Professional Documents

Culture Documents

Income Tax 05

Uploaded by

AMJAD ULLA ROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax 05

Uploaded by

AMJAD ULLA RCopyright:

Available Formats

(a) He is a government employee.

(b) He is a private sector employee, receiving gratuity of ₹ 5,00,000 at the time of retirement.

(c) He is a private sector employee and is not in receipt of gratuity at the time of retirement.

ILLUSTRATION 37

Mr. X is employed in ABC Ltd. getting basic pay ₹22,000 p.m., dearness allowance ₹5,000 p.m. He was retired

on 21.12.2018. The employer has allowed him pension of ₹9,000 p.m. and the employee has requested for

commutation of 52% of his pension. The employer has allowed him such commutation on 01.02.2019 and

has paid ₹5,61,600. The employer has paid him gratuity of ₹6,95,000 and employee has completed service

of 20 years and 11 months.

Compute Tax Liability for the Assessment Year 2019-20.

LEAVE SALARY OR LEAVE ENCASHMENT

Generally, employees are allowed to take leave during the period of service. Employee may avail such leave

or in case the leave is not availed, then the leave may either lapse or be accumulated for future or allowed

to be encashed every year or at the time termination/ retirement. The payment received on account of

encashment of unavailed leave would form part of salary. However, section 10(10AA) provides exemption

in respect of amount received by way of encashment of unutilised earned leave by an employee at the

time of his retirement, whether on superannuation or otherwise.

Encashment of leave during tenure of service:

Leave encashment by an employee, while he continues to be in service, is fully taxable for all categories of

employees [Whether Govt. employee or a Private employee]

Encashment of unavailed leave at the time of retirement/ resignation

This is also taxable but employee can claim exemption u/s 10(10AA)

Exemption u/s 10(10AA)

I. Central Government/ State Govt. Employees:

It is fully exempt from tax.

II. Other Employees (i.e. Private employees including employees of local authority and statutory corporation)

It is exempt to the extent of the minimum of the following four amounts:

(a) Leave encashment actually received

(b) ₹3,00,000

(c) 10 X Average Monthly SALARY

(d) Cash equivalent of leave to the credit of the employee at the time of retirement or death

Unavailed Leave X Average Monthly SALARY

30

47 INCOME UNDER THE HEAD SALARIES

Notes:

1. Where leave salary is received from two or more employers in the same year, then the aggregate

amount of leave salary exempt from tax cannot exceed ₹ 3,00,000.

2. Where leave salary is received in any earlier year from a former employer and again received from

another employer in a later year, the limit of ₹ 3,00,000 will be reduced by the amount of leave salary

exempt earlier.

3. Salary for this purpose means basic salary and dearness allowance, if provided in the terms of

employment for retirement benefits and commission which is expressed as a fixed percentage of

turnover.

4. Average Monthly Salary: is to be calculated on the basis of the average of salary (as valued above)

drawn by the employee during the period of 10 months immediately preceding the date of his

retirement.

5. Any leave salary to the legal heirs of the deceased employee in respect of earned leave standing to

the credit of such employee at the time of his death is not taxable (both for private and Govt.

employees).

6. Even if there is voluntary retirement (e.g resignation) from services, the provisions of section

10(10AA) will apply.

ILLUSTRATION 38

Mr. Gupta retired on 1.12.2019 after 20 years 10 months of service, receiving leave salary of ₹ 5,00,000.

Other details of his salary income are:

48 INCOME UNDER THE HEAD SALARIES

Basic Salary : ₹ 5,000 p.m. (₹ 1,000 was increased w.e.f. 1.4.2019)

Dearness Allowance : ₹ 3,000 p.m. (60% of which is for retirement benefits)

Commission : ₹ 500 p.m.

Bonus : ₹ 1,000 p.m.

Leave availed during service: 480 days

He was entitled to 30 days leave every year.

You are required to compute his taxable leave salary assuming:

(a) He is a government employee.

(b) He is a non government employee.

ILLUSTRATION 39

a) Mr. Bhanu is working in Zebra Ltd. since last 25 years 9 months. Company allows 2 months leave for every

completed year of service to its employees. During the job, he had availed 20 months leave. At the time of

retirement on 10/8/2019, he got ₹ 1,50,000 as leave encashment. As on that date, his basic salary was ₹

5,000 p.m., D.A. was ₹ 2,000 p.m., Commission was 5% on turnover + ₹ 2,000 p.m. (Fixed p.m.). Turnover

effected by the assessee during last 12 months (evenly) ₹ 5,00,000. Bhanu got an increment of ₹ 1,000 p.m.

from 1/1/2018 in basic and ₹ 500 p.m. in D.A. Compute his taxable leave encashment salary.

b)How shall your answer differ if the assessee had taken 2 months leave instead of 20 months, during his

continuation of job.

ILLUSTRATION 40

Mr. Das retired on 31/3/2020. At the time of retirement, 18 months leave was lying to the credit of his

account. He received leave encashment equivalent to 18 months Basic salary ₹ 1,26,000. His employer

allows him 1½ months leave for every completed year of service. During his tenure, he availed of 12 months

leave. At the time of retirement, he also gets D.A. ₹ 3,000. His last increment of ₹ 1,000 in basic was on

1/4/2019. Find taxable leave encashment.

RETRENCHMENT COMPENSATION [Section 10(10B)]

The retrenchment compensation means the compensation paid under Industrial Disputes Act, 1947 or

under any Act, Rule, Order or Notification issued under any law. It also includes compensation paid on

transfer of employment under section 25F or closing down of an undertaking under section 25FF of the

Industrial Disputes Act, 1947.

