Professional Documents

Culture Documents

RMC No. 13-2020 Annex B - 1600-PT January 2018 ENCS

Uploaded by

Godfrey TejadaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC No. 13-2020 Annex B - 1600-PT January 2018 ENCS

Uploaded by

Godfrey TejadaCopyright:

Available Formats

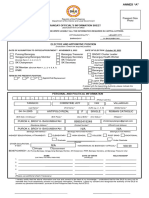

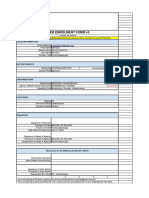

Annex “B”

Republic of the Philippines

For BIR BCS/ Department of Finance

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Monthly Remittance Return

1600-PT of Other Percentage Taxes Withheld

January 2018 Enter all required information in CAPITAL LETTERS using BLACK ink. Mark applicable boxes with an “X”.

Page 1 Two copies MUST be filed with the BIR and one held by the Taxpayer. 1600-PT 01/18 P1

For the month Number of

1 (MM/20YY) 2 0 2 Amended Return? Yes No 3 Any Tax Withheld? Yes No 4

Sheet/s Attached

Part I – Background Information

5 Taxpayer Identification Number (TIN) - - - 6 RDO Code

7 Withholding Agent’s Name (Last Name, First Name, Middle Name for Individuals OR Registered Name for Non-Individuals)

8 Registered Address (Indicate complete address. If branch, indicate the branch address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905)

8A ZIP Code

9 Contact Number 10 Category of Withholding Agent Private Government

11 Email Address

Are you availing of tax relief under

12 Special Law or International Tax Treaty? Yes No 12A If Yes, specify

Part II – Computation of Tax

ATC Tax Base Tax Rate Tax Withheld

13 . % .

14 . % .

15 . % .

16 . % .

17 . % .

18 Total Taxes Withheld (Sum of Items 13 to 17) .

19 Less: Taxes Remitted in Return Previously Filed, if this is an Amended Return .

20 Other Payments Made (attach proof) .

21 Total Tax Payments Made (Sum of Items 19 & 20) .

22 Tax Still Due/(Overremittance) (Item 18 Less Item 21) .

Add: Penalties 23 Surcharge .

24 Interest .

25 Compromise .

26 Total Penalties (Sum of Items 23 to 25) .

27 TOTAL AMOUNT STILL DUE/(Overremittance) (Sum of Items 22 and 26) .

If overremittance, apply for tax refund using BIR Form No. 1914 (Application for Tax Credits / Refunds).

I/We declare under the penalties of perjury that this return, and all its attachments, have been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct

pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information

as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes. (If Authorized Representative, attach authorization letter)

For Individual: For Non-Individual:

Signature over Printed Name of Taxpayer/Authorized Representative/Tax Agent Signature over Printed Name of President/Vice President/Authorized Officer or Representative/Tax Agent

(Indicate title/designation and TIN) (Indicate title/designation and TIN)

Tax Agent Accreditation No. / Date of Issue Expiry Date

Attorney’s Roll No.(If applicable) (MM/DD/YYYY) (MM/DD/YYYY)

Part III – Details of Payment

Drawee Bank/

Particulars Bank Code/Agency Number Date (MM/DD/YYYY) Amount

28 Cash/Bank Debit Memo .

29 Check .

30 Tax Debit Memo .

31 Others (Specify below)

.

Machine Validation/Revenue Official Receipt (ROR) Details (if not filed with an Authorized Agent Bank) Stamp of Receiving Office/AAB and Date of Receipt

(RO’s Signature/Bank Teller’s Initial)

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

BIR Form No.

Monthly Remittance Returns

1600-PT of Other Percentage Taxes Withheld

January 2018

Page 2 1600-PT 01/18 P2

TIN Withholding Agent’s Name

Schedule 1 - Monthly Alphalist of Payees from Whom Taxes were Withheld (format only) (Submit in electronic attachment for eFPS or email to

esubmission@bir.gov.ph)

TIN Name of Payees Amount of Income Amount of Tax Withheld

Seq. No. (Last Name, First Name, Middle Name for Individual)/ ATC Tax Rate

(Registered Name for Non-Individual)

Payment

(1) (2) (3) (4) (5) (6) (7)= (5x6)

1

2

3

4

5

Total Taxes Withheld and Remitted

Table 1 – Alphanumeric Tax Code (ATC)

NATURE OF PAYMENT TAX RATE ATC

APPLICABLE TO GOVERNMENT WITHHOLDING AGENTS ONLY:

