Professional Documents

Culture Documents

Analisis Laporan Keuangan Pertemuan 9 Kembalian Atas Investasi Dan Profitabilitas Exercise 8-1

Uploaded by

Ardilla Noor Paramashanti WirahadikusumaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analisis Laporan Keuangan Pertemuan 9 Kembalian Atas Investasi Dan Profitabilitas Exercise 8-1

Uploaded by

Ardilla Noor Paramashanti WirahadikusumaCopyright:

Available Formats

Elfrida Sahita Tiksna

19/453610/EE/07417

Analisis Laporan Keuangan

Pertemuan 9

Kembalian atas Investasi dan Profitabilitas

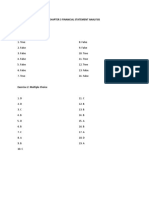

Exercise 8-1

a. Alternatif pertama:

NOPAT = $6,000,000 x 10%

= $600,000

Net Income = $600,000 – ($1,000,000 x 12%)(1-0.4)

= $528,000

Alternatif kedua:

NOPAT = $6,000,000 x 10%

= $600,000

Net Income = $600,000 – ($2,000,000 x 12%)(1-0.4)

= $456,000

b. Alternatif pertama:

ROCE = $528,000 / $5,000,000

= 10.56%

Alternatif kedua:

ROCE = $456,000 / $4,000,000

= 11.40%

c. Alternatif pertama:

Asset to Equity = $6,000,000 / $5,000,000

= 1.2

Alternatif pertama:

Asset to Equity = $6,000,000 / $4,000,000

= 1.5

Exercise 8-3

a. RNOA = 2 x 5% = 10%

b. ROCE = 10% + 1.786 x 4.4% = 17.86%

c. RNOA 10.00%

Leverage advantage 7.86%

Return On Equity 17.86%

Exercise 8-7

1. C. A Company with a large proportion of aged plant and equipment

2. A. Sales divided by average long-term operating assets

3. C. After-tax Operating profit margin and NOA turnover

You might also like

- Financial Ratios Questions With AnswersDocument6 pagesFinancial Ratios Questions With AnswersKyla Ramos Diamsay100% (1)

- Case 4 (1-6) GabungDocument12 pagesCase 4 (1-6) GabungFadhila HanifNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Exercise 8 - 1: Tugas Analisis Laporan Keuangan (Alk) Chapter 8 Dosen Pengampu: Dr. Aprilia Beta Suandi, SE., M. SCDocument3 pagesExercise 8 - 1: Tugas Analisis Laporan Keuangan (Alk) Chapter 8 Dosen Pengampu: Dr. Aprilia Beta Suandi, SE., M. SCArdilla Noor Paramashanti Wirahadikusuma100% (5)

- Im2 3Document35 pagesIm2 3musheeb1No ratings yet

- Kelompok 6 - Tugas Week 11 - Akuntansi Manajemen - LDocument4 pagesKelompok 6 - Tugas Week 11 - Akuntansi Manajemen - LRictu SempakNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Dewa Satria Rachman Lubis - 11 - 4-17Document15 pagesDewa Satria Rachman Lubis - 11 - 4-17DewaSatriaNo ratings yet

- Isna Wirda Lutfiyah - 17 - 4-17Document10 pagesIsna Wirda Lutfiyah - 17 - 4-17DewaSatriaNo ratings yet

- Dewa Satria Rachman LubisDocument13 pagesDewa Satria Rachman LubisDewaSatriaNo ratings yet

- P1. PRO O.L Solution CMA September 2022 ExaminationDocument6 pagesP1. PRO O.L Solution CMA September 2022 ExaminationAwal ShekNo ratings yet

- Chapter+2 3Document14 pagesChapter+2 3kanasanNo ratings yet

- Chapter15 LengkapDocument7 pagesChapter15 LengkapSulistyonoNo ratings yet

- Afm AssignmentDocument17 pagesAfm AssignmentHabtamuNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- ACCT 3110 CH 6 Homework E 1 2 3 7 8 11 12 14Document6 pagesACCT 3110 CH 6 Homework E 1 2 3 7 8 11 12 14John JobNo ratings yet

- CHAPTER 17 Borrowing Cost Problem 17-1 To 17-9 CFAS 2020 EditionDocument4 pagesCHAPTER 17 Borrowing Cost Problem 17-1 To 17-9 CFAS 2020 EditionMeljenice Closa PoloniaNo ratings yet

- D E+ D X RD+ E D+ E X : Return Richard ExpectDocument5 pagesD E+ D X RD+ E D+ E X : Return Richard ExpectSu Suan TanNo ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- Revision - 29 Aug, 28 Aug 2022Document9 pagesRevision - 29 Aug, 28 Aug 2022Kartik SujanNo ratings yet

- ACF 103 Tutorial 6 Solns Updated 2015Document18 pagesACF 103 Tutorial 6 Solns Updated 2015Carolina SuNo ratings yet

- Chapter 6-Receivables-Additional Concepts: Carrying Amount 148,000Document2 pagesChapter 6-Receivables-Additional Concepts: Carrying Amount 148,000Monica MonicaNo ratings yet

- Fundamentals of Financial Management (Brigham Houston-13 Edition)Document6 pagesFundamentals of Financial Management (Brigham Houston-13 Edition)samaraNo ratings yet

- Business Valuation Amendment 4 CW - Case Study 8 To 11Document9 pagesBusiness Valuation Amendment 4 CW - Case Study 8 To 11sairad1999No ratings yet

