Professional Documents

Culture Documents

Sales and Tax Declaration Form 2020

Uploaded by

k act100%(1)100% found this document useful (1 vote)

443 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

443 views1 pageSales and Tax Declaration Form 2020

Uploaded by

k actCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

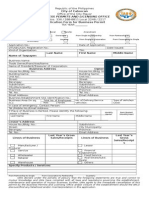

Republic of the Philippines SALES DECLARATION

Quezon City AND EVALUATION FORM

Pursuant to the provisions of Ordinance No. SP-91, series of 1993 as amended, otherwise known as the Quezon

City Revenue Code, pertaining to the payment of business taxes and fees in relation to the renewal of business

permits, I hereby declare the following:

Name of taxpayer (owner/operator)

Trade/Business Name

Type of business Corporation Partnership Single Proprietorship Cooperative SEC Reg. No.

Business address (number/street/building/barangay/district) No.______ Street

Building Name __________________________________________ Barangay ____________________________District No.

AREA (in MAYOR’S/BUSINESS GROSS SALES / RECEIPTS (in pesos)

KIND OF BUSINESS PERMIT NO.

sq. meters) 2018 2019

ORIGINAL DOCUMENTS TO BE PRESENTED IN THE

FOLLOWING ORDER FROM STEP 1 TO STEP __.

Please mark (✓)

2019 Business Permit

2019 Tax Bill and Official Receipt received from the

City Treasurer's Office

2019 Certified breakdown of sales, if there are two or

more lines of businesses/two or more branches

2019 Value Added Tax Returns/ Percentage Tax Returns,

whichever is applicable

I hereby certify, under the penalties of perjury, that 2018 Annual Income Tax Returns with complete set of

the entries herein declared are true and correct to Audited Financial Statement, with proof of payment

the best of my knowledge and belief as reflected in

my books of accounts.

Note: Taxpayer must present ALL applicable documents listed above to

proceed to evaluation. No other documents may be required from the

taxpayer other than those listed above.

NAME AND SIGNATURE OF TAX PAYER/

AUTHORIZED REPRESENTATIVE

Portion to be filled up by Quezon City Government personnel

TAX YEAR NATURE OF BUSINESS GROSS SALES/RECEIPTS (pesos) REMARKS/FINDINGS

Evaluator’s full name

Signature

Date of evaluation

QCG-CTO(BT)F1-V2

You might also like

- Sales Declaration and Evaluation FormDocument1 pageSales Declaration and Evaluation FormMcAsia Foodtrade Corp100% (1)

- Death Anniversary PDFDocument3 pagesDeath Anniversary PDFk actNo ratings yet

- Tax HillDocument235 pagesTax HillTawanda Tatenda Herbert100% (1)

- Memo To Suppliers - Invoicing Requirements - 2019Document5 pagesMemo To Suppliers - Invoicing Requirements - 2019Mark MagallanesNo ratings yet

- Fs - Evilla, E. (Vertam Farms Opc) 2020Document44 pagesFs - Evilla, E. (Vertam Farms Opc) 2020Ma Teresa B. Cerezo100% (2)

- RMC No 57 - Annexes A-CDocument13 pagesRMC No 57 - Annexes A-CRACNo ratings yet

- FLI - Response LetterDocument1 pageFLI - Response LetterSay QuintanaNo ratings yet

- Revenue Memorandum Order 26-2010Document2 pagesRevenue Memorandum Order 26-2010Jayvee OlayresNo ratings yet

- Cover Sheet: For Audited Financial StatementsDocument1 pageCover Sheet: For Audited Financial StatementsPamela Fayel SalazarNo ratings yet

- Affidavit of No ClientDocument1 pageAffidavit of No Client. adminNo ratings yet

- CERTIFICATION TCG 2019Document1 pageCERTIFICATION TCG 2019Ren A EleponioNo ratings yet

- Monitoring of Cash Advances 2018 FormatDocument8 pagesMonitoring of Cash Advances 2018 FormatMarivic Soriano50% (2)

