0% found this document useful (0 votes)

85 views10 pagesFinancial Management Course Overview

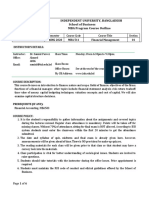

This document outlines the course plan for a financial management course. It includes sections on course perspective, major topics covered, course objectives, knowledge and skills developed, reference materials, evaluation criteria, class discipline guidelines, and student roles and responsibilities. The major topics covered are introduction to finance, problems in corporate finance, financial markets, time value of money, risk and return, cost of capital, and capital budgeting. The course objectives are for students to understand various financial concepts, techniques like TVM, and strategies like capital budgeting. Students will develop critical thinking, analytical, and business skills. The evaluation includes assignments, quizzes, midterm and final exams. Students are expected to adhere to attendance, participation, discipline and dress

Uploaded by

Aditya SinghCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

85 views10 pagesFinancial Management Course Overview

This document outlines the course plan for a financial management course. It includes sections on course perspective, major topics covered, course objectives, knowledge and skills developed, reference materials, evaluation criteria, class discipline guidelines, and student roles and responsibilities. The major topics covered are introduction to finance, problems in corporate finance, financial markets, time value of money, risk and return, cost of capital, and capital budgeting. The course objectives are for students to understand various financial concepts, techniques like TVM, and strategies like capital budgeting. Students will develop critical thinking, analytical, and business skills. The evaluation includes assignments, quizzes, midterm and final exams. Students are expected to adhere to attendance, participation, discipline and dress

Uploaded by

Aditya SinghCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd