Professional Documents

Culture Documents

Question 1: Tangible Asset: 20X4 DR Plant A (Cost) 200 20X5

Uploaded by

Lương Linh Giang0 ratings0% found this document useful (0 votes)

101 views3 pagesThe document discusses the accounting treatment for revaluation of tangible non-current assets for a company named XYZ. It provides details of the costs, accumulated depreciation and fair values of various plant and machinery assets as of year-ends 20X4 and 20X5. It also provides the required journal entries to account for the revaluation of Plant A which involves recognizing a revaluation surplus in 20X4 and revaluation deficit in 20X5. Similar journal entries are provided for the other assets Plant B, C and D. It also discusses the accounting for a government grant of $10 million received for acquisition of a machine, with journal entries to reduce the cost of asset and recognize the grant income over the useful life of the

Original Description:

Original Title

bài tập F7.2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the accounting treatment for revaluation of tangible non-current assets for a company named XYZ. It provides details of the costs, accumulated depreciation and fair values of various plant and machinery assets as of year-ends 20X4 and 20X5. It also provides the required journal entries to account for the revaluation of Plant A which involves recognizing a revaluation surplus in 20X4 and revaluation deficit in 20X5. Similar journal entries are provided for the other assets Plant B, C and D. It also discusses the accounting for a government grant of $10 million received for acquisition of a machine, with journal entries to reduce the cost of asset and recognize the grant income over the useful life of the

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

101 views3 pagesQuestion 1: Tangible Asset: 20X4 DR Plant A (Cost) 200 20X5

Uploaded by

Lương Linh GiangThe document discusses the accounting treatment for revaluation of tangible non-current assets for a company named XYZ. It provides details of the costs, accumulated depreciation and fair values of various plant and machinery assets as of year-ends 20X4 and 20X5. It also provides the required journal entries to account for the revaluation of Plant A which involves recognizing a revaluation surplus in 20X4 and revaluation deficit in 20X5. Similar journal entries are provided for the other assets Plant B, C and D. It also discusses the accounting for a government grant of $10 million received for acquisition of a machine, with journal entries to reduce the cost of asset and recognize the grant income over the useful life of the

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

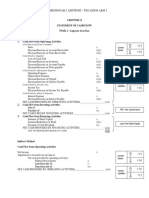

Question 1: Tangible asset

PPE of XYZ comprise of the following:

Plant Machinery

A B C D

at 31st Dec 20X4:

Cost 500 600 300 800

Accumulated Depn (100) (100) (200) (300)

Remaining useful years 4 5 1 5

Fair value as of 31st Dec 20X4 600 400 120 450

Fair value as of 31st Dec 20X5 200 470 - 350

XYZ wants to use the revaluation model on A from 20X4’s accounts onwards.

Company’s policy is to depreciate all assets using straight – line method.

Required:

- Fill in the following table and prepare journal entries for revaluation of NCA

Plant A Plant B

CV as at 31st Dec 20X4 400 500

Surplus/Deficit 200 (100)

FV as at 31st Dec 20X4 600 400

Depreciation for 20X5 (150) (80)

CV as at 31st Dec 20X5 450 320

Deficit/Surplus (250) 150

FV as at 31st Dec 20X5 200 470

Plant A

20X4 Dr Plant A (cost) 200

Cr Other comprehensive income (Revaluation surplus) 200

20X5 Dr Other comprehensive income (Revaluation deficit) 250

Dr Accumulated depreciation 150

Cr Plant A (cost) 400

Plant B

20X4 Dr Other comprehensive income (Revaluation deficit) 100

Cr Plant B 100

20X5 Dr Plant B 70

Dr Accumulated depreciation 80

Cr Other comprehensive income (Revaluation Surplus) 150

Plant C

20X4 Dr Machinery C 20

Cr OCI (Revaluation surplus) 20

20X5 Dr Depreciation expense 120

Cr Accumulated depreciation

Plant D

20X4 Dr OCI (Revaluation deficit ) 50

Cr Machinery D 50

20X5 Dr OCI (Revaluation deficit) 10

Dr Accumulated depreciation 90

Cr Machinery D 100

Question 3 (Gov grant):

On 1 January 2010, ABC acquired a machine at a cost of $60mil.

The economic useful life of the machine is estimated to be 10 years with a nil residual

value. ABC uses straight line depreciation.

