Professional Documents

Culture Documents

How The Global Petrochemical Industry Can Adapt To The High Level of Uncertainty

Uploaded by

fawmer61Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How The Global Petrochemical Industry Can Adapt To The High Level of Uncertainty

Uploaded by

fawmer61Copyright:

Available Formats

Ekaterina Kalinenko

and Luisa Sykes,

Euro Petroleum Consultants,

explain how the global

petrochemical industry can

adapt to the high level of

uncertainty and volatility in

energy markets and still

remain competitive.

T

he global petrochemical industry is navigating many challenges and adapting to very volatile

feedstock prices, changes in global supply and demand patterns, and strict environmental

regulations. The collapse in oil prices added another layer of complexity to the fundamental

changes taking place in global energy markets and impacting the dynamics of the

petrochemical sector.

The drop in naphtha prices has re-addressed the competitive position of European and Asian

petrochemical producers vs Middle Eastern and US producers. European and Asian naphtha-based crackers

have regained some competitive strength vs ethane based crackers and enjoyed strong margins throughout

2015. Ethane price advantage vs naphtha has been significantly reduced and the stronger Dollar vs the Euro

added strength to European petrochemical producers.

Winter 2016 Energy Global 27

infrastructure, high capital investment,

water availability and environmental

issues are also expected to restrict the

expansion of coal to chemicals projects

in the future.

The Middle East enjoys the world's

lowest cost ethylene production thanks

to cheap ethane – US$0.75/million Btu

vs an average of US$3.5/million Btu in the

US in the last three years. The region has

seen substantial capacity additions in the

last decade, growing at an average of 10%

since 2008. The expansion rate is

expected to be more moderate in the

future but several petrochemical projects

are still underway or at planning stage.

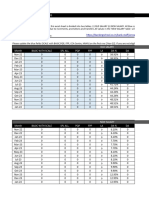

Figure 1. US ethylene and propylene capacity expansions (1000 bpd). The majority of the additional

petrochemical production will be

targeting export markets.

The global petrochemicals landscape was changing prior to It becomes quite clear from highlighting developments in

the collapse of oil prices in 2H14. A large amount of several parts of the globe that the expansion of the

petrochemical capacity has been added in China, the US and the petrochemical industry in the three geographical regions could

Middle East, threatening the fragile supply-demand balance lead to overcapacity and intense competition amongst

globally. The strategies implemented by the petrochemical petrochemical producers. The question facing many producers

industry in each region are quite distinct and are shaped by the around the world is ‘how to cope with greater degree of

particular conditions and characteristics of each region. Some of uncertainty and still run profitable operations and make the

these strategies have been challenged by the decline in oil right investment decisions’. Petrochemical producers globally

prices, leading to a potential re-shaping of the global will need to win competitive advantage to maintain or increase

petrochemical sector. market share based on feedstock costs, location and efficient

In the US, low ethane feedstock prices have triggered a running of their operations. Promoting maximum organisational

revival of the US petrochemical sector – a substantial number efficiency and improving operational performance should be

of ethylene and ethylene derivatives plants have been built and top objectives for all petrochemical operations.

new projects are in the pipeline. Six large scale ethylene

projects with a total capacity of 600 000 bpd are currently ‘Recipes’ to promote efficiency

under construction in the US and are expected to be completed during times of great uncertainty

between 2017 and 2018 (Figure 1). The US propylene business is In times of great economic uncertainty, companies are

also thriving. The tight US propylene market and the increase searching for ways to maximise their returns and obtain ‘the

supply of propane from natural gas production has driven the competitive edge’. A very effective way to promote these

investment in propane dehydrogenation plants (PDH) – six objectives is to implement operational excellence models,

projects are currently at various stages of development and are which are gaining a good track record within the oil, gas and

expected to add 190 000 bpd to current production levels in petrochemical industries. Many petrochemical companies are

the US. As the scope for expansion in the domestic market is adopting operational excellence models using key

fairly limited, US ethylene producers and even producers of performance indicators (KPIs) to measure business and

on-purpose propylene production will be targeting export operational systems such as management and leadership, loss

markets. of production and control, production optimisation, reliability

China is the largest consumer of petrochemical feedstock and maintenance, etc.