Amount of Compensation to be included under Head Salary

Amount of Retrenchment Compensation Less Exemption u/s10 (10B)

Exemption u/s.10 (10B) :

Minimum of following is exempt

i) Actual Compensation received.

ii) ₹5,00,000/-

iii) [15 X Completed yrs of service including part in excess of 6 mths] X[ Average Monthly Salary/26 ]

49 INCOME UNDER THE HEAD SALARIES

Average Monthly salary:

- in the case of monthly paid workman, in the three complete calendar months,

- in the case of weekly paid workman, in the four calendar weeks,

- in the case of daily paid workman, in the twelve full working weeks,

Salary includes all but does not include bonus & employers PF contribution

Special point

If compensation received by workman in accordance with specified scheme of Central government

then such compensation is fully exempt.

Compensation received by a workman at the time of closing down of the undertaking in which he

is employed is treated as compensation received at the time of his retrenchment.

ILLUSTRATION 41

Mr. X received retrenchment compensation of ₹10,00,000 after 30 years 4 months of service. At the time of

retrenchment, he was receiving basic salary of ₹20,000 p.m.; dearness allowance of ₹ 5,000 p.m. Compute

his taxable retrenchment compensation.

Voluntary Retirement Receipts [Section 10(10C)]

Lumpsum payment or otherwise received by an employee at the time of voluntary retirement would be

taxable as “profits in lieu of salary”. However, it would be exempt under section 10(10C), subject to the

following conditions:

Exemption u/s. 10(10C):

Types of Employee Employees of Central or State Govt or Local Authority or

Statutory corporation or public sector Company

Company or Co-operative Society

Declared University, IIT, Notified IIM or Notified institutions

Conditions to be satisfied Compensation received on Voluntary Retirement and

The scheme of Voluntary Retirement should be as per rule 2BA.

Amount of Exemption - Actual Compensation received/receivable

Least of following

- 5,00,000

- 3 months Total SALARY X Completed years of service (Part Ignored

- Current SALARY per month X Balance months of service left

SALARY = Basic + DA(retirement Benefits) + Commission % of turnover

Special Points :

1. [Rule 2BA] : The scheme of Voluntary Retirement should be framed in accordance with below

guidelines.

50 INCOME UNDER THE HEAD SALARIES

i. Employee should have completed 10 yrs of service or 40 yrs of age. [This condition is not applicable

in the case of an employee of a public sector company]

ii. Scheme should be applicable to all employee (except Directors)

iii. Scheme should be drawn to result in overall reduction in existing strength of employees.

iv. Vacancy caused by voluntary retirement should not be filled up.

v. Retiring employee shall not be employed in other concern of same management.

If the guidelines are not followed , exemption shall not be available

vi. 2. Exemption under 10(10C) can be claimed only Once by the Assessee.

ILLUSTRATION 42

Mr. Dutta received voluntary retirement compensation of ₹ 7,00,000 after 30 years 4 months of service. He

still has 6 years of service left. At the time of voluntary retirement, he was drawing basic salary ₹ 20,000 p.m.;

Dearness allowance (which forms part of pay) ₹ 5,000 p.m. Compute his taxable voluntary retirement

compensation, assuming that he does not claim any relief under section 89.

PROVIDENT FUND

Provident fund scheme is a scheme intended to give substantial benefits to an employee at the time of his

retirement. Under this scheme, a specified sum is deducted from the salary of the employee as his

contribution towards the fund. The employer also generally contributes the same amount out of his pocket,

to the fund. The contributions of the employer and the employee are invested in approved securities. Interest

earned thereon is also credited to the account of the employee. Thus, the credit balance in a provident fund

account of an employee consists of the following:

(i) employee’s contribution

(ii) interest on employee’s contribution

(iii) employer’s contribution

(iv) interest on employer’s contribution.

The accumulated balance is paid to the employee at the time of his retirement or resignation. In the case of

death of the employee, the same is paid to his legal heirs.

The provident fund represents an important source of small savings available to the Government. Hence, the

Income-tax Act, 1961 gives certain deductions on savings in a provident fund account.

51 INCOME UNDER THE HEAD SALARIES

1. Recognised Provident Fund: Recognised provident fund means a provident fund recognised by the

Commissioner of Income-tax for the purposes of income-tax. It is governed by Part A of Schedule IV to the

Income-tax Act, 1961.

This schedule contains various rules regarding the following:

(a) Recognition of the fund

(b) Employee’s and employer’s contribution to the fund

(c) Treatment of accumulated balance etc.

A fund constituted under the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952 will also be

a Recognised Provident Fund.

2. Unrecognised Provident Fund (URPF): A fund not recognised by the Commissioner of Income-tax is

Unrecognised Provident Fund.

3. Statutory Provident Fund (SPF): The SPF is governed by Provident Funds Act, 1925. It applies to employees

of government, railways, semi-government institutions, local bodies, universities and all recognised

educational institutions.

4. Public Provident Fund (PPF): Public provident fund is operated under the Public Provident Fund Act, 1968.

A membership of the fund is open to every individual though it is ideally suited to self-employed people. A

salaried employee may also contribute to PPF in addition to the fund operated by his employer. An individual

may contribute to the fund on his own behalf as also on behalf of a minor of whom he is the guardian.

For getting a deduction under section 80C, a member is required to contribute to the PPF a minimum of ₹

500 in a year. The maximum amount that may qualify for deduction on this account is ₹ 1,50,000 as per PPF

rules.

A member of PPF may deposit his contribution in as many installments in multiples of ₹ 500 as is convenient

to him. The sums contributed to PPF earn interest at 8% p.a. (April, 2019 to June, 2019) and 7.9% p.a. (from

1st July, 2019) compounded annually. The amount of contribution may be paid at any of the offices or branch

offices of the State Bank of India or its subsidiaries and specified branches of banks or any Post Office.

