Professional Documents

Culture Documents

Non-Current Assets Held For Sale and Discontinued Operations

Uploaded by

Angela Nicole AguilarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Non-Current Assets Held For Sale and Discontinued Operations

Uploaded by

Angela Nicole AguilarCopyright:

Available Formats

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held

FRS Non-current assets held for sale and discontinued operations

Chapter 9 1. Introduction

Non-current Assets Held for Sale and Discontinued Operations

As its name suggests, this IFRS covers two areas, namely:

Reference: IFRS 5 • non-current assets held for sale; and

• discontinued operations.

Contents: Page With regard to ‘non-current assets’, this IFRS essentially suggests that there needs to be a

further classification in the statement of financial position: ‘non-current assets held for sale’.

1. Introduction 310 In addition, it specifies that ‘held for sale assets’ are not to be depreciated.

2. Definitions 310

This IFRS does not apply to the following assets since these assets are covered by their own

3. Non-current assets held for sale: identification 311 specific standards:

3.1 Overview 311 • Deferred tax assets (IAS 12)

3.2 Criteria to be met before a non-current asset is classified as ‘held for sale’ 311 • Assets relating to employee benefits (IAS 19)

3.2.1 General criteria 311 • Financial assets (IAS 39)

3.2.2 Criteria where a completed sale is not expected within one year • Investment property measured under the fair value model (IAS 40)

311

3.2.3 Criteria where the asset is acquired with the intention to sell • Non-current assets measured at fair value less point-of-sale costs (IAS 41: Agriculture)

312

• Contractual rights under insurance contracts (IFRS 4)

4. Non-current assets held for sale: measurement 312

4.1 General measurement principles 312

2. Definitions

4.2 Measurement principles specific to the cost model 313

4.2.1 The basic principles when the cost model was used 313

Example 1: reclassification of an asset measured using the cost model 313 Definitions included in Appendix A of the IFRS include the following:

Example 2: reclassification of an asset measured using the cost model 315

4.2.2 The tax effect when the cost model was used 316 • Current asset: an asset

Example 3: tax effect of reclassification and the cost model 316 - that is expected to be realised within 12 months after the end of the reporting period;

4.3 Measurement principles specific to the revaluation model 317 - that is expected to be sold, used or realised (converted into cash) as part of the

4.3.1 The principles when the revaluation model was used 317 normal operating cycle;

Example 4: reclassification of an asset using the revaluation model 318 - that is held mainly for the purpose of being traded; or

Example 5: re-measurement of an asset held for sale, using the 320 - that is a cash or cash equivalents that is not restricted in use within the 12 month

revaluation model period after the end of the reporting period.

4.4 Reversal of classification as ‘held for sale’ 321 • non-current asset: an asset that does not meet the definition of a current asset

Example 6: re-measurement of assets no longer ‘held for sale’ 322 • discontinued operation: a component of an entity that either has been disposed of or is

classified as held for sale and:

5. Non-current assets held for sale: disclosure 322 a) represents a separate major line of business or geographical area of operations,

5.1 Overview 322 b) is part of a single co-ordinated plan to dispose of a separate major line of business or

5.2 In the statement of financial position 322 geographical area of operations; or

5.3 In the statement of financial position or notes thereto 323 c) is a subsidiary acquired exclusively with view to resale.

5.4 Other note disclosure 323

Example 7: disclosure of non-current assets held for sale 323 • component of an entity: operations and cash flows that can be clearly distinguished,

operationally and for financial reporting purposes, from the rest of the entity.

6. Discontinued operations: identification 325

• disposal group: a group of assets to be disposed of, by sale or otherwise, together as a

7. Discontinued operations: measurement 325 group in a single transaction, and liabilities directly associated with those assets that will

be transferred in the transaction. The group includes goodwill acquired in a business

8. Discontinued operations: disclosure 326 combination if the group is a cash-generating unit to which goodwill has been allocated in

8.1 In the statement of comprehensive income 326 accordance with the requirements of paragraphs 80-87 of IAS 36 Impairment of Assets

8.2 In the statement of cash flows 327 (as revised in 2004) or if it is an operation within a cash-generating unit.

8.3 Other note disclosure 328

8.3.1 Components no longer held for sale 328 • firm purchase commitment: an agreement with an unrelated party, binding on both

8.3.2 Criteria met after the end of the reporting period 328 parties and usually legally enforceable, that:

a) specifies all significant terms, including the price and timing of the transactions; and

9. Summary 329 b) includes a disincentive for non-performance that is sufficiently large to make

performance highly probable.

• highly probable: significantly more likely than probable.

• probable: more likely than not.

309 Chapter 9 310 Chapter 9

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held for sale and discontinued operations

• During the initial one-year period, circumstances arise that were previously considered

3. Non-current assets held for sale: identification (IFRS 5.6 - .12) unlikely and, as a result, a non-current asset (or disposal group) previously classified as

held for sale is not sold by the end of the period, and:

3.1 Overview - during the initial one-year period the entity took action necessary to respond to the

change in circumstances,

The main thrust of IFRS 5 is that non-current assets that are ‘held for sale’ must be classified - the non-current asset (or disposal group) is being actively marketed at a price that is

separately in the statement of financial position (i.e. a machine that is held for sale will no reasonable, given the change in circumstances, and

longer be included as part of property, plant and equipment). Certain criteria must first be - the criteria in paragraph 7 (that sets out that the asset must be available for immediate

met before a non-current asset is classified as a ‘non-current asset held for sale’. sale) and paragraph 8 (that sets out that the sale must be highly probable) are met.

3.2 Criteria to be met before a non-current asset is classified as ‘held for sale’ 3.2.3 Criteria where the asset is acquired with the intention to sell (IFRS 5.11)

3.2.1 General criteria It may happen that an entity acquires a non-current asset (or disposal group) exclusively with

the view to its subsequent disposal. In this case, the non-current asset must be classified as

A non-current asset (or disposal group) must be classified as held for sale if its carrying ‘held for sale’ immediately on acquisition date, on condition that:

amount will be recovered mainly through a sale transaction than through continuing use. • the one-year requirement is met (unless a longer period is allowed by paragraph 9 and the

related appendix B); and

Non-current assets that meet all the following criteria may be separately classified as ‘non- • it is highly probable that any other criteria given in para 7 and para 8 that are not met

current assets held for sale’: immediately on the date of acquisition, will be met within a short period (usually three

• Is the asset available for sale immediately and at normal terms? The asset (or disposal months) after acquisition.

group) must be available for immediate sale in its present condition subject only to terms

that are usual and customary for sales of such assets (or disposal groups); 4. Non-current assets held for sale: measurement (IFRS 5.15 - .25)

• Has management committed itself to a sales plan? Management, with the necessary

authority to approve the action, must have committed itself to a plan to sell;

• Has an active programme to sell begun? The active programme must be to both locate a 4.1 General measurement principles

buyer and to complete the plan to sell the asset (or disposal group);

• Is the sale expected to happen within one year? The sale must be expected to qualify for An entity shall measure a non-current asset (or disposal group) classified as held for sale at

recognition as a completed sale within one year from the date of classification as held for the lower of its carrying amount and fair value less costs to sell.

sale, except as permitted by paragraph 9 and appendix B;

• Is the expected selling price reasonable? The asset (or disposal group) must be actively If a newly acquired asset (or disposal group) meets the criteria to be classified as held for sale,

marketed at a price that is reasonable in relation to its current fair value; and applying paragraph 15 will result in the asset being measured on initial recognition at the

• Is it unlikely that significant changes to the plan will be made? The actions required to lower of its carrying amount had it not been so classified (e.g. cost) and fair value less costs to

complete the plan must indicate that it is unlikely that significant changes to the plan will sell. Since the asset is newly acquired, its cost will equal its fair value. Therefore, an asset

be made or that the plan will be withdrawn. acquired as part of a business combination, shall initially be measured at fair value (its cost)

less costs to sell.

This means that assets that are to be abandoned should not be classified and measured as

‘held for sale’ since their carrying amount will be recovered principally through continuing For all other assets (other than newly acquired assets) that are classified as non-current assets

use (until date of abandonment) rather than through a sale. This means that depreciation on held for sale, there are two distinct phases of its life:

assets that are to be abandoned should not cease. • Before it was classified as held for sale; and

• Once it is classified as held for sale.

3.2.2 Criteria where a completed sale is not expected within one year (Appendix B)

Before an asset is classified as held for sale, it is measured in terms of its own relevant IFRS.

There may be occasions where the asset would still be ‘held for sale’ even though the sale If, for example, the asset is an item of property, plant and equipment, the asset will have been

may not be completed and recognised as a sale within one year. This happens when: measured in terms of IAS 16, which will mean that:

• on initial acquisition, the asset will have been recorded at cost; and

• At the date that the entity commits itself to a plan to sell a non-current asset (or disposal • subsequently, the asset will have been depreciated, revalued (if the revaluation model

group), it reasonably expects that others (not a buyer) will impose conditions on the was used to measure the asset) and reviewed for impairments annually (whether the cost

transfer of the asset (or disposal group) that will extend the period required to complete or revaluation model were used).

the sale, and:

- actions necessary to respond to those conditions cannot be initiated until after a firm If this asset is then to be reclassified as ‘held for sale’, it will be measured as follows:

purchase commitment is obtained, and • In terms of its previous relevant IFRS:

- a firm purchase commitment is highly probable within one year. Immediately before reclassifying the asset as ‘held for sale’, the asset must be re-

• An entity obtains a firm purchase commitment and, as a result, a buyer or others measured using its previous measurement model; for example if the asset was previously

unexpectedly impose conditions on the transfer of a non-current asset (or disposal group) an item of property, plant and equipment that was measured using the:

previously classified as held for sale that will extend the period required to complete the • Cost model: depreciate to date of reclassification and then check for impairments; or

sale, and: • Revaluation model: depreciate to date of reclassification, revalue if appropriate and

- timely actions necessary to respond to the conditions have been taken, and check for impairments; then

- a favourable resolution of the delaying factors is expected.

311 Chapter 9 312 Chapter 9

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held for sale and discontinued operations

• In terms of IFRS 5: Journal: 1 January 20X3 Debit Credit

On reclassifying the asset as ‘held for sale’,

- re-measure to the lower of ‘carrying amount’ and ‘fair value less costs to sell’; and Impairment loss (expense) 15 000

- stop depreciating it. - Plant: accumulated impairment loss 15 000

Impairment loss before initial classification as ‘held for sale’

If, in the unusual instance a sale is not expected to occur within one year, it may be necessary

(depending on materiality) to measure the ‘costs to sell’ at their present value. Note: There is no depreciation on this asset.

4.2 Measurement principles specific to the cost model

B. If ‘fair value less costs to sell’ subsequently increases: recognise a ‘reversal of impairment loss’

4.2.1 The basic principles when the cost model was used (income) – limited to accumulated impairment losses

If an asset measured under the cost model is re-classified as ‘held for sale’:

• immediately before reclassifying the asset as ‘held for sale’, the asset must be re- Workings: C

measured using its previous measurement model (i.e. the cost model per IAS 16, if the

item was previously property, plant and equipment); New fair value less costs to sell: 70 000 – 2 000 68 000

• then, in terms of IFRS 5: Prior fair value less costs to sell: 100 000 cost – 20 000 accum depreciation – (65 000)

- re-measure it to the lower of ‘carrying amount’ and ‘fair value less costs to sell’; 15 000 impairment loss

- stop depreciating it; and Impairment loss reversed*: 68 000 – 65 000 3 000

- re-measure to ‘fair value less costs to sell’ whenever appropriate: any impairment loss

will be expensed in the statement of comprehensive income whereas impairment * Note: the ‘accumulated impairment loss’ is 15 000 before the reversal, thus the reversal of 3 000 is

losses reversed are recognised as income but are limited to the asset’s accumulated not limited (the previous accumulated impairment loss is bigger: 15 000 is bigger than 3 000).

impairment losses.

Journal: 30 June 20X3 Debit Credit

You may have noticed that, when using the cost model, there can be no initial increase in the

carrying amount on classification as ‘held for sale’ because the non-current asset must Plant: accumulated impairment loss 3 000

initially be measured at the lower of its ‘carrying amount’ and ‘fair value less costs to sell’. - Impairment loss reversed (income) 3 000

For example, an asset with a ‘carrying amount’ of 80 000 and ‘fair value less costs to sell’ of Reversal of impairment loss: on re-measurement of ‘NCA held for sale’

90 000 will not be adjusted because the lower of the two is the current carrying amount of

80 000. Note: There is no depreciation on this asset. The impairment to date is C12 000 (15 000 – 3 000)

Example 1: reclassification of an asset measured using the cost model

C. If ‘fair value less costs to sell’ subsequently increases: recognise a ‘reversal of impairment loss’

An item of plant, measured using the cost model, has a carrying amount of C80 000 (cost: (income) – limited to accumulated impairment losses

100 000 and accumulated depreciation: 20 000) on 1 January 20X3 on which date all criteria

for separate classification as a ‘non-current asset held for sale’ are met. Workings: C

Required: New fair value less costs to sell: 90 000 – 5 000 85 000

Show the journal entries relating to the reclassification of the plant assuming that: Prior fair value less costs to sell 100 000 – 20 000 accum depreciation – (65 000)

A. the fair value is C70 000 and the expected costs to sell are C5 000 on 1 January 20X3; 15 000 impairment loss

B. on 30 June 20X3 (6-months later), the fair value is C70 000 and expected costs to sell are Increase in value 20 000

C2 000; Limited to prior cumulative impairment losses 15 000

C. on 30 June 20X3 (6-months later), the fair value is C90 000 and expected costs to sell are Impairment loss reversed*: 85 000 – 65 000 = 20 000 limited to 15 000 15 000

C5 000.

* Note: the difference between the latest ‘fair value less costs to sell’ (85 000) and the prior ‘fair value

Solution to example 1: reclassification of an asset using the cost model

less costs to sell’ (65 000) of 20 000 is limited to the previous ‘accumulated impairment loss’ of 15

000.

Comment: this example explains the limit to the reversal of the impairment loss.

Journal: 30 June 20X3 Debit Credit

A. If carrying amount > ‘fair value less costs to sell’: recognise an ‘impairment loss’ (expense)

Plant: accumulated impairment loss 15 000

Workings: C - Impairment loss reversed (income) 15 000

Reversal of impairment loss on re-measurement of ‘non-current asset held

Carrying amount given 80 000 for sale’

Fair value less costs to sell: 70 000 – 5 000 (65 000)

Decrease in value (impairment loss) 80 000 – 65 000 15 000 Note: There is no depreciation on this asset. The impairment to date is C0 (15 000 – 15 000)

313 Chapter 9 314 Chapter 9

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held for sale and discontinued operations

Example 2: reclassification of an asset measured using the cost model C. If ‘fair value less costs to sell’ subsequently increases: recognise a ‘reversal of impairment loss’

(income) – limited to accumulated impairment losses

An item of plant, measured using the cost model (i.e. at historical carrying amount), has a

carrying amount of 80 000 (cost 100 000) on 1 January 20X3 on which date all criteria for

Workings: C

separate classification as a ‘non-current asset held for sale’ are met. This asset had previously

been impaired by 3 000 (i.e. this is the balance on the accumulated impairment loss account).

New fair value less costs to sell: 90 000 – 5 000 85 000

Prior fair value less costs to sell 70 000 – 5 000 (65 000)

Required:

Show the journal entries relating to the reclassification of the plant assuming: Increase in value 20 000

A. the fair value is 70 000 and the expected costs to sell are 5 000 on 1 January 20X3; Limited to prior cumulative impairment losses 15 000 + 3 000 18 000

B. 6 months later, on 30 June 20X3, the fair value is 70 000 and the expected costs to sell are Impairment loss reversed*: 85 000 – 65 000 = 20 000 limited to 15 000 18 000

2 000;

C. 6 months later, on 30 June 20X3, the fair value is 90 000 and the expected costs to sell are * Note: The difference between the latest ‘fair value less costs to sell’ and the prior ‘fair value less

5 000. costs to sell’ of 20 000 is limited to the ‘cumulative impairment loss’ recognised of 18 000, calculated

as follows:

Solution to example 2: reclassification of an asset measured using the cost model C

Impairment loss: 18 000

Comment: this example explains the limit to the reversal of the impairment loss. It differs from the - before reclassification given 3 000

previous example in that this asset had previously been impaired before it was reclassified as a non- - on reclassification 80 000 – 65 000 15 000

current asset held for sale.

