Professional Documents

Culture Documents

Inc Tax Syllabus

Inc Tax Syllabus

Uploaded by

Divya KarunakaranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inc Tax Syllabus

Inc Tax Syllabus

Uploaded by

Divya KarunakaranCopyright:

Available Formats

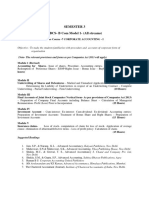

U16CO14

B.Com Hours per week 6

Semester-VI Credits 6

Core Course 12 (CC -12)

INCOME TAX LAW AND PRACTICE

Objective

To facilitate an understanding of the basic concepts and the computation of income

Unit I Introduction:

Basic concepts – Capital and revenue – Residential status- Incidence of Tax-Incomes exempt

from tax- Agricultural income- Tax slabs-Return of Income –Self Assessment-

Tax deduction at Source-Advance tax

Unit II Salary

Computation of income under the head Salaries- Basis of charge- Different forms of salary-

Allowances- Perquisites and their valuation – Deduction from salary- Provident funds-

Deductions under section 80C-Important 80 Subsections-Calculation of tax liability on salary

income

Unit III House Property

Computation of income under the head Income from House property- Basis of charge-

Determination of annual value- Income from let out property- Self occupied property-

Deductions allowed

Unit IV Business & Profession

Computation of Profits and gains from business and profession- Basis of charge-

Deductions –Valuation of stock

Unit V Capital Gains

Computation of income from capital gains- Basis of Charge- Computation of long term and

short term capital gains- Exemptions- Computation of income from other sources-

Books Recommended

1.Reddy and Reddy , Income Tax Law and Practice, Margham Publications, Chennai

2.Mehrotra and Goyal ,Income Tax Law and Practice, Sahitya Bhavan, Agra

3.Vinod Singhania, Students guide to Income Tax, Taxmann Publications,New Delhi

Marks Scheme

Section A (2*10=20 Marks Section B ( 5*5= 25 Marks) Section C(3*10=30Marks)

Questions 1 to 10 11a) Theory 11 b) Problem Questions 16 to 20

Theory Questions only 12a) Problem 12b) Problem Problems only

13a) Problem 13b) Problem

14a) Problem 14 b) Problem

15 a) Theory 15b) Problem

You might also like

- Tax Revision KitDocument260 pagesTax Revision KitEvans Lelach63% (16)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Cost Accounting SyllabusDocument1 pageCost Accounting SyllabusSuresh KrishnaNo ratings yet

- M. Com II TaxationDocument7 pagesM. Com II TaxationShree PatilNo ratings yet

- TittleDocument9 pagesTittleMaha PraveenNo ratings yet

- Income Tax IDocument4 pagesIncome Tax InishatNo ratings yet

- Sub Total 30 23Document28 pagesSub Total 30 23PRAGASH PAULNo ratings yet

- Tax Management SyllabusDocument2 pagesTax Management Syllabusbs_sharathNo ratings yet

- B.Com-3rd Year Pass Course 2016-17Document22 pagesB.Com-3rd Year Pass Course 2016-17Geetanjali BharadwajNo ratings yet

- LCC Book Keeping First Level (Effective From 1 January 2008) A) Syllabus TopicsDocument3 pagesLCC Book Keeping First Level (Effective From 1 January 2008) A) Syllabus TopicsrachelylNo ratings yet

- Principle of Taxation LawDocument3 pagesPrinciple of Taxation LawTaraChandraChouhanNo ratings yet

- Syllabus of Principle of Taxation Law For BALLB V SemesterDocument3 pagesSyllabus of Principle of Taxation Law For BALLB V SemesterYashNo ratings yet

- Tax Sybba FinanceDocument9 pagesTax Sybba FinancemayurNo ratings yet

- Income TaxDocument2 pagesIncome TaxHAREESHNo ratings yet

- Sem 3 Taxation - 2Document5 pagesSem 3 Taxation - 2Nidhip ShahNo ratings yet

- Am 3Document2 pagesAm 3Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Tax Management SyllabusDocument2 pagesTax Management Syllabusbs_sharathNo ratings yet

- NMCCDocument13 pagesNMCCMaddyNo ratings yet

- Corporate Accounting PDFDocument5 pagesCorporate Accounting PDFshivaji jadhavNo ratings yet

- 6 Trim 6 FIN - Corporate Tax PlanningDocument3 pages6 Trim 6 FIN - Corporate Tax Planning27vxjtfbh8No ratings yet

- 19COP16 Direct Taxes: Programme Course Code(s) TitleDocument1 page19COP16 Direct Taxes: Programme Course Code(s) Titleemmanual cheeranNo ratings yet

- Tax Management - NotesDocument66 pagesTax Management - NotesKarthick PNo ratings yet

