Professional Documents

Culture Documents

Tax Mapping Operation Division

Tax Mapping Operation Division

Uploaded by

Mars Rañola-CamilonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Mapping Operation Division

Tax Mapping Operation Division

Uploaded by

Mars Rañola-CamilonCopyright:

Available Formats

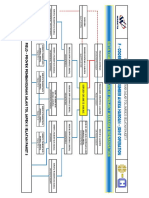

TAX MAPPING OPERATION DIVISION

Establishes and maintains a system for real property

identification, accounting and verification by the use of maps

and Geographic Information System (GIS) showing graphically

all properties subject to assessment and by gathering all data

concerning the same.

AVERAGE

TASK PERSONNEL INVOLVED TRANSACTION/WEEK

MAJOR FUNCTION

Manual Plotting

(Consolidation/Segregation) Draftsman III, Draftsman II 50 PARCELS

-New segregation

Digitization(Consolidation/Segregation) Tax Mapper III, Draftsman

-New segregation II, Administrative Assistant 200 PARCELS

-Updating of GIS I, Detailed

Verification and Issuance of Certification All

200 RPU'S

(No Improvement) Division Staff

Issuance of Tax Map All Division Staff 40 Tax Maps

Verification (Property Identification Number, Location) All Division Staff 750 RPU'S

MINOR FUNCTION

Supports other Departments (OFFICE OF THE

CITY MAYOR , SP, Treasury, BPLO, CBO, ENGR, USDO, CPDO,

Barangays, Academic Institutions) ;

-ISSUANCE OF TAX MAPPING AS REFERENCE/ATTACHMENTS All Division Staff AS NEEDS ARISES

-VERIFICATION OF LOT OWNERS/LOCATION

-VERIFICATION OF BOUNDARY.

-PIN VERIFICATION

-PROJECTION OF OVERLAPPING PROPERTY.

Ocular inspection. (Land and Building Assessment/Re-

Classification) Tax Mapper III, Tax Mapper II 6 RPU’S

-Joint operation with other offices (BPLO, CPDO, CEO)

You might also like

- You Are My Shepherd David Haas PDFDocument2 pagesYou Are My Shepherd David Haas PDFMars Rañola-CamilonNo ratings yet

- Letter of Intent To Purchase Real Estate PDFDocument1 pageLetter of Intent To Purchase Real Estate PDFMars Rañola-Camilon100% (1)

- Sale Lopez To Anuran - Dors PDFDocument3 pagesSale Lopez To Anuran - Dors PDFMars Rañola-CamilonNo ratings yet

- Office of The City Assessor/1101 Mandate, Vision/Mission, Major Final Output, Performance Indicators and Targets Cy 2020Document2 pagesOffice of The City Assessor/1101 Mandate, Vision/Mission, Major Final Output, Performance Indicators and Targets Cy 2020Charles D. FloresNo ratings yet

- Administrative and Finance Department Accounting DivisionDocument10 pagesAdministrative and Finance Department Accounting Divisionjulie anne mae mendozaNo ratings yet

- Untitled SpreadsheetDocument2 pagesUntitled SpreadsheetElaine MaikahNo ratings yet

- A.ppe Consolidation 2013Document64 pagesA.ppe Consolidation 2013norvel19No ratings yet

- a.PPE - Consolidation - 2016 - San Jacinto DistrictDocument26 pagesa.PPE - Consolidation - 2016 - San Jacinto Districtnorvel_19No ratings yet

- PresentationDocument27 pagesPresentationkhaled ellessyNo ratings yet

- Pay CommDocument8 pagesPay Commanon-887561100% (2)

- Sphere I Ii Car IiiDocument17 pagesSphere I Ii Car IiiJeremiah TrinidadNo ratings yet

- PASSO OS RevisedDocument14 pagesPASSO OS RevisedJosephus DaguploNo ratings yet

- Draft AOM - Inventory ReportDocument8 pagesDraft AOM - Inventory ReportGuiller MagsumbolNo ratings yet

- Marven GOVERNMENT Tax Laws Notes 2023Document20 pagesMarven GOVERNMENT Tax Laws Notes 2023marveen juadiongNo ratings yet