A. If carrying amount > ‘fair value less costs to sell’: recognise an ‘impairment loss’ (expense) Journal: 30 June 20X3 Debit Credit

Workings: C Plant: accumulated impairment loss 18 000

Carrying amount given 80 000 - Impairment loss reversed (income) 18 000

Fair value less costs to sell: 70 000 – 5 000 (65 000) Reversal of impairment loss on re-measurement of ‘asset held for sale’

Decrease in value (impairment loss) 80 000 – 65 000 15 000

Note: There is no depreciation on this asset. The impairment to date is now C0 (18 000 - 18 000)

Journal: 1 January 20X3 Debit Credit

4.2.2 The tax effect when the cost model was used

Impairment loss (expense) 15 000

- Plant: accumulated impairment loss 15 000 As soon as an asset is classified as held for sale, depreciation thereon ceases. The tax

Impairment loss on initial classification of NCA as ‘held for sale’ authorities, however, do not stop deducting tax allowances (where tax allowances were due in

terms of the tax legislation) simply because you have decided to sell the asset. The difference

Note: There is no depreciation on this asset. The impairment to date is now C18 000 (3 000 + 15 000) between the nil depreciation and the tax allowance (if appropriate) causes deferred tax. The

principles affecting the current tax payable and deferred tax balances are therefore exactly the

B. If ‘fair value less costs to sell’ subsequently increases: recognise a ‘reversal of impairment loss’ same as for any other non-current asset.

(income) – limited to accumulated impairment losses

Example 3: tax effect of reclassification and the cost model

Workings: C

An item of plant, measured using the cost model (i.e. at historical carrying amount), has a

New fair value less costs to sell 70 000 – 2 000 68 000 carrying amount of C70 000 (cost 100 000) and a tax base of C90 000 on 1 January 20X3 on

Prior fair value less costs to sell 70 000 – 5 000 (65 000) which date all criteria for separate classification as a ‘non-current asset held for sale’ are met.

Increase in value (impairment loss reversed*) 68 000 – 65 000 3 000 The fair value less costs to sell on this date are C65 000. This asset had not previously been

impaired. The tax authorities allow a deduction of 10% on the cost of this asset. The tax rate

* Note: the ‘accumulated impairment loss’ is 18 000 before this reversal (15 000 + 3 000), therefore is 30%. The profit before tax is correctly calculated to be C200 000. There are no temporary

the impairment loss reversal of 3 000 is not limited (the previous accumulated impairment loss is or permanent differences other than those evident from the information provided.

bigger: 18 000 is bigger than 3 000).

Required:

Journal: 30 June 20X3 Debit Credit A. Calculate the current normal tax payable and the deferred tax balance at 31 December

20X3.

Plant: accumulated impairment loss 3 000 B. Journalise the current normal tax and the deferred tax for the year ended 31 December

- Impairment loss reversed (income) 3 000 20X3.

Reversal of impairment loss on re-measurement of ‘asset held for sale’

Note: There is no depreciation on this asset. The impairment to date is now C15 000 (18 000 - 3 000)

315 Chapter 9 316 Chapter 9

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held for sale and discontinued operations

Solution to example 3: tax effect of reclassification and the cost model Example 4: reclassification of an asset measured using the revaluation model

A: Calculations An item of plant, revalued to fair value using the revaluation model, met all criteria for

classification as ‘held for sale’ on 1 January 20X4. The following information is relevant:

Current normal income tax Calculations C

Cost: 100 000 (purchased 1 January 20X1)

Profit before tax 200 000 Depreciation: 10% per annum straight-line to nil residual values.

Add back depreciation Assets held for sale are not depreciated 0 Fair value: 120 000 (revalued 1 January 20X3).

Add back impairment Impairment on re-classification as ‘held for sale’ 5 000 Revaluations are performed using the net replacement value method

Less tax allowance 100 000 x 10% (10 000)

Taxable profits 195 000 Required:

Current tax 195 000 x 30% 58 500 Show all journal entries relating to the reclassification as ‘held for sale’ assuming that:

A. The fair value is C100 000 and the expected selling costs are C9 000 on 1 January 20X4;

Deferred tax: Carrying Tax Temporary Deferred B. The fair value is C150 000 and the expected selling costs are C20 000 on 1 January 20X4.

Non-current asset held for sale amount base difference tax C. The fair value is C60 000 and the expected selling costs are C20 000 on 1 January 20X4.

Balance – 1 January 20X3 70 000 90 000 20 000 6 000 Asset Solution to example 4: reclassification of an asset measured using the revaluation model

Less impairment to ‘fair value –

(5 000) 0 Cr DT, A. If the actual carrying amount > historical carrying amount (i.e. there is already a revaluation

costs to sell’ (70 000 – 65 000) (1 500)

Dr TE

Depreciation/ tax allowance 0 (10 000) surplus) and the fair value decreases on date of reclassification (although not entirely

Balance – 31 December 20X3 65 000 80 000 15 000 4 500 Asset removing the revaluation surplus balance) and there are costs to sell: reverse revaluation

surplus due to drop in fair value and recognise selling costs as an ‘impairment loss’ (expense)

B: Journals

Workings: C

31 December 20X3 Debit Credit

Fair value (1 January 20X3) 120 000

Tax expense 58 500 Accumulated depreciation (31 December 20X3: since 120 000/ 8 remaining years (15 000)

Current tax payable (liability) 58 500 the revaluation on 1 January 20X3)

Current normal tax payable (estimated) Actual carrying amount (1 January 20X4): 120 000 – 15 000 105 000

Fair value Given (100 000)

Tax expense 1 500 Decrease in value (all through revaluation surplus) See below for calculation of RS balance 5 000

Deferred tax (liability) 1 500

Deferred tax adjustment Actual carrying amount (1 January 20X4): 120 000 – 15 000 (above) 105 000

Historical carrying amount (1 January 20X4) 100 000/ 10 years x 7 years (70 000)

Balance on the revaluation surplus (1 January 20X4): Proof: (120 000 – 80 000) / 8 x 7 years 35 000

4.3 Measurement principles specific to the revaluation model Decrease in value (above) (5 000)

Balance on the revaluation surplus (1 January 20X4): Further balance against which further 30 000

4.3.1 The principles when the revaluation model was used devaluation would be processed (IAS16)

If an asset measured under the revaluation model is reclassified as ‘held for sale’:

Journals: 1 January 20X4 Debit Credit

• immediately before reclassifying the asset as ‘held for sale’, the asset must be re-

measured using its previous measurement model (i.e. the revaluation model per IAS 16); Plant: accumulated depreciation and impairment losses 15 000

- Plant: cost 15 000

• then, in terms of IFRS 5: NRVM: Accumulated depreciation set-off against cost

- re-measure it to the lower of ‘carrying amount’ and ‘fair value less costs to sell’;

- stop depreciating it; and Revaluation surplus FV: C100 000 – Carrying amount: C105 000 5 000

- then re-measure it to ‘fair value less costs to sell’ whenever appropriate: any further - Plant: cost 5 000

impairment loss (e.g. the selling costs) is expensed (even if there is a revaluation Re-measurement to FV before reclassification

surplus) whereas an impairment loss reversed is recognised as income but is limited

to the asset’s accumulated impairment losses. Impairment loss (selling costs) (expense) 9 000

- Plant: accumulated depreciation and impairment losses 9 000

Re-measurement to lower of CA or FV less costs to sell on reclassification:

CA: 100 000 – FV less Costs to Sell: (100 000 – 9 000)

Note: There is no further depreciation on this asset.