The tax treatment is given below:

Recognised Provident Fund (RPF)

Employees Employer’s Interest on Payment of

Contribution Contribution Provident Fund Accumulated balance

Deduction u/s 80C from Exempt upto 12% of Exempt upto 9.5% p.a Exempt u/s 10(12)

GTI is available to SALARY

employee Excess Taxable under (Refer special point

Excess Taxable under Salary below)

Salary

Note : SALARY = Basic + DA(retirement Benefits) + Commission % of turnover

52 INCOME UNDER THE HEAD SALARIES

Un Recognised Provident Fund (URPF)

Employees Employer’s Interest on Payment of

Contribution Contribution Provident Fund Accumulated balance

Deduction u/s 80C is Not Taxable Not Taxable Taxable in P/Y of Receipt

NOT available to

employee - Employers contribution + interest

on it taxable as profit in lieu of salary

u/s 17(3)

- Interest on Employee contribution

taxable under IFOS

Statutory Provident Fund (SPF)

Employees Employer’s Interest on Payment of

Contribution Contribution Provident Fund Accumulated balance

Deduction u/s 80C from Not Taxable Not Taxable Exempt u/s 10(11)

GTI is available to

employee

Public Provident Fund (PPF)

Employees Employer’s Interest on Payment of

Contribution Contribution Provident Fund Accumulated balance

Deduction u/s 80C from No employers Exempt from Tax Fully exempt u/s 10(11)

GTI is available to Contribution

employee

Special point : Accumulated balance of RPF is exempt only if :

i. Continuous Service of at least 5 yrs is completed (Current employer & Former employer) OR

ii. Termination due to :

ILL health or

Discontinuance of employer business or

Other reason beyond employee control or

iii. Takes up new employment & Accumulated balance transferred to new RPF A/c under new employer.

iv. if the entire balance standing to the credit of the employee transferred to his NPS account referred to in

section 80CCD and notified by the Central Government.

If none of above situations exist, then amount shall be treated as if PF is unrecognised since Beginning

ILLUSTRATION 43

Mr. A retires from service on December 31, 2019, after 25 years of service. Following are the particulars of

his income/investments for the previous year 2019-20:

53 INCOME UNDER THE HEAD SALARIES

Particulars Amount (₹)

Basic pay @ ₹ 16,000 per month for 9 months 1,44,000

Dearness pay (50% forms part of the retirement benefits) ₹ 8,000 per month for 72,000

9 months

Lumpsum payment received from the Unrecognized Provident Fund 6,00,000

Deposits in the PPF account 40,000

Out of the amount received from the unrecognised provident fund, the employer’s contribution was ₹

2,20,000 and the interest thereon ₹ 50,000. The employee’s contribution was ₹ 2,70,000 and the interest

thereon ₹ 60,000. What is the taxable portion of the amount received from the unrecognized provident fund

in the hands of Mr. A for the assessment year 2020-21?

ILLUSTRATION 44

Mr. B is working in XYZ Ltd. and has given the details of his income for the P.Y. 2019-20. You are required to

compute his gross salary from the details given below:

Basic Salary ₹ 10,000 p.m.

D.A. (50% is for retirement benefits) ₹ 8,000 p.m.

Commission as a percentage of turnover 0.1% Turnover during the year ₹ 50,00,000

Bonus ₹ 40,000

Gratuity ₹ 25,000

His own contribution in the RPF ₹ 20,000

Employer’s contribution to RPF 20% of his basic salary

Interest accrued in the RPF @ 13% p.a. ₹ 13,000

SOLUTION

Computation of Gross Salary of Mr. B for the A.Y.2020-21

Particulars ₹ ₹

Basic Salary [ ₹ 10,000 × 12]

Dearness Allowance [₹ 8,000 × 12]

Commission on turnover [0.1% × ₹ 50,00,000]

Bonus

Gratuity [Note 1]

Employee’s contribution to RPF [Note 2]

Employers contribution to RPF [20% of ₹ 1,20,000]

Less: Exempt [Note 3]

Interest accrued in the RPF @ 13% p.a.

Less: Exempt @ 9.5% p.a.

Gross Salary

54 INCOME UNDER THE HEAD SALARIES

Note 1: Gratuity received during service is fully taxable.

Note 2: Employee’s contribution to RPF is not taxable. It is eligible for deduction under section 80C.

Note 3: Employers contribution in the RPF is exempt up to 12% of the salary.

i.e., 12% of [Basic Salary + Dearness Allowance forming part of retirement benefits + Commission based on

turnover] = 12% of [₹ 1,20,000 + (50% × ₹ 96,000) + ₹ 5,000] = 12% of ₹ 1,73,000 = ₹ 20,760

ILLUSTRATION 45

Mr. X has the following salary structure –

Basic pay ₹ 10,000 p.m. Commission (fixed) ₹ 2,000

DA ₹ 1,000 p.m. Entertainment allowance ₹ 2,000 p.m.

X contributes ₹ 20,000 to provident fund. Employer also makes a matching contribution. Compute gross

salary of if –

a) Mr. X is a Government employee and such provident fund is a statutory provident fund.

b) Mr. X is an employee of Y Ltd. and such fund is a recognized fund.

c) Mr. X is an employee of Z Ltd. and such fund is an unrecognized fund.