- DPC July To December 2021Document16 pagesDPC July To December 2021Zyreen Kate BCNo ratings yet

- Assessment Report On Tax Mapping Capabilities of Lgus: A. IntroductionDocument19 pagesAssessment Report On Tax Mapping Capabilities of Lgus: A. Introductionjunayrah galmanNo ratings yet

- Aropbn 41 BDocument12 pagesAropbn 41 BPruthvi Pruthvi Raj B KNo ratings yet

- Individual Performance Commitment and Review (IPCR) : Steawart B. Baccay, CpaDocument6 pagesIndividual Performance Commitment and Review (IPCR) : Steawart B. Baccay, CpaPj TignimanNo ratings yet

- SB Order 18 2023 13092023Document12 pagesSB Order 18 2023 13092023dapjalNo ratings yet

- Dashboard: System Administrator (Sysadmin) - Konversi - Data Tahun: 2014Document4 pagesDashboard: System Administrator (Sysadmin) - Konversi - Data Tahun: 2014NurhidayatNo ratings yet

- Sugar Regulatory Administration Executive Summary 2021Document5 pagesSugar Regulatory Administration Executive Summary 2021Jinyoung ParkNo ratings yet

- RMC No. 5 2021 - W - AttachmentsDocument21 pagesRMC No. 5 2021 - W - Attachmentsjamdan15092704No ratings yet

- Office of The Mayor: Republic of The Philippines Province of Occidental Mindoro Municipality of SablayanDocument4 pagesOffice of The Mayor: Republic of The Philippines Province of Occidental Mindoro Municipality of Sablayanbhem silverioNo ratings yet

- CBEC-GST Software: Commissioner and Other Supervisory OfficersDocument28 pagesCBEC-GST Software: Commissioner and Other Supervisory OfficersAnish BapnaNo ratings yet

- Pa 9 24 2021Document14 pagesPa 9 24 2021Johanes TayamNo ratings yet

- Executive Summary: Page - 1Document22 pagesExecutive Summary: Page - 1Yoosuf Mohamed IrsathNo ratings yet

- 14-A Bir Rmo No. 5-2009 (Annex A)Document1 page14-A Bir Rmo No. 5-2009 (Annex A)Clarissa SawaliNo ratings yet

- ''UttarPradesh - BUDAUN - PG18-19'' (3) OrighnalDocument10 pages''UttarPradesh - BUDAUN - PG18-19'' (3) OrighnalAjit singhNo ratings yet

- RMC No. 5-2021Document3 pagesRMC No. 5-2021Jose Mari AguilaNo ratings yet

- Business Plan 2022Document1 pageBusiness Plan 2022cmos.peopleNo ratings yet

- JDM - SDO - SDS - Finance - 30april14Document19 pagesJDM - SDO - SDS - Finance - 30april14Khae ZzleNo ratings yet

- Office of The City Engineer - Administrative Services /8751 Mandate, Vision/Mission, Major Final Output, Performance Indicators Targets Cy 2021Document2 pagesOffice of The City Engineer - Administrative Services /8751 Mandate, Vision/Mission, Major Final Output, Performance Indicators Targets Cy 2021Charles D. FloresNo ratings yet

- Updated 2017 2022 PIP As Input To FY 2020 Budget Preparation Chapter 15 As of 12april19 PDFDocument1 pageUpdated 2017 2022 PIP As Input To FY 2020 Budget Preparation Chapter 15 As of 12april19 PDFdetailsNo ratings yet

- 1.residential (Land) Residential (Building) 2. Agricultural (Land) Agricultural (Building) 3. Commercial (Land) Commercial (Building)Document4 pages1.residential (Land) Residential (Building) 2. Agricultural (Land) Agricultural (Building) 3. Commercial (Land) Commercial (Building)Mary Jane Katipunan CalumbaNo ratings yet

- 1.residential (Land) Residential (Building) 2. Agricultural (Land) Agricultural (Building) 3. Commercial (Land) Commercial (Building)Document4 pages1.residential (Land) Residential (Building) 2. Agricultural (Land) Agricultural (Building) 3. Commercial (Land) Commercial (Building)Mary Jane Katipunan CalumbaNo ratings yet