ABC received a grant of $10m from the government on 1 Jan 2010 for the machine

acquisition

Required:

Using journalize entries to illustrate the accounting treatment for the gov grant of $10m

Dr Cash $10m

Cr Cost of assets $10m

Dr Depreciation expense $5m

Cr Accumulated depreciation $5m *

Cost of asset decreases by $10m, the new depreciation would be: (60-10)/10=$5m

You might also like

- The Panic of 1907: Heralding a New Era of Finance, Capitalism, and DemocracyFrom EverandThe Panic of 1907: Heralding a New Era of Finance, Capitalism, and DemocracyRating: 4 out of 5 stars4/5 (2)

- Ch02 Stakeholder Relationships Social Responsibility and Corporate GovernanceDocument20 pagesCh02 Stakeholder Relationships Social Responsibility and Corporate GovernanceDhoni KhanNo ratings yet

- ch23 Mish11ge EmbfmDocument48 pagesch23 Mish11ge EmbfmRakib HasanNo ratings yet

- Chapter 4Document3 pagesChapter 4Ngao BáiNo ratings yet

- Chapter 18Document62 pagesChapter 18RushilHandaNo ratings yet

- DTTC 2Document44 pagesDTTC 2ngochanhime0906No ratings yet

- Homework Questions Statistics in Pivot TablesDocument1 pageHomework Questions Statistics in Pivot TablesBĂNG NGUYỄN NGỌCNo ratings yet

- Marketing Mix 4Ps: PRODUCT: (OMO-Top 1 Washing Powder Trusted by Vietnamese Women)Document6 pagesMarketing Mix 4Ps: PRODUCT: (OMO-Top 1 Washing Powder Trusted by Vietnamese Women)Vy Nguyễn Trần Tường100% (1)

- Toyota Thailand Consulting Case StudyDocument4 pagesToyota Thailand Consulting Case StudySiwaporn WanveeratikulNo ratings yet

- Use The Information in Exhibit 1 and Exhibit 2 To Answer Question 7 To 12Document1 pageUse The Information in Exhibit 1 and Exhibit 2 To Answer Question 7 To 12Nguyên ThảoNo ratings yet

- Everpia Financial Analysis ReportDocument31 pagesEverpia Financial Analysis ReportThuỳ LinhNo ratings yet

- Key - Unit 6 - Esp 2 - FuturesDocument8 pagesKey - Unit 6 - Esp 2 - FuturesBò SữaNo ratings yet

- Ie426 HW5Document2 pagesIe426 HW5fulmanti deviNo ratings yet

- Spartans CaseDocument1 pageSpartans CaseSaran SeeranganNo ratings yet

- TERI - Corporate Finance - Major Test PDFDocument8 pagesTERI - Corporate Finance - Major Test PDFAnanditaKarNo ratings yet

- MNC Nep PresentationDocument53 pagesMNC Nep PresentationSaajan RathodNo ratings yet

- Lotus TeaDocument23 pagesLotus TeaStaffany Tran0% (1)

- HASBRO INC 10-K (Annual Reports) 2009-02-25Document151 pagesHASBRO INC 10-K (Annual Reports) 2009-02-25http://secwatch.comNo ratings yet

- Practice For Group Work Week 2-3Document4 pagesPractice For Group Work Week 2-3ENRICH YOUR ENGLISHNo ratings yet

- Devonia Laboratories LTD Has Recently Carried Out Successful Clinical TrialsDocument2 pagesDevonia Laboratories LTD Has Recently Carried Out Successful Clinical TrialsAmit PandeyNo ratings yet

- Inglés ChangeDocument5 pagesInglés ChangeLourdes G-pNo ratings yet

- Materi Chapter 23 Cash FlowDocument2 pagesMateri Chapter 23 Cash FlowM Reza andriantoNo ratings yet

- Practice Test Paper (Executive) - 1Document91 pagesPractice Test Paper (Executive) - 1isha raiNo ratings yet

- Bài tập tuần 4 - Case Study SOCADocument2 pagesBài tập tuần 4 - Case Study SOCAThảo HuỳnhNo ratings yet

- SCM301m Quiz 2 KeyDocument15 pagesSCM301m Quiz 2 KeyVu Dieu LinhNo ratings yet

- Ekonomi TeknikDocument2 pagesEkonomi Tekniksanjaya aryandiNo ratings yet

- Chap 18Document37 pagesChap 18Ethel K. EastmanNo ratings yet

- Planning Case Study D3 D4Document3 pagesPlanning Case Study D3 D4Van Vien NguyenNo ratings yet

- Case 1Document5 pagesCase 1Baongoc Lephuoc0% (1)

- Class 1Document4 pagesClass 1skjacobpoolNo ratings yet

- Tutorial 1Document2 pagesTutorial 1KHANH Du Ngoc0% (1)

- 2010国际贸易原理 复习题Document6 pages2010国际贸易原理 复习题Mai HeoNo ratings yet

- Lemon Homework 23 11Document4 pagesLemon Homework 23 11Huy VuNo ratings yet

- DISTRIBUTION NETWORKS-Last Mile Delivery With Customer Pickup and Just in TimeDocument16 pagesDISTRIBUTION NETWORKS-Last Mile Delivery With Customer Pickup and Just in TimeKshitij BhargavaNo ratings yet

