Honors Worldwide Loyalty Wars: Divya Iyer PGP15/140Document8 pagesHilton Honors Worldwide Loyalty Wars: Divya Iyer PGP15/140Divya IyerNo ratings yet

- Mountain Man Brewing Company ProjectDocument41 pagesMountain Man Brewing Company Projectmon309250% (2)

- Tale of Two Companies, Case SummaryDocument3 pagesTale of Two Companies, Case Summaryshershah hassan0% (1)

- Ashish Patel Roll No. - 190101033 Section - E Q1. Calculate Margin For All Scenarios Answer: AnswerDocument3 pagesAshish Patel Roll No. - 190101033 Section - E Q1. Calculate Margin For All Scenarios Answer: AnswerAshish PatelNo ratings yet

- TripadvisorDocument12 pagesTripadvisorsvdNo ratings yet

- Infosys's Relationship Scorecard: Measuring Transformational RelationshipsDocument6 pagesInfosys's Relationship Scorecard: Measuring Transformational RelationshipsVijeta GourNo ratings yet

- Vanguard Final PDFDocument2 pagesVanguard Final PDFAnubhav911No ratings yet

- Lighting Market in India: Market Size (2011) 9.2 Billion Growth of 16.2 % From 2010 CAGR of 12.8 % (2005 To 2011)Document2 pagesLighting Market in India: Market Size (2011) 9.2 Billion Growth of 16.2 % From 2010 CAGR of 12.8 % (2005 To 2011)Nimish Joshi100% (1)

- Group 3 - London Olympic Games 2012Document27 pagesGroup 3 - London Olympic Games 2012Arieviana Ayu LaksmiNo ratings yet

- Pilgrim Bank C QuestionsDocument1 pagePilgrim Bank C QuestionsShahriar ShahidNo ratings yet

- Section-B Group-2 MM2 Case ProjectDocument11 pagesSection-B Group-2 MM2 Case ProjectSusheel MenonNo ratings yet

- CRM of TowngasDocument6 pagesCRM of TowngasBrijesh PandeyNo ratings yet

- Aqualisa CaseDocument6 pagesAqualisa CaseArjun Talwar100% (1)

- The Fashion Channel Case StudyDocument3 pagesThe Fashion Channel Case StudyMadhur PahujaNo ratings yet

- Case MethodDocument10 pagesCase MethodEka Moses MarpaungNo ratings yet

- Patient Transfusion Testing IndustryDocument9 pagesPatient Transfusion Testing IndustryRasagna RajNo ratings yet

- Customer Relationship Management at Capital One (UKDocument25 pagesCustomer Relationship Management at Capital One (UKRakesh SharmaNo ratings yet

- Hilton HHonorsDocument5 pagesHilton HHonorsArjun KalraNo ratings yet

- All Stars Sports Catalog Case Study Analysis: Decision Making at The TopDocument14 pagesAll Stars Sports Catalog Case Study Analysis: Decision Making at The TopHARJOT SINGH100% (1)

- Crafting Winning Strategies in A Mature Market: The US Wine Industry in 2001Document12 pagesCrafting Winning Strategies in A Mature Market: The US Wine Industry in 2001Devika NarulaNo ratings yet

- Commerce Bank CaseDocument4 pagesCommerce Bank Casecrest_troughNo ratings yet

- Hilton Hhonors WorldwideDocument35 pagesHilton Hhonors Worldwidevivekchaubey67% (3)

- Customer Centricity at Commerce Bank: Presented by Group No. 08Document7 pagesCustomer Centricity at Commerce Bank: Presented by Group No. 08bhavnaNo ratings yet

- Silvia Caffe - Case - TextDocument1 pageSilvia Caffe - Case - TextShubhankar AsijaNo ratings yet

- Pilgrim Bank Case: AMR AssignmentDocument8 pagesPilgrim Bank Case: AMR AssignmentRahulTiwariNo ratings yet

- Alpen Bank in Romania: Authors: Aleksandre Chiqobava, Natia Bliadze and Murtaz PutkaradzeDocument14 pagesAlpen Bank in Romania: Authors: Aleksandre Chiqobava, Natia Bliadze and Murtaz Putkaradzeprerna2goelNo ratings yet

- Alpha Bank Launching Credit Card in RomaniaDocument6 pagesAlpha Bank Launching Credit Card in RomaniaBadea TeodorNo ratings yet

- SAL ES: "Marketing Strategy Is The Brain To Create Competitive Advantage - Not Present in Adamjee"Document1 pageSAL ES: "Marketing Strategy Is The Brain To Create Competitive Advantage - Not Present in Adamjee"9874567No ratings yet

- Financials VarietyDocument2 pagesFinancials Variety9874567No ratings yet

- Analysis of TruEarthDocument4 pagesAnalysis of TruEarth9874567100% (1)

- North-East % Contribution by Each Category North-Central% Contribution by Each CategoryDocument4 pagesNorth-East % Contribution by Each Category North-Central% Contribution by Each Category9874567No ratings yet

- 12 SW PrintingDocument13 pages12 SW Printing9874567No ratings yet

- Coca-Cola Company - 2007: A. Case AbstractDocument14 pagesCoca-Cola Company - 2007: A. Case Abstract987456750% (4)

- Employment - Form NetsolDocument8 pagesEmployment - Form Netsol9874567No ratings yet

