Professional Documents

Culture Documents

Dof Department Order No. 023-01

Uploaded by

Ralph Ronald CatipayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dof Department Order No. 023-01

Uploaded by

Ralph Ronald CatipayCopyright:

Available Formats

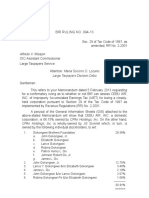

DOF DEPARTMENT ORDER NO.

023-01

PROVIDING FOR THE IMPLEMENTING RULES OF THE FIRST PARAGRAPH OF SECTION 4 OF THE NATIONAL

INTERNAL REVENUE CODE OF 1997, REPEALING FOR THIS PURPOSE DEPARTMENT ORDER NO. 005-99

AND REVENUE ADMINISTRATIVE ORDER NO. 1-99

WHEREAS, Section 4 of the National Internal Revenue Code of 1997 ("the NIRC") vests with the

Commissioner of Internal Revenue exclusive and original jurisdiction to interpret its provisions and other

tax laws, subject to review by the Secretary of Finance;

WHEREAS, Department Order No. 005-99, dated January 26, 1999 and Revenue Administrative Order

No. 1-99, dated February 5, 1999, implements the power of the Secretary of Finance to review rulings of

the Commissioner of Internal Revenue;

NOW THEREFORE, I, JOSE ISIDRO N. CAMACHO, Secretary of Finance, by virtue of the powers of

supervision and control over the Bureau of Internal Revenue granted to me by Section 2 of the NIRC and

Book IV, Title II, Chapter 4, Section 18 of the Administrative Code of 1987, do hereby order.

SECTION 1. Scope of this Order. — This Department Order shall apply to all rulings of the Bureau of

Internal Revenue (BIR) that implement the provisions of the NIRC and other tax laws.

SECTION 2. Validity of Rulings. — A ruling by the Commissioner of Internal Revenue shall be

presumed valid unless modified, reversed or superseded by the Secretary of Finance.

SECTION 3. Rulings Adverse to the Taxpayer. — A taxpayer who receives an adverse ruling from the

Commissioner of Internal Revenue may, within thirty (30) days from the date of receipt of such ruling,

seek its review by the Secretary of Finance, either by himself/itself or through his/its duly accredited

agent or representative. The request for review shall be in writing and under oath, and must:

a) be addressed to the Secretary of Finance and filed with the Revenue Operations Group,

Department of Finance, DOF Building, BSP Complex, Roxas Boulevard corner Pablo Ocampo Street, City

of Manila

b) contain the heading "Request for Review of BIR Ruling No. ____";

c) allege and show that the request was filed within the reglementary period;

d) allege the material facts upon which the ruling was requested;

e) state that exactly the same set of facts were presented to the BIR;

f) define the issues to be resolved;

g) contain the facts and the law relied upon to dispute the ruling of the Commissioner;

h) be signed by or on behalf of the taxpayer filing the request for review, provided that, only those

lawyers engaged by the taxpayer and/or tax agents accredited by the BIR may sign on behalf of the

taxpayer;

i) indicate the Taxpayer Identification Number (TIN) of the taxpayer;

j) be accompanied by a copy of the Commissioner's challenged ruling;

k) contain a statement of the Office of the Commissioner of Internal Revenue, indicating that a

copy of the request for review of the ruling was received by the Commissioner's Office and;

l) specifically state that the taxpayer does not have a pending assessment or case in any court of

justice where the same issues are being considered.

Furthermore, the taxpayer must, at the time of filing of the request for review, submit a duplicate copy

of the records on file with the BIR pertaining to his request, which set of records must be authenticated

and certified by the BIR.

These are mandatory requirements, and failure to comply with any of the stated substantive

requirements shall be sufficient basis for the Secretary of Finance to dismiss with prejudice the request

for review.

SECTION 4. Affirmation, Reversal or Modification by the Secretary of Finance. — The Secretary of

Finance may affirm, reverse or modify a ruling of the Commissioner of Internal Revenue. The action of

the Secretary shall consider only the same set of facts presented to the BIR in the first instance.

In the case of an affirmation, the Secretary of Finance may rely wholly on the reasons stated in the ruling

of the Commissioner of Internal Revenue.

Subject to the provisions of Section 246 of the NIRC, a reversal or modification of the ruling shall

terminate its effectivity upon the earlier date of the receipt of written notice of such reversal or

modification by the taxpayer or by the BIR.

SECTION 5. Certification Fee to be Imposed by the BIR. — For this purpose, the BIR is given the

authority to impose appropriate certification fees to carry out the provisions of this Order.

SECTION 6. Repealing Clause. — Department Order No. 005-99 and Revenue Administrative Order

No. 1-99, as well as all other existing Department Orders and issuances of the Commissioner of Internal

Revenue that are inconsistent with this Order, are hereby repealed.

SECTION 7. Effectivity. — This Department Order shall take effect immediately.

Done in the City of Manila this 5th day of October 2001.

(SGD.) JOSE ISIDRO N. CAMACHO

Secretary

You might also like

- BIR Ruling Determines CEBU Air Inc Subject to IAETDocument4 pagesBIR Ruling Determines CEBU Air Inc Subject to IAETseraphinajewelineNo ratings yet

- Sec Memo Circular No.6 Series of 2008 Section 3Document2 pagesSec Memo Circular No.6 Series of 2008 Section 3orlyNo ratings yet

- Waiver & QuitclaimDocument1 pageWaiver & QuitclaimAnonymous uMI5BmNo ratings yet

- Tax Law for BusinessDocument3 pagesTax Law for BusinessJianSadakoNo ratings yet

- BIR Audit ManualDocument89 pagesBIR Audit ManualRivera RwlrNo ratings yet

- Business Name Undertaking DocumentDocument2 pagesBusiness Name Undertaking DocumentAnonymous dtceNuyIFI100% (1)

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- Affidavit of Assumption of ResponsibilityDocument1 pageAffidavit of Assumption of ResponsibilityJennifer Cerio100% (1)

- Deed of Absolute SaleDocument2 pagesDeed of Absolute SaleHenna CapaoNo ratings yet

- SEC SMR Format 2yrs - 2018 - 10 CopiesDocument1 pageSEC SMR Format 2yrs - 2018 - 10 CopiesMarvin CeledioNo ratings yet

- Affidavit of AccidentDocument2 pagesAffidavit of AccidentGillian Caye Geniza BrionesNo ratings yet

- Ramo 1-98Document8 pagesRamo 1-98abi_demdamNo ratings yet

- Application For Closure of BusinessDocument2 pagesApplication For Closure of BusinessallanNo ratings yet

- Sample SMRDocument1 pageSample SMRearl0917No ratings yet

- Consented Abduction-2Document3 pagesConsented Abduction-2Rolex VizcondeNo ratings yet

- KAMMPIL Inc. 2022 Financial Statements Audit Representation LetterDocument10 pagesKAMMPIL Inc. 2022 Financial Statements Audit Representation LetterJOHN MARK ARGUELLESNo ratings yet

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- Affidavit of Incident Windshield DamageDocument2 pagesAffidavit of Incident Windshield Damagejc cayananNo ratings yet

- Affidavit For Moto PropioDocument1 pageAffidavit For Moto PropioErnel DicoNo ratings yet

- BIR Ruling on Informer's RewardDocument4 pagesBIR Ruling on Informer's RewardAnonymous fnlSh4KHIgNo ratings yet

- 2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Document2 pages2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Yya Ladignon100% (2)

- Sworn Statement For Application of Permit To Use Loose Leaf Books of AccountsDocument1 pageSworn Statement For Application of Permit To Use Loose Leaf Books of AccountsTesston BullionNo ratings yet

- Affidavit attesting to accuracy of 2020 sales recordsDocument1 pageAffidavit attesting to accuracy of 2020 sales recordsCha GomezNo ratings yet

- Security Bank Audited Financial Statements 2017Document141 pagesSecurity Bank Audited Financial Statements 2017crystal01heartNo ratings yet

- Contractor's License Amnesty Application RequirementsDocument11 pagesContractor's License Amnesty Application RequirementsArlyn JarabeNo ratings yet

- APPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Document7 pagesAPPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Albert YsegNo ratings yet

- Affidavit Damage To VehicleDocument2 pagesAffidavit Damage To VehicleJude SampangNo ratings yet

- SEC Form 17-C report on changes in control or assetsDocument12 pagesSEC Form 17-C report on changes in control or assetscamileholicNo ratings yet

- Affidavit of Extraordinary PrescriptionDocument2 pagesAffidavit of Extraordinary PrescriptionPaul Joseph MercadoNo ratings yet

- Pbcom V CirDocument9 pagesPbcom V CirAbby ParwaniNo ratings yet

- Review XXXX ("Petition") Filed by Complainant-Appellant XXXXXX inDocument2 pagesReview XXXX ("Petition") Filed by Complainant-Appellant XXXXXX inIpe Closa100% (1)

