Professional Documents

Culture Documents

Abba Abdi Bangsa Annual Report PDF Free

Uploaded by

KarnottaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abba Abdi Bangsa Annual Report PDF Free

Uploaded by

KarnottaCopyright:

Available Formats

PT Abdi Bangsa Tbk. Others PT Abdi Bangsa Tbk.

Others

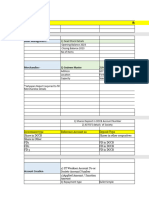

Head Office Jakarta Stock Exchange Building, Summary of Financial Statement Board of Commissioners Board of Directors

Tower II 26th Floor President Commissioner Adi Sasono President Director Erick Thohir

Jl. Lenjd. Sudirman Kav. 52-53 (million rupiah) Commissioners Drs. H. Sugiharto, Drs. Abdul Ghani Director Yahya Basalamah

Jakarta 12190 2002 2003 2004 Ir. Zaim Uchrowi

Phone (021) 515-0682 Number of Employees 421

Total Assets 63,531 57,098 126,853

Fax (021) 515-3041 Current Assets 29,087 19,413 59,315

http://www.republika.co.id of which

Business Daily Newspaper Cash on hand and in banks 3,883 1,341 11,749

Company Status PMDN Trade receivables 12,626 13,191 13,731

Inventories 226 404 554

Non-Current Assets 34,443 37,685 67,538

PT. Abdi Bangsa Tbk.

of which

In 2004, the Company was recorded net loss at Fixed Assets-Net 22,904 8,901 37,211

Rp 16.365 billion, up from last year net loss at Rp 7.374 billion. Deffered Tax Assets 9,204 12,185 9,599

Established on November 28th 1992 by Abdi Bangsa Foun- Other Assets 2,335 16,099 37,211 No Type of Listing Listing Date Trading Date Number of Shares Total Listed

dation as PT. Abdi Massa then changed to PT. Abdi Bangsa. Got the pub- per Listing Shares

Liabilities 10,167 10,981 35,905

lication permit to issued Republika Daily Newspaper. Headquartered in Jl. Current Liabilities 9,097 9,293 31,866

Warung Buncit 37, South Jakarta, Republika is the 4th biggest newspaper of which

1 Company Listing 03-Apr-02 03-Apr-02 400,000,000 400,000,000

issued in Jakarta and 7th nationally based on SRI - AC Nielsen research Trade payable 2,360 3,099 5,919 2 Right Issue 31-Jul-02 03-Sep-02 240,000,000 640,000,000

(Media Index 2000/2001) Accrued expenses 1,026 925 2,792

Taxes payable 2,415 4,113 3,682

Non-Current Liabilities 1,070 1,688 4,039

Minority Interests in Subsidiaries n.a 127 2,549 Underwriter

Shareholders' Equity 53,364 45,990 88,399 PT Rifan Financindo Sekuritas

Paid-up capital 64,000 64,000 115,200

Paid-up capital Stock Price, Frequency, Trading Days, Number and Value of Shares Traded and Market Capitalization

in excess of par value (2,493) (2,493) 4,936

Stock Price Trading Shares Traded Listed Market

Retained earnings (8,144) (15,517) (31,737)

Month High Low Close Frequency Day Volume Value Shares Capitalization

Net Sales 43,321 49,429 67,067 (Rp) (Rp) (Rp) (Thousand Shares) (Rp Million) (Rp Million)

Cost of Good Sold 27,780 32,996 37,319 January-04 0 0 275 0 0 0.00 0.00 640,000,000 176,000.00

Gross Profit 15,541 16,433 29,749 February-04 0 0 275 0 0 0.00 0.00 640,000,000 176,000.00

Operating Expenses 21,071 21,146 29,691 March-04 0 0 275 0 0 0.00 0.00 640,000,000 176,000.00

Operating Profit (Loss) (5,530) (4,713) 57 April-04 0 0 275 0 0 0.00 0.00 640,000,000 176,000.00

Other Income (Expenses) (929) (5,550) 2,520 May-04 0 0 275 0 0 0.00 0.00 640,000,000 176,000.00

Profit (Loss) before Taxes (6,459) (10,263) 2,577 June-04 0 0 275 0 0 0.00 0.00 640,000,000 176,000.00