- Advertising's Role in Marketing: Web Review QuestionsDocument4 pagesAdvertising's Role in Marketing: Web Review Questions9874567No ratings yet

- 06 Anheuser BuschDocument13 pages06 Anheuser Busch9874567No ratings yet

- Hypothesis TestingDocument6 pagesHypothesis TestingFahad JavaidNo ratings yet

- Income Redistribu0on: Public Finance Week 4: Lecture 1 Hina KhalidDocument27 pagesIncome Redistribu0on: Public Finance Week 4: Lecture 1 Hina Khalid9874567No ratings yet

- 07 Hewlett PackardDocument16 pages07 Hewlett Packard9874567No ratings yet

- AIESEC's Networking Dinner Invitees 2013 + 2012Document10 pagesAIESEC's Networking Dinner Invitees 2013 + 20129874567No ratings yet

- Fed Flat TaxDocument21 pagesFed Flat Tax9874567No ratings yet

- Dairy Farm 100 Cows Project Financials Excel Sheet Dairy Farming PDFDocument16 pagesDairy Farm 100 Cows Project Financials Excel Sheet Dairy Farming PDFDrAnant S. NigamNo ratings yet

- Chapter 2 HomeworkDocument2 pagesChapter 2 Homeworkkabi7725No ratings yet

- ActiveDocument5 pagesActivePal RozsnyoiNo ratings yet

- 180-Day OCHR Fact SheetDocument2 pages180-Day OCHR Fact SheetRich DawsonNo ratings yet

- (LN) Engineering Economy - EnginerdmathDocument39 pages(LN) Engineering Economy - EnginerdmathBambi InjangNo ratings yet

- Coduri Piese Logan 1Document5 pagesCoduri Piese Logan 1Barsan AdrianNo ratings yet

- Harley Davidson Indonesia - Daftar Harga Motor Harley Davidson Terbaru 2023 Oto PDFDocument1 pageHarley Davidson Indonesia - Daftar Harga Motor Harley Davidson Terbaru 2023 Oto PDFDwi NabillaNo ratings yet

- Municipal Solid Waste Management: Opportunities For Russia - Summary of Key FindingsDocument24 pagesMunicipal Solid Waste Management: Opportunities For Russia - Summary of Key FindingsIFC Sustainability100% (1)

- UntitledDocument43 pagesUntitledThaddeus TungNo ratings yet

- Jute - The Golden FiberDocument43 pagesJute - The Golden FiberSwati Milind RajputNo ratings yet

- Davos The Nordic Way FinalDocument15 pagesDavos The Nordic Way FinalJosh HughesNo ratings yet

- 5UIBE StudyGuideDocument69 pages5UIBE StudyGuideYan Myo Zaw100% (1)

- For Each Question 23 - 30, Mark One Letter (A, B or C) For The Correct Answer. - You Will Hear The Conversation TwiceDocument2 pagesFor Each Question 23 - 30, Mark One Letter (A, B or C) For The Correct Answer. - You Will Hear The Conversation TwiceMa Emilia100% (1)

- Https Secure - Icicidirect.com IDirectTrading Trading Equity IClick2GainDocument1 pageHttps Secure - Icicidirect.com IDirectTrading Trading Equity IClick2GainVijay KurkureNo ratings yet

- Cloze Test Practice SetDocument3 pagesCloze Test Practice SetRohiniNo ratings yet

- Economics of The SingularityDocument4 pagesEconomics of The Singularityapi-26444772No ratings yet

- Biomass Feasibility StudyDocument51 pagesBiomass Feasibility StudySalli MarindhaNo ratings yet

- Return On Invested CapitalDocument3 pagesReturn On Invested CapitalZohairNo ratings yet

- Chapter 6a (Depreciation)Document11 pagesChapter 6a (Depreciation)quraisha irdinaNo ratings yet

- Theories of Multiplier, Accelerator and Business CyclesDocument30 pagesTheories of Multiplier, Accelerator and Business CyclesProfessor Tarun DasNo ratings yet

- UzBekistan Market OverviewDocument21 pagesUzBekistan Market OverviewmanojNo ratings yet

- Didi Ticket PDFDocument3 pagesDidi Ticket PDFSukirti KapoorNo ratings yet

- Environmental Factors For Conducting BusinessDocument5 pagesEnvironmental Factors For Conducting BusinessjaiontyNo ratings yet

- Cleantech 101Document13 pagesCleantech 101api-25918538No ratings yet

- Glastonbury Festival B1 EXERCISEDocument2 pagesGlastonbury Festival B1 EXERCISEBlanca LSNo ratings yet

- Jida Communication Philippines Inc.: Project Plan 2024Document25 pagesJida Communication Philippines Inc.: Project Plan 2024Jasmine Concepcion A. CuaresmaNo ratings yet

- Kapatiran Brochure Updated PDFDocument2 pagesKapatiran Brochure Updated PDFCfc-sfc Naic ChapterNo ratings yet

- Company Profile Shiv DevelopersDocument10 pagesCompany Profile Shiv Developersomkarmhatr2307No ratings yet

- Ponzi SchemeDocument9 pagesPonzi Schemesekhar5640% (1)

- Ubs Europe EtfDocument44 pagesUbs Europe Etfaklank_218105No ratings yet