Professional Documents

Culture Documents

India's Small Scale LNG Sector Primed for Growth

Uploaded by

fawmer61Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India's Small Scale LNG Sector Primed for Growth

Uploaded by

fawmer61Copyright:

Available Formats

Vidur Singhal and Mayank Garg, VEnergy,

India, argue that the small scale LNG

sector is about to take off in India.

O

n 29 January 2004, India received its first ever

import cargo of LNG. The LNG tanker, Disha,

carrying 138 000 m3 of natural gas supplied by

RasGas, reached the greenfield LNG terminal at

Dahej, Gujarat, India. Since then, LNG imports in India have

increased steadily, and total imports 2014 – 2015 financial

year stood close to 11.5 million tpy. Presently, there are

four LNG terminals operating on the west coast of India, at

Dahej, Hazira, Dabhol and Kochi, with total regasification

capacity close to 20 million tpy.

Even though India has developed infrastructure to

import LNG, and has also secured a reliable supply of LNG

with long-term contracts, LNG marketing companies,

including GAIL, Petronet, Bharat Petrolium Corp. Ltd (BPCL)

and Indian Oil Corp. Ltd (IOCL), have struggled to market

this LNG in India, due to several factors.

Spring 2016 Energy Global 23

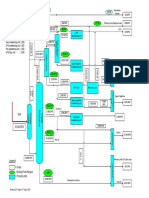

Lack of an integrated gas pipeline in major sectors, such as the power and fertiliser

grid industries. In the power sector, LNG has to compete with

One of the major factors for the constrained growth of coal, which is available domestically and is imported in

LNG demand in India is the lack of an integrated gas India. With the average power generation cost from coal

pipeline grid across the country to enable supply of approximately US$0.50/kWh, power produced from LNG

regasified LNG to the end consumer. Currently, India has is more than twice that produced from coal. While there

a network of only 13 000 km of natural gas transmission has been focus on reducing emissions and using cleaner

pipelines, with a design capacity of approximately forms of energy, and gas does provide a good alternative

330 million m3/d. This pipeline network is expected to fuel to meet these clean energy targets, the current

expand to approximately 28 000 km, with a total design government has been focusing more towards solar power.

capacity of approximatley 731 million m3/d in the To date, approximately 10 000 MW of gas-based power

next 5 – 6 years, but progress has been slow because of generating capacity in India lies stranded, as there are no

difficulties faced by GAIL in land acquisition and off-takers for the expensive power generated using LNG

receiving comfort letters from the anchor customers to as fuel.

ensure minimum utilisation of the new pipelines to be

constructed. Small scale LNG, and its distribution in Regulated and fixed price of urea

cryogenic containers over road, railways and inland In the fertiliser sector, as the price of urea is regulated

waterways, can be a viable alternative to a gas pipeline. and fixed in India, it is very difficult to fit LNG into the

Under its flagship project, ‘Sahaj Ganga’, VLNG is already market. It is being argued that it is more economical to

developing a small scale LNG supply chain in the eastern import fertilisers directly in India, in comparison to

part of India. manufacturing them, with a gas delivered price of above

US$14/million Btu.

Alternative fuels

The other major reason for the constrained growth of Overcoming these problems

LNG in India is the competitive price of alternative fuels Given these factors, LNG marketing companies are

struggling to market the

already contracted

volumes in India. For

instance, GAIL is

struggling to market

LNG from its US

contract, and is now

considering trading it in

global markets.

Petronet’s Kochi LNG

terminal currently stands

at 1% utilisation, due to

the delayed pipeline

connectivity to the gas

grid and end consumers.

Many new LNG

terminals were

announced in the last

few years for both the

east and west coast of

India. However, it is

unlikely that all of these

projects will be realised.