- AML Act Key Features Explained in 40 CharactersDocument19 pagesAML Act Key Features Explained in 40 CharactersDanielleNo ratings yet

- Sample Affidavit Format: Name of Account Holder, Son of Mr. .., Resident of ..Document1 pageSample Affidavit Format: Name of Account Holder, Son of Mr. .., Resident of ..Devprakash AgnihotriNo ratings yet

- Deed of Sole HeirDocument1 pageDeed of Sole HeirLuisa LopezNo ratings yet

- Increase of Authorized Capital Stock: Additional Requirements Depending On The Kind of Payment On SubscriptionDocument3 pagesIncrease of Authorized Capital Stock: Additional Requirements Depending On The Kind of Payment On SubscriptionsejinmaNo ratings yet

- Letter - Update Tax Exemption As of March 25, 2013Document10 pagesLetter - Update Tax Exemption As of March 25, 2013Jhoana Parica FranciscoNo ratings yet

- BIR Ruling DA-C-133 431-08Document5 pagesBIR Ruling DA-C-133 431-08Lee Anne YabutNo ratings yet

- BIR Ruling No. 242-18 (Gift Certs.)Document7 pagesBIR Ruling No. 242-18 (Gift Certs.)LizNo ratings yet

- Philippine parental consent affidavitDocument3 pagesPhilippine parental consent affidavitJayson YuzonNo ratings yet

- Annex C.1 - BITCDocument1 pageAnnex C.1 - BITCMoro oil SalimbaoNo ratings yet

- Annex C.1Document1 pageAnnex C.1Eric OlayNo ratings yet

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDocument29 pages209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaNo ratings yet

- Compliance Monitoring CertificateDocument1 pageCompliance Monitoring CertificateEly SibayanNo ratings yet

- RR 1-98Document9 pagesRR 1-98Crnc NavidadNo ratings yet

- Revenue Code - Isabela City - Ordinance 15-438Document237 pagesRevenue Code - Isabela City - Ordinance 15-438imranNo ratings yet

- Ffidavit: Republic of The Philippines) Province of Camarines Sur) Municipality of Ocampo) S.SDocument1 pageFfidavit: Republic of The Philippines) Province of Camarines Sur) Municipality of Ocampo) S.SMichael Mendoza MarpuriNo ratings yet

- Bir Ruling Da 086 08Document5 pagesBir Ruling Da 086 08Orlando O. CalundanNo ratings yet

- Affidavit of UndertakingDocument1 pageAffidavit of UndertakingMaria OzawiNo ratings yet

- Petition For Dropping LTFRBDocument3 pagesPetition For Dropping LTFRBMegan Camille SanchezNo ratings yet

- BIR Ruling No. OT-026-20 (RMO 9-14)Document4 pagesBIR Ruling No. OT-026-20 (RMO 9-14)Hailin QuintosNo ratings yet

- Bir Ruling 332-12Document3 pagesBir Ruling 332-12Neil MayorNo ratings yet

- Auditor AffidavitDocument2 pagesAuditor AffidaviterjieNo ratings yet

- Materials For How To Handle BIR Audit Common Issues - 2021 Sept 21Document71 pagesMaterials For How To Handle BIR Audit Common Issues - 2021 Sept 21cool_peach100% (1)

- Ramo 1-2019Document74 pagesRamo 1-2019Donato Vergara IIINo ratings yet

- Special Power of AttorneyDocument1 pageSpecial Power of AttorneygbvNo ratings yet

- Non Operation With SpaDocument2 pagesNon Operation With SpaRobert marollanoNo ratings yet

- Department Order No. 7Document3 pagesDepartment Order No. 7Pat PatNo ratings yet

- Rulings - HTML: From The BIR WebsiteDocument3 pagesRulings - HTML: From The BIR WebsiteLeighNo ratings yet

- Bureau of Internal RevenueDocument4 pagesBureau of Internal RevenueYna YnaNo ratings yet

- Revenue Bulletin No. 1-2003 No Ruling AreasDocument3 pagesRevenue Bulletin No. 1-2003 No Ruling AreasArianne CyrilNo ratings yet

- Abano Evid Kenzo 1Document11 pagesAbano Evid Kenzo 1Ralph Ronald CatipayNo ratings yet

- Evidence Revised Rules (Am-19!08!15-Sc)Document29 pagesEvidence Revised Rules (Am-19!08!15-Sc)Ralph Ronald CatipayNo ratings yet