and petrochemical derivatives. But it is also committed to a The main objective of operational excellence programmes is

strategy of import substitution that will impact global markets to neutralise risk and maximise value creation. The operational

by reducing a significant volume of petrochemical imports into excellence approach is placing people at the centre of business

the country. China’s import substitution strategy has led to improvement practices. Key drivers of operational excellence for

substantial investment in the domestic petrochemical sector, improving organisational performance include strong leadership,

leading to overcapacity in some segments of the industry and conductive organisational structure and clear focus, and a plan of

the recourse to export markets. However, the expected increase action. Strong leadership implies commitment by corporate

in domestic demand is likely to absorb excess supply in the not leaders to embrace the operational excellence approach – the

so distant future. China has limited crude and gas resources but leadership must present clear and unambiguous goals and plans.

plenty of coal availability. In order to utilise the vast coal A suitable organisational structure can be categorised as including

resources, a large number of coal to chemicals projects are a well informed workforce with well integrated team structures, a

currently underway in China. However, current low naphtha clear line of accountability and performance measurements and

prices are challenging the fragile coal to olefins economics and motivational feedback on goals and achievements within the

some projects could be in jeopardy. Additionally, the lack of teams. A clear focus and plan of action is the ‘touching stone’ of

28 Energy Global Winter 2016

the operational excellence process requiring a good competitiveness, return on assets and production

communication system. The aim is to identify all the areas that competencies. The efforts were focused on the creation of a

need to be tackled and improved with particular emphasis on system of unified principles, standards and procedures to form

training and development. A clear plan of action is designed to the kernel of the corporate culture for continuous

promote best practices and work towards improving improvement of the whole company.

organisational performance. The system was built by reorganising the company culture,

in the first place, through integration of the leadership vision

Implementing operational and practices, teamwork in addressing problems, diagnostics

excellence programmes of the business goals described above, implementation

Petrochemical companies can post dozens of implemented mechanism structuring (analysis – implementation –

operational excellence projects similar to the programme maintenance) and release of the available added value

developed and implemented by Petrochemical Industries potential. Apart from attaining the global objectives, the

Company (PIC). The achieved results were presented at the expected deliverables included the development of the ‘road

International Operational Excellence Conference, organised by map’ with sustainable annual cost recovery, a significant

Euro Petroleum Consultants (EPC) in Istanbul, Turkey in increase in the daily average output and perceivable

spring 2015. improvements in the corporate culture.

Based in Kuwait, PIC was founded in 1963 as the first The operational excellence pilot project was launched at

chemical fertiliser complex of its kind in the region. Today, PIC SIBUR’s synthetic rubber plant. The top priority task was to

is a petrochemical industry leader in Kuwait and throughout optimise workplaces and to motivate staff to get involved in

the Middle East. In addition to manufacturing and marketing generating ideas for performance improvement. It was

fertilisers, olefins and aromatics in Kuwait, PIC participates in elimination of losses and recognition of each participant’s

multiple joint ventures that also produce and market contribution to the plant’s performance that was used as the

chemicals both locally and internationally. foundation for the improvement programme. The results

At the initial stage of the programme development, PIC’s obtained built a case for rolling the programme out across the

concept of operational improvements implied formulation of entire organisation.

vision, strategy and objectives. The company decided to Tomskneftekhim, another SIBUR plant, and one of the

develop the programme on the basis of three classical largest Russian polymer producers, has also benefitted from

principles: lean production (lean), quality management the implementation of the operational excellence programme.

(six sigma) and project management (PM). The first stage of the programme involved training key

Among the top priorities were HR performance, focus on executives to understand the principles of the programme. In

the consumer’s individual needs and the process approach the opinion of the company’s management, organisational

under the slogan ‘Better, Faster, Cheaper!’. The operational changes depend on how well managers understand the

performance metric included criteria such as expenditure essence of the corporate improvement culture, and the actual

level, production cycle time and the rejection rate. results impacting the workplace where the updated plant

Improvements were introduced by using a standard procedure management system is expected to have maximum effect.

aimed at building a knowledge management system as the As the improvement projects were being implemented,

backbone for further optimisation. A critical factor was the updated estimates showed a two fold growth in the

effective employee engagement, i.e. explicit goal setting and economic benefit of the projects, with work time losses

adequate incentives, effective interaction and communication, reduced by 40% and the increase in the plant’s profitability

and a consistent process of project evaluation and selection. nearly 20 times as high as the consultancy costs.