Recently, the terminal to

be jointly developed by

BPCL and Mitsui at

Mangalore has been

cancelled, given the low

utilisation of the nearby

Kochi terminal. Any LNG

import growth forecast

based primarily on the

demand by power and

Figure 1. Current Indian gas infrastructure, including LNG terminals and pipelines under fertiliser sectors in India

construction. is questionable, and may

lead to disappointment

24 Energy Global Spring 2016

amongst global LNG producers, traders and marketing volumes, given the push to reduce pollution levels in

companies. major cities, and as a cheaper alternative fuel to diesel

For sustained growth in LNG imports in India, leading and petrol.

to the utilisation of the existing terminal and

justification of the new terminals being announced, the Distribution

industry needs to find other sectors where LNG Most of this demand will be distributed in nature, will

provides a more economical alternative to existing fuels. require aggregation at the regional level, and will be

In addition to this, more flexible LNG distribution served through customised flexible supply and

methods need to be adopted that are different from the distribution models and not through gas pipelines. LNG

current approach of regasifying the LNG that is distributed in small volumes from the main storage to

imported at the terminal and is then dependent on the the satellite hubs and then to end consumers using

gas pipeline network to distribute it to the end multiple modes of transportation, such as road, railways

consumers. and inland waterways, will be the most effective way to

serve these end consumers. This method of supplying

Industries that can benefit from and distributing LNG will allow serving the end

LNG consumers according to their individual requirements.

India consumes more than 80 million tpy of liquid fossil The Indian peninsula is geographically well suited to

fuels, such as high sulfur diesel (HSD), heavy fuel oil build this distributed network to supply LNG in small

(HFO), liquefied petroleum gas (LPG) and naphtha in the volumes to end consumers. It can be envisioned that, in

transportation, industries and mining sectors, and is one a few years, there will be small LNG storage facilities at

of the major sources of pollution. LNG targeted towards all of the major ports of India, connected to the big LNG

the replacement of these liquid fuels provides a good terminals via small LNG carriers moving along the

opportunity. LNG contracts are typically indexed to country’s coastline. From these small storage hubs on

crude oil prices, and thus provide a natural hedge when the ports along the east and west coast of India, LNG

trying to replace crude oil derivative products, such as will be distributed to satellite hubs, LCNG stations, and

petrol, diesel, LPG and naphtha. In India, with the to the end consumers through truck, railways and inland

removal of subsidy on diesel prices, and the existing waterway barges in cryogenic containers.

central duty, state taxes and different cess on crude oil

products, LNG is available at a competitive price. At the Leading the way

current level of oil prices, LNG used as a replacement India’s major challenge in the growth of small scale LNG

for diesel can provide up to 40% fuel savings. is that the end consumer is reluctant to take any steps

Sectors that can be targeted are transportation, towards transitioning to LNG unless a reliable and

industries, city gas distribution and mining. LNG is continuous supply of LNG is demonstrated to them.

quickly becoming a viable fuel in long haul trucking in Meanwhile, the infrastructure companies that should be

China, Europe and the US, and the same opportunity is building the small scale LNG distribution network are

available in India. Public transport can switch to cheaper looking for a minimum demand off-take before they

LNG and help bring down the pollution level in cities, develop the network. VEnergy believes that the small

which is quickly becoming a major problem. In view of scale LNG growth story in India will be written by small

this impending opportunity, Tata Motors has already companies and new age entrepreneurs who will be able

developed commercial vehicles that run on LNG, and to identify small opportunities in different parts of the

other major commercial auto manufacturers are at country and will develop solutions accordingly. Several

different stages of rolling out trucks running on LNG. such companies will grow in different parts of India and

Even railways provide a promising opportunity for the together they will be able to cover much of the country.

use of LNG. For instance, Indian Railways has already Already, a few companies have announced plans to

started a pilot project, and plans to have commercial develop such facilities on different ports. As mentioned

LNG operations in place in the next 3 – 4 years. Inland before, one such project was recently announced by

waterways, which are being pushed by the present VLNG, which, as a part of its flagship project,

government, also provide a new opportunity for LNG. ‘Sahaj Ganga’, announced that it will develop a small