Tax on Carriers and Keepers of Garages 3% WB 030

Franchise Tax on Gas and Utilities 2% WB 040

Franchise Tax on radio & radio & TV broadcasting companies whose annual gross receipts do not exceed P10M &

3% WB 050

who are not VAT-registered taxpayers

Tax on Life Insurance Premiums 2% WB 070

Tax on Overseas Dispatch, Message or Conversation from the Philippines 10% WB 090

Business tax on Agents of Foreign Insurance Companies – Insurance Agents 4% WB 120

Business tax on Agents of Foreign Insurance Companies – Owner of the Property 5% WB 121

Tax on International Carriers 3% WB 130

Tax on Cockpits 18% WB 140

Tax on amusement places, such as cabarets, night and day clubs, videoke bars, karaoke bars, karaoke television,

18% WB 150

karaoke boxes, music lounges and other similar establishments

Tax on Boxing exhibitions 10% WB 160

Tax on Professional basketball games 15% WB 170

Tax on jai-alai and race tracks 30% WB 180

Tax on sale, barter or exchange of stocks listed and traded through Local Stock exchange 6/10 of 1% WB 200

Tax on shares of stock sold or exchanged through initial and secondary public offering:

- Not over 25% 4% WB 201

- Over 25% but not exceeding 33 1/3% 2% WB 202

- Over 33 1/3% 1% WB 203

Tax on Banks and Non-Bank Financial Intermediaries Performing Quasi Banking Functions

A. On interest, commissions and discounts from lending activities as well as income from financial leasing, on

the basis of the remaining maturities of instrument from which such receipts are derived

- Maturity period is five years or less 5% WB 301

- Maturity period is more than five years 1% WB 303

B. On dividends and equity shares and net income of subsidiaries 0% WB 102

C. On royalties, rentals of property, real or personal, profits from exchange and all other items treated as gross

7% WB 103

income under the Code

D. On net trading gains within the taxable year on foreign currency, debt securities, derivatives and other

7% WB 104

similar financial instruments

Tax on Other Non-Banks Financial Intermediaries not Performing Quasi-Banking Functions

A. On interest, commissions and discounts from lending activities as well as Income from financial leasing, on

the basis of the remaining maturities of Instrument from which such receipts are derived

- Maturity period is five years or less 5% WB 108

- Maturity period is more than five years 1% WB 109

B. On all other items treated as gross income under the code 5% WB 110

APPLICABLE TO BOTH GOVERNMENT AND PRIVATE WITHHOLDING AGENTS:

Persons Exempt from VAT under Sec. 109BB (creditable)-Government Withholding Agent 3% WB 080

Persons Exempt from VAT under Sec. 109BB (creditable)-Private Withholding Agent 3% WB 082

Persons Exempt from VAT under Section 109BB (final) (Section 116 applies) 3% WB 084

MMC ______ AAE _____ MCZ _____ AES _____

MLIB ______ ECHR _____ YVL _____ RRGM _____

MTMI ______ RCC _____ TBV _____

LCB ______ MTM _____ JHB _____

NAC ______ RSDV _____ WPM _____

RPRR ______ JBA _____ GPS _____

You might also like

- Define Key Terms Used in Treasury DirectDocument7 pagesDefine Key Terms Used in Treasury DirectSteveManning100% (4)

- Credit TransferDocument21 pagesCredit TransferRajendra PilludaNo ratings yet

- ADIBDocument5 pagesADIBMohamed BathaqiliNo ratings yet

- Accounting For Taxes & Employee BenefitsDocument5 pagesAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Office of The Punong Barangay: Republic of The Philippines Province of Agusan Del Sur City of Bayugan Barangay PoblacionDocument3 pagesOffice of The Punong Barangay: Republic of The Philippines Province of Agusan Del Sur City of Bayugan Barangay PoblacionMARIMOTO100% (1)

- Ra 11261Document3 pagesRa 11261Kirsten Divine JueleNo ratings yet

- Philippine Education Co., Inc. vs. SorianoDocument2 pagesPhilippine Education Co., Inc. vs. SorianoKym Algarme0% (1)

- Resolution of Barangay SecretariesDocument17 pagesResolution of Barangay SecretariesJoanna QuizonNo ratings yet

- 1600-PT January 2018 ENCS FinalDocument2 pages1600-PT January 2018 ENCS FinalBrgy Sta. Cruz100% (7)

- Appoitnment BSPODocument1 pageAppoitnment BSPOTonton Barangay Council100% (1)

- Appointment: Republic of The Philippines MUNICIPALITY OF - Province of PangasinanDocument1 pageAppointment: Republic of The Philippines MUNICIPALITY OF - Province of Pangasinandesiree joy corpuzNo ratings yet