317 Chapter 9 318 Chapter 9

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held for sale and discontinued operations

B. If the actual carrying amount > historical carrying amount (i.e. there is already a revaluation Journals: 1 January 20X4 Debit Credit

surplus) and fair value increases and there are expected costs to sell: increase revaluation

surplus due to increase in fair value and recognise the expected selling costs as an ‘impairment Plant: accumulated depreciation and impairment losses 15 000

loss’ (expense) - Plant: cost 15 000

NRVM: Accumulated depreciation set-off against cost: 120 000/ 8 years

Workings: C remaining on date of revaluation

Revaluation surplus (ACA: 105 000 – HCA: 70 000) 35 000

Fair value 120 000 Impairment loss (HCA: 70 000 – FV: 60 000) 10 000

Accumulated depreciation (31 December 20X3: 120 000/ 8 remaining years (15 000) - Plant: cost 35 000

since the revaluation on 1 January 20X3) - Plant: accumulated depreciation and impairment losses 10 000

Actual carrying amount (1 January 20X4): 120 000 – 15 000 105 000 Re-measurement to FV before reclassification: FV: 60 000 – CA: 105 000

Fair value given 150 000

Increase in value (all through revaluation surplus) Through revaluation surplus (45 000) Impairment loss (selling costs) (expense) 20 000

because carrying amount is already - Plant: accumulated depreciation and impairment losses 20 000

above the HCA: 100 000 / 10 x 7 Re-measurement to lower of CA or FV less costs to sell on reclassification:

CA: 60 000 – FV less costs to sell (60 000 – 20 000)

Journals: 1 January 20X4 Debit Credit Note: There is no further depreciation on this asset.

Plant: accumulated depreciation and impairment losses 15 000

Example 5: re-measurement of an asset held for sale using the revaluation model

- Plant: cost 15 000

NRVM: Accumulated depreciation set-off against cost: 120 000/ 8 years

An item of plant, revalued to fair value using the revaluation model, met all criteria for

remaining on date of revaluation

classification as ‘held for sale’ on 1 January 20X4. The following information is relevant:

Plant: cost 45 000

- Revaluation surplus 45 000 Cost: 100 000 (purchased 1 January 20X1)

Re-measurement to FV before reclassification: Depreciation: 10% per annum straight-line to nil residual values.

FV: 150 000 – Carrying amount: 105 000 Fair value: 120 000 (revalued 1 January 20X3).

Revaluations are performed using the net replacement value method

Impairment loss (selling costs) (expense) 20 000 The ‘fair value less costs to sell’ on 1 January 20X4 was as follows:

- Plant: accumulated depreciation and impairment losses 20 000 • Fair value (1 January 20X4): 100 000; and

Re-measurement to lower of CA or FV less costs to sell on • Expected selling costs (1 January 20X4): 9 000.

reclassification:

Carrying amount: 150 000 – FV less costs to sell: (150 000 – 20 000) Required:

Note: There is no further depreciation on this asset. Show all journal entries relating to the re-measurement of the ‘non-current asset held for sale’

on 30 June 20X4 assuming that on the 30 June 20X4:

A. The fair value is 110 000 and the expected selling costs are 15 000;

C. If the actual carrying amount > historical carrying amount (i.e. there is already a B. The fair value is C110 000 and the expected selling costs are C3 000;

revaluation surplus) and fair value decreases removing the entire balance on the C. The fair value is 90 000 and the expected selling costs are 3 000.

revaluation surplus and there are expected costs to sell: reverse revaluation surplus

due to decrease in fair value and recognise the expected selling costs as an ‘impairment Solution to example 5: re-measurement of an asset held for sale: the revaluation model

loss’ (expense)

Comment: this example explains the limit on the impairment loss that may be reversed.

Workings: C

A. If the new fair value less costs to sell > previous fair value less costs to sell:

Fair value 120 000 reverse the impairment loss limited to prior cumulative impairment losses

Accumulated depreciation (31 December 20X3: since 120 000/ 8 years (15 000)

the revaluation on 1 January 20X3) Workings: C

Actual carrying amount (1 January 20X4): 120 000 – 15 000 105 000

Fair value given (60 000) New fair value less costs to sell (30 June 20X4) 110 000 (FV) – 15 000 (cost to sell) 95 000

Decrease in value (all through revaluation surplus) See below for calculation of RS bal 45 000 Prior fair value less costs to sell (1 January 20X4) 100 000 (FV) – 9 000 (costs to sell) (91 000)

Increase in value 4 000

Actual carrying amount (1 January 20X4): 120 000 – 15 000 105 000 Limited to prior cumulative impairment losses 100 000 (FV before reclassification) – 9 000

Historical carrying amount (1 January 20X4) 100 000/ 10years x 7 years (70 000) 91 000 (FV – costs to sell)

Balance on the revaluation surplus (1 January 20X4): (120 000 – 80 000) / 8 x 7 years 35 000 Therefore: impairment loss reversed Maximum that may be reversed is 9 000; 4 000

Decrease in value (above) 45 000 thus there is no limitation to the reversal

Reversal: revaluation surplus balance Balance in this account (above) 35 000 in this case

Impairment loss (balancing figure) 45 000 – 35 000 10 000

319 Chapter 9 320 Chapter 9

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held for sale and discontinued operations

Journals: 30 June 20X4 Debit Credit Example 6: re-measurement of assets no longer classified as ‘held for sale’

Plant: accumulated depreciation and impairment losses 4 000 Plant, with a cost of C100 000 (1 January 20X1) and accumulated depreciation of C20 000 on

- Impairment loss reversed (income) 4 000 31 December 20X2 (10% straight-line for 2 years), was reclassified as ‘held for sale’ on

Re-measurement of non-current asset held for sale: increase in fair value 31 December 20X2 and immediately impaired to its ‘fair value less costs to sell’ of C65 000.

less costs to sell On 30 June 20X3 (six months later), it ceased to meet all criteria necessary for classification

as ‘held for sale’. On this date its recoverable amount is determined to be C85 000.

B. If the new fair value less costs to sell > previous fair value less costs to sell: Required:

reverse the impairment loss limited to prior cumulative impairment losses Show all journal entries relating to the re-measurement of plant previously held as a ‘non-

current asset held for sale’.

Workings: C

Solution to example 6: re-measurement of assets no longer classified as ‘held for sale’

New fair value less costs to sell (30 June 20X4) 110 000 (FV) – 3 000 (cost to sell) 107 000

Prior fair value less costs to sell (1 January 20X4) 100 000 (FV) – 9 000 (costs to sell) (91 000) Workings: C

Increase in value 16 000 New carrying amount (30 June 20X3) to be lower of: 75 000

Limited to prior cumulative impairment losses 100 000 (FV before reclassification) – 9 000 • Carrying amount had the asset never 100 000 – 20 000 – 100 000 x 10% x 6/12 75 000

91 000 (FV – costs to sell) been classified as ‘held for sale’

Therefore: reversal of impairment loss 9 000 • Recoverable amount Given 85 000

Current carrying amount (30 June 20X3) Fair value – costs to sell (65 000)

Journals: 30 June 20X4 Debit Credit Impairment loss to be reversed 10 000

Plant: accumulated impairment loss 9 000

- Reversal of impairment loss (income) 9 000 Journals: Debit Credit

Re-measurement of non-current asset held for sale: increase in fair value

less costs to sell (limited to 9 000) 30 June 20X3

Plant: accumulated impairment loss 10 000

- Impairment loss reversed (income) 10 000

C. If the new fair value less costs to sell < previous fair value less costs to sell: Reversal of impairment loss on reclassification of ‘non-current asset

recognise a further impairment loss held for sale’ as ‘property, plant and equipment’: criteria no longer met

Workings: C Note: Depreciation on this asset will now begin again.

New fair value less costs to sell (30 June 20X4) 90 000 (FV) – 3 000 (cost to sell) 87 000

Prior fair value less costs to sell (1 January 20X4) 100 000 (FV) – 9 000 (costs to sell) 91 000

Decrease in value (impairment loss) 4 000 5. Non-current assets held for sale: disclosure (IFRS 5.30 and .38 - .42)

Journals: 30 June 20X4 Debit Credit 5.1 Overview

Impairment loss (expense) 4 000

Extra disclosure is required where the financial statements include either:

- Plant: accumulated depreciation and impairment losses 4 000

• a ‘non-current asset held for sale’; or

Re-measurement of non-current asset held for sale: decrease in fair value

• a ‘sale of a non-current asset’.

less costs to sell

The classification affects the period during which it was classified as ‘held for sale’. This

4.4 Reversal of classification as ‘held for sale’ (IFRS 5.26 - .29) means that no adjustment should be made to the measurement or presentation of the affected

assets in the comparative periods presented.