Small to medium sized industries, which are scale LNG supply chain along the river Ganges on the

currently using diesel, LPG and fuel oil, can also absorb a back of National Waterway 1 to distribute LNG in the

significant volume of LNG at much higher prices, eastern and central part of India and target diesel, LPG

provided a reliable supply is ensured to them. Also, with and HFO replacement with LNG.

the gradual tightening of the state pollution control

boards on the sulfur and particulate matter (PM) Conclusion

emissions, industries will be pushed towards using clean With the removal of subsidy on diesel prices, growing

fuels. concerns over high pollution levels in cities, availability

Heavy machinery used in coal mining currently uses of LNG import infrastructure, and competitive long-term

diesel, but can be converted to using LNG as fuel. This LNG contracts secured by GAIL and Petronet LNG,

has already started to happen in the US, but there is an VEnergy believes that the small scale LNG sector is on

opportunity to create this demand in India too. City gas the cusp of take-off in India, and can add up to

distribution also has strong potential to absorb LNG 10 million tpy of LNG demand in the next 10 years.

Spring 2016 Energy Global 25

You might also like

- GH Paper March Issue LNG IndustryDocument4 pagesGH Paper March Issue LNG IndustryPawan ChaturvediNo ratings yet

- Gas For Energy Transition: Presented at High Level Summit On Human Capital Development Toward Net Zero EmissionDocument12 pagesGas For Energy Transition: Presented at High Level Summit On Human Capital Development Toward Net Zero Emissionmineral geologistNo ratings yet

- GP - 201401 Optimize Small Scale LNG ProcessDocument6 pagesGP - 201401 Optimize Small Scale LNG ProcessAndri SaputraNo ratings yet

- City Gas Distribution: Indian Gas Chain (Source: GGCL Investors Meet, Marchv27, 2008)Document18 pagesCity Gas Distribution: Indian Gas Chain (Source: GGCL Investors Meet, Marchv27, 2008)Snehil TripathiNo ratings yet

- Dabhol Power Project: Group 3Document7 pagesDabhol Power Project: Group 3Nischal Singhal ce18b045No ratings yet

- Overview LNG Central Java V.1.2.REV1Document10 pagesOverview LNG Central Java V.1.2.REV1sigit l.prabowoNo ratings yet

- Presentation Slides About India LNGDocument3 pagesPresentation Slides About India LNGSatish Kumar100% (1)

- Commercial Use of STranded GasDocument6 pagesCommercial Use of STranded GasaidanNo ratings yet

- LNG Import in India & Petronet LNG LimitedDocument11 pagesLNG Import in India & Petronet LNG LimitedMarcelo Varejão CasarinNo ratings yet

- Asean LNG Power Market Update Opportunities 2019Document26 pagesAsean LNG Power Market Update Opportunities 2019Gaurav DuttaNo ratings yet

- Cost Economics Emerging Business ModelsDocument11 pagesCost Economics Emerging Business ModelsAnoop PrajapatiNo ratings yet

- NGVA Europe - Encouraging Progress in LNG Blue Corridors ProjectDocument2 pagesNGVA Europe - Encouraging Progress in LNG Blue Corridors ProjectGeorge AndreiNo ratings yet

- Hydrogen Valley Feasibility Study Report Final VersionDocument141 pagesHydrogen Valley Feasibility Study Report Final Versionambergris200No ratings yet

- Check For Answers. Hope You Will Find ItDocument11 pagesCheck For Answers. Hope You Will Find ItMohammad Nazmul IslamNo ratings yet

- City Gas DistributionDocument6 pagesCity Gas DistributionVineeth DivakaranNo ratings yet

- Oil and Gas Guide 2014 V1Document23 pagesOil and Gas Guide 2014 V1oidaadmNo ratings yet

- 1 s2.0 S0360544218325441 MainDocument12 pages1 s2.0 S0360544218325441 MainSuleman AhmadNo ratings yet