Transferred Balance (Conversion of URPF to RPF) [Rule 11(4) of Part A of the Fourth schedule]

Where the employee is a member of unrecognised provident fund, which is accorded recognition by the

Commissioner of Income tax for the first time, the outstanding balance under unrecognised fund is

transferred to recognised provident fund. Such balance is called transferred balance. which is taxable in p/y

of Conversion

To calculate the taxable amount, if any, the Unrecognised provident fund shall be treated as recognised

fund since the beginning.

Calculation of Transferred balance

It Includes the following

1. Employer contribution in URPF in excess of 12% till date of conversion

2. Interest in excess of 9.5% till date of conversion

Note: Employee shall be eligible for deduction u/s 80C for all contributions after the date of recognition, but

no deduction shall be available on the contributions prior to recognition.

ILLUSTRATION 46

Mr. Sharma has been appointed as an accountant of ABC Ltd as on 1/4/2017, since then he is working with

the same company. The salary structure and increment details are as under:

Basic ₹ 5000 - 1000 - 8000 -1500 - 14000

D.A. ₹ 3000 – 500 – 5000 – 1000 - 10000

55 INCOME UNDER THE HEAD SALARIES

He and his employer contribute to URPF 14% of basic and DA.

Every year 9% interest is credited to such fund. As on 1/4/2019, the fund gets recognition. Hence, the

accumulated balance in URPF was transferred to RPF. Comment on tax treatment of such transferred

balance.

Solution

Statement showing treatment of transferred balance :

Exempted amount considering the

Year Employer’s contribution to fund Difference

fund as RPF

2017-2018 14% of (60,000 + 36,000) i.e. ₹ 13,440 12% of ₹ 96,000 i.e. ₹ 11,520 ₹ 1,920

2018-2019 14% of (72,000 + 42,000) i.e. ₹ 15,960 12% of ₹ 1,14,000 i.e. ₹ 13,680 ₹ 2,280

Total ₹ 4,200

Current year (i.e. 2018-19) contribution shall be treated as RPF and taxable amount will be ₹ 2,640 [being (14

-12)% of (₹ 84,000 + ₹ 48,000) i.e. 2% of ₹ 1,32,000].

Since interest rate is less than the exempted limit (i.e. 9%), hence interest portion is not taxable.

Total taxable salary on account of provident fund for the A.Y. 2019-20 is ₹ 6,840 (being ₹ 4,200 + ₹ 2,640).

OTHER THEORETICAL POINTS OF THE CHAPTER

Profits in lieu of salary [Section 17(3)]

It includes the following:

(i) Compensation on The amount of any compensation due to or received by an assessee from his

account of termination employer or former employer at or in connection with the termination of his

of his employment employment.

(ii) Compensation on The amount of any compensation due to or received by an assessee from his

account of modification employer or former employer at or in connection with the modification of the

of the terms and terms and conditions of employment.

conditions ofUsually, such compensation is treated as a capital receipt. However, by virtue

employment of this provision, the same is treated as a revenue receipt and is chargeable as

salary.

(iii) Payment from Any payment due to or received by an assessee from his employer or former

provident fund or other employer from a provident or other fund other than

fund - Gratuity [Section 10(10)]

- Pension [Section 10(10A)]

- Compensation received by a workman under Industrial Disputes Act, 1947

[Section 10(10B)]

- from provident fund or public provident fund [Section 10(11)]

- from recognized provident fund [Section 10(12)]

- from approved superannuation fund [Section 10(13)]

- any House Rent Allowance [Section 10(13A)],

to the extent to which it does not consist of employee’s contributions or

interest on such contributions.

56 INCOME UNDER THE HEAD SALARIES

(iv) Keyman Insurance Any sum received by an assessee under a Keyman Insurance policy including

policy the sum allocated by way of bonus on such policy.

(v) Lumpsum Payment Any amount, whether in lumpsum or otherwise, due to the assessee or

or otherwise received by him, from any person -

(a) before joining employment with that person, or

(b) after cessation of his employment with that person.

RELIEF UNDER SECTION 89

(1) On account of arrears of salary or advance salary:

Where, by reason of any portion of an assessee’s salary being paid in arrears or in advance or by

reason of his having received in any one financial year salary for more than 12 months, his income

is assessed at a rate higher than that at which it would otherwise have been assessed, the relief to

be granted u/s 89(1) shall be as under:

(A) : Where any portion of the assessee’s salary is received in arrears or in advance

Step 1: Calculate the tax payable of the previous year in which the arrears/advance Salary is received

a. On Total income inclusive of additional salary.

b. On Total income exclusive of additional salary.

The difference between (a) and (b) is the tax on additional salary included in the total income.

Step 2: Calculate the tax payable of every previous year to which the additional salary relates

a. On total income including additional salary of that particular previous year.

b. On total income excluding additional salary.

Calculate the difference between (a) and (b) for every previous year to which the additional salary

relates and aggregates the same.

Step 3: The excess between the tax on additional salary as calculated under step 1 and 2 shall be

the relief admissible u/s 89(1). If there is no excess, no relief is admissible.

If the tax calculated in step 1 is less than tax calculated in step 2, the assessee need not apply for

relief.

(2) On account of family pension: Similar tax relief is extended to assessees who receive arrears

of family pension as defined in the Explanation to clause (iia) of section 57.

“Family pension” means a regular monthly amount payable by the employer to a person

belonging to the family of an employee in the event of his death.

(3) No relief at the time of Voluntary retirement or termination of service: No relief shall be

granted in respect of any amount received or receivable by an assessee on his voluntary

57 INCOME UNDER THE HEAD SALARIES

retirement or termination of his service, in accordance with any scheme or schemes of

voluntary retirement or a scheme of voluntary separation (in the case of a public sector

company), if exemption under section 10(10C) in respect of such compensation received on

voluntary retirement or termination of his service or voluntary separation has been claimed

by the assessee in respect of the same assessment year or any other assessment year.