If a non-current asset that was previously classified as ‘held for sale’ no longer meets the

criteria necessary for such a classification, the asset must immediately cease to be classified 5.2 In the statement of financial position

as ‘held for sale’ and must be re-measured to the lower of:

• its carrying amount had the non-current asset never been classified as ‘held for Non-current assets (or non-current assets within a disposal group) that are ‘held for sale’ must

sale’(adjusted for any depreciation, amortisation and/ or revaluations that would have be shown separately in the statement of financial position.

been recognised had the asset not been classified as held for sale); and

• its recoverable amount. If a disposal group includes liabilities, these liabilities must also be shown separately from

other liabilities in the statement of financial position and may not be set-off against the assets

within the disposal group.

321 Chapter 9 322 Chapter 9

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held for sale and discontinued operations

5.3 In the statement of financial position or notes thereto Solution to example 7: disclosure of non-current assets held for sale

Major classifications of assets within the total of the ‘non-current assets held for sale’ and Comment: this example explains how to disclose non-current assets held for sale, as well as how to

major classifications of liabilities within the total ‘liabilities of a disposal group’ must be disclose a non-current asset that is no longer held for sale.

shown in the notes (unless shown in the statement of financial position).

Company name

5.4 Other note disclosure Statement of financial position

At 31 December 20X3

An entity shall disclose the following information in the notes in the period in which a non- 20X3 20X2

current asset (or disposal group) has been classified as held for sale or sold: Non-current assets C C

a) a description of the non-current asset (or disposal group); Property, plant and equipment 26 70 000 480 000

b) a description of the facts and circumstances of the sale, or leading to the expected Non-current assets (and disposal groups) held for sale 27 445 000 65 000

disposal, and the expected manner and timing of that disposal;

c) the gain or loss recognised in accordance with IFRS 5 (paragraph 20-22) and, if not Non-current liabilities

separately presented in the statement of comprehensive income, the caption in the Liabilities of a disposal group (for disclosure purposes only) 27 xxx xxx

statement of comprehensive income that includes that gain or loss;

d) if applicable, the segment in which the non-current asset (or disposal group) is presented Company name

in accordance with IAS 14 Segment Reporting. Notes to the financial statements

For the year ended 31 December 20X3

If, during the current period, there was a decision to reverse the plan to sell the non-current 20X3 20X2

asset (or disposal group), the following extra disclosure would be required: C C

a) the description of the facts and circumstances leading to the decision not to sell; and 5. Profit before tax

b) the effect of the decision on the results of operations for all periods presented. Profit before tax is stated after taking into consideration the following (income)/ expenses:

Depreciation – factory building 30 000 60 000

Example 7: disclosure of non-current assets held for sale

Depreciation – plant 5 000 10 000

Impairment loss – asset held for sale 5 000 15 000

Assume that an entity owns only the following non-current assets:

Impairment loss reversed – asset no longer held for sale (10 000) 0

• Plant; and

• Factory buildings. 26. Property, plant and equipment

Factory building 0 480 000

Details of the plant are as follows:

Plant 70 000 0

• Plant was purchased on 1 January 20X1 at a cost of C100 000;

70 000 480 000

• Depreciation is provided over 10 years to a nil residual value on the straight-line basis;

• Plant was reclassified as ‘held for sale’ on 31 December 20X2 and immediately impaired Factory building:

to its ‘fair value less costs to sell’ of C65 000; Net carrying amount – 1 January 480 000 540 000

• On 30 June 20X3 (six months later), plant ceased to meet all criteria necessary for Gross carrying amount – 1 January 600 000 600 000

classification as ‘held for sale’, on which date its recoverable amount is C85 000. Accumulated depreciation and impairment losses – 1 January (120 000) (60 000)

Depreciation (to 30 June 20X5) (30 000) (60 000)

Details of the factory buildings are as follows: Impairment loss (to fair value less costs to sell: 450 000 – 445 000) (5 000) 0

• The factory buildings were purchased on 1 January 20X1 at a cost of C600 000, Non-current asset now classified as ‘held for sale’ (445 000) 0

• Depreciation is provided over 10 years to nil residual values on the straight-line basis

• Factory buildings were reclassified as ‘held for sale’ on 30 June 20X3’ at a ‘fair value Net carrying amount – 31 December 0 480 000

less cost to sell’ of C445 000. Gross carrying amount – 31 December 0 600 000

Accumulated depreciation and impairment losses – 31 December 0 (120 000)

Required: Plant:

Disclose all information necessary in relation to the plant and factory buildings in the Net carrying amount – 1 January 0 90 000

financial statements for the year ended 31 December 20X3.

Gross carrying amount – 1 January 0 100 000

Accumulated depreciation and impairment losses – 1 January 0 (10 000)

Non-current asset no longer classified as ‘held for sale’ 65 000 0

Reversal of impairment loss (to lower of HCA: 75 000 or RA:85 000) 10 000 0

Depreciation (20X3: 75 000 / 7,5 remaining years x 6/12) (5 000) (10 000)

Impairment loss (to fair value less costs to sell: 80 000 – 65 000) 0 (15 000)

Non-current asset now classified as ‘held for sale’ 0 (65 000)

Net carrying amount – 31 December 70 000 0

Gross carrying amount – 31 December 100 000 0

Accumulated depreciation and impairment losses – 31 December (30 000) 0

323 Chapter 9 324 Chapter 9

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held for sale and discontinued operations

27. Non-current assets held for sale 20X3 20X2

8. Discontinued operations: disclosure

C C

Factory buildings 445 000 0

Plant 0 65 000 8.1 In the statement of comprehensive income

Less non-current interest bearing liabilities (disclosure purpose) 0 0

445 000 65 000 A single amount must be presented on the face of the statement of comprehensive income

being the total of:

The company is transferring its business to a new location and thus the existing factory building is • the post-tax profit or loss of the discontinued operations;

to be sold (circumstances leading to the decision). • the post-tax gain or loss recognised on measurement to fair value less costs to sell; and

The sale is expected to take place within 7 months of the end of the reporting period (expected • the post-tax gain or loss recognised on disposal of assets/ disposal groups making up the

timing). The factory building is expected to be sold as a going concern (expected manner of sale). discontinued operations.

The plant is no longer classified as ‘held for sale’ since it is now intended to be redeployed to other

existing factories rather than to be sold together with the factory buildings (reasons for the An analysis of this single amount that is presented in the statement of comprehensive income

decision not to sell). must be presented ‘for all periods presented’. This analysis may be done in the statement of

comprehensive income (see suggested presentation option A on the next page) or in the notes

The effect on current year profit from operations is as follows: C (see suggested presentation option B on the next page) and must show the following:

- Gross (Impairment loss reversed: 10 000 – deprec.:5 000) 5 000 • revenue of discontinued operations;

- Tax (1 500) • expenses of discontinued operations;

- Net 3 500 • profit (or loss) before tax of discontinued operations; and

• tax expense of discontinued operations.

6. Discontinued operations: identification (IAS 5.31 - .36) An entity must also disclose the following either in the statement of comprehensive income or

in the notes thereto ‘for all periods presented’ (with the exception of the change in estimate):

• gain or loss on re-measurement to ‘fair value less selling costs’;

IFRS 5 requires that, where a component is identified as a discontinued operation, it must be • gain or loss on disposal of the discontinued operation (made up by assets/ disposal

separately disclosed in the financial statements. The following definitions are provided in groups);

IFRS 5: • tax effects of the above; and

• changes to estimates made in respect of discontinued operations disposed of in a prior

A component of an entity comprise: period (showing nature and amount); examples of such changes include outcomes of

• operations and cash flows previous uncertainties relating to:

• that can be clearly distinguished, operationally and for financial reporting purposes, - the disposal transaction (e.g. adjustments to the selling price); and

• from the rest of the entity. - the operations of the component before its disposal (e.g. adjustments to warranty/

legal obligations retained by the entity).