- Assignment Calculation of LNG Supply From Loading Terminal To Power PlantDocument16 pagesAssignment Calculation of LNG Supply From Loading Terminal To Power PlantLusiFadilahNo ratings yet

- Press Release - Indian Gas Transmission Business: Sun Is Shining, The Weather Is SweetDocument10 pagesPress Release - Indian Gas Transmission Business: Sun Is Shining, The Weather Is Sweetanzin_87No ratings yet

- Narendra Nath Veluri Day1 Green Hydrogen in India April2023Document34 pagesNarendra Nath Veluri Day1 Green Hydrogen in India April2023Praneet PayodhiNo ratings yet

- Hoegh-LNG-presentation For VietnamDocument18 pagesHoegh-LNG-presentation For VietnamJeffryNo ratings yet

- TotalEnergies 2022 Strategy and Outlook LNG Focus PresentationDocument12 pagesTotalEnergies 2022 Strategy and Outlook LNG Focus Presentationgasra.meetingNo ratings yet

- Howe Robinson LNG UpdateDocument1 pageHowe Robinson LNG UpdateBobby QuintosNo ratings yet

- SFR 20020831 LNGDocument7 pagesSFR 20020831 LNGVidhu PrabhakarNo ratings yet

- Decision Making in Nepal's Electricity BureaucracyDocument4 pagesDecision Making in Nepal's Electricity BureaucracyVikasNo ratings yet

- FSRU Asia Summitt - FSRUs in South AsiaDocument4 pagesFSRU Asia Summitt - FSRUs in South AsiaHFNo ratings yet

- LNG Terminals in IndiaDocument20 pagesLNG Terminals in IndiaJyotishko BanerjeeNo ratings yet

- Renewable and Sustainable Energy Reviews: SciencedirectDocument15 pagesRenewable and Sustainable Energy Reviews: SciencedirectcahyaniwindartoNo ratings yet

- CGD BusinessDocument39 pagesCGD BusinessPradeep Aneja100% (1)

- Natural Gas in India: CGD Sector GrowthDocument19 pagesNatural Gas in India: CGD Sector GrowthAnkit PandeyNo ratings yet

- Innovative Business Case For L&T in LNG and RLNG Applications in IndiaDocument8 pagesInnovative Business Case For L&T in LNG and RLNG Applications in IndiaAakash ChhariaNo ratings yet

- DF Electric LNG Carrier ConceptDocument6 pagesDF Electric LNG Carrier ConceptHrNo ratings yet

- Estimating Capital Cost of Small Scale LNG CarrierDocument5 pagesEstimating Capital Cost of Small Scale LNG CarrierccelesteNo ratings yet

- Petroleum and Gas Pipeline IndiaDocument4 pagesPetroleum and Gas Pipeline IndiazarrarNo ratings yet

- Small Scale LNG Power Generation in The PhilippinesDocument18 pagesSmall Scale LNG Power Generation in The Philippinesmardirad100% (1)

- LNG EconomicsDocument19 pagesLNG EconomicsCal50% (2)

- Completing The LNG Value ChainDocument8 pagesCompleting The LNG Value ChainManoj Gupta100% (1)

- Cameron Liquefaction ProjectDocument2 pagesCameron Liquefaction Projectbkonly4uNo ratings yet

- CNG CARRIERS 20040801.CNG - CarrDocument6 pagesCNG CARRIERS 20040801.CNG - CarrTASSOUNGOSNo ratings yet

- AbtngDocument5 pagesAbtngSushant PaiNo ratings yet

- Dual-Fuel Engine Using LPG: Shipbuilding & EquipmentDocument2 pagesDual-Fuel Engine Using LPG: Shipbuilding & EquipmentRanjan DiptanshuNo ratings yet

- Developing Nigeria's Domestic Gas InfrastructureDocument19 pagesDeveloping Nigeria's Domestic Gas InfrastructuresegunoyesNo ratings yet

