Professional Documents

Culture Documents

Tutorial - Depreciation 19 PDF

Uploaded by

Setsuna Teru0 ratings0% found this document useful (0 votes)

16 views2 pagesOriginal Title

Tutorial - Depreciation 19.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesTutorial - Depreciation 19 PDF

Uploaded by

Setsuna TeruCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

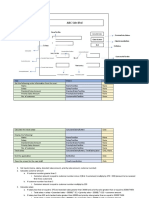

Mathematics for Business GS 1129

Week 4 and 5 Tutorial

Depreciation

1. A new car costs $25,000. Each year the car depreciates by 9% of its

value at the start of the year. What will the car worth at the end of 4

years?

2. Jack owns the Deli café. He buys an espresso machine for $800.00.

Each year the expresso machine depreciates by 4% of its value at the

start of the year. What will it worth at the end of 10 years?

3. Garry has a restaurant in town. He bought a freezer for $ 1,888.00

Each year the freezer depreciates by 5% of its value at the start of the

year. What will the freezer worth at the end of 8 years?

4. Jini has a body shop for automobiles. He bought a spray-painting

machine for $10,500.00, and it has a useful life of 5 years. Its scrap

value is $800. Calculate the depreciated values over the 5 years using

the double-declining balance method.

5. From question 4, if Jini decided to buy two of these spray-painting

machines. Calculate the total depreciated values and the total values

over the 5 years for these two machines using the double-declining

balance method.

6. The new computer equipment at Leisure Travel has a cost of

$ 14, 500. It has an estimated life of 8 years, and a scrap value of

$ 2100. Find (a) the annual depreciation and (b) the book value at the

end of 4 years using the straight-line method of depreciation.

7. If a company owned ten of the similar computer equipment as in

question 6, find (a) the total annual depreciation and (b) the total book

values at the end of 4 years for these ten computers using the straight-

line method of depreciation.

Politeknik Brunei , General Studies Department, Mathematics

8. Jessica bought some white boards for her reading clinic at a cost of

$ 3,620 per unit. The estimated life of a white board is 5 years, with

scarp value of $ 400. If Jessica owned three of these white boards, use

the double-declining-balance method of depreciation to find (a) the

annual rate of depreciation, (b) the total amount of depreciation in the

first year, (c) the total accumulated depreciation at the end of the third

year, and (d) the total book value at the end of the third year for these

three whiteboards.

Answer:

1. $17143.74

2. $531.87

3. $1,252.54

4. Year 1 4,200 6,300

Year 2 2,520 3,780

Year 3 1,512 2,268

Year 4 907.2 1,360.8

Year 5 544.32 816.48

5. Year 1 8,400 12,600

Year 2 5,040 7,560

Year 3 3,024 4,536

Year 4 1,814.4 2,721.6

Year 5 1,088.64 1,632.96

6. (a) $ 1,550 ; (b) $ 8, 300

7. (a) $ 15,550 ; (b) $ 83, 000

8. (a) 0.4 / 40 %

(b) $4,344

(c)

Year Depreciation Book Value

1 6516

2 2606.4 3909.6

3 1563.84 2345.76

Accumulated

depreciation

= $ 8514.24

(d) $ 2345.76

Politeknik Brunei , General Studies Department, Mathematics

You might also like

- Singapore Math Challenge, Grades 5 - 8From EverandSingapore Math Challenge, Grades 5 - 8Rating: 2 out of 5 stars2/5 (2)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Capital Expenditure Decisions: NPV and IRR AnalysisDocument48 pagesCapital Expenditure Decisions: NPV and IRR AnalysisAliNo ratings yet

- Marilog High School of Agriculture General Mathematics Final ExamDocument2 pagesMarilog High School of Agriculture General Mathematics Final ExamJeffren P. Miguel100% (3)

- A. Straight Line MethodDocument4 pagesA. Straight Line MethodEliza Gail ConsuegraNo ratings yet

- Chapter 16 Capital Expenditure DecisionsDocument44 pagesChapter 16 Capital Expenditure DecisionsCamille Donaire Lim100% (2)

- Math Worksheet on Simple Interest and Word ProblemsDocument2 pagesMath Worksheet on Simple Interest and Word ProblemsRenart LdsNo ratings yet