- Vat Relief Esub Validtn Report 3rd Qtr2018Document3 pagesVat Relief Esub Validtn Report 3rd Qtr2018KarlayaanNo ratings yet

- Inventory of Unused ReceiptsDocument1 pageInventory of Unused ReceiptsAnna SunNo ratings yet

- Management's Responsibility for 2019 Financial StatementsDocument1 pageManagement's Responsibility for 2019 Financial StatementsRich GatdulaNo ratings yet

- Ch5 Mini Case AnalyticsDocument7 pagesCh5 Mini Case AnalyticsRuany Lisbeth100% (2)

- Tax Amnesty Filing ProceduresDocument15 pagesTax Amnesty Filing ProceduresIML2016No ratings yet

- BIR Form No. 1900Document2 pagesBIR Form No. 1900Aldrin Laloma100% (1)

- China Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0Document48 pagesChina Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0KyonNo ratings yet

- Social Security Collection ListDocument8 pagesSocial Security Collection ListLala MagayanesNo ratings yet

- Annex A C of RMC No. 57 2015Document13 pagesAnnex A C of RMC No. 57 2015Cheresse Agrabio RanarioNo ratings yet

- Letter For LOADocument1 pageLetter For LOAmaeNo ratings yet

- Annex C.1Document1 pageAnnex C.1Eric OlayNo ratings yet

- PTU Permit for Loose-Leaf Books & RecordsDocument1 pagePTU Permit for Loose-Leaf Books & RecordsPaola VirataNo ratings yet

- Secretary Certificate - RFIDDocument1 pageSecretary Certificate - RFIDDixie ImperialNo ratings yet

- BIR-CASH-RECEIPTS-JOURNAL ExcelDocument11 pagesBIR-CASH-RECEIPTS-JOURNAL ExcelGlaiza SantosNo ratings yet

- Letter of EFPS For BIRDocument2 pagesLetter of EFPS For BIRLetty Tamayo100% (1)

- Affidavit of Lost CorDocument1 pageAffidavit of Lost CorLouie Jean Ramos100% (1)

- Annex "D": Securities and Exchange CommissionDocument4 pagesAnnex "D": Securities and Exchange CommissionaileenNo ratings yet

- Sworn Declaration BirDocument1 pageSworn Declaration Birynid wageNo ratings yet

- Employer'S Virtual Pag-Ibig Enrollment FormDocument2 pagesEmployer'S Virtual Pag-Ibig Enrollment FormRobert Paul A Moreno0% (2)

- Efps Letter 009Document1 pageEfps Letter 009ElsieJhadeWandasAmandoNo ratings yet

- EFPS Letter of Intent SampleDocument1 pageEFPS Letter of Intent SampleBernardino PacificAceNo ratings yet

- Pasig BPLO Charter. Udate 12-6-2018Document7 pagesPasig BPLO Charter. Udate 12-6-2018Roy LataquinNo ratings yet

- Branch Office Expression of Interest For Amnesty of Fines and Penalties at SECDocument2 pagesBranch Office Expression of Interest For Amnesty of Fines and Penalties at SECcsb1683100% (1)

- Department Order No. 174Document2 pagesDepartment Order No. 174aces solutions100% (1)

- RMO 12 2013 List of Unused Expired ORsSIsCIs Annex DDocument2 pagesRMO 12 2013 List of Unused Expired ORsSIsCIs Annex DMIS MijerssNo ratings yet

- eSRS Reg Form PDFDocument1 pageeSRS Reg Form PDFDarlyn Etang100% (1)

- 1 - PCAB - Application LetterDocument1 page1 - PCAB - Application LetterMardeOpamenNo ratings yet

- Certificate of No Renovation PDFDocument1 pageCertificate of No Renovation PDFRaymond RomanoNo ratings yet

- How to File Form 2316, Annex C and Annex F by Feb. 28Document4 pagesHow to File Form 2316, Annex C and Annex F by Feb. 28Ivan Benedicto100% (1)