- Spe 128342 PDFDocument23 pagesSpe 128342 PDFDaniel DamboNo ratings yet

- WTF 2000 Waste To Fuel: Silcasia EnergyDocument8 pagesWTF 2000 Waste To Fuel: Silcasia EnergyMohammed JowardharNo ratings yet

- CGDDocument24 pagesCGDTusar PalNo ratings yet

- IEEFA Presentation - Indonesia's Downstream Coal Plans Add Up To A Black Hole - Jan 22Document21 pagesIEEFA Presentation - Indonesia's Downstream Coal Plans Add Up To A Black Hole - Jan 22ik43207No ratings yet

- Energies: Workflow For Probabilistic Resource Estimation: Jafurah Basin Case Study (Saudi Arabia)Document24 pagesEnergies: Workflow For Probabilistic Resource Estimation: Jafurah Basin Case Study (Saudi Arabia)SaidNo ratings yet

- SSRN Id1983117Document12 pagesSSRN Id1983117Mudit Kothari0% (1)

- Study On Possible Reductions of Gas Flaring in CameroonDocument19 pagesStudy On Possible Reductions of Gas Flaring in CameroonSahyuo Buo100% (2)

- Qatars Gas RevolutionDocument2 pagesQatars Gas Revolutionxtrooz abiNo ratings yet

- Aeroderivative Gas Turbines For LNG Liquefaction PlantsDocument19 pagesAeroderivative Gas Turbines For LNG Liquefaction PlantsAnibal Rios100% (2)

- Basics of CGD For MBA Oil - Gas StudentsDocument53 pagesBasics of CGD For MBA Oil - Gas StudentsUJJWALNo ratings yet

- Extended Abstract - Joana Antunes - MEGEDocument10 pagesExtended Abstract - Joana Antunes - MEGEMarcosGonzalezNo ratings yet

- Nigerian Gas OverviewDocument15 pagesNigerian Gas OverviewKagiso KayaNo ratings yet

- Engie Shelves Cameroon As LNG Moves Offshore: Vol. 6 / No. 134 / 14 July 2016Document9 pagesEngie Shelves Cameroon As LNG Moves Offshore: Vol. 6 / No. 134 / 14 July 2016hortalemosNo ratings yet

- Information Technology Solutions: LNG Expertise That Is Hard To BeatDocument2 pagesInformation Technology Solutions: LNG Expertise That Is Hard To BeatPaulo Ivo100% (1)

- CR - 2022 - December - Gas Utility Sector - ThematicDocument14 pagesCR - 2022 - December - Gas Utility Sector - ThematicMohanGuptaNo ratings yet

- Powerhouse Hydrogen Hydrocarbon Engineering 3 June 2014Document4 pagesPowerhouse Hydrogen Hydrocarbon Engineering 3 June 2014RaulNo ratings yet

- 10 11648 J Ogce 20210906 13Document13 pages10 11648 J Ogce 20210906 13altamirano21No ratings yet

- Hydrogen: A renewable energy perspectiveFrom EverandHydrogen: A renewable energy perspectiveNo ratings yet

- Designing Shell & Tube Heat Exchangers - Avoid Vibration From The StartDocument5 pagesDesigning Shell & Tube Heat Exchangers - Avoid Vibration From The Startfawmer61No ratings yet

- Tips for increasing water and wastewater pump productivityDocument2 pagesTips for increasing water and wastewater pump productivityfawmer61No ratings yet

- How the global petrochemical industry can adapt to uncertainty and volatilityDocument3 pagesHow the global petrochemical industry can adapt to uncertainty and volatilityfawmer61No ratings yet

- Pump Cavitation and How To Avoid ItDocument5 pagesPump Cavitation and How To Avoid Itfawmer61No ratings yet

- New Thinking About EfficiencyDocument2 pagesNew Thinking About Efficiencyfawmer61No ratings yet