- Da11 Doh105Document15 pagesDa11 Doh105Melvin BanzonNo ratings yet

- Abano Evid Kenzo 1Document11 pagesAbano Evid Kenzo 1Ralph Ronald CatipayNo ratings yet

- Downloadable PDF - Leveraging Article 36 - How To Free Your Client From An Inconvenient MarriageDocument12 pagesDownloadable PDF - Leveraging Article 36 - How To Free Your Client From An Inconvenient MarriageRalph Ronald CatipayNo ratings yet

- DTI Supplemental Advisory (5 April 2020)Document9 pagesDTI Supplemental Advisory (5 April 2020)Ralph Ronald CatipayNo ratings yet

- Agrarian Reform Law ExplainedDocument5 pagesAgrarian Reform Law ExplainedRalph Ronald CatipayNo ratings yet

- 2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFDocument73 pages2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFCris Anonuevo100% (1)

- Philippines joint circular on COVID-19 social aidDocument27 pagesPhilippines joint circular on COVID-19 social aidJeremy Ryan ChuaNo ratings yet

- CDC Investors Guide - Annex ADocument13 pagesCDC Investors Guide - Annex ARalph Ronald CatipayNo ratings yet

- Revised Code CGDocument19 pagesRevised Code CGRheneir MoraNo ratings yet

- 2020 CORPORATE LAW OutlineDocument60 pages2020 CORPORATE LAW OutlineRalph Ronald Catipay60% (5)

- Republic Act No. 1071Document2 pagesRepublic Act No. 1071Ralph Ronald CatipayNo ratings yet

- Billie Blanco AGRASOC Outline Reviewer As of Apr 14 Without Highlights PDFDocument105 pagesBillie Blanco AGRASOC Outline Reviewer As of Apr 14 Without Highlights PDFRalph Ronald CatipayNo ratings yet

- The Investor's Guide to Business in the PhilippinesDocument62 pagesThe Investor's Guide to Business in the PhilippinesMartin MartelNo ratings yet

- Revised Guidelines For The Sale and Lease of BCDA Properties PDFDocument8 pagesRevised Guidelines For The Sale and Lease of BCDA Properties PDFRalph Ronald CatipayNo ratings yet

- Agrasoc Reviewer MTDocument66 pagesAgrasoc Reviewer MTRalph Ronald Catipay100% (2)

- New SMRDocument2 pagesNew SMRFrancis ChrisNo ratings yet

- Da11 Doh105Document15 pagesDa11 Doh105Melvin BanzonNo ratings yet

- Da11 Doh105Document15 pagesDa11 Doh105Melvin BanzonNo ratings yet

- The Investor's Guide to Business in the PhilippinesDocument62 pagesThe Investor's Guide to Business in the PhilippinesMartin MartelNo ratings yet

- Political Law Some Relevant Questions and Suggested Answers (Pre-Week Notes)Document22 pagesPolitical Law Some Relevant Questions and Suggested Answers (Pre-Week Notes)Mary Louise100% (2)

- Revised Guidelines For The Sale and Lease of BCDA Properties PDFDocument8 pagesRevised Guidelines For The Sale and Lease of BCDA Properties PDFRalph Ronald CatipayNo ratings yet

- ASG Civpro Post-Midterms Transcript PDFDocument68 pagesASG Civpro Post-Midterms Transcript PDFRalph Ronald CatipayNo ratings yet

- LAST MINUTE REMEDIAL LAW TIPSDocument39 pagesLAST MINUTE REMEDIAL LAW TIPSRalph Ronald CatipayNo ratings yet

- 2 Hacienda Luisita V PARC Aug 21Document8 pages2 Hacienda Luisita V PARC Aug 21Ralph Ronald CatipayNo ratings yet

- Political Law: 2019 Mock-Bar ExaminationsDocument15 pagesPolitical Law: 2019 Mock-Bar ExaminationsRalph Ronald CatipayNo ratings yet

- Special Proceedings SY 2019-2020 Semestral ExaminationDocument5 pagesSpecial Proceedings SY 2019-2020 Semestral ExaminationRalph Ronald CatipayNo ratings yet

- 2019 Political Law Last Minute TipsDocument22 pages2019 Political Law Last Minute TipsMuhammadIbnSuluNo ratings yet

- Mock-Bar Exams in Legal Ethics & Practical ExercisesDocument19 pagesMock-Bar Exams in Legal Ethics & Practical ExercisesRalph Ronald CatipayNo ratings yet

- FC Sem 1 Basic Features of Indian ConstitutionDocument4 pagesFC Sem 1 Basic Features of Indian ConstitutionDineshNo ratings yet