- Huaho PresentationDocument39 pagesHuaho PresentationSetsuna Teru0% (2)

- Huaho PresentationDocument39 pagesHuaho PresentationSetsuna Teru0% (2)

- Huaho PresentationDocument39 pagesHuaho PresentationSetsuna Teru0% (2)

- Investing and Compounding Interest Rates ExplainedDocument4 pagesInvesting and Compounding Interest Rates ExplainedJufel RamirezNo ratings yet

- 0580 Practice Test 4 2024 (Paper 4)Document22 pages0580 Practice Test 4 2024 (Paper 4)AFRAH ANEESNo ratings yet

- Chapter 15 TB Hilton PDFDocument52 pagesChapter 15 TB Hilton PDFBOB MARLOWNo ratings yet

- Grinding Equipment: Product CatalogueDocument32 pagesGrinding Equipment: Product CatalogueSebastian Nuñez RiquelmeNo ratings yet

- Gulf Shores Surgery Centers, An Investor-Owned Chain of Ambulatory Surgery Centers With Six Locations in Florida's PanhandleDocument3 pagesGulf Shores Surgery Centers, An Investor-Owned Chain of Ambulatory Surgery Centers With Six Locations in Florida's PanhandleAaliaNo ratings yet

- Mathematics for Business GS 1129 - Simple & Compound InterestDocument2 pagesMathematics for Business GS 1129 - Simple & Compound InterestSetsuna TeruNo ratings yet

- PASSIONIST SISTERS’ SCHOOL MATH EXAMDocument3 pagesPASSIONIST SISTERS’ SCHOOL MATH EXAMMiraflorNo ratings yet

- FIN3120 Exam Paper May 2022Document4 pagesFIN3120 Exam Paper May 2022Risvana RizzNo ratings yet

- Modern Macrame Revenue & Expenses Year OneDocument93 pagesModern Macrame Revenue & Expenses Year OneSnehaNo ratings yet

- Exhibit 1 Total Number of Individuals Per Barangay Urban Areas Number of Individuals % Number of RespondentsDocument8 pagesExhibit 1 Total Number of Individuals Per Barangay Urban Areas Number of Individuals % Number of RespondentsJo MalaluanNo ratings yet

- Starbucks Share Valuation and Sensitivity AnalysisDocument4 pagesStarbucks Share Valuation and Sensitivity Analysismiranda100% (1)

- Disha Publication - Leading Exam Book PublisherDocument5 pagesDisha Publication - Leading Exam Book PublisherAnuj TripathiNo ratings yet

- Type 1 Average Type 1 To 3Document32 pagesType 1 Average Type 1 To 3yuvrajbarariaNo ratings yet

- Making Bookkeeping For Truck DriversDocument3 pagesMaking Bookkeeping For Truck DriverskavithaNo ratings yet

- APCO-IASC 1P01 - Winter 2019Document8 pagesAPCO-IASC 1P01 - Winter 2019KashémNo ratings yet

- Extended Response/Problem Business-Related Mathematics Session OneDocument2 pagesExtended Response/Problem Business-Related Mathematics Session Onesbmiller87No ratings yet

- DAY 03 Simple Interest (21 Days 21 Marathon)Document7 pagesDAY 03 Simple Interest (21 Days 21 Marathon)bomihij827No ratings yet

- Part-1- Maths- Last Day Super-300 Questions (3)Document20 pagesPart-1- Maths- Last Day Super-300 Questions (3)sourabhgoyal3075No ratings yet

- 1 B121F Assignment 2 Sep08Document7 pages1 B121F Assignment 2 Sep08Vincent ChuNo ratings yet

- Simple and Compound InterestDocument4 pagesSimple and Compound InterestJosé Pedro MesquitaNo ratings yet

- Week 6 Go LiveDocument3 pagesWeek 6 Go Livewriter topNo ratings yet

- Bus Lines Scenario Comparison Profit AnalysisDocument10 pagesBus Lines Scenario Comparison Profit AnalysisMATHITU PETERNo ratings yet

- MBA Program Fees for International Students at Stamford International UniversityDocument2 pagesMBA Program Fees for International Students at Stamford International UniversityhenryNo ratings yet