- Unit 9: Trade: Total of Payments (Khong Chac)Document32 pagesUnit 9: Trade: Total of Payments (Khong Chac)Đinh Thị Mỹ LinhNo ratings yet

- T NG H P Writing Task 1 SampleDocument50 pagesT NG H P Writing Task 1 Samplengân nguyễnNo ratings yet

- Business Economics Final Exam Study GuideDocument8 pagesBusiness Economics Final Exam Study GuideAnnaNo ratings yet

- Chapter 6Document9 pagesChapter 6Sao Nguyễn ToànNo ratings yet

- Shiseido in ChinaDocument6 pagesShiseido in ChinaThanh Trúc Nguyễn ĐăngNo ratings yet

- PPB - Module A Unit 3 Retail Banking, Wholesale Banking.Document17 pagesPPB - Module A Unit 3 Retail Banking, Wholesale Banking.kamalray75_188704880No ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- CV mẫuDocument22 pagesCV mẫuHồng Anh NguyễnNo ratings yet

- CH07 Assessment PreparationDocument13 pagesCH07 Assessment PreparationEthan RuppNo ratings yet

- Liquidity Requirement Model AnswersDocument3 pagesLiquidity Requirement Model AnswersHadeerMounirNo ratings yet

- CHAP - 04 - Managing and Pricing Non-Deposit LiabilitiesDocument52 pagesCHAP - 04 - Managing and Pricing Non-Deposit LiabilitiesTran Thanh NganNo ratings yet

- ASSESSMENT SCOR Model (OM)Document3 pagesASSESSMENT SCOR Model (OM)Rahul AgarwalNo ratings yet

- Nguyen Thi Mai. 19071422. INS4018.02Document15 pagesNguyen Thi Mai. 19071422. INS4018.0219071422 Nguyễn Thị MaiNo ratings yet

- Threat of New EntrantsDocument15 pagesThreat of New Entrantslokesh_bhatiya50% (2)

- Paper Nhóm 2 Đã Chỉnh SửaDocument11 pagesPaper Nhóm 2 Đã Chỉnh SửaThùy Thùy100% (1)

- Introduce: Chuong Duong Beverages Joint Stock CompanyDocument5 pagesIntroduce: Chuong Duong Beverages Joint Stock CompanyThu Võ ThịNo ratings yet

- Matsushita's Culture Changes With JapanDocument2 pagesMatsushita's Culture Changes With JapanTooShort4BBall100% (2)

- Ch08 - Ch09 - Recruiting TrainingDocument38 pagesCh08 - Ch09 - Recruiting TrainingTú Quyên DươngNo ratings yet

- Group 6 - Case Study OptimizationDocument17 pagesGroup 6 - Case Study OptimizationLinh ChiNo ratings yet

- Case 3. Mass Customization in Starbucks - Faisel MohamedDocument3 pagesCase 3. Mass Customization in Starbucks - Faisel MohamedFaisel MohamedNo ratings yet

- Chap013 PDFDocument35 pagesChap013 PDFym5c2324No ratings yet

- (Topic 6) Decision TreeDocument2 pages(Topic 6) Decision TreePusat Tuisyen MahajayaNo ratings yet

- Homework Exercises - 9 AnswersDocument9 pagesHomework Exercises - 9 AnswersLương Thế CườngNo ratings yet

- Stock SolutionDocument9 pagesStock Solution신동호No ratings yet

- Chapter 14Document47 pagesChapter 14Anh LýNo ratings yet

- Question 1: Tangible Asset Plant Machinery A B C DDocument7 pagesQuestion 1: Tangible Asset Plant Machinery A B C DTrang TranNo ratings yet

- f7 FsDocument91 pagesf7 FsLương Linh GiangNo ratings yet

- F7INTFR Study Question Bank Sample D14 J15Document53 pagesF7INTFR Study Question Bank Sample D14 J15Onaderu Oluwagbenga Enoch100% (3)

- ACCA FR (F7) Course NotesDocument253 pagesACCA FR (F7) Course NotesAhsanMughalAcca100% (2)

- ACCA FR (F7) Course NotesDocument253 pagesACCA FR (F7) Course NotesAhsanMughalAcca100% (2)

- DI Industry4.0Document25 pagesDI Industry4.0Sinan YorgancigilNo ratings yet

- Confidence in The Future Human Machine Collaboration PDFDocument10 pagesConfidence in The Future Human Machine Collaboration PDFJuan ChandraNo ratings yet

- PWC Future of Audit Summary Report July 2019 PDFDocument10 pagesPWC Future of Audit Summary Report July 2019 PDFLương Linh GiangNo ratings yet