- Arellano V Pascual (2010)Document2 pagesArellano V Pascual (2010)EM RG100% (2)

- Regulation establishes procedures for Oromia customary courtsDocument44 pagesRegulation establishes procedures for Oromia customary courtsMilkii Way92% (26)

- Claim in A NutshellDocument11 pagesClaim in A NutshellRebel X100% (3)

- 23 - Shrout Bill Plea in Bar and DemandDocument11 pages23 - Shrout Bill Plea in Bar and DemandFreeman Lawyer0% (1)

- Assignment ContractDocument3 pagesAssignment ContractDavid DameronNo ratings yet

- Definition and Scope of Constitutional LawDocument5 pagesDefinition and Scope of Constitutional LawElisha ChitananaNo ratings yet

- Case Analysis: Enrollment: Contract Law & FerpaDocument3 pagesCase Analysis: Enrollment: Contract Law & FerpaJenny B.No ratings yet

- Atty Disbarment Case ReviewedDocument10 pagesAtty Disbarment Case ReviewedbchiefulNo ratings yet

- The Nuremburg Code (Wiki)Document4 pagesThe Nuremburg Code (Wiki)Tara AlvaradoNo ratings yet

- T He Case: vs. EDNA MALNGAN y MAYO, AppellantDocument18 pagesT He Case: vs. EDNA MALNGAN y MAYO, AppellantVin BautistaNo ratings yet

- Constitutional Provisions For Women in IndiaDocument13 pagesConstitutional Provisions For Women in Indiarishabhsingh261No ratings yet

- Issa Nabongo Wanina Appeals Wildlife ConvictionDocument5 pagesIssa Nabongo Wanina Appeals Wildlife ConvictionChris MorrisNo ratings yet

- Ra 4670 Magna Carta For Public School TeachersDocument8 pagesRa 4670 Magna Carta For Public School TeachersMary Claire De GuzmanNo ratings yet

- Guidelines For Drafting An Endorsement ContractDocument6 pagesGuidelines For Drafting An Endorsement ContractGabriel LajaraNo ratings yet

- D READ This Understanding The Executor OfficeDocument27 pagesD READ This Understanding The Executor OfficeDean Golden100% (3)

- Company LawDocument13 pagesCompany LawIrene Gomachas50% (2)

- Clause 5: RD TH RD THDocument13 pagesClause 5: RD TH RD THjewonNo ratings yet

- CivPro Dynamic Builders Vs PrebiteroDocument2 pagesCivPro Dynamic Builders Vs PrebiteroSheena PalmaresNo ratings yet

- De OcampoDocument3 pagesDe Ocampovmanalo16No ratings yet

- Insurance Premium and Loss RulesDocument2 pagesInsurance Premium and Loss Rulesjury jasonNo ratings yet

- The Evolving Pakistani Criminal Justice System - A Study of The Raymond Davis MatterDocument43 pagesThe Evolving Pakistani Criminal Justice System - A Study of The Raymond Davis MatterMuhammad Atif ArslanNo ratings yet

- Pre-Trial BriefDocument7 pagesPre-Trial Briefleo.rosarioNo ratings yet

- Paper Ge05: Fundamentals of Ethics, Corporate Governance and Business LawDocument6 pagesPaper Ge05: Fundamentals of Ethics, Corporate Governance and Business LawRefa- E- Alam 1110884030No ratings yet

- Demanda de Puigdemont Demanda Davant Del Comitè de Drets Humans de l'ONUDocument37 pagesDemanda de Puigdemont Demanda Davant Del Comitè de Drets Humans de l'ONUModerador Noticies Web100% (1)

- Investigating The Existence and Effectiveness of Musical Copyright Law in LesothoDocument11 pagesInvestigating The Existence and Effectiveness of Musical Copyright Law in LesothoTakura BhilaNo ratings yet

- Levis Vs VogueDocument12 pagesLevis Vs VoguedayneblazeNo ratings yet

- Tan Ying Hong V Tan Sian San & Ors, (2010) 2 MLJ 1Document14 pagesTan Ying Hong V Tan Sian San & Ors, (2010) 2 MLJ 1syazana sallehNo ratings yet

- United States v. Elder, 177 U.S. 104 (1900)Document20 pagesUnited States v. Elder, 177 U.S. 104 (1900)Scribd Government DocsNo ratings yet

- CNLU HART-FULLER DEBATEDocument19 pagesCNLU HART-FULLER DEBATEShatakshi Sharma100% (1)