Such process needs to be well established, continuous and

consider borrowing needs. Conclusion

According to PIC, thanks to continuous leadership training The petrochemical industry needs to adapt to the high level

of top managers, annual awareness sessions and quarterly of uncertainty and volatility in energy markets and still remain

trainings for identifying improvement possibilities, the competitive. Investing in projects benefiting from competitive

company saved US$173 million, successfully completed advantage is one of the keys for success, as well as having a

524 projects, obtained 84 certified project managers (leaders), clear view of what markets and clients are more promising.

acquired new competencies and revised the corporate culture Investing in operational excellence will guarantee best

to conform to the best global practices. practices, best results and best operational performance.

Operational excellence was no less topical for Russian Operational excellence models are being widely applied

petrochemical companies. One of the most remarkable across the petrochemical industry as the positive impact of

examples is the new production system developed under the their implementation becomes more evident. These models

operational excellence programme and implemented at the are based on the concept of leadership, teamwork and

enterprises of the Russian petrochemical giant problem solving, aiming to create a continuous improvement

PJSC SIBUR Holding. SIBUR is a Russian gas processing and environment throughput the organisation, focusing on

petrochemicals company headquartered in Moscow. It client/market requirements and optimising all activities for

operates 26 production sites located throughout Russia and the best operational results.

employs over 25 000 personnel.

This article was originally published in the December 2015 issue of

SIBUR pursued an ambitious goal – to gain operational Hydrocarbon Engineering. Register for your free copy of the magazine here:

excellence and become world class in terms of market http://www.energyglobal.com/signin/?mgz=hydrocarbon-engineering

Winter 2016 Energy Global 29

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Designing Shell & Tube Heat Exchangers - Avoid Vibration From The StartDocument5 pagesDesigning Shell & Tube Heat Exchangers - Avoid Vibration From The Startfawmer61No ratings yet

- Pump Cavitation and How To Avoid ItDocument5 pagesPump Cavitation and How To Avoid Itfawmer61No ratings yet

- 8 - HEURTEY PETROCHEM Flux Distribution in Fired Heaters A Case StudyDocument27 pages8 - HEURTEY PETROCHEM Flux Distribution in Fired Heaters A Case Studyfawmer61No ratings yet

- Small Scale LNG Sector Is About To Take Off in IndiaDocument3 pagesSmall Scale LNG Sector Is About To Take Off in Indiafawmer61No ratings yet

- The North American Storage BoomDocument4 pagesThe North American Storage Boomfawmer61No ratings yet

- New Thinking About EfficiencyDocument2 pagesNew Thinking About Efficiencyfawmer61No ratings yet

- Tips For Correct Pump SelectionDocument2 pagesTips For Correct Pump Selectionfawmer61No ratings yet

- Designing Atmospheric Crude Distillation For Bitumen Service PDFDocument6 pagesDesigning Atmospheric Crude Distillation For Bitumen Service PDFfawmer61No ratings yet

- ARTC2011 AnneMetteSorensenDocument13 pagesARTC2011 AnneMetteSorensenfawmer61No ratings yet

- Activated Carbon OptionsDocument2 pagesActivated Carbon Optionsfawmer61No ratings yet

- Stress Corrosion Cracking PDFDocument2 pagesStress Corrosion Cracking PDFfawmer61No ratings yet

- Steam Tracing 101Document2 pagesSteam Tracing 101fawmer61100% (1)

- A Discussion of HVAC Coil CoatingsDocument4 pagesA Discussion of HVAC Coil Coatingsfawmer61No ratings yet

- Explosibility TestingDocument3 pagesExplosibility Testingfawmer61No ratings yet

- Optimize CO2 RemovalDocument5 pagesOptimize CO2 Removalfawmer61No ratings yet

- Fix A Fouled FractionatorDocument3 pagesFix A Fouled Fractionatorfawmer61No ratings yet

- Optimizing Mercury Removal Processes For Industrial WastewaterDocument3 pagesOptimizing Mercury Removal Processes For Industrial Wastewaterfawmer61No ratings yet

- Automating For EfficiencyDocument6 pagesAutomating For EfficiencySteven A McMurrayNo ratings yet

- Tackle Exchanger FlawsDocument3 pagesTackle Exchanger Flawsfawmer61No ratings yet

- Sealing Solutions To The RescueDocument4 pagesSealing Solutions To The Rescuefawmer61100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Inventory (Questions) : Question No. H-1Document4 pagesInventory (Questions) : Question No. H-1manadish nawazNo ratings yet

- Complaint Handling at United Bank by Mahlet TeshomeDocument55 pagesComplaint Handling at United Bank by Mahlet TeshomeAmmanNo ratings yet