- Form 3: Annex D Fidelity Bond ApplicationDocument2 pagesForm 3: Annex D Fidelity Bond ApplicationMark Idaloy0% (1)

- Letter DPWHDocument1 pageLetter DPWHChristian BurgosNo ratings yet

- Barangay Secretary Punong Barangay Date DateDocument1 pageBarangay Secretary Punong Barangay Date DateOmar DizonNo ratings yet

- Reso No. 101-A-2022 Commendation For Barangay TipoloDocument2 pagesReso No. 101-A-2022 Commendation For Barangay TipoloRica Carmel LanzaderasNo ratings yet

- TUPAD Coordinator's Accomplishment ReportDocument1 pageTUPAD Coordinator's Accomplishment ReportJM LopezNo ratings yet

- Certificate of Accreditation: Ligas Kooperatiba NG Bayan Sa Pagpapaunlad (LKBP)Document4 pagesCertificate of Accreditation: Ligas Kooperatiba NG Bayan Sa Pagpapaunlad (LKBP)Hil HariNo ratings yet

- 11.08.23 Annex A BOIS Form Revised 2023 TineDocument2 pages11.08.23 Annex A BOIS Form Revised 2023 TineSamantha marquez50% (2)

- Complaiance To Barangay Full Disclosure PolicyDocument1 pageComplaiance To Barangay Full Disclosure Policysan nicolas 2nd betis guagua pampangaNo ratings yet

- Boxing Ring Letter RequestDocument1 pageBoxing Ring Letter RequestALFRED BUAONo ratings yet

- Resolution 16 Republic Act No. 11285 Energy Efficiency and Conservation ActDocument5 pagesResolution 16 Republic Act No. 11285 Energy Efficiency and Conservation ActBARANGAY MOLINO IINo ratings yet

- Malay Ordinance Requires Ferry FranchiseDocument3 pagesMalay Ordinance Requires Ferry FranchiseMichael jay sarmiento100% (1)

- Barangay Certificate for Lizabeth VerduguezDocument2 pagesBarangay Certificate for Lizabeth VerduguezEduardo CasesNo ratings yet

- BDRRMC Resolution Approves Communication Device FundingDocument2 pagesBDRRMC Resolution Approves Communication Device FundingJoan Sauler100% (1)

- Appointment Letter Daig BDCDocument1 pageAppointment Letter Daig BDCHeraiah FaithNo ratings yet

- Upgrading Math Teaching Standards Towards GlobalizationDocument1 pageUpgrading Math Teaching Standards Towards GlobalizationJoseph S. Palileo Jr.No ratings yet

- Post Activity Report BADocument3 pagesPost Activity Report BAJonathanNo ratings yet

- Office of The Punong Barangay: Holy Ghost Extension BarangayDocument2 pagesOffice of The Punong Barangay: Holy Ghost Extension BarangayHge BarangayNo ratings yet

- Junjun B. Bindoy, Barangay Case No. 1234xxx For: Breach of ContractDocument2 pagesJunjun B. Bindoy, Barangay Case No. 1234xxx For: Breach of ContractMartin EspinosaNo ratings yet

- Letter Request For Meralco Busted LightsDocument1 pageLetter Request For Meralco Busted LightsJenneriza DC Del Rosario100% (1)

- Barangay Napo Project ProposalsDocument5 pagesBarangay Napo Project ProposalsLyka Abdullah TayuanNo ratings yet

- BHW Solicitation LetterDocument1 pageBHW Solicitation LetterCheska MarieNo ratings yet

- EO - Designation of Brgy Info OfficerDocument2 pagesEO - Designation of Brgy Info OfficerP2LT UTIT-CAABAY JAGS100% (1)

- Appointment: Republic of The Philippines Municipality of San Quintin Province of PangasinanDocument3 pagesAppointment: Republic of The Philippines Municipality of San Quintin Province of Pangasinandesiree joy corpuzNo ratings yet

- Draft EO Designation of The Barangay Secretary As The Lead Action Officer RA 11934 Sim Registration Act DisseminationDocument2 pagesDraft EO Designation of The Barangay Secretary As The Lead Action Officer RA 11934 Sim Registration Act DisseminationJohn Que100% (2)

- Barangay Sta. Cruz: Republic of The Philippines First District, Quezon CityDocument2 pagesBarangay Sta. Cruz: Republic of The Philippines First District, Quezon CityOokie Nam100% (1)

- Seal of Good Local Governance For Barangay (SGLGB) Barangay ProfileDocument4 pagesSeal of Good Local Governance For Barangay (SGLGB) Barangay ProfileJay Nerva MontenegroNo ratings yet