A component of an entity may be a cash-generating unit or any group thereof.

Option A: If the analysis of the profit or loss is presented on the face of the statement of

A discontinued operation is comprehensive income, the statement of comprehensive income will look something like this

• a component of an entity that has either been (the figures are all assumed):

- disposed of, or

- is classified as held for sale; Example Ltd

• and meets one of the following criteria: Statement of comprehensive income

- represents a separate major line of business or geographical area of operations; or For the year ended 31 December 20X3 (extracts)

- is part of a single co-ordinated plan to dispose of a separate major line of business or 20X3 20X3 20X3 20X2 20X2 20X2

geographical area of operations; or C’000 C’000 C’000 C’000 C’000 C’000

- is a subsidiary acquired exclusively with a view to resale. Continuing Discontinued Total Continuing Discontinued Total

Revenue 800 150 800 790

Expenses (300) (100) (400) (500)

Profit before tax 500 50 400 290

7. Discontinued operations: measurement

Taxation expense (150) (60) (180) (97)

Gains/ (losses) after tax 40 7

A discontinued operation is, in effect, constituted by non-current assets (or disposal groups) Gain/ (loss): re-measurement 30 10

held for sale that, together, comprise a component that meets the definition of a ‘discontinued to fair value less costs to sell

operation’. Therefore, the principles that are adopted when measuring the individual non- Gain/ (loss): disposal of assets 20 0

current assets (or disposal groups) held for sale are also used when measuring the elements of in the discontinued operations

a discontinued operation. Tax on gains/ (losses) (10) (3)

If the non-current asset (or disposal group) does not meet the definition of a ‘component’, the Profit for the period 350 30 380 220 200 420

related transactions and adjustments will not be disclosed as ‘discontinued operations’ but Other comprehensive income 0 0 0 0 0 0

rather as part of ‘continuing operations’. Total comprehensive income 350 30 380 220 200 420

325 Chapter 9 326 Chapter 9

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held for sale and discontinued operations

Option B: If the total profit or loss is presented in the statement of comprehensive income, 8.3 Other note disclosure

with the analysis in the notes, the statement of comprehensive income and notes will look

something like this (the figures are all assumed): 8.3.1 Components no longer held for sale (IFRS 5.37)

Example Ltd Where the component is no longer ‘held for sale’, the amounts previously disclosed as

Statement of comprehensive income ‘discontinued operations’ in the prior periods must be reclassified and included in ‘continuing

For the year ended 31 December 20X3 (extracts) operations’. This will facilitate better comparability.

20X3 20X2

Note C’000 C’000 See the examples of disclosure provided in 8.1 and assume that the discontinued operation

Revenue 800 800 was first classified as such in 20X2, but that during 20X3 the criteria for classification as

Expenses (300) (400) ‘discontinued’ were no longer met. Notice that the 20X2 figures shown below, whereas

Profit before tax 500 400 previously split into ‘continuing’, ‘discontinuing’ and ‘total’ (in 8.1) are now restated in one

Taxation expense (150) (180) column. Although IFRS 5 does not require it, it is suggested that a note be included

Profit from continuing operations 350 220 explaining to the user that a previously classified ‘discontinued operation’ has been

Profit from discontinued operations 4&5 30 200 reabsorbed into the figures representing the ‘continuing operations’ of the entity, thus

Profit for the period 380 420 explaining the re-presentation of the 20X2 figures.

Other comprehensive income 0 0

Total comprehensive income 380 420 Example Ltd

Statement of comprehensive income

For the year ended 31 December 20X3 (extracts)

Example Ltd

20X3 20X2

Notes to the financial statements

C’000 C’000

For the year ended 31 December 20X3 (extracts)

Restated

20X3 20X2

Revenue 1 000 1 600

4. Discontinued operation: analysis of profit C’000 C’000

Expenses (400) (900)

The profit from discontinued operations is analysed as follows:

Profit before tax 600 700

• Revenue 150 790

Tax expense (220) (280)

• Expenses (100) (500)

Profit for the period 380 420

• Profit before tax 50 290

Other comprehensive income 0 0

• Tax (60) (97)

• Gains/ (losses) after tax 40 7 Total comprehensive income 380 420

• Gain/ (loss on re-measurement to fair value less costs to sell 30 10

• Gain/ (loss) on disposal of assets in the/ the discontinued 20 0 The above amounts are assumed amounts: notice how they tie up with the previous explanatory

operations examples in Option A and Option B.

• Tax on gains/ (losses) (10) (3)

• Profit for the period 30 200 8.3.2 Criteria met after the end of the reporting period (IAS 5.12)

If the criteria for separate classification and measurement as ‘held for sale’ are met during the

8.2 In the statement of cash flows

post-reporting date period, no adjustments should be made to the amounts and no

reclassification of the assets as ‘held for sale’ should take place. This is treated as a non-

In respect of discontinued operations, an entity shall disclose the following either on the face

adjusting event with the following disclosure being necessary:

of the statement of cash flows or in the notes thereto ‘for all periods presented’ [para 33(c)]:

• a description of the non-current asset (or disposal group);

• net cash flows from operating activities;

• a description of the facts and circumstances leading to the expected disposal;

• net cash flows from investing activities; and

• the expected manner and timing of the disposal; and

• net cash flows from financing activities.

• the segment (if applicable) in which the non-current asset (or disposal group) is presented.

Example Ltd The note disclosure of an event after the reporting period might look like this:

Notes to the statement of cash flows

For the year ended 31 December 20X3 (extracts)

Example Ltd

20X3 20X2

Notes to the financial statements

4. Discontinued operation C’000 C’000

For the year ended 31 December 20X3 (extracts)

Included in the statement of cash flows are the following net cash flows resulting from a

discontinued operation:

4. Events after the reporting period

Net cash flows from operating activities (assumed figures) 5 6

Net cash flows from investing activities (assumed figures) 0 1

On 15 February 20X4, the board of directors decided to dispose of the shoe division following

Net cash flows from financing activities (assumed figures) (8) (4)

severe losses incurred by it during the past 2 years. The division is expected to continue operations

Net cash outflows (assumed figures) (3) 3

until 30 April 20X4, after which its assets will be sold on a piecemeal basis. The entire disposal of

the division is expected to be completed by 31 August 20X4.

327 Chapter 9 328 Chapter 9

Gripping IFRS Non-current assets held for sale and discontinued operations Gripping IFRS Non-current assets held for sale and discontinued operations

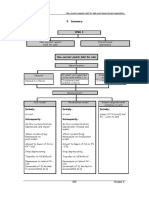

9. Summary

Non-current assets held for sale

IFRS 5 No longer held for sale

Non-current assets Discontinued

held for sale operations Transfer back to PPE Remeasure to lower of:

• CA (had asset never been classified

as NCAHforS); and

• RA

Resume depreciation

Non-current assets held for sale

Identification

Discontinued operations

General If asset not expected Assets acquired with

to be sold within 1 yr intention to sell Identification Measurement Disclosure

Normal 6 criteria 3 scenarios and 2 criteria

related criteria

A component that has Same as for non- Statement of

been disposed of or is current assets held comprehensive income:

classified as held for for sale Face:

Measurement sale and is: Total profit or loss from

• Separate major line discontinued operations

or area Notes or on the face:;

• Part of a single Analysis of total profit

Cost model Revaluation model Assets acquired with disposal plan or Gain or loss on re-

intention to sell • Is a subsidiary measurement

acquired to sell Gain or loss on disposal of

Initially: Initially: Initially: assets

Tax effects of above

at cost at cost Lower of CA (cost) and Changes in estimates

FV – costs to sell Statement of cash flows:

Subsequently: Subsequently: (face or notes)

Operating activities

Before reclassification: Before reclassification: Investing activities

Depreciate and impair Depreciate; revalue and Financing activities

impair Other notes:

