Professional Documents

Culture Documents

FA Assignment#1 - Deepak Nitrite: 1. Summarized Balance Sheet Equation For Last Two Years

Uploaded by

BhaktaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FA Assignment#1 - Deepak Nitrite: 1. Summarized Balance Sheet Equation For Last Two Years

Uploaded by

BhaktaCopyright:

Available Formats

Bhakta Ranjan Deka EPGP-12B-038

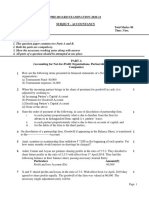

FA Assignment#1 - Deepak Nitrite

1. Summarized Balance Sheet Equation for last two years:

Balance sheet equation: Assets (A) = Liabilities (L) + Owners Equity (OE)

Summarized balance sheet (all figures in crores)

Date Assets (A) = Liabilities (L) + Owners’ Equity (OE)

As on 31st March 2019 2927.78 = 1856.2 + 1071.58

As on 31st March 2018 2590.56 = 1668.42 + 922.14

Comment: Capital Work in progress in 31-Mar-2018 (954.51 Cr) reduced to 33.87 Cr on 31- Mar-2019; which

implies the Property, Plant and equipment growth from 582.91 Cr in 31-Mar-2018 to 1700.57 Cr on 32-Mar-

2019. So company’s fixed asset (tangible assets) goes up. Inventory from 325.42 Cr to 410.73 Cr and Trade

receivable from 411.77 Cr to 574.96 Cr increased as on 31-Mar-2019 compared to 31-mar-2018. But Cash and

Cash equivalent including Bank Balance has gone down on 31-Mar-2019 compared to 31-mar-2018.

2. Five biggest items as part of the “total assets” and the “total liabilities” and “equity side”

Total Asset Total Liabilities Owners’ Equity

Items Value % Items Value % Items Value %

Property, Plant and Borrowings (Current + Non- Equity Share

Equipment as on 31st Current) as on 31st Mar Capital as on 31st

Mar 2019 1700.57 58.08 2019 1124.91 60.6 mar 2019 27.28 2.5

Creditors other than micro

enterprises and small

Inventories as on 31st enterprises as on 31st Mar Other Equity as

Mar 2019 410.73 14.03 2019 496.78 26.76 on 31st Mar 2019 1044.31 97.46

Net Tax (Current +Non- Equity Share

Trade Receivables as on Current) as on 31st Mar Capital as on 31st

31st Mar 2019 574.96 19.64 2019 81.2 4.4 mar 2018 27.28 2.96

Capital Work in Borrowings (Current + Non-

Progress as on 31st Mar Current) as on 31st Mar Other Equity as

2018 954.51 36.85 2018 882.03 52.87 on 31st Mar 2019 894.86 97.04

Creditors other than micro

enterprises and small

Inventories as on 31st enterprises as on 31st Mar

Mar 2018 325.42 12.56 2018 488.92 29.3

*All figures in crores

Comment: On 31st Mar 2019, Tangible assets increased to 58% i.e. 1700.57 Cr from 36.85% (954.51 Cr.) on

31st Mar 2018 which means company has able to convert last financial year Work in Progress to Fixed asset.

Trade receivable is 574.96 Cr, indicates that company give credit to its dealer network. Borrowing (current and

non-current) as on 31st Mar 2019 is almost 61% of total liabilities indicates that company is investing on

tangible assets from Loan. Other equity share raised to 1044.31 Cr from 894.86 Cr, whereas equity share

remains same i.e. 27.28 Cr means company retained earnings from previous financial year.

3. 2 items missing and 2 items interesting

Missing Items: Balance sheet does not contain Depreciation of assets has not been shown. Contingent liability

is not mention but may be part of Non-Current Liability.

Interesting items: Trade payable is Nil for both the year indicates that company buys goods with cash or cash

equivalent. There is no current investment as on 31st Mar 2019 indicates that company is not looking for short

term financial security. Differed Tax liabilities (Net) 4.65% indicates that manufacturing unit is set up in tax

benefit areas. Moreover, even though company has no payable to its suppliers but its borrowing heavily from

the landers.

