Professional Documents

Culture Documents

Example For Slide #42 : Sources of Income Taxable Income Foreign Income Tax Paid

Example For Slide #42 : Sources of Income Taxable Income Foreign Income Tax Paid

Uploaded by

kdjasldkajOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example For Slide #42 : Sources of Income Taxable Income Foreign Income Tax Paid

Example For Slide #42 : Sources of Income Taxable Income Foreign Income Tax Paid

Uploaded by

kdjasldkajCopyright:

Available Formats

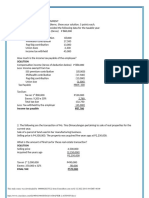

Example for Slide #42

Diego, A resident Filipino, has a 2018 taxable income in Japan of 350,000 on which he paid

income tax of 15,000. He has no income in the Philippines. If the foreign income tax is claimed

as a tax credit, what will be his income tax due after deducting the tax credit?

Philippine Income Tax on 350,000 20,000

Less: Tax Credit

Limit: (350/350 x 20) 20,000

Actual 15,000

Allowed 15,000

Income Tax Still Due: 5,000

Example for Slide # 47

Gabriela, a resident citizen, has the following data on his net income and income taxes for the

year 2018:

Sources of Income Taxable Income Foreign Income Tax Paid

Philippines 480,000 -

Japan 192,000 25,000

Taiwan 96,000 30,000

Total 768,000 55,000

A. Philippine Income Tax for 768,000 122,000

B. Allowable Tax Credit

Limitation 1

Japan

Limit: (192/768 x 122) 30,500

Actual: 25,000

Allowed: 25,000

Taiwan

Limit: (96/768 x 122) 15,250

Actual: 30,000

Allowed: 15,250

40,250

Limitation 2

Limit: (288/768 x 122) 45,750

Actual: 55,000

Allowed: 45,750

C. Philippine Income tax Still Due

Philippine Income Tax (a) 122,000

Less: Tax Credit 40,250

Income Tax Still Due 81,750

You might also like

- FABM 2 Module 9 Income Tax DueDocument11 pagesFABM 2 Module 9 Income Tax DueJOHN PAUL LAGAO100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- Taxation Final Pre-Board - SolutionsDocument14 pagesTaxation Final Pre-Board - SolutionsMischievous MaeNo ratings yet

- Assignment Bsma 1a April 6Document27 pagesAssignment Bsma 1a April 6Maeca Angela Serrano100% (1)

- Quiz On Income TaxationDocument4 pagesQuiz On Income TaxationLenard Josh Ingalla100% (1)

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Answers, Solutions and Clarifications FileDocument3 pagesAnswers, Solutions and Clarifications FileAnnie LindNo ratings yet

- Ppe ProblemDocument3 pagesPpe ProblemJanuary Ann BeteNo ratings yet

- Cases On Taxation For Individualss AnswersDocument11 pagesCases On Taxation For Individualss AnswersMitchie Faustino100% (2)

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- Practice Exercises: Donor'S TaxDocument37 pagesPractice Exercises: Donor'S TaxErica NicolasuraNo ratings yet

- Tax QuizDocument3 pagesTax QuizLora Mae JuanitoNo ratings yet

- Taxation Cup SeriesDocument5 pagesTaxation Cup SeriesGlaiza Atillo Batuto Orgino100% (1)

- 8.2 Assignment - Regular Income Tax For IndividualsDocument8 pages8.2 Assignment - Regular Income Tax For Individualssam imperialNo ratings yet

- Word Problems TaDocument15 pagesWord Problems TaMaissyNo ratings yet

- QUIZ 4 - Income TaxDocument4 pagesQUIZ 4 - Income TaxTUAZON JR., NESTOR A.No ratings yet

- Quiz 3 Key To CorrectionDocument5 pagesQuiz 3 Key To CorrectionanimeilaaaaNo ratings yet

- Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022Document9 pagesAma Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022Meg CruzNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- Income in Foreign Country: Two WaysDocument3 pagesIncome in Foreign Country: Two WaysPaul Anthony AspuriaNo ratings yet

- Casibang OEDocument2 pagesCasibang OEKrung KrungNo ratings yet

- Learning Activity 3 - Inc TaxDocument3 pagesLearning Activity 3 - Inc TaxErica FlorentinoNo ratings yet

- Sources of IncomeDocument3 pagesSources of IncomeChenna Mae ReyesNo ratings yet

- Reviewer Fabm2Document3 pagesReviewer Fabm2Mark LappayNo ratings yet

- He Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeDocument15 pagesHe Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeEarl Daniel RemorozaNo ratings yet

- Acc309 Sem 2Document7 pagesAcc309 Sem 2megankoh21No ratings yet

- BLT 134 Quiz February 3 2016 SolutionsDocument5 pagesBLT 134 Quiz February 3 2016 SolutionsChris WongNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Cbtax01 Chapter 2 ActivityDocument2 pagesCbtax01 Chapter 2 ActivityDamayan XeroxanNo ratings yet

- Finals Take No 2Document2 pagesFinals Take No 2Wally AranasNo ratings yet

- Income Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument11 pagesIncome Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersAudette AquinoNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- Taxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Document4 pagesTaxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Beatrice ReynanciaNo ratings yet

- ASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationDocument4 pagesASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationElaiza Jayne PongaseNo ratings yet

- Answers Chapter 9 Income TaxesDocument17 pagesAnswers Chapter 9 Income TaxesJeannamy PanizalesNo ratings yet

- BSMA Taxation of IndividualsDocument32 pagesBSMA Taxation of IndividualsAngela CanayaNo ratings yet

- Sol. Man. - Chapter 9 - Income Taxes - 2021Document18 pagesSol. Man. - Chapter 9 - Income Taxes - 2021Ventilacion, Jayson M.No ratings yet

- Income Taxes: Problem 1: True or FalseDocument17 pagesIncome Taxes: Problem 1: True or FalseJean Mira AribalNo ratings yet

- Taxation Suggested SolutionsDocument3 pagesTaxation Suggested SolutionsSteven Mark MananguNo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- Quiz (Tax)Document3 pagesQuiz (Tax)Rein ConcepcionNo ratings yet

- PRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionDocument7 pagesPRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionEnrique Hills RiveraNo ratings yet

- Arcebal QuizonFITDocument4 pagesArcebal QuizonFITVheia ArcebalNo ratings yet

- 16 20Document2 pages16 20Marc RafaelNo ratings yet

- Problem 1. Assume The Following Information Related To A Private EmployeeDocument5 pagesProblem 1. Assume The Following Information Related To A Private EmployeeAlelie dela CruzNo ratings yet

- Finals Exam SolutionsDocument6 pagesFinals Exam SolutionsZhengzhou CalNo ratings yet

- Problem Solving Posttest Week2Document3 pagesProblem Solving Posttest Week2Cale HenituseNo ratings yet

- Assignment Bsma 1a April 6Document27 pagesAssignment Bsma 1a April 6Maeca Angela SerranoNo ratings yet

- Tax 1 1Document1 pageTax 1 1Krizel rochaNo ratings yet

- Question Income From Salary Solved in ClassDocument4 pagesQuestion Income From Salary Solved in ClassFozle Rabby 182-11-5893No ratings yet

- Income Tax On CorporationDocument21 pagesIncome Tax On CorporationMaria LicuananNo ratings yet

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- Exam TaxationDocument2 pagesExam Taxationathena leila bordanNo ratings yet

- TAX.03 Exercises On Corporate Income TaxationDocument7 pagesTAX.03 Exercises On Corporate Income Taxationleon gumbocNo ratings yet

- Documents and Reports.: Ms ExelDocument2 pagesDocuments and Reports.: Ms ExelkdjasldkajNo ratings yet

- Rachelle Anne P. Pagaduan BA 12Document1 pageRachelle Anne P. Pagaduan BA 12kdjasldkajNo ratings yet

- Terms: Dagdag Knowledge LangDocument3 pagesTerms: Dagdag Knowledge LangkdjasldkajNo ratings yet

- Results, Findings and InterpretationDocument3 pagesResults, Findings and InterpretationkdjasldkajNo ratings yet

- Account TitlesDocument8 pagesAccount TitleskdjasldkajNo ratings yet

- Suggested Activities To Help Our CommunitiesDocument2 pagesSuggested Activities To Help Our CommunitieskdjasldkajNo ratings yet

- Rachelle Anne Peruna Pagaduan: SummaryDocument2 pagesRachelle Anne Peruna Pagaduan: SummarykdjasldkajNo ratings yet

- S.O.P Category Exact Answer: What Is The Most Prescribed Learning Materials Nowadays?Document3 pagesS.O.P Category Exact Answer: What Is The Most Prescribed Learning Materials Nowadays?kdjasldkajNo ratings yet

- Tle Reviewer:: Development of Electronics TechnologyDocument8 pagesTle Reviewer:: Development of Electronics TechnologykdjasldkajNo ratings yet

- Synthesis TopicsDocument3 pagesSynthesis TopicskdjasldkajNo ratings yet

- Date Account Titles Debit Credit 2017 April 2 4 5 6 7 10: Company Name General Journal April 31, 2017Document7 pagesDate Account Titles Debit Credit 2017 April 2 4 5 6 7 10: Company Name General Journal April 31, 2017kdjasldkajNo ratings yet

- Signing of Memorandum of Agreement: Attendance SheetDocument3 pagesSigning of Memorandum of Agreement: Attendance SheetkdjasldkajNo ratings yet

- CalayagDocument2 pagesCalayagkdjasldkajNo ratings yet

- What Is The Most Convenient Learning Materials That You Use?Document3 pagesWhat Is The Most Convenient Learning Materials That You Use?kdjasldkajNo ratings yet

- Reflection Paper in CledDocument1 pageReflection Paper in CledkdjasldkajNo ratings yet

- Letter of Request For Teaching Area and ParticipantsDocument1 pageLetter of Request For Teaching Area and ParticipantskdjasldkajNo ratings yet

- Results, Findings and InterpretationDocument3 pagesResults, Findings and InterpretationkdjasldkajNo ratings yet

- Mariella Nullar Stem-1: How Does It Help You?Document3 pagesMariella Nullar Stem-1: How Does It Help You?kdjasldkajNo ratings yet

- Letter For Nstp1Document2 pagesLetter For Nstp1kdjasldkajNo ratings yet