Professional Documents

Culture Documents

RMO No. 57-2016 PDF

Uploaded by

Gabriel EdizaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMO No. 57-2016 PDF

Uploaded by

Gabriel EdizaCopyright:

Available Formats

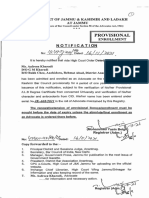

REPUBLIC OF THE PHILiPPINES

FNANCE

DF PARTN,TENT OF-

ffi^.t fiq- RE-{\OF- TNTERNAL REVEI*UE

f, I -.J \

-..-.f I'

;:'*;

Fi }t t; i]r/ l;

August 31, 2016

REVENuE MEilIoRANDuM ORDER No. .5 V - fD lb

TO National Investigatlon Divisions

Regional lnvestigation Divisions

Other eoncsrned Revenue SfEcials

Sub.!ect Special R.evalidation of Outstanding Letters of Authority

Under the Run After Tax fvaders {RATE} Prograrn

ln view of the policy to strictly monitor existing tax investigations/ audits and

reporting on cases under the RATE Program, all outstanding Letters of Authority (LA),

for which no Preliminary Assessments/Final Assessments have been issued or no

cases have been filed with the Department af Justice or the Courts as of June 30,

2016, shall be submitted to the Commissioner for special revalidation.

The special revalidation shall be covered by the issuance of a new LA under

the name{s) of the investigating officer to whom the same is assignedlre-assigned" All

requests for special revalidaticn shail be supparted rvith progress reports on the cases

and justification for revalidation. Subject to the exceptions pro,rieied herein, no

investigation shall be commenced without the LA having been revalidated as stated in

this Order.

For strict comp[iance

/ / {S.",4,C1

". {t'*"i,

CAESAR R, ilUI-AY

Commissioner

0il 1 I 3I

You might also like

- RMO No. 54-2016 PDFDocument3 pagesRMO No. 54-2016 PDFGabriel EdizaNo ratings yet

- A"OI.O of Act: SUBJECT: Lmplementing Section Known Act" Lnitial Section ofDocument1 pageA"OI.O of Act: SUBJECT: Lmplementing Section Known Act" Lnitial Section ofAbbeyNo ratings yet

- RMC No. 29-2019Document2 pagesRMC No. 29-2019AmberlyNo ratings yet

- RMC No. 124-2019Document1 pageRMC No. 124-2019Melody Lim DayagNo ratings yet

- RR No. 5-2022Document1 pageRR No. 5-2022Premiumly SoloNo ratings yet

- RR No. 10-2016Document2 pagesRR No. 10-2016Romer LesondatoNo ratings yet

- l-1, '.TRJ 4: Bureau Revei (IieDocument1 pagel-1, '.TRJ 4: Bureau Revei (IieEarl PatrickNo ratings yet

- RMO No 17-2017Document2 pagesRMO No 17-2017fatmaaleahNo ratings yet

- RMC No 9-2016 - Clarification On Taxability of NSSLA For Income Tax, GRT and DSTDocument3 pagesRMC No 9-2016 - Clarification On Taxability of NSSLA For Income Tax, GRT and DSTdignaNo ratings yet

- RR No. 15-2018 PDFDocument2 pagesRR No. 15-2018 PDFmark linganNo ratings yet

- RR No. 15-2018Document2 pagesRR No. 15-2018CaitlinNo ratings yet

- Recetveb: 0-? /uslfuqDocument2 pagesRecetveb: 0-? /uslfuqJohn RoeNo ratings yet

- Recetveb: 0-? /uslfuqDocument2 pagesRecetveb: 0-? /uslfuqDu Baladad Andrew MichaelNo ratings yet

- 827442-B2707Ph3Prop-Model SpecificationDocument299 pages827442-B2707Ph3Prop-Model SpecificationDaniel RouareNo ratings yet

- P) :EOT : Portion To Presgibing The LnternalDocument1 pageP) :EOT : Portion To Presgibing The LnternalLarry Tobias Jr.No ratings yet

- RMC 70-2019Document1 pageRMC 70-2019Earl PatrickNo ratings yet

- L': - Benro "Document1 pageL': - Benro "jennilyn pabloNo ratings yet

- RMC No. 45-2017Document3 pagesRMC No. 45-2017Nigel Lorenzo ReyesNo ratings yet

- E:li, Rali: I'He OIIDocument2 pagesE:li, Rali: I'He OIIDarlene BelosoNo ratings yet

- Tax Ordinance No. 2021-22Document3 pagesTax Ordinance No. 2021-22Evangeline PalitayanNo ratings yet

- RMC No. 141-2019 Reiterating The Salient Points Arising From RMC No. 14-16 On The Proper Execution of Waivers PDFDocument2 pagesRMC No. 141-2019 Reiterating The Salient Points Arising From RMC No. 14-16 On The Proper Execution of Waivers PDFKriszan ManiponNo ratings yet