Profit (Loss) after Taxes (4,398) (7,374) (16,365) July-04 0 0 275 0 0 0.00 0.00 640,000,000 176,000.00

August-04 0 0 275 0 0 0.00 0.00 640,000,000 176,000.00

Per Share Data (Rap) September-04 0 0 275 0 0 0.00 0.00 640,000,000 176,000.00

Earnings (Loss) per Share (7) (12) (14) October-04 300 300 225 1 1 4.00 1.00 640,000,000 259,200.00

Equity per Share 83 72 77 November-04 0 0 225 0 0 0.00 0.00 640,000,000 259,200.00

Dividend per Share n.a n.a n.a December-04 0 0 225 0 0 0.00 0.00 640,000,000 259,200.00

Closing Price 275 275 225 January-05 275 230 275 157 8 1,305.00 339.00 640,000,000 316,800.00

February-05 280 275 275 35 4 208.00 58.00 640,000,000 316,800.00

Financial Ratios March-05 0 0 275 0 0 0.00 0.00 640,000,000 316,800.00

PER (x) (40.02) (23.87) (15.84) April-05 0 0 275 0 0 0.00 0.00 640,000,000 316,800.00

PBV (x) 3.30 3.83 2.93 May-05 0 0 275 0 0 0.00 0.00 640,000,000 316,800.00

Dividend Payout (%) n.a n.a n.a June-05 0 0 275 0 0 0.00 0.00 640,000,000 316,800.00

Dividend Yield (%) n.a n.a n.a

Stock Price and Traded Chart

Current Ratio (x) 0.31 0.48 0.54

Debt to Equity (x) 0.19 0.24 0.41

Leverage Ratio (x) 0.16 0.19 0.28 Stock Price (Rp) Thousand Shares

Shareholders Operating Profit Margin (x) n.a n.a n.a 350 0

Net Profit Margin (x) n.a n.a n.a

PT Indopac Usaha Prima 41.65% Inventory Turnover (x) 93.40 52.37 53.62 300

0

Yayasan Abdi Bangsa 9.67% Total Assets Turnover (x) 0.68 0.87 0.53

Roni Y Hoetomo 9.08% ROI (%) (6.92) (12.91) (12.90) 250

Robbyanto Budiman 8.42% ROE (%) (8.24) (16.03) (18.51) 0

Erick Thohir 7.60% 200

A

PER = -19,36x ; PBV = 3,58x (June 2005) 0

PT Kharisma Kapital Perdana 6.37%

Financial Year: December 31 150

Yanatera Bulog 4.60% Public Accountant: Doli, Bambang & Sudarmadji

0

Kopkar PT Abdi Bangsa Tbk 4.17% 100

PT Reksa Dana Fleksi 1.89%

Lilik Oetomo 1.65% 50

0

PT PNM Venture Capital 1.65%

Yayasan Dana Pensiun PT Telkom 1.25% - -

Jan- Feb- Mar- Apr- May- Jun- Jul- Aug- Sep- Oct- Nov- Dec- Jan- Feb- Mar- Apr- May- Jun-

Public 2.00% 04 04 04 04 04 04 04 04 04 04 04 04 05 05 05 05 05 05

692 Indonesian Capital Market Directory 2005 Institute for Economic and Financial Research 693

You might also like

- Icmd 2010Document2 pagesIcmd 2010meilindaNo ratings yet

- Roti LK TW I 2020Document100 pagesRoti LK TW I 2020rois hekmatyarNo ratings yet

- ICBP Financial Results Summary 1Q20Document8 pagesICBP Financial Results Summary 1Q20ayun fauziah16No ratings yet

- Inru ICMD 2009Document2 pagesInru ICMD 2009abdillahtantowyjauhariNo ratings yet

- Neraca PT Indofood 019,020Document2 pagesNeraca PT Indofood 019,020Nur Abdillah AkmalNo ratings yet

- KEJUDocument90 pagesKEJUDina sofianaNo ratings yet

- Kbri ICMD 2009Document2 pagesKbri ICMD 2009abdillahtantowyjauhariNo ratings yet

- Indofoodcbp Sukses Makmur Bilingual 31 Dec 22Document7 pagesIndofoodcbp Sukses Makmur Bilingual 31 Dec 22Cry Cinta Putri AnjelNo ratings yet