- Factors Influencing The Development of CSR Reporting Practices: Experts' Versus Preparers' Points of ViewDocument11 pagesFactors Influencing The Development of CSR Reporting Practices: Experts' Versus Preparers' Points of ViewLương Linh GiangNo ratings yet

- International TrackingDocument5 pagesInternational TrackingChaItanya KrIshnaNo ratings yet

- Interbond 2340UPC Application Guidelines Rev 03 180321Document6 pagesInterbond 2340UPC Application Guidelines Rev 03 180321Kingsman 86No ratings yet

- Pranay Pizza PlanDocument8 pagesPranay Pizza PlanNaresh KumarNo ratings yet

- Economics Project 2023-24 Class 11Document6 pagesEconomics Project 2023-24 Class 11Mantra RNo ratings yet

- Conscious Clarity: Embracing The Beautiful Restraints of Living With LessDocument13 pagesConscious Clarity: Embracing The Beautiful Restraints of Living With LessRaquel Mantovani100% (1)

- Fuel ConsumptionDocument12 pagesFuel Consumptionjeri adovelinNo ratings yet

- Kotak StatementDocument9 pagesKotak StatementHarsh SinghNo ratings yet

- 2019 MEFMI Prospectus PDFDocument44 pages2019 MEFMI Prospectus PDFBlessing KatukaNo ratings yet

- Order Receipt: Gate Academy LearningDocument1 pageOrder Receipt: Gate Academy LearningRajeshchaudharyNo ratings yet

- Lower - Timeframe - Bullish - Order - FlowDocument30 pagesLower - Timeframe - Bullish - Order - FlowAleepha Lelana100% (5)

- OBS 615: Managerial Decision Making Processes and TechniquesDocument51 pagesOBS 615: Managerial Decision Making Processes and Techniquesmohamed2002No ratings yet

- SHS Timetable GR 10 SY 2023-2024Document1 pageSHS Timetable GR 10 SY 2023-2024AndikoNo ratings yet

- Kidde Mounting Straps and Wall Brackets For Clean Agent and Nitrogen Pilot and Driver Cylinders K-85-1230Document6 pagesKidde Mounting Straps and Wall Brackets For Clean Agent and Nitrogen Pilot and Driver Cylinders K-85-1230Isa KumNo ratings yet

- New Heritage Doll Company Capital BudgetDocument10 pagesNew Heritage Doll Company Capital BudgetIris Belen Medina OrozcoNo ratings yet

- Ditta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Document36 pagesDitta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Ummaya MalikNo ratings yet

- INVOICE Jco PassDocument3 pagesINVOICE Jco PasseldaNo ratings yet

- Industrial Statistics 2067-68Document89 pagesIndustrial Statistics 2067-68Rajiv LamichhaneNo ratings yet

- AccountingDocument3 pagesAccountingKeith Pam Baranda SalamancaNo ratings yet

- Activity Based Costing - Practice QuestionsDocument8 pagesActivity Based Costing - Practice QuestionsSuchita GaonkarNo ratings yet

- BIR Form No. 0605Document2 pagesBIR Form No. 0605Ronald varrie BautistaNo ratings yet

- Economies: A Review of Global Challenges and Survival Strategies of Small and Medium Enterprises (Smes)Document24 pagesEconomies: A Review of Global Challenges and Survival Strategies of Small and Medium Enterprises (Smes)Kelsey Olivar MendozaNo ratings yet

- Carrefour UAE 2020Document1 pageCarrefour UAE 2020Genius icloud50% (2)

- Worksheet - DiagramsDocument4 pagesWorksheet - DiagramsRyan The YouTuberNo ratings yet

- Multan Electric Power Company: Say No To CorruptionDocument2 pagesMultan Electric Power Company: Say No To CorruptionKhizar AbbasNo ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- Inventory ManagementDocument5 pagesInventory ManagementPrince MehraNo ratings yet

- GSTR-1 Iff 22ajppp6106n1zu 032023Document4 pagesGSTR-1 Iff 22ajppp6106n1zu 032023Bhavesh JainNo ratings yet

- Telangana RailWire Plans 2020Document1 pageTelangana RailWire Plans 2020Mayank GuptaNo ratings yet

- Demo Lesson PlanDocument41 pagesDemo Lesson PlanLeslie Anne Viray AgcanasNo ratings yet

- Meeting Minutes/Notes: Apparel Brands Pty LTD Meeting Minutes/Notes Date: Time: Location: Attendance: Agenda ItemsDocument2 pagesMeeting Minutes/Notes: Apparel Brands Pty LTD Meeting Minutes/Notes Date: Time: Location: Attendance: Agenda ItemsnattyNo ratings yet