- Postgraduate PG Mba Semester 1 2019 November Entrepreneurship Development 2019 PatternDocument2 pagesPostgraduate PG Mba Semester 1 2019 November Entrepreneurship Development 2019 PatternIVYNo ratings yet

- Arrears Estimator OfficersDocument9 pagesArrears Estimator OfficersRavi ManglaniNo ratings yet

- 320 33 Powerpoint Slides Chapter 15 Externalities Public GoodsDocument8 pages320 33 Powerpoint Slides Chapter 15 Externalities Public GoodsPrateek KhandelwalNo ratings yet

- Economics 511Document21 pagesEconomics 511RebeccaNo ratings yet

- Statistical Appendix MECA October 2023Document29 pagesStatistical Appendix MECA October 2023Abeerh HallakNo ratings yet

- CVP QUIZ TeachersDocument5 pagesCVP QUIZ TeachersAron Ace AycoNo ratings yet

- Textbook Chapter 10 Managing Change: Q What Is Personal Change?Document8 pagesTextbook Chapter 10 Managing Change: Q What Is Personal Change?Yashasvi SharmaNo ratings yet

- GPB AR Form BarangayDocument2 pagesGPB AR Form BarangayDonavel Nodora Jojuico100% (1)

- YAMAICHIDocument1 pageYAMAICHILoc NguyenNo ratings yet

- Policy Status ReportDocument6 pagesPolicy Status ReportBenson BennyNo ratings yet

- Hamilton Housewares Pvt. Ltd.-Rakholi: Salary Slip For The Month of February 2020Document1 pageHamilton Housewares Pvt. Ltd.-Rakholi: Salary Slip For The Month of February 2020KRISHNA SINGHNo ratings yet

- Plan-Do-Check-Adjust (PDCA) Cycle: W. Edwards Deming Toyota Production System Lean ManufacturingDocument29 pagesPlan-Do-Check-Adjust (PDCA) Cycle: W. Edwards Deming Toyota Production System Lean ManufacturingnozediNo ratings yet

- Cities & Buildings VocabularyDocument9 pagesCities & Buildings VocabularyNicoleNo ratings yet

- Braudel - Production Away From Home - Wheels of CommereDocument79 pagesBraudel - Production Away From Home - Wheels of CommerefrankmandellNo ratings yet

- Checklist Annexure V1.3Document5 pagesChecklist Annexure V1.3Praveen KumarNo ratings yet

- Shelf Drilling Pareto Conference Sep 2023 VFDocument34 pagesShelf Drilling Pareto Conference Sep 2023 VFAhmed Arabi AldeebNo ratings yet

- Account 83403139320 PDFDocument4 pagesAccount 83403139320 PDFblackson knightsonNo ratings yet

- Coating Inspector Program Level 1 Studen 1Document20 pagesCoating Inspector Program Level 1 Studen 1AhmedBalaoutaNo ratings yet

- Cashew - Nut - - - group - 78 - -đã chuyển đổiDocument3 pagesCashew - Nut - - - group - 78 - -đã chuyển đổiThùy Linh DươngNo ratings yet

- Timmy LiewDocument2 pagesTimmy LiewRachaelNo ratings yet

- Economics AQA Section2 Workbook AnswersDocument27 pagesEconomics AQA Section2 Workbook AnswersABDULLAH KhanNo ratings yet

- Zipline Conveyor SPLT1134ENWB 02Document4 pagesZipline Conveyor SPLT1134ENWB 02JrbritoNo ratings yet

- Chapter 19 Testbank Solution Manual Management AccountingDocument66 pagesChapter 19 Testbank Solution Manual Management AccountingTrinh LêNo ratings yet

- Pompa SumpitDocument2 pagesPompa SumpitMulyadi MulNo ratings yet

- Macroeconomics Principles and Applications 5th Edition Hall Lieberman Solution ManualDocument9 pagesMacroeconomics Principles and Applications 5th Edition Hall Lieberman Solution Manualjared100% (26)

- DPWHDocument2,166 pagesDPWHLGU SAN ANTONIONo ratings yet

- Walmart Inc.: Monthly Rates of ReturnDocument11 pagesWalmart Inc.: Monthly Rates of ReturnChristopher KipsangNo ratings yet

- Customer Satisfaction Survey FormDocument2 pagesCustomer Satisfaction Survey FormJoseNo ratings yet