- PT Gozco Plantations TBK.: Summary of Financial StatementDocument2 pagesPT Gozco Plantations TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Nama: Ariyadi Kelas: Manajemen A NIM: B1021181029 Makul: Pengantar BisnisDocument2 pagesNama: Ariyadi Kelas: Manajemen A NIM: B1021181029 Makul: Pengantar BisnisariyadiNo ratings yet

- Indofood Financial Statements 2020Document3 pagesIndofood Financial Statements 2020Siti MukaromahNo ratings yet

- lAPORAN KEUANGAN AKRADocument187 pageslAPORAN KEUANGAN AKRAAnsyah CooyNo ratings yet

- PT Supreme Cable Manufacturing 2021 Consolidated Financial StatementsDocument79 pagesPT Supreme Cable Manufacturing 2021 Consolidated Financial StatementsReza Pratama NugrahaNo ratings yet

- SCCO LKT Per 31 Des 2022Document87 pagesSCCO LKT Per 31 Des 2022Jefri Formen PangaribuanNo ratings yet

- PT Nippon Indosari Corpindo Tbk Interim Financial Report for Q1 2022Document101 pagesPT Nippon Indosari Corpindo Tbk Interim Financial Report for Q1 2022Fendy HendrawanNo ratings yet

- Rmba - Icmd 2011 (B02)Document2 pagesRmba - Icmd 2011 (B02)annisa lahjieNo ratings yet

- Indofood Sukses Makmur TBK - Billingual - 31 - Des - 2017 - Released - Pages-6-10 PDFDocument5 pagesIndofood Sukses Makmur TBK - Billingual - 31 - Des - 2017 - Released - Pages-6-10 PDFdeviNo ratings yet

- IndofoodSuksesMakmurTbk Billingual 30 September 2022Document8 pagesIndofoodSuksesMakmurTbk Billingual 30 September 2022Ananda SherlyNo ratings yet

- PT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementDocument2 pagesPT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementKhaerudin RangersNo ratings yet

- PT Pelat Timah Nusantara TBK.: Summary of Financial StatementDocument2 pagesPT Pelat Timah Nusantara TBK.: Summary of Financial StatementTarigan SalmanNo ratings yet

- AKRA - Annual Report - 2018-378-380Document3 pagesAKRA - Annual Report - 2018-378-380Ba babanaNo ratings yet

- IndofoodDocument5 pagesIndofoodFajar kahfi al thoriqNo ratings yet

- CPIN Financial ReportDocument6 pagesCPIN Financial ReportTasya FebristiNo ratings yet

- Financial Statement HRUM 2022 Resized (1)Document7 pagesFinancial Statement HRUM 2022 Resized (1)Maritza ZahwaNo ratings yet

- Indofood CBP Financial Position 2019Document7 pagesIndofood CBP Financial Position 2019Silvia AyuniNo ratings yet

- CF-Export-05-03-2024 19Document13 pagesCF-Export-05-03-2024 19v4d4f8hkc2No ratings yet

- Akpi LK TW I 2018Document86 pagesAkpi LK TW I 2018Cahyo FirliNo ratings yet

- Kren 0920Document193 pagesKren 0920Andreas Kristian Aldes SimamoraNo ratings yet

- UEU Undergraduate 394 LampiranDocument54 pagesUEU Undergraduate 394 Lampiranali71usmanNo ratings yet

- Indofood Financial StatementsDocument7 pagesIndofood Financial StatementsfiqihNo ratings yet

- LK PT Ifishdeco Konsolidasian 2021Document74 pagesLK PT Ifishdeco Konsolidasian 2021Pramayurgy WilyakaNo ratings yet

- Akra LK TW Iv 2019Document151 pagesAkra LK TW Iv 2019Ratih NoviantiNo ratings yet

- jaduda jatDocument7 pagesjaduda jatAbhay TiwariNo ratings yet

- MAMI 31 12 2021 AuditedDocument75 pagesMAMI 31 12 2021 AuditedYuari AdeNo ratings yet

- Akr Corporindo TBK Bilingual 31 Mar 2020 Releasedv.1Document143 pagesAkr Corporindo TBK Bilingual 31 Mar 2020 Releasedv.1insta instaNo ratings yet