Components no longer held

When reclassifying: When reclassifying: for sale

Remeasure on Remeasure on revaluation Criteria met after the end

cost model model of the reporting period

Adjust to lower of CA or Adjust to lower of CA or FV

FV – CtS – CtS

Stop depreciating Stop depreciating

Transfer to NCAHforS Transfer to NCAHforS

Remeasure to latest FV – Remeasure to latest FV –

CtS CtS

(reversals of IL limited (reversals of IL limited to

to accumulated IL’s) accumulated IL’s)

329 Chapter 9 330 Chapter 9

You might also like

- CH 17Document37 pagesCH 17Claire Anne Sulam0% (1)

- Ifrs 5: 9. SummaryDocument14 pagesIfrs 5: 9. SummaryCISA PwCNo ratings yet

- Accntg4 Non-Current Assets Held For Sale and Discontinued Operations NewDocument32 pagesAccntg4 Non-Current Assets Held For Sale and Discontinued Operations NewALYSSA MAE ABAAGNo ratings yet

- ACCO 3133 - Midterm Exam - August 18, 2013Document12 pagesACCO 3133 - Midterm Exam - August 18, 2013April Roes Catimbang OrlinNo ratings yet

- Non Current Assets Held For Sale and Discontinue OperationDocument20 pagesNon Current Assets Held For Sale and Discontinue Operationmax pNo ratings yet

- ACC 577 Quiz Week 3Document12 pagesACC 577 Quiz Week 3Mary100% (2)

- The One-Day Marketing Plan: Organizing and Completing a Plan that WorksFrom EverandThe One-Day Marketing Plan: Organizing and Completing a Plan that WorksRating: 3 out of 5 stars3/5 (1)

- Pfrs 5 - Nca Held For Sale & Discontinued OpnsDocument23 pagesPfrs 5 - Nca Held For Sale & Discontinued OpnsAdrianIlagan100% (1)

- Chapter9 - Noncurrentassetsheldforsale2008 - Gripping IFRS 2008 by ICAPDocument22 pagesChapter9 - Noncurrentassetsheldforsale2008 - Gripping IFRS 2008 by ICAPFalah Ud Din SheryarNo ratings yet

- Final Project - FA Assignment Financial Analysis of VoltasDocument26 pagesFinal Project - FA Assignment Financial Analysis of VoltasHarvey100% (2)

- Techniques of Investment AnalysisDocument32 pagesTechniques of Investment AnalysisPranjal Verma0% (1)

- Ifrs 5Document42 pagesIfrs 5Queenie Rose BacolodNo ratings yet

- 10 Ifrs 5Document6 pages10 Ifrs 5Nafiul IslamNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument20 pagesNon-Current Assets Held For Sale and Discontinued OperationsKryztel BranzuelaNo ratings yet

- FRS 38 (2017)Document30 pagesFRS 38 (2017)kik leeNo ratings yet

- IFRS 5 Non Current Assets Held For SaleDocument20 pagesIFRS 5 Non Current Assets Held For SaleMd KamruzzamanNo ratings yet

- Non-Current Asset Held For Sale & Discontinued Operations WorkBookDocument16 pagesNon-Current Asset Held For Sale & Discontinued Operations WorkBookMusawer ShirzaiNo ratings yet

- Non Current Assets Held For Sale and Discontinued OperationsDocument20 pagesNon Current Assets Held For Sale and Discontinued OperationsMehreen KhanNo ratings yet

- Assets Held For SaleDocument76 pagesAssets Held For SaleMkaroNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument20 pagesNon-Current Assets Held For Sale and Discontinued OperationsJoshua RiveraNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument37 pagesNon-Current Assets Held For Sale and Discontinued OperationsAshish agrawalNo ratings yet

- 08.ifrs05 BV2009 PDFDocument41 pages08.ifrs05 BV2009 PDFkimberly tenebroNo ratings yet

- Ey Ctools Good Real Estate 2019Document132 pagesEy Ctools Good Real Estate 2019ariannemungcalcpaNo ratings yet

- IFRS in Practice IAS 36 Impairment of Assets 2020 2021Document71 pagesIFRS in Practice IAS 36 Impairment of Assets 2020 2021Ayushman GuptaNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument19 pagesNon-Current Assets Held For Sale and Discontinued OperationshumnarviosNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument63 pagesNon-Current Assets Held For Sale and Discontinued OperationsElegbede Mariam GbolasieNo ratings yet

- Category A & B & C (Accounting)Document330 pagesCategory A & B & C (Accounting)AdityaNo ratings yet

- IAS38Document36 pagesIAS38zaka ud dinNo ratings yet

- Ifrs 9 PDFDocument32 pagesIfrs 9 PDFmirirai midziNo ratings yet

- Ifrs at A Glance IFRS 5 Non-Current Assets Held For Sale: and Discontinued OperationsDocument4 pagesIfrs at A Glance IFRS 5 Non-Current Assets Held For Sale: and Discontinued OperationsNoor Ul Hussain MirzaNo ratings yet

- NCA Held For SaleDocument48 pagesNCA Held For SaleHemaram NaiduNo ratings yet

- 105 Non CurrentDocument42 pages105 Non Currentchandrakantchainani606No ratings yet

- IMS Proschool IFRS EbookDocument143 pagesIMS Proschool IFRS EbookhariinshrNo ratings yet

- Ia3 CH4Document2 pagesIa3 CH4Reen DomingoNo ratings yet

- 5 Ind AS 105 Non-Current Assets Held For Sale and Discontinued OperationsDocument22 pages5 Ind AS 105 Non-Current Assets Held For Sale and Discontinued OperationsravikanthcaNo ratings yet

- FRS 105 Non-Current AssetsDocument25 pagesFRS 105 Non-Current Assetswisemaverick_5084303No ratings yet

- Ifrs 5: Classification of Non Current Assets (Or Disposal Groups) As Held For Sale or As Held For Distribution To OwnersDocument1 pageIfrs 5: Classification of Non Current Assets (Or Disposal Groups) As Held For Sale or As Held For Distribution To OwnersEmey CalbayNo ratings yet

- IFRS 5 Non Current Assets Held For SaleDocument8 pagesIFRS 5 Non Current Assets Held For Saleharir22No ratings yet

- 6352 Discontinued Operation and Noncurrent Asset Held For SaleDocument3 pages6352 Discontinued Operation and Noncurrent Asset Held For SaleCukeeNo ratings yet

- Good Real Estate Group (International) LimitedDocument127 pagesGood Real Estate Group (International) LimitedBanna SplitNo ratings yet

- Gtil 2011 Navigating The Accounting For Business Combinations Applying Ifrs 3 in Practice PDFDocument92 pagesGtil 2011 Navigating The Accounting For Business Combinations Applying Ifrs 3 in Practice PDFNguyen Binh MinhNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument22 pagesNon-Current Assets Held For Sale and Discontinued Operationsshalu salamNo ratings yet

- BV2018 - MFRS 5 Non Current Assets Held For Sale and Discontinued OperationsDocument22 pagesBV2018 - MFRS 5 Non Current Assets Held For Sale and Discontinued OperationsAndrew ChongNo ratings yet

- Grant Thorton IAS 36 - ENDocument6 pagesGrant Thorton IAS 36 - ENNguyen Binh MinhNo ratings yet

- IA3Document21 pagesIA3Jane ManahanNo ratings yet

- 2a IAS 38 Intangible Assets Class Slides 2022 - Lecture 2 (Colour)Document21 pages2a IAS 38 Intangible Assets Class Slides 2022 - Lecture 2 (Colour)Mphatso ManyambaNo ratings yet

- IFRS 5 Non-Current Assets Held For Sale and Discontinued OperationsDocument1 pageIFRS 5 Non-Current Assets Held For Sale and Discontinued OperationsKazi MahbubNo ratings yet

- PAS 38 - Intangible AssetsDocument15 pagesPAS 38 - Intangible AssetsKrizzia DizonNo ratings yet

- Module 17 - 19 Eng IFRS 5 EngDocument22 pagesModule 17 - 19 Eng IFRS 5 Engmokgadihlaraka132No ratings yet

- FAC1502 - Study Unit 12 - 2021Document9 pagesFAC1502 - Study Unit 12 - 2021Ndila mangalisoNo ratings yet

