Professional Documents

Culture Documents

Itc - Reversal Entries

Itc - Reversal Entries

Uploaded by

soumav1230 ratings0% found this document useful (0 votes)

8 views3 pagesOriginal Title

_ITC_REVERSAL ENTRIES.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views3 pagesItc - Reversal Entries

Itc - Reversal Entries

Uploaded by

soumav123Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

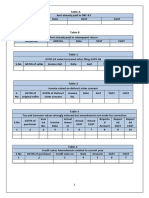

ITC REVERSAL CASES

1 IF PAYMENT MADE AFTER 180 DAYS

2 ASSEST SALE BEFORE THE TENURE

3 INPUT USED FOR PERSONAL USE RATHER THAN BUSINESS USE

4 DEPRECIATION CLAIMED ON THE ITC OF ASSET

ITC REVERSAL A/C

Reversal of Input tax credit for inward sup

1) GGST ITC REVERSAL

SGST ITC REVERSAL

IGST ITC REVERSAL

GGST ITC INTEREST INTERIM

SGST ITC INTEREST INTERIM

IGST ITC INTEREST INTERIM

GGST ITC RECEIVABLE

SGST ITC RECEIVABLE

IGST ITC RECEIVABLE

GGST INTEREST PAYABLE ACCONT

SGST INTEREST PAYABLE ACCONY

IGST INTEREST PAYABLE ACCONY

when payment made after 180 days

PURCHASE /EXPENCESA/C DR AIC DR 1 GGST ITC REVERSAL

SGST ITC REVERSAL

CGST -ITC RECEIVABLE AIC DR IGST ITC REVERSAL

SGST-ITC RECEIVABLE AIC DR

IGST-ITC RECEIVABLE AIC DR GGST ITC RECEIVABLE

CESS-ITC RECEIVABLE AIC DR SGST ITC RECEIVABLE

IGST ITC RECEIVABLE

TO VENDOR/BANK 2 PURCHASE /EXPENCESA/C DR

GGST ITC REVERSAL

SGST ITC REVERSAL

IGST ITC REVERSAL

** after making paymet entry will be reve

of Input tax credit for inward supplies when GST payment not made by the Supplier

ITC REVERSAL DR 2) PARTY/VENDOR A/C DR 4)

ITC REVERSAL DR GGST ITC REVERSAL CR

ITC REVERSAL DR SGST ITC REVERSAL CR

ITC INTEREST INTERIM DR IGST ITC REVERSAL CR

ITC INTEREST INTERIM DR GGST ITC INTEREST INTERIM CR

ITC INTEREST INTERIM DR SGST ITC INTEREST INTERIM CR

ITC RECEIVABLE CR IGST ITC INTEREST INTERIM CR

ITC RECEIVABLE CR

ITC RECEIVABLE CR 3) GGST INTEREST PAYABLE ACCONT DR

INTEREST PAYABLE ACCONT CR SGST INTEREST PAYABLE ACCONY DR

INTEREST PAYABLE ACCONY CR IGST INTEREST PAYABLE ACCONY DR

INTEREST PAYABLE ACCONY CR TO BANK

ment made after 180 days

ITC REVERSAL DR

ITC REVERSAL DR

ITC REVERSAL DR

ITC RECEIVABLE CR at HQ level E ledger balance

ITC RECEIVABLE CR at HQ level E ledger balance

ITC RECEIVABLE CR at HQ level E ledger balance

E /EXPENCESA/C DR DR

ITC REVERSAL CR

ITC REVERSAL CR

ITC REVERSAL CR

making paymet entry will be reversed.