ILLUSTRATION 47

In the case of Mr. Hari, who turned 67 years on 28.3.2020, you are informed that the salary

(computed) for the previous year 2019-20 is ₹ 10,20,000 and arrears of salary received is ₹ 3,45,000.

Further, you are given the following details relating to the earlier years to which the arrears of salary

received is attributable to:

Compute the relief available under section 89 and the tax payable for the A.Y. 2020-21.

Note: Rates of Taxes:

Note – Education cess@2% and secondary and higher education cess@1% was attracted on the

income-tax for all above preceding years.

58 INCOME UNDER THE HEAD SALARIES

SOLUTION

Computation of tax payable by Mr. Hari for the A.Y.2020-21

Computation of tax payable on arrears of salary if charged to tax in the respective AYs

Computation of relief under section 89

Tax payable for A.Y.2020-21 after relief under section 89

59 INCOME UNDER THE HEAD SALARIES

EXERCISE

Question 1

Mr. Mohit is employed with XY Ltd. on a basic salary of ₹ 10,000 p.m. He is also entitled to dearness allowance

@100% of basic salary, 50% of which is included in salary as per terms of employment. The company gives

him house rent allowance of ₹ 6,000 p.m. which was increased to ₹ 7,000 p.m. with effect from 01.01.2020.

He also got an increment of ₹ 1,000 p.m. in his basic salary with effect from 01.02.2020. Rent paid by him

during the previous year 2019-20 is as under:

April and May, 2019 - Nil, as he stayed with his parents

June to October, 2019 - ₹ 6,000 p.m. for an accommodation in Ghaziabad

November, 2019 to March, 2020 - ₹ 8,000 p.m. for an accommodation in Delhi

Compute his gross salary for assessment year 2020-21.

Question 2

Mr. X is employed with AB Ltd. on a monthly salary of ₹ 25,000 per month and an entertainment allowance

and commission of ₹ 1,000 p.m. each. The company provides him with the following benefits:

1. A company owned accommodation is provided to him in Delhi. Furniture costing ₹ 2,40,000 was provided

on 1.8.2019.

2. A personal loan of ₹ 5,00,000 on 1.7.2019 on which it charges interest @ 6.75% p.a. The entire loan is still

outstanding. (Assume SBI rate of interest on 1.4.2019 was 12.75% p.a.)

3. His son is allowed to use a motor cycle belonging to the company. The company had purchased this

motor cycle for ₹ 60,000 on 1.5.2016. The motor cycle was finally sold to him on 1.8.2019 for ₹ 30,000.

4. Professional tax paid by Mr. X is ₹ 2,000.

Compute the income from salary of Mr. X for the A.Y. 2020-21.

Question 3

Mr. Balaji, employed as Production Manager in Beta Ltd., furnishes you the following information for the

year ended 31.03.2020:

I) Basic salary upto 31.10.2019 ₹ 50,000 p.m. Basic salary from 01.11.2019 ₹ 60,000 p.m.

Note: Salary is due and paid on the last day of every month.

(ii) Dearness allowance @ 40% of basic salary.

(iii) Bonus equal to one month salary. Paid in October 2019 on basic salary plus dearness allowance applicable

for that month.

(iv) Contribution of employer to recognized provident fund account of the employee@16% of basic salary.

(v) Professional tax paid ₹ 2,500 of which ₹ 2,000 was paid by the employer.

(vi) Facility of laptop and computer was provided to Balaji for both official and personal use. Cost of laptop ₹

45,000 and computer ₹ 35,000 were acquired by the company on 01.12.2019.

60 INCOME UNDER THE HEAD SALARIES

(vii) Motor car owned by the employer (cubic capacity of engine exceeds 1.60 litres) provided to the

employee from 01.11.2019 meant for both official and personal use. Repair and running expenses of ₹ 45,000

from 01.11.2019 to 31.03.2020, were fully met by the employer. The motor car was self-driven by the

employee.

(viii) Leave travel concession given to employee, his wife and three children (one daughter aged 7 and twin

sons aged 3). Cost of air tickets (economy class) reimbursed by the employer ₹ 30,000 for adults and ₹ 45,000

for three children. Balaji is eligible for availing exemption this year to the extent it is permissible in law.

Compute the salary income chargeable to tax in the hands of Mr. Balaji for the assessment year 2020-21.

Question 4

From the following details, find out the salary chargeable to tax for the A.Y.2020-21 -

Mr. X is a regular employee of Rama & Co., in Gurgaon. He was appointed on 1.1.2019 in the scale of ₹ 20,000

-₹ 1,000 - ₹ 30,000. He is paid 10% D.A. & Bonus equivalent to one month pay based on salary of March every

year. He contributes 15% of his pay and D.A. towards his recognized provident fund and the company

contributes the same amount.

He is provided free housing facility which has been taken on rent by the company at ₹ 10,000 per month. He

is also provided with following facilities:

(i) Facility of laptop costing ₹ 50,000.

(ii) Company reimbursed the medical treatment bill of his brother of ₹ 25,000, who is dependent on him.

(iii) The monthly salary of ₹ 1,000 of a house keeper is reimbursed by the company.

(iv) A gift voucher of ₹ 10,000 on the occasion of his marriage anniversary.

(v) Conveyance allowance of ₹ 1,000 per month is given by the company towards actual reimbursement.

(vi) He is provided personal accident policy for which premium of ₹ 5,000 is paid by the company.

(vii) He is getting telephone allowance @₹ 500 per month.

Question 5

Mrs. Jaya is the marketing manager in XYZ limited. She gives you the following particulars:

Basic Salary ₹65,000 p.m.