- Ey Ctools Good Group 2020Document159 pagesEy Ctools Good Group 2020Cristhian HuaytaNo ratings yet

- EY-IFRS-FS-20 - Part 1Document50 pagesEY-IFRS-FS-20 - Part 1Hung LeNo ratings yet

- Unit 8: Indian Accounting Standard 105: Non-Current Assets Held For Sale and Discontinued OperationsDocument25 pagesUnit 8: Indian Accounting Standard 105: Non-Current Assets Held For Sale and Discontinued OperationsJyotiNo ratings yet

- AC3103 Seminar 19: Biosensors International Group (BIG) Valuation and Impairment Testing of IntangiblesDocument39 pagesAC3103 Seminar 19: Biosensors International Group (BIG) Valuation and Impairment Testing of IntangiblesTanisha GuptaNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument20 pagesNon-Current Assets Held For Sale and Discontinued OperationsUEL Accounting & AuditingNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument51 pagesNon-Current Assets Held For Sale and Discontinued OperationsDudz Aquino SantosNo ratings yet

- Ey Ctools Good Group 2021Document162 pagesEy Ctools Good Group 2021KGNo ratings yet

- IFRS Study Notes - Day 1Document76 pagesIFRS Study Notes - Day 1Obisike EmeziNo ratings yet

- IAS Plus: IASB Publishes IFRS 5 Non-Current Assets Held For Sale and Discontinued OperationsDocument4 pagesIAS Plus: IASB Publishes IFRS 5 Non-Current Assets Held For Sale and Discontinued Operationsvyoung1988No ratings yet

- International Financial Reporting Standard 5: Non Current Assets Held For Sale and Discontinued OperationsDocument1 pageInternational Financial Reporting Standard 5: Non Current Assets Held For Sale and Discontinued OperationsEmey CalbayNo ratings yet

- ACC2001 Lecture 3Document35 pagesACC2001 Lecture 3michael krueseiNo ratings yet

- 2.2 Discontinued OperationsDocument64 pages2.2 Discontinued Operationstirodkar.sneha13No ratings yet

- BV2021CR - MFRS5 Non-Current Assets Held For Sale and Discontinued OperationsDocument24 pagesBV2021CR - MFRS5 Non-Current Assets Held For Sale and Discontinued OperationsChee Juan PhangNo ratings yet

- Aguilar, Angela Nicole DM 2A4 ParasiteDocument3 pagesAguilar, Angela Nicole DM 2A4 ParasiteAngela Nicole AguilarNo ratings yet

- Question: Paano Malalaman If May QUOROM Sa: ShareholdingsDocument3 pagesQuestion: Paano Malalaman If May QUOROM Sa: ShareholdingsAngela Nicole AguilarNo ratings yet

- Aguilar, Angela Nicole DM 2A4 ParasiteDocument1 pageAguilar, Angela Nicole DM 2A4 ParasiteAngela Nicole AguilarNo ratings yet

- Certain Rumors He Was Killed byDocument2 pagesCertain Rumors He Was Killed byAngela Nicole AguilarNo ratings yet

- 2604 Liworiz HW4Document2 pages2604 Liworiz HW4Angela Nicole Aguilar100% (3)

- The Information System: An Accountant'S PerspectiveDocument5 pagesThe Information System: An Accountant'S PerspectivexxpinkywitchxxNo ratings yet

- Exer4-Lecture-data Properties and ValidationDocument8 pagesExer4-Lecture-data Properties and ValidationKiana FernandezNo ratings yet

- AccessDocument3 pagesAccessAngela Nicole AguilarNo ratings yet

- 19th Century WorldDocument2 pages19th Century WorldAngela Nicole AguilarNo ratings yet

- 19th Century WorldDocument2 pages19th Century WorldAngela Nicole AguilarNo ratings yet

- 19th Century WorldDocument2 pages19th Century WorldAngela Nicole AguilarNo ratings yet

- AccessDocument3 pagesAccessAngela Nicole AguilarNo ratings yet

- Plant Property andDocument2 pagesPlant Property andAngela Nicole AguilarNo ratings yet

- 19th Century WorldDocument2 pages19th Century WorldAngela Nicole AguilarNo ratings yet

- The Information System: An Accountant'S PerspectiveDocument5 pagesThe Information System: An Accountant'S PerspectivexxpinkywitchxxNo ratings yet

- Plant Property and Equipment Handout With NotesDocument7 pagesPlant Property and Equipment Handout With NotesAngela Nicole AguilarNo ratings yet

- Class 12 Accounts Notes Chapter 4 Studyguide360Document26 pagesClass 12 Accounts Notes Chapter 4 Studyguide360Ali ssNo ratings yet

- Hightec Corporation Has A Seven Year Contract With Magichip CompDocument1 pageHightec Corporation Has A Seven Year Contract With Magichip CompAmit PandeyNo ratings yet

- Meaning of Financial StatementsDocument2 pagesMeaning of Financial StatementsDaily LifeNo ratings yet

- LK PT Ifishdeco Konsolidasian 2021Document74 pagesLK PT Ifishdeco Konsolidasian 2021Pramayurgy WilyakaNo ratings yet

- Wharton On Coursera: Introduction To Corporate Finance: DiscountingDocument7 pagesWharton On Coursera: Introduction To Corporate Finance: Discountingjhon doeNo ratings yet

- Quiz Chapter 4 Accounts ReceivableDocument9 pagesQuiz Chapter 4 Accounts ReceivableClene DoconteNo ratings yet

- Accounting For Decision Making CH#13 QUIZDocument13 pagesAccounting For Decision Making CH#13 QUIZlisaNo ratings yet

- ACCT 2251 Practice FinalDocument20 pagesACCT 2251 Practice FinalHạnhNekoNo ratings yet

- Impairment of AssetsDocument3 pagesImpairment of Assetsber tingNo ratings yet

- Welcome To Project Seminar 3Document38 pagesWelcome To Project Seminar 3sree anugraphics0% (1)

- A Comparison of CAPM and APTDocument3 pagesA Comparison of CAPM and APTShayanNsNo ratings yet

- Tutorial 1 (With Solution)Document5 pagesTutorial 1 (With Solution)Aiden YingNo ratings yet

- Perpetual Vs Periodic InventoryDocument14 pagesPerpetual Vs Periodic InventoryJamie-Lee O'ConnorNo ratings yet

- A Project On "Economic Value Added" in Kirloskar Oil Engines LTDDocument19 pagesA Project On "Economic Value Added" in Kirloskar Oil Engines LTDPrayag GokhaleNo ratings yet

- Economic Value Added (Eva) - Literature Review and Relevant IssuesDocument7 pagesEconomic Value Added (Eva) - Literature Review and Relevant IssuesafmzmxkayjyosoNo ratings yet

- Chapter 7 Prospective Analysis: Valuation Theory and ConceptsDocument9 pagesChapter 7 Prospective Analysis: Valuation Theory and ConceptsIrwan AdimasNo ratings yet

- Ratio Analysis: Under Armour, Inc (UA) : Liqudity RatiosDocument1 pageRatio Analysis: Under Armour, Inc (UA) : Liqudity RatiosMaryam AhmadiNo ratings yet

- Sample Reports Guide For The Financial EdgeDocument404 pagesSample Reports Guide For The Financial EdgeAdi PermanaNo ratings yet

- Finance Assignment Case AnalysisDocument6 pagesFinance Assignment Case AnalysisBinayak GhimireNo ratings yet

- Revenue - Fundamental Principle - Standards - SourcesDocument6 pagesRevenue - Fundamental Principle - Standards - SourcesAlelie Joy dela CruzNo ratings yet

- Financial Accounting and ReportingDocument6 pagesFinancial Accounting and ReportingHarvey ManalangNo ratings yet

- Drone Shop, Inc.: Strategic Business PlanDocument26 pagesDrone Shop, Inc.: Strategic Business PlanBobbyNo ratings yet

- Bikaji Foods International LTD Ipo Date, PriceDocument1 pageBikaji Foods International LTD Ipo Date, PriceJatin JainNo ratings yet

- Quiz 5Document6 pagesQuiz 5mulya25No ratings yet

- 17002Document2 pages17002Alvin YercNo ratings yet