- Jharkhand State Forest Development Corporaton LTDDocument9 pagesJharkhand State Forest Development Corporaton LTDmdNo ratings yet

- OIS CBSE GR-8 Answer Key Compound Interest PDFDocument6 pagesOIS CBSE GR-8 Answer Key Compound Interest PDFlavaramNo ratings yet

- Exponential Functions ProjectDocument5 pagesExponential Functions ProjectDomNo ratings yet

- Simple and Compound Interest ProblemsDocument2 pagesSimple and Compound Interest ProblemsAyushNo ratings yet

- Present Value - Extra Topic Chapt 9 12 AdvDocument5 pagesPresent Value - Extra Topic Chapt 9 12 AdvlokNo ratings yet

- Activity 5 Depreciation AKDocument4 pagesActivity 5 Depreciation AKPrincess Joy CenizaNo ratings yet

- Financial Management QsDocument4 pagesFinancial Management QsJM EyNo ratings yet

- Soal Risk and Return AnuitasDocument9 pagesSoal Risk and Return AnuitasRiottarooz PermanaNo ratings yet

- General Beauregard's Battle PlanningDocument4 pagesGeneral Beauregard's Battle PlanningraymondNo ratings yet

- Mathematics SecondaryDocument3 pagesMathematics SecondaryPUTRINo ratings yet

- Amortization & Arithmetic GradientDocument13 pagesAmortization & Arithmetic GradientCathleen Ann TorrijosNo ratings yet

- Xii 2021 22 t2 Assign App MathsDocument3 pagesXii 2021 22 t2 Assign App MathsShalini JhaNo ratings yet

- Worksheet On Partnerships: RD TH THDocument2 pagesWorksheet On Partnerships: RD TH THMAHESH VNo ratings yet

- Data (2)Document3 pagesData (2)DinoNo ratings yet

- IMT CeresDocument6 pagesIMT Ceresprincy lawrenceNo ratings yet

- Homework 1 MHRDocument3 pagesHomework 1 MHRRafael RangelNo ratings yet

- 03 Fixing ErrorsDocument6 pages03 Fixing ErrorsPranay JainNo ratings yet

- School allowance snapshot provides math and logic practiceDocument4 pagesSchool allowance snapshot provides math and logic practicearvic estemberNo ratings yet

- Past Exam Questions Workbook (21F)Document20 pagesPast Exam Questions Workbook (21F)bonyantunNo ratings yet

- Engineering Economics Exam MidDocument7 pagesEngineering Economics Exam MidMark M.No ratings yet

- C2A October 2010 Questions and Solutions PDFDocument35 pagesC2A October 2010 Questions and Solutions PDFJeff GundyNo ratings yet

- CEA Data CollectionDocument8 pagesCEA Data CollectionJohn Cesar PaunatNo ratings yet

- Gen Math AssessmentDocument4 pagesGen Math AssessmentChristine CalixtroNo ratings yet

- Loan Amortization Template JKDocument8 pagesLoan Amortization Template JK1976kamarajNo ratings yet

- Children Education Savings - Investment InsightsDocument2 pagesChildren Education Savings - Investment InsightsSaravanan JNo ratings yet

- Compound Interest E 02Document4 pagesCompound Interest E 02detectivedevil001No ratings yet

- F3 Tables and FormulasDocument12 pagesF3 Tables and FormulastutorbritzNo ratings yet

- Compound 2Document7 pagesCompound 2Marc MatthewsNo ratings yet

- Present Value of Annuity CalculatorDocument3 pagesPresent Value of Annuity CalculatorMotivational QuotesNo ratings yet

- 25 - 07 - 2022 Practice SetDocument4 pages25 - 07 - 2022 Practice SetSakshi TapaseNo ratings yet

- Tutotial 2 - Time Value of Money FVPVDocument5 pagesTutotial 2 - Time Value of Money FVPVAmy LimnaNo ratings yet

- Report Writing Language of A ReportDocument12 pagesReport Writing Language of A ReportSetsuna TeruNo ratings yet

- Australia iron ore and wheat production correlation chartDocument1 pageAustralia iron ore and wheat production correlation chartSetsuna TeruNo ratings yet