- Certification: Office of The Punong BarangayDocument8 pagesCertification: Office of The Punong BarangayDaryl Jozef DelosoNo ratings yet

- Bois Form - Revised 2018Document2 pagesBois Form - Revised 2018Trisha Marie DogupNo ratings yet

- 14th Month PayDocument2 pages14th Month PayMicky MoranteNo ratings yet

- Appointment of WatcherDocument1 pageAppointment of Watcherdelacruzanaliza11No ratings yet

- OFBS Enrolment Form - NGA-GOCC-GFI TemplateDocument10 pagesOFBS Enrolment Form - NGA-GOCC-GFI Templatejenny lyn toledoNo ratings yet

- Water ResoDocument2 pagesWater Resoaba mojosNo ratings yet

- Office of The Sangguniang Kabataan: Province of Rizal Barangay Dulong Bayan IDocument2 pagesOffice of The Sangguniang Kabataan: Province of Rizal Barangay Dulong Bayan IMariel Anne AlvarezNo ratings yet

- SK Order SkitDocument4 pagesSK Order SkitML.TumagayNo ratings yet

- Benefits and Privileges of Barangay and SK OfficialsDocument7 pagesBenefits and Privileges of Barangay and SK OfficialsAnn Shelley PadillaNo ratings yet

- LNB CamSur MC No 03 S 2022 Remittance Annual DuesDocument2 pagesLNB CamSur MC No 03 S 2022 Remittance Annual Duesfinance2018 approNo ratings yet

- Barangay Appropriations, Commitments and DisbursementsDocument59 pagesBarangay Appropriations, Commitments and DisbursementsNichelle De Rama100% (1)

- Certificate For Net Take Home PayDocument2 pagesCertificate For Net Take Home PayPgas PaccoNo ratings yet

- Certification ElectricDocument1 pageCertification ElectricReynold Briones Azusano ButeresNo ratings yet

- Office of The Sangguniang Bayan: Action Taken On The Minutes of The Previous SessionDocument4 pagesOffice of The Sangguniang Bayan: Action Taken On The Minutes of The Previous SessionEstrella RoseteNo ratings yet

- Rbi Form ADocument1 pageRbi Form ARose Martinez BayNo ratings yet

- Transmittal Letter AbyipDocument1 pageTransmittal Letter AbyipRodjhen Anne P. BarquillaNo ratings yet

- Resolution No.114-S-2017 - Jan. 19, 2017 Declaration of Non-Working Holiday in Gto.Document1 pageResolution No.114-S-2017 - Jan. 19, 2017 Declaration of Non-Working Holiday in Gto.joisid17No ratings yet

- Oath of Undertaking TemplateDocument2 pagesOath of Undertaking TemplateQUeen Dai SY RamirezNo ratings yet

- Office of The Punong BarangayDocument1 pageOffice of The Punong BarangayBarangay Pangil100% (1)

- Utilization 10% SKDocument1 pageUtilization 10% SKMarieta Alejo100% (2)

- Beswmc-E oDocument2 pagesBeswmc-E oyna garcesNo ratings yet

- Application Letter JuneeDocument1 pageApplication Letter Juneeruby casas100% (1)

- LNB National - ELECTION - ForM - Annex M - Promissory NoteDocument1 pageLNB National - ELECTION - ForM - Annex M - Promissory NoteKing PerezNo ratings yet

- ATTENDANCE SHEETS For SICAP BADACDocument3 pagesATTENDANCE SHEETS For SICAP BADACDona JojuicoNo ratings yet

- Supplemental Aip Fidelity BondDocument4 pagesSupplemental Aip Fidelity BondCazy Mel EugenioNo ratings yet

- Office of The Punong Barangay Barangay Bagong SikatDocument2 pagesOffice of The Punong Barangay Barangay Bagong SikatMicky MoranteNo ratings yet

- Pweding I-EditDocument14 pagesPweding I-EditChristopher Torres100% (1)

- RMC No. 13-2020 Annex A - 1600-VT January 2018 ENCS PDFDocument2 pagesRMC No. 13-2020 Annex A - 1600-VT January 2018 ENCS PDFGodfrey Tejada0% (1)

- Alba Resort v. CADocument15 pagesAlba Resort v. CAGodfrey TejadaNo ratings yet

- 2 98 PDFDocument131 pages2 98 PDFGodfrey TejadaNo ratings yet

- RMC No. 13-2020 Annex B - 1600-PT January 2018 ENCS PDFDocument2 pagesRMC No. 13-2020 Annex B - 1600-PT January 2018 ENCS PDFGodfrey TejadaNo ratings yet