- What's Up DownunderDocument3 pagesWhat's Up Downunderfawmer61No ratings yet

- Challenges Faced by The Russian Oil and Gas IndustryDocument4 pagesChallenges Faced by The Russian Oil and Gas Industryfawmer61No ratings yet

- 2 - Technology Selection & Project Execution - A Case in Point IRPC - Upstream Project For Hygiene & Value Added Products PDFDocument21 pages2 - Technology Selection & Project Execution - A Case in Point IRPC - Upstream Project For Hygiene & Value Added Products PDFfawmer61No ratings yet

- RFCC units maximize propylene production from heavy residual feedstocksDocument11 pagesRFCC units maximize propylene production from heavy residual feedstocksNguyễn Thành Tài100% (1)

- ARTC2011 AnneMetteSorensenDocument13 pagesARTC2011 AnneMetteSorensenfawmer61No ratings yet

- Delayed Coking - Is There Anything New (Q)Document36 pagesDelayed Coking - Is There Anything New (Q)fawmer61No ratings yet

- Options For Making Low Sulfur BunkerDocument16 pagesOptions For Making Low Sulfur Bunkerfawmer61No ratings yet

- The North American Storage BoomDocument4 pagesThe North American Storage Boomfawmer61No ratings yet

- 8 - HEURTEY PETROCHEM Flux Distribution in Fired Heaters A Case StudyDocument27 pages8 - HEURTEY PETROCHEM Flux Distribution in Fired Heaters A Case Studyfawmer61No ratings yet

- Biofuels - Should We Stay or Should We Go (Q)Document4 pagesBiofuels - Should We Stay or Should We Go (Q)fawmer61No ratings yet

- Piping Design Layout and Stress AnalysisDocument19 pagesPiping Design Layout and Stress AnalysisSolomon EmavwodiaNo ratings yet

- FTI Tech AdvancedCladdingPreInsulationSystemsDocument5 pagesFTI Tech AdvancedCladdingPreInsulationSystemseoseos12No ratings yet

- Troubleshooting Your Piping Integrity Takes A Joint EffortDocument1 pageTroubleshooting Your Piping Integrity Takes A Joint Effortfawmer61No ratings yet

- A Discussion of HVAC Coil CoatingsDocument4 pagesA Discussion of HVAC Coil Coatingsfawmer61No ratings yet

- Designing Atmospheric Crude Distillation For Bitumen Service PDFDocument6 pagesDesigning Atmospheric Crude Distillation For Bitumen Service PDFfawmer61No ratings yet

- Activated Carbon OptionsDocument2 pagesActivated Carbon Optionsfawmer61No ratings yet

- Advances in Flowmeter TechnologyDocument4 pagesAdvances in Flowmeter Technologyfawmer61No ratings yet

- Adiabatic Flame TemperatrueDocument1 pageAdiabatic Flame Temperatruefawmer61No ratings yet

- Fundamentals of Cooling Tower DesignDocument3 pagesFundamentals of Cooling Tower Designfawmer61No ratings yet

- Stress Corrosion Cracking ExplainedDocument2 pagesStress Corrosion Cracking Explainedfawmer61No ratings yet

- Steam Tracing 101Document2 pagesSteam Tracing 101fawmer61100% (1)

- 5 Strategies For Boiler or Furnace Users in Response To NAAQS RevisionsDocument5 pages5 Strategies For Boiler or Furnace Users in Response To NAAQS Revisionsfawmer61No ratings yet

- Optimize CO2 RemovalDocument5 pagesOptimize CO2 Removalfawmer61No ratings yet

- Explosibility TestingDocument3 pagesExplosibility Testingfawmer61No ratings yet

- Detail of Licenses Issued For Construction of LPG Storage & Filling PlantsDocument3 pagesDetail of Licenses Issued For Construction of LPG Storage & Filling PlantsAsad FawadNo ratings yet