- RMC No. 141-2019 Reiterating The Salient Points Arising From RMC No. 14-16 On The Proper Execution of Waivers PDFDocument2 pagesRMC No. 141-2019 Reiterating The Salient Points Arising From RMC No. 14-16 On The Proper Execution of Waivers PDFKriszan ManiponNo ratings yet

- RR No. 32-2020Document1 pageRR No. 32-2020JejomarNo ratings yet

- RMC No. 16-2021Document2 pagesRMC No. 16-2021Leichelle BautistaNo ratings yet

- AUtomatic Review of Dismissed Drug CasesDocument1 pageAUtomatic Review of Dismissed Drug CasesMichelle BondNo ratings yet

- RR 9-2018 Tax On StockDocument2 pagesRR 9-2018 Tax On StockRomer LesondatoNo ratings yet

- Rmo No.45-2019Document2 pagesRmo No.45-2019Earl PatrickNo ratings yet

- RR No. 9-2016 PDFDocument1 pageRR No. 9-2016 PDFJames SusukiNo ratings yet

- RMC No. 105-2016 PDFDocument1 pageRMC No. 105-2016 PDFReymund BumanglagNo ratings yet

- Soviet Reinforcement in EuropeDocument14 pagesSoviet Reinforcement in EuropeBatteriefuhrerNo ratings yet

- In Of: Subject To of of Any TheDocument3 pagesIn Of: Subject To of of Any TheBok CoolNo ratings yet

- 05152020165422circular AAODocument6 pages05152020165422circular AAOShimlaNo ratings yet

- CMO No.08 2015 Mandatory Electronic Processing of Transshipment of PEZA Locators To PEZA Zones and Other ProceduresDocument20 pagesCMO No.08 2015 Mandatory Electronic Processing of Transshipment of PEZA Locators To PEZA Zones and Other ProceduresSheenaNo ratings yet

- DO - 097 - S1991 Guidelines in Submission of Samples, Payment of Fees and RemittanceDocument8 pagesDO - 097 - S1991 Guidelines in Submission of Samples, Payment of Fees and RemittanceMark James MateoNo ratings yet

- RR 5-2016Document3 pagesRR 5-2016McrislbNo ratings yet

- RR No. 1-2017Document3 pagesRR No. 1-2017Kayelyn LatNo ratings yet

- Top SecretDocument55 pagesTop SecretGuillermoNo ratings yet

- RMC 100 2019Document1 pageRMC 100 2019Raymart SalamidaNo ratings yet

- RMC No. 56-2021Document1 pageRMC No. 56-2021Enrryson SebastianNo ratings yet

- RR No. 6-2018Document2 pagesRR No. 6-2018Andrew Benedict PardilloNo ratings yet

- Revenue Survey and Assessment, Bombay, 1869Document270 pagesRevenue Survey and Assessment, Bombay, 1869snaponumesh0% (1)

- Pgsworn Statement2018page 1Document1 pagePgsworn Statement2018page 1Rhea CastroNo ratings yet

- B2707Ph3Prop AirframeEngineTechAgreement (PW)Document94 pagesB2707Ph3Prop AirframeEngineTechAgreement (PW)Daniel RouareNo ratings yet

- Dtic Ad0385910 PDFDocument311 pagesDtic Ad0385910 PDFBill M. SpragueNo ratings yet

- 4?' of For All: NO. AODocument1 page4?' of For All: NO. AOKythkatNo ratings yet

- RMO No. 24-2016Document3 pagesRMO No. 24-2016Karl Anthony Rigoroso MargateNo ratings yet

- RMC No. 45-2021Document1 pageRMC No. 45-2021Raffy AmosNo ratings yet

- Fficd$T: "' F, Ffi::Ijlff:Hhffj:Illtlhfil',I:J." ::'"Document1 pageFficd$T: "' F, Ffi::Ijlff:Hhffj:Illtlhfil',I:J." ::'"Maureen PascualNo ratings yet

- EPF AppealDocument14 pagesEPF AppealJACOB A.No ratings yet

- Original Doc Grencofe PhytoDocument2 pagesOriginal Doc Grencofe PhytoAndri EzNawanNo ratings yet

- Oil As A Factor in The German War Effort, 1933-1945Document223 pagesOil As A Factor in The German War Effort, 1933-1945aso48100% (3)

- A TH T AT C Icat: U EN IC ION Ertif EDocument9 pagesA TH T AT C Icat: U EN IC ION Ertif ESam SamNo ratings yet

- Tw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Document1 pageTw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Lenin Rey PolonNo ratings yet

- RMC No. 57-2021Document1 pageRMC No. 57-2021Enrryson SebastianNo ratings yet

- V'Jan: $'upre1ne (!courtDocument18 pagesV'Jan: $'upre1ne (!courtIan San AndresNo ratings yet

- RMC No. 25-2024Document1 pageRMC No. 25-2024Anostasia NemusNo ratings yet

- RMC No 4-2016Document1 pageRMC No 4-2016Lianda RomeNo ratings yet

- RMO No. 64-2016 PDFDocument1 pageRMO No. 64-2016 PDFGabriel EdizaNo ratings yet