- Annex DDocument8 pagesAnnex DVicky Tamo-oNo ratings yet

- Business Permits and Licensing Office: City of CaloocanDocument2 pagesBusiness Permits and Licensing Office: City of CaloocanCarl Walfred Adajar Dael100% (1)

- Letter To BIR - Correction of Return PeriodDocument1 pageLetter To BIR - Correction of Return PeriodmaeNo ratings yet

- Ahlens Realty Quarterly Tax Returns ReportDocument2 pagesAhlens Realty Quarterly Tax Returns ReportTe Amo Guid100% (1)

- Letter of Request For Data FixDocument1 pageLetter of Request For Data FixTANCITY INC100% (1)

- Authorization To TransactDocument1 pageAuthorization To Transactjoy buedoNo ratings yet

- Annex C.1: Sworn Application For Tax ClearanceDocument1 pageAnnex C.1: Sworn Application For Tax Clearancekenneth june reyes100% (1)

- Letter Request to Use Loose-Leaf Books for AccountingDocument6 pagesLetter Request to Use Loose-Leaf Books for AccountingBaldovino VenturesNo ratings yet

- Requirements for securing tax clearanceDocument1 pageRequirements for securing tax clearanceDenzel Edward Cariaga100% (2)

- Physician's Gross Income AffidavitDocument1 pagePhysician's Gross Income AffidavitNicolo Jay PajaritoNo ratings yet

- Request Letter For Change AddressDocument1 pageRequest Letter For Change AddressPinkwork CompanyNo ratings yet

- Income Payor DeclarationDocument1 pageIncome Payor DeclarationMahko albert RslesNo ratings yet

- Annex D Bir InventoryDocument17 pagesAnnex D Bir InventoryDada SalesNo ratings yet

- Rmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeDocument2 pagesRmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeShitake Mitsuki100% (1)

- Application for Authority to Print Receipts and InvoicesDocument1 pageApplication for Authority to Print Receipts and InvoicesShane Shane100% (4)

- Letter For Correction of SSS ContributionsDocument1 pageLetter For Correction of SSS ContributionsFreann Sharisse Austria100% (1)

- Rmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeDocument2 pagesRmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeShitake MitsukiNo ratings yet

- Republic of The Philippines: Quezon CityDocument1 pageRepublic of The Philippines: Quezon CityCharina Marie CaduaNo ratings yet

- Tax Declaration Form 2021Document1 pageTax Declaration Form 2021Jessica SantosNo ratings yet

- BPLO AF - 002 Business Renewal FormDocument1 pageBPLO AF - 002 Business Renewal FormAdrian Joseph GarciaNo ratings yet

- 2022 GrossReceipts - SalesDeclarationFormDocument1 page2022 GrossReceipts - SalesDeclarationFormMark Anthony AlvarioNo ratings yet

- BPLO AF - 002 Renewal FormDocument1 pageBPLO AF - 002 Renewal FormJane CMNo ratings yet

- Application Form For Business Permit: AmendmentDocument2 pagesApplication Form For Business Permit: AmendmentPatbing-sooNo ratings yet

- Gift Certificate Template 09Document1 pageGift Certificate Template 09k actNo ratings yet

- BIR Tax Deadlines January 2020Document40 pagesBIR Tax Deadlines January 2020MICHA FERRERNo ratings yet

- ClearanceDocument1 pageClearancek actNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V03Document2 pagesSLF065 MultiPurposeLoanApplicationForm V03Belle Adante100% (1)

- SSSForms Change Request PDFDocument4 pagesSSSForms Change Request PDFEppNo ratings yet

- ClearanceDocument1 pageClearanceDonna EvangelistaNo ratings yet

- 9-Anniversary Death PDFDocument3 pages9-Anniversary Death PDFk actNo ratings yet

- 2017treasurers AffidavitDocument1 page2017treasurers AffidavitIMEENo ratings yet