Page 1

You might also like

- FA Assignment#2 Profit and Loss Statement Company Name: Deepak NitriteDocument1 pageFA Assignment#2 Profit and Loss Statement Company Name: Deepak NitriteBhaktaNo ratings yet

- Assignment Financial Accounting: CompaniesDocument2 pagesAssignment Financial Accounting: Companiesrrajurastogi10No ratings yet

- Assignment 1 Financial AccountingDocument2 pagesAssignment 1 Financial Accountingrrajurastogi10No ratings yet

- Laporan Keuangan PT Indika Energy TBK 31 Mar 2019 PDFDocument188 pagesLaporan Keuangan PT Indika Energy TBK 31 Mar 2019 PDFMirzal FuadiNo ratings yet

- LK Indr 2019 Q1Document84 pagesLK Indr 2019 Q1David GunawanNo ratings yet

- Ratio Analysis of Bajaj Auto LTDDocument4 pagesRatio Analysis of Bajaj Auto LTDRadhika KadamNo ratings yet

- Ratio Analysis of Bajaj Auto LTDDocument4 pagesRatio Analysis of Bajaj Auto LTDRadhika KadamNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelSSSNIPDNo ratings yet

- ACC304-Group Assignment 1-2020Document3 pagesACC304-Group Assignment 1-2020George AdjeiNo ratings yet

- C1 Free Problem Solving Session Nov 2019 - Set 5Document6 pagesC1 Free Problem Solving Session Nov 2019 - Set 5JMwaipNo ratings yet

- AP 300Q Quizzer On Audit of Liabilities ResaDocument13 pagesAP 300Q Quizzer On Audit of Liabilities Resaryan rosalesNo ratings yet

- Intermediate Accounting 2 Prelim Exam Part II PDF FreeDocument5 pagesIntermediate Accounting 2 Prelim Exam Part II PDF FreeShairine AquinoNo ratings yet

- FinalDocument104 pagesFinalEZEKIELNo ratings yet

- Data18 FyDocument66 pagesData18 FyYessica LidiaNo ratings yet

- AP Quiz Liab2Document4 pagesAP Quiz Liab2maurNo ratings yet

- 2019 Friendly Hills BankDocument36 pages2019 Friendly Hills BankNate TobikNo ratings yet

- Textbook Materials - ch3Document40 pagesTextbook Materials - ch3OZZYMANNo ratings yet

- July 31, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal First Quarter ENDED JUNE 30, 2018Document17 pagesJuly 31, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal First Quarter ENDED JUNE 30, 2018Black Star11No ratings yet

- Prelim ExaminationDocument9 pagesPrelim ExaminationShannel Angelica Claire RiveraNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisShamim IqbalNo ratings yet

- Pt. Mitra Adiperkasa TBK Dan Entitas Anak /and Its SubsidiariesDocument120 pagesPt. Mitra Adiperkasa TBK Dan Entitas Anak /and Its SubsidiariesChandra SasmitaNo ratings yet

- FA Dec 2019Document6 pagesFA Dec 2019Shawn LiewNo ratings yet

- Case 7 SolutionsDocument3 pagesCase 7 SolutionsMichale Jacomilla50% (2)

- May 2020 Financial Accounting Paper 1.1Document18 pagesMay 2020 Financial Accounting Paper 1.1MahediNo ratings yet

- Consolidated FS BMTR 31 Maret 2020Document95 pagesConsolidated FS BMTR 31 Maret 2020Akbar Rianiri BakriNo ratings yet

- DFS MAR 2019 JHDocument94 pagesDFS MAR 2019 JHRajendra AvinashNo ratings yet

- Analyzing, Interpreting, and Capitalizing Operating Lease: $ in Millions Mar. 2019 Dec. 2018Document3 pagesAnalyzing, Interpreting, and Capitalizing Operating Lease: $ in Millions Mar. 2019 Dec. 2018zuhaib zulfiqarNo ratings yet

- Lecture 2 PDFDocument62 pagesLecture 2 PDFsyingNo ratings yet

- Apii LK TW I 2020Document67 pagesApii LK TW I 2020Gustina LubisNo ratings yet

- LCC-L2 Saturday Class-1b Incomplete Record-Sole Trader (S) (151022)Document2 pagesLCC-L2 Saturday Class-1b Incomplete Record-Sole Trader (S) (151022)wu alanNo ratings yet

- Chapter-2 Homework MisstatementsDocument4 pagesChapter-2 Homework MisstatementsKenneth Christian WilburNo ratings yet

- ACC111 Finals ExaminationDocument4 pagesACC111 Finals ExaminationVan De LeonNo ratings yet

- Far160 - Dec 2019 - QDocument8 pagesFar160 - Dec 2019 - QNur ain Natasha ShaharudinNo ratings yet

- Tutorial Questions Borrowing Costs - 2019Document7 pagesTutorial Questions Borrowing Costs - 2019Noah MigealNo ratings yet

- Universiti Teknologi Mara Common Test 1: Confidential 1 AC/OCT 2019/FAR160Document4 pagesUniversiti Teknologi Mara Common Test 1: Confidential 1 AC/OCT 2019/FAR160Nurul Syaza MusaNo ratings yet