Dearness Allowance ₹22,000 p.m. (30% is for retirement benefits)

Bonus ₹17,000 p.m.

Her employer has provided her with an accommodation on 1st April, 2019 at a concessional rent. The house

was taken on lease by XYZ Ltd. for ₹12,000 p.m. Mrs. Jaya occupied the house from 1st November, 2019.

₹4,800 p.m. is recovered from the salary of Mrs. Jaya.

The employer gave her a gift voucher of ₹8,000 on her birthday. She contributes 18% of her salary (Basic Pay+

30% of DA) towards recognized provident fund and the company contributes the same amount.

The company pays medical insurance premium to effect insurance on the health of Mrs. Jaya ₹18,000. Motor

car owned by the employer (cubic capacity of engine 1.4 litres) provided to Mrs. Jaya from 1 st November,

61 INCOME UNDER THE HEAD SALARIES

2019 which is used for both official and personal purposes. Repair and running expenses of ₹50,000 were

fully met by the company. The motor car was self- driven by the employee.

Compute the income chargeable to tax under the head “Salaries” in the hands of Mrs. Jaya for the Assessment

Year 2020-21. Also compute her tax liability for A.Y. 2020-21

Question 6

Mr. Nambi, a salaried employee, furnishes the following details for the financial year 2019-20:

Particulars

Basic salary 6,00,000

Dearness allowance 3,20,000

Commission 50,000

Entertainment allowance 7,500

Profession Tax (of this, 50% paid by employer) 7,000

Health insurance premium paid by employer 9,000

Gift voucher given by employer on his birthday 12,000

Life insurance premium of Nambi Paid by employer 34,000

Laptop provided for use at home . Actual cost of Laptop to employer 30,000

[Children of the assessee are also using the Laptop at home]

Employer -Company owns a Tata Nano car, which was provided to the assessee, Both for official and personal

use. No driver was provided. (Engine cubic capacity less than 1.6 litres)

Annual credit card fees paid by employer [Credit card is not exclusively used for 2,000 Official purposes;

details of usage are not available]

You are required to compute the income chargeable under the head "Salaries" for the assessment year 2020-

21.

Question 7

Mr. X is employed in ABC Ltd. getting basic pay ₹20,000 p.m., dearness allowance ₹7,000 p.m. The employer

has contributed ₹3,500 to the unrecognised provident fund and the employee has also contributed equal

amount. The employee was retired on 31.10.2019 after serving the employer for 20 years and 6 months and

employer has credited interest ₹21,000 to the provident fund account on 31.10.2019 and interest rate is 12%

p.a.

The employer has paid provident fund balance ₹10,00,000 to the employee on 01.11.2019 out of which

employee’s contribution is ₹4,00,000 and employer’s contribution is also ₹4,00,000 and balance is interest.

Employer has paid gratuity ₹2,60,000 and allowed him pension ₹5,000 p.m. The employee was allowed

commutation of pension on 01.01.2019 for 40% of the pension and has paid ₹2,40,000.

Compute employee’s Tax Liability for the Assessment Year 2020-21.

62 INCOME UNDER THE HEAD SALARIES

Meaning of Salary for different purposes

For Retirement benefit

Gratuity (covered by the Payment of Gratuity Act) (Basic + DA) last drawn

Gratuity (not covered by the Payment of Gratuity Act) (Basic +DA1 + Commission2) being average of last 10 months

preceding the month of retirement.

Leave encashment (Basic +DA1 + Commission2) being average of last 10 months

immediately from the retirement.

Voluntarily retirement (Basic +DA1 + Commission2) last drawn

For regular benefit

Rent Free Accommodation (Basic + DA1 + Commission + Bonus + Fees + Any other

taxable allowance + Any other monetary benefits excluding

perquisite)

Specified employee (Basic + DA + Commission2 + Bonus + Fees + Any other

taxable allowance + Any other monetary benefits –

Deduction u/s 16)

Entertainment Allowance Basic only

Any other case (Basic +DA1 + Commission2)

1. DA only if it forms a part of retirement benefit.

2. Commission as a fixed percentage on turnover.

63 INCOME UNDER THE HEAD SALARIES

You might also like

- Tinas Resturant AnalysisDocument19 pagesTinas Resturant Analysisapi-388014325100% (2)

- 3 Manacsa&Tan 2012 Strong Republic SidetrackedDocument41 pages3 Manacsa&Tan 2012 Strong Republic SidetrackedGil Osila JaradalNo ratings yet

- Payment of GratuityDocument11 pagesPayment of GratuityHari NaamNo ratings yet

- Contractor DatabaseDocument10 pagesContractor DatabaseVishal SaxenaNo ratings yet

- Develop Your Leadership SkillsDocument22 pagesDevelop Your Leadership Skillsektasharma123No ratings yet

- Income Under The Head Salaries: (Section 15 - 17)Document55 pagesIncome Under The Head Salaries: (Section 15 - 17)leela naga janaki rajitha attiliNo ratings yet

- Head Salary PDFDocument48 pagesHead Salary PDFRvi MahayNo ratings yet

- Income Tax Law and PracticesDocument26 pagesIncome Tax Law and Practicesremruata rascalralteNo ratings yet

- incone from salary ppts.pdf348Document48 pagesincone from salary ppts.pdf348saloniagarwalagarwal3No ratings yet

- Income From SalaryDocument29 pagesIncome From SalaryIsmail SayyadNo ratings yet