- RMO No. 54-2016 PDFDocument3 pagesRMO No. 54-2016 PDFGabriel EdizaNo ratings yet

- 2019 - Sample Notice To Change NomineeDocument1 page2019 - Sample Notice To Change NomineeGabriel EdizaNo ratings yet

- Preferred StocksDocument4 pagesPreferred StocksGabriel EdizaNo ratings yet

- Cases For Mock Class RecitationDocument1 pageCases For Mock Class RecitationJobar BuenaguaNo ratings yet

- Schaffer V WeastDocument6 pagesSchaffer V Weastapi-372339051No ratings yet

- Client & Consultant: Model Services AgreementDocument32 pagesClient & Consultant: Model Services AgreementMạnh Kiên TôNo ratings yet

- Noti Prov 17112021Document143 pagesNoti Prov 17112021EeliyaNo ratings yet

- Labour Court CasesDocument10 pagesLabour Court Casest bhavanaNo ratings yet

- 1 Relucio VS Civil ServiceDocument1 page1 Relucio VS Civil ServiceRobin Cunanan100% (1)

- Law, Land Tenure and Gender Review: Southern Africa (Zambia)Document108 pagesLaw, Land Tenure and Gender Review: Southern Africa (Zambia)United Nations Human Settlements Programme (UN-HABITAT)100% (1)

- NYAG USPS ComplaintDocument64 pagesNYAG USPS ComplaintLaw&Crime100% (2)

- How To Write A First Class Law DissertationDocument36 pagesHow To Write A First Class Law DissertationAngela Canares100% (1)

- Project Supply and Contract ManagementDocument29 pagesProject Supply and Contract ManagementIsaac Tetteh CharnorNo ratings yet

- Child AbuseDocument24 pagesChild Abuseapi-357231993No ratings yet

- Jessica Watkins - Oath Keepers - DetentionDocument21 pagesJessica Watkins - Oath Keepers - DetentionWashington ExaminerNo ratings yet

- Corporation Law Course Syllabus Part I - General ProvisionsDocument11 pagesCorporation Law Course Syllabus Part I - General ProvisionsJani MisterioNo ratings yet

- Ethics in Intellectual Property RightsDocument26 pagesEthics in Intellectual Property RightsMary GraceNo ratings yet

- SPL Rules For TncsDocument33 pagesSPL Rules For Tncsopengov0% (1)

- Landmark Cases - Rafael Y. Arcega and Teresita F. Arcega Vs CA and Rizal Commercial Banking Corp GR 122206Document3 pagesLandmark Cases - Rafael Y. Arcega and Teresita F. Arcega Vs CA and Rizal Commercial Banking Corp GR 122206Lu CasNo ratings yet

- Pepsi-Cola v. Secretary of Labor-2Document11 pagesPepsi-Cola v. Secretary of Labor-2SophiaFrancescaEspinosaNo ratings yet

- Cyber Law 2000Document3 pagesCyber Law 2000MANJUNATHA SNo ratings yet

- 4.G.k. Gimena vs. SabioDocument1 page4.G.k. Gimena vs. SabioJimNo ratings yet

- 8 - Part Eight-Supplementary Cases - Pgs 104 - 123Document21 pages8 - Part Eight-Supplementary Cases - Pgs 104 - 123DylanNo ratings yet

- Case Title Pen Development Corporation and Las Brisas Resort Corporation, G.R. NO. 211845Document2 pagesCase Title Pen Development Corporation and Las Brisas Resort Corporation, G.R. NO. 211845Margreth Vasquez100% (1)

- Advancing Youth Civic Engagement and Human RightsDocument88 pagesAdvancing Youth Civic Engagement and Human RightsDoug Ragan100% (1)

- Nunez Vs Atty RicafortDocument3 pagesNunez Vs Atty Ricafortjilo03No ratings yet

- People vs. CuizonDocument16 pagesPeople vs. CuizonFe PortabesNo ratings yet

- Central Office: 2018doif - LF./ )Document1 pageCentral Office: 2018doif - LF./ )Glenn FabiculanaNo ratings yet

- Faculty of Law, Osmania UniversityDocument1 pageFaculty of Law, Osmania UniversityuseridnoNo ratings yet

- All Culpable Homicide Is Not Amounts To Murder, But All Murders Are Culpable HomicideDocument11 pagesAll Culpable Homicide Is Not Amounts To Murder, But All Murders Are Culpable HomicideinderpreetNo ratings yet

- Civ Pro OutlineDocument81 pagesCiv Pro OutlineJ FilterNo ratings yet

- Sunace International Management Services v. NLRCDocument4 pagesSunace International Management Services v. NLRCRyan Jhay YangNo ratings yet

- Nolasco Vs Cruz-Pano - JaredDigestDocument2 pagesNolasco Vs Cruz-Pano - JaredDigestElaine Dianne Laig SamonteNo ratings yet