- Afr AssignmentDocument5 pagesAfr Assignmentshahid sjNo ratings yet

- Summary of Consolidated Financial Statements For The Fiscal Year Ended March 31, 2020 Under Japanese GAAPDocument25 pagesSummary of Consolidated Financial Statements For The Fiscal Year Ended March 31, 2020 Under Japanese GAAPEvgeniyNo ratings yet

- Ir - PTKS H1 2019Document3 pagesIr - PTKS H1 2019Lian PutraNo ratings yet

- Analysis of Anuual Report of Tata Consultancy Services (TCS) 2019Document17 pagesAnalysis of Anuual Report of Tata Consultancy Services (TCS) 2019AparnaNo ratings yet

- News 16112Document1 pageNews 16112tareq mahmudNo ratings yet

- Mock+Exams AAA+RM+Questions+March+2019+FINALDocument12 pagesMock+Exams AAA+RM+Questions+March+2019+FINALJawad rahmanaccaNo ratings yet

- Period PV of 1 at 10% PV of Ordinary Annuity of 1 at 10%Document1 pagePeriod PV of 1 at 10% PV of Ordinary Annuity of 1 at 10%Vhiena May EstrelladoNo ratings yet

- 03 Zutter Smart MFBrief 15e ch03Document85 pages03 Zutter Smart MFBrief 15e ch03Komang MulianaNo ratings yet

- QP Class Xii AccountancyDocument8 pagesQP Class Xii AccountancyRKS TECHNo ratings yet

- This Study Resource Was: Problem 1Document2 pagesThis Study Resource Was: Problem 1Michelle J UrbodaNo ratings yet

- Credit Research Report - Bajaj FinanceDocument8 pagesCredit Research Report - Bajaj FinanceKeval ShahNo ratings yet

- Solutions - LiabilitiesDocument10 pagesSolutions - LiabilitiesjhobsNo ratings yet

- Class XII Accounts Set 4Document7 pagesClass XII Accounts Set 4HTML Learning HubNo ratings yet

- Financial Statements 31032019 PTRODocument105 pagesFinancial Statements 31032019 PTRORindang Jr.No ratings yet

- Consolidated Financial Results For The Year Ended March 31, 2018 (Prepared in Accordance With IFRS)Document22 pagesConsolidated Financial Results For The Year Ended March 31, 2018 (Prepared in Accordance With IFRS)Cristian Navarro MartínezNo ratings yet

- 2nd Quarter Financial Report 2019Document94 pages2nd Quarter Financial Report 2019Vika OktarinaNo ratings yet

- 9706 w19 QP 31Document13 pages9706 w19 QP 31PontuChowdhuryNo ratings yet

- 4 Audit of Investments Docx Accounting Examination PDF Copy DownloadedDocument12 pages4 Audit of Investments Docx Accounting Examination PDF Copy DownloadedJANISCHAJEAN RECTONo ratings yet

- Far670 Solution Jul 2020Document4 pagesFar670 Solution Jul 2020siti hazwaniNo ratings yet

- Screenshot 2023-12-04 at 6.26.08 PMDocument25 pagesScreenshot 2023-12-04 at 6.26.08 PMdokaniavedikaNo ratings yet

- C1 Free Problem Solving (May 2021) - Set 5Document8 pagesC1 Free Problem Solving (May 2021) - Set 5JMwaipNo ratings yet

- ENT503M MidtermQuestionnaireDocument7 pagesENT503M MidtermQuestionnaireNevan NovaNo ratings yet

- MSU3506 Final Exam 2019 (E)Document9 pagesMSU3506 Final Exam 2019 (E)DulmaNo ratings yet

- APL Laundry and Linen Private LimitedDocument3 pagesAPL Laundry and Linen Private LimitedAnurag SharmaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Exam Managerial Economics 2017-18 Marks: 10 Time: 15 MinutesDocument3 pagesExam Managerial Economics 2017-18 Marks: 10 Time: 15 MinutesBhaktaNo ratings yet

- Exam Managerial Economics 2016-17 Quiz 1 Marks: 10 Time: 15 MinutesDocument36 pagesExam Managerial Economics 2016-17 Quiz 1 Marks: 10 Time: 15 MinutesBhaktaNo ratings yet

- Managerial Economics 2017-18 Quiz 2Document3 pagesManagerial Economics 2017-18 Quiz 2BhaktaNo ratings yet

- Indian Institute of Management-Kozhikode: Quantitative TechniquesDocument21 pagesIndian Institute of Management-Kozhikode: Quantitative TechniquesBhaktaNo ratings yet