- Freight Model Contract2Document13 pagesFreight Model Contract2Raphael Dafe Gab-MomohNo ratings yet

- Investment in AssociateDocument26 pagesInvestment in AssociateJay-L TanNo ratings yet

- Part 1 - Decision Tree For Addressing Surplus Cash in A CorporationDocument4 pagesPart 1 - Decision Tree For Addressing Surplus Cash in A CorporationbaxterNo ratings yet

- Hero MotoCorp LTDDocument10 pagesHero MotoCorp LTDpranav sarawagiNo ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- Investor Presentation (Company Update)Document24 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- D12 1Document12 pagesD12 1Charmine de la CruzNo ratings yet

- Asian Paints (India) Ltd. Balance Sheet AnalysisDocument15 pagesAsian Paints (India) Ltd. Balance Sheet AnalysistoabhishekpalNo ratings yet

- Final Account, Income Statement and Financial Analysis Practice QuestionsDocument36 pagesFinal Account, Income Statement and Financial Analysis Practice QuestionsMansi GoelNo ratings yet

- Adventure Travel Agency Marketing PlanDocument20 pagesAdventure Travel Agency Marketing PlanczrnaNo ratings yet

- 5.1 Project Evaluation ExerciseDocument17 pages5.1 Project Evaluation ExerciseHTNo ratings yet

- The Accounting Cycle:: Capturing Economic EventsDocument42 pagesThe Accounting Cycle:: Capturing Economic EventsIfrah BashirNo ratings yet

- Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueDocument66 pagesConsolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueNadeem TahaNo ratings yet

- Demo-C Tfin52 67Document5 pagesDemo-C Tfin52 67namank005No ratings yet

- Renata Limited: Symbol: RENATA Sector: Pharmaceuticals & ChemicalsDocument1 pageRenata Limited: Symbol: RENATA Sector: Pharmaceuticals & ChemicalsNayyab Alam TurjoNo ratings yet

- Fsa 04Document24 pagesFsa 04ferahNo ratings yet

- Entrepreneurship HandoutsDocument13 pagesEntrepreneurship HandoutsAbdulmuizz Abdulazis Salim100% (1)

- Andi Woodworks Pvt. Ltd. - 14-15Document17 pagesAndi Woodworks Pvt. Ltd. - 14-15Aayush agarwalNo ratings yet

- Case Background: Case - TSE International CompanyDocument9 pagesCase Background: Case - TSE International CompanyAvinash AgrawalNo ratings yet

- ABC Company Balance Sheet and Income Statement AnalysisDocument8 pagesABC Company Balance Sheet and Income Statement AnalysisMinh Van NguyenNo ratings yet

- Revenue Regulations on Cooperative Tax ExemptionsDocument5 pagesRevenue Regulations on Cooperative Tax ExemptionsmatinikkiNo ratings yet

- Role of Income TaxDocument109 pagesRole of Income TaxS. M. IMRAN100% (1)

- ND, NS, N & yDocument5 pagesND, NS, N & yArina Farihan AzharNo ratings yet

- Discussion Questions: Hac311 - Tutorial Solutions Chapter 4: Accounting For RevenueDocument7 pagesDiscussion Questions: Hac311 - Tutorial Solutions Chapter 4: Accounting For RevenueAbdulaziz BsebsuNo ratings yet

- Birla RatioDocument22 pagesBirla RatioveeraranjithNo ratings yet

- Accounting FormulaDocument4 pagesAccounting FormulaAndrea AbayaNo ratings yet

- Citcon EoIDocument3 pagesCitcon EoIShesh Narayan MishraNo ratings yet

- Summer Training Reporton Dabur India Ltd. (Working Capital Analysis of Major FMCG Companies) For Bba and Mba StudentsDocument52 pagesSummer Training Reporton Dabur India Ltd. (Working Capital Analysis of Major FMCG Companies) For Bba and Mba Studentssandeep sheoran67% (3)