SG

You might also like

- Partnership Act 1932Document38 pagesPartnership Act 1932Priya Chawla100% (2)

- Shailesh Black BookDocument57 pagesShailesh Black Bookshailesh prajapatiNo ratings yet

- Certificate of Live BirthDocument2 pagesCertificate of Live BirthRoakh100% (1)

- Form Gstr-2: Government of India/State Department ofDocument13 pagesForm Gstr-2: Government of India/State Department ofParameshwar RaoNo ratings yet

- GST Entries For Every Month SalesDocument3 pagesGST Entries For Every Month SalesGiri Sukumar100% (1)

- INPUT TAX CREDIT (ITC) " Under GST Regime - Taxguru - inDocument20 pagesINPUT TAX CREDIT (ITC) " Under GST Regime - Taxguru - inAtin KumarNo ratings yet

- Form GSTR-3B (August'21) : Particulars Total Taxable Value Igst CGST Sgst/UtgstDocument3 pagesForm GSTR-3B (August'21) : Particulars Total Taxable Value Igst CGST Sgst/UtgstDost BhawanaNo ratings yet

- ComplianceDocument4 pagesComplianceAnkur BiswasNo ratings yet

- Goods & Service Tax (OFI) White Paper On AccountingDocument9 pagesGoods & Service Tax (OFI) White Paper On AccountingRahul JainNo ratings yet

- GST HandbookDocument27 pagesGST HandbookShahnawaz Shaikh0% (1)

- S B GabhawallaDocument59 pagesS B GabhawallaaksNo ratings yet

- Payable (28,413) (6,505) (6,505)Document6 pagesPayable (28,413) (6,505) (6,505)EXELIENT TAX SERVICESNo ratings yet

- Adobe Scan Jul 18, 2022Document1 pageAdobe Scan Jul 18, 2022lavi krishnaniNo ratings yet

- Ty Baf Sem Vi All Sample Question PaperDocument35 pagesTy Baf Sem Vi All Sample Question Paperjainam shahNo ratings yet

- TablesDocument6 pagesTablesShiva PatwariNo ratings yet

- CH 12 Goods and Service TaxDocument15 pagesCH 12 Goods and Service TaxHarshul MittalNo ratings yet

- Purchase Invoices and Bill of SupplyDocument38 pagesPurchase Invoices and Bill of SupplySHIV SHANKARNo ratings yet

- BMS (CBCS) Sem 2 BaDocument29 pagesBMS (CBCS) Sem 2 BaTanisha BawneNo ratings yet

- GST Accounting EntriesDocument24 pagesGST Accounting EntriesRamesh KumarNo ratings yet

- Calculation of GSTDocument13 pagesCalculation of GSTSukanta PalNo ratings yet

- ITC Condition TaxmanDocument5 pagesITC Condition TaxmanSubhasish ChatterjeeNo ratings yet

- GST OverviewDocument18 pagesGST Overviewrathoursoumya1305No ratings yet

- GST PRACTICE SETs - SET 7 (9th Edition)Document6 pagesGST PRACTICE SETs - SET 7 (9th Edition)Ismail RizwanNo ratings yet

- Original 1692010361 Cs Project Report TemplateDocument12 pagesOriginal 1692010361 Cs Project Report TemplatedeepakasopaNo ratings yet

- Deduction Under Capital GainsDocument14 pagesDeduction Under Capital GainsHemal PanchalNo ratings yet

- Return GST IndiaDocument56 pagesReturn GST IndiathecoltNo ratings yet

- Calculation of Tax Liability Assignment: Rishabh KaushikDocument22 pagesCalculation of Tax Liability Assignment: Rishabh KaushikLkNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument15 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaNeeraj ChandrolNo ratings yet

- Concept of Input Tax Credit: © Indirect Taxes Committee, ICAIDocument35 pagesConcept of Input Tax Credit: © Indirect Taxes Committee, ICAIyennamNo ratings yet

- CA Inter Compact Books For May 21Document216 pagesCA Inter Compact Books For May 21Rahul AgrawalNo ratings yet

- Fa PresentationDocument40 pagesFa PresentationMithra AreeckalNo ratings yet

- 1613200874GST Question Bank - May 2021 (With Solutions) PDFDocument157 pages1613200874GST Question Bank - May 2021 (With Solutions) PDFKhusboo ChowdhuryNo ratings yet

- Study Material of TaxationDocument4 pagesStudy Material of TaxationAishuNo ratings yet