- Final Draft-Attitude BehaviourDocument2 pagesFinal Draft-Attitude BehaviourBhaktaNo ratings yet

- FA Assignment#4 Statement of Changes in Equity Company Name: Deepak NitriteDocument2 pagesFA Assignment#4 Statement of Changes in Equity Company Name: Deepak NitriteBhaktaNo ratings yet

- FA Assignment#3 Linking Balance Sheet With Profit and Loss Statement Company Name: Deepak NitriteDocument1 pageFA Assignment#3 Linking Balance Sheet With Profit and Loss Statement Company Name: Deepak NitriteBhaktaNo ratings yet

- 12 Altprob 8eDocument4 pages12 Altprob 8eRama DulceNo ratings yet

- Acctg-5 Problem 15-12Document7 pagesAcctg-5 Problem 15-12Maria Fe Joanna AbonitaNo ratings yet

- Donna JamisonDocument1 pageDonna JamisonIre LeeNo ratings yet

- Financial Statement Analysis-Test BankDocument35 pagesFinancial Statement Analysis-Test BankSameh YassienNo ratings yet

- Fortis HealthcareDocument3 pagesFortis HealthcareAnant ChhajedNo ratings yet

- Feedback Control Systems 5th Edition Phillips Solutions ManualDocument35 pagesFeedback Control Systems 5th Edition Phillips Solutions Manualfactivesiennesewwz2jj100% (21)

- Category A & B & C (Accounting)Document330 pagesCategory A & B & C (Accounting)AdityaNo ratings yet

- Chapter 19 - Biological AssetsDocument40 pagesChapter 19 - Biological AssetsDidik DidiksterNo ratings yet

- Chapter 5 - Biological AssetsDocument4 pagesChapter 5 - Biological AssetsMarjorie PrietosNo ratings yet

- Assignment 3Document3 pagesAssignment 3Nate LoNo ratings yet

- Acc 201 ch6 HWDocument6 pagesAcc 201 ch6 HWTrickster TwelveNo ratings yet

- Annual Report: Zeppelin GMBHDocument84 pagesAnnual Report: Zeppelin GMBHShubham KumarNo ratings yet

- Daftar Fa Swpi 30 September 2021 GabunganDocument721 pagesDaftar Fa Swpi 30 September 2021 Gabunganamelia lestariNo ratings yet

- Autonomous Branches.Document7 pagesAutonomous Branches.Axam Ndawula100% (1)

- 3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênDocument76 pages3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênHoàng Vũ HuyNo ratings yet

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFDocument139 pagesAccounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFbeenie manNo ratings yet

- Consolidated JDEDocument75 pagesConsolidated JDERamesh KumarNo ratings yet

- Chapter 4 Financial StatementsDocument29 pagesChapter 4 Financial StatementsAmaan MirzaNo ratings yet

- Asset Accounting: Use Transaction Code: OaxeDocument12 pagesAsset Accounting: Use Transaction Code: OaxejsphdvdNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- 1 - ch09 Inventory Edit ALTAF Ringkas PDFDocument20 pages1 - ch09 Inventory Edit ALTAF Ringkas PDFRina Agustina ManikNo ratings yet

- Solutions - Chapter 7Document18 pagesSolutions - Chapter 7Dre ThathipNo ratings yet

- Part II ProjectDocument81 pagesPart II ProjectTasmay Enterprises100% (2)

- Stephensonrealestaterecapitalizationcompiled 130418215434 Phpapp01Document29 pagesStephensonrealestaterecapitalizationcompiled 130418215434 Phpapp01atul parad100% (2)

- Working Capital Mangement of Wipro Limited: Dr.M.Yasodha, Vaijayantthi.R, Shree Harshini.G, Nivetha.VDocument8 pagesWorking Capital Mangement of Wipro Limited: Dr.M.Yasodha, Vaijayantthi.R, Shree Harshini.G, Nivetha.Vshreyas kadamNo ratings yet

- Book Keeping and Accounts Level 2 Model Answers Series 4 2013Document11 pagesBook Keeping and Accounts Level 2 Model Answers Series 4 2013Angelina Papageorgiou100% (1)

- FAR Dry Run ReviewerDocument5 pagesFAR Dry Run ReviewerJohn Ace MadriagaNo ratings yet

- Indoor Soccer Facility Business PlanDocument30 pagesIndoor Soccer Facility Business PlanKamran Lakhany100% (2)

- AD1101 AY15 - 16 Sem 1 Lecture 1Document21 pagesAD1101 AY15 - 16 Sem 1 Lecture 1weeeeeshNo ratings yet