- Salary IncomeDocument83 pagesSalary IncomechitkarashellyNo ratings yet

- Income From SalaryDocument60 pagesIncome From SalaryroopamNo ratings yet

- Taxation of Leave SalaryDocument1 pageTaxation of Leave SalaryJPNo ratings yet

- Income from Salaries GuideDocument65 pagesIncome from Salaries GuideRupaliNo ratings yet

- Notes On Income From SalaryDocument5 pagesNotes On Income From SalaryNarendra KelkarNo ratings yet

- Incomes On RetirementDocument11 pagesIncomes On RetirementShabnam HabeebNo ratings yet

- Taxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBDocument32 pagesTaxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBRupal DalalNo ratings yet

- 40 40 Income From Salary BTDocument55 pages40 40 Income From Salary BTkiranshingoteNo ratings yet

- Salary Income-Pg DTDocument11 pagesSalary Income-Pg DTOnkar BandichhodeNo ratings yet

- Retirement Benefits: Taxable Limits and ExemptionsDocument38 pagesRetirement Benefits: Taxable Limits and ExemptionsVineet GargNo ratings yet

- Meaning of Salary': Condition For Charging Income U/H "Salaries"Document21 pagesMeaning of Salary': Condition For Charging Income U/H "Salaries"kiranshingoteNo ratings yet

- RETIREMENT BENEFITS EXPLAINEDDocument5 pagesRETIREMENT BENEFITS EXPLAINEDYusufNo ratings yet

- Final Indirect Tax ProjectDocument39 pagesFinal Indirect Tax Projectssg1015No ratings yet

- 2.2-Module 2-Part 2 PDFDocument12 pages2.2-Module 2-Part 2 PDFArpita ArtaniNo ratings yet

- 2.2 Module 2 Part 2Document12 pages2.2 Module 2 Part 2Arpita ArtaniNo ratings yet

- 5.3 Exemptions From Income From SalariesDocument3 pages5.3 Exemptions From Income From SalariesYash DedhiaNo ratings yet

- Salary SimplifiedDocument16 pagesSalary SimplifiedaruunstalinNo ratings yet

- Retirement BenefitsDocument10 pagesRetirement BenefitsRs AbhishekNo ratings yet

- EFFORTS BY-Ravleen Kaur Roll No-01391101818Document8 pagesEFFORTS BY-Ravleen Kaur Roll No-01391101818Harleen KaurNo ratings yet

- Retirement BenefitsDocument14 pagesRetirement BenefitsAnupNo ratings yet

- Salaxy Examples (Taxation)Document21 pagesSalaxy Examples (Taxation)PARTH NAIKNo ratings yet

- Unit 2 Notes, Part 1Document19 pagesUnit 2 Notes, Part 1Sandip Kumar BhartiNo ratings yet

- Income Under The Head SalaryDocument56 pagesIncome Under The Head Salaryjyoti_yadavNo ratings yet

- Notes On SalariesDocument18 pagesNotes On SalariesParul KansariaNo ratings yet

- Exempted Incomes: Section-10 (10) - Sec-10 (A) - Sec-10 (AA) - Sec-10 (B)Document3 pagesExempted Incomes: Section-10 (10) - Sec-10 (A) - Sec-10 (AA) - Sec-10 (B)Aneesh VelluvalappilNo ratings yet

- Sunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Document14 pagesSunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Prashant singhNo ratings yet

- Sub: - Topic: - Sub Topic:-Prepared By: - Roll No: - Subject ToDocument6 pagesSub: - Topic: - Sub Topic:-Prepared By: - Roll No: - Subject ToShah SamkitNo ratings yet

- Q1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDocument40 pagesQ1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDhiraj YAdavNo ratings yet

- P2Document18 pagesP2YusufNo ratings yet

- GRATUITY BY Pooja MiglaniDocument9 pagesGRATUITY BY Pooja MiglaniBrahamdeep KaurNo ratings yet

- TAX SALARY CHAPTERDocument32 pagesTAX SALARY CHAPTERkiranshingoteNo ratings yet

- Income From SalaryDocument22 pagesIncome From SalaryJatin DrallNo ratings yet

- Taxiation AssignmentDocument9 pagesTaxiation AssignmentNoman AreebNo ratings yet

- About The Charts: CA Pooja Kamdar DateDocument8 pagesAbout The Charts: CA Pooja Kamdar DatekbalakarthikaNo ratings yet

- Rahul Agrawal's Salary Income AnalysisDocument32 pagesRahul Agrawal's Salary Income AnalysiskiranshingoteNo ratings yet

- Module 2 - Income From SalariesDocument22 pagesModule 2 - Income From SalariesAishwarya NNo ratings yet

- Income From Salary-1Document25 pagesIncome From Salary-1Ila SinghNo ratings yet

- Unit 2 Income From Salary Meaning of SalaryDocument34 pagesUnit 2 Income From Salary Meaning of SalaryrahulahujaNo ratings yet

- 4.1 Salary Theory and Problems 1Document15 pages4.1 Salary Theory and Problems 1Krishna GuptaNo ratings yet

- Unit 2 Tax NotesDocument49 pagesUnit 2 Tax NotesrahulahujaNo ratings yet

- Income From SalariesDocument28 pagesIncome From SalariesAshok Kumar Meheta100% (2)

- Rahul Agrawal's Salary Income AnalysisDocument32 pagesRahul Agrawal's Salary Income AnalysiskiranshingoteNo ratings yet

- Income Not Forming Part OF Total IncomeDocument35 pagesIncome Not Forming Part OF Total IncomeBeing HumaneNo ratings yet

- GratuityDocument7 pagesGratuitySandeep TakNo ratings yet

- Tax On Salary IncomeDocument15 pagesTax On Salary Incomeapi-19778412No ratings yet

- Mission Completed Shubham2Document63 pagesMission Completed Shubham2Ravi SinghNo ratings yet