- Amendment in ITC Availment Rule - WEF Oct 2019 - RSVA & CODocument2 pagesAmendment in ITC Availment Rule - WEF Oct 2019 - RSVA & COanon_18081010No ratings yet

- Cargo Agent Presentation For GST March 2018Document13 pagesCargo Agent Presentation For GST March 2018rishi pandeyNo ratings yet

- Issues of Present TaxationDocument36 pagesIssues of Present TaxationvijayNo ratings yet

- GST Invoice ProformaDocument10 pagesGST Invoice ProformaBest Better100% (2)

- For GST Concept and GST Jounral EntriesDocument11 pagesFor GST Concept and GST Jounral EntriesaditikaushikNo ratings yet

- CA Final IDT Corrigendum May 19Document1 pageCA Final IDT Corrigendum May 19Natasha PrasharNo ratings yet

- Input Tax Credit Under GSTDocument35 pagesInput Tax Credit Under GSTGiri SukumarNo ratings yet

- GST Basic For WebsiteDocument17 pagesGST Basic For WebsiteUdit JalanNo ratings yet

- Loss Assessment & GST ImplicationsDocument13 pagesLoss Assessment & GST ImplicationsShiba PadhiNo ratings yet

- Ccac 1.3 Electronic Accounting Final Exam of GSTDocument7 pagesCcac 1.3 Electronic Accounting Final Exam of GSTkishenmanocha485No ratings yet

- GSTR ReturnDocument136 pagesGSTR Returnyoyorikee0% (1)

- Accounting Entries Under GSTDocument9 pagesAccounting Entries Under GSTLovaraju RajuNo ratings yet

- GST (Payment of Tax) FinalDocument6 pagesGST (Payment of Tax) FinalDARK KING GamersNo ratings yet

- Account StatementDocument2 pagesAccount Statementmca2k15.manitNo ratings yet

- GST e Booklet PDFDocument7 pagesGST e Booklet PDFshravaniNo ratings yet

- Goods & Services Tax (GST) : SimplifiedDocument7 pagesGoods & Services Tax (GST) : SimplifiedJibin J ThomasNo ratings yet

- Icici Bank GST GuidelinesDocument7 pagesIcici Bank GST GuidelinesShivam GuptaNo ratings yet

- GST e Booklet PDFDocument7 pagesGST e Booklet PDFshravaniNo ratings yet

- Format Variation StatementDocument8 pagesFormat Variation StatementabhishekNo ratings yet

- Zero Rated Supplies Under GST: CA Sachin Kumar JainDocument3 pagesZero Rated Supplies Under GST: CA Sachin Kumar Jainparam.ginniNo ratings yet

- How To Pass Accounting Entries Under GST - GST Impact On FinancialsDocument9 pagesHow To Pass Accounting Entries Under GST - GST Impact On FinancialsHimanshu ChaudharyNo ratings yet

- Form GSTR-1: Government of India/State Department ofDocument11 pagesForm GSTR-1: Government of India/State Department ofManish PandeyNo ratings yet

- Accounting For GSTDocument30 pagesAccounting For GSTHarnitNo ratings yet

- ProjectDocument37 pagesProjectcontactnilkanth123No ratings yet

- Crypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationFrom EverandCrypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationNo ratings yet

- The Interaction Between Public and Private International Law Some New Trends Gautam Narasimhan William V JohnDocument14 pagesThe Interaction Between Public and Private International Law Some New Trends Gautam Narasimhan William V Johnsyuhada fadilahNo ratings yet

- Rico Auto Industries: Valuations Become Attractive Post-Correction Upgraded To BuyDocument2 pagesRico Auto Industries: Valuations Become Attractive Post-Correction Upgraded To Buyajd.nanthakumarNo ratings yet

- 3 Ch. Cas. 1, 22 Eng. Rep. 931 (Ch. 1682)Document6 pages3 Ch. Cas. 1, 22 Eng. Rep. 931 (Ch. 1682)Abhishek RajNo ratings yet

- Servitudes Part 2: Property LawDocument60 pagesServitudes Part 2: Property LawFacu BernardoNo ratings yet