- FYBBA AccountingDocument6 pagesFYBBA AccountingcadkthNo ratings yet

- Part A Answer All The Question 4 1 4Document3 pagesPart A Answer All The Question 4 1 4jeyappradhaNo ratings yet

- DTL Whole SyllabusDocument4 pagesDTL Whole Syllabuss58200204No ratings yet

- Principle of Taxation LawDocument3 pagesPrinciple of Taxation LawAnantHimanshuEkkaNo ratings yet

- Accountancy XI Smart Skills - 2020-21Document106 pagesAccountancy XI Smart Skills - 2020-21daamansuneja2No ratings yet

- CBCS .AB Corporate Accounting I Model 1Document12 pagesCBCS .AB Corporate Accounting I Model 1anjuoh21No ratings yet

- Course Outline - Income Tax - 2020Document9 pagesCourse Outline - Income Tax - 2020Mayank AameriaNo ratings yet

- Black Book PDFDocument101 pagesBlack Book PDFA 53 Gracy AsirNo ratings yet

- SYBCOM ACCOUNTS SEM IV Syllabus PDFDocument8 pagesSYBCOM ACCOUNTS SEM IV Syllabus PDFshrikantNo ratings yet

- 2018-19 Semester - 2018149124113Document48 pages2018-19 Semester - 2018149124113Kirti ChoudharyNo ratings yet

- Syllabus ITDocument2 pagesSyllabus ITUma RaoNo ratings yet

- BBA C202 Hons NEP 2022 Pages 9Document1 pageBBA C202 Hons NEP 2022 Pages 9saumyaaggarwal04augNo ratings yet

- AcctXI PDFDocument41 pagesAcctXI PDFAshwin ChauriyaNo ratings yet

- Accountancy First Year Revised Syllabus W.E.F. Session 2023 24Document3 pagesAccountancy First Year Revised Syllabus W.E.F. Session 2023 24sarsengmesNo ratings yet

- Icwai: The Institute of Cost and Works Accountants of India (ICWAI)Document12 pagesIcwai: The Institute of Cost and Works Accountants of India (ICWAI)mknatoo1963No ratings yet

- Commerce Hons RegularDocument48 pagesCommerce Hons RegularHimanshu palNo ratings yet

- II M.Com Even Semester 2023-24Document7 pagesII M.Com Even Semester 2023-24pgkathiravan007No ratings yet

- BBA Semester VI SyllabusDocument19 pagesBBA Semester VI SyllabusManju LakshmananNo ratings yet

- Dar-E-Arqam Girls College Sargodha Test No 1 (CH 1) : Q#1 Mcqs A B C DDocument8 pagesDar-E-Arqam Girls College Sargodha Test No 1 (CH 1) : Q#1 Mcqs A B C DsabaNo ratings yet

- Course Outline (Laws and Tax Management) PGDMDocument2 pagesCourse Outline (Laws and Tax Management) PGDMAmritaNo ratings yet

- Bcom P SyllabusDocument6 pagesBcom P SyllabusbhavukmahindruNo ratings yet

- Semester IIIDocument5 pagesSemester IIIayusharma1608No ratings yet

- Income TaxDocument109 pagesIncome TaxDaksh KohliNo ratings yet

- BCom 3rd and 4th Sem SyllabusDocument26 pagesBCom 3rd and 4th Sem Syllabusshurikenjutsu123No ratings yet

- Sri Venkateswara University: TirupatiDocument25 pagesSri Venkateswara University: TirupatiGopiNo ratings yet

- Social BookDocument72 pagesSocial BookKARANNo ratings yet

- Income Tax and Tds Practiotioner CourseDocument8 pagesIncome Tax and Tds Practiotioner CourseSujata GugaleNo ratings yet

- SY BCom NewDocument42 pagesSY BCom NewAamir KhanNo ratings yet

- AFIN 102 Financial Accounting Objectives:: ContentsDocument4 pagesAFIN 102 Financial Accounting Objectives:: ContentsApolloniousNo ratings yet

- 12 Accountancy English 2020 21Document464 pages12 Accountancy English 2020 21Anuja bisht100% (1)

- Corporate Tax PlanningDocument2 pagesCorporate Tax Planningsulagna sambitaNo ratings yet

- Financial-Mgmt I SEM5Document7 pagesFinancial-Mgmt I SEM5Samiksha ParasharNo ratings yet

- Syllabus: Choice Based Credit System (CBCS)Document41 pagesSyllabus: Choice Based Credit System (CBCS)Shilpi ChakrabortyNo ratings yet

- Accountancy Second Year Revised Syllabus W.E.F. Session 2023 24Document5 pagesAccountancy Second Year Revised Syllabus W.E.F. Session 2023 24uttamsonowal084No ratings yet