- Laporan Keuangan TELE Q3 2017Document112 pagesLaporan Keuangan TELE Q3 2017Hastrid Rina DewiNo ratings yet

- Quarterly Report Inai 2022 Period 4Document126 pagesQuarterly Report Inai 2022 Period 4vgenetik30No ratings yet

- PT Pancabudi Financial Statements 2017Document138 pagesPT Pancabudi Financial Statements 2017Dedi DanversNo ratings yet

- 117 - 102 - 116 - 234-FINAL REPORT PT Panca Budi Idaman TBK Dan Entitas Anak 31 Desember 2017 PDFDocument138 pages117 - 102 - 116 - 234-FINAL REPORT PT Panca Budi Idaman TBK Dan Entitas Anak 31 Desember 2017 PDFYanNo ratings yet

- Cpin 131231ieDocument114 pagesCpin 131231ieRayhan DzikriNo ratings yet

- Saip ICMD 2009Document2 pagesSaip ICMD 2009abdillahtantowyjauhariNo ratings yet

- Balance Sheet A2z AccountingDocument21 pagesBalance Sheet A2z AccountingWilson PrashanthNo ratings yet

- PT Semen Gresik (Persero) Tbk. Financial Summary and RatiosDocument2 pagesPT Semen Gresik (Persero) Tbk. Financial Summary and RatiosKhaerudin RangersNo ratings yet

- Abba PDFDocument2 pagesAbba PDFAndriPigeonNo ratings yet

- Laporan Keuangan ANJT 2021Document89 pagesLaporan Keuangan ANJT 2021Yaugo Bagus WicaksonoNo ratings yet

- 5bf19a1123_99c569a228Document115 pages5bf19a1123_99c569a228insta instaNo ratings yet

- TFCO LapKeu2020 - NewDocument107 pagesTFCO LapKeu2020 - Newmuniya altezaNo ratings yet

- The Philippine Stock Exchange, Inc.: February 26, 2021Document212 pagesThe Philippine Stock Exchange, Inc.: February 26, 2021Algen Lyn MendozaNo ratings yet

- PT BTN Financial Statements 2019Document259 pagesPT BTN Financial Statements 2019davaNo ratings yet

- PT Hanjaya Mandala Sampoerna Financial StatementsDocument81 pagesPT Hanjaya Mandala Sampoerna Financial StatementsAbdul GopurNo ratings yet

- ICBPLaporanTahunan2017SummaryDocument5 pagesICBPLaporanTahunan2017SummaryKevin LetsoinNo ratings yet

- Temas TBK Consol Maret 2023Document115 pagesTemas TBK Consol Maret 2023Tpc YtNo ratings yet

- PT Jaya Agra Wattie TBK Dan Entitas Anak/And Its SubsidiariesDocument90 pagesPT Jaya Agra Wattie TBK Dan Entitas Anak/And Its SubsidiariesDina sofianaNo ratings yet

- A SriDocument2 pagesA SriMugiwara LuffyNo ratings yet

- Laporan Keuangan Auditan 2020Document219 pagesLaporan Keuangan Auditan 2020Muhammad Hasan SafariNo ratings yet

- SMRA LapKeu FY 2022Document204 pagesSMRA LapKeu FY 2022seanprilyNo ratings yet

- BLTZDocument3 pagesBLTZBerbagi GameNo ratings yet

- Hollcim 2Document10 pagesHollcim 2Gabriela RonabasaNo ratings yet

- Sari Roti Annual Report 2019Document105 pagesSari Roti Annual Report 2019zanmatto22100% (4)

- Influence of Social Sciences On Buyer BehaviorDocument5 pagesInfluence of Social Sciences On Buyer BehaviorRavindra Reddy ThotaNo ratings yet

- Application For Registration Private Education Institution Part Time 2019Document10 pagesApplication For Registration Private Education Institution Part Time 2019Btwins123No ratings yet

- MTN FinancialsDocument200 pagesMTN FinancialsIshaan SharmaNo ratings yet

- This Study Resource Was: Assignment 1: Due On Sep.4, 2020 The Solution Is For Your Own Reference Only. Do Not CIRCULATEDocument5 pagesThis Study Resource Was: Assignment 1: Due On Sep.4, 2020 The Solution Is For Your Own Reference Only. Do Not CIRCULATEMukeshwaran BaskaranNo ratings yet