- 1.residential (Land) Residential (Building) 2. Agricultural (Land) Agricultural (Building) 3. Commercial (Land) Commercial (Building)Document4 pages1.residential (Land) Residential (Building) 2. Agricultural (Land) Agricultural (Building) 3. Commercial (Land) Commercial (Building)Mary Jane Katipunan CalumbaNo ratings yet

- Publication Pub 11 06 2017Document68 pagesPublication Pub 11 06 2017Lenin Rey PolonNo ratings yet

- Book 1Document2 pagesBook 1Mary Jane Katipunan CalumbaNo ratings yet

- Rpcppe 2023 - PpeDocument21 pagesRpcppe 2023 - PpeJeur CasioNo ratings yet

- 1.residential (Land) Residential (Building) 2. Agricultural (Land) Agricultural (Building) 3. Commercial (Land) Commercial (Building)Document2 pages1.residential (Land) Residential (Building) 2. Agricultural (Land) Agricultural (Building) 3. Commercial (Land) Commercial (Building)Mary Jane Katipunan CalumbaNo ratings yet

- RPT2018Document2 pagesRPT2018Mary Jane Katipunan CalumbaNo ratings yet

- Digital Tax Parcel MappingDocument3 pagesDigital Tax Parcel MappingNurah LaNo ratings yet

- Revenue Memorandum Circular No. - I A: Quezon CityDocument3 pagesRevenue Memorandum Circular No. - I A: Quezon Cityguess whoNo ratings yet

- Saaodb 2014 2nd QTRDocument2 pagesSaaodb 2014 2nd QTRtesdaro12No ratings yet

- 6 2023 Mark Ruby D. Opawon Final 1Document39 pages6 2023 Mark Ruby D. Opawon Final 1Mark Ruby OpawonNo ratings yet

- Alur Komunikasi Data Proyek1Document1 pageAlur Komunikasi Data Proyek1Radit and bambangNo ratings yet

- Barangay Buenasuerte Notes To Financial StatementsDocument5 pagesBarangay Buenasuerte Notes To Financial StatementsRose Macoy CastilloNo ratings yet

- RMC No. 44-2021 RevisedDocument2 pagesRMC No. 44-2021 RevisedDessere Ann AnchetaNo ratings yet

- March: Republic Philippines Department of Finance OI-RevenueDocument2 pagesMarch: Republic Philippines Department of Finance OI-Revenueantonio espirituNo ratings yet

- Consolidation of BADocument12 pagesConsolidation of BAVikrant PathakNo ratings yet

- AOM 2023 001 San FranciscoDocument15 pagesAOM 2023 001 San FranciscoKen BocsNo ratings yet

- AOM 2023-001 - MaljoDocument17 pagesAOM 2023-001 - MaljoKen BocsNo ratings yet

- Ipcr 2020Document390 pagesIpcr 2020Kirsten Rose ConconNo ratings yet

- Office of The City Engineer - Construction Services /8752 Mandate, Vision/Mission, Major Final Output, Performance Indicators and Targets Cy 2021Document2 pagesOffice of The City Engineer - Construction Services /8752 Mandate, Vision/Mission, Major Final Output, Performance Indicators and Targets Cy 2021Charles D. FloresNo ratings yet

- LBP Form No. 5 Acctg 2017Document9 pagesLBP Form No. 5 Acctg 2017Toriaga Jr RogieNo ratings yet

- GST Ready Reckoner 2020 - 10062020Document240 pagesGST Ready Reckoner 2020 - 10062020P S AmritNo ratings yet

- IBPS CRP RRBs VIII-NoticeDocument1 pageIBPS CRP RRBs VIII-NoticeHarish SharmaNo ratings yet

- Tax Advisory - Alphalist Data Entry and Validation Module Version 7.2Document1 pageTax Advisory - Alphalist Data Entry and Validation Module Version 7.2pelgonehNo ratings yet

- PA Budget 2020Document93 pagesPA Budget 2020Zyreen Kate BCNo ratings yet

- Internal Factors That Affects The OrganizationDocument2 pagesInternal Factors That Affects The OrganizationMars Rañola-CamilonNo ratings yet