- RMC No. 13-2020Document1 pageRMC No. 13-2020Godfrey TejadaNo ratings yet

- RMC No. 13-2020 Annex B - 1600-PT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex B - 1600-PT 2018 GuidelinesGodfrey TejadaNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT January 2018 ENCS PDFDocument2 pagesRMC No. 13-2020 Annex A - 1600-VT January 2018 ENCS PDFGodfrey Tejada0% (1)

- RMC No. 13-2020 Annex A - 1600-VT January 2018 ENCSDocument2 pagesRMC No. 13-2020 Annex A - 1600-VT January 2018 ENCSGodfrey Tejada100% (2)

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- RMC No. 13-2020Document1 pageRMC No. 13-2020Godfrey TejadaNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- Unit 2 Internal Check SystemDocument24 pagesUnit 2 Internal Check SystemShaifaliChauhanNo ratings yet

- PressRelease PALIG Unveiling Sign On Schottegatweg (ENG)Document2 pagesPressRelease PALIG Unveiling Sign On Schottegatweg (ENG)Knipselkrant CuracaoNo ratings yet

- All Banks Contact NumbersDocument2 pagesAll Banks Contact NumbersKashif NiaziNo ratings yet

- Economics 3400 Money and Banking: PrerequisitesDocument2 pagesEconomics 3400 Money and Banking: PrerequisitessherNo ratings yet

- Nilgiris District Cooperative Bank OverviewDocument5 pagesNilgiris District Cooperative Bank OverviewSurenNo ratings yet

- Development of India's Mutual Fund IndustryDocument41 pagesDevelopment of India's Mutual Fund IndustryDeep Bhalodia100% (1)

- Importance of Customer ServiceDocument6 pagesImportance of Customer ServiceLogesh Ranganathan100% (1)

- Ferr ExpoDocument6 pagesFerr ExpoAnonymous uiD5GJBgNo ratings yet

- Sem 3Document9 pagesSem 3shioamn100% (1)

- Bse 20170810Document49 pagesBse 20170810BellwetherSataraNo ratings yet

- TEA Final ReportDocument18 pagesTEA Final ReportSpectrum News100% (1)

- Resume TWDocument1 pageResume TWapi-271182842No ratings yet

- Agency Correspondence: Allianz Life Insurance Malaysia BerhadDocument2 pagesAgency Correspondence: Allianz Life Insurance Malaysia BerhadKt TanNo ratings yet

- Apollo Change Request Form PDFDocument1 pageApollo Change Request Form PDFJituNo ratings yet

- G.R. No. 104528 PNB Vs Office of The PresidentDocument4 pagesG.R. No. 104528 PNB Vs Office of The PresidentJun RinonNo ratings yet

- OE Powerpoint PresentationDocument35 pagesOE Powerpoint PresentationAnonymous ibpKT07GNo ratings yet

- Factors Affecting Non-Performing Loans: Case Study On Development Bank of Ethiopia Central RegionDocument15 pagesFactors Affecting Non-Performing Loans: Case Study On Development Bank of Ethiopia Central RegionJASH MATHEW67% (3)

- Tandon Committee PresentationDocument13 pagesTandon Committee PresentationNitharshini Kannan0% (1)

- OpTransactionHistoryUX514 10 2023Document6 pagesOpTransactionHistoryUX514 10 2023Praveen SainiNo ratings yet

- Comex Gold Warrants: Frequently Asked QuestionsDocument2 pagesComex Gold Warrants: Frequently Asked QuestionsMarco PoloNo ratings yet

- HARLEY-DAVIDSON INC v. HARTFORD ACCIDENT AND INDEMNITY COMPANY Et Al Notice of RemovalDocument7 pagesHARLEY-DAVIDSON INC v. HARTFORD ACCIDENT AND INDEMNITY COMPANY Et Al Notice of RemovalACELitigationWatchNo ratings yet

- Sumer Project Report On Insurance by PchhinaDocument22 pagesSumer Project Report On Insurance by Pchhinapchhina50% (6)

- Lelong BlacklistedDocument3 pagesLelong BlacklistedAndy WilliamNo ratings yet

- Example of A Cash Up TemplateDocument48 pagesExample of A Cash Up TemplateJovitoMasapiNo ratings yet

- Why Hawala/Hundi Money Transfer Systems Continue Despite Being IllegalDocument3 pagesWhy Hawala/Hundi Money Transfer Systems Continue Despite Being IllegalShaqif Hasan SajibNo ratings yet