- Logistics Operator Resume - Zarqelain MhamedDocument1 pageLogistics Operator Resume - Zarqelain MhamedAboumaachar IssamNo ratings yet

- 2016 Annual Report AarpDocument40 pages2016 Annual Report AarpKhanh PhucNo ratings yet

- Annexure ADocument5 pagesAnnexure AsgacrewariNo ratings yet

- Marketing Strategies of Gems and Jewellery RetailersDocument68 pagesMarketing Strategies of Gems and Jewellery Retailersmanoj varmaNo ratings yet

- Attachment J.1 Statement of Objectives (Soo) Usaid Udhyam Nepal ActivityDocument31 pagesAttachment J.1 Statement of Objectives (Soo) Usaid Udhyam Nepal ActivityManoj MaharjanNo ratings yet

- Bank Letter of Guarantee FormatDocument3 pagesBank Letter of Guarantee FormatRupesh More100% (1)

- Passion River Films: Follow Me On Twitter @allenchou For Info On Our Future Events, VisitDocument42 pagesPassion River Films: Follow Me On Twitter @allenchou For Info On Our Future Events, Visitaurelia450No ratings yet

- Simulation 9 - Bookkeeping TemplateDocument3 pagesSimulation 9 - Bookkeeping Templateapi-520325493No ratings yet

- Learning Resource - Accounting and The Business EnvironmentDocument109 pagesLearning Resource - Accounting and The Business EnvironmentCrystal Castor LabragueNo ratings yet

- Ca Final: Paper 8: Indirect Tax LawsDocument499 pagesCa Final: Paper 8: Indirect Tax LawsMaroju Rajitha100% (1)

- HACCP: A Systematic Approach to Food SafetyDocument3 pagesHACCP: A Systematic Approach to Food SafetyWaqar IbrahimNo ratings yet

- Deputy Accounts Officer Job at UniversityDocument6 pagesDeputy Accounts Officer Job at UniversityuppaliNo ratings yet

- Moto BillDocument1 pageMoto Billmyyes3994No ratings yet

- Instruction Kit for eForm SH-8 (Letter of OfferDocument11 pagesInstruction Kit for eForm SH-8 (Letter of Offermaddy14350No ratings yet

- The Role of Financial Management: Instructor: Ajab Khan BurkiDocument20 pagesThe Role of Financial Management: Instructor: Ajab Khan BurkiGaurav KarkiNo ratings yet

- Aea 210Document61 pagesAea 210alfred asajileNo ratings yet

- Kohinoor Chemical Company (Bangladesh) Limited: Industry & Strategy Analysis ofDocument4 pagesKohinoor Chemical Company (Bangladesh) Limited: Industry & Strategy Analysis ofWazed AliNo ratings yet

- IRIS Guideline 6 2014 SPECIAL PROCESSESDocument12 pagesIRIS Guideline 6 2014 SPECIAL PROCESSESmnmlNo ratings yet

- CopelandDocument49 pagesCopelandRUMA AKTERNo ratings yet

- Purchase Order for Gas Detection EquipmentDocument6 pagesPurchase Order for Gas Detection EquipmentYogesh BadheNo ratings yet

- Muddy Waters - YY - 11182020Document71 pagesMuddy Waters - YY - 11182020AlpNo ratings yet

- Mullins Pol 540 Rexaminling The Resource Curse EndnotesDocument13 pagesMullins Pol 540 Rexaminling The Resource Curse Endnotesapi-548598990No ratings yet

- 2020 Kickbook-ClDocument119 pages2020 Kickbook-ClMohan RanganNo ratings yet

- Flinn (ISA 315 + ISA 240 + ISA 570)Document2 pagesFlinn (ISA 315 + ISA 240 + ISA 570)Zareen AbbasNo ratings yet

- International in Production and Operation ManagementDocument9 pagesInternational in Production and Operation ManagementOrea DonnanNo ratings yet

- Allocative Efficiency Vs X EfficiencyDocument25 pagesAllocative Efficiency Vs X EfficiencyaasdNo ratings yet