- Movie ticket price vs demand and supply graphDocument1 pageMovie ticket price vs demand and supply graphSetsuna TeruNo ratings yet

- Hua Ho Report CSB PDFDocument20 pagesHua Ho Report CSB PDFSetsuna TeruNo ratings yet

- Report Writing Language of A ReportDocument12 pagesReport Writing Language of A ReportSetsuna TeruNo ratings yet

- Report Writing Language of A ReportDocument12 pagesReport Writing Language of A ReportSetsuna TeruNo ratings yet

- Hua Ho Report CSB PDFDocument20 pagesHua Ho Report CSB PDFSetsuna TeruNo ratings yet

- Tutorial Skate-Away UidDocument3 pagesTutorial Skate-Away UidSetsuna TeruNo ratings yet

- Week 2 - Tutorial 1 - Part IV - Currency Exchange PDFDocument3 pagesWeek 2 - Tutorial 1 - Part IV - Currency Exchange PDFSetsuna TeruNo ratings yet

- Tutorial Electricity UidDocument4 pagesTutorial Electricity UidSetsuna TeruNo ratings yet

- Report Writing Language of A ReportDocument12 pagesReport Writing Language of A ReportSetsuna TeruNo ratings yet

- Tutorial Abc SDN BHD UidDocument4 pagesTutorial Abc SDN BHD UidSetsuna TeruNo ratings yet

- Tutorial Skate-Away UidDocument3 pagesTutorial Skate-Away UidSetsuna TeruNo ratings yet

- Tutorial Abc SDN BHD UidDocument4 pagesTutorial Abc SDN BHD UidSetsuna TeruNo ratings yet

- Chain of Infection PDFDocument3 pagesChain of Infection PDFSetsuna TeruNo ratings yet

- Chain of Infection PDFDocument3 pagesChain of Infection PDFSetsuna TeruNo ratings yet

- Chain of Infection PDFDocument3 pagesChain of Infection PDFSetsuna TeruNo ratings yet

- Week 2 - Tutorial 1 - Part IV - Currency Exchange PDFDocument3 pagesWeek 2 - Tutorial 1 - Part IV - Currency Exchange PDFSetsuna TeruNo ratings yet

- Week 2 - Tutorial 1 - Part I - Earning An Income and Payroll Cost PDFDocument1 pageWeek 2 - Tutorial 1 - Part I - Earning An Income and Payroll Cost PDFSetsuna TeruNo ratings yet

- Plague-Pestilence-Pandemic Certificate of Achievement Gzxqgry PDFDocument2 pagesPlague-Pestilence-Pandemic Certificate of Achievement Gzxqgry PDFSetsuna TeruNo ratings yet

- Tutorial Electricity UidDocument4 pagesTutorial Electricity UidSetsuna TeruNo ratings yet

- Week 2 - Tutorial 1 - Part I - Earning An Income and Payroll Cost PDFDocument1 pageWeek 2 - Tutorial 1 - Part I - Earning An Income and Payroll Cost PDFSetsuna TeruNo ratings yet

- Week 2 - Tutorial 1 - Part I - Earning An Income and Payroll Cost PDFDocument1 pageWeek 2 - Tutorial 1 - Part I - Earning An Income and Payroll Cost PDFSetsuna TeruNo ratings yet

- Week 2 - Tutorial 1 - Part I - Earning An Income and Payroll Cost PDFDocument1 pageWeek 2 - Tutorial 1 - Part I - Earning An Income and Payroll Cost PDFSetsuna TeruNo ratings yet

- Mathematics for Business - Mark-up, Discounts, Profit and Loss Word ProblemsDocument2 pagesMathematics for Business - Mark-up, Discounts, Profit and Loss Word ProblemsSetsuna TeruNo ratings yet

- Mathematics for Business - Mark-up, Discounts, Profit and Loss Word ProblemsDocument2 pagesMathematics for Business - Mark-up, Discounts, Profit and Loss Word ProblemsSetsuna TeruNo ratings yet