- Coal Directory PDFDocument203 pagesCoal Directory PDFJEFY JEAN ANo ratings yet

- Leonido Pulido PPT - Sept 3 2020Document16 pagesLeonido Pulido PPT - Sept 3 2020Karen Jella EscobinNo ratings yet

- 2011 Trinidad y TobagoDocument26 pages2011 Trinidad y TobagorubenpeNo ratings yet

- PPE - PL - GCC Oil and GasDocument65 pagesPPE - PL - GCC Oil and Gasاريت ينرذرذNo ratings yet

- Change ManagementDocument12 pagesChange ManagementVarsha Patil-KhachaneNo ratings yet

- World Lubricants MarketDocument14 pagesWorld Lubricants Marketarman chowdhuryNo ratings yet

- Proses Pengolahan GasDocument66 pagesProses Pengolahan GasWahyu HaryadiNo ratings yet

- 2022.SEP.12 1630SGT - ForwardCurveDocument7 pages2022.SEP.12 1630SGT - ForwardCurveRavel AraújoNo ratings yet

- 002.randy WrightDocument34 pages002.randy Wrightmitch980No ratings yet

- Session 2 ButanGas Serbia Goran Djurdjevic Serban PopaDocument13 pagesSession 2 ButanGas Serbia Goran Djurdjevic Serban Popatrinhvonga7289No ratings yet

- VAPEXDocument45 pagesVAPEXIng Jose BelisarioNo ratings yet

- Gasification by ShellDocument22 pagesGasification by Shellkagaku09100% (1)

- Malaysia OG Services DirectoryDocument145 pagesMalaysia OG Services DirectoryAlagendranNo ratings yet

- Visio ORC 1@35000BPD New HRA PDFDocument1 pageVisio ORC 1@35000BPD New HRA PDFAsifNo ratings yet

- 2023 Refining 101Document45 pages2023 Refining 101ebook ebookNo ratings yet

- Pakistan Energy Yearbook 2021 HighlightsDocument157 pagesPakistan Energy Yearbook 2021 HighlightsSajid AliNo ratings yet

- Introduction to Petroleum EngineeringDocument26 pagesIntroduction to Petroleum EngineeringKevin Lijaya LukmanNo ratings yet

- Apag 20171110Document16 pagesApag 20171110egif_thahirNo ratings yet

- Miller Field Decommissioning: Steve Johnston - Miller Decommissioning Manager NPF Conference, Bergen - February 2009Document22 pagesMiller Field Decommissioning: Steve Johnston - Miller Decommissioning Manager NPF Conference, Bergen - February 2009foobar2016No ratings yet

- Crude Oil PricesDocument4 pagesCrude Oil PricesPrakarn KorkiatNo ratings yet

- Oil & Gas GlossaryDocument31 pagesOil & Gas Glossarytulks100% (2)

- Review of LPG Usage in Nigeria - TrendsDocument8 pagesReview of LPG Usage in Nigeria - TrendsEsther olanipekunNo ratings yet

- Feasibility Report On Production of LPG From Natural GasDocument18 pagesFeasibility Report On Production of LPG From Natural GasDanish KhanNo ratings yet

- Sonatrach: Investment Plan 2012-2016Document14 pagesSonatrach: Investment Plan 2012-2016Gargiulo AnitaNo ratings yet

- Oil & Gas Industry in Arabic World 1Document42 pagesOil & Gas Industry in Arabic World 1Suleiman BaruniNo ratings yet

- Seoul FLNG Conference PresentationsDocument39 pagesSeoul FLNG Conference Presentationsstavros7No ratings yet

- ICG Consulting, IranDocument23 pagesICG Consulting, IranShashi BhushanNo ratings yet

- Jack-Up Punch-Through at Maersk Al Shaheen Field Off Qatar - 2015 PDFDocument2 pagesJack-Up Punch-Through at Maersk Al Shaheen Field Off Qatar - 2015 PDFZine L DelNo ratings yet

- Inameta Flash Media June2014Document12 pagesInameta Flash Media June2014Muhamad Safii100% (1)