- Bird LawsuitDocument21 pagesBird LawsuitGMG EditorialNo ratings yet

- Geddes Case BriefDocument5 pagesGeddes Case BriefEric DeAndrè TownsendNo ratings yet

- 14 Canceran v. PeopleDocument13 pages14 Canceran v. PeopleStephanie SerapioNo ratings yet

- Joint Declaration of China - Asean Prosecutors - General Conference ChinaDocument4 pagesJoint Declaration of China - Asean Prosecutors - General Conference ChinaM INo ratings yet

- CS FORM No. 100 Revised September 2016Document3 pagesCS FORM No. 100 Revised September 2016Xcali BurNo ratings yet

- SRA Principles and Code of ConductDocument35 pagesSRA Principles and Code of ConductDang DangNo ratings yet

- Land Titles NotesDocument10 pagesLand Titles NotesAerylle GuraNo ratings yet

- Residence and Travel Questionnaire: Tataaia/Nb/Dm/126Document2 pagesResidence and Travel Questionnaire: Tataaia/Nb/Dm/126Data CentrumNo ratings yet

- No.123 Landlord and Tenant Responsibility For State and Condition of Property PDFDocument82 pagesNo.123 Landlord and Tenant Responsibility For State and Condition of Property PDFOptiks HamiltonNo ratings yet

- Gainor v. Sidley, Austin, Brow - Document No. 66Document17 pagesGainor v. Sidley, Austin, Brow - Document No. 66Justia.comNo ratings yet

- Buenavista, MarinduqueDocument2 pagesBuenavista, MarinduqueSunStar Philippine NewsNo ratings yet

- Ispat ExpressDocument1 pageIspat ExpressJagannath MajhiNo ratings yet

- Bca Lu Nappqp01 PDFDocument3 pagesBca Lu Nappqp01 PDFj100% (1)

- Unauthorized Practice of Law Receiver Kevin Singer Receivership Specialists Whistleblower Leak - Gregg Foster, John Rachlin, Richard Marquis - Contra Costa County District Attorney - California Attorney General Kamala Harris - State Bar of California Jayne KimDocument54 pagesUnauthorized Practice of Law Receiver Kevin Singer Receivership Specialists Whistleblower Leak - Gregg Foster, John Rachlin, Richard Marquis - Contra Costa County District Attorney - California Attorney General Kamala Harris - State Bar of California Jayne KimCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (1)

- Leave No Marks - Enhanced Interrogation TechniquesDocument57 pagesLeave No Marks - Enhanced Interrogation Techniquesda5id665100% (2)

- Adm. Case No. 8108 July 15, 2014 Dante La Jimenez & Lauro G. VizcondeDocument6 pagesAdm. Case No. 8108 July 15, 2014 Dante La Jimenez & Lauro G. VizcondeZyrene CabaldoNo ratings yet

- Ignacio V AttyDocument2 pagesIgnacio V AttyEdith OliverosNo ratings yet

- Personally Identifiable Information (PII) - The 21st Century ThreatDocument12 pagesPersonally Identifiable Information (PII) - The 21st Century Threatpp3naloziNo ratings yet

- Rule On Dna & Electronic EvidenceDocument11 pagesRule On Dna & Electronic EvidenceMarefel Anora100% (1)

- American Revolution Pre-AssessmentDocument22 pagesAmerican Revolution Pre-Assessmentapi-314226075No ratings yet

- The Fight Over The Rizal LawDocument2 pagesThe Fight Over The Rizal LawDarwin FlamencoNo ratings yet

- Central Azucarera de Bais Employees Union v. Central Azucarera de Bais, Nov. 17, 2010Document2 pagesCentral Azucarera de Bais Employees Union v. Central Azucarera de Bais, Nov. 17, 2010Andrea GatchalianNo ratings yet

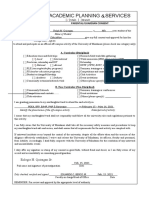

- Academic Planning Services: Main BranchDocument1 pageAcademic Planning Services: Main BranchDave RuizNo ratings yet