- 5s ChineseDocument72 pages5s ChineseTonyNo ratings yet

- Iifl PMSDocument12 pagesIifl PMSkaviraj sasteNo ratings yet

- Political Economy and Migration Policy: Gary P. Freeman and Alan E. KesslerDocument25 pagesPolitical Economy and Migration Policy: Gary P. Freeman and Alan E. KesslerJuan ArroyoNo ratings yet

- Dimensional 2035 Target Date Fund HoldingsDocument394 pagesDimensional 2035 Target Date Fund HoldingsEdgar salvador Arreola valenciaNo ratings yet

- Pe Final Mocktest - Fow9Document12 pagesPe Final Mocktest - Fow9wwwpa2005No ratings yet

- Nasm3036 (MS35489)Document7 pagesNasm3036 (MS35489)Bogdan RusuNo ratings yet

- Chapter 4: Option Pricing Models: The Binomial ModelDocument10 pagesChapter 4: Option Pricing Models: The Binomial ModelTami DoanNo ratings yet

- Government Intervention in Economies: Benefits and CriticismsDocument2 pagesGovernment Intervention in Economies: Benefits and CriticismsDominique KristelleNo ratings yet

- Bank Deposit Slip SL: 11768 Bank Deposit Slip SL: 11768 Bank Deposit Slip SL: 11768Document2 pagesBank Deposit Slip SL: 11768 Bank Deposit Slip SL: 11768 Bank Deposit Slip SL: 11768Gazi Md. Ifthakhar HossainNo ratings yet

- Cambridge International AS & A Level: EconomicsDocument15 pagesCambridge International AS & A Level: EconomicsDivya SinghNo ratings yet

- Accounting & Marketing Students ListDocument9 pagesAccounting & Marketing Students ListJustine Brylle DomantayNo ratings yet

- Using The Balanced Scorecard As A Strategic Management SystemDocument19 pagesUsing The Balanced Scorecard As A Strategic Management Systemkaran jainNo ratings yet

- 452 Idbi Statement PDFDocument2 pages452 Idbi Statement PDFKicha KichaNo ratings yet

- Life at Adventz Oct 2017 by TS DarbariDocument32 pagesLife at Adventz Oct 2017 by TS DarbariT S DarbariNo ratings yet

- Statistics at A Glance Contract: NLT / Efrp Open InterestDocument32 pagesStatistics at A Glance Contract: NLT / Efrp Open InterestWilson KuyahNo ratings yet

- Hire Purchase System: Presidency CollegeDocument9 pagesHire Purchase System: Presidency CollegeNoor ameenaNo ratings yet

- Assignment 2Document3 pagesAssignment 2Maria ConnollyNo ratings yet

- Case 6 - M. Gerry Naufal. R. G. YP A 69Document3 pagesCase 6 - M. Gerry Naufal. R. G. YP A 69m.gerryNo ratings yet

- Chapter 2 MacroDocument50 pagesChapter 2 Macroabyu adaneNo ratings yet

- Great Multicash (21 Years Savings Account) : Especially For MR Prospect at Age 38 AnbDocument10 pagesGreat Multicash (21 Years Savings Account) : Especially For MR Prospect at Age 38 AnbAlvin AngNo ratings yet

- 2 April 2018Document60 pages2 April 2018siva kNo ratings yet

- Chapter 10 QuestionsDocument6 pagesChapter 10 QuestionsAgatha AgatonNo ratings yet

- Kolkata GemsDocument6 pagesKolkata GemsAnkit JainNo ratings yet

- Principles of Corporate Finance 11th Edition Brealey Solutions ManualDocument26 pagesPrinciples of Corporate Finance 11th Edition Brealey Solutions ManualJamesJacksonnqpf100% (40)

- Pipe ReinforcementDocument12 pagesPipe ReinforcementZohaibNo ratings yet

- PRETESTsjdjsjjDocument5 pagesPRETESTsjdjsjjduonggiatuan007No ratings yet

- The Companies Act, 2013 - Ready Reckoner: TH THDocument45 pagesThe Companies Act, 2013 - Ready Reckoner: TH THPratyaksha RoyNo ratings yet

- Swastik Invoice 2Document1 pageSwastik Invoice 2Amit PrajapatiNo ratings yet

- Catalogue EuDocument65 pagesCatalogue EuHrayr DaghlianNo ratings yet