Professional Documents

Culture Documents

Unshakeable 1

Unshakeable 1

Uploaded by

AdrianOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unshakeable 1

Unshakeable 1

Uploaded by

AdrianCopyright:

Available Formats

FOREWORD

John C Bogle, founder of Vanguard, which has more than $3 trillion in assets under management

As 2016 began, I started my Saturday morning reading the New York Times while eating

breakfast. After scanning the front page (and pulling out the crossword puzzle for later), I turned

my attention to the business section. Displayed prominently at the top of section Bl was Ron

Lieber's Your Money column, which featured essential money management strategies written on

index cards by six personal finance experts.

Ron's point was to show that effective money management does not need to be complicated, with

the key points of managing your money fitting on a single index card. Five out of the six index

cards addressed the topic of how to invest your savings, and each gave the same simple advice:

invest in index funds.

That message is getting through to investors. In 1975 I created the world's first index mutual

fund, and I've been singing its praises ever since. In those early days, I was a lone voice without

much of an audience. Today an enormous choir has developed to help me spread the word.

Investors are hearing our voices loud and clear, and are voting with their feet-in other words,

their dollars.

Since the end of 2007, mutual fund investors have added almost $1.65 trillion to their holdings of

equity index funds while reducing their holdings of actively managed mutual funds by $750

billion. That swing of $2.4 trillion in investor preferences over the last nine years is, I believe,

unprecedented in the history of the mutual fund industry.

Over the past seven years, Tony Robbins has been on a mission to help the average investor win

the game, preach the message of index funds, and tell investors to stop overpaying for

underperformance. In his journey, he has spoken to some of the greatest minds in finance.

Although I'm not sure I belong in that category, Tony came to my office at Vanguard to get my

thoughts on investing. Let me tell you, Tony is a force of nature! After spending just a few

minutes with Tony, I completely understand how he's been able to inspire millions of people all

over the world.

We had such a great time speaking with each other that our scheduled 45-minute interview ended

up lasting four hours. It was one of the most wide-ranging and probing interviews I've done in

my 65-year career in the mutual fund industry. Tony's energy and passion are contagious and

energizing; I knew right away his book would have a huge impact on investors.

But even I underestimated just how big an impact Tony would have. His first book on investing,

Money: Master the Game, has sold over one mill ion copies and spent seven months at the top of

the New York Times Business Best Sellers list. Now he returns with Unshakeable, which is sure

to add even more value to readers. Unshakeable presents insights from some of the most

important figures in the investing world, such as Warren Buffett and Yale endowment fund

manager David Swensen. Both Warren and David have said time and again that index funds are

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Ats StrategyDocument9 pagesAts StrategypradeephdNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Task 19Document3 pagesTask 19Medha SinghNo ratings yet

- Wiley Chapter 1. Financial Accounting. IFRS EditionDocument67 pagesWiley Chapter 1. Financial Accounting. IFRS Editionshuguftarashid100% (2)

- Accounting From Incomplete Records For BookDocument21 pagesAccounting From Incomplete Records For BookbinuNo ratings yet

- Simple and Compound InterestDocument122 pagesSimple and Compound InterestSum ChumpNo ratings yet

- MACR-05 - SEBI Takeover CodeDocument29 pagesMACR-05 - SEBI Takeover CodeVivek KuchhalNo ratings yet

- 4.1 Theory Common Size StatementDocument3 pages4.1 Theory Common Size StatementNinad GadreNo ratings yet

- Berkshire Hathaway - Barclays CapitalDocument64 pagesBerkshire Hathaway - Barclays Capitalneo269No ratings yet

- CAF 3 CMA Grand Test 4 With Solution S23 ST AcademyDocument6 pagesCAF 3 CMA Grand Test 4 With Solution S23 ST AcademyAwais AliNo ratings yet

- DFPI Orders Silicon Valley Bank 03102023Document2 pagesDFPI Orders Silicon Valley Bank 03102023Jillian SmithNo ratings yet

- Finman FinalsDocument4 pagesFinman FinalsDianarose RioNo ratings yet

- Hedge Fund ValuationDocument4 pagesHedge Fund ValuationFarnaz ChavoushiNo ratings yet

- Group Assignment Cover Sheet: Student DetailsDocument25 pagesGroup Assignment Cover Sheet: Student DetailsMy Le Thi HoangNo ratings yet

- Excel Petroleum EconomicsDocument3 pagesExcel Petroleum Economicseunice DJIAFEUANo ratings yet

- ICAEW Financial ManagementDocument12 pagesICAEW Financial Managementcima2k15No ratings yet

- MCQ of Financial Statement AnalysisDocument8 pagesMCQ of Financial Statement AnalysisRahul Ghosale100% (11)

- Warren Buffett Stock Picks ValuationDocument11 pagesWarren Buffett Stock Picks ValuationOld School Value75% (4)

- CH 14Document16 pagesCH 14Jenil ParmarNo ratings yet

- AG Pernod Ricard VF AnDocument144 pagesAG Pernod Ricard VF AnArleneminiNo ratings yet

- CLWETAX Finals Module 5 7Document12 pagesCLWETAX Finals Module 5 7johndanielsantosNo ratings yet

- Carter Manufacturing: Do We Really Have Income?Document33 pagesCarter Manufacturing: Do We Really Have Income?zulqarnain016134No ratings yet

- List of Common Accounting Terms and DefinitionsDocument4 pagesList of Common Accounting Terms and DefinitionsJohnny CarlosNo ratings yet

- Chapter 1 Group 8Document3 pagesChapter 1 Group 8emanuela patreciaNo ratings yet

- 10 Must Read Books For Stock Market Investors in India - Trade BrainsDocument35 pages10 Must Read Books For Stock Market Investors in India - Trade BrainsCHANDRAKISHORE SINGHNo ratings yet

- ch15 PDFDocument9 pagesch15 PDFRetno Tri SeptiyaniNo ratings yet

- Abba Abdi Bangsa Annual Report PDF FreeDocument1 pageAbba Abdi Bangsa Annual Report PDF FreeKarnottaNo ratings yet

- Apr 24Document8 pagesApr 24Mobilkamu JakartaNo ratings yet

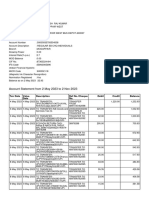

- Account Statement From 2 May 2023 To 2 Nov 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument14 pagesAccount Statement From 2 May 2023 To 2 Nov 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanthoshRajNo ratings yet

- 21 Commissioner Vs ManningDocument1 page21 Commissioner Vs ManningRaymart SalamidaNo ratings yet

- Journal EntriesDocument7 pagesJournal Entriesb20cs099No ratings yet