- 77taxability of Retirement Benefits 231122 092942Document9 pages77taxability of Retirement Benefits 231122 092942jasontamang565No ratings yet

- Income From SalaryDocument21 pagesIncome From SalaryAditya Avasare60% (10)

- Enhancement in Gratuity Limit Under Payment of Gratuity ActDocument4 pagesEnhancement in Gratuity Limit Under Payment of Gratuity ActPaymaster ServicesNo ratings yet

- Unit 2 Tax NotesDocument49 pagesUnit 2 Tax NotesP RajputNo ratings yet

- Income From Salary GuideDocument11 pagesIncome From Salary Guiderakshitha9reddy-1No ratings yet

- Unit 2 of Income TaxDocument20 pagesUnit 2 of Income TaxHemal PanchalNo ratings yet

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsFrom EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNo ratings yet

- 1 2Document15 pages1 2AMJAD ULLA RNo ratings yet

- 1 2Document15 pages1 2AMJAD ULLA RNo ratings yet

- Income Tax 01Document10 pagesIncome Tax 01AMJAD ULLA RNo ratings yet

- G.S.R (E) :-In Exercise of The Powers Conferred by Section 168 of The Central Goods andDocument1 pageG.S.R (E) :-In Exercise of The Powers Conferred by Section 168 of The Central Goods andkumar45caNo ratings yet

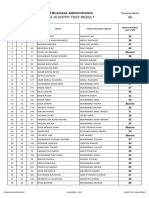

- Entry Test Result MPhil 2014 PDFDocument11 pagesEntry Test Result MPhil 2014 PDFHafizAhmadNo ratings yet

- Best Frequency Strategies - How Often To Post On Social Media PDFDocument24 pagesBest Frequency Strategies - How Often To Post On Social Media PDFLiet CanasNo ratings yet

- ELEC 121 - Philippine Popular CultureDocument10 pagesELEC 121 - Philippine Popular CultureMARITONI MEDALLANo ratings yet

- Plant Property and Equipment - Part 1 - PW - CWRDocument51 pagesPlant Property and Equipment - Part 1 - PW - CWRBENEDICT ANDREI SANTIAGONo ratings yet

- ICICI Health Insurance Policy DetailsDocument3 pagesICICI Health Insurance Policy DetailsarjunNo ratings yet

- Plastic PackagingDocument47 pagesPlastic PackagingRajaSekarsajja100% (1)

- KEB GM 2014 3 - enDocument109 pagesKEB GM 2014 3 - envankarpNo ratings yet

- Decolonising The FutureDocument20 pagesDecolonising The Futurebybee7207No ratings yet

- Analyzing Air Asia in Business Competition Era: AirasiaDocument14 pagesAnalyzing Air Asia in Business Competition Era: Airasiashwaytank10No ratings yet

- The Difficult Patient' As Perceived by Family Physicians: Dov Steinmetz and Hava TabenkinDocument6 pagesThe Difficult Patient' As Perceived by Family Physicians: Dov Steinmetz and Hava TabenkinRomulo Vincent PerezNo ratings yet

- Routine Pile Load Test-Ga-13.04.2021Document1 pageRoutine Pile Load Test-Ga-13.04.2021Digambar JadhavNo ratings yet

- IWR 0174 Ed12 - Jabra Headsets Amplifiers - OmniPCXplatforms - SoftphonesDocument83 pagesIWR 0174 Ed12 - Jabra Headsets Amplifiers - OmniPCXplatforms - SoftphonesAsnake TegenawNo ratings yet

- mPassBook 161022 150423 2918Document4 pagesmPassBook 161022 150423 2918Ashish kumarNo ratings yet

- The Bank and The Mundhra AffairDocument14 pagesThe Bank and The Mundhra AffairAmbika MehrotraNo ratings yet

- Macalintal v. PETDocument5 pagesMacalintal v. PETJazem AnsamaNo ratings yet

- Subhra Ranjan IR Updated Notes @upscmaterials PDFDocument216 pagesSubhra Ranjan IR Updated Notes @upscmaterials PDFSachin SrivastavaNo ratings yet

- United States v. Bueno-Hernandez, 10th Cir. (2012)Document3 pagesUnited States v. Bueno-Hernandez, 10th Cir. (2012)Scribd Government DocsNo ratings yet

- MP Process Flow - MBA - MM - MHRMDocument2 pagesMP Process Flow - MBA - MM - MHRMKAVITHA A/P PARIMAL MoeNo ratings yet

- Big Kaiser2019 PDFDocument624 pagesBig Kaiser2019 PDFGoto SamNo ratings yet

- 2003 June Calc Paper 6 (H)Document20 pages2003 June Calc Paper 6 (H)abbasfazilNo ratings yet

- Market Profiling, Targeting and PositioningDocument16 pagesMarket Profiling, Targeting and PositioningMichelle RotairoNo ratings yet

- Combined SGMA 591Document46 pagesCombined SGMA 591Steve BallerNo ratings yet

- NTPC Limited: (A Government of India Enterprise)Document7 pagesNTPC Limited: (A Government of India Enterprise)Yogesh PandeyNo ratings yet

- Joysticks For Hoist & Crane Control SystemsDocument5 pagesJoysticks For Hoist & Crane Control SystemsRunnTechNo ratings yet

- Capital Harness XC LaunchDocument36 pagesCapital Harness XC LaunchnizarfebNo ratings yet

- Bloodborne Pathogens Program: Western Oklahoma State College Employee Training HandbookDocument35 pagesBloodborne Pathogens Program: Western Oklahoma State College Employee Training HandbookKashaNo ratings yet