- Week 13and14 Assignment FINALSDocument10 pagesWeek 13and14 Assignment FINALSkristelle0marisseNo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- AFAR ANSWER KeyDocument6 pagesAFAR ANSWER KeyCheska JaplosNo ratings yet

- Farrel Gunawan LB41 2201752590 Assignment Engineering Economy (Break Even Analysis and Payback Period)Document3 pagesFarrel Gunawan LB41 2201752590 Assignment Engineering Economy (Break Even Analysis and Payback Period)Farel GunawanNo ratings yet

- Sol. Man. - Chapter 3 - The Accounting EquationDocument8 pagesSol. Man. - Chapter 3 - The Accounting EquationMae Ann Tomimbang MaglinteNo ratings yet

- Chapter 22 - Teacher's Manual - Far Part 1bDocument13 pagesChapter 22 - Teacher's Manual - Far Part 1bPacifico HernandezNo ratings yet

- Akmen CH 12 KelarDocument19 pagesAkmen CH 12 KelarFadhliyaFNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 10 - SolutionsDocument9 pagesACF 103 - Fundamentals of Finance Tutorial 10 - SolutionsThảo Trần Thị ThuNo ratings yet

- Funding The Business Answer To End of Chapter ExercisesDocument2 pagesFunding The Business Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Sol. Man. - Chapter 15 EpsDocument12 pagesSol. Man. - Chapter 15 Epsfinn mertensNo ratings yet

- This Study Resource Was: Financial Management Part 2 Handouts Analysis and Interpretation of Financial StatementsDocument6 pagesThis Study Resource Was: Financial Management Part 2 Handouts Analysis and Interpretation of Financial StatementsRengeline LucasNo ratings yet

- General Knowledge: EconomicsDocument32 pagesGeneral Knowledge: EconomicsrevandifitroNo ratings yet

- Chapter 4 - Concept Questions and Exercises StudentDocument9 pagesChapter 4 - Concept Questions and Exercises StudentVõ Lê Khánh HuyềnNo ratings yet

- ACF 103 Tutorial 10 SolnsDocument9 pagesACF 103 Tutorial 10 SolnsTroisNo ratings yet

- Chapter6E2010 PDFDocument12 pagesChapter6E2010 PDFutcm77No ratings yet

- Finman Activity1 SantosDocument9 pagesFinman Activity1 SantosJken OrtizNo ratings yet

- PB Exam - Answers - SolutionsDocument5 pagesPB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Assignment No. 2 Group Members M. Sameer Rimsha Shakeel Saniya Khurram Wajeeha SiddiqiDocument31 pagesAssignment No. 2 Group Members M. Sameer Rimsha Shakeel Saniya Khurram Wajeeha SiddiqiSameer AsifNo ratings yet

- Capital Budgeting ExercisesDocument9 pagesCapital Budgeting ExercisessaynaNo ratings yet

- Chapter 3 Financial Statement AnalysisDocument6 pagesChapter 3 Financial Statement AnalysisCatherine VenturaNo ratings yet

- Haupt Company: AnswersDocument3 pagesHaupt Company: AnswersRieshananth ThambiaiyahNo ratings yet

- Solution Maf503 - Jun 2016 AmmendDocument10 pagesSolution Maf503 - Jun 2016 Ammendanis izzatiNo ratings yet

- Afs - Practice Question SolutionsDocument3 pagesAfs - Practice Question SolutionsShakeel IqbalNo ratings yet

- Chapter 6 - Activity 2: Problem 1 (Day Sales Outstanding)Document8 pagesChapter 6 - Activity 2: Problem 1 (Day Sales Outstanding)Ravena ReyesNo ratings yet

- Tugas 12 - C16 - Distributions To ShareholdersDocument9 pagesTugas 12 - C16 - Distributions To ShareholdersIqbal BaihaqiNo ratings yet

- Sri Arthauli RezekiDocument4 pagesSri Arthauli RezekiMoe ChannelNo ratings yet

- Answers and Solutions Chap 3Document8 pagesAnswers and Solutions Chap 3Ricalyn BugarinNo ratings yet

- MAF253 SS Common Test May 2022Document7 pagesMAF253 SS Common Test May 2022Nurfatihah JohariNo ratings yet

- Gitman IM Ch09Document24 pagesGitman IM Ch09Imran FarmanNo ratings yet

- Solutions of End-of-Chapter Four ProblemsDocument4 pagesSolutions of End-of-Chapter Four Problemsctyre34No ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 10 - SolutionsDocument9 pagesACF 103 - Fundamentals of Finance Tutorial 10 - SolutionsRiri FahraniNo ratings yet

- FIN-AW3 AnswersDocument18 pagesFIN-AW3 AnswersRameesh DeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Exercise 9-4 ADocument3 pagesExercise 9-4 AArdilla Noor Paramashanti WirahadikusumaNo ratings yet

- Audit Procedures and Evidences: SA500, SA501, SA530, Dan SA265Document7 pagesAudit Procedures and Evidences: SA500, SA501, SA530, Dan SA265Ardilla Noor Paramashanti WirahadikusumaNo ratings yet

- Chapter 21Document18 pagesChapter 21Ardilla Noor Paramashanti Wirahadikusuma100% (1)

- API IDN DS2 en Excel v2 562039Document440 pagesAPI IDN DS2 en Excel v2 562039Ardilla Noor Paramashanti WirahadikusumaNo ratings yet

- Digital - 2016!4!20404773 MK Nurul Aghnia Zahrah Terkunci DikonversiDocument19 pagesDigital - 2016!4!20404773 MK Nurul Aghnia Zahrah Terkunci DikonversiArdilla Noor Paramashanti WirahadikusumaNo ratings yet